Scam advice

Be wary of emails, phone calls and text messages claiming to be from the ATO.

If you think a phone call, SMS, voicemail, email or interaction on social media claiming to be from the ATO isn't genuine, don't engage with it. You should either:

- phone us on 1800 008 540

- go to Verify or report a scam to see how to spot and report a scam.

Stay up to date on the latest scam alerts by subscribing to our general email updates. You will also receive updates on all new general content on our website.

Misinformation

Misinformation is another online risk to watch out for. It can appear on websites, social media platforms, or in messages, and often contains false or misleading claims. While it may not be a scam, misinformation can still cause harm – especially if it leads you to make decisions based on incorrect or incomplete information.

It’s important to stay alert and consider the source of the information you see online. If something doesn’t seem right, check it against official government websites or speak to a trusted professional.

For more help, see Protect yourself from misinformation and disinformation.

Latest scam alerts

These are examples of ATO, myGov and myID scams, but it doesn't cover all scams.

- February 2026 – Cryptocurrency email scam

- October 2025 – DocuSign email scam

- November 2024 – ATO impersonation email scam

- November 2024 – myGovID and myID scams

- March 2024 – myGov email impersonation scams

- November 2023 – Multifactor Authentication (MFA) email scam

- August 2023 – tax time SMS and email scams

- January 2023 – ATO social media impersonation accounts scam

- July 2022 – tax refund SMS scams

- June 2022 – 2022 tax lodgment email scam

- April 2022 – fake TFN/ABN application scams

- February 2022 – SMS and email scams – cryptocurrency

February 2026 – Cryptocurrency email scam

We have received reports of a new email impersonation scam claiming you are holding cryptocurrency in a 'non‑KYC decentralised wallet'. The scammers are pretending to be from the ATO or myGov and are asking people to make an immediate declaration by calling the phone number on the email to avoid further action.

Some variations may also include small attachments that should not be opened.

The ATO will never:

- Email you demanding immediate disclosure of cryptocurrency or other assets.

- Threaten arrest, prosecution or legal action via email or SMS.

- Request payment or personal details through unsolicited communication.

What to do if you receive this message:

- Do not respond.

- Do not call the number.

- Do not provide any information.

- Do not open attachments.

- Report the email by forwarding it to ReportScams@ato.gov.au.

- If you have shared information or engaged with the sender, phone us as soon as possible on 1800 008 540.

The following image is an example of the format this scam can take.

October 2025 – DocuSign email scam

We have received reports of a new ATO impersonation email scam circulating in the community. The scam advises people they have an outstanding tax-related ‘DocuSign’ that requires action.

The scam looks like a real ‘DocuSign’ email, making it appear familiar and trustworthy to recipients who have used the platform previously.

Scammers attempt to trick recipients into clicking on the Review Document button by naming the document 'Declaration and Final Release'. The email also details (often in the subject line) tax-related text such as ‘notice of assessment’. This approach falsely implies the DocuSign is from the ATO and that we are holding the recipient's tax refund until this action is completed.

The following image is an example of the scam email.

If the recipient clicks on the Review Document button, an embedded link directs them to a fake myGov sign in page. This is designed to steal personal information, such as their myGov sign in credentials, name, date of birth and drivers licence details. Scammers then use this information to:

- commit refund fraud in their name

- access their myGov account to steal their tax refund

- steal their superannuation

- sell the personal identity to organised crime groups online.

The following image is an example of the fake myGov sign in page.

The ATO will NEVER use DocuSign to finalise a tax refund.

If you receive an email like this, report it to us by forwarding the email to ReportScams@ato.gov.au then delete it.

Remember:

- We will never send an unsolicited message that directs you to a log in page or ask you to send personal identifying information through SMS or email.

- Don’t click on links, open attachments or download any files from suspicious emails or SMS. We will never send an unsolicited SMS that contains a hyperlink.

- We will send legitimate email communication via ATO online services. You can check this by signing in to your myGov account. You can also contact your tax agent or us.

If someone claiming to be from the ATO contacts you and tells you are owed a refund, have a tax debt, or asks for your myGov sign in credentials, bank details or personal information such as your tax file number, it is likely a scam.

If you aren’t sure if it’s really the ATO contacting you, do not engage. Phone us on 1800 008 540 to check.

Learn more on how to protect yourself and stay scam safe.

November 2024 – ATO impersonation email scam

We’re receiving reports of a new email scam attempting to steal personal identifying information by return email.

Scammers pretending to be from the ‘Australian Taxation Office' or 'myGov’ are emailing and falsely telling people their taxable income has been recalculated and they are due to receive compensation. To claim the amount, they are asked to reply to the email with personal identifying information such as payslips, TFN, drivers licence and Medicare details.

Scammers use this information in a variety of ways to:

- commit refund fraud in your name

- access your myGov account to steal your tax refund

- steal your superannuation

- sell your identity to organised crime groups on the dark web or via other means.

Be aware, the sender's email address looks legitimate. The following image is an example of the format this scam can take.

If you receive an email like this, do not reply with any of your personal information.

To help protect yourself we remind you:

- We will never send an unsolicited message asking you to return personal identifying information through SMS or Email.

- Know your tax affairs – legitimate email communication from us can be located in ATO online services. You can check this by logging into your myGov account. You can also contact your tax agent or the ATO.

- If someone claiming to be from the ATO contacts you and advises that you have a debt or are owed a refund or asks for your myGov sign in credentials, bank or personal details such as your TFN, it is likely they are a scammer.

- Don’t click on links, open attachments or download any files from suspicious emails or SMS; we will never send an unsolicited SMS that contains a hyperlink.

- We are on Facebook, Instagram, X and LinkedIn, but we will never use these social media platforms to discuss your personal information or documentation, or ask you to make payments.

If you’re unsure if it’s really the ATO, don’t engage with them. Phone us on 1800 008 540 to check. You can report any suspicious contact claiming to be from the ATO to ReportScams@ato.gov.au.

November 2024 – myGovID and myID scams

We are seeing ATO impersonation scams relating to the recent name change of myGovID to myID, which occurred on 13 November.

myID is a new name and a new look – but it is used the same way as myGovID.

The community does not need to take any action, as the change has already been implemented. You don't need to set up a new myID or reconfirm your details as part of this change. If you are asked to do this, it's a scam.

We have communicated this change through activities (including email) to myID users.

Scammers are trying to trick the community into thinking they need to reconfirm their details via a link. The link directs users to a fraudulent myGov sign in page designed to steal personal information, including myGov sign in credentials.

These details can be used later in identity theft or other fraudulent activity such as refund fraud.

The following image is one example of the format this scam can take.

Fake myID confirm details email

To protect yourself we remind you:

- We won't send you an SMS or email with a link or QR code to log on to online services. You should access them directly by typing ato.gov.au or my.gov.au into your browser.

- We will never send an unsolicited message asking you to return personal identifying information through SMS or email.

- Don’t click on links, open attachments or download any files from suspicious emails or SMS; we will never send an unsolicited SMS that contains a hyperlink.

- Only download the myID app from the official app stores (Google Play and the App Store).

- Never share your login code with anyone.

We are on FacebookExternal Link, InstagramExternal Link, XExternal Link and LinkedInExternal Link, but we will never use these social media platforms to private message, discuss your personal information, documentation, or ask you to make payments.

The following images are examples of other myGovID scams.

If you’re unsure whether it’s really the ATO, don’t reply. Phone us on 1800 008 540 to check.

Report any suspicious contact claiming to be from the ATO to ReportScams@ato.gov.au.

March 2024 – myGov email impersonation scams

The ATO and Services Australia are warning the community to stay vigilant as we continue to receive a high number of phishing scam reports that impersonate government agencies.

In February, ATO branded emails containing links to fake myGov websites were the most commonly reported scam by the community and approximately 75% of all email scams reported to the ATO over the past 6 months have linked to a fake myGov sign in page.

Scammers use fake myGov websites to steal your sign in credentials and gain access to your myGov account. Once the scammer has access, they can make fraudulent lodgments in your name and also change bank details so that any payments are redirected to a scammers account.

Scammers use different phrases to trick people into opening these links. Some examples are:

'You are due to receive an ATO Direct refund'

‘You have a new message in your myGov inbox – click here to view”

'You need to update your details to allow your Tax return to be processed'

'We need to verify your incoming tax deposit'

'ATO Refund failed due to incorrect BSB/Account number'

‘Your income statement is ready, click on the link to view’

The following images are examples of the format this scam can take.

The ATO and myGov won't send you an SMS or email with a link to access online services. These should be accessed directly by typing ato.gov.au or my.gov.au into your browser.

Report any suspicious contact claiming to be from the ATO to ReportScams@ato.gov.au.

- You can find out more about scams impersonating myGov at my.gov.au/scams External Link

- Scams that are not impersonating the ATO, myGov or a Services Australia brand can be reported to ScamwatchExternal Link.

November 2023 – Multifactor Authentication (MFA) email scam

We’re seeing an increase in reports about an email scam impersonating the ATO.

Scammers are emailing clients advising them that due to ATO security updates, they are required to update the multifactor authentication (MFA) on their ATO account.

The scam email includes a QR code which takes you to a fake myGov sign in page, designed to steal your myGov sign in details.

The following images are examples of what the scam may look like.

The ATO will never send you an email with a QR code or a link to log in to our online services.

If you receive an email like this, don't scan the QR code, click on links, open attachments or download files. Forward the email to reportscams@ato.gov.au, and then delete it.

You can report other types of scams to ScamwatchExternal Link or contact the Australian Cyber Security CentreExternal Link to report cybercrime.

August 2023 – tax time SMS and email scams

This tax time, we're receiving an increased number of reports about several ATO impersonation SMS and email scams.

These scams encourage people to click on a link that directs them to fake myGov sign in pages designed to steal their username and password.

Scammers use many different phrases to try and trick recipients into opening these links. These include (but are not limited to):

- 'You are due to receive an ATO Direct refund'

- 'You have an ATO notification'

- 'You need to update your details to allow your Tax return to be processed'

- 'We need to verify your incoming tax deposit'

- 'ATO Refund failed due to incorrect BSB/Account number'

- 'Due to receive a refund, click here to receive a rebate'

The following images are examples of the format this scam can take.

Don't open any links or provide the information requested.

We won't send you an SMS or email with a link to log on to online services. They should be accessed directly by typing ato.gov.au or my.gov.au into your browser.

While we may use SMS or email to ask you to contact us, we will never ask you to return personal information through these channels.

Report any suspicious contact claiming to be from the ATO to ReportScams@ato.gov.au.

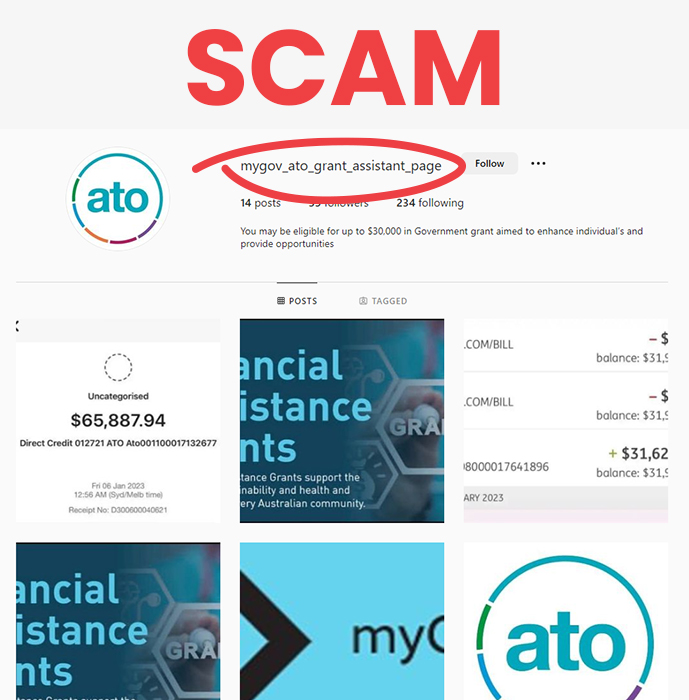

January 2023 – ATO social media impersonation accounts scam

We're seeing an increase in fake social media accounts impersonating the ATO, our employees and senior executive staff across Facebook, Twitter, TikTok, Instagram and other platforms.

These fake accounts ask users that interact with the ATO to send them a direct message so they can help with their enquiry.

The people behind these fake accounts are trying to steal your personal information, including phone numbers, email addresses and bank account information.

Our only official accounts are on FacebookExternal Link, XExternal Link, InstagramExternal Link and LinkedInExternal Link.

The best way to verify that it's really the ATO is to:

- check how many people follow the account. Our verified Facebook and LinkedIn accounts have over 200,000 followers, and our Twitter account has over 65,000 followers

- check activity on the accounts. Our social media channels have been operating for around 10 years – if it's a newly created account, or only has a few posts, it's not us

- look for the grey tick next to our username (@ato_gov_au) on X (@ato_gov_au) and the blue tick next to our name (Australian Taxation Office) on Facebook (Australian Taxation Office) and Instagram (@austaxoffice)

- make sure any email addresses provided to you end with ‘.gov.au’.

The following images show examples of what impersonation accounts might look like.

If you're approached by an impersonation account, don't engage with them. Take a screenshot of the account, email the information to reportscams@ato.gov.au and block the account through the social media platform's reporting function.

July 2022 – tax refund SMS scams

We're concerned about a high volume of SMS scams pretending to be from the ATO.

These scams tell you that you're owed an income tax repayment and ask you to click a hyperlink and complete a form.

Clicking the link takes you to a fake ATO webpage that asks for your personal identifying information, including your credit card details.

If you receive an SMS like this, don't click on any links. Report the scam to us.

The following image shows one example of what this scam can look like.

The real ATO won't send you an SMS with a link to sign in to our online services. We'll also never ask for your credit card details.

If you’re ever unsure whether it’s really the ATO, don’t reply. Phone us on 1800 008 540 to check.

June 2022 – 2022 tax lodgment email scam

We're seeing an increase in email phishing scams claiming to be from the ATO.

These scams tell people their '2022 tax lodgment' has been received. The email asks them to open an attachment to sign a document and complete their 'to do list details'.

Opening the attachment takes you to a fake Microsoft login page designed to steal your login details. Entering your password could give the scammer access to your Microsoft account, allowing them to reset your passwords for other accounts like banking and online shopping.

If you get an email like this, don't click on any links or open any attachments. Forward the email to reportscams@ato.gov.au, and then delete it.

The following images are examples of the format this scam can take.

The real ATO won't send you an email or SMS with a link to sign in to our online services.

While we may use email or SMS to ask you to contact us, we will never send an unsolicited message asking you to return personal identifying information through these channels.

Remember to protect your passwords and update them regularly.

April 2022 – fake TFN/ABN application scams

We're seeing an increase in scams involving fake tax file number (TFN) applications.

These scams tell people they can help them get a TFN for a fee. But instead of delivering this service, these fraudulent websites steal the person's money and personal information.

These scams are often advertised on social media platforms like Facebook, Twitter and Instagram.

Applying for a TFN is free. Find out how you can apply for a TFN.

If you're applying for a TFN through a tax agent, always check they are registered with the Tax Practitioners BoardExternal Link.

The same goes for Australian business number (ABN) applications – never give out your personal information, unless you're sure of who you're dealing with.

February 2022 – SMS and email scams – cryptocurrency

We’re receiving reports of cryptocurrency scams.

Scammers pretending to be from the ATO are telling people they are suspected of being involved in cryptocurrency tax evasion. They are then asking them to ‘connect their wallet’ and provide detailed information via a link.

If you receive an SMS or email like this, don’t click on the link. It will take you to a fake myGov log on page, designed to steal your personal information.

The following image is one example of the format this scam can take.

The real ATO won't send you an SMS or email with a link to sign in to our online services.

And while we may use SMS or email to ask you to contact us, we will never ask you to return personal information through these channels.

If you’re ever unsure whether it’s really the ATO, don’t reply. Phone us on 1800 008 540 to check.

Previous scam alerts

- November 2021 phone and email scams – superannuation

- November 2021 phone scam – fake tax debt

- October 2021 email scam – update financial information

- August 2021 phone scam – new payment methods

- May 2021 email scam – update your myGovID details

- February 2021 phone scam – suspended TFN

- October 2020 email scam – JobKeeper and backing business investment claims

- September 2020 phone and SMS scams – fake tax debt

- July 2020 SMS and email scams – verify your myGov details

November 2021 phone and email scams – superannuation

We're concerned about an increase in scams involving fake superannuation investments.

Scammers are phoning and emailing people, pretending to be financial advisers or super experts. They are encouraging people to invest their super in a supposedly high performing self-managed super fund (SMSF).

These scammers will start by asking you for some information and may ask you to do a super comparison online. They are likely to be persistent and may contact you multiple times.

Sometimes, they will fraudulently use the name and Australian Financial Service Licence (AFSL) of a real business and set up a fake website to appear legitimate.

They will tell you there is no need for you to engage directly with the ATO, ASIC or any other tax or super professional.

If you agree to invest, they will transfer your super into bank accounts they control and disappear with it.

If you provide them with enough personal information (even if you don’t agree to invest), they may use this to transfer your super from your existing account without you knowing. Ultimately, stealing your super savings.

Always check who you are dealing with before providing any personal or financial information.

Be cautious about anyone who contacts you with unsolicited financial advice:

- Check ASIC's Professional registersExternal Link to make sure they are licensed professionals.

- Conduct an online search to independently verify their identity and to see if there are any reviews or indications of scam activity related to their website, email address or phone number.

- If in doubt, check with another registered tax professional.

If you receive an SMS, email or letters from the ATO about an SMSF that you didn't establish contact us on 13 10 20 immediately.

ASIC has more information about how to recognise and report super scamsExternal Link.

November 2021 phone scam – fake tax debt

We're reminding people to look out for phone scams about fake tax debts.

Scammers pretending to be from the ATO are calling people and telling them they have a tax debt that they need to pay straight away.

We will use phone, email and SMS to contact you. But we will never:

- send a pre-recorded message to your phone

- threaten you with immediate arrest

- demand payment through unusual methods like gift cards or payments to personal bank accounts

- insist you stay on the line until a payment is made.

Phone calls from the real ATO will show up as 'No caller ID' on your phone.

If you're ever unsure whether it's really the ATO, don't reply. You should phone us on 1800 008 540 to check.

We have more information on how you can identify and report tax and super scams.

October 2021 email scam – update your financial information

We're receiving reports about a new email scam impersonating the ATO.

Scammers are sending emails telling people they will receive a tax refund. They ask them to update their financial information on an attached form to process the refund.

The following image is an example of the scam email.

If you receive an email like this, delete it. Don't open the attachment or click on any links.

If you receive a message from the ATO asking for your personal information, phone us on 1800 008 540 to make sure it's legitimate. If you think it's fraudulent, report it by sending an email to reportscams@ato.gov.au.

You should never give out your personal information unless you are sure of who you are dealing with.

August 2021 phone scam – new payment methods

We're receiving reports of scammers demanding money by new methods.

This includes things like:

- ‘cardless cash’ ATM withdrawals

- retail gift cards, such as JB hi-fi, Myer and Woolworths

- courier services who collect the cash payments

- cash delivery made in person at a pre-determined public location.

Scammers are trying to trick people into making payments by pretending to be from the ATO and other agencies, such as the Australian Federal Police.

They might tell you that your TFN has been suspended or compromised due to money laundering or other illegal activity, or that you owe a debt.

The real ATO will never demand payment by these methods. You should always check legitimate ways to pay a tax debt on our website before making a payment.

If you have paid money to a scammer through one of these methods or are concerned about your personal safety, report it to your local police straight away and specify all the details.

We also strongly encourage you to contact your financial institution immediately. In some cases, they may be able to stop a transaction or close your account if the scammer has your account details.

Remember, if you’re ever unsure whether an ATO contact is genuine, hang up and phone us on 1800 008 540 to check.

See How to pay for legitimate ways to pay a tax debt.

May 2021 email scam – update your myGovID details

We’re receiving reports of a new email scam that asks people to update their myGov or myGovID details. As of November 2024, myGovID is now myID.

Scammers pretending to be from the ‘myGov customer care team’ are sending emails telling people they need to verify their identity by clicking on a link.

The following image is one example of the format this scam can take.

Don’t click any links and don’t provide the information requested.

The link goes to a fake myGov sign in page designed to steal your personal information, including your passport and drivers licence details.

You will get email or SMS notifications from myGov whenever there are new messages in your myGov Inbox. However, these messages won't include a link to sign in to your myGov account.

Always access our online services directly via one of the following:

- my.gov.au

- ato.gov.au

- the ATO app.

As of November 2024, myGovID is now myID. When downloading the myID app, make sure it's from either the Apple App Store or the Google Play Store.

If you receive an SMS or email that looks like it’s from myGov but it contains a link or appears suspicious, you can report it to ScamWatch. If you have clicked on a link or provided your personal information, you can contact Services Australia’s Scams and Identity Theft Helpdesk on 1800 941 126.

February 2021 phone scam – suspended TFN

We are receiving increasing reports of people losing money to automated phone scams.

Scammers pretending to be from the ATO tell people their tax file number (TFN) has either been:

- suspended due to illegal activity

- compromised by a scammer.

They request the call recipient either pay a fine to release their TFN or transfer all bank funds into a holding account to protect it from future misuse.

We:

- do not suspend TFNs

- will never request you pay a fine or transfer money in order to protect your TFN pending legal action.

Phone calls from us don't show a number on caller ID. We will never send unsolicited pre-recorded messages to your phone.

If you receive a phone call like this, hang up and do not provide the information requested.

If you’re unsure whether an ATO contact is genuine, phone us on 1800 008 540 to check.

An example of this type of scam is Audio recording of suspended TFN scam (MP3, 82KB)This link will download a file

October 2020 email scam – JobKeeper and backing business investment claims

We are receiving reports of email scams about claims for JobKeeper and Backing Business Investment.

The fake emails say we are investigating your claims. They ask you to provide valuable personal information, including copies of your drivers licence and Medicare card.

The following image is one example of an email scam currently circulating.

Don't provide the information requested, don't click on any links and delete the email straight away.

If you receive a message from the ATO asking for your personal information, phone us on 1800 008 540 to make sure it's legitimate. If you think it's fraudulent, report it by sending an email to reportscams@ato.gov.au.

You should never give out your personal information unless you are sure of who you are dealing with.

September 2020 phone and SMS scams – fake tax debt

We are concerned about the increasing number of people paying fake tax debt scammers.

Scammers pretending to be from the ATO are contacting members of the community, telling them that they have a tax debt and that if they don't pay it straight away they will be arrested.

These scammers will often request payment through unusual methods, such as cryptocurrency, pre-paid credit cards or gift cards. They will try to keep people on the line until they have paid.

If you receive a phone call, text message or voicemail like this, don't send payment or provide any personal information. Hang up and delete the message.

We will never:

- threaten you with immediate arrest

- demand payment through unusual methods.

If you are not sure if it's the ATO contacting you, phone us on 1800 008 540 to check.

It's also a good idea to know your tax affairs. You can:

- log in to ATO online services through myGov to check your individual tax affairs

- log in to Online services for business to check your business tax affairs

- contact your tax or BAS agent

- contact us.

July 2020 SMS and email scams – verify your myGov details

We are receiving increasing reports of several myGov-related SMS and email scams. These scams look like they have come from a myGov or ATO email address. They also might appear in your legitimate ATO or myGov SMS message thread.

The following image is one example of an SMS scam currently circulating.

Don’t click any links and don’t provide the information requested.

You will get email or SMS notifications from myGov when there are new messages in your myGov Inbox. However, these messages won't ask you to click on a link to sign in to your myGov account.

Always access our online services directly via one of the following:

- my.gov.au

- ato.gov.au

- the ATO app.

All online management of your personal tax affairs should be done in ATO online services, accessed through your genuine myGov account.

Any communications containing your personal information, such as your tax file number (TFN), will be sent to your myGov Inbox and not your email account.

You can make accessing your myGov account more secure by opting to receive a security code via SMS. It’s a quick and secure way to sign in to access ATO online services.

If you receive an SMS or email from the ATO that you think is fraudulent, report it by sending an email to reportscams@ato.gov.au.

If you receive an SMS or email that looks like it’s from myGov but it contains a link or appears suspicious, email reportascam@servicesaustralia.gov.au.

If you have clicked on a link or provided your personal information, phone Services Australia on 1800 941 126.