Universities Accord (Cutting Student Debt by 20 Per Cent) Act 2025 (30 of 2025)

Schedule 2 Fairer repayment system

Part 1 Amendments

Higher Education Support Act 2003

6 Sections 154-20, 154-25 and 154-30

Repeal the sections, substitute:

154-20 Amounts payable to the Commonwealth

(1) The amount that a person is liable to pay under section 154-1, in respect of an *income year, is the amount that is the least of the following:

(a) the amount worked out under subsection (2);

(b) the amount equal to 10% of the person's *repayment income for the income year;

(c) the amount of the person's *repayable debt for the income year.

(2) For the purposes of paragraph (1)(a), the amount is the sum of the following amounts:

(a) 15% of the part of the person's *repayment income that exceeds the *minimum repayment income but does not exceed $125,000;

(b) 17% of the part of the person's repayment income that exceeds $125,000.

Note: The amount of $125,000 mentioned in paragraphs (a) and (b) is indexed under section 154-25.

154-25 Indexation of HELP repayment thresholds

(1) This section applies in relation to the following amounts (each of which is an indexable amount ):

(a) the *minimum repayment income;

(b) the amount mentioned in paragraphs 154-20(2)(a) and (b).

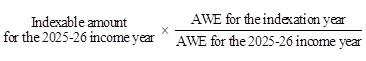

(2) At the start of each *income year (an indexation year ) after the 2025-26 income year, each indexable amount is replaced by the amount worked out using the following formula:

where:

AWE , for an income year, is the number of dollars in the sum of:

(a) the average weekly earnings for all employees (total earnings) for the reference period in the *quarter ending on 31 December immediately before the income year, as published by the *Australian Statistician; and

(b) the average weekly earnings for all employees (total earnings) for the reference period in the quarter ending on 30 June that is immediately before the quarter referred to in paragraph (a), as published by the Australian Statistician.

(3) If an amount worked out under subsection (2) is an amount made up of dollars and cents, round the amount down to the nearest dollar.

Publication of indexation amounts

(4) The Minister must cause to be published in the Gazette, before the start of an indexation year, the replacement indexable amount for the indexation year. However, a failure by the Minister to do so does not invalidate the indexation.

Definitions

(5) In this section:

reference period , in a *quarter, is the period described by the *Australian Statistician as the pay period ending on or before a specified day that is the third Friday of the middle month of that quarter.

Copyright notice

© Australian Taxation Office for the Commonwealth of Australia

You are free to copy, adapt, modify, transmit and distribute material on this website as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).