| Disclaimer This edited version has been archived due to the length of time since original publication. It should not be regarded as indicative of the ATO's current views. The law may have changed since original publication, and views in the edited version may also be affected by subsequent precedents and new approaches to the application of the law. You cannot rely on this record in your tax affairs. It is not binding and provides you with no protection (including from any underpaid tax, penalty or interest). In addition, this record is not an authority for the purposes of establishing a reasonably arguable position for you to apply to your own circumstances. For more information on the status of edited versions of private advice and reasons we publish them, see PS LA 2008/4. |

Edited version of your private ruling

Authorisation Number: 1011995960123

This edited version of your ruling will be published in the public register of private binding rulings after from the issue date of the ruling. The attached private rulings fact sheet has more information. 28 days

Please check this edited version to be sure that there are no details remaining that you think may allow you to be identified. If you have any concerns about this ruling you wish to discuss, you will find our contact details in the fact sheet.

Ruling

Subject: GST and software support services

Question 1

Is your supply of software support services subject to GST?

Answer

Yes.

Relevant facts and circumstances

You contract with an overseas company to provide remote support for a software package. Australian residents purchase the software online from the overseas company. The overseas company pays you a fee to provide support for the software with customer contact via an Australian based phone number. You access a server located overseas which holds the software. No software is located on computers located in Australia.

Relevant legislative provisions

A New Tax System (Goods and Services Tax) Act 1999 section 38-190

Reasons for decision

Summary

Your supply of software support services is subject to GST as it is provided to entities in Australia.

Detailed reasoning

Item 2 in subsection 38-190(1) of the A New Tax System (Goods and Services Tax) Act 1999 (GST Act) allows for the GST supply of services to non-residents who are not in Australia:

38-190 Supplies of things, other than goods or real property, for consumption outside Australia

(1) The third column of this table sets out supplies that are GST-free (except to the extent that they are supplies of goods or *real property):

Supplies of things, other than goods or real property, for consumption outside Australia | ||

Item |

Topic |

These supplies are GST-free (except to the extent that they are supplies of goods or *real property)... |

… |

… |

… |

2 |

Supply to *non-resident outside Australia. |

a supply that is made to a *non-resident who is not in Australia when the thing supplied is done, and: (a) the supply is neither a supply of work physically performed on goods situated in Australia when the work is done nor a supply directly connected with *real property situated in Australia; or (b) the *non-resident acquires the thing in *carrying on the non-resident's *enterprise, but is not *registered or *required to be registered. |

However, Item 2 is restricted by subsection 38-190(3) of the GST Act which states:

(3) Without limiting subsection (2) or (2A), a supply covered by item 2 in that table is not GST-free if:

(a) it is a supply under an agreement entered into, whether directly or indirectly, with a *non-resident; and

(b) the supply is provided, or the agreement requires it to be provided, to another entity in Australia.

The arrangement you have with the overseas based software company to provide support services to Australian residents is considered to be one where you make a supply to a non-resident company and, at the same time, provide the supply to Australian customers. On face value this is the type of situation contemplated by the exclusion to GST-free status encompassed in subsection 38-190(3) of the GST Act.

The Goods and Services Tax public ruling GSTR 2005/6 'Goods and services tax: the scope of subsection 38-190(3) and its application to supplies of things (other than goods or real property) made to non-residents that are GST-free under item 2 in the table in subsection 38-190(1) of the A New Tax System (Goods and Services Tax) Act 1999' contains an example (paras 264-275) that mirrors your arrangement:

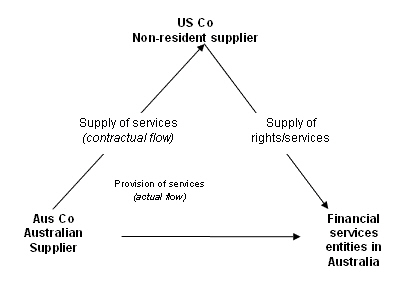

Example 1 - characterisation of a supply of software and technical support services made by an Australian supplier to a non-resident company and provided to an Australian customer

264. US Co, a non-resident parent company, provides credit card and related payments system software world-wide to entities in the financial services industry. It adapts the software to the particular needs of each client. This software is supplied by the granting of a licence to use the intellectual property. The licence allows the financial service entities receiving the software to modify or adapt or copy the software as they like. These licences are granted outside of Australia.

265. US Co does not carry on business in Australia either through a place of business of its own or through an agent acting on its behalf.

266. US Co's contracts with its customers require US Co to provide technical support for the software supplied. As US Co has no presence in other countries, the non-resident company contracts with its global subsidiaries to perform the support services in relation to the software.

267. Aus Co, a GST registered Australian subsidiary of US Co, provides such technical support services in relation to software licensed by US Co to financial services entities in Australia.

268. The issues considered below are the characterisation of the thing supplied by Aus Co to US Co, and the impact that characterisation has on the GST treatment of the supply.

Characterisation of the supply by Aus Co to US Co

270. Various rights are granted under the contract made between Aus Co and US Co. However, performance of the contract by Aus Co involves providing a service to the customers of US Co in Australia. In this circumstance, we do not consider that the supply by Aus Co to US Co could be characterised as anything other than the supply of a service. The fact that the service is provided to the financial services entities in Australia by Aus Co and not by US Co does not, in our view, transform the character of the supply made by Aus Co to US Co from a service to a right. Also, the character of the supply by Aus Co to US Co remains the same irrespective of whether the supply by US Co to the Australian financial service entities is determined to be a composite supply of rights or a mixed supply of rights and services to the Australian customer.

Item 2

271. The supply by Aus Co is made to a non-resident, US Co, which is not in Australia when the technical support services are performed. The supply satisfies the requirements of item 2 and is, therefore, a supply covered by item 2.

Subsection 38-190(3)

272. The supply of technical support services by Aus Co to US Co is a supply under an agreement entered into with a non-resident. Paragraph 38-190(3)(a) is therefore satisfied.

(i) Provided to another entity

273. Under the agreement with US Co, Aus Co is required to provide technical support services to financial service entities (in Australia). The supply is made to US Co but is provided to each of these other entities. The actual flow of the technical support services is to the Australian financial services entities. The services are not, therefore, provided to US Co.

(ii) Provided to that other entity in Australia

274. The Australian financial services entities are in Australia when the service is performed. The supply of technical support services is for the purposes of the Australian financial services entities in Australia.

275. Subsection 38-190(3) negates the GST-free status of the supply covered by item 2. (How to determine whether a supply is provided to another entity in Australia is discussed fully in the next Part at paragraphs 323 to 435).

Given the nature of your services and the fact that you are registered for GST, your supply of software support services will be subject to GST.

Copyright notice

© Australian Taxation Office for the Commonwealth of Australia

You are free to copy, adapt, modify, transmit and distribute material on this website as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).