GST issues registers

Tourism and hospitality industry partnershipIssue 20 - Commercial accommodation

The supply of commercial residential premises ('commercial accommodation') is a taxable supply. However, Division 87 provides that long-term stays in commercial residential premises are given a lower value than would otherwise apply, reducing the amount of GST payable.

Issue

What is the GST treatment of commercial accommodation?

For source of ATO view, refer to the general application of the principles in GSTR 2000/20 - Goods and services tax: commercial residential premises.

Decision

Under Division 87, the value of a taxable supply of 'commercial accommodation' that:

- •

- is provided in 'commercial residential premises' that are 'predominantly for long-term accommodation'

- •

- is provided to an individual as 'long-term accommodation',

is 50% of what would be the price of the supply.

The supplier may choose not to apply this special rule, instead treating the supply of commercial accommodation as input taxed under Division 40.

'Commercial accommodation'

Commercial accommodation means the right to occupy the whole or any part of commercial residential premises, and includes (if provided as part of the right to occupy) the supply of cleaning and maintenance, electricity, gas, air-conditioning or heating, as well as telephone, television, radio or similar things.

Any service that is provided separately to that which is supplied as part of the tariff is unlikely to be within the meaning of commercial accommodation and therefore the GST concession will not apply. For example, separately metered electricity, mini bar items, personal laundry or dry cleaning charges, meals and phone calls are separate supplies. These items will attract the full GST rate.

'Residential premises' and 'commercial residential premises'

'Commercial residential premises' means:

- (a)

- a hotel, motel, inn, hostel or boarding house

- (b)

- premises used to provide accommodation in connection with a school

- (c)

- a ship that is mainly let out on hire in the ordinary course of a business of letting ships out on hire

- (d)

- a ship that is mainly used for entertainment or transport in the ordinary course of a business of providing ships for entertainment or transport

- (e)

- a marina at which one or more of the berths are occupied, or are to be occupied, by ships used as residences

- (f)

- a caravan park or a camping ground, or

- (g)

- anything similar to residential premises described in paragraphs (a) to (e).

However, it does not include premises to the extent that they are used to provide accommodation to students in connection with an education institution that is not a school.

The main characteristics of commercial residential premises are:

- (i)

- Commercial intention: The establishment is operated on a commercial basis.

- (ii)

- Multiple occupancy: The establishment provides sleeping accommodation on a multiple occupancy basis.

- (iii)

- Holding out to the public: The establishment holds itself out as premises that will receive travellers who are willing and able to pay for accommodation.

- (iv)

- Accommodation is the main purpose: The provision of accommodation is the establishment's primary purpose, or one of its main purposes, after the service of food and/or drink.

- (v)

- Central management: The establishment has central management to accept reservations, allocate rooms, receive payments and arrange the services provided throughout the premises.

- (vi)

- Management offers accommodation in its own right: The management has control of the premises as a whole, whether or not they own the property or any part of it and lets them in its own right, rather than as an agent.

- (vii)

- Services offered to guests: periodic cleaning, provision of food, laundering services, telephone (allowing the guest to be billed for calls made), and minor services, like wake-up calls or taxi bookings.

- (viii)

- Status of guests: Those being provided with accommodation are guests, boarders or lodgers. Guests or lodgers can expect a reasonable amount of privacy from management, their staff and other guests, but not to the same level expected by a tenant.

'Residential premises' is defined in the GST Act as land or a building that is occupied as a residence, or is intended to be occupied, and is capable of being occupied, as a residence, and includes a floating home. Common physical characteristics of residential premises that provide accommodation are that the premises:

- (a)

- provide occupants with sleeping accommodation and at least some basic facilities for day to day living

- (b)

- may be in any form, including detached buildings, semidetached buildings, strata-title apartments, single rooms or suites of rooms within larger premises.

Further information about commercial residential premises and residential premises can be found in GSTR 2000/20.

'Predominantly for long-term accommodation'

This phrase in relation to commercial residential premises means that at least 70% of the individuals who are provided with commercial accommodation in the premises are provided with commercial accommodation as 'long-term accommodation'.

GSTR 2000/20 provides methods that could be used to determine if your commercial residential premises is predominantly for long-term accommodation:

- •

- your actual occupancy of your premises for the twelve months preceding the month for which the booking is made, or

- •

- your projected occupancy for the twelve months following the month in which the booking is made.

If it is inappropriate to use either of these methods, you may adopt a reasonable alternative.

When looking at actual or projected occupancy, examine the number of supplies of accommodation, or the number of bookings that are for 28 days or more, rather than the number of people in each room. You may include bookings made by corporate entities for individuals, provided each individual stays for 28 days or more.

Where there are two or more individuals sharing a room, who are charged separately you may count each of them in calculating the 70% figure. This may occur where rooms are booked on an independent twin/share basis or, if you operate dormitory style commercial residential premises, such as a youth hostel.

'Long-term accommodation'

This phrase means that commercial accommodation is provided to an individual for a continuous period of 28 days or more in the same premises.

In working out the number of days in the period, you may count the day on which the individual is provided with commercial accommodation (more commonly known as the 'check-in' day) and disregard the day on which the individual ceases to be provided with commercial accommodation (more commonly known as the 'check-out' day).

In terms of continuity, a guest who is provided with long-term accommodation in a hotel, motel, inn, hostel, boarding house, caravan park, camping ground or similar premises does not need to physically occupy the premises for the entire duration of the stay for the stay to be continuous. For example, a guest who occasionally leaves the premises overnight to travel, will maintain continuity of the stay provided they are charged for the days they are absent, and their suite or room may not be let in their absence. If management moves a guest to another room (either when a guest is present or away) and charges for the new room, then this will be treated as one continuous stay.

By way of another example in relation to caravan parks, the right to occupy is granted when a site is hired for a caravan, even if the caravan is left unoccupied for most of the time. The continuity of the stay is not broken. Where the operator moves a caravan from one site to another, but effectively maintains the bookings, this is a continuous site rental. However, if the owner of a caravan and the park operator agree to 'store' the caravan in another area of the park for an agreed fee, the continuity of the site rental ceases when the caravan is moved. The storage breaks the continuity of the stay as the storage of the caravan is a separate supply, subject to the basic rules (section 9-5).

Election for a supplier of long-term stays of commercial accommodation

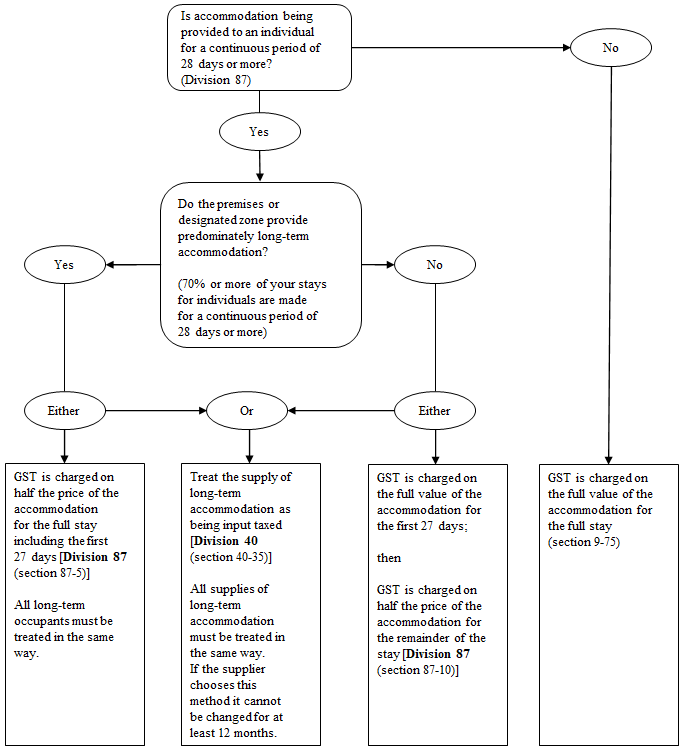

The following diagram is extracted from Goods and Services Tax Bulletin GSTB 2001/2 - Accommodation in caravan parks and camping grounds. The various meanings discussed above are applicable to this diagram.

Where there is a supply of long-term accommodation and the commercial residential premises are predominantly for long-term accommodation (that is, 70% or more of stays are for 28 or more continuous days), the supplier can choose to use either the half GST method for the entire stay of each long-term accommodation or the input taxed method for the entire stay of each long-term accommodation.

Where there is a supply of long-term accommodation and the commercial residential premises are not predominantly for long-term accommodation (that is less than 70% of stays are for 28 or more continuous days), the supplier can choose to use either the half GST method from the 28th day onwards for each long-term accommodation (and the full GST for the first 27 days) or the input taxed method for the entire stay of each long-term accommodation.

When the supplier first makes a choice, that choice applies for a minimum of 12 months.

Calculating the GST for commercial accommodation

The initial requirement to consider is whether the commercial accommodation provided is long-term (28 continuous days or more) or short-term (27 continuous days or less).

For long-term accommodation:

Suppliers of long-term accommodation may choose to either:

- (a)

- include no GST in their long-term accommodation prices (that is, the supply will be input taxed). If the provider chooses this option, they will not have to pay any GST to the ATO. However, the supplier will not be able to claim input tax credits for GST included in the price of goods and services they acquire for use in providing that accommodation. This option is equivalent to the GST treatment of residential rents (paragraph 40-35(1)(b)); or

- (b)

- charge a concessional (reduced) amount of GST provided for under Division 87 of the GST Act. Concessional GST treatment is only available for stays of 28 days or more (long-term accommodation). The extent to which the concession applies will depend on whether the commercial residential premises are predominantly for long-term accommodation or not (see flowchart diagram above). The supplier will be able to claim input tax credits for GST included in the price of goods and services they acquire in carrying on their enterprise. The examples below provide further illustration.

Example 1 - premises is predominantly for long-term accommodation

Irene is a long-term resident at Dalgety Creek Caravan Park. The caravan park provides predominantly long-term accommodation because more than 70% of the total guests stay for long-term. Dalgety Creek's GST-inclusive site fee for both short and long-term stays is $66 per week ($60 plus $6 GST). Because Dalgety Creek provides predominantly long-term accommodation, the GST for Irene is worked out on half that amount. To work out the actual fee, $66 is halved, leaving $33. The GST is 10 percent of $33; that is $3.30. Irene pays $63.30 ($60 plus $3.30 GST).

Example 2 - input taxed option

Danny decides to book a holiday cabin for a six week holiday. Because more than 70% of cabins are occupied by guests staying 28 days or more, the owner has chosen to input tax his supplies of long term accommodation. The usual fee for a cabin is $100 per week plus $10 GST. Based on these amounts, the price of a six week stay would be $660 ($600 plus $60 GST). However, as Danny is staying long term, and the operator has chosen to use the input taxed option, no GST is added to the usual cabin fee. Therefore, the total price for Danny's stay $600. (See the GST Bulletin GSTB 2001/3 - Simplified calculation of input tax for caravan park operators).

Example 3 - premises is not predominantly for long-term accommodation

Ralph accepts a temporary work transfer to Adelaide and books into Marble Heights for two months. Marble Heights charges $220 ($200 plus $20 GST) per night for a room. Less than 70% of their guests stay for 28 days or more. For the first 27 days, Ralph will be charged at the normal rate of $220 per night. From day 28 onwards, GST will be calculated on half the GST inclusive price. Half $220 is $110. The concessional GST amount is 10% of $110; that is $11.

So Ralph will be charged:

- •

- $220 per night for the first 27 days

- •

- $211 per night for the rest of his stay.

For short-term accommodation:

All supplies of commercial accommodation in which guests stay for less than 28 days are subject to GST at the normal rate of 10% regardless of whether the premises are predominantly for long-term accommodation or not.

Example 4 - short-term accommodation

Sally decides to book a holiday cabin for a two week holiday at Dalgety Creek Caravan Park. The caravan park provides predominantly long-term accommodation because more than 70% of the total guests stay for long-term. Dalgety Creek's GST-inclusive site fee for both short and long-term stays is $66 per week ($60 plus $6 GST). As Sally does not stay on a long-term basis (that is, she does not stay for 28 days or more), Sally's stay cannot be treated at the concessional rate. Therefore, Sally is charged the full GST-inclusive rate of $66 per week, even though Dalgety Creek Caravan Park provides predominantly long-term accommodation.

References

- •

- GSTB 2001/3 - Simplified calculation of input tax for caravan park operators

- •

- See also GSTB 2001/2 - Accommodation in caravan parks and camping grounds

- •

- See GSTR 2000/20 - Goods and Services Tax: commercial residential premises

- •

- Property and Construction Industry Partnership - issues register - section 03 - commercial residential premises

© AUSTRALIAN TAXATION OFFICE FOR THE COMMONWEALTH OF AUSTRALIA

You are free to copy, adapt, modify, transmit and distribute this material as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).

Copyright notice

© Australian Taxation Office for the Commonwealth of Australia

You are free to copy, adapt, modify, transmit and distribute material on this website as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).