Class Ruling

CR 2004/51

Income tax: Westfield America Trust - Westfield Group merger stapling arrangement

This version is no longer current. Please follow this link to view the current version. |

-

Please note that the PDF version is the authorised version of this ruling.This document incorporates revisions made since original publication. View its history and amending notices, if applicable.

FOI status:

may be released| What this Class Ruling is about | |

| Date of effect | |

| Withdrawal | |

| Arrangement | |

| Ruling | |

| Explanation | |

| Detailed contents list | |

| Glossary of Terms | |

| Westfield Stapled Group |

| Preamble |

| The number, subject heading, What this Class Ruling is about (including Tax law(s), Class of persons and Qualifications sections), Date of effect, Withdrawal, Arrangement and Ruling parts of this document are a 'public ruling' in terms of Part IVAAA of the Taxation Administration Act 1953. CR 2001/1 explains Class Rulings and Taxation Rulings TR 92/1 and TR 97/16 together explain when a Ruling is a 'public ruling' and how it is binding on the Commissioner. |

What this Class Ruling is about

1. This Ruling sets out the Commissioner's opinion on the way in which the 'tax law(s)' identified below apply to the defined class of persons, who take part in the arrangement to which this Ruling relates.

Tax law(s)

2. The tax laws dealt with in this Ruling are:

- •

- subsection 6(1) of the Income Tax Assessment Act 1936 (ITAA 1936);

- •

- subsection 95(1) of the ITAA 1936;

- •

- Division 104 of the Income Tax Assessment Act 1997 (ITAA 1997);

- •

- section 104-70 of the ITAA 1997;

- •

- section 104-155 of the ITAA 1997;

- •

- section 109-5 of the ITAA 1997;

- •

- section 109-10 of the ITAA 1997;

- •

- section 110-25 of the ITAA 1997;

- •

- section 110-55 of the ITAA 1997;

- •

- section 112-25 of the ITAA 1997;

- •

- Division 725 of the ITAA 1997;

- •

- section 725-50 of the ITAA 1997;

- •

- section 725-55 of the ITAA 1997;

- •

- Subdivision 727-E of the ITAA 1997; and

- •

- section 727-360 of the ITAA 1997.

Class of persons

3. The class of persons to which this Ruling applies are those owners of ordinary units (original WFA units) in Westfield America Trust (WFA) who:

- •

- participate in the arrangement that is the subject of this Ruling;

- •

- hold their original WFA units on capital account; and

- •

- are residents of Australia within the meaning of that term in subsection 6(1) of the ITAA 1936.

Qualifications

4. The Commissioner makes this Ruling based on the precise arrangement identified in this Ruling.

5. The class of persons defined in this Ruling may rely on its contents provided the arrangement actually carried out is carried out in accordance with the arrangement described in paragraphs 10 to 18.

6. If the arrangement actually carried out is materially different from the arrangement that is described in this Ruling, then:

- •

- this Ruling has no binding effect on the Commissioner because the arrangement entered into is not the arrangement on which the Commissioner has ruled; and

- •

- this Ruling may be withdrawn or modified.

7. This work is copyright. Apart from any use as permitted under the Copyright Act 1968, no part may be reproduced by any process without prior written permission from the Commonwealth. Requests and inquiries concerning reproduction and rights should be addressed to:

- Commonwealth Copyright Administration

- Intellectual Property Branch

- Department of Communications, Information Technology and the Arts

- GPO Box 2154

- CANBERRA ACT 2601

- or by e-mail to: commonwealth.copyright@dcita.gov.au

Date of effect

8. This Ruling applies to the income year ending 30 June 2005. The arrangement will be completed within that income year.

Withdrawal

9. This Ruling is withdrawn and ceases to have effect after 30 June 2005. The Ruling continues to apply, in respect of the tax laws ruled upon, to all persons within the specified class who enter into the arrangement during the term of the Ruling.

Arrangement

10. The Arrangement that is the subject of the Ruling is described below. This description is based on the documents identified below. These documents, or the relevant parts of them, form part of and are to be read with this description. The relevant documents or parts of documents incorporated into this description of the arrangement are:

- •

- Class Ruling request from Greenwoods & Freehills dated 24 February 2004;

- •

- amendments to Class Ruling from Greenwoods & Freehills dated 8 April 2004 and 29 April 2004;

- •

- draft Westfield Group stapling deed, and modified deed;

- •

- draft deed poll (undated);

- •

- draft Explanatory Memorandum in relation to a proposal to staple the shares of Westfield Holdings Limited (WSF) and the units of Westfield Trust (WFT) and WFA from Mallesons Stephen Jaques;

- •

- draft Implementation Deed dated 20 April 2004;

- •

- ASIC briefing note on Westfield Group restructure prepared by Mallesons Stephen Jaques dated 15 April 2004;

- •

- draft WFA Special notice about the sale facility dated 13 May 2004;

- •

- draft Westfield Group Merger - WFA overview dated 20 May 2004;

- •

- notes of meetings between ATO, Greenwoods & Freehills and Speed & Stracey from 8 April 2004 to date; and

- •

- e-mails from Greenwoods & Freehills from 19 February to date.

Note 1: certain information has been provided on a commercial-in-confidence basis and will not be disclosed or released under the Freedom of Information legislation.

Note 2: certain terms used in this Ruling are defined and explained in the Glossary of terms, at Appendix A.

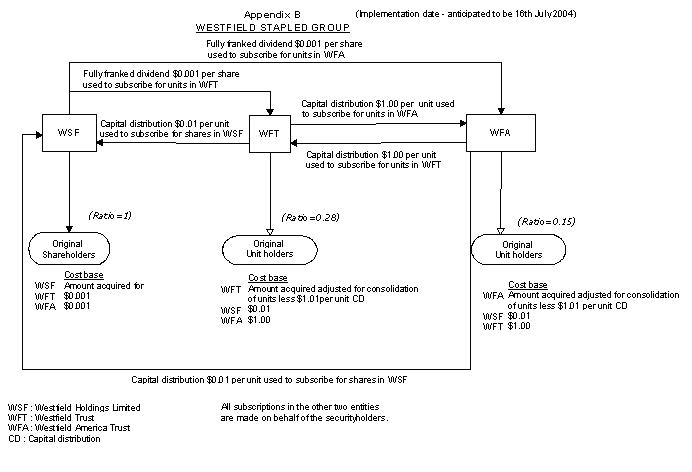

Note 3: the dates presently contemplated for the events described below are set out in the diagram at Appendix B.

11. On 22 April 2004, WSF announced that it would merge with WFT and WFA. The merger is to be achieved by means of a scheme of arrangement between WSF and its shareholders and by amendment of the constitutions of WSF, WFT and WFA, resulting in the issue of securities of each entity to investors in each other entity. The securities will be stapled to form a Westfield Group stapled security.

12. The merger ratios determine the entitlement of existing share and unit holders to Westfield Group stapled securities and are as follows:

| Entity | Merger Ratio | No. of Westfield Group stapled securities per 1,000 existing securities |

|---|---|---|

| WSF | 1.00 | 1,000 |

| WFT | 0.28 | 280 |

| WFA | 0.15 | 150 |

13. In order for the merger to proceed, five key steps must be completed:

| Step 1 | Approval by WSF shareholders of the share scheme resolution |

| Step 2 | Approval by WSF shareholders of the general resolutions |

| Step 3 | Approval of the WFT resolutions at a meeting of WFT members |

| Step 4 | Approval of the WFA resolutions at a meeting of WFA members |

| Step 5 | Approval by the Court of the share scheme and lodgment of the share scheme order with ASIC |

14. The arrangement that is the subject of this Ruling is referred to as the stapling arrangement. It is separate from the sale facility arrangement which is the subject of a separate class ruling (CR 2004/54).

Stapling arrangement

15. The stapling arrangement, as it relates to WFA unitholders on the stapling record date, consists of the following steps:

- •

- the consolidation of original WFA units in the ratio of 0.15 consolidated WFA units for each original WFA unit that is held by a unitholder at that time with the total holding being rounded up to the next whole number of consolidated WFA units;

- •

- the payment of a capital distribution of $1.01 for each consolidated WFA unit;

- •

- the application of the payment by WFA on behalf of each unitholder to subscribe for one new unit in WFT (new WFT unit) for $1.00 and one new share in WSF (new WSF share) for $0.01; and

- •

- the stapling of one new WFT unit and one new WSF share to each consolidated WFA unit to form a Westfield Group stapled security which will be offered for listing on the Australian Stock Exchange.

16. All of these steps will take place on the implementation date for the scheme. It is presently contemplated that the stapling record date will be 12 July 2004 and the implementation date 16 July 2004.

17. The stapling will take place in accordance with the stapling deed. The effect of the deed is to impose restrictions on the transferability of the individual securities comprising the stapled security. Each individual security (that is, consolidated WFA unit, new WFT unit and new WSF share) will retain its legal character. There will be no variation to the rights or obligations attaching to, or to the beneficial ownership of, the individual securities comprising the Westfield Group stapled security as a consequence of stapling.

Internalised Management

18. Once the arrangement is carried into effect, further development of property to be held by WFT or WFA primarily for the purpose of deriving rent may be carried out by the trusts themselves, assuming corresponding development risks, and so internalising the management of such developments. WFT or WFA may also manage the letting of their own properties for rent, assuming corresponding risks, and so internalising the management of such operations. No such changes of operation by WFT or WFA will have the effect of diverting any other trading business income to the trusts, or of conveying control over any activities producing such trading business income to the trusts.

Ruling

Consolidation of original WFA units

19. The consolidation of original WFA units will not result in a CGT event happening. Each unitholder will be taken to have a cost base and reduced cost base for their consolidated WFA units based on the cost base and reduced cost base of the original WFA units and which reflects the merger ratio for the consolidation of the units (subsection 112-25(4) of the ITAA 1997).

Capital distribution

20. The capital distribution to the holders of consolidated WFA units will result in CGT event E4 in section 104-70 of the ITAA 1997 happening to each of their consolidated WFA units.

21. The consequences for each WFA unitholder will depend upon the cost base of each of their consolidated WFA units and other non-assessable payments made by WFA during the income year.

Issue of new shares and units

22. The first element of the cost base and reduced cost base of:

- •

- each new WFT unit acquired under the arrangement will be $1.00; and

- •

- each new WSF share acquired under the arrangement will be $0.01;

(sections 110-25 and 110-55 of the ITAA 1997).

23. Each new WFT unit and new WSF share will be acquired at the time they are issued on the implementation date (section 109-10 of the ITAA 1997).

24. The issue of new WFT units and new WSF shares will not result in CGT event H2 in section 104-155 of the ITAA 1997 happening to WFA unitholders.

25. The issue of new WFA units to stapling record date holders of WSF shares and WFT units will not have any direct value shifting consequences for WFA unitholders because section 725-50 of the ITAA 1997 is not satisfied.

Stapling of securities

26. No CGT event in Division 104 of the ITAA 1997 will happen as a result of the stapling of each consolidated WFA unit to a new WFT unit and a new WSF share.

Explanation

Consolidation of original WFA units

27. Subsection 112-25(4) of the ITAA 1997 provides that, if two or more CGT assets are merged into a single asset where the beneficial ownership of the old and new assets remains the same, the merger does not result in the happening of a CGT event. It also provides that each element of the cost base and reduced cost base of the new asset (at the time of merging) is the sum of the corresponding elements of each original asset.

28. Accordingly, the consolidation of original WFA units will not result in a CGT event happening to unitholders.

29. Each WFA unitholder will be taken to have a cost base and reduced cost base for their consolidated WFA units based on the cost base and reduced cost base of their original WFA units and which reflects the merger ratio (0.15).

30. Subsection 109-5(1) of the ITAA 1997 generally provides that a CGT asset is acquired when it commences to be owned.

31. If one or more consolidated WFA units can be formed from a parcel of original WFA units that all have the same acquisition date, the WFA unitholder will be taken to have acquired those consolidated WFA units on the date of acquisition of the original WFA units. Where a fraction of a unit is on consolidation rounded up to a whole number that part rounded up will be taken to have been acquired on the earliest acquisition date of the original WFA units held by the unitholder.

Capital distribution

32. Under section 104-70 of the ITAA 1997, CGT event E4 happens if the trustee of a trust makes a payment to a unitholder in respect of their unit in the trust and some or all of the payment is not included in the unitholder's assessable income.

33. The consequences of CGT event E4 happening are determined on an annual basis, that is, having regard to all such CGT events that happen to a unit during an income year.

34. If CGT event E4 happens during an income year, a unitholder will make a capital gain if the total of the non-assessable payments made by the trustee during the income year in relation to a unit exceeds the cost base of the unit.

35. However if the sum of the non-assessable payments is not more than the cost base of the unit the cost base and reduced cost base are reduced.

36. The distribution to be paid by WFA on the implementation date of $1.01 per consolidated WFA unit will not be included in the assessable income of the WFA unitholder. Therefore, the distribution by WFA under the stapling arrangement will result in CGT event E4 happening to each consolidated WFA unit.

37. Accordingly, the cost base and reduced cost base of each consolidated WFA unit will be reduced by $1.01. A unitholder whose cost base for each consolidated WFA unit is less than $1.01 will make a capital gain to the extent of the difference.

Issue of shares and units

38. Sections 110-25 and 110-55 of the ITAA 1997 provide that the first element of the cost base and reduced cost base, respectively, of a CGT asset is the money paid in respect of its acquisition.

39. Owners of consolidated WFA units will be taken to have paid $1.00 for each new WFT unit and $0.01 for each new WSF share (as a result of that amount being applied by WFA on the unitholder's behalf).

40. Accordingly, the first element of the cost base and reduced cost base of each new WFT unit will be $1.00 and each new WSF share will be $0.01.

41. If a company issues or allots equity interests or a trustee issues units in circumstances where no contract is entered into in respect of the acquisition, the equity interest and units are taken to have been acquired at the time of issue or allotment (Items 2 and 3 in the table in section 109-10 of the ITAA 1997).

42. Accordingly, an owner of a consolidated WFA unit will be taken to have acquired each new WFT unit and new WSF share at the time they are issued on the implementation date.

CGT event H2

43. CGT event H2 in section 104-155 of the ITAA 1997 happens if:

- •

- an act, transaction or event occurs in relation to a CGT asset owned by a taxpayer; and

- •

- the act, transaction or event does not result in an adjustment being made to the asset's cost base or reduced cost base.

44. As the act, transaction or event that occurs under the arrangement in relation to the consolidated WFA units results in a reduction in the cost base for owners of those units, CGT event H2 will not happen.

Application of Division 725

45. Division 725 of the ITAA 1997 may apply where there is a direct value shift under a scheme involving equity interests in an entity. For Division 725 to have consequences, paragraph 725-50(b) requires, amongst other things, that the 'controlling entity test' be satisfied.

46. The 'controlling entity test' is satisfied for value shifting purposes, if, an entity (the controller) controls the target entity at some time during the period starting when the scheme is entered into and ending when the scheme has been carried out.

47. Subdivision 727-E of the ITAA 1997 sets out the circumstances in which an entity will be regarded as controlling another entity for value shifting purposes.

- •

- all of the documents and any other material referred to in paragraph 10 of this Ruling; and

- •

- all of the facts comprising the arrangement as described in paragraphs 10 to 18 of this Ruling,

it is considered that, for the purposes of section 727-360 of the ITAA 1997, WFA is a fixed trust for the period starting when the scheme is entered into and ending when it is carried out.

49. As a fixed trust, section 727-360 of the ITAA 1997 contains the relevant tests for whether an entity controls WFA for value shifting purposes. On the basis of the information provided regarding the beneficial ownership of WFA it is considered that there is no entity that would be regarded as controlling WFA for value shifting purposes under the tests in section 727-360 during this period.

50. Therefore, as the threshold requirement in paragraph 725-50(b) of the ITAA 1997 is not satisfied, Division 725 can have no consequences for the WFA unitholders in respect of the arrangement.

Stapling of securities

51. The effect of stapling is to apply restrictions to the transferability of the individual securities that together make up the Westfield Group stapled security. Each individual security (that is, consolidated WFA unit, new WFT unit and new WSF share) will retain its legal character. There will be no variation to the rights or obligations attaching to, or to the beneficial ownership of, the individual securities that make up the Westfield Group stapled security as a consequence of stapling.

52. Therefore, no CGT event in Division 104 of the ITAA 1997 happens as a consequence of the stapling of each consolidated WFA unit to each new WFT unit and new WSF share.

Detailed contents list

53. Below is a detailed contents list for this Class Ruling:

| Paragraph | |

|---|---|

| What this Class Ruling is about | 1 |

| Tax law(s) | 2 |

| Class of persons | 3 |

| Qualifications | 4 |

| Date of effect | 8 |

| Withdrawal | 9 |

| Arrangement | 10 |

| Stapling arrangement | 15 |

| Internalised Management | 18 |

| Ruling | 19 |

| Consolidation of original WFA units | 19 |

| Capital distribution | 20 |

| Issue of new shares and units | 21 |

| Stapling of securities | 26 |

| Explanation | 27 |

| Consolidation of original WFA units | 27 |

| Capital distribution | 32 |

| Issue of shares and units | 38 |

| CGT event H2 | 43 |

| Application of Division 725 | 45 |

| Stapling of securities | 51 |

| Detailed contents list | 53 |

Commissioner of Taxation

2 June 2004

Appendix A

Glossary of Terms

| Ruling Terminology | Meaning |

|---|---|

| Certain terms used in this Ruling have the same meaning as corresponding terms in The Westfield Group Merger Explanatory Memorandum and sales facility notices in relation to a proposal to staple the shares of WSF and the units of WFT and WFA | |

| effective date | Effective Date |

| implementation date | Implementation Date |

| original WFA unit | Existing WFA Unit |

| share scheme | Share Scheme |

| stapling record date | Stapling Record Date |

| Westfield Group stapled security | Stapled Security |

| Other terms used in this ruling have the following meaning | |

| consolidated WFA unit | a Restructured WFA Unit, as that term is used in the explanatory memorandum, that a unitholder owns immediately after the time when their existing WFA units are merged on the implementation date |

| new WFT unit | A WFT unit issued to an existing owner of a consolidated WFA unit on the implementation date |

| new WSF share | A WSF share issued to an existing owner of a consolidated WFA unit on the implementation date |

Appendix B

Not previously released as a draft.

References

ATO references:

NO 2004/6625

Related Rulings/Determinations:

CR 2001/1

TR 92/1

TR 97/16

CR 2004/52

CR 2004/53

CR 2004/54

CR 2004/55

CR 2004/56

Legislative References:

ITAA 1936 6(1)

ITAA 1936 95(1)

ITAA 1997 Div 104

ITAA 1997 104-70

ITAA 1997 104-155

ITAA 1997 109-5

ITAA 1997 109-5(1)

ITAA 1997 109-10

ITAA 1997 110-25

ITAA 1997 110-55

ITAA 1997 112-25

ITAA 1997 112-25(4)

ITAA 1997 Div 725

ITAA 1997 725-50

ITAA 1997 725-50(b)

ITAA 1997 725-55

ITAA 1997 Subdiv 727-E

ITAA 1997 727-360

Copyright Act 1968

TAA 1953 Pt IVAAA

| Date: | Version: | Change: | |

| You are here | 1 July 2004 | Original ruling | |

| 1 July 2005 | Withdrawn |

Copyright notice

© Australian Taxation Office for the Commonwealth of Australia

You are free to copy, adapt, modify, transmit and distribute material on this website as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).