PAYG withholding and reporting obligations relating to remediation payments

Our commitment to you

This publication provides you with the following level of protection:

This publication provides you with the following level of protection:

We are committed to providing you with accurate, consistent and clear information to help you understand your rights and entitlements and meet your obligations. If you follow our information in this publication and it turns out to be incorrect, or it is misleading and you make a mistake as a result, we must still apply the law correctly. If that means you owe us money, we must ask you to pay it but we will not charge you a penalty. Also, if you acted reasonably and in good faith we will not charge you interest. If you make an honest mistake trying to follow our information in this publication and you owe us money as a result, we will not charge you a penalty. However, we will ask you to pay the money, and we may also charge you interest. If correcting the mistake means we owe you money, we will pay it to you. We will also pay you any interest you are entitled to. If you feel that this publication does not fully cover your circumstances, or you are unsure how it applies to you, you can seek further assistance from us. This publication was current at April 2021. |

This fact sheet contains information in relation to financial institutions making remediation payments to customers.

What are remediation payments?

Financial institutions undertake activities to review the services provided to customers where a systemic issue caused by misconduct or other compliance failure in relation to those services has been identified. Following these reviews, the financial institutions may make remediation payments to customers who have suffered a loss or detriment in order to place affected customers in the position they would have been in had the misconduct or other compliance failure not occurred.

The breadth and quantum of such payments have significantly increased as a result of the Final Report of the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry.

Remediation payments may include one or more of the following:

- •

- refund of fees for no service

- •

- refund of fees for deficient financial advice

- •

- payment of underpaid credit interest

- •

- refund of overcharged debit interest

- •

- compensation for increased interest costs for overcharged interest

- •

- refund of insurance premiums

- •

- compensation for loss of earnings

- •

- compensation for loss of portfolio value

- •

- amount representing inconvenience caused to customer

- •

- interest in relation to the delay of receiving one of the remediation payments identified above.

This fact sheet provides information in relation to the pay as you go (PAYG) withholding and reporting obligations for financial institutions arising from making remediation payments. Whilst the above is not an exhaustive list of all types of payments, the general principles discussed in this fact sheet would apply across other types of remediation payments that are similar in nature.

What are the PAYG withholding obligations for a financial institution when it makes a remediation payment to a customer and where they have a record that their customer's address is inside Australia?

To the extent the remediation payment relates to a Part VA investment, PAYG withholding is required to be made from the payment where the payment is income for the investor and they have not, by the time the payment is made:

- •

- quoted a tax file number (TFN) or Australian business number (ABN) in connection with their investment, or

- •

- informed the financial institution that they are exempt from quoting a TFN.

The requirement to withhold from the payment is subject to the usual PAYG withholding thresholds, however, it is not affected by:

- •

- how the remediation payment is made (for example, via cheque, paid to another account held by the customer with the financial institution or paid to an account held by the customer with another financial institution), or

- •

- whether the Part VA investment no longer exists, and the account has been closed.

→ For more information, see How do the PAYG withholding thresholds apply making remediation payments in this fact sheet.

In determining whether the payment relates to a Part VA investment, a financial institution should consider the circumstances that have given rise to the need to remediate.

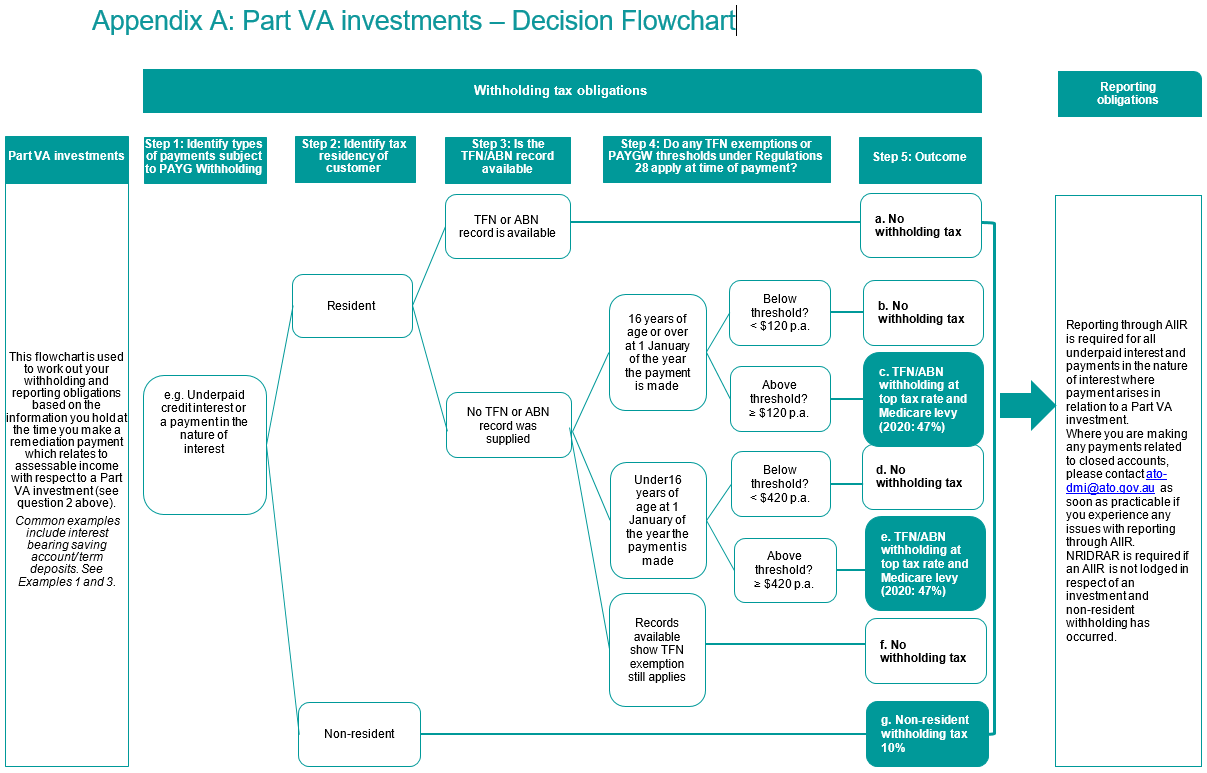

→ For information on the reporting obligations, see What information do financial institutions need to report to the ATO in relation to remediation payments? and the flowcharts in this fact sheet.

Example 1 - payment relates to a Part VA investment

During the 2014-15 income year, Sally invested $200,000 into a term deposit for one year at Bank A. Bank A miscalculated the interest rate and paid interest at a lower rate to Sally on maturity.

During the 2019-20 income year, Bank A realises the mistake and pays $1,675 to Sally, made up of the following amounts:

- •

- $1,500 for underpaid credit interest

- •

- $175 interest in relation to the delay in payment of the underpaid credit interest.

Sally is 40 years old and provided her TFN and an Australian address to Bank A at the time the account was opened. Bank A has retained details of her TFN and address.

The payment of both components of the remediation payment are made in relation to a Part VA investment, however, Bank A does not need to withhold tax on either amount as Sally has quoted her TFN in relation to the investment and Bank A has an address for Sally inside Australia at the time of payment.

Example 2 - payment does not relate to a Part VA investment

During the 2014-15 income year, Alex had a mortgage of $100,000 with Bank B. Based on the terms and conditions in the loan contract, the correct amount of interest Alex should have incurred for that income year was $4,000. Bank B, however, miscalculated the interest and charged Alex $4,200.

Alex refinanced his mortgage with another Bank, however, he still maintains an interest-bearing savings account with Bank B.

Bank B realised their mistake during the 2019-20 income year and pays $210 into Alex's saving account, made up of the following amounts:

- •

- $200 for overcharged debit interest

- •

- $10 interest in relation to the delay in rectifying the overcharged interest.

Alex has not quoted his TFN but he has notified Bank B of his address which is in Australia.

Bank B is not required to withhold an amount from the payment of $210. The payment is not made in respect to a Part VA investment. It is being paid in relation to overcharged interest on the mortgage.

What if the financial institution no longer has a record of whether the customer has quoted a TFN/ABN?

PAYG withholding is required based on the information held by the financial institution at the time of making the remediation payment. If the financial institution does not have a record that a customer quoted their TFN or ABN in connection with their Part VA investment, then an amount must be withheld on the basis that the customer did not quote their TFN or ABN. However, if the financial institution can contact the customer, they may provide them with an opportunity to quote their TFN (or ABN if applicable) prior to making the remediation payment.

Example 3 - payment relates to Part VA investment

During the 2009-10 income year, John invested $200,000 into a term deposit for one year at Bank C. Bank C miscalculated the interest rate and paid interest at a lower rate to John on maturity.

During the 2019-20 income year, Bank C pays $475 to John, made up of the following:

- •

- $430 for underpaid credit interest

- •

- $45 interest in relation to the delay in payment of the underpaid credit interest.

John is 55 years old and Bank C has a record of his address which is in Australia. However, John is no longer a customer of Bank C and the Bank no longer has a record of whether John quoted his TFN in relation to the investment.

Bank C needs to withhold tax at the highest marginal tax rate for individuals for the 2019-20 income year on both the $430 and $45.

How do the PAYG withholding thresholds apply when making remediation payments?

The thresholds under regulation 28 of Tax Administration Regulations 2017 apply to the payment where the requirements are met at the time of payment. This is because whether PAYG withholding is required is based on the information held by the financial institution at the time of making the payment.

Example 4 - thresholds

During the 2009-10 income year, Mary deposited $10,000 in an interest-bearing savings account for one year at Bank C. Bank C miscalculated the interest rate and paid interest at a lower rate to Mary. Bank C no longer has a record of whether Mary quoted her TFN in relation to the investment.

During the 2019-20 income year, Bank C pays $130 to Mary, made up of the following:

- •

- $125 for underpaid interest

- •

- $5 interest in relation to the delay in payment of the underpaid credit interest.

Mary is an Australian resident for tax purposes who was 15 years old in 2010.

The payment is above the relevant thresholds under regulation 28 because at the time of making the payment:

- •

- Mary is no longer aged under 16

- •

- the amount paid is greater than $120.

Accordingly, Bank C needs to withhold tax at the highest marginal tax rate for individuals for the 2019-20 income year on both the $125 and $5.

What are the PAYG withholding obligations for a financial institution if it makes a remediation payment to a customer and where they have a record that their customer's address is outside of Australia?

Australian financial institutions are generally required to withhold from interest payments that are made to their customers who are not Australian residents. Interest payments include payments that are in the nature of interest.

PAYG withholding will be required when a remediation payment is interest and is made to a customer where the financial institution has a record that the customer's address is outside of Australia.

Example 5 - interest withholding tax

We refer to the same scenario given at Example 3. If John had given Bank C an address outside of Australia in that example, Bank C would be required to withhold in relation to both components that made up the payment of $475.

Example 6 - interest withholding tax

We refer to the same scenario given at Example 2. If Alex had given Bank B an address outside of Australia in that example, Bank B would be required to withhold in relation to the interest for the delay in rectifying the overcharged interest.

→ See also: https://www.ato.gov.au/Business/International-tax-for-business/Payments-to-foreign-residents/

What information do financial institutions need to report to the ATO in relation to remediation payments?

Financial institutions are required to lodge an Annual Investment Income Report (AIIR) if any of the following occur:

- •

- the amount of income paid or credited to an investment is $1 or more and the total number of investments accepted by the investment body during the year is 10 or more

- •

- an amount has been withheld from an investment because a TFN, ABN, or exemption was not quoted

- •

- the investment is a farm management deposit.

A PAYG withholding from interest, dividend and royalty payments paid to non-residents annual report (NRIDRAR) is required if an AIIR is not lodged in respect of an investment and non-resident withholding has occurred.

The ATO uses the information provided by third parties, including financial institutions, to make it easier for taxpayers to comply with their tax obligations by offering pre-fill for certain labels in their tax return and for compliance action.

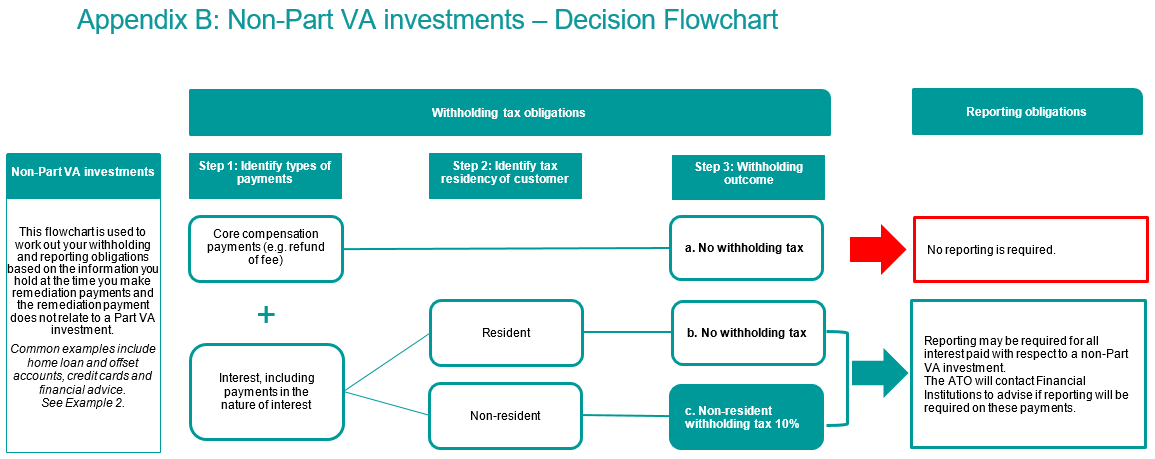

Please note that reporting is required for all interest including payments in the nature of interest paid with respect to a Part VA investment. Reporting may be required in relation to payments in the nature of interest with respect to non-Part VA investments.

→ For more information, see Appendix B of this fact sheet.

If a financial institution has any difficulties in reporting any amounts to the ATO, please email ato-dmi@ato.gov.au

→ See also:

- https://www.ato.gov.au/business/third-party-reporting/annual-investment-income-report/

- https://www.ato.gov.au/Individuals/Income-and-deductions/In-detail/Compensation-payments/Compensation-paid-from-financial-institutions/

How can financial institutions provide certainty for their customers in relation to their tax outcome?

It is important that financial institutions provide their customers with an itemised breakdown of the components to any remediation payments. This information will assist customers to understand the nature of the payment and facilitate compliance with their taxation obligations.

Public guidance

You can also refer customers to the following available resources:

- •

- TFN and ABN information for savings accounts and investments

- •

- Compensation paid from financial institutions

- •

- Fee for no service to super funds

- •

- Refund of overcharged insurance premiums to superfunds

- •

- Fee for deficient advice to superfunds

© AUSTRALIAN TAXATION OFFICE FOR THE COMMONWEALTH OF AUSTRALIA

You are free to copy, adapt, modify, transmit and distribute this material as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).

Date of publication: 9 April 2021