Class Ruling

CR 2004/55

Income tax: Westfield Trust - Westfield Group merger sale facility

This version is no longer current. Please follow this link to view the current version. |

-

Please note that the PDF version is the authorised version of this ruling.This document has changed over time. View its history.

FOI status:

may be released| What this Class Ruling is about | |

| Date of effect | |

| Withdrawal | |

| Arrangement | |

| Ruling | |

| Explanation | |

| Detailed contents list | |

| Glossary of Terms | |

| Sale Facility |

| Preamble |

| The number, subject heading, What this Class Ruling is about (including Tax law(s), Class of persons and Qualifications sections), Date of effect, Withdrawal, Arrangement and Ruling parts of this document are a 'public ruling' in terms of Part IVAAA of the Taxation Administration Act 1953. CR 2001/1 explains Class Rulings and Taxation Rulings TR 92/1 and TR 97/16 together explain when a Ruling is a 'public ruling' and how it is binding on the Commissioner. |

What this Class Ruling is about

1. This Ruling sets out the Commissioner's opinion on the way in which the 'tax law(s)' identified below apply to the defined class of persons, who take part in the arrangement to which this Ruling relates.

Tax law(s)

2. The tax laws dealt with in this Ruling are:

- •

- subsection 6(1) of the Income Tax Assessment Act 1936 (ITAA 1936);

- •

- section 104-10 of the Income Tax Assessment Act 1997 (ITAA 1997);

- •

- section 108-5 of the ITAA 1997;

- •

- section 109-5 of the ITAA 1997;

- •

- section 110-25 of the ITAA 1997;

- •

- section 110-55 of the ITAA 1997;

- •

- section 112-30 of the ITAA 1997; and

- •

- section 116-20 of the ITAA 1997.

Class of persons

3. The class of persons to which this Ruling applies are the owners of ordinary units in Westfield Trust (WFT) who:

- •

- choose to dispose of their WFT units under the arrangement that is the subject of this Ruling;

- •

- hold those WFT units on capital account, and

- •

- are residents of Australia within the meaning of that term in subsection 6(1) of the ITAA 1936.

Qualifications

4. The Commissioner makes this Ruling based on the precise arrangement identified in this Ruling.

5. The class of persons defined in this Ruling may rely on its contents provided the arrangement actually carried out is carried out in accordance with the arrangement described in paragraphs 10 to 23.

6. If the arrangement actually carried out is materially different from the arrangement that is described in this Ruling, then:

- •

- this Ruling has no binding effect on the Commissioner because the arrangement entered into is not the arrangement on which the Commissioner has ruled; and

- •

- this Ruling may be withdrawn or modified.

7. This work is copyright. Apart from any use as permitted under the Copyright Act 1968, no part may be reproduced by any process without prior written permission from the Commonwealth. Requests and inquiries concerning reproduction and rights should be addressed to:

- Commonwealth Copyright Administration

- Intellectual Property Branch

- Department of Communications, Information Technology and the Arts

- GPO Box 2154

- CANBERRA ACT 2601

- or by e-mail to: commonwealth.copyright@dcita.gov.au

Date of effect

8. This Ruling applies to the income year ending 30 June 2005. The arrangement will be completed during that income year.

Withdrawal

9. This Ruling is withdrawn and ceases to have effect after 30 June 2005. The Ruling continues to apply, in respect of the tax laws ruled upon, to all persons within the specified class who enter into the arrangement during the term of the Ruling.

Arrangement

10. The arrangement that is the subject of the Ruling is described below. This description is based on the documents identified below. These documents, or the relevant parts of them, form part of and are to be read with this description. The relevant documents or parts of documents incorporated into this description of the arrangement are:

- •

- Class Ruling request from Greenwoods & Freehills dated 29 April 2004

- •

- amendments to Class Ruling from Greenwoods & Freehills dated 10 May 2004

- •

- draft Westfield Group stapling deed, and modified deed

- •

- draft deed poll (undated)

- •

- draft Explanatory Memorandum in relation to a proposal to staple the shares of Westfield Holdings Limited (WSF) and the units of WFT and Westfield America Trust (WFA) from Mallesons Stephen Jaques

- •

- draft Implementation Deed dated 20 April 2004

- •

- ASIC briefing note on Westfield Group restructure prepared by Mallesons Stephen Jaques dated 15 April 2004.

- •

- draft Westfield Holdings Limited Special notice about the sale facility dated 13 May 2004

- •

- draft Westfield Group Merger - WFT overview dated 20 May 2004

- •

- notes of meetings between ATO, Greenwoods & Freehills and Speed & Stracey from 8 April 2004 to date, and

- •

- e-mails from Greenwoods & Freehills from 19 February to date.

Note 1: certain information has been provided on a commercial-in-confidence basis and will not be disclosed or released under the Freedom of Information legislation.

Note 2: certain terms used in this Ruling are defined and explained in the Glossary of terms, at Appendix A.

11. On 22 April 2004, WSF announced that it would merge with WFT and WFA. The merger is to be achieved by means of a scheme of arrangement between WSF and its shareholders and by amendment of the constitutions of WSF, WFT and WFA, resulting in the issue of securities of each entity to investors in each other entity. The securities will be stapled to form a Westfield Group stapled security.

12. The merger ratios determine the entitlement of existing share and unit holders to Westfield Group stapled securities and are as follows:

| Entity | Merger ratio | No. of Westfield

Group stapled securities per 1,000 existing securities |

|---|---|---|

| WSF | 1.00 | 1,000 |

| WFT | 0.28 | 280 |

| WFA | 0.15 | 150 |

13. In order for the merger to proceed, five key steps must be completed:

| Step 1 | Approval by WSF shareholders of the share scheme resolution |

| Step 2 | Approval by WSF shareholders of the general resolutions |

| Step 3 | Approval of the WFT resolutions at a meeting of WFT members |

| Step 4 | Approval of the WFA resolutions at a meeting of WFA members |

| Step 5 | Approval by the Court of the share scheme and lodgment of the share scheme order with ASIC |

14. The arrangement that is the subject of this Ruling is a 'sale facility' which is an integral part of the Merger. It is separate from the stapling arrangement which is the subject of a separate class ruling, Class Ruling CR 2004/52.

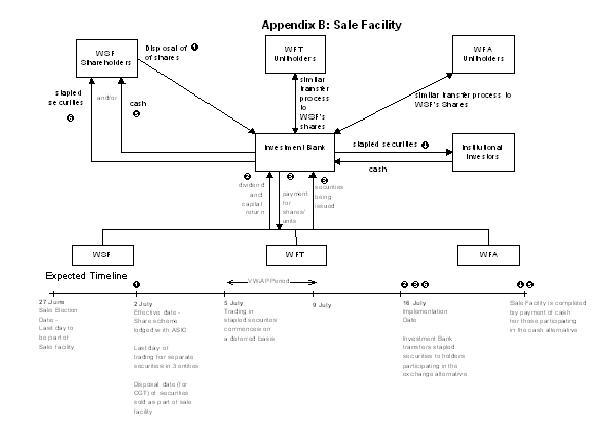

15. The dates presently contemplated for the events described below are set out in the following table and in the diagram at Appendix B.

| Event | Date |

|---|---|

| Sale facility election date | 27 June 2004 |

| Effective date | 2 July 2004 |

| First day of trading in Westfield Group stapled securities | 5 July 2004 |

| Stapling record date | 12 July 2004 |

| Implementation date | 16 July 2004 |

The sale facility

16. WFT unitholders can elect to sell some or all of their WFT units to a financial institution (Investment Bank) under the sale facility. No brokerage or other fees will be charged on a sale under the sale facility.

17. To participate in the sale facility, a WFT unitholder must complete and lodge an election form by the sale facility election date. If the merger proceeds, the WFT unitholder then becomes bound to transfer the specified number of units to the Investment Bank. The Investment Bank will be bound by deed poll in favour of WFT and each unitholder to perform its obligations in respect of the sale facility. Unitholders can also sell their other WFT units (not the subject of an election to use the sale facility) on market until the effective date.

18. A contract for the sale of WFT units between a WFT unitholder and the Investment Bank will be formed on the date on which all of the conditions precedent to the formation of the contract are satisfied (the effective date).

19. WFT unitholders may elect to participate in the sale facility for all or some of their WFT units and for each unit may elect to receive cash from the Investment Bank (cash alternative) or to have Westfield Group stapled securities transferred to them by the Investment Bank (exchange by sale alternative).

Cash Alternative

20. By electing to participate in the cash alternative, a WFT unitholder agrees to sell their WFT units to the Investment Bank for an amount described as the adjusted sale facility price. For a WFT unit, the adjusted sale facility price is equal to the adjusted sale facility amount divided by the number of WFT units sold in the sale facility. The adjusted sale facility amount is the total cash proceeds received by a WFT unitholder for WFT units sold in the sale facility, and is calculated as the number of WFT units sold in the sale facility multiplied by the merger ratio (0.28) and rounded up to the next whole number multiplied by the sale facility price for a Westfield Group stapled security.

21. The sale facility price for a Westfield Group stapled security will be determined by reference to the price paid by institutional and other investors for Westfield Group stapled securities which will be sold to such investors by the Investment Bank. Westfield Group will announce this price as soon as possible after the merger.

Exchange by Sale Alternative

22. By electing to participate in the exchange by sale alternative, a unitholder agrees to sell WFT units to the Investment Bank for consideration of 0.28 Westfield Group stapled securities per WFT unit disposed of. The total number of Westfield Group stapled securities transferred to a WFT unitholder is calculated as the number of WFT units disposed of in the exchange by sale alternative multiplied by the merger ratio (0.28) and will be rounded up to the next whole number.

23. Westfield Group stapled securities will be transferred to the unitholder by the Investment Bank on the implementation date for the scheme.

Ruling

Disposal of WFT units

24. CGT event A1 in section 104-10 of the ITAA 1997 will happen when a WFT unitholder disposes of a WFT unit to the Investment Bank under the sale facility. The event happens on the effective date.

25. For the purposes of section 116-20 of the ITAA 1997, the capital proceeds from the CGT event happening to each WFT unit will be:

- •

- for those unitholders who choose the cash alternative - the amount of money received, and

- •

- for those unitholders who choose the exchange by sale alternative - the market value on the effective date of a WSF share, WFT unit and WFA unit comprising a Westfield Group stapled security multiplied by the merger ratio of 0.28.

26. Any capital gain or capital loss from the disposal of a WFT unit that was acquired before 20 September 1985 will be disregarded (paragraph 104-10(5)(a) of the ITAA 1997).

Acquisition of Westfield Group stapled securities under exchange by sale alternative

27. Each WSF share, WFT unit and WFA unit that together make up a Westfield Group stapled security acquired under the exchange by sale alternative is a separate CGT asset for the purposes of section 108-5 of the ITAA 1997. WFT unitholders will be taken to have acquired these assets on the effective date (section 109-5 of the ITAA 1997).

28. The first element of the cost base and reduced cost base of each WSF share, WFT unit and WFA unit is a reasonable part of the market value on the effective date of the WFT units given to acquire them (sections 110-25, 110-55 and 112-30 of the ITAA 1997).

Explanation

Disposal of unit under sale facility

29. CGT event A1 in section 104-10 of the ITAA 1997 will happen when a WFT unitholder disposes of a unit to the Investment Bank under the sale facility. The time of the event is when the contract for sale is entered into. The contract will be entered into on the effective date. At this time there will be acceptance by the unitholder of the offer by the Investment Bank and the final condition precedent to formation of the contract (that is, approval by the Court of the share scheme and lodgment of the share scheme order) will be satisfied.

30. The unitholder will make a capital gain if the capital proceeds from the disposal of the unit exceed its cost base. They will make a capital loss if the capital proceeds are less than the reduced cost base of the unit (subsection 104-10(4) of the ITAA 1997). The amount of capital proceeds will depend on whether the unitholder chooses the 'cash alternative' or the 'exchange by sale alternative': refer to paragraphs 32 to 35 for a more detailed explanation.

31. Under both the cash alternative and the exchange by sale alternative, any capital gain or capital loss from a WFT unit that the unitholder acquired before 20 September 1985 is disregarded (paragraph 104-10(5)(a) of the ITAA 1997).

Capital proceeds

32. The capital proceeds from a CGT event is the total of:

- •

- the money that is received, or which is entitled to be received, in respect of the event happening, and

- •

- the market value of any property that is received, or which is entitled to be received, in respect of the event happening. The market value is determined at the time of the event (section 116-20 of the ITAA 1997).

33. Under the cash alternative, the only consideration that WFT unitholders will receive for each unit is an amount of money (the adjusted sale facility price). Accordingly, this amount will be the capital proceeds for each unit.

34. Under the exchange by sale alternative, the only consideration that WFT unitholders will receive for their WFT units are Westfield Group stapled securities, comprising one WSF share, one WFT unit and one WFA unit, in the ratio of 0.28 Westfield Group stapled securities for each original WFT unit transferred to the Investment Bank. Accordingly, the capital proceeds that WFT unitholders receive for each WFT unit will be the market value (when CGT event A1 happened) of the shares and units that together make up a Westfield Group stapled security multiplied by the merger ratio of 0.28.

35. The Commissioner is satisfied that the volume weighted average price (VWAP) for Westfield Group stapled securities over the first five days of trading on a deferred settlement basis is a reasonable measure of the market value of the share and units that together make up a Westfield Group stapled security at the time CGT event A1 happened to the original WFT units. The VWAP is the average price of security transactions for a period taking into account the number of securities in each transaction. It is calculated by dividing the total dollars traded over the period by the total number of securities traded over the period. Westfield Group will announce this price as soon as practicable after the end of the VWAP period.

Cost base and time of acquisition of securities that make up a Westfield Group stapled security acquired under the exchange by sale alternative.

36. If a taxpayer acquires a CGT asset as a result of another entity disposing of it to them under CGT event A1, the time of acquisition of the asset is taken to be the time when the disposal contract is entered into, or, if there is no contract, when the disposing entity stops being the asset's owner (subsection 109-5(2) of the ITAA 1997).

37. Under the exchange by sale alternative, the disposal of the Westfield Group stapled securities by the Investment Bank to the unitholder will result in CGT event A1 happening to the Investment Bank. That event happens under a contract entered into between the Investment Bank and the WFT unitholder on the effective date.

38. Accordingly, under the exchange by sale alternative, a unitholder will be taken to have acquired each WSF share, WFT unit and WFA unit (comprising a Westfield Group stapled security) at the same time the unitholder is taken to dispose of their original WFT units.

39. The first element of the cost base and reduced cost base of a CGT asset is the total of the:

- •

- money that is paid, or required to be paid, in respect of acquiring it, and

- •

- market value of any property that is given, or which is required to be given, in respect of acquiring it. The market value is determined at the time of acquisition (sections 110-25 and 110-55 of the ITAA 1997).

40. If a CGT asset is acquired because of a transaction and only part of the expenditure (including the giving of property) incurred under the transaction relates to the acquisition of the asset, the first element of the cost base and reduced cost base of the asset is that part of the expenditure that is reasonably attributable to the acquisition of the asset (subsection 112-30(1) of the ITAA 1997).

41. WFT unitholders will give as consideration in respect of the acquisition of each WSF share, WFT unit and WFA unit that together make up a Westfield Group stapled security, original WFT units in the ratio of one original WFT unit for every 0.28 Westfield Group stapled securities to be received. The market value of this consideration is worked out on the effective date.

42. The Commissioner considers it reasonable to apportion the market value of the original WFT units across the individual securities comprising a Westfield Group stapled security in the same ratio as the net tangible assets of each entity.

43. The Commissioner is satisfied that the VWAP for Westfield Group stapled securities over the first five days of trading on a deferred settlement basis can be used to determine the market value on the effective date of the original WFT units disposed of to the Investment Bank. This value, and the apportionment details referred to in paragraph 42 of this Ruling, will be announced by the Westfield Group as soon as practicable after the end of the VWAP period.

Detailed contents list

44. Below is a detailed contents list for this Class Ruling:

| Paragraph | |

|---|---|

| What this Class Ruling is about | 1 |

| Tax law(s) | 2 |

| Class of persons | 3 |

| Qualifications | 4 |

| Date of effect | 8 |

| Withdrawal | 9 |

| Arrangement | 10 |

| The Sale Facility | 16 |

| Cash Alternative | 20 |

| Exchange by Sale Alternative | 22 |

| Ruling | 24 |

| Disposal of WFT units | 24 |

| Acquisitions of Westfield Group stapled securities under exchange by sale alternative | 27 |

| Explanation | 29 |

| Disposal ofunit under sale facility | 29 |

| Capital proceeds | 32 |

| Cost base and time of acquisition of secutiries that make up a Westfield Group stapled security acquired under the exchange by sale alternative | 36 |

| Detailed contents list | 44 |

Commissioner of Taxation

2 June 2004

Appendix A

Glossary of terms

| Ruling Terminology | Meaning |

|---|---|

| Certain terms used in this Ruling have the same meaning as corresponding terms in The Westfield Group Merger Explanatory Memorandum and sales facility notices in relation to a proposal to staple the shares of WSF and the units of WFT and WFA. | |

| effective date | Effective Date |

| implementation date | Implementation Date |

| Share scheme | Share scheme |

| Westfield Group stapled security | Stapled Security |

| WFA unit | WFA Unit |

| WFT unit | WFT Unit |

| Other terms used in this ruling have the following meaning | |

| sale facility election date | the latest date and time for the lodgement of an election form to participate in the sale facility, as advised in the Special Notice about the Sale Facility for WSF, WFA or WFT. |

Appendix B

Not previously released as a draft.

References

ATO references:

NO 2004/6638

Related Rulings/Determinations:

CR 2001/1

TR 92/1

TR 97/16

CR 2004/51

CR 2004/52

CR 2004/53

CR 2004/54

CR 2004/56

Legislative References:

ITAA 1936 6(1)

ITAA 1997 104-10

ITAA 1997 104-10(4)

ITAA 1997 104-10(5)(a)

ITAA 1997 108-5

ITAA 1997 109-5

ITAA 1997 109-5(2)

ITAA 1997 110-25

ITAA 1997 110-55

ITAA 1997 112-30

ITAA 1997 112-30(1)

ITAA 1997 116-20

Copyright Act 1968

TAA 1953 Pt IVAAA

| Date: | Version: | Change: | |

| You are here | 1 July 2004 | Original ruling | |

| 1 July 2005 | Withdrawn |