Practical Compliance Guideline

PCG 2024/1

Intangibles migration arrangements

-

This document has changed over time. View its history.There is a Compendium for this document: PCG 2024/1EC .

| Table of Contents | Paragraph |

|---|---|

| What this Guideline is about | |

| How to use this Guideline | |

| Structure of this Guideline | |

| Date of effect | |

| PART 1 – Our compliance approach | |

| The ATO's role and compliance approach | |

| Reporting your self-assessment | |

| Evidencing your self-assessment | |

| PART 2 – Our risk assessment framework | |

| Identifying Intangibles Migration Arrangements | |

| Excluded Intangibles Arrangements | |

| Excluded Outbound Distribution Arrangement | |

| Excluded Inbound Distribution Arrangement | |

| Excluded Low Value Services Arrangement | |

| Applying the risk assessment framework | |

| Risk rating | |

| Definition of terms used in the risk assessment framework | |

| Risk Assessment Framework Table 1 – risk factors – Migration of your intangible assets | |

| Risk Assessment Framework Table 2 – risk factors – other Intangibles Migration Arrangements | |

| PART 3 – Our evidence expectations | |

| APPENDIX 1 – Examples of Intangibles Migration Arrangements | |

| Example 1 – centralisation of intangible assets – red zone | |

| Example 2 – bifurcation of intangible assets – red zone | |

| Example 3 – non-recognition of Australian intangible assets and DEMPE activities – red zone | |

| Example 4 – Migration of pre-commercialised intangible assets – red zone | |

| Example 5 – Migration of pre-commercialised intangible assets – red zone | |

| Example 6 – transfer of intangible assets to a foreign hybrid entity – red zone | |

| Example 7 – bifurcation of intangible assets – red zone | |

| Example 8 – cost contribution arrangement – red zone | |

| Example 9 – transfer of rights to intangible assets under a licence agreement – amber zone | |

| Example 10 – centralisation of intangible assets – blue zone | |

| Example 11 – contract research and development arrangement – blue zone | |

| Example 12 – centralisation of intangible assets – green zone | |

| Example 13 – contract research and development arrangement – green zone | |

| Example 14 – cost contribution arrangement – green zone | |

| Example 15 – service arrangement – out of scope | |

| APPENDIX 2 – Evidence expectations | |

| Evidencing the commercial considerations and your decision-making process | |

| Evidencing the legal form and substance of your Intangibles Migration Arrangements | |

| Legal agreements | |

| Guidelines, manuals, policies and governance-like documents | |

| Transfer pricing documentation | |

| Country-by-country reporting documentation | |

| Identifying and evidencing the intangible assets and connected DEMPE activities | |

| Identifying intangible assets | |

| Identifying DEMPE activities | |

| Evidencing intangible assets and DEMPE activities | |

| Evidencing the tax and profit outcomes of your Intangibles Migration Arrangements | |

| Simplified record keeping |

|

Relying on this Guideline

This Practical Compliance Guideline sets out a practical administration approach to assist taxpayers in complying with relevant tax laws. Provided you follow this Guideline in good faith, the Commissioner will administer the law in accordance with this approach. |

1. This Guideline explains when we are likely to apply resources to consider the potential application of the general anti-avoidance rules (GAARs) or the transfer pricing rules to certain cross-border related party Intangibles Migration Arrangements with respect to structuring issues and tax risks associated with:

- •

- Migration of intangible assets, and

- •

- mischaracterisation and non-recognition of Australian activities connected with intangible assets.

2. Our compliance approach in relation to the pricing aspects of Intangibles Migration Arrangements is not covered by this Guideline. Where the basic rule in section 815-130 of the Income Tax Assessment Act 1997 (ITAA 1997) applies, transfer pricing in respect of, and valuation of, an intangible asset is dependent on the facts and circumstances. It is therefore beyond the scope of this Guideline to specify the level of risk associated with the pricing or valuation outcomes for particular related party dealings which arise in connection with properly characterised Intangibles Migration Arrangements.

- •

- 'Intangibles Migration Arrangements' refers to cross-border arrangements involving the Migration of intangible assets, or arrangements with similar effect. This includes arrangements relating to Australian development, enhancement, maintenance, protection and exploitation (DEMPE) activities in connection with intangible assets held offshore.[1]

- Consistent with the focus of this Guideline on the tax risks outlined in paragraph 1 of this Guideline, certain distribution and low-value services arrangements potentially involving intangible assets are excluded from the scope of this Guideline. These are defined as 'Excluded Intangibles Arrangements' in paragraphs 39 to 49 of this Guideline.

- •

- 'Intangible assets' refer to property, assets and rights that are not physical or financial assets[2], which are capable of being controlled for use in commercial activities, and are not restricted by any accounting or legal concepts or definitions – see paragraphs 6.6 to 6.8 of Chapter VI of the Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations, as approved by the Council of the Organisation for Economic Co-operation and Development (OECD Transfer Pricing Guidelines) and last amended on 20 January 2022.[3]

- •

- 'Migration' refers to any restructure or change associated with your intangible assets that allows another entity to access, hold, use, transfer or benefit from the intangible assets.

- •

- Any reference to 'you' refers to the relevant Australian entity who is a party to the Intangibles Migration Arrangement.

- •

- All legislative references in this Guideline are to the ITAA 1997, unless otherwise indicated.

4. This Guideline does not address our compliance approach to other tax issues that might arise in connection with Intangibles Migration Arrangements (for example, tax risks associated with amounts not being appropriately characterised as royalties, including but not limited to those outlined in Taxpayer Alerts TA 2018/2 Mischaracterisation of activities or payments in connection with intangible assets[4], or TA 2022/2 Treaty shopping arrangements to obtain reduced withholding tax rates).[5]

5. For the avoidance of doubt, our compliance approach with respect to the proposed multinational tax integrity measure (Denying deductions for payments relating to intangible assets connected with low corporate tax jurisdictions)[6] is not covered by this Guideline.

6. Additional schedules or changes to the Risk Assessment Framework may be included in this Guideline in the future to provide further guidance about Intangibles Migration Arrangements in response to what the ATO is seeing.

7. You can use the framework set out in this Guideline to understand:

- •

- the kinds of compliance risks that may be presented by your Intangibles Migration Arrangements, enabling you to make informed decisions about the likelihood that you will be subject to compliance action

- •

- the features of Intangibles Migration Arrangements we consider to present greater compliance risk

- •

- the evidence we are likely to ask you to produce in relation to your Intangibles Migration Arrangements, including the intensity of engagement you can expect based on the compliance risks associated with your Intangibles Migration Arrangements.

8. This Guideline is divided into the following parts:

- •

- Part 1 – Our compliance approach – provides our compliance approach for Intangibles Migration Arrangements.

- •

- Part 2 – Our risk assessment framework – explains how we assess the compliance risks of Intangibles Migration Arrangements.

- •

- Part 3 – Our evidence expectations – provides an outline of the types and level of evidence that we will have regard to when examining your Intangibles Migration Arrangements.

9. This Guideline applies from 17 January 2024, the date of issue, and will apply to existing and new arrangements.

10. We will review the use and application of this Guideline. If we need to make changes to the Guideline (for example, by adding additional examples) we will publicly consult on these.

PART 1 – Our compliance approach

The ATO's role and compliance approach

11. We will have regard to our risk assessment framework in assessing and identifying compliance risks in scope of this Guideline that are associated with these arrangements. If we review your Intangibles Migration Arrangements, we may consider other factors beyond those contained in this Guideline, having regard to the relevant facts and circumstances of your Intangibles Migration Arrangements.

12. This Guideline sets out our compliance approach in relation to the tax risks in scope of this Guideline. The risk assessment framework of this Guideline does not assess the level of risk associated with other tax risks that might arise in connection with Intangibles Migration Arrangements, or the pricing or valuation outcomes. A risk rating under this Guideline therefore will not affect our compliance approach in relation to those issues and risks.

13. This Guideline does not reflect a statement of the Commissioner's interpretation of the taxation laws.[7] The information provided in this Guideline does not replace, alter or affect our interpretation of the law in any way or relieve you of your legal obligations in complying with all relevant tax laws.

14. Australia's income tax law places an onus on taxpayers to self-assess their compliance with relevant tax laws. In some cases, Subdivision 815-B may require the identification of arm's length conditions with regard to arrangements or circumstances different from the form of your Intangibles Migration Arrangements (the exceptions to the basic rule contained in subsections 815-130(2) to (4)). In these cases, we will have specific regard to relevant ATO views, such as Taxation Ruling TR 2014/6 Income tax: transfer pricing – the application of section 815-130 of the Income Tax Assessment Act 1997.

15. To the extent relevant and appropriate, any action we may take in applying the transfer pricing provisions will be made so as to best achieve consistency with the relevant transfer pricing guidelines published by the OECD.[8] This includes our risk assessment approach to the application of transfer pricing provisions in relation to the tax risks in scope of this Guideline. Of particular relevance are Chapters I, VI and IX of the OECD Transfer Pricing Guidelines.[9]

16. While valuation and pricing outcomes are outside the scope of this Guideline and are not part of the risk assessment framework, in reviewing Intangibles Migration Arrangements, we also review Intangibles Migration Arrangements to ensure they properly comply with other Australian tax obligations with regards to the recognition of gains associated with intangible assets and Australian DEMPE activities, such as those imposed by the capital gains tax (CGT), capital allowance provisions and provisions in relation to the recognition of gains from the results of certain R&D activities under Division 355.[10] We will have regard to evidence relevant to the tax and profit outcomes of your Intangibles Migration Arrangement in doing so.

17. We may also consider the application of the GAARs (including the diverted profits tax (DPT))[11], particularly in circumstances where an arrangement (or a part of an arrangement) lacks substance or there is insufficient objective probative evidence of the stated non-tax or commercial rationale for the arrangement (or any part of the arrangement). In these circumstances, we will have specific regard to our administrative processes and published guidance including Law Administration Practice Statements PS LA 2005/24 Application of General Anti-Avoidance Rules and PS LA 2017/2 Diverted profits tax assessments, and Practical Compliance Guideline PCG 2018/5 Diverted profits tax. The application of the GAARs might preclude the application of the transfer pricing, CGT or capital allowance provisions, for example, if the alternative postulate is that there would have been no transfer or licensing of intangible assets rather than a dispute about the conditions or the consideration that should have applied to the transfer or licensing of intangible assets.

18. Our compliance approach will vary depending on the risk zone of your Intangibles Migration Arrangement. The risk rating will influence whether and how we are likely to engage with you to understand your Intangibles Migration Arrangement:

| Risk zone | Risk rating |

|---|---|

| Green | Lower risk |

| Blue | Lower to medium risk |

| Amber | Medium risk |

| Red | Higher risk |

| White | Further risk assessment not required |

19. If your arrangement is in the green zone (lower risk), we will not apply our resources to further examine or audit your arrangement with respect to tax risks in scope of this Guideline, other than to verify your self-assessment.

20. If your arrangement is in the blue zone (lower to medium risk) or amber zone (medium risk), we may engage with you to understand the compliance risks of your Intangibles Migration Arrangement. In our engagement with you, we will have regard to the risk rating of your arrangement. The higher the risk rating, the more likely it is that we will seek evidence beyond your risk assessment as part of any review.

21. If your arrangement is in the red zone (higher risk), we will prioritise our resources to review your arrangement. This may involve commencing a further review or audit. The red zone is a reflection of the features that we consider indicate greater risk; however, it is not a presumption that there is necessarily non-compliance with Australian tax law. We will have regard to the relevant facts and circumstances, including evidence verifying the commercial or non-tax rationale, when we review your Intangibles Migration Arrangement.

22. If your Intangibles Migration Arrangement is in the white zone, you do not need to apply the risk assessment framework. We are unlikely to apply compliance resources to further re-examine your arrangement beyond verifying that you can substantiate that the conditions for white zone have been met.

23. Your Intangibles Migration Arrangement is in the white zone if any of the following apply to your Intangibles Migration Arrangement for the current year:

- (a)

- There is a settlement agreement between you and the ATO, where the terms of the settlement cover the Australian tax outcomes related to the arrangement for the current year, and you have met the conditions of the agreement.

- (b)

- There is a court decision in relation to the Australian tax outcomes of the arrangement, where you were a party to the proceeding.

- (c)

- We have conducted a review or audit of the arrangement and provided you with a 'low risk' rating[12] (or a 'high assurance' rating as part of a Justified Trust review) in relation to the Australian tax outcomes of any relevant Migration and the characterisation and recognition of Australian DEMPE activities connected with the Intangibles Migration Arrangement.

AND

- (d)

- There has not been a material change in the conditions of the Intangibles Migration Arrangement since the time of the agreement, decision, review or audit. This includes a material change in the conditions which informed the basis of the ATO's risk or assurance rating in the context of a review or audit.

24. Where you are seeking entry to the advance pricing arrangement (APA) program, we will have regard to your risk rating in accordance with our risk assessment framework.[13] We will also have regard to evidence of the nature identified in this Guideline with respect to your Intangibles Migration Arrangements both when you are seeking entry to the APA program, as well as during the APA period.

25. If, having considered the compliance risks presented by your arrangements in accordance with our risk assessment framework, you consider there is a potential compliance risk associated with your Intangibles Migration Arrangements, you can engage with us by contacting IntangiblesArrangements@ato.gov.au. Alternatively, if you have a dedicated relationship manager, you may approach them directly for assistance with your Intangibles Migration Arrangement. Engaging with us early, including prior to entering into your Intangibles Migration Arrangements, will assist us to cooperatively work with you to assure your arrangement or resolve any issues that may be associated with your Intangibles Migration Arrangements.

Reporting your self-assessment

26. You may be required to report your risk rating for each Intangibles Migration Arrangement or on another basis. For example, you may have other disclosure requirements if you are required to complete a reportable tax position schedule.

27. It is best practice to apply this Guideline to assess your Intangibles Migration Arrangements, however, we will not require reporting of the risk rating in relation to past Migration in reportable tax position schedules beyond a period specified in the relevant instructions.

28. While we may not require the reporting of risk rating for past Migration in reportable tax position schedules, we may still review such arrangements and you should consider our evidence expectations.

Evidencing your self-assessment

29. We may engage with you to verify your self-assessment, having regard to your application of our risk assessment framework and our evidence expectations (as outlined in Part 3 and Appendix 2 to this Guideline).

30. We may also prioritise our resources to further examine or audit your Intangibles Migration Arrangements where we are unable to obtain evidence to substantiate your self-assessment against our risk assessment framework, notwithstanding that your Intangibles Migration Arrangement may be in a lower risk zone based on the risk assessment framework.

PART 2 – Our risk assessment framework

31. This Part is designed to explain how to assess the compliance risks of your Intangibles Migration Arrangements.

32. Our risk assessment framework includes an assessment of the risk of your Intangibles Migration Arrangements based on risk factors set out in Risk Assessment Framework Tables 1 and 2 in this Part, which cover the features of arrangements that we consider indicate compliance risks.

33. In this risk assessment framework:

- •

- Risk Assessment Framework Table 1 (RAF Table 1) should be used to assess the compliance risks in relation to a Migration of your intangible assets

- •

- Risk Assessment Framework Table 2 (RAF Table 2) should be used to assess the compliance risks associated with your Australian activities connected with intangible assets held overseas, in particular, any risks of mischaracterisation and non-recognition of such activities.

34. Your self-assessment will involve an assessment of your Intangibles Migration Arrangements against each of the risk factors in the applicable table to determine the risk rating of your arrangement with respect to that risk.

35. You should apply our risk assessment framework to each Intangibles Migration Arrangement that you have during the income year before tax returns for the relevant income year are lodged.

Identifying Intangibles Migration Arrangements

36. For the purposes of applying this Guideline, arrangements (whether or not in writing) relating to the DEMPE or Migration of multiple intangible assets should be treated as one Intangibles Migration Arrangement if, having regard to the facts and circumstances, it is more reasonable and appropriate to treat them as one Intangibles Migration Arrangement. For example:

- •

- You may have more than one dealing or arrangement connected with the same intangible asset (such as a contract R&D service agreement as well as a licensing agreement with the owner of certain intangible assets). It is likely to be more reasonable and appropriate to treat all your dealings or arrangements in connection with the same intangible assets as one Intangibles Migration Arrangement.

- •

- Some intangible assets may be naturally or substantively grouped together in the context of your business, for example, all intangible assets associated with a particular product or service, or all policies relating to a particular business function. In such circumstances and where appropriate, you may adopt the grouping according to your business systems and governance systems and consider the dealings and transactions related to the intangible assets as one Intangibles Migration Arrangement if it is more reasonable and appropriate to do so in the circumstances. Other examples include substantially similar or related manuals, standards and protocols that relate to the same aspects of a process of producing or modifying a product.

- •

- Where a group of associated or related intangible assets are more valuable in combination compared to in isolation[14], it may be less reasonable to treat dealings and arrangements in relation to each individual asset as separate Intangibles Migration Arrangements. For example, the patent, associated trademarks and regulatory approval in relation to a pharmaceutical product where the value of each asset may be of limited value but significantly more valuable in combination. It would also be relevant to consider if the assets are naturally grouped together by your business and in your systems.

37. There can be more than one Relevant Entity[15] in relation to one Intangibles Migration Arrangement – for example, if you have engaged different entities to perform contract R&D and contract manufacturing activities related to the same product, those entities are relevant entities in relation to the one Intangibles Migration Arrangement.

38. The examples in Appendix 1 to this Guideline illustrate how the principles of grouping can be applied to identify Intangibles Migration Arrangements in applying the risk assessment framework.

Excluded Intangibles Arrangements

39. An arrangement is an Excluded Intangibles Arrangement if, once you have identified your Intangibles Migration Arrangements in accordance with paragraphs 36 to 38 of this Guideline, it is in one of the following 3 categories.

40. These exclusions from the scope of the Guideline are to make it easier for you to apply this Guideline. These exclusions do not represent an assessment of other tax and transfer pricing risks that are outside of the scope of this Guideline (such as the characterisation of payments or receipts, for example, the tax risks described in TA 2018/2).

41. The exclusions do not preclude us from reviewing your arrangements if consideration of the facts and circumstances indicate that further compliance activities are appropriate.

Excluded Outbound Distribution Arrangement

42. An arrangement is an Excluded Outbound Distribution Arrangement if all of the following criteria are satisfied:

- •

- It is an arrangement that only involves the grant of rights by you to a foreign distributor (Relevant Entity) where the Relevant Entity (and its associates in the same jurisdiction) do not undertake any activities other than the importation and distribution functions in relation to tangible finished goods in the foreign jurisdiction where the Relevant Entity is located.

- •

- The grant of rights under the agreement is limited to the right to use the intangible assets (typically brand, logos, trademarks) for the purposes of performing the distribution function in that jurisdiction only – for example, the rights granted should not include any sub-licensing rights or right for further development of the intangible assets.

- •

- You include the residual profits[16] relating to the use of the intangible assets (such as residual profits from the sale of products associated with the intangible assets) in your Australian assessable income in the current income year.

Excluded Inbound Distribution Arrangement

43. An arrangement is an Excluded Inbound Distribution Arrangement if all of the following criteria are satisfied:

- •

- you are a distributor of imported tangible finished goods in Australia

- •

- you have been granted the right to use intangible assets by an international related party solely in connection with the distribution function, and such rights are limited to Australia only

- •

- the intangible assets over which rights are granted are not connected to[17] intangible assets that have previously been Migrated from Australia by you or an Australian associate of yours at any time

- •

- the intangible assets are not connected to products that were originally developed in Australia, unique to the Australian market, or predominantly sold in the Australian market (either currently or historically), and

- •

- you and your Australian associates have not conducted development, enhancement or maintenance (DEM) activities including R&D or regulatory activities in Australia (including where you have engaged other entities to perform such DEM activities) that are related to these intangible assets or intangible assets that are connected to these intangible assets, either currently or historically. If you or your Australian associates have claimed Australian R&D tax offsets in relation to these intangible assets (or connected intangible assets) currently or historically, you do not satisfy this criterion.

Excluded Low Value Services Arrangement

44. It is important to note that this exclusion only applies if your self-assessment reflects the substance of the arrangement as a low value adding intra-group service arrangement.

45. An arrangement is an Excluded Low Value Services Arrangement if it is an arrangement under which you receive or provide low value adding intra-group services that:

- •

- are only supportive in nature

- •

- do not constitute your core business or that of an Australian associate, or that of the related party receiving such services from you

- •

- satisfy the definition outlined in paragraphs 7.43 to 7.63 of Section D of Chapter VII of the OECD Transfer Pricing Guidelines

- •

- are not services described in paragraphs 48 to 49 of this Guideline, and

- •

- the materiality threshold is satisfied if you provide services under the arrangement.

46. The materiality threshold for outbound low value services arrangement is met if the costs of the relevant services you provide under the arrangement is $2 million or less, or not more than 10% of the total expenses of your Australian economic group[18], whichever is lower.

47. Examples of low value adding intra-group services arrangements include:

- •

- administration services, for example, activities that involve or relate to the control, facilitation and monitoring of your business' human (staffing) and financial resources (assets)

- •

- information technology services that are not part of the principal activity of the group

- •

- accounting, auditing, processing and management of accounts activities, and

- •

- other general services of an administrative or clerical nature.

48. For the purposes of this Guideline, a service between related parties is not a low value adding intra-group service if it:

- •

- is not of a merely supportive nature

- •

- contributes significantly to the creation, enhancement or maintenance of value in the multinational economic group

- •

- requires the use of unique and valuable intangibles or leads to the creation of unique and valuable intangibles, or

- •

- involves the assumption of control of substantial or significant risk by or gives rise to the creation of significant risk for, the service provider.

49. Services that are not low value adding intra-group services[19] include:

- •

- services constituting the core business of the multinational group

- •

- R&D activities, including software development and other technical services

- •

- manufacturing and production services

- •

- purchasing or procurement activities relating to raw materials or other materials that are used in the manufacturing or production process

- •

- sales, marketing and distribution activities

- •

- financial transactions

- •

- extraction, exploration, or processing of natural resources

- •

- insurance and reinsurance activities, and

- •

- strategic management services (other than management supervision of services that qualify as low value adding intra-group services).

Applying the risk assessment framework

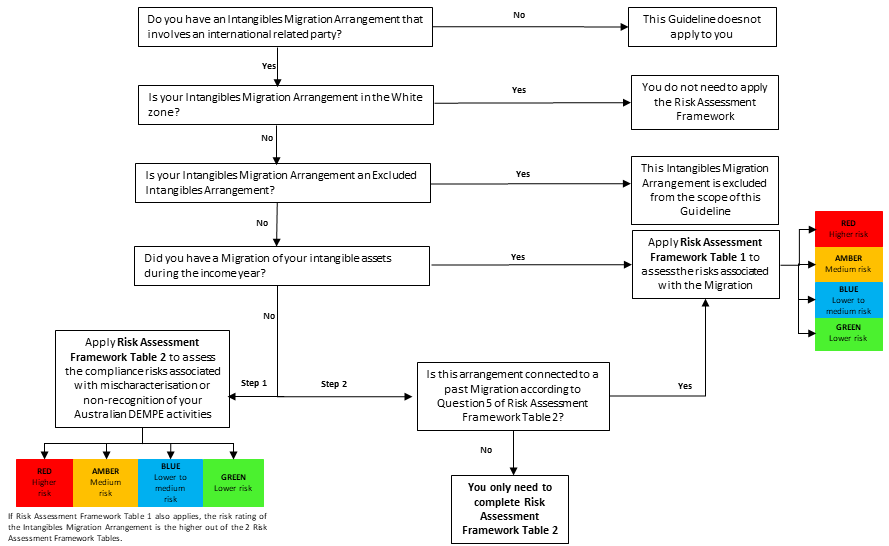

50. If you have more than one Intangibles Migration Arrangement, complete the risk assessment framework in relation to each Intangibles Migration Arrangement.[20] The risk assessment framework is also depicted in Diagram 1:

Diagram 1: Roadmap to the risk assessment framework

51. Answer the following questions to apply the risk assessment framework to each of your Intangibles Migration Arrangements:

- 1.

- Do you have an Intangibles Migration Arrangement that involves an international related party?

- You have an Intangibles Migration Arrangements if you have entered into an arrangement involving the Migration of intangible assets in the current year, or have an arrangement relating to Australian DEMPE activities in connection with intangible assets held offshore.[21]

- If no, the risk assessment framework and compliance approach set out in this Guideline do not apply to you.

- 2.

- Is your Intangibles Migration Arrangement in the white zone according to paragraph 23 of this Guideline?

- If yes, you do not need to apply the risk assessment framework to this Intangibles Migration Arrangement.

- 3.

- Is your Intangibles Migration Arrangement an Excluded Intangibles Arrangement?

- If yes, this arrangement is excluded from the scope of this Guideline and the risk assessment framework and compliance approach set out in this Guideline do not apply to this Intangibles Migration Arrangement.

- 4.

- Did you have a Migration of your intangible assets during the income year?

- A 'Migration' refers to any restructure or change associated with your intangible assets that allows another entity to access, hold, use, transfer, or benefit from the intangible assets.

- •

- If yes, apply RAF Table 1.

- •

- If no, apply RAF Table 2 – refer to Question 5 of RAF Table 2 to determine whether you also need to apply RAF Table 1 to a connected past Migration.

52. For each of your Intangibles Migration Arrangements, your risk zone rating is determined by the number of points you score in either RAF Tables 1 or 2 of this Guideline:

- •

- Red zone (higher risk) – 35 points or more

- •

- Amber zone (medium risk) – 25 – 34 points

- •

- Blue zone (lower to medium risk) – 20 to 24 points

- •

- Green zone (lower risk) – less than 20 points.

53. The risk rating under each RAF table reflects the assessment of the compliance risks posed by an arrangement with respect to a Migration of intangible assets or the mischaracterisation or non-recognition of Australian activities connected with intangible assets respectively.

54. If you achieve a different risk rating under the 2 RAF tables, the higher risk rating would be the overall risk rating for an Intangibles Migration Arrangement.

Definition of terms used in the risk assessment framework

55. The following terms are used in the risk assessment framework. A reference to the singular is also a reference to the plural.

- •

-

Relevant Entity

means:

- -

- in RAF Table 1, the international related party referenced in Question 1 for the type of transaction or change that applies to your Intangibles Migration Arrangement, as well as any other international related party referenced in Question 2 where the Relevant Intangible Assets have been Migrated[22] to that entity under a related arrangement to the initial transaction or change

- -

- in RAF Table 2, the international related party referenced in Question 1 of RAF Table 2

- -

- where the party to the transaction or change is a branch (in a jurisdiction other than Australia) of a Relevant Entity, this term also refers to that branch of the Relevant Entity.

- •

- Relevant Intangible Assets means the intangible assets which are the subject of your transaction or arrangement that you have identified in Question 1 of RAF Table 1 or 2.

- •

- International related party takes its definition from the instructions to the International Dealings Schedule for the relevant income year[23], and also includes an entity which is part of your income tax consolidated group or multiple entry consolidated group and satisfies that definition.

- •

- Specified jurisdiction takes its definition from 'specified countries' in the instructions to the International Dealings Schedule for the relevant income year.[24]

56. For the purpose of RAF Table 1, related arrangements are arrangements that are connected to the restructure or change. Examples include but are not limited to:

- •

- transactions included in your internal documentation as part of an overall restructure or change, for example, transactions included in a step plan for a restructure or project

- •

- a back-to-back assignment of assets, and

- •

- a cost sharing agreement under which another party may obtain the rights or economic ownership to an asset initially acquired by another cost sharing agreement participant.

Risk Assessment Framework Table 1 – risk factors – Migration of your intangible assets

57. Complete RAF Table 1 to assess the compliance risks in relation to a Migration of intangible assets.

|

A. Restructure or change

1. Did you have a restructure or change associated with intangible assets held by you or from which you benefit (whether in legal form or in substance), where any of the following apply?

For example, there has been a change in your activities such that you are no longer considered to be an 'entrepreneur' and have become a 'distributor' or 'service provider', or where the activities of your international related party in relation to those intangible assets have changed such that they have become an 'entrepreneur' instead of a 'service provider' to you. |

| 2. In connection with or following the restructure or change identified in Question 1, do any of the following apply? If yes, assign

5 points.

Examples include but are not limited to:

|

|

B. Circumstances of the Relevant Entity

3. Following the restructure or change identified in Question 1, what is the category that best describes the circumstances of the Relevant Entity in connection with the Relevant Intangible Assets? In this question, references to Relevant Intangible Assets include intangible assets related to the Relevant Intangible Assets that Question 2 applies to. Where there is more than one Relevant Entity in your Intangibles Migration Arrangement, include the score for the Relevant Entity with the highest number of points. Category 1 (assign 15 points ) if any of the following apply:

Category 2 (assign 10 points ) if any of the following apply:

Category 3 (assign 5 points ) if all of the following apply in relation to the current income year:

Category 4 (assign 0 points ) if any of the following apply:

4. Is the Relevant Entity a tax resident in the jurisdiction which is also the jurisdiction in which the products or services related to the Relevant Intangible Assets are predominantly sold to unrelated or third parties? If yes, and if the circumstances of the Relevant Entity are best described as Category 2 or 3, you can subtract 5 points. |

|

C. Tax outcomes

5. Do any of the following apply to the Intangibles Migration Arrangement? Assign 10 points if one of the following apply, assign 20 points if 2 or more apply. In this question, references to Relevant Intangible Assets include intangible assets related to the Relevant Intangible Assets that Question 2 applies to.

If only (g) applies, your risk score for this question is 15 points. 6. Where there is more than one Relevant Entity in your Intangibles Migration Arrangement, include the score for the Relevant Entity with the highest number of points for this question. Assign 10 points if, as a result of the restructure or change identified in Question 1, excluding the upfront gains arising from the restructure or change in the year of the transaction (whether capital or revenue)[31], your taxable income is, or might reasonably be expected to be, less than it would have been if the restructure or change had not been entered into. In considering your response to this question, take into account the outcomes of the restructure or change over the life of the arrangement or the life of the intangible assets. |

|

D. Undocumented or unrecognised dealings

7. Assign 15 points if your arrangement is of the kind described in Example 3 in Appendix 1 to this Guideline, where the Relevant Entity is substantially using or directly benefiting from your intangible assets and:

While this is dependent on the facts and circumstances, examples of where this can apply include:

|

Risk Assessment Framework Table 2 – risk factors – other Intangibles Migration Arrangements

58. Complete RAF Table 2 if, during the income year, you had an Intangibles Migration Arrangement involving Australian activities in connection with intangible assets held offshore.

59. If you have applied RAF Table 1 to a Migration that took place in the current year, you do not need to apply RAF Table 2 in relation to the resulting arrangement in the same year. However, you should apply RAF Table 2 to assess any ongoing arrangement in subsequent years.

60. You may need to also complete RAF Table 1 if your current Intangibles Migration Arrangement is connected to a past restructure or change (see Section D). Refer to paragraphs 26 to 28 of this Guideline for our expectations regarding reporting of your self-assessment in relation to a past restructure or change.

|

A. Your overall characterisation

1. Under the arrangement, do you undertake development, enhancement, maintenance or protection (DEMP) activities in connection with intangible assets for the benefit of an international related party (Relevant Entity) that holds, or has legal or economic ownership of the intangible assets (Relevant Intangible Assets)? If your answer is yes, assign the following risk score depending on how many of the following DEMP activities apply to you (that is, 1 – 10 points , 2 – 15 points , 3 – 20 points), and proceed to the next question.

Examples include manufacturing activities, marketing activities, installation, customisation or other support services for digital products, conducting regulatory functions[32] to seek market access and authorisation. If your answer to this question is no, apart from considering whether or not you need to also complete RAF Table 1 in relation to a connected Migration in the past (see Question 5), you do not need to proceed with the rest of this Risk Assessment Framework Table for this arrangement. |

|

B. Circumstances of the Relevant Entity

2. What is the category that best describes the activities of the Relevant Entity in connection with the Relevant Intangible Assets? In answering this question, the 'Relevant Entity' is the related party that has granted the right to use, or otherwise made available the intangible assets to you.[33] Where there is more than one Relevant Entity in your Intangibles Migration Arrangement, include the score for the Relevant Entity with the highest number of points. Category 1 (assign 15 points ) if any of the following apply:

Category 2 (assign 10 points ) if any of the following apply:

Category 3 (assign 0 points ) if any of the following apply:

3. If the circumstances of the Relevant Entity are considered to be Category 1 or 2, and you receive and include residual profits[36] (or a share of the residual profits) associated with the use of the Relevant Intangible Assets in your Australian assessable income in the current income year, you can subtract 5 points. |

|

C. Tax outcomes

4. Do any of the following apply to the Intangibles Migration Arrangement? Assign 5 points if one or more of the following apply:

|

|

D. Connection with a past Migration – complete RAF Table 1 in relation to the Migration of your intangible assets

5. Do any of the following apply to your Intangibles Migration Arrangement?

If yes, you need to also complete RAF Table 1 of this Guideline in relation to the past restructure or change. |

PART 3 – Our evidence expectations

61. Appendix 2 to this Guideline sets out the types of evidence that we are likely to have regard to when examining your Intangibles Migration Arrangements and would typically expect taxpayers to be able to produce to substantiate their arrangements.

62. As explained in Part 1 of this Guideline and our compliance approach, the higher the risk rating, the more likely it is that we will seek evidence beyond your self-assessment as part of any review of an arrangement. The risk rating of your arrangement will also influence the type and level of evidence we expect from you to substantiate the arrangement.

63. The evidence outlined in Appendix 2 to this Guideline is intended to serve as a general guide and should not be treated as an exhaustive list. It is not the intention of this Guideline to unnecessarily impose burdensome requirements on you in respect of the evidence required to substantiate your Intangibles Migration Arrangements. However, setting out the kinds of information and documents we are likely to request may assist you to mitigate the level of compliance risk posed by your Intangibles Migration Arrangements and ensure that any engagement with us is as efficient as possible.

64. We recognise that certain evidence identified in Appendix 2 to this Guideline may not be relevant to the facts and circumstances of your Intangibles Migration Arrangements or that it may be difficult for you to assess the degree of evidence that is expected. In these circumstances, your substantiation should focus on whether there is sufficient evidence to enable us to verify the information and to reach a proper assessment of your Intangibles Migration Arrangements.

65. The type and level of evidence we expect from you will be influenced by the complexity of your business and the extent to which your Intangibles Migration Arrangements contribute to that business. We will also consider your business systems and governance processes, including any appropriate materiality thresholds that you apply or follow in your business in relation to the management or governance of your, or your global group's, intangible assets, to focus on evidence that can reasonably be expected to be created and relied on in your business.

66. The expectations outlined in this Part and Appendix 2 to this Guideline should not be viewed as replacing or substituting the requirements for transfer pricing documentation under Subdivision 284-E of Schedule 1 to the TAA (refer to Taxation Ruling TR 2014/8 Income tax: transfer pricing documentation and Subdivision 284-E). Notwithstanding that, our Evidence Expectations may assist you in being able to support and verify your transfer pricing documentation for the purposes of Subdivision 284-E of Schedule 1 to the TAA.

APPENDIX 1 – Examples of Intangibles Migration Arrangements

67. This Appendix provides examples of Intangibles Migration Arrangements to illustrate the kinds of matters we will generally consider in assessing the compliance risks relating to your Intangibles Migration Arrangements. The application of the risk assessment framework is also included to illustrate how the framework applies to arrangements. They highlight the circumstances in which we consider the compliance risks that may be associated with your Intangibles Migration Arrangements and the facts that may support this assessment.

68. It is important to note that any reference to a particular intangible asset, industry or commercial activity in the examples is illustrative and does not limit the particulars of an example arrangement to any one industry.

| Level of risk | Examples of arrangements |

|---|---|

| Red zone (Higher risk) | Example 1 – centralisation of intangible assets

Example 2 – bifurcation of intangible assets Example 3 – non-recognition of Australian intangible assets and DEMPE activities Example 4 – Migration of pre--commercialised intangible assets Example 5 – Migration of pre-commercialised intangible assets Example 6 – transfer of intangible assets to a foreign hybrid entity Example 7 – bifurcation of intangible assets Example 8 – cost contribution arrangement |

| Amber zone (Medium risk) | Example 9 – transfer of rights to intangible assets under licence agreement |

| Blue zone (lower to medium risk) | Example 10 – centralisation of intangible assets

Example 11 – contract research and development arrangement |

| Green zone (Lower risk) | Example 12 – centralisation of intangible assets

Example 13 – contract research and development arrangement Example 14 – cost contribution arrangement |

| Out of scope | Example 15 – service arrangement involving intangible assets |

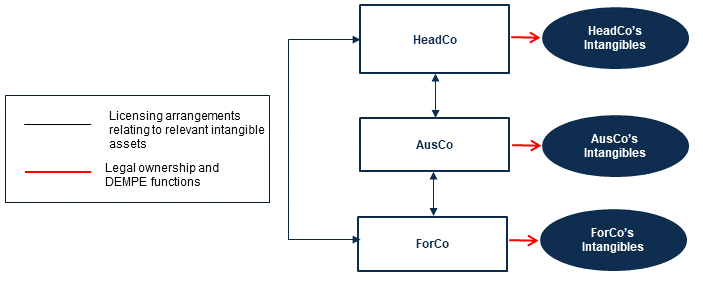

Example 1 – centralisation of intangible assets – red zone

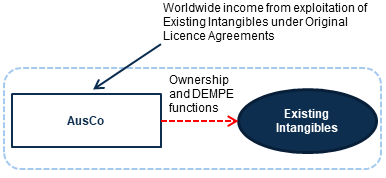

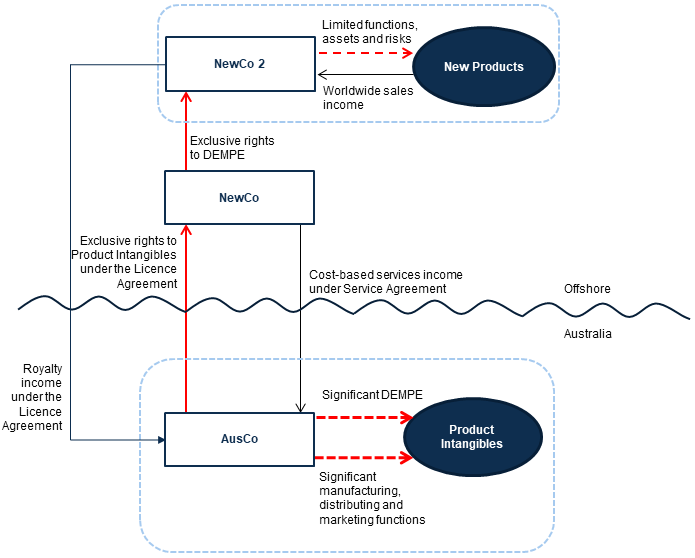

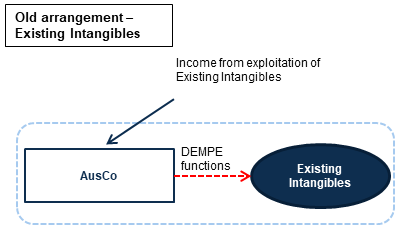

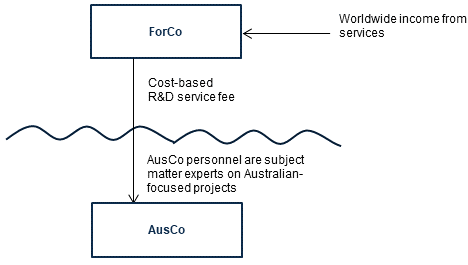

Diagram 2: Example 1 – overview of original arrangement

Original arrangement

69. AusCo is part of a global group that manufactures, markets and sells goods and provides services associated with those sales. AusCo and its international related parties exploit valuable intangible assets in undertaking their operations. The intangible assets include patents, know-how, trade marks, copyright and other intangible assets or rights (Existing Intangibles). These Existing Intangibles are naturally grouped together in the internal systems and governance processes of the AusCo's global group.

70. AusCo owns, manages and controls DEMPE activities associated with the Existing Intangibles and assumes associated risks. AusCo derives royalties from its international related parties for the exploitation of the Existing Intangibles globally under licence agreements between AusCo and its international related parties (Original Licence Agreements).

Decision to centralise intangible assets

71. AusCo and the global group decide that the Existing Intangibles and any new or future intangible assets that are created or developed (New Intangibles) should be centralised in a new entity (NewCo) to be located in a foreign jurisdiction, where NewCo is expected to qualify for a tax concession for income derived from intangible assets. The New Intangibles will initially comprise adaptations of the patents, know-how, trade marks, copyright and other intangible assets or rights that form part of the Existing Intangibles.

72. As a result of the decision to centralise, AusCo enters into a licence agreement (Existing Intangibles Licence) with NewCo to transfer the rights to the Existing Intangibles to NewCo. The term of the Existing Intangibles Licence is based on a period determined to reflect the remaining useful life of the Existing Intangibles at the time. Under the Existing Intangibles Licence, NewCo will pay royalties to AusCo for the right to exploit and sub-licence the Existing Intangibles to other international related parties, including AusCo. These royalties decline over the term of the Existing Intangibles Licence and are based on a formula designed by staff in AusCo's finance department to reflect the declining value of the Existing Intangibles over the term of the Existing Intangibles Licence.

73. The Original Licence Agreements between AusCo and its international related parties are terminated. No payments are made to AusCo as a result of the termination. AusCo and its international related parties subsequently execute a master Licence Agreement with NewCo (New Intangibles Licence). Under this agreement, NewCo receives worldwide royalty income from the rights to exploit the Existing Intangibles and any New Intangibles developed.

74. NewCo and AusCo also enter into a contract R&D Services Agreement. Under this agreement, AusCo will provide R&D services to NewCo in relation to the New Intangibles in return for a fee determined with regard to the costs incurred by AusCo in the provision of the R&D services. Any New Intangibles that are developed as a result of the R&D undertaken by AusCo under the R&D Services Agreement will be owned by NewCo.

Diagram 3: Example 1 – overview of new arrangement

![This diagram illustrates the arrangements AusCo and NewCo enter into upon deciding to centralise the Intangible Assets in NewCo, including royalty arrangements relating to the Existing Intangibles and New Intangibles and an R[amp ]D arrangement. This is described in paragraphs 72 to 76 of the Guideline](/law/view/sgif/cog/pcg2024-001_03.gif)

New arrangement

75. In the first year following the centralisation of the intangible assets in NewCo, the functions performed, assets used, and risks assumed by AusCo do not substantially change. AusCo continues to employ the same specialised staff and use its expertise and assets to manage, perform and control DEMPE activities associated with the New Intangibles. While the development of the Existing Intangibles ceased as a result of the New Arrangement, AusCo continued to perform and control the management and exploitation of the Existing Intangibles. The functions performed, assets used, and risks assumed by AusCo under the R&D Services Agreement with NewCo result in the development of New Intangibles. The R&D Services Agreement states that the New Intangibles are owned by NewCo. The use of the New Intangibles is subject to the New Intangibles Licence, where AusCo and its international related parties pay royalties to NewCo. NewCo manages and performs limited DEMPE activities and assumes limited risks in connection with the Existing Intangibles or the New Intangibles.

76. In the second year following the centralisation of the intangible assets to NewCo, NewCo hires some additional staff and acquires additional assets to assist it in the management of DEMPE activities. These staff and assets are not sufficient to allow NewCo to wholly manage, perform or control the DEMPE activities connected with the New Intangibles and the Existing Intangibles and assume the associated risks. AusCo continues to undertake the majority of the DEMPE activities while receiving cost-based remuneration under the R&D Services Agreement and declining royalties under the Existing Intangibles Licence. NewCo receives royalty income from AusCo and its international related parties for the use and exploitation of the Existing Intangibles and New Intangibles.

Risk assessment

77. This is a Migration of intangible assets. The relevant Intangibles Migration Arrangement includes all dealings with international related parties in relation to Existing Intangibles and New Intangibles, which are closely related intangible assets.

78. This is not an Excluded Intangibles Arrangement. It is not an Excluded Outbound Distribution Arrangement because NewCo does not merely have limited rights to the intangible assets for the purposes of distribution in that jurisdiction only, nor is it an Excluded Low Value Services Arrangement.

79. According to RAF Table 1 of this Guideline, the risk assessment is as follows:

| Risk assessment factor | Application of criteria | Score |

|---|---|---|

| Restructure or change |

|

5 |

| Circumstances of the Relevant Entity |

|

15 |

| Tax outcomes – Question 5 | NewCo is expected to qualify for concessional taxation on the income from the New Intangibles. | 10 |

| Tax outcomes – Question 6 | Had the New Arrangement not occurred, AusCo would have continued to own and derive income from the exploitation of the Existing Intangibles and the New Intangibles. In addition, AusCo would not have been required to pay royalties to NewCo for the use of the New Intangibles that AusCo developed. | 10 |

80. The total risk score in relation to the New Arrangement is 40. [39] The New Arrangement would be regarded as a red zone (higher-risk) Intangibles Migration Arrangement.

81. AusCo continued to perform and control DEMPE activities with respect to the Existing Intangibles and the New Intangibles. The New Arrangement does not appropriately recognise AusCo's contributions to the New Intangibles, either through a recognition of the intrinsic link between the Existing and New Intangibles or a recognition of the DEMPE activities performed by AusCo in substance in relation to the New Intangibles.

82. Had the New Arrangement not occurred, AusCo would have continued to own and derive income from the exploitation of the Existing Intangibles and the New Intangibles. AusCo would not have been required to pay royalties to NewCo for the use of the New Intangibles that AusCo developed after entering into the New Arrangement.

83. We will consider the potential application of the transfer pricing provisions, including the exceptions to the basic rule within Subdivision 815-B, and the CGT or capital allowances provisions where relevant. Additionally, we will consider whether the arrangement was entered into or carried out for the dominant or principal purpose of obtaining a tax benefit. This may attract the operation of the GAAR in Part IVA of the ITAA 1936, the application of the DPT, or both.

Interaction and application of RAF Table 2

84. In the year of the Migration, only RAF Table 1 needs to be applied. In subsequent years, RAF Table 2 of this Guideline will also be relevant. Question 5 of RAF Table 2 requires an assessment of a connected past Migration under RAF Table 1. In this example, that would involve an assessment of the entry into the New Arrangement, which is shown in Table 3 above. The higher risk rating out of RAF Tables 1 and 2 will apply, therefore, the risk rating under RAF Table 1 for the connected past Migration will apply regardless of the risk rating under RAF Table 2. That is, the New Arrangement will be in the red zone (higher risk).

85. For illustration purposes, the application of RAF Table 2 to the New Arrangement in subsequent years after the Migration is also included below.

| Risk assessment factor | Application of criteria | Score |

|---|---|---|

| Overall characterisation – AusCo | AusCo performs R&D activities in relation to New Intangibles which are held by ForCo and undertakes the majority of the DEMP activities. | 20 |

| Circumstances of the Relevant Entity | From the second year, NewCo has hired some additional staff and acquired additional assets to assist it in the management of DEMPE activities, though those are not sufficient to allow NewCo to wholly manage, perform or control the DEMPE activities connected with the New Intangibles and the Existing Intangibles and assume the associated risks.

As such, the Relevant Entity may be best described as Category 2 – unless those personnel undertaking DEMPE functions were initially from AusCo, in which case the circumstances of NewCo would be considered to fall within Category 1. |

10 |

| Tax outcomes | NewCo is expected to qualify for concessional taxation on the income from the New Intangibles. | 5 |

86. If NewCo's circumstances remain in Category 1, the risk rating under RAF Table 2 will also be in the red zone.

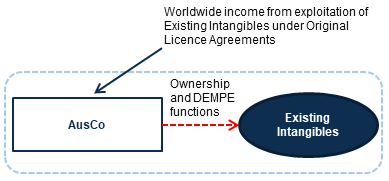

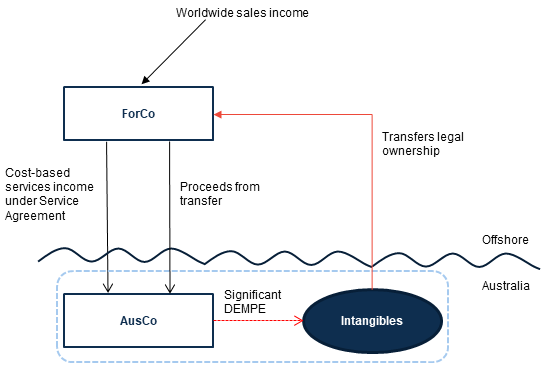

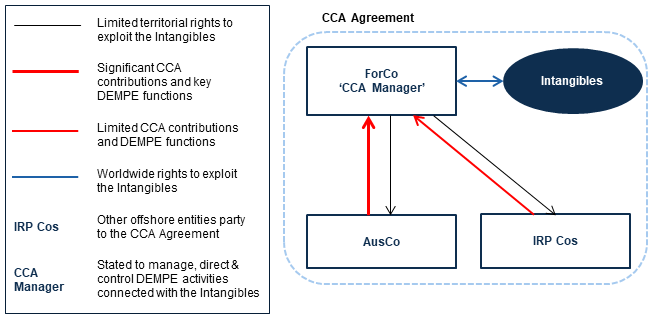

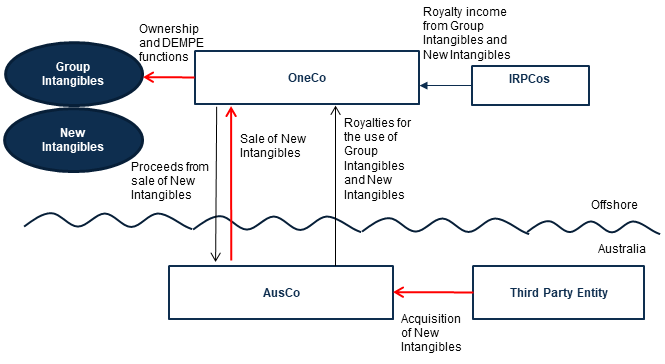

Example 2 – bifurcation of intangible assets – red zone

Diagram 4: Example 2 – overview of original arrangement

Original arrangement

87. AusCo is part of a global group that manufactures, markets and sells goods. AusCo and its international related parties exploit valuable intangible assets in undertaking their operations. The intangible assets include patents, know-how, trade marks, copyright and other intangible assets or rights (Existing Intangibles), which are grouped together in the internal systems of AusCo's global group.

88. AusCo manages, performs and controls the DEMPE activities associated with the existing intangibles and assumes associated risks. AusCo derives royalties from the international related parties for the exploitation of the existing intangibles globally under licence agreements between AusCo and the international related parties (Original Licence Agreements).

Diagram 5: Example 2 – overview of new arrangement

![This diagram illustrates the New Arrangement under which AusCo bifurcates the Existing Intangibles into Australian Intangibles and Offshore Intangibles. The Offshore Intangibles are sold to NewCo and AusCo provides R[amp ]D services to NewCo going forward](/law/view/sgif/cog/pcg2024-001_05.gif)

New arrangement

89. AusCo and its global group decide that a new entity located in a foreign jurisdiction (NewCo) should exploit the Existing Intangibles in offshore markets by owning the relevant intangible assets (Offshore Intangibles). NewCo is in a specified country.[40]

90. As part of this decision, AusCo will continue to exploit the Existing Intangibles in Australia only and will own the relevant intangible assets and undertake the associated DEMPE activities as a result (Australian Intangibles).

91. The decision to transfer the Offshore Intangibles to NewCo (and bifurcate the Existing Intangibles into Australian Intangibles and Offshore Intangibles) is stated to be based on a desire to facilitate expansion into emerging markets and establish a global centre of expertise for new product development (New Arrangement). While AusCo has prepared transfer pricing documentation that focuses on determining whether the cost-based R&D services income received under the R&D arrangement is arm's length, it is not able to evidence the commercial rationale in making the decision to transfer the Offshore Intangibles to NewCo.

92. To implement the New Arrangement, AusCo enters into a sale agreement (Sale Agreement) with NewCo, transferring the Offshore Intangibles to NewCo for an amount of consideration. This amount was determined by reference to a valuation that was undertaken by AusCo in relation to the Offshore Intangibles. The Sale Agreement provides that any entitlement to royalties connected with the Offshore Intangibles will be novated to NewCo. This includes the royalties AusCo received from the international related parties under the Original Licence Agreements. No payments are made to AusCo as a result of the termination.

93. NewCo and AusCo also enter into an agreement where AusCo will provide R&D services to NewCo for cost-based remuneration (R&D Agreement). Under the R&D Agreement any new Offshore Intangibles that are developed as a result of the R&D undertaken by AusCo will be owned by NewCo.

94. At the time the New Arrangement is implemented, NewCo does not have sufficient assets or employ sufficiently qualified staff to wholly manage, perform or control the DEMPE of the Offshore Intangibles and assume the associated risks.

95. Some members of AusCo's management relocate to the jurisdiction of NewCo to facilitate the New Arrangement. However, AusCo continues to otherwise employ specialised staff and use its expertise and assets to manage, perform and control DEMPE activities associated with the bifurcated Australian Intangibles and the Offshore Intangibles, and assume the associated risks. AusCo is remunerated for these activities with a cost-based service fee pursuant to the R&D Agreement with NewCo.

96. AusCo continues to own the Australian Intangibles, which allows it to manufacture, market and sell goods in the Australian market. AusCo continues to manufacture, market and sell goods associated with the Australian Intangibles in the Australian market and derive associated profits, but no longer receives royalties from international related parties for the exploitation of the Offshore Intangibles in undertaking similar functions offshore.

97. In subsequent years, AusCo continues to primarily manage, perform and control the DEMPE of both the Australian Intangibles and the Offshore Intangibles. There is limited new product development undertaken by NewCo independent of the DEMPE activities outsourced to, and managed and controlled by, AusCo in relation to the Offshore Intangibles.

Risk assessment

98. This is a Migration of intangible assets. The Migration involves the transfer of Offshore Intangibles to NewCo. NewCo is the Relevant Entity.

99. According to RAF Table 1 of this Guideline, the risk assessment is as follows.

| Risk assessment factor | Application of criteria | Score |

|---|---|---|

| Restructure or change | AusCo has transferred Offshore Intangibles to NewCo; post-transfer, AusCo provides R&D services to NewCo.

AusCo also continues to conduct DEMPE on intangibles that are connected or closely related to Offshore Intangibles, being the Australian Intangibles. |

5 |

| Circumstances of the Relevant Entity | At the time the New Arrangement is implemented, NewCo does not have sufficient assets or employ sufficiently qualified staff to wholly manage, perform or control the DEMPE of the Offshore Intangibles and assume the associated risks.

The relocation of staff who had previously performed the same activities in Australia would not result in this being in a category other than Category 1. |

15 |

| Tax outcomes – Question 5 | NewCo is tax resident of a specified country, therefore satisfying the definition of 'Specified jurisdiction' for the purposes of the risk assessment framework (paragraph 55 of this Guideline). | 10 |

| Tax outcomes – Question 6 | Had the New Arrangement not occurred AusCo would have continued to own and derive income from the exploitation of the Existing Intangibles, including the bifurcated Offshore Intangibles. | 10 |

100. The total risk score in relation to the New Arrangement is 40. The New Arrangement would be regarded as a red zone (higher-risk) Intangibles Migration Arrangement.

101. There is a risk that the New Arrangement has artificially bifurcated the Existing Intangibles into Australian Intangibles and Offshore Intangibles such that the New Arrangement is not arm's length in nature or is structured to avoid tax obligations. The risk in this regard is emphasised where AusCo is not able to provide evidence substantiating its decision-making for entering into this arrangement or does not recognise or provide evidence referring to anticipated or potential Australian tax impacts that were considered in making the decision to enter into the arrangement.

102. AusCo continued to manage and control the DEMPE activities of the Offshore Intangibles, which in economic substance was inconsistent with the form of the New Arrangement. We may take the view that an independent entity dealing wholly independently in circumstances comparable to AusCo would not have entered into the New Arrangement with NewCo, as it involved AusCo disposing of the Offshore Intangibles and associated income streams under non-arm's length conditions.

103. We may also take the view that the distinction between the Australian Intangibles and the Offshore Intangibles and the separation of DEMPE activities in relation to these assets lacks commercial rationale and economic substance.

104. We will consider the potential application of the transfer pricing provisions, including the exceptions to the basic rule within Subdivision 815-B, the CGT provisions and the capital allowances provisions. Additionally, we will consider whether the arrangement was entered into or carried out for the dominant or principal purpose of obtaining a tax benefit. This may attract the operation of the GAAR in Part IVA of the ITAA 1936, the application of the DPT, or both.

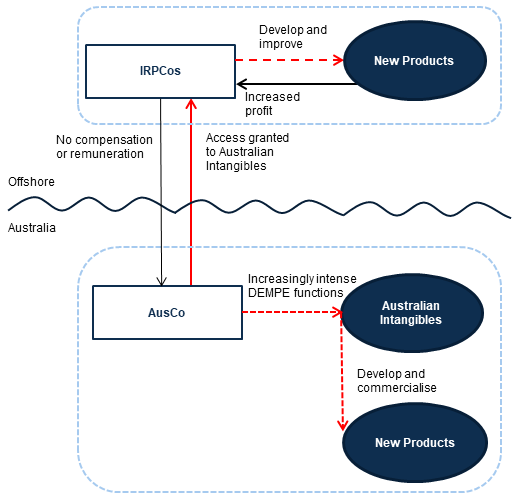

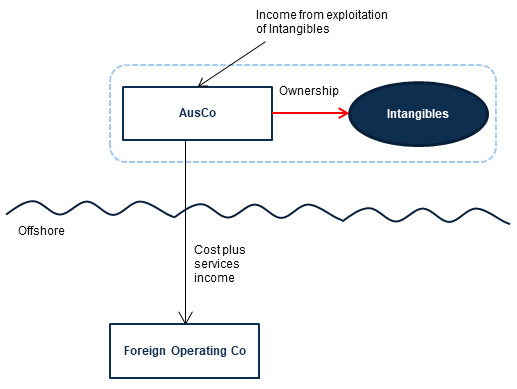

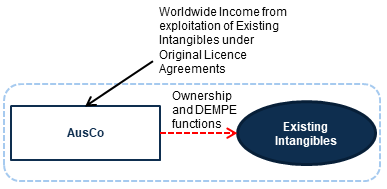

Example 3 – non-recognition of Australian intangible assets and DEMPE activities – red zone

Diagram 6: Example 3 – overview of arrangement

105. AusCo is part of a global group that manufactures and sells goods and provides associated services. AusCo and its international related parties have historically recognised the use of minimal valuable intangible assets in undertaking their operations, aside from certain trade marks and intangible assets associated with the global group's brand and product lines. A number of these trade marks are owned by AusCo and connected with products and services exclusively distributed in Australia. AusCo manages, performs and controls DEMPE activities connected with its Australian trade marks and assumes associated risks.

106. Over a number of years, AusCo's DEMPE activities increase in intensity, resulting in the development and commercialisation of a number of new and improved products and services. Several new identifiable intangible assets are developed from these activities. AusCo does not account for any additional intangible assets in its financial statements or register the relevant intangible assets for legal protection. The relevant intangible assets include patentable products and processes, know-how, copyright and other intangible assets or rights. These intangible assets and the Australian trade marks are developed, maintained, enhanced and owned by AusCo (Australian Intangibles).

107. AusCo does not formally recognise any Australian Intangibles or engage in annual review or analysis of its processes and activities associated with the Australian Intangibles. Likewise, AusCo's global group does not maintain a comprehensive contemporaneous R&D or intellectual property policy or other relevant processes or guidelines.

108. In the following years, a number of AusCo's international related parties (IRPCos) are granted access to the Australian Intangibles and use these assets to develop and improve equivalent products and services in offshore jurisdictions. AusCo does not enter into any legal agreements for the transfer or licensing of these assets with its international related parties or update its transfer pricing policy or documentation in connection with these dealings.

109. The profitability of AusCo's international related parties increases as a result of accessing and exploiting the Australian Intangibles and the functions performed, assets used, and risks assumed by AusCo in connection with the DEMPE of the Australian Intangibles. AusCo does not receive compensation or remuneration from its international related parties in connection with their access to, and use of, the Australian Intangibles.

Risk assessment

110. This is a Migration of intangible assets. According to RAF Table 1 of this Guideline, the risk assessment is as follows.

| Risk assessment factor | Application of criteria | Score |

|---|---|---|

| Restructure or change | AusCo has made the Australian Intangibles available to IRPCos, which are the Relevant Intangible Assets for the purposes of RAF Table 1. AusCo continues to be involved in the DEMPE of Australian Intangibles. | 5 |

| Circumstances of the Relevant Entity | IRPCos do not perform, manage or control the DEMPE activities associated with Australian Intangibles, which are performed by AusCo, along with the assumption of the associated risks in respect of the Australian Intangibles, IRPCos are best described to be Category 1. | 15 |

| Undocumented or unrecognised dealings | AusCo receives no compensation or remuneration as a result of this arrangement. AusCo and the global group do not have documentation that identify the intangible assets that are relevant to the Intangibles Migration Arrangement or evidences the processes and activities associated with the relevant intangible assets. | 15 |

111. The total risk score for this arrangement is 35. This arrangement would be regarded as a red zone (higher-risk) Intangibles Migration Arrangement.

112. There is a risk that the dealings entered into by AusCo may not be consistent with AusCo's best economic interests having regard to the commercial options realistically available to AusCo. AusCo granted access to and use of the Australian Intangibles to its international related parties where no agreements or form of remuneration were considered or recognised.

113. The effect of the arrangement is that AusCo has allowed its international related parties to exploit and derive benefits in connection with the Australian Intangibles for nil consideration. The arrangement fails to appropriately recognise DEMPE activities managed, performed and controlled by AusCo, development of Australian Intangibles from AusCo's activities and exploitation of assets developed by AusCo by AusCo's international related parties. The risk is heightened where the DEMP activities undertaken by AusCo are extensive, or where the intangible assets are of particular commercial value and substantially used by IRPCos, such that it can be reasonably expected that the use of, or access to them would give rise to remuneration to AusCo.

114. We will consider the potential application of the transfer pricing provisions, including the exceptions to the basic rule within Subdivision 815-B. Additionally, we will consider whether the arrangement was entered into or carried out for the dominant or principal purpose of obtaining a tax benefit. This may attract the operation of the GAAR in Part IVA of the ITAA 1936, the application of the DPT, or both.

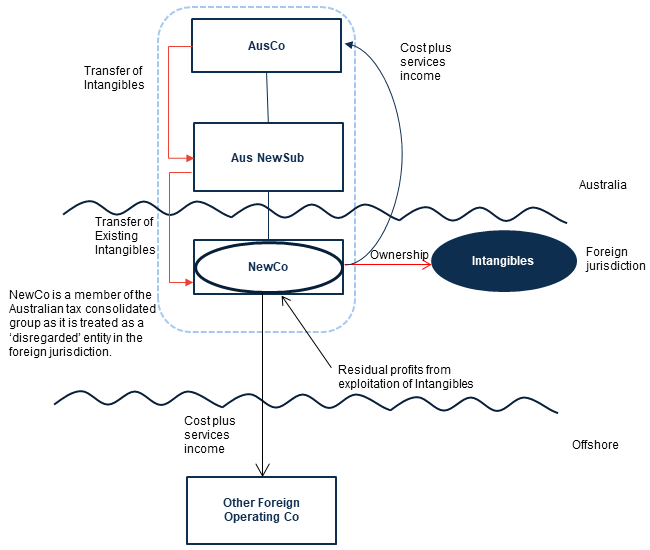

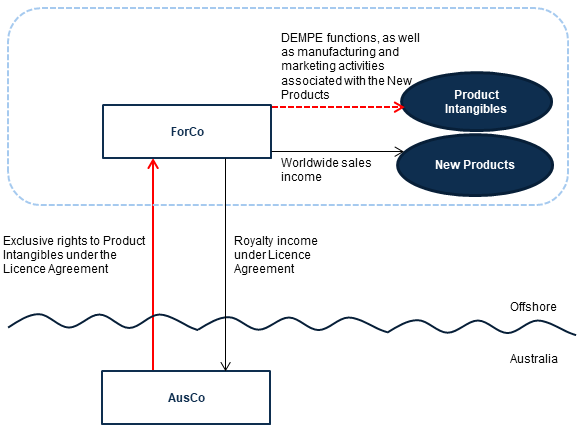

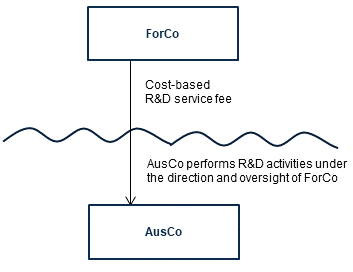

Example 4 – Migration of pre-commercialised intangible assets – red zone

Diagram 7: Example 4 – overview of arrangement

115. AusCo is part of a global group that develops, manufactures, markets and sells products globally. AusCo and its international related parties engage in the DEMPE of valuable intangible assets in undertaking their operations. These intangible assets include patents, know-how, trade marks, copyright and other intangible assets or rights. In the global group's internal systems, such intangible assets are grouped together by product line.

116. AusCo spent a number of years undertaking R&D in Australia to develop a new product range, which resulted in the development of pre-commercialised intangible assets (Product Intangibles). AusCo owns the Product Intangibles. AusCo considers the Product Intangibles to be strategically important to their business.

117. Prior to the Product Intangibles being commercialised, AusCo and the global group decide to incorporate a new entity in an offshore jurisdiction (which is a specified country), NewCo, for the stated purpose of further developing, manufacturing and commercialising the new products associated with the Product Intangibles (New Products). While AusCo has the capability and capacity to develop, manufacture and commercialise the New Products, the global group decides that NewCo should instead own the rights to the Product Intangibles.

118. In addition, at the time of this decision, the global group decides that NewCo 2, another new entity incorporated in the offshore jurisdiction, should ultimately own the rights to the Product Intangibles. The plan for the Product Intangibles to be transferred from NewCo to NewCo 2 is set out in a step plan for the restructure.

119. As a result of this decision, AusCo and NewCo first enter into a licence agreement (Licence Agreement). The Licence Agreement grants NewCo the exclusive rights to develop, manufacture and commercialise the Product Intangibles, including the associated New Products. Under the Licence Agreement, NewCo pays ongoing royalties to AusCo in relation to worldwide sales of the New Products. As a result of the Licence Agreement, the effective control of the Product Intangibles is transferred from AusCo to NewCo and, as a consequence, all of the worldwide income that will be received from the global commercial sales of the New Products will be derived by NewCo.

120. At the time of entering into the Licence Agreement, NewCo does not have sufficient assets or employ sufficiently qualified staff to undertake the DEMPE activities which are undertaken by AusCo. NewCo subsequently enters into various service agreements (Service Agreements) with AusCo, under which AusCo agrees to provide services for the development, manufacture and distribution of the New Products. The Service Agreements remunerate AusCo with a cost-based service fee.

Post-transfer of the rights to the Product Intangibles

121. Following the transfer of the rights to the Product Intangibles to NewCo, the functions performed, assets used, and risks assumed by AusCo do not substantially change. AusCo continues to employ specialised staff and uses its expertise and assets to manage, perform and control DEMPE activities associated with the Product Intangibles. The functions performed, assets used, and risks assumed by AusCo in connection with activities covered by the Services Agreements with NewCo results in the commercialisation of the Product Intangibles. NewCo has limited relevantly qualified staff and manages and performs limited activities, owns limited assets and assumes limited risks in connection with the Product Intangibles.

122. Once the New Products are commercialised, under a novation agreement. NewCo transfers the exclusive rights to the Product Intangibles to NewCo 2, which also has limited relevantly qualified staff and capacity to manage and perform DEMPE activities related to the Product Intangibles. NewCo 2 owns limited assets and has limited capacity to assume risks in connection with the Product Intangibles. Intercompany agreements related to the New Products and Product Intangibles were also novated by NewCo to NewCo 2.

123. AusCo manufactures, distributes and markets the New Products on behalf of NewCo 2 under the Service Agreements. In undertaking these activities, AusCo employs specialised staff and uses its expertise and assets to manufacture and sell the New Products to the global market. However, AusCo only receives cost-based remuneration from NewCo 2 in accordance with the terms of the Service Agreements and royalties from the commercial sales of the New Products. NewCo 2 continues to have limited qualified staff, manages and performs limited activities, and assumes limited risks in connection with the manufacture, distribution and marketing of the New Products. NewCo 2 derives the worldwide income from the sale of the New Products. AusCo derives a royalty income under the Licence Agreement, now with NewCo 2.

Risk assessment

124. This is a Migration of intangible assets and not an Excluded Outbound Distribution Arrangement because NewCo has the exclusive rights to develop, manufacture and commercialise the Product Intangibles worldwide.

125. The Relevant Entity includes both NewCo and NewCo 2. NewCo 2 is a Relevant Entity because the Relevant Intangibles Assets were transferred to NewCo as part of a related arrangement to the initial transfer, as evidenced in a step plan for the overall restructure. In addition, NewCo 2 engages AusCo to undertake further development of the Product Intangibles as well as the distribution of New Products under the Service Agreements.

126. According to RAF Table 1 of this Guideline, the risk assessment is as follows.

| Risk assessment factor | Application of criteria | Score |

|---|---|---|

| Restructure or change | AusCo and NewCo enter into a licence agreement in relation to the Product Intangibles. Afterwards, AusCo continues to provide development, manufacturing and distribution services in relation to New Products. | 5 |

| Circumstances of the Relevant Entity | At the time of entering into the Licence Agreement, NewCo does not have sufficient assets or employ sufficiently qualified staff to undertake the DEMPE activities which are undertaken by AusCo. | 15 |

| Tax outcomes – Question 5 | Both NewCo and NewCo 2 are tax residents of a Specified jurisdiction. | 10 |

| Tax outcomes – Question 6 | As a consequence of AusCo transferring the rights to control or use its Product Intangibles to NewCo, AusCo did not derive the worldwide income from the sale of the New Products, which was a strategically important product to AusCo. | 10 |

127. The total risk score for this arrangement is 40. This arrangement would be regarded as a red zone (higher-risk) Intangibles Migration Arrangement.

128. In subsequent years, RAF Table 2 of this Guideline will also be relevant in assessing the risks associated with mischaracterisation of Australian activities connected with DEMPE of the intangible assets. In summary, the risk score under this Table will also result in a red zone (higher-risk) rating – a total of 40 points, based on overall characterisation (20 points as AusCo continues to manufacture, market and perform other DEMP activities in connection with the New Products and Product Intangibles), circumstances of NewCo (or NewCo 2) – Category 1 (15 points) and tax outcomes – NewCo and New Co2 are tax residents of a Specified jurisdiction according to the definition in paragraph 55 of this Guideline (5 points).

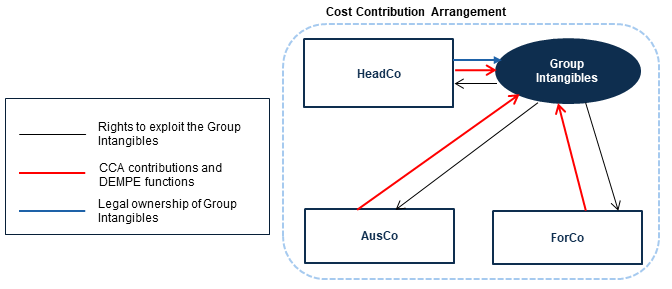

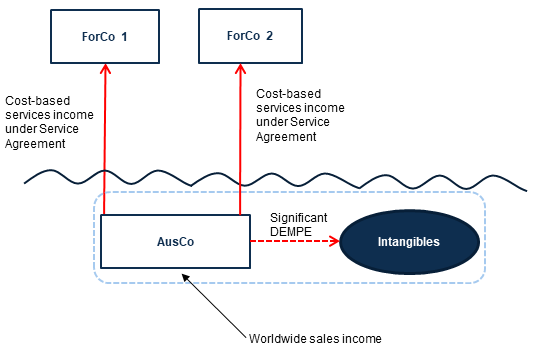

129. There is a risk that AusCo's entry into the Licence Agreement and Service Agreements with NewCo (and NewCo 2) lacks commercial and economic substance, is structured to avoid tax, or may not be an arrangement that independent entities dealing wholly independently in comparable circumstances to that of AusCo and NewCo would have entered into. This risk is emphasised where AusCo is not able to evidence its decision-making for entering into these arrangements.