Draft Practical Compliance Guideline

PCG 2021/D4 (Finalised)

Intangibles Arrangements

-

This draft was re-released as PCG 2023/D2 Intangibles Arrangements on 17 May 2023 for further consultation.There is a Compendium for this document: PCG 2024/1EC .This document has been finalised.

| Table of Contents | Paragraph |

|---|---|

| What this draft Guideline is about | |

| Structure of this Guideline | |

| Date of effect | |

| PART ONE - OUR COMPLIANCE APPROACH | |

| The ATO's role and compliance approach | |

| Reporting your self-assessment | |

| Evidencing your self-assessment | |

| PART TWO - OUR RISK ASSESSMENT FRAMEWORK | |

| Documents and Evidence Expectations | |

| Understanding and evidencing the commercial considerations and your business decision | |

| Understanding the legal form of your Intangibles Arrangements | |

| Legal agreements | |

| Guidelines, manuals, policies and governance-like documents | |

| Transfer pricing documentation | |

| Country-by-Country reporting documentation | |

| Identifying and evidencing the intangible assets and connected development, enhancement, maintenance, protection and exploitation activities | |

| Identifying intangible assets | |

| Identifying development, enhancement, maintenance, protection and exploitation activities | |

| Evidencing intangible assets and development, enhancement, maintenance, protection and exploitation activities | |

| Analysing the tax and profit outcomes of your Intangibles Arrangements | |

| Simplified record keeping | |

| APPENDIX 1 - Risk Factors | |

| APPENDIX 2 - Risk Factor E - Examples of Arrangements | |

| Example 1 - centralisation of intangible assets - high risk | |

| Example 2 - bifurcation of intangible assets - high risk | |

| Example 3 - non-recognition of Australian intangible assets and DEMPE activities - high risk | |

| Example 4 - migration of pre-commercialised intangible assets - high risk | |

| Example 5 - non-arm's length licence arrangements - high risk | |

| Example 6 - centralisation of intangible assets - medium risk | |

| Example 7 - transfer of rights to intangible assets under a licence agreement - medium risk | |

| Example 8 - contract research and development arrangement - medium risk | |

| Example 9 - cost contribution arrangement - medium risk | |

| Example 10 - centralisation of intangible assets - low risk | |

| Example 11 - contract research and development arrangement - low risk | |

| Example 12 - cost contribution arrangement - low risk | |

| Your comments |

|

Relying on this draft Guideline

This Practical Compliance Guideline is a draft for consultation purposes only. When the final Guideline issues, it will have the following preamble: This Practical Compliance Guideline sets out a practical administration approach to assist taxpayers in complying with relevant tax laws. Provided you follow this Guideline in good faith, the Commissioner will administer the law in accordance with this approach. |

What this draft Guideline is about

1. This draft Guideline[1] sets out our compliance approach to international arrangements connected with the development, enhancement, maintenance, protection and exploitation (DEMPE) of intangible assets[2] and/or involving a migration of intangible assets. A 'migration' refers to any transaction or transactions that allows an offshore party to access, hold, use, transfer, or obtain benefits in connection with intangible assets and/or associated rights. These arrangements are collectively referred to as 'Intangibles Arrangements' in this Guideline

2. This Guideline applies to Intangibles Arrangements and focuses on tax risks associated with the potential application of the transfer pricing provisions.[3] It also focuses on other tax risks that may be associated with Intangibles Arrangements, specifically the withholding tax provisions[4], capital gains tax (CGT)[5], capital allowances[6], the general anti-avoidance rule (GAAR) [7] and the diverted profits tax (DPT)[8]. All of these tax risks are relevant to our compliance approach and are collectively referred to as 'compliance risks' in this Guideline.

3. This Guideline has been prepared to accompany the release and publication of Taxpayer Alerts TA 2018/2 Mischaracterisation of activities or payments in connection with intangible assets and TA 2020/1 Non-arm's length arrangements and schemes connected with the development, enhancement, maintenance, protection and exploitation of intangible assets.

4. It is not the intention of this Guideline to limit, deter or prevent arm's length dealings involving intangible assets. Rather it is intended that this Guideline will serve as a point of reference and assist you to understand arrangements which we see as representing a higher risk from a compliance perspective.

5. We use the framework set out in this Guideline to assess the compliance risks associated with your Intangibles Arrangements and tailor our engagement with you.

6. You can use the framework set out in this Guideline to understand:

- •

- the compliance risks that may be presented by your Intangibles Arrangements

- •

- the type of analysis we undertake to assess compliance risks, and the documents and evidence we expect you to have and maintain to substantiate your Intangibles Arrangements

- •

- the level of engagement we would generally expect from you based on our assessment of the compliance risks of your Intangibles Arrangements, and

- •

- how you can work with us to mitigate any compliance risks in relation to your Intangibles Arrangements.

7. The application of this Guideline allows us to differentiate risk and prioritise our compliance resources. This Guideline will also outline the ways in which we are likely to engage with you based on the level of risk of your Intangibles Arrangements.

8. The guidance contained in this Guideline is divided into the following parts:

- •

- Part One - Our Compliance Approach - provides an outline of our compliance approach for Intangibles Arrangements.

- •

- Part Two - Our Risk Assessment Framework - provides an outline of our risk assessment framework, which explains how we assess the compliance risks of Intangibles Arrangements.

9. This Guideline does not limit the operation of the law.[9] The information provided in this Guideline does not replace, alter or affect our interpretation of the law in any way or relieve you of your legal obligations in complying with all relevant tax laws.

10. If your Intangibles Arrangements are subject to review, you can expect that we will test the conditions and tax outcomes of your arrangements. We are not limited by this Guideline when testing the actual conditions of your Intangibles Arrangements for compliance with Australia's transfer pricing rules. Similarly, we are not limited by this Guideline when testing the purpose of your Intangibles Arrangements under the GAAR or DPT provisions, for example.

11. When finalised, this Guideline is proposed to apply both before and after its date of issue.

PART ONE - OUR COMPLIANCE APPROACH

The ATO's role and compliance approach

12. We review Intangibles Arrangements with a focus on identifying those that mischaracterise Australian activities connected with DEMPE of intangible assets. We are concerned that these arrangements may be non-arm's length or structured to avoid tax obligations, resulting in inappropriate outcomes for Australian tax purposes. Our concerns include whether functions performed, assets used and risks assumed by Australian entities in connection with the DEMPE of intangible assets are properly recognised and remunerated in accordance with the arm's length requirements of the transfer pricing provisions in the taxation law.

13. Australia's income tax law places an onus on taxpayers to self-assess their compliance with relevant tax laws, including the transfer pricing rules.

14. The transfer pricing rules under Subdivision 815-B require taxpayers to assess whether the conditions of their international arrangements reliably reflect 'arm's length conditions', such that no transfer pricing benefit is obtained. Former Division 13 of Part III of the ITAA 1936 and Subdivision 815-A of do not require taxpayers to self-assess but allow the Commissioner to make a determination regarding the arm's length nature of a taxpayer's international related party arrangements.

15. In some cases, Subdivision 815-B may require the identification of arm's length conditions with regard to arrangements or circumstances different from the form of your Intangibles Arrangements (the exceptions to the basic rule contained in subsections 815-130(2) to (4)). In these cases, we will have specific regard to relevant ATO views, such as Taxation Ruling TR 2014/6 Income tax: transfer pricing - the application of section 815-130 of the Income Tax Assessment Act 1997.

16. To the extent relevant and applicable, any action we may take in applying the transfer pricing provisions will be made so as best to achieve consistency with the relevant transfer pricing guidelines published by the OECD.[10] Of particular relevance are Chapters I, VI and IX of the OECD TPG.

17. Chapter I of the 2017 edition of the OECD TPG outlines the basic operation of the arm's length principle. Our risk assessment approach follows this principle, having particular regard to the accurate delineation of Intangibles Arrangements through an understanding of their economically relevant characteristics.

18. Chapter VI of the 2017 edition of the OECD TPG outlines special considerations for intangibles. Our risk assessment approach follows the principles discussed in Chapter VI regarding the identification and ownership of intangibles, the undertaking and control of DEMPE activities in connection with intangibles, and transactions involving the use or transfer of intangibles (or the rights to exploit them).

19. Chapter IX of the 2017 edition of the OECD TPG provides guidance on analysing transfer pricing outcomes in relation to business restructuring situations, examples of which include sales of assets or the relocation of business operations (that is, the transfer of functions, assets and risks). Specifically, it prescribes a two-step framework, whereby the arm's length nature of the restructuring itself must first be assessed before determining arm's length conditions for any post-restructuring controlled transactions.[11] Our risk assessment approach has particular regard to these principles in arrangements where we consider there to have been a migration of intangible assets.

20. We are also concerned that parties to such arrangements may fail to properly comply with Australian income tax obligations such as those imposed by the CGT and capital allowance provisions. We are particularly concerned where intangible assets and/or associated rights are migrated to international related parties as part of non-arm's length arrangements and/or in a manner intended to avoid Australian tax.

21. We also review arrangements to identify those that mischaracterise intangible assets and/or activities or conditions connected with intangible assets. Our concerns include whether intangible assets have been appropriately recognised for Australian tax purposes and whether Australian royalty withholding tax obligations, under Subdivision 12-F of Schedule 1 to the TAA, have been met.

22. In some cases, we may also consider the application of other income tax provisions, such as the GAAR and/or the DPT[12], particularly in circumstances where such arrangements lack evidence of commercial rationale and/or substance. Where a taxpayer has obtained a tax benefit in connection with an Intangibles Arrangement, and the other legislative conditions are met, the Commissioner may cancel the tax benefit. Where a taxpayer has obtained a DPT tax benefit in connection with an Intangibles Arrangement, and the other legislative conditions are met, the Commissioner may issue a DPT assessment. In these circumstances, we will have specific regard to our internal processes, relevant ATO views and further guidance, which are documented in Law Administration Practice Statement PS LA 2005/24 Application of General Anti-Avoidance Rules, PCG 2018/5 and PS LA 2017/2.

23. This Guideline does not alter or supersede the guidance and processes outlined in the materials referred to in paragraph 22 of this Guideline, and should be considered alongside these materials where relevant to your Intangibles Arrangements. It does not relieve you of your obligation to self-assess your compliance with all relevant taxation laws; rather, it is designed to explain how we assess the risk posed by Intangibles Arrangements, enabling you to self-assess and mitigate your compliance risk with respect to your Intangibles Arrangements.

24. The level of engagement you can expect from us will be based on our assessment of the compliance risks of your Intangibles Arrangements. We explain how we will assess the compliance risks of your Intangibles Arrangements and how we will engage with you under the framework set out in this Guideline.

25. We will typically apply our risk assessment framework to your Intangibles Arrangements and identify compliance risks associated with these arrangements in the course of our engagement or assurance activities. Our primary objective in the course of these activities is to obtain the information and documents necessary to gain assurance that the tax outcomes associated with your Intangibles Arrangements accord with the requirements of the relevant tax provisions. This is also the case where you have approached us voluntarily to assure your Intangibles Arrangements.

26. We encourage you to engage with us if, having considered the compliance risks presented by your arrangements in accordance with our risk assessment framework, you consider that there is a potential compliance risk associated with your Intangibles Arrangements. Engaging with us early, including prior to entering into your Intangibles Arrangement, will assist us to cooperatively work with you to assure your arrangement or resolve any issues that may be associated with your Intangibles Arrangements.

27. The advance pricing arrangement (APA) program can provide certainty with respect to covered Intangibles Arrangements for an agreed period.[13] Where you are seeking entry into the APA program, we would expect documentation and evidence of the nature identified in this Guideline to be produced and maintained with respect to your Intangibles Arrangements.

28. If we review your Intangibles Arrangements, we may consider other factors beyond those contained in this Guideline, having regard to relevant facts and circumstances of your Intangibles Arrangements.

29. We are committed to working with you to resolve any issues associated with your Intangibles Arrangements as early and cooperatively as possible.

30. Where we are unable to resolve disputes that may arise in respect of your Intangibles Arrangements under our compliance approach, you will be able to access your review and objection rights, where and when relevant.

Reporting your self-assessment

31. If you are required to complete a reportable tax position (RTP) schedule, you may be asked to disclose:

- •

- how your Intangibles Arrangements compare to each of the Risk Factors in Appendix 1 of this Guideline, specifically whether your Intangibles Arrangements exhibit Risk Factors that have been described as High, Medium or Low Risk Factors, and/or

- •

- how your Intangibles Arrangements compare to the Examples of Arrangements in Appendix 2 of this Guideline, specifically whether you have entered into any arrangement or variation of an arrangement described in the High, Medium or Low Risk examples, or

- •

- that you chose not to, or could not, self-assess your risk.

Evidencing your self-assessment

32. We may, in the course of our ordinary engagement and assurance activities, or any specific assurance activity relating to this Guideline, fact-check your self-assessment, having regard to our Documentation and Evidence Expectations as outlined in paragraphs 42 to 74 of this Guideline. If you are unable to provide adequate evidence to support your assessment, or we disagree with your assessment, we may undertake further engagement and assurance activity.

PART TWO - OUR RISK ASSESSMENT FRAMEWORK

33. Our compliance approach will vary depending on the level of risk presented by your Intangibles Arrangements. This part is designed to explain how we assess the compliance risks of Intangibles Arrangements.

34. Our risk assessment framework includes an assessment of the risk of your Intangibles Arrangements based on:

- •

- Risk Factors (set out in Appendix 1 of this Guideline) which outline features and Examples of Arrangements that we will use to inform our assessment of the compliance risks in your Intangibles Arrangements, and

- •

- Documentation and Evidence Expectations (set out in paragraphs 42 to 74 of this Guideline), including the level of evidence that we will have regard to when assessing your Intangibles Arrangements against the Risk Factors to assess the level of risk posed by your arrangement.

35. The Risk Factors include High, Medium and Low Risk Factors and focus on:

- •

- understanding and evidencing the commercial considerations and your decision making, in particular where you have restructured or had a change associated with your Intangibles Arrangements

- •

- understanding the form of your Intangibles Arrangements

- •

- identifying and evidencing the intangible assets and connected DEMPE activities of your Intangibles Arrangements

- •

- analysing the tax and profit outcomes of your Intangibles Arrangements, and

- •

- understanding the type of example arrangements we consider to be High, Medium or Low risk, which have been described in Appendix 2 of this Guideline.

36. We will have regard to each of the Risk Factors to inform our assessment of the compliance risks of your Intangibles Arrangements, including how we will engage with you. The Risk Factors serve as general guidance only and do not form an exhaustive list of features or examples of arrangements we may consider when assessing the level of risk posed by your Intangibles Arrangements.

37. The Examples of Arrangements, as detailed in Risk Factor E in Appendix 1 of this Guideline, and further set out in Appendix 2 of this Guideline, provide practical guidance to determine the level of risk presented by your Intangibles Arrangements. The examples are categorised into High, Medium and Low risk examples. Appendix 2 of this Guideline will be updated where new or emerging examples of arrangements are identified.

38. In the course of our engagement and assurance activities, we may seek information and/or documents regarding the facts and circumstances of your Intangibles Arrangements in order to validate or assess the Risk Factors as they relate to your Intangibles Arrangements. The information and documents that we would typically seek are outlined in paragraphs 42 to 74 of this Guideline. We would expect detailed documentation of the nature identified in this Guideline to be produced and maintained with respect to your Intangibles Arrangements.

39. If your Intangibles Arrangements exhibit one or more of the High Risk Factors, our compliance approach will likely include further engagement with you to assess the compliance risks of your Intangibles Arrangements. This may involve commencing a further review or audit. We will typically prioritise our resources to address Intangibles Arrangements that pose the highest level of risk. In these circumstances, our expectation is that you provide us with information and documentation, having regard to the Documentation and Evidence Expectations as outlined in paragraphs 42 to 74 of this Guideline, so that we can substantiate your Intangibles Arrangements.

40. While exhibiting Medium or Low Risk Factors may not exclude your Intangibles Arrangements from further review, they will influence our engagement with you. Improving your documentation and having contemporaneous evidence to substantiate your arrangement will also assist you to substantiate Medium or Low Risk Factors that your Intangibles Arrangements may exhibit and mitigate the level of compliance risk posed by your Intangibles Arrangements.

41. Where you are seeking entry to the APA program, we will have regard to the Risk Factors that your Intangibles Arrangements exhibit, including the documentation you have maintained according to our Documentation and Evidence Expectations. If your documentation does not substantiate your arrangement, it may limit our ability to provide you with greater certainty and/or engage in APA discussions. We will be open to entering into early engagement APA discussions with you and will be more likely to invite you to make a formal APA application where your Intangibles Arrangements exhibit the Low Risk Factors and you are able to substantiate your Intangibles Arrangements according to our Documentation and Evidence Expectations.

Documentation and Evidence Expectations

42. This section outlines documentation and evidence we would generally expect when assessing the level of compliance risk posed by your Intangibles Arrangements according to our risk assessment framework. It sets out the type and level of documentation that we will have regard to when assessing your Intangibles Arrangements against the Risk Factors.

43. The documents outlined in this section are intended to serve as a general guide and should not be treated as an exhaustive list of the kinds of documents, evidence and matters we may take into account in the event we need to review your Intangibles Arrangements.

44. We recognise that certain documents identified in this section may not be relevant to the facts and circumstances of your Intangibles Arrangements or that it may be difficult for you to assess the degree of documentation that is required to assess the risk of your Intangibles Arrangements. The Risk Factors are designed to assist you in this regard.

45. The type and level of documentation we will expect from you will be influenced by the complexity of your arrangement. We will take into consideration your natural business systems and governance processes and systems to focus on documentation and evidence that can reasonably be expected to be created and relied on in your business, taking into account the compliance risks involved with your Intangibles Arrangements.

46. The Documentation and Evidence Expectations outlined in this section will assist you in assessing whether you have maintained documentation that adequately supports and substantiates the position you have taken with respect to your Intangibles Arrangements and your risk assessment according to our risk assessment framework. The Documentation and Evidence Expectations outlined in this section may also assist you in supporting and/or verifying your transfer pricing documentation for the purposes of Subdivision 284-E of Schedule 1 to the TAA (refer to Taxation Ruling TR 2014/8 Income tax: transfer pricing documentation and Subdivision 284-E).

47. As a preliminary matter, we will typically review the following information in our possession, where relevant, including (and depending on) whether you have relevant international related party dealings, are a significant global entity (SGE) and/or have disclosed a relevant Category C reportable tax position[14]:

- •

- Australian income tax returns

- •

- general purpose financial statements

- •

- International Dealings Schedules

- •

- Country-by-Country reporting data exchanged automatically or by exchange of information request, including any available Masterfile, Local File Parts A and B and/or Country-by-Country Report

- •

- information obtained from foreign jurisdictions through exchange of information processes, and

- •

- other information obtained previously by the ATO in connection with any engagement or review, and other relevant information from third party / public sources or other government agencies.

48. The Documentation and Evidence Expectations outlined in this section are categorised as:

- •

- understanding and evidencing the commercial considerations and your decision making

- •

- understanding the legal form of your intangibles arrangements

- •

- identifying and evidencing the intangible assets and connected DEMPE activities, and

- •

- analysing the tax and profit outcomes of your intangibles arrangements.

Understanding and evidencing the commercial considerations and your business decisions

49. In circumstances where you have restructured or had a change associated with your Intangibles Arrangements, we will typically require an understanding of the circumstances in which the restructure or change was entered into or occurred. We will typically require contemporaneous documents to verify the market value of any intangibles acquired or sold, identify and evidence any tax and commercial objectives considered and any other considerations connected with the decision to enter into the restructure or arrangement, including whether other or alternative arrangements were considered and the reasons why any alternative arrangements were not pursued. This information is integral to, and an important part of, our assessment of the commerciality of your Intangibles Arrangements and potential compliance risks.

50. The evidence we may require includes:

- (a)

- internal or independent reviews, cost-benefit analyses, forecasts, projections, modelling, reports or advice commissioned or obtained in relation to your Intangibles Arrangements and associated commercial objectives - this could include quantifiable productivity gains, cost savings, synergistic benefits, location/jurisdiction-specific benefits, reduction of non-income tax costs, provision of connected government incentives and any other relevant costs and benefits associated with your Intangibles Arrangements

- (b)

- the documents created or provided by personnel or tax advisers disclosing anticipated or potential Australian tax effects of the Intangibles Arrangements, including financial models disclosing projected or potential tax impacts and slides or step plans in connection with developing arrangements

- (c)

- briefing materials, analysis and data produced in connection with the documents outlined in paragraph 50(a) of this Guideline, including those produced by or for internal and independent specialists

- (d)

- presentations and other papers prepared in relation to your Intangibles Arrangements and associated commercial objectives, including papers provided to the taxpayer's management team, board of directors or any other group or subgroup responsible for considering or making recommendations on the arrangements

- (e)

- minutes of board and other meetings at which all Intangibles Arrangements, including alternative arrangements not pursued, were considered and any correspondence with tax advisers or tax personnel in relation to preparing or revising the minutes

- (f)

- commercial, regulatory and tax advice obtained in connection with your Intangibles Arrangements

- (g)

- details of any changes to the transfer pricing policy in the relevant period, including the rationale for any such changes and the pricing and profit outcomes before and after the change event for all parties connected to your Intangibles Arrangements (for example, reports documenting functional analyses undertaken for relevant entities, correspondence exchanged between key decision makers regarding the benefits of certain structures, and actuarial reports of cost modelling), and

- (h)

- details of any changes to inter-company agreements and company policies in the relevant period.

Understanding the legal form of your Intangibles Arrangements

51. To assess the compliance risks presented by your Intangibles Arrangements, we must understand the specific transactions entered into as part of your Intangibles Arrangements. We will require the documents that disclose the detailed legal form of your Intangibles Arrangements to assist us in understanding your Intangibles Arrangements in totality.

52. The evidence we may require to understand the legal form of your Intangibles Arrangements includes:

- (a)

- legal agreements, memoranda and like documents associated with your Intangibles Arrangements, including any amendments to, or restatements of, such documents

- (b)

- details of ownership of intangible assets, including whether ownership rights in the intangible asset may have been diluted

- (c)

- details of the planning in connection with setting up the legal arrangements or entering into legal documentation, for example, planning on choice of employees or officers to be appointed as directors of new entities and policies to protect intangible assets

- (d)

- guidelines, manuals, policies, procedures, specifications and like documents relevant to your Intangibles Arrangements that are developed and/or maintained by you, your global group, a related party or a third party under the direction of you, your global group or a related party. This includes any such documents that instruct and detail conduct of parties with any connection to the Intangibles Arrangements, the relevant intangible assets and the connected DEMPE activities, and

- (e)

- transfer pricing documentation including any specific or supplementary analysis or valuation and/or other reports produced for transactions which form part of your Intangibles Arrangements.

53. Obtaining the legal agreements, memoranda and other documents associated with your Intangibles Arrangements allows us to form a preliminary view of your Intangibles Arrangements, which includes all relevant intangible assets, associated activities and entities involved in the arrangements. This includes, for example, relevant asset purchase agreements, sale agreements, royalty or licensing agreements, associated contract research and development (R&D) service agreements with international related parties, including any amendments to, or restatements of, such agreements.

54. Where legal agreements are not yet drafted or are subject to change, we may require available draft or interim agreements, memoranda or like documents. If relevant agreements and documents are subject to change, this will impact our ability to determine the level of risk presented by your Intangibles Arrangements. In these circumstances we may be unable to provide you with greater certainty regarding your tax outcomes.

55. We may also request relevant agreements or other documents between other international related parties and, in certain circumstances, third parties to allow us to obtain a holistic understanding of your global group's Intangibles Arrangements. For example, where international related parties with which the Australian entity has entered into agreements have similar or dissimilar arrangements with other international related parties in connection with intangible assets.

Guidelines, manuals, policies and governance-like documents

56. Obtaining your internal guidelines, manuals, policies, procedures, specifications, governance and like documents relevant to your Intangibles Arrangements allows us to establish whether you, your global group, or relevant international related parties have policies and work processes in place that are of relevance to your arrangements. This includes, for example, relevant group intellectual property management policies evidencing whether intangible assets are managed by a central team, R&D policies or other policies concerning the development, management and commercialisation of your intangible assets.

57. These facts and documents enable us to understand the broader circumstances surrounding your Intangibles Arrangements and inform our assessment of risk. For example, we may have concerns where your group intellectual property management and R&D policies appear to be inconsistent with your legal agreements or your actual conduct or dealings with other parties in relation to the intangible assets.

Transfer pricing documentation

58. Obtaining your transfer pricing documentation allows us to gain an overall understanding of the operation of your Intangibles Arrangements, including the identification of all relevant intangible assets, entities, activities and associated transfer pricing outcomes. This documentation allows us to assess the degree to which your transfer pricing analysis supports the arm's length nature of your Intangibles Arrangements, which would inform our risk assessment.

59. We may also compare your transfer pricing documentation with your group intellectual property management and R&D policies, legal agreements with international related parties and/or your actual conduct or dealings with other parties in relation to the intangible assets to better understand your Intangibles Arrangements.

Country-by-Country reporting documentation

60. If you are an SGE, we will also consider information provided as a part of any available Country-by-Country reporting documentation, such as agreements provided in Part B of your local file and master file documentation. We may request further information, such as the underlying data and records that you used to prepare your Country-by-Country reporting.

Identifying and evidencing the intangible assets and connected development, enhancement, maintenance, protection and exploitation activities

61. The identification of relevant intangible assets and connected DEMPE activities is critical to assessing the level of compliance risks presented by your Intangibles Arrangements. As such, in addition to obtaining an understanding of the legal form of your Intangibles Arrangements, we will seek to identify and/or clarify relevant intangible assets and connected DEMPE activities in more specific detail. We will do so to clarify how your Intangibles Arrangements operate in substance and mitigate any uncertainty arising from your legal form documents.

62. We may also require specific documents and evidence to identify and clarify your intangible assets and DEMPE activities due to the:

- •

- difficulties you may encounter in identifying and tracking intangible assets through the various stages of development, commercialisation and exploitation

- •

- fact that certain intangible assets may be intrinsically connected or linked to certain other assets or DEMPE activities

- •

- ease with which certain intangible assets and DEMPE activities may be altered or moved, and

- •

- complex nature of a multinational group's value chains connected with intangible assets and DEMPE activities.

63. These issues necessitate discussions with management and or the review of specific documentation to inform our risk assessment.

64. The documents and evidence we may require you to identify and clarify intangible assets relevant to your Intangibles Arrangements include documents which detail, describe and evidence the names/identifiers and functions of relevant intangible assets and the products, processes or other relevant commercial activities they are associated with. We will also seek to obtain evidence of the nature of relevant assets (for example, copyright, patent, design or model, plan, know-how, secret formula or process, trademark or other like property or right) and whether such assets have been registered. Our document and evidence expectations extend to know-how assets relating to business processes, interpretation of data, a valuable concept or business innovation not able to be registered.

65. The evidence we may require includes:

- •

- intangible asset registers

- •

- AASB Standard 138-compliant[15] financial statements and associated records or documents relevant to the recognition of intangible assets

- •

- registration documents, such as those required by and produced for IP Australia

- •

- internal or external database extracts or other relevant digital or physical records

- •

- relevant reports, specifications or R&D stage-gate documents, particularly where intangible assets are in development or in a pre-commercialised state

- •

- guidelines, manuals, policies, procedures and like documents relevant to the identification and recognition of relevant intangible assets of you or of members of your global group, including governance documents over approval of business plans where know-how is reflected in decision-making accountability, and

- •

- any additional or like documents that may assist us in identifying and understanding relevant assets.

Identifying development, enhancement, maintenance, protection and exploitation activities

66. We may require contemporaneous documentation and evidence to clarify the DEMPE activities connected with your Intangibles Arrangements in more specific detail. We expect that the functions performed, assets used and risks assumed by relevant entities in connection with the DEMPE of intangible assets will be detailed in your transfer pricing documentation. We may seek to clarify this information, for example, by obtaining correspondence of persons involved in DEMPE activities or by identifying and interviewing specific personnel involved in DEMPE activities, relevant decision makers and approval points and any activities outsourced to third or related parties.

67. The evidence we may require includes:

- (a)

- organisational charts, including description of roles and responsibilities of individuals involved in DEMPE activities

- (b)

- correspondence of persons identified as involved in DEMPE activities

- (c)

- guidelines, manuals, policies, procedures and like documents relevant to you, your global group's or your international related parties' DEMPE activities

- (d)

- internal or external database extracts or other relevant digital or physical records relating to DEMPE activities

- (e)

- relevant reports, specifications or R&D stage-gate documents associated with DEMPE activities

- (f)

- documents associated with any R&D tax incentive claims lodged with the Department of Industry, Innovation and Science, and

- (g)

- any additional or like documents that may assist us in identifying and understanding your DEMPE activities.

Evidencing intangible assets and development, enhancement, maintenance, protection and exploitation activities

68. We may also seek to obtain evidence to substantiate aspects of your legal form documents, the nature of relevant intangible assets and aspects of DEMPE activities. We request this information to obtain assurance that the substance of your Intangibles Arrangements aligns with the legal form of the arrangement and consider whether there are any associated compliance risks.

69. We may require documents to ensure that the obligations outlined in your legal form arrangements are consistent with what is occurring in practice. We will analyse the functions performed by relevant entities in connection with the Intangibles Arrangements with reference to specific clauses in legal agreements, group policies, correspondence and/or transfer pricing documentation. We may also require information and documents, including email correspondence, which demonstrate that entities stated to manage, control and/or perform DEMPE activities and assume associated risks have the capability, financial capacity and assets to do so in substance.

70. The evidence we may require includes:

- (a)

- approvals, authorisations, correspondence and meeting minutes which demonstrate that the DEMPE activities undertaken by relevant entities are consistent with those specified in your legal form agreements, for example, directions and approvals received from entities that manage and control risks associated with DEMPE activities

- (b)

- meeting minutes, reports, scopes of work, internal or external database extracts or other relevant digital or physical records which demonstrate functions performed, assets used and risks assumed in connection with DEMPE activities

- (c)

- documents detailing the assets and capabilities of relevant entities, including relevant employment contracts and key performance indicators, employee head count and qualifications, and planning documents

- (d)

- documents detailing the financial position of relevant entities and profit outcomes associated with your Intangibles Arrangements, including general purpose financial statements, accounts and annual reports

- (e)

- contemporaneous valuation reports, working papers and associated documentation where intangible assets and relevant functions have been transferred offshore, and

- (f)

- any additional or like documents that may assist us in identifying and understanding your DEMPE activities.

Analysing the tax and profit outcomes of your Intangibles Arrangements

71. We may require documents to assess the appropriateness of the tax and profit outcomes resulting from your arrangements, including the transfer pricing method and comparability studies applied, where relevant.

72. The evidence we may require includes:

- (a)

- comparability studies, valuations, projections and other analyses which have been obtained or applied to determine the nature and quantum of transactions executed under the arrangement, including any connected advice obtained from internal or independent specialists

- (b)

- any financial modelling or projections, including models of anticipated tax impacts of options or arrangements prepared by tax personnel or tax advisers

- (c)

- analyses, data and briefing materials underlying any valuations, projections, other analyses and connected advice obtained from internal or independent specialists that have been applied to determine the nature and quantum of transactions executed under the arrangement

- (d)

- evidence of actual cash flows in connection with the arrangement

- (e)

- financial, transactional and tax information for relevant domestic and offshore entities, including general purpose financial statements, accounts, annual reports, general ledger entries and other accounting or reporting documentation where relevant, and

- (f)

- tax information for relevant domestic and offshore entities including foreign income tax returns, foreign notices of assessment (or equivalent), foreign tax receipts and notices of refund (or equivalent), foreign tax instalment notices and running balance accounts (or equivalent), any advice or valuations obtained in relation to the potential tax consequences of proposed structures or transactions, any approvals of tax holidays or other reductions in tax and relevant correspondence from foreign revenue agencies.

73. If you are eligible to apply any of the simplified transfer pricing record-keeping options under Practical Compliance Guideline PCG 2017/2 Simplified transfer pricing record-keeping options, we will have regard to the record-keeping obligations outlined in PCG 2017/2, where relevant.

74. PCG 2017/2 is not available to small taxpayers and distributors in relation to international related-party dealings involving royalties, licence fees or R&D arrangements. We note:

- •

- The performance of DEMPE functions that materially contribute to the value of intangible assets, as described in this Guideline, will not fall within the definition of 'low value adding intra-group services' for the purposes of PCG 2017/2.

- •

- Technical services considered under PCG 2017/2 also exclude the use of intellectual property, know-how, processes, systems or other like intangible assets or rights.

| Risk focus areas - Intangibles Arrangements | High risk factors | Medium risk factors | Low risk factors |

| A. Understanding and evidencing the commercial considerations and your decision making, in particular where you have restructured or had a change associated with your Intangibles Arrangements |

|

|

|

| B. Understanding the form of your Intangibles Arrangements |

|

|

|

| C. Identifying and evidencing the intangible assets and connected DEMPE activities of your Intangibles Arrangements |

|

|

|

| D. Analysing the tax and profit outcomes of your Intangibles Arrangements |

|

|

|

| E. Understanding the type of example arrangements we consider to be high, medium or low risk, as described in Appendix 2 of this Guideline |

|

|

|

APPENDIX 2 - Risk Factor E - Examples of Arrangements

75. Appendix 2 of this Guideline provides examples of Intangibles Arrangements that we will use to assess the level of risk of your Intangibles Arrangements based on Risk Factor E of our Risk Factors Appendix 1 of this Guideline. The examples in this Guideline are categorised as High, Medium and Low risk.

76. The examples in Appendix 2 of this Guideline are provided to illustrate the kinds of matters we will generally consider in assessing the compliance risks relating to your Intangibles Arrangements. They highlight the circumstances in which we consider the different compliance risks that may be associated with your Intangibles Arrangements and the facts that may support this assessment. Any reference to a particular intangible asset, industry or commercial activity in the examples is anecdotal and does not limit the particulars of an arrangement to any one industry.

| Level of risk | Examples of Arrangements |

| High risk | Example 1 - centralisation of intangible assets

Example 2 - bifurcation of intangible assets Example 3 - non-recognition of Australian intangible assets and DEMPE activities Example 4 - migration of pre-commercialised intangible assets Example 5 - non-arm's length licence arrangements |

| Medium risk | Example 6 - centralisation of intangible assets

Example 7 - transfer of rights to intangible assets via a Licence Agreement Example 8 - contract research and development arrangement Example 9 - cost contribution arrangement |

| Low risk | Example 10 - centralisation of intangible assets

Example 11 - contract research and development arrangement Example 12 - cost contribution arrangement |

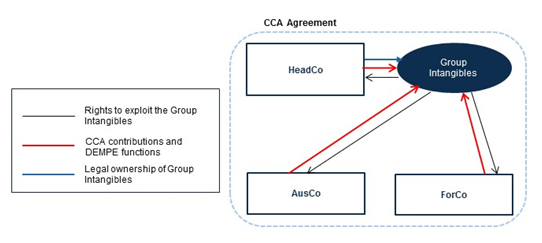

Example 1 - centralisation of intangible assets - high risk

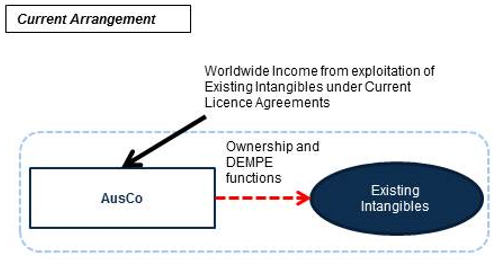

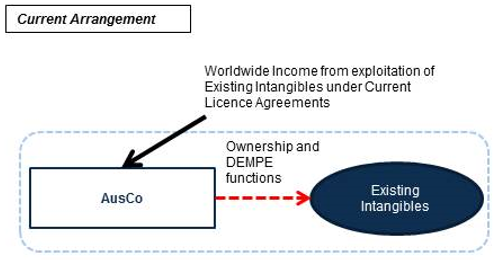

Current Arrangement

77. AusCo is part of a global group that manufactures, markets and sells goods and provides services associated with those sales. AusCo and its international related parties exploit valuable intangible assets in undertaking their operations. The intangible assets include patents, know-how trademarks, copyright and other intangible assets or rights (Existing Intangibles).

78. AusCo owns, manages and controls DEMPE activities associated with the Existing Intangibles and assumes associated risks. AusCo derives royalties from its international related parties for the exploitation of the Existing Intangibles globally under current licence agreements between AusCo and its international related parties (Current Licence Agreements).

![This diagram illustrates the arrangements AusCo and NewCo enter into upon deciding to centralise the Intangible Assets in NewCo, including royalty arrangements relating to the Existing Intangibles and New Intangibles and an R[amp ]D arrangement.](/law/view/sgif/cog/pcg2021-d004b.gif)

Decision to centralise intangible assets

79. AusCo and the global group decide that the Existing Intangibles and any new or future intangible assets that are created or developed (New Intangibles) should be centralised in a new entity (NewCo) to be located in a foreign jurisdiction. The New Intangibles will initially comprise adaptations of the patents, know-how, trademarks, copyright and other intangible assets or rights that form part of the Existing Intangibles. The documentation maintained or provided by AusCo does not substantiate the commercial rationale underpinning the decision to centralise.

80. As a result of the decision to centralise, AusCo enters into a licence agreement (Existing Intangibles Licence) with NewCo to transfer the rights to the Existing Intangibles to NewCo. The term of the Existing Intangibles Licence is based on a period determined to reflect the remaining useful life of the Existing Intangibles at the time. Under the Existing Intangibles Licence, NewCo will pay royalties to AusCo for the right to exploit and sub-licence the Existing Intangibles to other international related parties, including AusCo. These royalties decline over the term of the Existing Intangibles Licence and are based on a formula designed to reflect the declining value of the Existing Intangibles over the term of the Existing Intangibles Licence. The documentation maintained or provided by AusCo does not substantiate the arm's length nature of the pricing of this arrangement.

81. The Current Licence Agreements between AusCo and its international related parties are terminated as a result of the decision to centralise. No payments were made to AusCo as a result of the termination. AusCo and its international related parties subsequently execute a master Licence Agreement with NewCo (New Intangibles Licence). Under this agreement, NewCo receives worldwide royalty income from the rights to exploit the Existing Intangibles and any New Intangibles developed.

82. NewCo and AusCo also enter into a contract R&D Services Agreement. Under this agreement, AusCo will provide R&D services to NewCo in relation to the New Intangibles in return for a fee determined with regard to the costs incurred by AusCo in the provision of the R&D services. Any New Intangibles that are developed as a result of the R&D undertaken by AusCo under the R&D Services Agreement will be owned by NewCo and AusCo's use of those New Intangibles will be subject to the New Intangibles Licence.

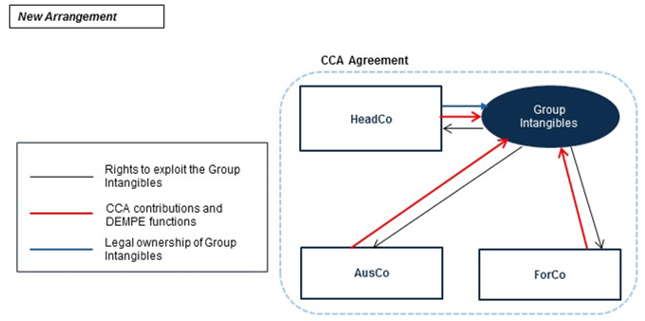

New Arrangement

83. In the first year following the centralisation of the intangible assets in NewCo, the functions performed, assets used and risks assumed by AusCo do not substantially change. AusCo continues to employ the same specialised staff and use its expertise and assets to manage, perform and control DEMPE activities associated with the New Intangibles. While the development of the Existing Intangibles ceased as a result of the New Arrangement, AusCo continued to perform and control the management and exploitation of the Existing Intangibles. The functions performed, assets used and risks assumed by AusCo under the R&D Services Agreement with NewCo results in the development of New Intangibles. The R&D Services Agreement states that the New Intangibles are owned by NewCo. The use of the New Intangibles is subject to the New Intangibles Licence, where AusCo and its international related parties pay royalties to NewCo. NewCo manages and performs limited DEMPE activities and assumes limited risks in connection with the Existing Intangibles or the New Intangibles.

84. In the second year following the centralisation of the intangible assets to NewCo, NewCo hires some additional staff and acquires additional assets to assist it in the management of DEMPE activities. These staff and assets are not sufficient to allow NewCo to wholly manage, perform or control the DEMPE activities connected with the New Intangibles and the Existing Intangibles and assume the associated risks. AusCo continues to undertake the majority of the DEMPE activities while receiving a cost-based remuneration under the R&D Services Agreement and declining royalties under the Existing Intangibles Licence. NewCo receives royalty income from AusCo and its international related parties for the use and exploitation of the Existing Intangibles and New Intangibles.

Risk assessment

85. The New Arrangement would be regarded as a High Risk Intangibles Arrangement.

86. There is a risk that AusCo's entry into the New Arrangement is not commercially rational and may not be consistent with AusCo's best economic interests having regard to the commercial options realistically available to it, disregarding anticipated or potential tax impacts. This risk is emphasised where AusCo has not maintained or is not able to provide documentation substantiating its decision-making regarding entering into the New Arrangement or does not recognise or provide documents referring to anticipated or potential Australian tax impacts considered in making the decision to centralise.

87. AusCo continued to perform and control DEMPE activities with respect to the Existing Intangibles and the New Intangibles, which in economic substance was inconsistent with terms and conditions of the various licences and the R&D Services Agreement between AusCo and NewCo under the New Arrangement. The New Arrangement does not appropriately recognise AusCo's contributions to the New Intangibles, either through a recognition of the intrinsic link between the Existing and New Intangibles or a recognition of the DEMPE activities performed by AusCo in substance in relation to the New Intangibles.

88. Had the New Arrangement not occurred, AusCo would have continued to own and derive income from the exploitation of the Existing Intangibles and the New Intangibles. AusCo would not have been required to pay royalties to NewCo for the use of the New Intangibles that AusCo developed after entering into the New Arrangement.

89. Understanding the (non-tax) commercial considerations for making and implementing the New Arrangement and the relevance of anticipated or potential tax impacts considered in connection with the decision to centralise, including any alternative options and their (non-tax) commercial value considered by AusCo and the global group prior to the decision to centralise, will be essential to our risk assessment. We may take the view that an independent entity dealing wholly independently in circumstances comparable to AusCo would not have entered into the New Arrangement. The New Arrangement required AusCo to dispose of its rights to current and future valuable intangible assets and associated income streams on non-arm's length terms.

90. As AusCo has not maintained or provided substantiating documentation, there is a risk that AusCo may not have appropriately priced its arrangements, including, but not limited to, not giving consideration to whether the Existing Intangibles Licence adequately compensates AusCo for the termination of the Current Licence Agreements.

91. While assessing the risk, we will consider the potential application of the transfer pricing provisions, including the exceptions to the basic rule within Subdivision 815-B, and the CGT or capital allowances provisions where relevant, Additionally, we will consider whether the arrangement was entered into or carried out for the dominant or principal purpose of obtaining a tax benefit. This may attract the operation of the GAAR in Part IVA of the ITAA 1936 and/or the application of the DPT.

Risk Factors and Documentation and Evidence Expectations

92. In assessing the risk, we will request certain documentation, taking into account the Risk Factors and Documentation and Evidence Expectations. While the typical documentation and evidence that we will seek is outlined in paragraphs 42 to 74 of this Guideline, our focus under this Example will be on:

- •

- understanding the (non-tax) commercial considerations of AusCo's decision to enter into the New Arrangement and the relevance of anticipated or potential tax impacts in implementing the New Arrangement, including the impact of the New Arrangement on AusCo's profitability and tax outcomes - this will include understanding AusCo's business decision-making processes, associated analyses and the global group's internal policies or guidelines governing its intangible assets and/or R&D processes and practices

- •

- identifying the Existing Intangibles and the New Intangibles with specificity and evidencing the DEMPE activities connected with these assets, as well as a comparison of the terms and conditions of the relevant agreements that AusCo entered into with NewCo - this will include understanding the link between the Existing Intangibles and the New Intangibles and the connected DEMPE activities

- •

- identifying any relevant or comparable third-party arrangements entered into by AusCo or the global group regarding like intangible assets or R&D to understand their market behaviour and conduct with independent entities, and

- •

- understanding the foreign tax implications of AusCo and its international related parties in connection with the arrangement referred to in this Example.

Example 2 - bifurcation of intangible assets - high risk

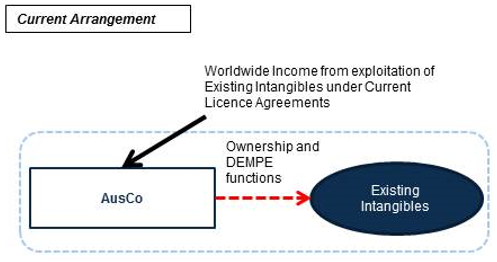

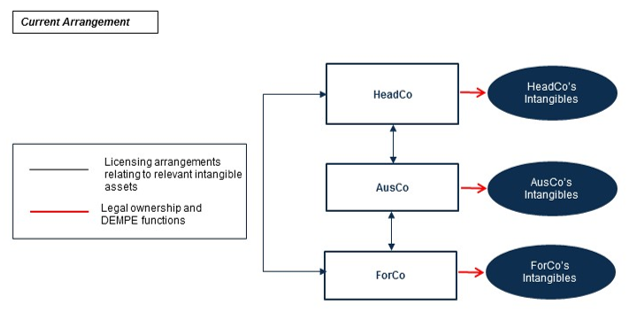

Current Arrangement

93. AusCo is part of a global group that manufactures, markets and sells goods. AusCo and its international related parties exploit valuable intangible assets in undertaking their operations. The intangible assets include patents, know-how, trademarks, copyright and other intangible assets or rights (Existing Intangibles).

94. AusCo manages, performs and controls the DEMPE activities associated with the existing intangibles and assumes associated risks. AusCo derives royalties from the international related parties for the exploitation of the existing intangibles globally under current licence agreements between AusCo and the international related parties (current licence agreements).

![This diagram illustrates the New Arrangement under which AusCo bifurcates the Existing Intangibles into Australian Intangibles and Offshore Intangibles. The Offshore Intangibles are sold to NewCo and AusCo provides R[amp ]D services to NewCo going forward.](/law/view/sgif/cog/pcg2021-d004d.gif)

New Arrangement

95. AusCo and its global group decide that a new entity located in a foreign jurisdiction (NewCo) should exploit the Existing Intangibles in offshore markets by owning the relevant intangible assets (Offshore Intangibles).

96. As part of this decision, AusCo will continue to exploit the Existing Intangibles in Australia only and will own the relevant intangible assets and undertake the associated DEMPE activities as a result (Australian Intangibles).

97. The decision to transfer the Offshore Intangibles to NewCo (and bifurcate the Existing Intangibles into Australian Intangibles and Offshore Intangibles) is stated to be based on a desire to facilitate expansion into emerging markets and establish a global centre of expertise for new product development (New Arrangement). The documentation maintained or provided by AusCo does not substantiate the commercial rationale or does not recognise or provide documents referring to anticipated or potential Australian tax impacts considered in making the decision to transfer the Offshore Intangibles to NewCo.

98. To implement the New Arrangement, AusCo enters into a sale agreement (Sale Agreement) with NewCo, transferring the Offshore Intangibles to NewCo for an amount of consideration. This amount was determined by reference to a valuation that was undertaken by AusCo in relation to the Offshore Intangibles. The Sale Agreement provides that any entitlement to royalties connected with the Offshore Intangibles will be novated to NewCo. This includes the royalties AusCo received from the international related parties under the Current Licence Agreements. No payments are made to AusCo as a result of the termination. The documentation maintained or provided by AusCo does not substantiate the arm's length nature of the pricing of all arrangements in connection with the restructure, including, but not limited to, the Sale Agreement and the decision to terminate and novate the Current Licence Agreements.

99. NewCo and AusCo also enter into an agreement where AusCo will provide R&D services to NewCo for cost-based remuneration (R&D Agreement). Under the R&D Agreement any new Offshore Intangibles that are developed as a result of the R&D undertaken by AusCo will be owned by NewCo.

100. At the time the New Arrangement is implemented, NewCo does not have sufficient assets or employ sufficiently qualified staff to wholly manage, perform or control the DEMPE of the Offshore Intangibles and assume the associated risks.

101. Some members of AusCo's management relocate to the jurisdiction of NewCo to facilitate the New Arrangement. However, AusCo continues to otherwise employ specialised staff and use its expertise and assets to manage, perform and control DEMPE activities associated with the Bifurcated Australian Intangibles and the Offshore Intangibles, and assume the associated risks. AusCo is remunerated for these activities with a cost-based service fee pursuant to the R&D Agreement with NewCo.

102. AusCo continues to own the Australian Intangibles, which allows it to manufacture, market and sell goods in the Australian market. AusCo continues to manufacture, market and sell goods associated with the Australian Intangibles in the Australian market and derive associated profits, but no longer receives royalties from international related parties for the exploitation of the Offshore Intangibles in undertaking similar functions offshore.

103. In subsequent years, AusCo continues to primarily manage, perform and control the DEMPE of both the Australian Intangibles and the Offshore Intangibles. There is limited new product development undertaken by NewCo independent of the DEMPE activities outsourced to, and managed and controlled by, AusCo in relation to the Offshore Intangibles.

Risk assessment

104. The New Arrangement would be regarded as a High Risk Intangibles Arrangement.

105. There is a risk that the New Arrangement has artificially bifurcated the Existing Intangibles into Australian Intangibles and Offshore Intangibles such that the New Arrangement is not arm's length in nature or is structured to avoid tax obligations.

106. Had the New Arrangement not occurred AusCo would have continued to own and derive income from the exploitation of the Existing Intangibles, including the bifurcated Offshore Intangibles. Understanding the commercial considerations underpinning the bifurcation of the Existing Intangibles into Australian Intangibles and Offshore Intangibles, the business need for the New Arrangement and the associated profit and tax outcomes will be essential to our risk assessment. The risk in this regard is emphasised where AusCo is not able to provide documentation substantiating its decision-making for entering into this arrangement or does not recognise or provide documents referring to anticipated or potential Australian tax impacts that were considered in making the decision to enter into the arrangement.

107. AusCo continued to manage and control the DEMPE activities of the Offshore Intangibles, which in economic substance was inconsistent with the form of the New Arrangement. We may take the view that an independent entity dealing wholly independently in circumstances comparable to AusCo would not have entered into the New Arrangement with NewCo, as it involved AusCo disposing of the Offshore Intangibles and associated income streams under non-arm's length conditions.

108. We may also take the view that the distinction between the Australian Intangibles and the Offshore Intangibles and the separation of DEMPE activities in relation to these assets lacks commercial rationale and economic substance.

109. As AusCo has not maintained or provided substantiating documentation, there is also a risk that AusCo may not have appropriately priced its arrangements, including not giving consideration to whether the AusCo was adequately compensated for the termination of the Current Licence Agreements or AusCo's sale under the Sale Agreement.

110. While assessing the risk, we will consider the potential application of the transfer pricing provisions (including the exceptions to the basic rule within Subdivision 815-B), the CGT provisions and the capital allowances provisions. Additionally, we will consider whether the arrangement was entered into or carried out for the dominant or principal purpose of obtaining a tax benefit. This may attract the operation of the GAAR in Part IVA of the ITAA 1936 and/or the application of the DPT.

Risk Factors and Documentation and Evidence Expectations

111. In assessing the risk, we will request certain documentation, taking into account the Risk Factors and Documentation and Evidence Expectations. While the typical documentation and evidence that we will seek is outlined in paragraphs 42 to 74 of this Guideline, our focus under this Example will be on:

- •

- understanding the (non-tax) commercial benefits and the anticipated or potential tax impacts of implementing the Bifurcation Arrangement and the decision-making process for implementing the New Arrangement

- •

- identifying the Existing Intangibles, including the bifurcated Australian Intangibles and Offshore Intangibles with specificity- this will include understanding the intrinsic link between the Offshore Intangibles and the Bifurcated Australian Intangibles, as well as the valuation processes that were relied upon to determine the value of the Offshore Intangibles

- •

- evidencing the DEMPE activities associated with the Bifurcated Australian Intangibles and Offshore Intangibles, as well as a comparison to the terms and conditions of the relevant agreements that AusCo entered into with NewCo as a result of the New Arrangement

- •

- identifying any relevant or comparable third party arrangements entered into by AusCo or the global group regarding like intangible assets or R&D to understand market behaviour and conduct with independent entities, particularly the bifurcation of such intangible assets, and

- •

- understanding the foreign tax implications of AusCo and its international related parties in connection with the arrangements referred to in this Example.

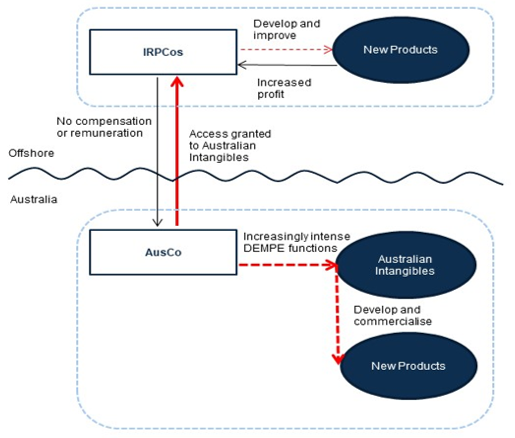

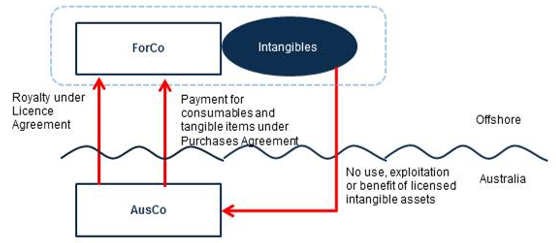

Example 3 - non-recognition of Australian intangible assets and DEMPE activities - high risk

112. AusCo is part of a global group that manufactures and sells goods and provides associated services. AusCo and its international related parties have historically recognised the use of minimal valuable intangible assets in undertaking their operations aside from certain trademarks and intangible assets associated with the global group's brand and product lines. A number of these trademarks are owned by AusCo and connected with products and services exclusively distributed in Australia. AusCo manages, performs and controls DEMPE activities connected with its Australian trademarks and assumes associated risks.

113. Over a number of years, AusCo's DEMPE activities increase in intensity, resulting in the development and commercialisation of a number of new and improved products and services. Several new identifiable intangible assets are developed from these activities. AusCo does not account for any additional intangible assets in its financial statements or register the relevant intangible assets for legal protection. The relevant intangible assets include patentable products and processes, know-how, copyright and other intangible assets or rights. These intangible assets and the Australian trademarks are developed, maintained, enhanced and owned by AusCo (Australian Intangibles).

114. AusCo does not formally recognise any Australian Intangibles or engage in annual review or analysis of its processes and activities associated with the Australian Intangibles. Likewise, AusCo's global group does not maintain a comprehensive contemporaneous R&D or intellectual property policy or other relevant processes or guidelines.

115. In the following years, a number of AusCo's international related parties are granted access to the Australian Intangibles and use these assets to develop and improve equivalent products and services in offshore jurisdictions. AusCo does not enter into any legal agreements for the transfer or licensing of these assets with its international related parties or update its transfer pricing policy or documentation in connection with these dealings.

116. The profitability of AusCo's international related parties increases as a result of accessing and exploiting the Australian Intangibles and the functions performed, assets used and risks assumed by AusCo in connection with the DEMPE of the Australian Intangibles. AusCo does not receive compensation or remuneration from its international related parties in connection with their access to, and use of, the Australian Intangibles.

Risk assessment

117. This arrangement would be regarded as a High Risk Intangibles Arrangement.

118. There is a risk that the dealings entered into by AusCo may not be consistent with AusCo's best economic interests having regard to the commercial options realistically available to AusCo. AusCo granted access to and use of the Australian Intangibles to its international related parties where no agreements or form of remuneration were considered or recognised.

119. The absence of legal agreements between AusCo and its international related parties may impede AusCo's ability to protect its interests with respect to the Australian Intangibles. The lack of compensation or remuneration from the international related parties for access to and use of the Australian Intangibles may be inconsistent with arrangements that might reasonably be expected to be entered into between independent entities dealing wholly independently in comparable circumstances.

120. The effect of the arrangement is that AusCo has allowed its international related parties to exploit and derive benefits in connection with the Australian Intangibles for nil consideration. The arrangement fails to appropriately recognise DEMPE activities managed, performed and controlled by AusCo, development of Australian Intangibles from AusCo's activities and exploitation of assets developed by AusCo by AusCo's international related parties.

121. We may take the view that the conditions that operate between AusCo and its international related parties in connection with their commercial or financial relations are conditions that differ from arm's length conditions. Understanding the conditions that operate between AusCo and its international related parties in their commercial or financial relations compared to the conditions that operate between independent entities dealing wholly independently in comparable circumstances to that of AusCo and its international related parties will be essential to our risk assessment.

122. While assessing the risk, we will consider the potential application of the transfer pricing provisions including the exceptions to the basic rule within Subdivision 815-B. Additionally, we will consider whether the arrangement was entered into or carried out for the dominant or principal purpose of obtaining a tax benefit. This may attract the operation of the GAAR in Part IVA of the ITAA 1936 and/or the application of the DPT.

Risk Factors and Documentation and Evidence Expectations

123. In assessing the risk, we will request certain documentation, taking into account the Risk Factors and Documentation and Evidence Expectations. While the typical documentation and evidence that we will seek is outlined in paragraphs 42 to 74 of this Guideline, our focus under this Example will be on:

- •

- understanding the economic substance of AusCo's international related party arrangements - this will include obtaining contemporaneous documentation to evidence the DEMPE activities connected with the Australian Intangibles and documents disclosing anticipated or potential tax impacts considered in relation to implementing the arrangements

- •

- understanding how the international related parties exploit and utilise the Australian intangibles - this will include understanding the value and benefit of the Australian Intangibles

- •

- in the absence of documentation to evidence the functions undertaken, assets held and risks assumed by AusCo, we may need to undertake interviews with key personnel within AusCo or its global group, and

- •

- understanding the foreign tax implications of AusCo and its international related parties in connection with the arrangements referred to in this Example.

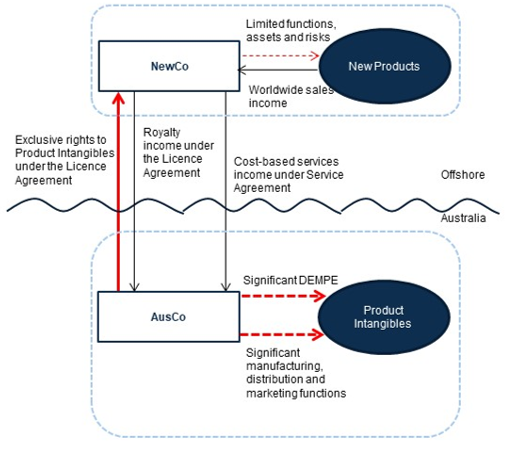

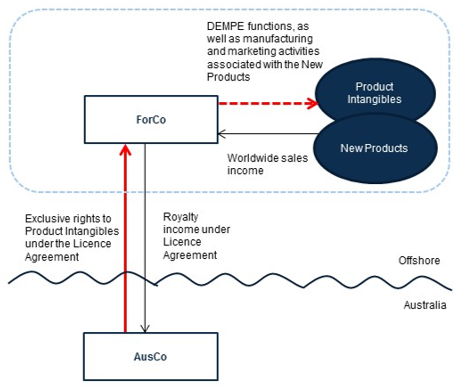

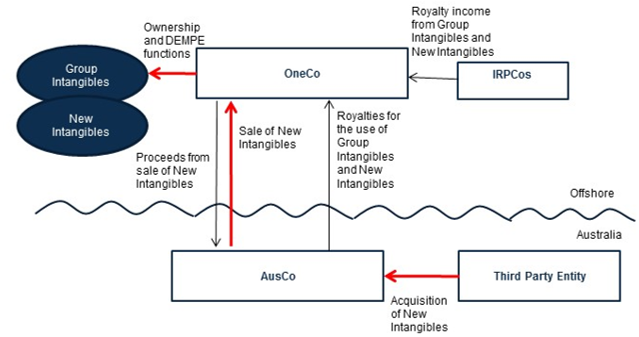

Example 4 - migration of pre-commercialised intangible assets - high risk

124. AusCo is part of a global group that develops, manufactures, markets and sells products globally. AusCo and its international related parties engage in the DEMPE of valuable intangible assets in undertaking their operations. These intangible assets include patents, know-how, trademarks, copyright and other intangible assets or rights.

125. AusCo spent a number of years undertaking R&D in Australia to develop a new product range, which resulted in the development of pre-commercialised intangible assets (Product Intangibles). AusCo owns the Product Intangibles. AusCo considers the Product Intangibles to be strategically important to their business.

126. Prior to the Product Intangibles being commercialised, AusCo and the global group decide to incorporate a new entity in an offshore jurisdiction NewCo for the stated purpose of further developing, manufacturing and commercialising the new products associated with the Product Intangibles (New Products). While AusCo has the capability and capacity to develop, manufacture and commercialise the New Products, the global group decides that NewCo should instead own the rights to the Product Intangibles. The documentation maintained or provided by AusCo does not substantiate the commercial rationale underpinning this decision or does not recognise the consideration of anticipated or potential tax impacts in making the decision.

127. As a result of this decision, AusCo and NewCo enter into a licence agreement (Licence Agreement). The Licence Agreement grants NewCo the exclusive rights to develop, manufacture and commercialise the Product Intangibles, including the associated New Products. Under the Licence Agreement, NewCo pays ongoing royalties to AusCo in relation to worldwide sales of the New Products. As a result of the Licence Agreement, the effective control of the Product Intangibles is transferred from AusCo to NewCo and, as a consequence, all of the worldwide income that will be received from the global commercial sales of the New Products will be derived by NewCo. The documentation maintained or provided by AusCo does not substantiate the arm's length nature of the pricing or terms of this arrangement.

128. At the time of entering into the Licence Agreement, NewCo does not have sufficient assets or employ sufficiently qualified staff to undertake the DEMPE activities which are undertaken by AusCo. NewCo subsequently enters into various service agreements (Service Agreements) with AusCo, under which AusCo agrees to provide services for the development, manufacture and distribution of the New Products. The Service Agreements remunerate AusCo with a cost-based service fee. The documentation maintained or provided by AusCo does not substantiate the commercial rationale or the arm's length nature of the pricing of this arrangement.

Post-transfer of the rights to the Product Intangibles

129. Following the transfer of the rights to the Product Intangibles to NewCo, the functions performed, assets used and risks assumed by AusCo do not substantially change. AusCo continues to employ specialised staff and uses its expertise and assets to manage, perform and control DEMPE activities associated with the Product Intangibles. The functions performed, assets used and risks assumed by AusCo in connection with activities covered by the Services Agreements with NewCo results in the commercialisation of the Product Intangibles. NewCo has limited relevantly qualified staff and manages and performs limited activities, owns limited assets and assumes limited risks in connection with the Product Intangibles.

130. Once the New Products are commercialised, AusCo manufactures, distributes and markets the New Products on behalf of NewCo under the Service Agreements. In undertaking these activities, AusCo employs specialised staff and uses its expertise and assets to manufacture and sell the New Products to the global market. However, AusCo only receives cost-based remuneration from NewCo in accordance with the terms of the Service Agreements and royalties from the commercial sales of the New Products. NewCo continues to have limited qualified staff, manages and performs limited activities, and assumes limited risks in connection with the manufacture, distribution and marketing of the New Products. NewCo derives the worldwide income from the sale of the New Products.

Risk assessment

131. The arrangement between AusCo and NewCo would be regarded as a High Risk Intangibles Arrangement.

132. There is a risk that AusCo's entry into the Licence Agreement and Service Agreements with NewCo lacks commercial and economic substance or may not be an arrangement that independent entities dealing wholly independently in comparable circumstances to that of AusCo and NewCo would have entered into. This risk is emphasised where AusCo is not able to provide documentation substantiating its decision-making for entering into these arrangements or does not provide documents created or provided by personnel or tax advisers which disclose anticipated or potential tax impacts that were taken into account in connection with deciding to implement the arrangements.

133. AusCo owned and developed the Product Intangibles and had the capability, expertise and capacity to continue to develop, manufacture and commercialise them for market. The Product Intangibles were strategically important to AusCo's business. AusCo did not require NewCo as a partner to develop or commercialise the Product Intangibles. NewCo did not have the capability or capacity to develop or commercialise the Product Intangibles at the time the arrangements were implemented.