Universities Accord (Cutting Student Debt by 20 Per Cent) Act 2025 (30 of 2025)

Schedule 1 Debt reduction

Part 1 Amendments

Australian Apprenticeship Support Loans Act 2014

6 After section 35

Insert:

35A Reduction in AASL debts incurred before 1 January 2025

(1) For the purposes of working out a person's former accumulated AASL debt in relation to the person's accumulated AASL debt for the financial year starting on 1 July 2024, section 31 has effect as if the method statement in subsection (1) of that section included the following step after step 7:

Step 8. Reduce the amount worked out under step 7 by 20%.

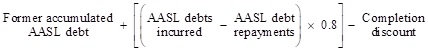

(2) For the purposes of working out a person's accumulated AASL debt for the financial year starting on 1 July 2024, section 35 has effect as if the formula in subsection (1) of that section were omitted and substituted with the following:

Copyright notice

© Australian Taxation Office for the Commonwealth of Australia

You are free to copy, adapt, modify, transmit and distribute material on this website as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).