Practical Compliance Guideline

PCG 2017/13

Division 7A - unpaid present entitlements under sub-trust arrangements maturing in the 2017, 2018, 2019 or 2020 income years

This version is no longer current. Please follow this link to view the current version. |

-

This document incorporates revisions made since original publication. View its history and amending notices, if applicable.

| Table of Contents | Paragraph |

|---|---|

| What this Guideline is about | |

| When this Guideline applies | |

| Background - Division 7A and UPEs | |

| Administrative guidance in PS LA 2010/4 | |

| Obligation to repay the principal of the loan, entered into under investment Option 1, is not met at the end of the loan term in the 2017, 2018, 2019 or 2020 income year | |

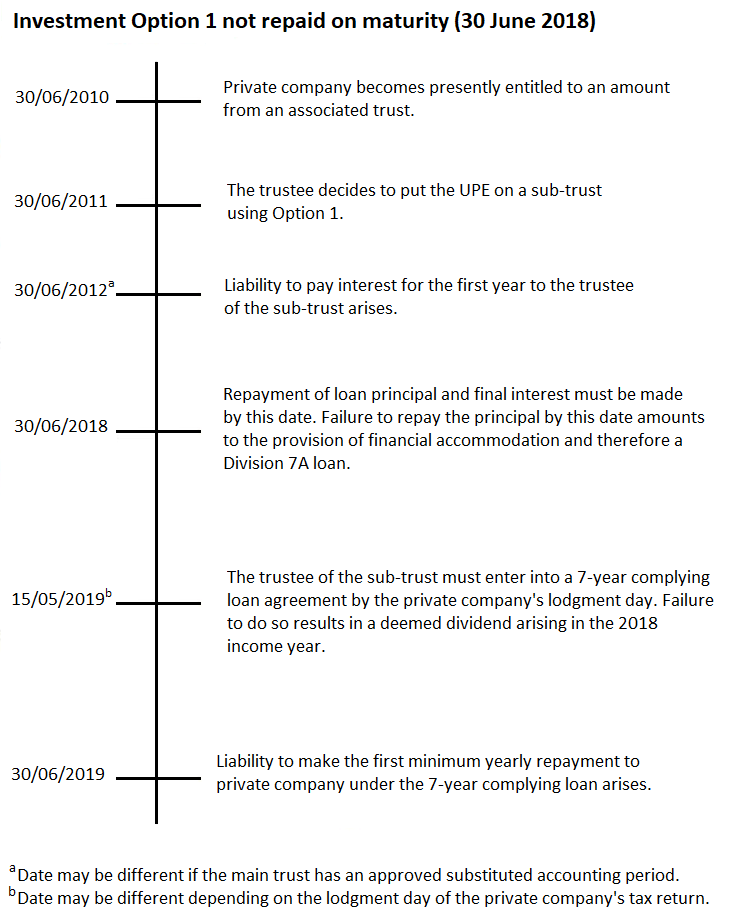

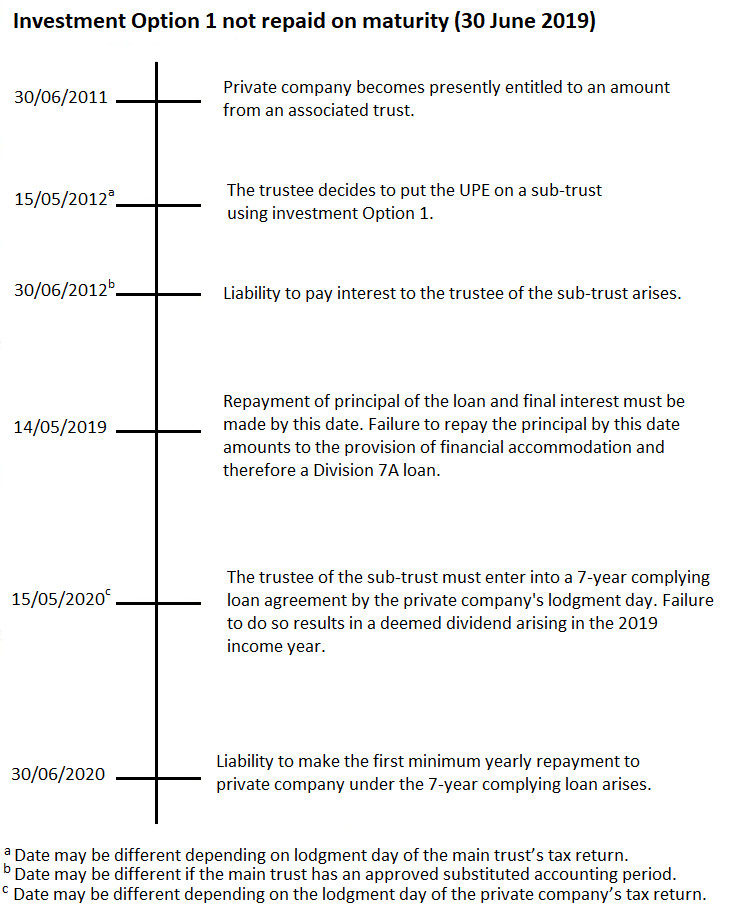

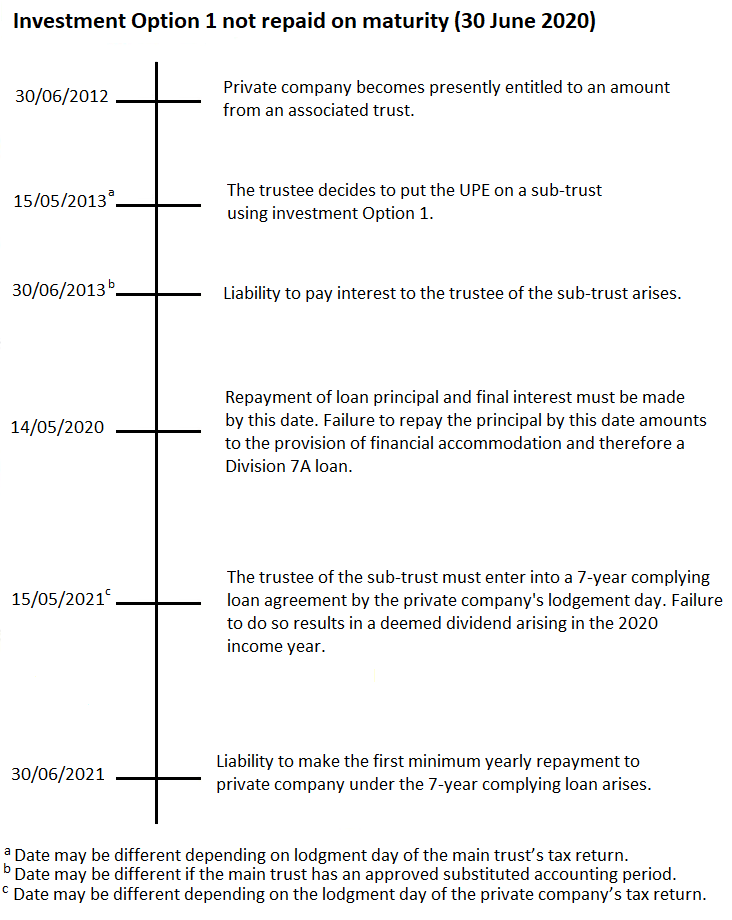

| Application of section 109R to complying loans entered into after maturity of sub-trust arrangements |

|

Relying on this Guideline

This Practical Compliance Guideline sets out a practical administration approach to assist taxpayers in complying with relevant tax laws. Provided you follow this guideline in good faith, the Commissioner will administer the law in accordance with this approach. |

1. This Guideline applies to a private company (or trustee[1]) beneficiary of a trust and sub-trust where the trustee:

- •

- has, in accordance with Law Administration Practice Statement PS LA 2010/4 Division 7A: trust entitlements, validly adopted investment Option 1[2] on, or before, 30 June 2013 to place funds representing an unpaid present entitlement (UPE) under a sub-trust arrangement on a 7-year interest only loan with the main trust, and

- •

- does not repay the principal of the loan when it matures in the 2017[3], 2018, 2019 or 2020 income year.

2. This Guideline only applies where a UPE has been dealt with in accordance with investment Option 1 as described in paragraph 1 of this Guideline and the repayment of the principal of the loan is required to be made in the 2017, 2018, 2019 or 2020 income year.

Background - Division 7A and UPEs

3. Division 7A of Part III of the Income Tax Assessment Act 1936[4] (Division 7A) contains integrity provisions that aim to prevent tax-free distributions of private company profits to shareholders and their associates.

4. Broadly speaking, it does this by deeming a private company to have paid a dividend[5] to a shareholder, or shareholder's associate, if it makes a loan to the shareholder or associate and that loan is not repaid in full or put on complying terms[6] before the private company's lodgment day.[7]

5. For the purposes of Division 7A, a 'loan' includes the provision of credit or any other form of financial accommodation.[8]

6. Taxation Ruling TR 2010/3 Income tax: Division 7A loans: trust entitlements explains the Commissioner's view of how Division 7A applies where a private company beneficiary has, or had, a present entitlement to an amount of income from an associated trust that is part of the same family group as the private company.

7. Relevantly, TR 2010/3 states that a UPE, that has not been satisfied from a trust to a private company beneficiary in the same family group, is the provision of financial accommodation and therefore a 'loan' where:

- (a)

- the trustee continues to use the funds representing the UPE for trust purposes, and

- (b)

- the company does not call for either payment of the UPE or the investment of the funds for the company's sole benefit (rather than their use for the benefit of the trust).[9]

Administrative guidance in PS LA 2010/4

8. PS LA 2010/4 provides guidance on the administrative aspects of TR 2010/3 including where the UPE funds remain intermingled with funds of the trust but are claimed to be held on sub-trust for the sole benefit of the private company beneficiary.

9. PS LA 2010/4 states that the Commissioner will consider that the UPE funds in the sub-trust are held for the sole benefit of the private company beneficiary if they are lent to the main trust under a 7-year interest only loan with the principal of the loan repayable at the end of the 7-year interest only loan (investment Option 1).[10]

10. A trustee adopting investment Option 1 must document the terms of the investment agreement and the investment agreement must be legally binding. The terms of the investment must include the obligation to repay the principal of the loan at the end of the term.[11]

Obligation to repay the principal of the loan, entered into under investment Option 1, is not met at the end of the loan term in the 2017, 2018, 2019 or 2020 income year

11. Those trustees who adopted investment Option 1 on, or before, 30 June 2013[12] will, under the terms of the investment agreement, be obligated to repay the principal of the loan in the 2017 income year, 2018 income year, 2019 income year or 2020 income year. PS LA 2010/4 makes it clear that to comply with investment Option 1, the trustee must actually repay the principal of the loan at the end of the loan term and meet this term of the investment agreement.[13]

12. The Commissioner maintains the clear expectation that this term of the investment agreement be met and that the principal of the loan, entered into under investment Option 1, must be repaid at the end of the loan term.

13. If the trustee fails to meet this term of the investment agreement, when an investment Option 1 matures in the 2017, 2018, 2019 or 2020 income year, any unpaid principal of the loan will be treated by the Commissioner as the provision of financial accommodation and therefore a Division 7A loan.

14. If all, or part, of the principal of the loan is not repaid on or before the date of maturity, the Commissioner will accept that a 7-year loan on complying terms in accordance with section 109N may be put in place between the sub-trust and the private company beneficiary prior to the private company's lodgment day. This will provide a further period for the amount to be repaid with periodic payments of both principal and interest.

15. However, if such a 7-year loan on complying terms in accordance with section 109N is not put in place between the sub-trust and the private company beneficiary prior to the private company's lodgment day, a deemed dividend will arise at the end of the income year in which the loan matures.

16. The three following timelines outline the key dates of which the relevant parties to sub-trust arrangements under this Guideline where the investment Option 1 is not repaid on 30 June 2018, 30 June 2019 or on 30 June 2020 must take note.

17. The Commissioner will not accept that the rolling over of all or part of the investment Option 1 that is not repaid into a further investment option described in PS LA 2010/4 will prevent the provision of financial accommodation to which Division 7A may apply. Consequently, the approach in PS LA 2010/4 will cease in respect of existing (original) sub-trust arrangements at the time the investment Option 1 matures.

18. Where the facts and circumstances indicate that there has never been an intention to repay the principal of loan at the end of the 7-year interest only loan, the sub-trust arrangement was not entered into in accordance with PS LA 2010/4 and this may lead the Commissioner to consider that the purported arrangement was a sham, and/or that there was fraud or evasion. In these circumstances, the Commissioner may go back beyond the standard period of review[14] and deem a dividend in the income year in which the provision of financial accommodation originally arose.

Application of section 109R to complying loans entered into after maturity of sub-trust arrangements

19. Section 109R can apply in some circumstances to not treat a payment as a repayment of a loan for Division 7A purposes.

20. The Commissioner will not seek to apply section 109R to the principal of a loan under a sub-trust arrangement that is not repaid and is the subject of a 7-year loan on complying terms under section 109N in accordance with this Guideline.

Commissioner of Taxation

19 July 2017

Amendment history

| Date of amendment | Part | Comment |

|---|---|---|

| 27 June 2019 | Paragraphs 1, 2, 11, 13 and 16. | These amendments extend the application of this Guideline to sub trust arrangements maturing in the 2020 income year. |

| 15 August 2018 | Paragraphs 1, 2, 11, 13 and 16. Additional timeline added at paragraph 16. | These amendments extend the application of this Guideline to sub trust arrangements maturing in the 2019 income year. |

© AUSTRALIAN TAXATION OFFICE FOR THE COMMONWEALTH OF AUSTRALIA

You are free to copy, adapt, modify, transmit and distribute this material as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).

It is acknowledged that sub-trust arrangements may be entered into as a result of an unpaid present entitlement (UPE) between a trust and a private company, as well as a UPE that arises between two trusts. The latter is addressed in paragraphs 117 and 118 of PS LA 2010/4. Any reference in this Guideline to a private company beneficiary should also include a reference to a trustee beneficiary who has validly adopted investment Option 1 in accordance with PS LA 2010/4.

See paragraphs 62 to 73 of PS LA 2010/4.

It is likely that those using investment Option 1 for UPE's arising between 16 December 2009 and 30 June 2010 will have entered into the sub-trust arrangement in the 2011 income year and, therefore, the principal of the loan will not be due to be repaid until sometime in the 2018 income year. However, the Commissioner has been made aware that some private companies entered into the sub-trust arrangement in the 2010 income year and, therefore, the principal of the loan will be due to be repaid in the 2017 income year.

All legislative references in this Guideline are to the Income Tax Assessment Act 1936 (ITAA 1936).

Section 109D.

Section 109N contains the requirements for a loan to be on complying terms for the purposes of Division 7A.

'Lodgment day' is defined in subsection 109D(6) to mean the earlier of the due or actual date of lodgment of the private company's return of income for the year of income.

Subsection 109D(3).

See paragraphs 19 to 26 of TR 2010/3.

See paragraph 58 of PS LA 2010/4. Alternatively, the funds may be lent to the main trust under:

- •

- an interest only 10-year loan with the UPE repayable at the end of the 10-year loan (Option 2), or

- •

- an investment in a specific income producing asset or investment with the UPE repayable upon the disposal of the asset or investment (Option 3).

See paragraphs 64 and 65 of PS LA 2010/4.

For a UPE arising between 16 December 2009 and 30 June 2010, the trustee had until 30 June 2011 to place the funds on sub-trust (see paragraph 47 of PS LA 2010/4).

See the table in paragraph 61 of PS LA 2010/4.

See section 170 which provides the period within which the Commissioner may amend an assessment. Item 5 of the table in subsection 170(1) states that the Commissioner can amend an assessment at any time where he or she is of the opinion that there has been fraud or evasion.

Related Rulings/Determinations:

TR 2010/3

Legislative References:

ITAA 1936

ITAA 1936 109D

ITAA 1936 109D(3)

ITAA 1936 109D(6)

ITAA 1936 109N

ITAA 1936 109R

Other References:

PS LA 2010/4

| Date: | Version: | Change: | |

| 19 July 2017 | Original guideline | ||

| 15 August 2018 | Updated guideline | ||

| You are here | 27 June 2019 | Updated guideline | |

| 30 June 2021 | Updated guideline | ||

| 7 June 2022 | Updated guideline | ||

| 10 August 2022 | Updated guideline |

Copyright notice

© Australian Taxation Office for the Commonwealth of Australia

You are free to copy, adapt, modify, transmit and distribute material on this website as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).