Excise guidelines for the alcohol industry

-

This document incorporates revisions made since original publication. View its history and amending notices, if applicable.

12 SPIRITS AND OTHER EXCISABLE BEVERAGES

12.1 PURPOSE

This Chapter deals with how excise law applies to spirits and other excisable beverages and discusses:

- •

- how spirits and other excisable beverages are classified

- •

- contents for duty purposes

- •

- special provisions for beverage spirits, and

- •

- responsibilities of licence holders.

12.2 INTRODUCTION

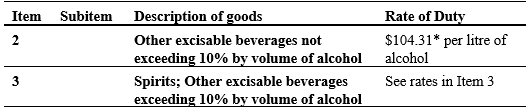

If your alcoholic products are not wine or beer, they will be classified to either item 2 or 3 of the Schedule to the Excise Tariff Act (Schedule), as either a spirit or an other excisable beverage (OEB). The main distinction between items 2 and 3 of the Schedule is whether the alcohol content is above or below 10% alcohol by volume. If it is below 10%, then the product is classified to item 2 of the Schedule. If it is above 10%, then the product is classified to item 3 of the Schedule.

This Chapter explains in more detail about how to classify ' excisable alcohol products ' to these items, particularly item 3 of the Schedule which has different rates of duty depending on the nature and intended use of the product.

12.3 POLICY AND PRACTICE

12.3.1 CLASSIFYING SPIRITS AND OTHER EXCISABLE BEVERAGES

The following is an extract from the Schedule which is relevant to spirits and other excisable beverages:

Figure 10: Extract of the Schedule relevant to spirits and other excisable beverages

*Rate of duty as at 3 February 2025. For the current rates of duty, refer to our tariff working page Excise duty rates for alcohol .

OEBs are beverages containing more than 1.15% alcohol by volume but exclude:

OEBs are classified to items 2 or 3 of the Schedule depending on their strength.

Spirits are classified to item 3 of the Schedule. [345]

Item 2 – other excisable beverages not exceeding 10% by volume of alcohol

Item 2 of the Schedule generally includes:

- •

- pre-mixed spirit based drinks, and

- •

- fermented products that are not beer or wine.

For an alcoholic beverage to be classified to item 2 of the Schedule, the answer to all of the following questions must be 'no':

- •

- Is the beverage under 1.15% alcohol by volume?

- •

- Is the beverage over 10% alcohol by volume?

- •

- Is the beverage wine?

- •

- Is the beverage brandy?

- •

- Is the beverage beer?

Example 12A

Beverage2Go manufactures a beverage that is 30% alcohol by volume. The beverage is delivered into the Australian domestic market in bottles that have instructions for mixing the beverage with other ingredients to make a particular style cocktail. The cocktail will have an alcoholic strength of 8% by volume. The beverage is not classified to item 2 of the Schedule.

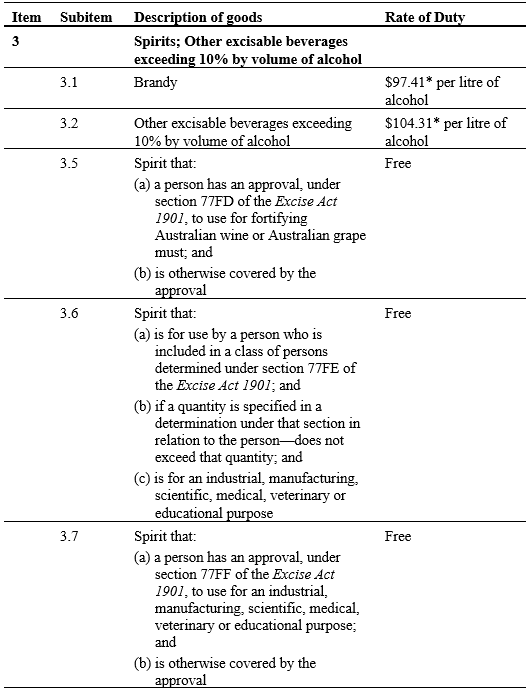

Item 3 – Spirits; other excisable beverages exceeding 10% by volume of alcohol

Item 3 of the Schedule contains a number of different subitems (that is, categories) of excisable alcohol products that attract different rates of duty depending on the nature of the product and its intended use.

Figure 11: Extract of the Schedule for items relating to spirits and other excisable beverages exceeding % by volume of alcohol

*Rate of duty as at 3 February 2025. For the current rates of duty, refer to our tariff working page Excise duty rates for alcohol .

Other excisable beverages and spirits

These subitems fall into 2 distinct groups of alcohol products.

1) Other excisable beverages exceeding 10% by volume of alcohol (item 3.2)

Other excisable beverages under item 3.2 of the Schedule covers:

- •

- all beverage spirits except brandy (for example, whisky, rum, vodka, gin, ouzo, tequila, schnapps, etc.), and

- •

- other alcoholic beverages that are not beer or wine and exceed 10% strength (for example, wine fortified above 22% strength is not wine as defined in the A New Tax System (Wine Equalisation Tax) Act 1999 (WET Act) and is therefore an OEB exceeding 10% strength).

2) Spirits

The term 'spirits' refers to:

- •

- brandy, being a spirit distilled from grape wine in such a manner that the spirit possesses the taste, aroma and other characteristics generally attributed to brandy [346] – subitem 3.1 of the Schedule

- •

- concessional spirit [347] (spirit with a free rate of duty when delivered into the Australian domestic market, if the conditions for the particular concessional subitem are met) – subitems 3.5 to 3.8 of the Schedule, and

- •

- spirits not elsewhere included of the Schedule to the Excise Tariff Act – subitem 3.10 of the Schedule.

Spirits not elsewhere included may include:

- •

- denatured spirit that does not meet the requirements for subitem 3.8 of the Schedule, and

- •

- concentrated wine flavours delivered for a use other than a concessional use.

12.3.2 CONTENTS FOR DUTY PURPOSES

Excise duty is levied on LALs at the rate specified in the relevant item of the Schedule.

Determination of volume

The requirements for measuring the volume of containers of excisable alcoholic beverages are detailed in Excise (Volume – Alcoholic excisable goods) Determination 2019 .

Refer to Section 6.3.6 Rules for measuring volume and alcoholic strength for further information in relation to volume measurement requirements.

Determination of strength

The requirements for measuring the alcoholic strength of excisable alcoholic beverages are detailed in Excise (Alcoholic strength of excisable goods) Determination 2019 .

Refer to Section 6.3.6 Rules for measuring volume and alcoholic strength for further information in relation to strength measurement requirements.

Strength and tariff classification for other excisable beverages

As noted at the beginning of this Chapter, there are separate tariff classifications for OEBs, depending on whether the content exceeds 10% by volume of alcohol.

A product labelled at 10% strength is classified to item 2 'Other excisable beverages not exceeding 10% by volume of alcohol' of the Schedule. However, if the actual strength of the contents exceeds the permitted variation of 0.2%, the product must be classified to subitem 3.2 ' Other excisable beverages exceeding 10% by volume of alcohol ' of the Schedule and the higher rate of duty applies.

Example 12B

Zed and cola in cans has a labelled strength of 10% but an actual strength of 10.2% alcohol by volume.

As the product does not exceed the permitted variation of 0.2%, the strength of the product for excise purposes is the labelled strength.

As the strength does not exceed 10%, the product is classified to item 2 of the Schedule.

Example 12C

Why and dry in cans has a labelled strength of 10% but an actual strength of 10.3% alcohol by volume.

As the product exceeds the permitted variation of 0.2%, the strength of the product for excise purposes is the actual strength.

As the strength exceeds 10%, the product is classified to subitem 3.2 of the Schedule.

Example 12D

Oops, lime and soda in cans has a labelled strength of 10.1% but an actual strength of 9.9% alcohol by volume.

As the product does not exceed the labelled strength, the strength of the product for excise purposes is the labelled strength.

As the strength exceeds 10%, the product is classified to subitem 3.2 of the Schedule.

12.3.3 SPECIAL PROVISIONS FOR BEVERAGE SPIRITS – BRANDY, WHISKY AND RUM

Brandy, whisky or rum

These spirits are defined in section 77FI of the Excise Act:

- •

- 'Brandy' means a spirit distilled from grape wine in such a manner that the spirit possesses the taste, aroma and other characteristics generally attributed to brandy.

- •

- 'Whisky' means a spirit obtained by the distillation of a fermented liquor of a mash of cereal grain in such a manner that the spirit possesses the taste, aroma and other characteristics generally attributed to whisky.

- •

- 'Rum' means a spirit obtained by the distillation of a fermented liquor derived from the products of sugar cane, being distillation carried out in such a manner that the spirit possesses the taste, aroma and other characteristics generally attributed to rum.

What products can be classified as brandy, whisky and rum will be determined taking into account the definitions in section 77FI of the Excise Act and the following considerations:

- •

- the particular prerequisite raw materials from which the spirits are distilled

- •

- the manner in which the spirits are distilled, so that they possess certain characteristics generally attributed to the particular spirit (recognising that taste, aroma and characteristics can vary, even within a particular spirit type, for example, light rum and dark rum)

- •

- the addition of other ingredients to the spirit post distillation and whether the end product still has the taste, aroma and characteristics generally attributed to the particular spirit, and

- •

- whether the spirits have been matured in wood by storage in wood for at least 2 years.

When spirit comes off the still, it will generally be colourless, characterless and of relatively high strength. Whether spirit possesses the taste, aroma and other characteristics generally attributed to brandy, whisky, or rum is a matter of fact taking into account these considerations.

One of the characteristics attributable to specific spirits is the strength of the spirit as distilled. In line with industry practice, we would not question the strength as a characteristic for brandy and whisky distilled up to a maximum of 95% alcohol by volume and for rum distilled up to a maximum of 96.5% alcohol by volume.

These characteristics are those that the spirit possesses when it comes off the still.

The following special provisions apply to brandy, whisky and rum.

Maturation requirement

You cannot deliver brandy, whisky or rum from our control unless they have been matured by storage in wood for at least 2 years. [349]

'Storage in wood' means that the part of the storage vessel – vats, casks or barrels – that is in contact with the spirit is made entirely of wood.

You must record the date on which the spirit is put into wood. If the spirit is temporarily held in non-wooden vessels, you cannot include that period for the purposes of maturation in wood. If you do not maintain accurate records, you may not be able to calculate the date when the spirit reaches the required maturation age.

You can deliver spirit that has not been stored in wood for at least 2 years, but it cannot be delivered as a product described as brandy, whisky or rum.

Describing spirits as 'old' or 'very old'

Unless spirits have been aged in wood for 5 or 10 years, respectively, you cannot describe the spirits as 'old' or 'very old' or in a way that could reasonably lead another person to believe that the spirits have been matured for that period. [350]

12.3.4 YOUR RESPONSIBILITIES AS A MANUFACTURER

If you are licensed to manufacture excisable alcohol products, you are responsible for the safe custody of all alcohol under your control. [351]

You may be responsible for paying an amount equal to the excise duty that would have been payable on any stolen, missing or unaccounted for excisable alcohol products. [352]

Where, after we take stock of excisable alcohol products manufactured, and the materials you use in the manufacturing process, it appears to us that not all the duty that should have been paid has been paid we can demand that you pay the amount that should have been paid. [353]

If you hold a manufacturer licence, you do not need a separate storage licence to store excisable alcohol products that you manufactured at those premises. You may also store excisable alcohol products that have been manufactured elsewhere by another entity and moved ' underbond ' into premises covered by your licence.

You are also responsible for ensuring that you comply with all conditions of your licence. [354]

You must also:

- •

- ensure excisable alcohol products are only delivered into the Australian domestic market with appropriate authority, such as in accordance with a periodic settlement permission or Delivery authority [355]

- •

- pay the correct amount of excise duty [356]

- •

- get permission to move 'underbond' excisable alcohol products [357]

- •

- ensure that your manufacture complies with the Excise Act and any conditions specified in your licence [358] not manufacture excisable alcohol products at premises that are not covered by your licence [359]

- •

- give us access to your factory when requested [360]

- •

- keep your excisable alcohol products safe and accounted for to our satisfaction [361]

- •

- provide all reasonable facilities to enable us to exercise our powers under the Excise Act [362]

- •

- provide sufficient lighting, correct weights and scales, and all labour necessary for

- •

- weighing material received into your factory

- •

- weighing all excisable alcohol products manufactured in your factory, and

- •

- taking stock of all material and excisable alcohol products contained in your factory. [363]

You must keep records, as directed by us and retain those records for the period directed. Your records must be available for us to inspect when requested. [364]

The information you may be requested to record includes:

- •

- the amount of excisable alcohol products produced showing all inputs, outputs and waste

- •

- details of all excisable alcohol products held in premises covered by your licence

- •

- all deliveries from premises covered by your licence

- •

- details of all duty payments and excise returns, and

- •

- any refunds and remissions.

It is good business practice to keep suitable and adequate records and these records are those that you would normally keep for your particular operations.

Access

We have the right to enter premises covered by your licence at any time and can examine and take account of all the goods at the premises. [365] Note: we will usually only seek to enter your premises during normal business hours.

Stop vehicles

We can stop any vehicle leaving premises covered by your licence and check that there is proper documentation for excisable alcohol products leaving the premises. We can question the driver about any goods in the vehicle. We can direct that the vehicle is unloaded and goods taken to particular parts of the premises for further examination. We must not detain a vehicle for longer than is necessary to do the checking. [366]

Search vehicles

We can stop and search any vehicle (not just vehicles leaving premises covered by a licence) without a warrant if we have reasonable grounds for believing that the vehicle contains excisable alcohol products and that the vehicle has been used, is being used or will be used in the commission of an offence against the Excise Act (and certain offences in the Crimes Act 1914 [367] and Criminal Code [368] relating to accessory after the fact, attempt to commit an offence, aid and abet someone to commit an offence and conspiracy to commit an offence). [369]

Examine goods

We can open packages and examine, weigh, mark and seal any excisable goods that are subject to ' excise control ' and lock up, seal, mark or fasten any plant in or on your factory. [370]

We can also:

- •

- supervise the manufacture of excisable alcohol products [371]

- •

- take samples of materials, partly manufactured excisable alcohol products and excisable alcohol products subject to excise control, and alcohol products that we have reasonable grounds for suspecting are excisable alcohol products on which duty has not been paid. [372]

12.4 PROCEDURES

If you need more information on spirits and other excisable beverages, contact us via:

- •

- ATO Online Services

- •

- phone 1300 137 290 , or

- •

- write to us at

- Australian Taxation Office

PO Box 3514

ALBURY NSW 2640

We will ordinarily respond to electronic requests within 28 business days. We will ordinarily finalise private rulings within 28 days of receiving all necessary information. If we cannot respond within 28 days, we will contact you within 14 days to obtain more information or negotiate an extended response date.

12.5 PENALTIES THAT CAN APPLY IN RELATION TO SPIRITS AND OTHER EXCISABLE BEVERAGES

The following are the penalties that may apply after conviction for an offence.

Manufacture

If you manufacture excisable alcohol products without a manufacturer licence, the penalty is 2 years in prison or the greater of 500 ' penalty units ' and 5 times the amount of duty that would have been payable if the goods had been entered for home consumption on the penalty day. [373]

If you manufacture excisable alcohol products contrary to the Excise Act or any conditions specified in your licence the penalty is a maximum of 2 years in prison or 500 penalty units. [374]

If you manufacture excisable alcohol products at premises that are not covered by your licence, the penalty is 2 years in prison or the greater of 500 penalty units and 5 times the amount of duty that would have been payable if the goods had been entered for home consumption on the penalty day. [375]

Move, alter or interfere

If you move underbond excisable alcohol products without approval, the penalty is a maximum of 2 years in prison or the greater of 500 penalty units and 5 times the amount of duty on the excisable alcohol products. [376]

Note: this includes moving underbond excisable alcohol products from your premises to any other location or for export.

If your movement of underbond excisable alcohol products does not comply with the permission to move the underbond excisable alcohol products, the penalty is a maximum of 2 years in prison or the greater of 500 penalty units and 5 times the amount of duty on the excisable alcohol products. [377]

If you move, alter or interfere with excisable alcohol products that are subject to excise control, without permission, the penalty is a maximum of 2 years in prison or the greater of 500 penalty units and 5 times the amount of duty on the excisable alcohol products. [378]

Deliver

If you deliver excisable alcohol products into the Australian domestic market contrary to your permission, the penalty is a maximum of 2 years in prison or the greater of 500 penalty units and 5 times the amount of duty on the excisable alcohol products. [379]

Sell

If you sell excisable alcohol products on which duty has not been paid (unless it is an underbond sale), the penalty is a maximum of 2 years in prison or the greater of 500 penalty units and 5 times the amount of duty on the excisable alcohol products. [380]

Records

If you do not keep, retain and produce records in accordance with a direction under section 50 of the Excise Act, the penalty is a maximum of 30 penalty units.

Directions

If you do not comply with a direction in regard to what parts of the factory can be used for various matters, the penalty is a maximum of 10 penalty units. [381]

False or misleading statements

If you make a false or misleading statement to us, the penalty is a maximum of 50 penalty units.

If you make a false or misleading statement, or an omission from a statement in respect of duty payable on particular goods, to us, a penalty not exceeding the sum of 50 penalty units and twice the amount of duty payable on those goods. [382]

If you describe spirits as 'old' or 'very old' or in a way that could reasonably lead another person to believe that the spirits have been matured in wood for 5 or 10 years, respectively, and they have not, the maximum penalty is 10 penalty units. [383]

Evade

If you evade the payment of any duty that is payable, the maximum penalty is 5 times the amount of duty evaded or where a court cannot determine the amount of that duty the penalty is a maximum of 500 units. [384]

Facilities etc.

If you do not provide all reasonable facilities for enabling us to exercise our powers under the Excise Act, the penalty is a maximum of 10 penalty units. [385]

If you do not provide sufficient lighting, correct weights and scales, and all labour necessary for weighing material received into, and all excisable alcohol products manufactured in, your factory and for taking stock of all material and excisable alcohol products contained in your factory, the maximum penalty is 10 penalty units. [386]

If we mark or seal excisable alcohol products or fasten, lock or seal any plant in your factory and you alter, break or erase the mark, seal, fastening or lock, the maximum penalty is 50 penalty units. [387]

12.6 TERMS USED

Deliver into the Australian domestic market

'Deliver into the Australian domestic market' [388] is the term we use in this Guide for when excisable alcohol products are released into domestic consumption. The term used in the legislation is 'deliver for home consumption'.

Normally, this will be by delivering the goods away from premises covered by a licence but includes using those goods yourself (for example, sales to staff).

The term 'home consumption' is not defined in the Excise Act and there is no definitive case law that looks at the issue in question. However, there are several cases where issues closely related to it are considered. [389]

The conclusion drawn from those cases is that 'home consumption' refers to the destination of goods as being within Australia as opposed to exporting them.

Excisable goods are goods on which excise duty is imposed. Excise duty is imposed on goods that are listed in the Schedule, or an Excise Tariff alteration, and manufactured in Australia.

As this Guide deals with alcohol products, we have used the term excisable alcohol products.

Excisable alcohol products include:

- •

- beer

- •

- spirits

- •

- premixed drinks known as ready-to-drink (RTD) beverages

- •

- brewed beverages that are not beer, and

- •

- spirit for non-beverage use, including denatured spirit.

Goods are subject to excise control from the point of manufacture until they have been delivered into the Australian domestic market or for export.

Goods subject to excise control cannot be moved, altered or interfered with except as authorised by the Excise Act.

An ' excise return ' [390] is the document that you use to advise us the volume of excisable alcohol products that you:

- •

- have delivered into the Australian domestic market during the period designated on your PSP, or

- •

- wish to deliver into the Australian domestic market following approval.

The value of a penalty unit is contained in section 4AA of the Crimes Act 1914 , and is indexed regularly. The dollar amount of a penalty unit is available at Penalties .

This is a written instruction issued under section 50 of the Excise Act to a licensed manufacturer, or proprietor of premises covered by a storage licence, to keep specified records, furnish specified returns, retain records for a specified period and produce those records on demand by us. The written instructions are incorporated into the licence conditions.

This is an expression not found in excise legislation but it is widely used to describe goods that are subject to excise control. Excisable goods that are subject to the Commissioner's control are commonly referred to as 'underbond goods' or as being 'underbond'. This includes goods that have not yet been delivered into the Australian domestic market and goods moving between premises under a movement permission.

12.7 LEGISLATION (quick reference guide)

In this Chapter, we have referred to the following legislation:

- •

- Excise Act 1901

- –

- section 4 – definitions

- –

- section 25 – only licensed manufacturers to manufacture excisable goods

- –

- section 26 – licensed manufacturers to manufacture in accordance with Act and licence

- –

- section 27 – licensed manufacturers to manufacture only at licensed premises

- –

- section 39D – conditions of licence

- –

- section 46 – supervision by officers

- –

- section 49 – facilities to officers

- –

- section 50 – record keeping

- –

- section 51 – collector may give directions

- –

- section 52 – weights and scales

- –

- section 53 – responsibility of manufacturers

- –

- section 54 – liability to pay duty

- –

- section 58 – entry for home consumption etc.

- –

- section 60 – persons to keep excisable goods safely etc.

- –

- section 61 – control of excisable goods

- –

- section 61A – permission to remove goods that are subject to CEO's control

- –

- section 61C – permission to deliver certain goods for home consumption without entry

- –

- section 62 – deficiency in duty

- –

- section 77FF – spirit for an industrial, manufacturing, scientific, medical, veterinary or educational purpose – specific approvals

- –

- section 77FI – delivery from CEO's control of brandy, whisky or rum

- –

- section 77FL – offence in relation to describing spirits as "old" or "very old"

- –

- section 86 – officers to have access to factories and approved places

- –

- section 87 – power to stop conveyances about to leave an excise place

- –

- section 87AA – searches of conveyances without warrant

- –

- section 91 – examine all goods

- –

- section 92 – seals etc. not to be broken

- –

- section 106 – samples

- –

- section 117A – unlawfully moving excisable goods

- –

- section 117B – unlawfully selling excisable goods

- –

- section 120 – offences

- •

- Excise Tariff Act 1921

- –

- The Schedule

- •

- A New Tax System (Wine Equalisation Tax) Act 1999

- –

- Subdivision 31-A – Wine

- •

- Crimes Act 1914

- –

- section 4AA – penalty units

- –

- section 6 – accessory after the fact

- •

- Criminal Code Act 1995

- –

- section 11.1 – attempt

- –

- section 11.2 – complicity and common purpose

- –

- section 11.5 – conspiracy

Amendment history

| Part | Comment |

|---|---|

| Throughout | This chapter was updated to take into account the law changes as a result of the Excise and Customs Legislation Amendment (Streamlining Administration) Act 2024 . |

| Throughout | Updated in line with current ATO style and accessibility requirements. |

Copyright notice

© Australian Taxation Office for the Commonwealth of Australia

You are free to copy, adapt, modify, transmit and distribute this material as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).

References

| Date: | Version: | |

| 1 July 2013 | Updated document | |

| 1 July 2015 | Updated document | |

| 7 September 2017 | Updated document | |

| 21 February 2018 | Updated document | |

| 5 August 2019 | Updated document | |

| 4 June 2021 | Updated document | |

| 9 July 2021 | Updated document | |

| 23 December 2021 | Updated document | |

| 25 February 2022 | Updated document | |

| 1 July 2024 | Updated document | |

| You are here | 27 June 2025 | Current document |

Copyright notice

© Australian Taxation Office for the Commonwealth of Australia

You are free to copy, adapt, modify, transmit and distribute material on this website as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).