Taxpayer Alert

TA 2022/2

Treaty shopping arrangements to obtain reduced withholding tax rates

| Table of Contents | Paragraph |

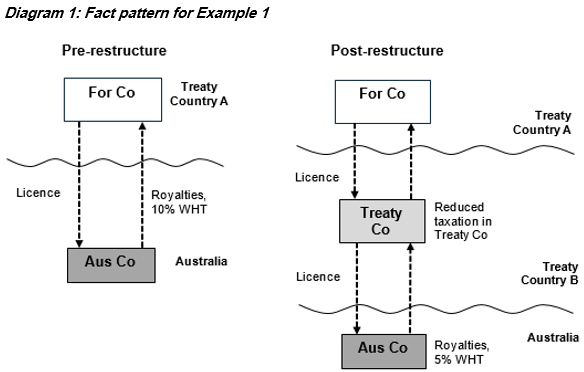

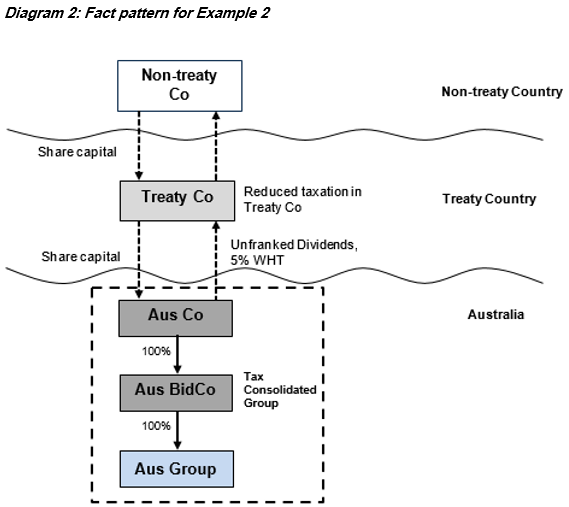

|---|---|

| Description | |

| Examples | |

| Example 1: Entity interposed to reduce Australian royalty withholding tax | |

| Example 2: Acquisition structured through a treaty jurisdiction to reduce Australian dividend withholding tax | |

| What are our concerns? | |

| What are we doing? | |

| What should you do? |

About Taxpayer Alerts

About Taxpayer Alerts

Alerts provide a summary of our concerns about new or emerging higher risk tax or superannuation arrangements or issues that we have under risk assessment. While an Alert describes a type of arrangement, it is not possible to cover every potential variation of the arrangement. The absence of an Alert on an arrangement or a variation of an arrangement does not mean that we accept or endorse the arrangement or variation, or the underlying tax consequences. Refer to PS LA 2008/15 for more about alerts. See Alerts issued to date. |

1. We are currently reviewing treaty shopping arrangements designed to obtain the benefit of a reduced withholding tax (WHT) rate under a double-tax agreement (DTA) in relation to royalty or dividend payments from Australia. Typically, this benefit is sought via the interposition of one or more related entities between an Australian resident and the ultimate recipient of the royalty or dividend, where the interposed entity is a resident of a treaty partner jurisdiction. The ultimate recipient is generally located in a jurisdiction that either does not have a DTA with Australia or, where it is a treaty partner of Australia, the DTA provides a less favourable treaty benefit.

2. A key purpose of Australia's treaty network is to eliminate double taxation without creating opportunities for tax avoidance practices, such as treaty shopping arrangements. We are concerned that some taxpayers have entered into, or are considering implementing, arrangements interposing entities in treaty jurisdictions to obtain a more favourable tax outcome under a DTA in the form of reduced WHT rates. These taxpayers may not be entitled to such benefits under our DTAs.

3. Arrangements that pose a potential risk of treaty shopping may display some of the following features and we are likely to make further enquiries where such factors exist:

- •

- Structures and restructures involving the interposition of an existing or newly incorporated entity between Australia and the ultimate recipient of royalties or unfranked dividends.

- •

- The interposed entity may have significant existing operations and employees and the taxpayer may contend that commercial benefits and/or synergies flow to the Australian operations or the interposed entity.

- •

- Royalty or unfranked dividend payments[1] (or potential future royalty or unfranked dividend payments) to the interposed entity are (or would be) subject to WHT at reduced rates under the relevant DTA compared with Australian domestic law or the applicable WHT rate under the DTA between Australia and the country of residence of the ultimate recipient.

4. The diagrams in this Alert (for Examples 1 and 2) illustrate simplified examples of some of the higher-risk arrangements of concern that will be subject to increased scrutiny. The arrangements may also involve multiple jurisdictions with a number of interposed entities in the holding structure.

Example 1: Entity interposed to reduce Australian royalty withholding tax

5. Aus Co is a member of the Foreign Co Group, with the ultimate parent company being For Co, a multinational corporation with a tax residence in Treaty Country A and operations through subsidiaries in numerous other jurisdictions, including Treaty Country B. Australia has concluded DTAs with each of Treaty Countries A and B.

6. Prior to the restructure, Aus Co had an exclusive licence agreement with For Co, which granted Aus Co the rights to use various patents and trademarks to facilitate their sales and marketing activities in the Australian market. Under the terms of the arrangement, Aus Co paid a licence fee to For Co. These payments constituted royalties in accordance with the definition under the relevant treaty article. As such, Aus Co's payments to For Co were subject to royalty WHT at the reduced rate of 10% provided under the DTA between Australia and Treaty Country A, rather than the 30% rate payable under Australian domestic tax law in the absence of DTA relief.[2]

7. In 2020, For Co undertook the following steps to restructure its Australian operations:

- •

- The exclusive licensing arrangement with Aus Co was terminated.

- •

- Another subsidiary of For Co, Treaty Co (a tax resident in Treaty Country B), was granted the rights to sub-licence the use of patents and trademarks in certain regions, including Australia.

- •

- Aus Co entered into a new exclusive licensing arrangement with Treaty Co.

- •

- The new agreement between Treaty Co and Aus Co operates in effect to grant rights that are similar in substance to the rights granted under the previous arrangement between Aus Co and For Co.

- •

- Aus Co now pays royalties to Treaty Co and payments are subsequently made by Treaty Co to For Co.

- •

- Treaty Co's activities mainly consist of the receipt and on-payment of royalties to For Co, reporting on its investment in Aus Co to For Co and complying with its corporate obligations.

8. As a result of the restructure:

- •

- Treaty Co applies the reduced royalty WHT rate of 5% under the DTA between Australia and Treaty Country B in respect of the royalty paid by Aus Co to Treaty Co.

- •

- There is reduced taxation paid by Treaty Co in respect of the royalty received from Aus Co in Treaty Country B.

- •

- There is reduced taxation in respect of any payments subsequently made to For Co from Treaty Co.

9. Aus Co asserts that the restructure was undertaken for a number of reasons, including that:

- •

- Treaty Country B provided a superior business environment compared with Treaty Country A for conducting its licensing operations.

- •

- The interposition of Treaty Co creates operational synergies between Aus Co and For Co's subsidiaries in Treaty Country B.

10. A lack of contemporaneous documentation and other objective evidence supporting these contentions may imply that accessing the reduced WHT rates was one of the principal or main reasons for interposing Treaty Co.

Example 2: Acquisition structured through a treaty jurisdiction to reduce Australian dividend withholding tax

11. Non-treaty Co is a conglomerate that invests in global infrastructure, including in Treaty Country. Non-treaty Co is located in a jurisdiction that does not have a DTA with Australia. In 2020, Non-treaty Co identified an opportunity to acquire Aus Group to grow its existing global portfolio. Prior to its successful acquisition of Aus Group, Treaty Co, Aus Co and Aus BidCo were incorporated as part of a series of transactions which resulted in Treaty Co (a non-resident for Australian tax purposes) being the holding company of Aus Co (an Australian tax resident), with Non-treaty Co indirectly holding 100% of Aus Group. Following the acquisition, Aus Group joined the Aus Co tax consolidated group.

12. The acquisition of Aus Group had the following further characteristics:

- •

- The funding for the acquisition was primarily sourced by Non-treaty Co.

- •

- Considerable future payments of unfranked dividends by Aus Co to Treaty Co were forecast prior to the acquisition.

- •

- Dividends received by Treaty Co are to be either repatriated to Non-treaty Co or kept in passive investments and not reinvested into any substantive commercial operations of Treaty Co.

- •

- Treaty Co is controlled by Non-treaty Co directors.

- •

- There are some common directorships between Non-treaty Co, Treaty Co and Aus Co.

13. As a result of the arrangement:

- •

- Treaty Co applies the reduced dividend WHT rate under the relevant DTA in respect of unfranked dividends paid by Aus Co to Treaty Co.

- •

- There is reduced taxation paid by Treaty Co in respect of the unfranked dividends received from Aus Co in Treaty Country.

- •

- There is reduced taxation in respect of any payments subsequently made to Non-treaty Co from Treaty Co.

14. Aus Co asserts that structuring the acquisition of Aus Group through Treaty Country was undertaken for a number of reasons, including that:

- •

- Treaty Co facilitates access to the expertise that exists in Non-treaty Co's infrastructure investments in Treaty Country

- •

- operational efficiencies, synergies and cost savings, and the improved ability to share knowledge and expertise were anticipated.

15. A lack of contemporaneous documentation and other objective evidence supporting these contentions may imply that accessing the reduced WHT rates was one of the principal or main reasons for structuring the acquisition of Aus Group through Treaty Country.

16. We are concerned that arrangements of the kind described in this Alert may be entered into or carried out by taxpayers for a principal or main purpose of obtaining a treaty benefit to which they would not otherwise be entitled. These arrangements may attract the operation of the anti-avoidance rules provided under Australia's DTAs. The anti-avoidance rules under our DTAs that may be applicable include[3]:

- •

- a Principal Purposes Test (PPT) contained either in some of Australia's DTAs themselves or in Article 7(1) of the Organisation for Economic Co-operation and Development's Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (MLI)

- •

- a Main Purposes Test (MPT) contained under the applicable royalty and dividend articles in a number of Australia's DTAs.[4]

17. Arrangements covered by this Alert also include those which may attract the operation of the general anti-avoidance rules and/or diverted profits tax in Part IVA of the Income Tax Assessment Act 1936 and other provisions under Australian domestic law.[5]

18. This Alert is not directed at arrangements which facilitate bona fide investment into Australia that obtain treaty benefits in a manner consistent with the object and purpose for which the benefit is intended to be conferred.

19. We are currently reviewing international transactions for these types of arrangements and engaging with taxpayers and advisers in respect of existing and proposed arrangements as part of our engagement and assurance activities.

20. The publication of Law Administration Practice Statement PS LA 2020/2 Administering general anti-abuse rules, such as a principal or main purposes test, included in any of Australia's tax treaties provides transparency for the tax community on how the ATO establishes that a principal or main purposes test applies. This assists with the early detection of treaty shopping arrangements and ensures such arrangements are likely to be subject to further review where warranted.

21. Where we identify arrangements that exhibit common treaty shopping features, such as those described in this Alert, they will be subject to increased scrutiny. We are likely to make further detailed enquiries and request contemporaneous evidence in relation to the relevant facts and circumstances of such arrangements to test the veracity of the commercial benefits that are asserted by taxpayers and/or their advisers.

22. The consequence of the PPT applying to an arrangement is that the reduced WHT rate under the respective DTA is denied and the Australian domestic rate of WHT is imposed.

23. If you have entered into, or are contemplating entering into, an arrangement of this type we encourage you to discuss your situation with us by emailing TaxTreaties@ato.gov.au

24. Even where your arrangement has existed for some time, we encourage you to engage with us, as the anti-avoidance rules under our DTAs may potentially apply in respect of payments in the future despite, for example, the arrangement being established prior to the MLI taking effect.

25. Penalties may apply to participants in and promoters of these types of arrangements.

Commissioner of Taxation

20 July 2022

© AUSTRALIAN TAXATION OFFICE FOR THE COMMONWEALTH OF AUSTRALIA

You are free to copy, adapt, modify, transmit and distribute this material as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).

Date of Issue: 20 July 2022

Date of Effect: N/A

Unfranked dividends not declared as conduit foreign income under Subdivision 802-A of the Income Tax Assessment Act 1997.

Under paragraph 7(c) of the Income Tax (Dividends, Interest and Royalties Withholding Tax) Act 1974.

Although this Alert focuses on the application of the MLI PPT, this is merely for ease of reference and it is intended that this Alert covers arrangements where any of these anti-avoidance rules may have application.

For DTAs whose operation is affected by the MLI, the PPT does not have retrospective effect and where the DTA contains an MPT provision, the MPT applies in respect of royalties and dividends paid before the date that the MLI came into effect in respect of that DTA.

The Commissioner may have other concerns in connection with the kinds of cross-border structures described in this Alert and may consider the application of other provisions including, for example, Subdivision 12-F in Schedule 1 to the Taxation Administration Act 1953, or Subdivision 815-B or Division 974 of the Income Tax Assessment Act 1997.

File n/a

Related Rulings/Determinations:

TR 2001/13

Related Practice Statements:

PS LA 2008/15

PS LA 2020/2

Other References: Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting Article 7(1)

Legislative References:

Part IVA ITAA 1936

ITAA 1997 Subdiv 802-A

ITAA 1997 Subdiv 815-B

ITAA 1997 Div 974

TAA 1953 Sch 1 Subdiv 12-F

Income Tax (Dividends, Interest and Royalties Withholding Tax) Act 1974 7(c)

Simon Hellmers

| Contact officer: | Kieran Starr |

| Email address: | Kieran.Starr@ato.gov.au |

| Telephone: | (02) 9374 1487 |

ISSN: 2651-9550

Copyright notice

© Australian Taxation Office for the Commonwealth of Australia

You are free to copy, adapt, modify, transmit and distribute material on this website as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).