GST considerations for buy-now, pay-later providers

March 2023Background

One key area of focus under the ATO's GST Financial Services and Insurance strategy is engaging with entities in the Fintech sector, including buy-now, pay-later providers. We are keen to engage with you to provide practical guidance and share our observations on how we assess GST risk in this area.

In this guidance, we set out the key GST considerations for buy-now, pay-later providers, focusing on how to determine your entitlement to input tax credits on related costs. This guidance provides practical insight into how we assess risk in this area.

If you rely on this guidance you have the protections that apply to Guidance - see How our advice and guidance protects you.

This guidance considers typical buy-now, pay-later arrangements. The GST implications for any particular arrangement will depend on the particular facts and circumstances of that arrangement.

GST considerations for buy-now, pay-later providers

The key GST considerations for buy-now, pay-later providers are:

- •

- Tax governance: It's critical to make sure that you have a well-designed tax control framework which is fit for purpose in mitigating the tax risks that arise in your business. For GST, the ATO's GST governance, data testing and transaction testing guide sets out how the ATO will review GST governance for top 100 and top 1,000 taxpayers. For entities who are yet to reach this size, investing in your tax governance framework will give you confidence in your reporting, minimise reporting errors and provide a strong foundation for the future.

- •

- GST classification of supplies: You must ensure that supplies are classified correctly for GST purposes, and that GST is remitted on taxable supplies you make. We have seen errors arise where supplies are incorrectly treated which has resulted in significant GST shortfalls - for example, where entities fail to remit GST on taxable supplies made to related entities that are not within their GST group. Goods and Services Tax Ruling GSTR 2002/2 Goods and services tax: GST treatment of financial supplies and related supplies and acquisitions provides the ATO view on classification of financial supplies.

- •

- Claiming input tax credits: Under Division 11 of the A New Tax System (Goods and Services Tax) Act 1999 (GST Act), input tax credits are generally not available on acquisitions to the extent they relate to making input taxed supplies.

- Apportionment methodologies used to determine the extent of recoverable GST must be fair and reasonable and reflective of the objective use of your costs in making input taxed and non-input taxed supplies. You must ensure that your apportionment methodology is well-documented and regularly reviewed. Guidance on apportionment methods that can be used for calculating extent of input tax credit entitlement is available in ATO public rulings; for example, Goods and Services Tax Ruling GSTR 2006/3 Goods and services tax: determining the extent of creditable purpose for providers of financial supplies.

- •

- Claiming reduced input tax credits (RITCs): Where input tax credits are denied under Division 11 of the GST Act, you may still be entitled to 75% RITCs under Division 70 of that Act for specified acquisitions that qualify under the A New Tax System (Goods and Services Tax) Regulations 2019 (GST Regulations). You should be prepared to provide documentation (for example, relevant workpapers, invoices and supporting general ledger records) to support RITCs claimed on these acquisitions, which demonstrates that the acquisition falls within an item in the GST Regulations. Goods and Services Tax Ruling GSTR 2004/1 Goods and services tax: reduced credit acquisitions provides guidance on which acquisitions are reduced credit acquisitions.

- •

- Reverse charged GST: Cross-border acquisitions that relate partly or solely to making input taxed supplies must be reverse charged under Division 84 of the GST Act (subject to exceptions). For these transactions, you will need to account for GST on your purchase, and can then claim back any available input tax credits.

- We have observed that a number of entities have failed to reverse charge cross-border acquisitions from third-party suppliers or overseas related parties, which has resulted in significant GST shortfalls. This is often caused by a poorly designed tax governance framework. We have published guidance on the application of the reverse charge provisions with practical recommendations for how you can minimise compliance risk in this area.

- •

- Significant and unusual transactions: The GST consequences of significant and unusual transactions require careful consideration. One example is ensuring that input tax credits on costs associated with initial public offerings, capital raising activities and costs associated with funding the buy-now, pay-later product are identified and appropriately denied.

If you've identified errors in reviewing your arrangements, you should let us know. If you make a voluntary disclosure, we may reduce any penalties we would usually charge you.

Supplies made by buy-now, pay-later providers

This guidance addresses instances where buy-now, pay-later providers provide credit to customers, rather than in alternate scenarios such as where buy-now, pay-later providers supply software to businesses which enable each business to provide credit to its customers.

Depending on the facts, a buy-now, pay-later provider may generally make:

- •

- input taxed supplies of credit when a customer initiates the provider's provision of payment to the merchant in exchange for the customer's obligation to repay the provider at a later date.[1] Input taxed supplies are made when the customer is provided with credit, regardless of whether interest or fees are charged to the customer.[2] As the supply is input taxed, no GST is payable in relation to fees charged to the customer, such as late fees or account fees. However, input tax credits are generally not available to the extent that acquisitions relate to making these supplies, regardless of whether any charge is made to the customer.

- •

- taxable supplies of services to merchants in enabling them to accept payment using the provider's facilities, with the provider then becoming liable to make payment to the merchant (and the customer's obligation to pay the merchant being discharged). These supplies are made in exchange for merchant fees, charged on a purchase transaction-by-transaction basis.

| Example 1: consideration for input taxed supplies

Isla Pay provides a buy-now, pay-later product which enables customers to buy and receive goods and services immediately from merchants, and repay the amount owing in 4 equal fortnightly instalments. Customers are not charged interest, but they are charged late fees if they fail to pay on time. When a customer accesses credit to make a purchase, Isla Pay makes payment to the merchant and the customer's obligation is to repay Isla Pay. Frank enters into such an arrangement to purchase a mobile phone from a merchant. Frank's obligation to repay (an interest in a debt) is consideration for Isla Pay's supply of an interest in a credit arrangement. Even if no monetary fees are charged to Frank, Isla Pay is still making an input taxed supply of credit. |

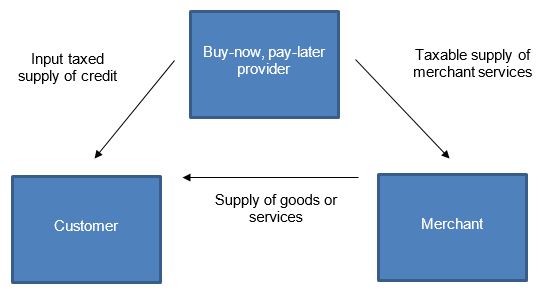

The supplies made in a typical 3-party buy-now, pay-later arrangement are outlined in Diagram 1 of this guidance.

Diagram 1: 3-party buy-now, pay-later arrangement

You will also need to consider other supplies you make - for instance, in relation to how the business is funded - as these should be considered in determining the creditable purpose of your acquisitions (including in the treatment of enterprise costs). For example, costs may relate to the issue of debt securities by a trust within the GST group as part of a warehouse funding arrangement (with certain costs relating only to these financial supplies).

Alternatively, if the trust is outside the GST group, you may need to pay GST on taxable supplies you make to the trust, and certain costs may have a real or substantial connection to these supplies of servicer services.[3]

GST implications for merchants

As with any arrangement, the GST consequences will depend on the particular facts and circumstances, including the contractual arrangements. This guidance does not address circumstances where there is an assignment of debt from the merchant as, under typical buy-now, pay-later arrangements, the customer's debt to the merchant is discharged by the buy-now, pay-later provider. Relevant guidance on assignment arrangements is provided in GSTR 2004/4.

While the GST consequences will depend on the facts of the particular arrangement, generally the merchant does not make a financial supply to the customer in circumstances where, under the relevant agreements:

- •

- the customer has the ability to initiate the buy-now, pay-later provider's payment to the merchant (a third party) in exchange for the customer's corresponding obligation to pay the buy-now, pay-later provider at a later time, and

- •

- the customer's obligation to pay the merchant for the underlying goods or services is discharged by the buy-now, pay-later provider. This will be either when the merchant agrees to accept the customer's use of the buy-now, pay-later provider's payment method, or the buy-now, pay-later provider pays the merchant on behalf of the customer.

Determining the entitlement to input tax credits

Under Division 11 of the GST Act, input tax credits are generally not available on acquisitions to the extent that they relate to the making of input taxed supplies. The extent to which input tax credits are recoverable under this provision is the 'extent of creditable purpose' (ECP).

Some exceptions apply where input tax credits can still be claimed, such as where you do not exceed the Financial Acquisitions Threshold, or where an acquisition qualifies for a reduced input tax credit.

There are 2 steps in applying Division 11 of the GST Act:

- •

- firstly, identifying whether a relevant connection exists between acquisitions and supplies

- •

- secondly, for acquisitions that relate to both input taxed and taxable or GST-free supplies, determining an apportionment method that gives a fair and reasonable reflection of the extent of the relationships between those acquisitions and supplies.

This means you will need to identify which of your acquisitions:

- •

- only relate to making input taxed supplies of credit to customers, for which no input tax credits are generally available

- •

- only relate to making taxable supplies to merchants, for which full input tax credits are available

- •

- relate to making both supplies, which means that acquisition has a partial extent of creditable purpose that must be determined on a fair and reasonable basis.

Relevant principles

There is no general proposition that all acquisitions made in a buy-now, pay-later business will relate to both supplies made. The application of these provisions requires the precise identification of the relevant acquisition and a factual enquiry into the connection between the acquisition and the making of supplies that would be input taxed.[4]

This requires an objective assessment of the facts to determine if a relevant connection exists between an acquisition and the making of input taxed supplies. An approach which looks through to the subjective intention or actual purpose for making the acquisition will be inconsistent with the operation of the provision.[5]

The identification of the relevant connection does not turn upon a characterisation of the purpose, or the occasion of the purpose, of the supplier in the sense of a broader commercial objective of the enterprise.[6] If an objective assessment shows that an acquisition only has a relevant connection to the making of input taxed supplies, the acquisition is not to be apportioned merely because those supplies may also serve a broader commercial objective (that is, has a wider consequence).

For example, a buy-now, pay-later provider may acquire advertising services to promote credit arrangements to potential new customers (Example 5 of this guidance provides such an example). This will serve a broader commercial purpose in that when the new customer accesses credit, the provider will supply taxable services to merchants. Depending on the business model, merchant fees may represent the principal source of revenues derived by the business. However, where an objective assessment shows that advertising services acquired only have a relevant connection to making input taxed supplies to customers (as they are intended to promote new credit arrangements to those customers), the acquisition is not to be apportioned merely because those supplies serve that broader commercial objective. Conversely, there may be advertising services which are only intended to promote supplies of merchant services to new merchants, and which only relate to making taxable supplies to merchants.

For the ATO's application of these principles in a different factual context relevant to credit cards and transaction accounts, see:

- •

- Goods and Services Tax Ruling GSTR 2019/2 Goods and services tax: determining the creditable purpose of acquisitions in a credit card issuing business

- •

- Goods and Services Tax Ruling GSTR 2020/1 Goods and service tax: determining the creditable purpose of acquisitions in relation to transaction accounts.

Examples of the determination of creditable purpose of common acquisitions

The following are examples which outline our views on the treatment of common types of acquisitions made by a buy-now, pay-later provider (who makes input taxed supplies of credit to customers and taxable supplies of services to merchants as described above), to illustrate the relevant principles.

Acquisitions that only relate to input taxed supplies of credit to customers

| Example 2: acquisitions of debt collection services

Isla Pay acquires debt collection services when it engages providers to recover debts from its customers. These services enable Isla Pay to enforce the customers' obligations to repay their debts. These acquisitions only have a real and substantial connection to the input taxed supply of credit made to the customers. While Isla Pay supplied taxable services to the merchant (from whom the customers made purchases) in relation to the transactions that gave rise to the debts, this fact itself does not establish a relevant connection between the acquisitions and those supplies. The relationship is too remote to establish a creditable purpose. |

| Example 3: acquisitions to process customer instalment payments

Isla Pay acquires card merchant services from its financial institution in accepting instalment payments from its customers via their debit or credit cards. These acquisitions enable Isla Pay to accept repayments from customers, in satisfaction of their obligations to repay the credit provided. These acquisitions only have a real and substantial connection to the input taxed supply of credit made to the customer. As with Example 2 of this guidance, the relationship between these acquisitions and the taxable supplies of merchant services in relation to the transactions that gave rise to the debts is insufficient to establish a creditable purpose. |

| Example 4: acquisitions for customer authorisation and verification

Isla Pay acquires services in undertaking proof of identity or credit checks (or both) at the time of onboarding a new customer, and in undertaking pre-authorisation activities for customer transactions. These acquisitions help Isla Pay assess the creditworthiness of the customer in order to determine whether it should offer them credit. The acquisitions are intended for use in originating supplies of credit to customers, and only have a real and substantial connection to these supplies. When the customer obtains credit in undertaking a purchase, Isla Pay will make taxable supplies of services to the merchant. However, this fact of itself does not establish a real and substantial connection between the acquisition and these supplies. |

| Example 5: acquisitions to advertise buy-now, pay-later products to new customers

Isla Pay acquires advertising services to promote its buy-now, pay-later product to potential new customers. The advertisements promote the features of the credit arrangement, such as the convenience and wide acceptance of the product, the ability to spread out payments over time, and that there are no interest charges. The advertisement contains a link to Isla Pay's website, which provides more information about the buy-now, pay-later product and how new customers can apply for the product. The advertisement is placed on social media, with potential new customers (rather than merchants) being the target audience. Viewed objectively, this acquisition is intended for originating supplies of credit to customers. The acquisitions only have a real and substantial connection to those supplies. While Isla Pay supplies services to merchants when the customer obtains credit to make a purchase, this fact itself is insufficient to establish a relevant connection between the acquisitions and those supplies. The relationship is too remote to establish a creditable purpose. |

Acquisitions that only relate to taxable supplies to merchants

| Example 6: acquisitions for merchant integrations

Isla Pay acquires services in setting up and maintaining integration into merchants' IT and physical systems in order to allow merchants to accept payments initiated by its customers. These acquisitions enable merchants to accept Isla Pay's facility as a payment method from customers, and therefore acquire taxable supplies of services. These acquisitions only relate to these supplies. |

Acquisitions that relate to both input taxed supplies to customers and taxable supplies to merchants

| Example 7: acquisitions to develop and maintain a customer smartphone app

Isla Pay makes acquisitions from a third-party technology provider to develop and maintain a customer smartphone app. The app is used to manage the debtor and creditor relationship with the customer; for instance, by enabling customers to view the amount of credit they can access, their recent transactions and upcoming repayments. These functions solely relate to the supplies of credit that Isla Pay makes to its customers. While Isla Pay supplies merchant services in relation to the transactions that customers can view using the application, this fact is not of itself sufficient to establish a real and substantial connection between the acquisitions to perform these functions and these taxable supplies. Other functions of the app are used by the customer to initiate their access to credit for a purchase transaction with a specific merchant. To this extent, the acquisition is used to make both input taxed supplies of credit to the customer and taxable supplies to merchants, and is partly creditable. |

| Example 8: enterprise costs

Isla Pay has a number of costs which are costs of its enterprise as a whole, such as audit costs, head office rent and office expenses.[7] These acquisitions do not have a direct connection to any particular supplies, and instead have an indirect connection to all activities of the enterprise. This acquisition is to be apportioned based on all supplies made by the enterprise, including the supply of credit and the supply of services to merchants, plus any other supplies made. |

How we risk assess apportionment methodologies

The apportionment methodology you use must reflect the objective intended use of acquisitions. The methodology used must have regard to whether some of the acquisitions only relate to making input taxed supplies, or conversely only relate to making taxable supplies.[8]

We expect buy-now, pay-later providers to analyse their acquisitions to determine their creditable purpose, rather than apportioning all acquisitions on the assumption that they all relate to both input taxed and taxable supplies. We also expect your methodology and analysis of acquisitions to be well-documented which will assist with preparing for any compliance reviews (see Table 2 of this guidance for examples).

| Treatment | Examples of acquisitions |

| Acquisitions that relate only to input taxed supplies | Debt collection costs

Advertising to originate new credit contracts Customer service for customers Merchant fees and processing costs for recovering payments from customers Customer credit checks, authorisation and fraud tools |

| Acquisitions that relate only to taxable supplies | Advertising to originate new merchant agreements

Customer service for merchants Costs for integration with merchants' systems |

| Acquisitions that relate to both supplies | Processing costs for payments to merchants when customers initiate the provision of credit |

We consider that the use of a revenue-based apportionment methodology gives rise to a significant risk that input tax credits may be overclaimed. Due to the nature of the business where complying customers are not charged interest, there is typically limited input taxed revenue to reflect the extent to which acquisitions relate to input taxed supplies of credit. Therefore, the use of this approach will be a high priority for review to test whether the GST recovery is appropriate based on an analysis of the objective use of the acquisitions that the method is applied to.

Even where a revenue-based apportionment methodology is only applied to acquisitions that relate to both supplies, we would need to carefully consider whether this is a fair and reasonable measure of the objective use of those acquisitions. The extent of creditable purpose of an acquisition is based on its relationship to the making of particular supplies, and revenue is only an indirect method of approximating this relationship.[9] A revenue-based method will, however, be fair and reasonable if the assumption holds that there is a proportionate relationship between the revenue used to measure the supplies made, and the use of the acquisitions that the revenue method applies to.[10]

To use an example, let's say an acquisition is used for processing a customer's purchase transaction with a particular merchant (for example, processing costs in making payments to the merchant, or in enabling the customer to initiate their access to credit for that particular transaction), through which a buy-now, pay-later provider makes both taxable and input taxed supplies. Such an acquisition can be viewed as equally relating to both supplies. Apportioning the acquisition based on the revenue derived from each supply may not fairly measure the objective use of the acquisition.

The following provides examples of high risk and low risk apportionment methods. This is not intended to be prescriptive but instead to illustrate how we assess the risk of different approaches. Note that the figures used are illustrative only.

| Example 9: high risk approach

In recovering input tax credits under Division 11 of the GST Act, Isla Pay uses a revenue-based apportionment methodology. The revenue derived from taxable supplies to merchants as a proportion of total revenue is 70%, so Isla Pay applies a 70% ECP rate to all of its acquisitions. Isla Pay's apportionment methodology is high risk and will be a high priority for ATO review. The method does not have regard to acquisitions that only relate to making particular supplies (for instance, acquisitions that only relate to making input taxed supplies of credit, such as debt collection costs, are recovered at 70% ECP, even though they have no creditable purpose). Even for acquisitions that relate to both supplies, we would need to consider whether revenue is an appropriate measure of the intended use of the acquisitions. |

| Example 10: low risk approach

In recovering input tax credits under Division 11 of the GST Act, Isla Pay analyses its acquisitions and determines the treatment applied as per Table 3 of this guidance.

Isla Pay uses a fair and reasonable apportionment method to apportion its remaining costs which do not directly relate to particular supplies, such as enterprise costs. Isla Pay reviews its apportionment methodology on an annual basis. |

Credit cards offered on buy-now, pay-later terms

We have also observed that some cards issued in 4-party credit card networks are being offered on buy-now, pay-later terms, with interest-free instalment payments. Where in substance the product is a credit card facility, we will apply Schedule 1 of Practical Compliance Guideline PCG 2019/8 ATO compliance approach to GST apportionment of acquisitions that relate to certain financial supplies.

| Example 11: credit card offered on buy-now, pay-later terms

Alfredo Pay issues a buy-now, pay-later product, which is a digital card that customers can use on their mobile device for in-store purchases, or to make online purchases. The card is issued by Alfredo Pay in a 4-party credit card network, and can be used to undertake transactions wherever the scheme operator's cards are accepted. On entry into the contract, the cardholder has the right to present the card as payment (up to a credit limit) and obtain credit from Alfredo Pay. Under this product, Alfredo Pay enables customers to split repayments for a purchase into regular instalments. There are no interest charges, though late payment fees apply. Alfredo Pay makes taxable supplies of interchange services to acquiring entities when transactions are undertaken on the digital card. The ATO will apply Schedule 1 - Credit Cards of PCG 2019/8 in reviewing Alfredo Pay's approach to apportioning the costs for this product. |

© AUSTRALIAN TAXATION OFFICE FOR THE COMMONWEALTH OF AUSTRALIA

You are free to copy, adapt, modify, transmit and distribute this material as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).

See table item 2 of subsection 40-5.09(3) of the GST Regulations and Commissioner of Taxation v American Express Wholesale Currency Services Pty Limited [2010] FCAFC 122 (Amex) at [174].

The Commissioner's view on interest-free loans is in paragraphs 37 to 41 of GSTR 2002/2.

The Commissioner's view on the provision of servicer services and determining the creditable purpose of acquisitions made by a home loan originator is in paragraphs 106 to 109BW of Goods and Services Tax Ruling GSTR 2004/4 Goods and services tax: assignment of payment streams including under a typical securitisation arrangement.

Rio Tinto Services Limited v Commissioner of Taxation [2015] FCAFC 117 at [7].

Axa Asia Pacific Holdings Limited v Commissioner of Taxation [2008] FCA 1834 at [122].

Rio Tinto Services Limited v Commissioner of Taxation [2015] FCAFC 117 at [7].

See paragraphs 136 to 148 of Goods and Services Tax Ruling GSTR 2008/1 Goods and services tax: when do you acquire anything or import goods solely or partly for a creditable purpose?

See paragraph 38A of GSTR 2006/3.

Amex at [123-127].

Amex at [127]; paragraph 105 of GSTR 2006/3.

Legislative References:

GST Act Div 11

GST Act Div 70

GST Act Div 84

ANTS(GST)R 2019

Case References:

Commissioner of Taxation v American Express Wholesale Currency Services Pty Limited

[2010] FCAFC 122

187 FCR 398

77 ATR 12

2010 ATC 20-212

273 ALR 501

[2015] FCAFC 117

235 FCR 159

2015 ATC 20-525

101 ATR 546 AXA Asia Pacific Holdings Limited v Commissioner of Taxation

[2008] FCA 1834

173 FCR 500

2008 ATC 20-074

(2008) 71 ATR 1 Rio Tinto Services Limited v Commissioner of Taxation

[2015] FCAFC 117

235 FCR 159

2015 ATC 20-525

Related Rulings/Determinations:

GSTR 2002/2

GSTR 2006/3

GSTR 2004/1

GSTR 2004/4

GSTR 2019/2

GSTR 2020/1

GSTR 2008/1

Other References:

PCG 2019/8