For income tax purposes, a company is a body corporate or any unincorporated association or body of persons, but does not include a partnership and a non-entity joint venture. For income tax purposes, the term 'companies' may represent a consolidated group of companies, rather than a single entity.

Companies are considered taxable if they have net tax of more than $0. This year's company statistics include information on the International dealings schedule for the first time.

The Companies section contains the following tables and graphs

- Table 17: Returns by taxable status, 2010–11 to 2012–13 income years

- Table 18: Selected income items, 2010–11 to 2012–13 income years

- Table 19: Selected expenses, 2010–11 to 2012–13 income years

- Table 20: Net tax, by company size, 2010–11 to 2012–13 income years

- Figure 5: Number of companies and net tax by size, 2012–13 income year

- Table 21: International revenue, by country, 2012–13 income year

- Table 22: International expenditure, by country, 2012–13 income year

We also have a set of more detailed tables available in the form of Excel spreadsheets containing company data at a much finer level.

Find out more

Data for each income year includes data processed up to 31 October of the following year. For example, data for the 2012–13 income year includes data processed up to 31 October 2014.

The number of companies has been rounded to the nearest five and totals may differ from the sum of components, due to rounding.

Table 17: Companies – returns by taxable status, 2010–11 to 2012–13 income years

Taxable status

|

2010–11

|

2011–12

|

2012–13

|

no.

|

%

|

no.

|

%

|

no.

|

%

|

Non–taxable companies

|

465,555

|

59.0

|

480,845

|

58.8

|

506,260

|

59.2

|

Taxable companies

|

323,425

|

41.7

|

337,035

|

41.2

|

348,485

|

40.8

|

Total

|

788,985

|

100.0

|

817,885

|

100.0

|

854,745

|

100.0

|

Table 18: Companies – selected income items, 2010–11 to 2012–13 income years

|

2010–11

|

2011–12

|

2012–13

|

no.

|

$m

|

no.

|

$m

|

no.

|

$m

|

Other sales of goods and services

|

293,570

|

1,759,014

|

305,265

|

1,878,319

|

323,030

|

1,978,501

|

Other gross income

|

331,375

|

323,778

|

343,495

|

307,804

|

359,175

|

311,980

|

Gross interest

|

416,945

|

207,632

|

423,665

|

214,888

|

427,305

|

193,356

|

Income from financial arrangements (TOFA)

|

225

|

17459

|

595

|

30,080

|

810

|

66,320

|

Total dividends

|

52,520

|

42,779

|

51,725

|

41,670

|

50,990

|

48,737

|

Gross rent and other leasing and hiring income

|

65,055

|

37,343

|

66,575

|

41,089

|

68,665

|

42,722

|

Unrealised gains on revaluation of assets to fair value

|

1,645

|

11,281

|

1,350

|

17,910

|

1,820

|

31,079

|

Gross distribution from trusts

|

59,210

|

28,283

|

59,300

|

29,366

|

61,905

|

30,539

|

Other income items

|

na

|

12,002

|

na

|

12,013

|

na

|

11,676

|

Total income

|

680,075

|

2,439,573

|

707,480

|

2,573,139

|

737,735

|

2,714,909

|

Notes:Other income items: this includes all income labels from the Income section of the Company income tax return form not listed in the table.Total income: components do not add to the number of companies as companies may declare more than one type of income.

Table 19: Companies – selected expenses, 2010–11 to 2012–13 income years

|

2010–11

|

2011–12

|

2012–13

|

no.

|

$m

|

no.

|

$m

|

no.

|

$m

|

Cost of sales

|

246,685

|

1,030,367

|

255,575

|

1,091,057

|

268,940

|

1,158,573

|

All other expenses

|

703,035

|

666,200

|

730,790

|

716,634

|

763,610

|

749,432

|

Interest expenses within Australia

|

296,010

|

150,535

|

304,095

|

154,900

|

318,545

|

131,047

|

Contractor, subcontractor and commission expenses

|

152,175

|

86,017

|

157,250

|

96,016

|

162,640

|

101,131

|

Depreciation expenses

|

451,600

|

66,271

|

463,385

|

70,501

|

476,325

|

81,392

|

Expenses from financial arrangements (TOFA)

|

275

|

15,214

|

680

|

19,187

|

995

|

61,319

|

Rent expenses

|

233,195

|

42,690

|

242,905

|

42,415

|

255,920

|

45,991

|

Interest expenses overseas

|

9,720

|

31,221

|

10,395

|

31,836

|

4,490

|

32,942

|

Superannuation expenses

|

325,515

|

27,234

|

334,560

|

29,257

|

348,130

|

29,474

|

Repairs and maintenance

|

277,805

|

20,063

|

283,015

|

21,796

|

291,885

|

22,732

|

Unrealised losses on revaluation of assets to fair value

|

2,255

|

18,380

|

2,595

|

19,323

|

2,210

|

20,800

|

Motor vehicle expenses

|

345,185

|

11,943

|

355,865

|

12,412

|

371,880

|

12,973

|

Royalty expenses within Australia

|

5,835

|

11,475

|

6,135

|

12,601

|

6,235

|

12,039

|

Other expense items

|

na

|

32,339

|

na

|

26,446

|

na

|

25,939

|

Total expenses

|

711,370

|

2,201,100

|

739,165

|

2,344,380

|

772,175

|

2,485,784

|

Notes:Other expense items: this includes all expense items from the Expenses section of the Company income tax return form not listed in the table.Total expenses: components do not add to the number of companies as companies may declare more than one type of income.

Table 20: Companies – net tax by company size, 2010–11 to 2012–13 income years

Company size

|

2010–11

|

2011–12

|

2012–13

|

no.

|

Net tax $m

|

no.

|

Net tax $m

|

no.

|

Net tax $m

|

Loss

|

1,670

|

<1

|

1,790

|

11

|

1,740

|

7

|

Nil

|

108,910

|

42

|

110,405

|

76

|

117,010

|

113

|

Micro

|

610,520

|

6,588

|

635,150

|

7,018

|

663,020

|

7,371

|

Small

|

51,960

|

6,028

|

53,805

|

6,394

|

55,700

|

6,558

|

Medium

|

13,805

|

7,652

|

14,540

|

7,730

|

14,965

|

8,177

|

Large

|

1,155

|

3,302

|

1,185

|

2,951

|

1,220

|

3,030

|

Very large

|

960

|

39,410

|

1,010

|

39,972

|

1,090

|

39,274

|

Total

|

788,985

|

63,023

|

817,885

|

64,152

|

854,745

|

64,530

|

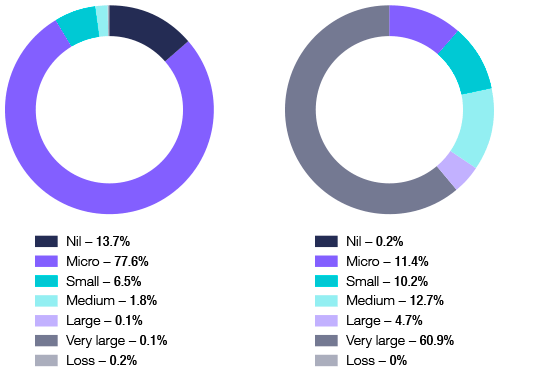

Figure 5. Number of companies and net tax, by size, 2012–13 income year

These charts show the percentage of companies within each entity size grouping and the contribution those companies make towards company income net tax.

Number of companies Amount of net tax

Table 21: Companies – international revenue, by country, 2012–13 income year

|

2012–13

|

|

no.

|

Revenue $m

|

Singapore

|

1,105

|

45,285

|

United States

|

2,380

|

14,266

|

Japan

|

380

|

10,414

|

United Kingdom

|

1,325

|

9,080

|

Switzerland

|

235

|

6,515

|

New Zealand

|

1,975

|

5,420

|

Other

|

na

|

31,768

|

Total

|

na

|

122,748

|

Notes: Companies that fill out the international dealings schedule only provide data for the 3 countries with the highest dollar value. For each of the 3 countries, a company can record up to 3 specific and 1 all other activity that generated revenue. The number is the total count of these activities by all companies for that foreign country. As such the data should be used as a guide only and not as a complete all inclusive figure.

Table 22: Companies – international expenditure, by country, 2012–13 income year

|

2012–13

|

|

no.

|

Expenditure $m

|

Singapore

|

1,470

|

55,118

|

United States

|

3,570

|

26,939

|

Japan

|

600

|

19,207

|

United Kingdom

|

1,915

|

13,818

|

Germany

|

885

|

11,006

|

Switzerland

|

460

|

9,130

|

Other

|

na

|

61,488

|

Total

|

na

|

196,706

|

Notes: Entities that fill out the international dealings schedule only provide data for the three countries with the highest dollar value. For each of the three countries, an entity can record up to three specific and one 'all other' activity that generated revenue and expenditure. The number is the total count of these activities by all entities for that foreign country. As such the data should be used as a guide only and not as a complete all inclusive figure.