LI 2025/D4 - Explanatory Statement

A New Tax System (Goods and Services Tax) Act 1999

Draft Explanatory Statement

General outline of instrument1. This instrument is made under subsection 17-20(1) of the A New Tax System (Goods and Services Tax) Act 1999 (GST Act).

2. The instrument allows you to correct a debit error or credit error ( error ) that relates to an amount of wine tax or wine tax credit that was made in working out your net amount for an earlier tax period in specific circumstances. You may correct the error by including the amount of the error from the earlier tax period, in working out the net amount for a later tax period.

3. This instrument replaces Wine Equalisation Tax: Correcting WET Errors Determination 2015.

4. The instrument is a legislative instrument for the purposes of the Legislation Act 2003.

5. Under subsection 33(3) of the Acts Interpretation Act 1901, where an Act confers a power to make, grant or issue any instrument of a legislative or administrative character (including rules, regulations or by-laws) the power shall be construed as including a power exercisable in the like manner and subject to the like conditions (if any) to repeal, rescind, revoke, amend, or vary any such instrument.

Date of effect6. This instrument commences on the day after it is registered on the Federal Register of Legislation.

Background7. Generally, when you make an error that results in your assessed net amount under the GST Act for a tax period being incorrect, you will need to request an amendment to the assessment, for that tax period, to correct the error. This instrument provides an alternative mechanism to allow errors made in earlier periods to be corrected in a later tax period.

What is an error?

8. An error is a mistake, in relation to an amount of wine tax or wine tax credits (defined in the A New Tax System (Wine Equalisation Tax) Act 1999 (WET Act)), that you have made in working out your net amount for a tax period that would, if it was the only mistake made, have resulted in your net amount or assessed net amount being overstated (a credit error) or understated (a debit error). An error must result in the net amount or assessed net amount for the relevant tax period being incorrect (that is, it must be quantified).

Example 1

On 15 December 2023, Wodehouse Company discovers it has not correctly accounted for Wine Equalisation Tax (WET) on supplies made for the tax period ended 30 September 2023, for which a GST return was lodged on 21 October 2023. However, it is unable to quantify the amounts and decides to engage an accounting firm to review its accounts.

On 12 February 2024, the accounting firm finalises the review for Wodehouse Company and identifies that a WET error was made in calculating the amount of WET attributable to the September 2023 tax period. The amount of the unreported WET that relates to the September 2023 tax period is $7,975. As this error has been quantified and a review by the accounting firm shows that this error has not been corrected via an amendment or in a subsequent GST return it now falls within the scope of this instrument.

9. Each separate error, and its effect on the net amount or assessed net amount, must be assessed as though it was the only mistake made in the earlier tax period. Where there are multiple errors made in working out a net amount for an earlier tax period, each individual error must be examined separately to determine whether it is a debit or credit error.

10. Debit error means a mistake you made in relation to wine tax or wine tax credits in working out a net amount for an earlier tax period that would, if it was the only mistake made in that tax period, have resulted in your net amount, or assessed net amount, being understated. In practice, this would result in your amount payable being understated or your refund being overstated.

11. Examples of debit errors include:

- (a)

- failing to include the wine tax liability on an assessable dealing, as defined in the WET Act, in the sum of the amounts of wine tax liabilities for the tax period,

- (b)

- understating the wine tax payable, for example, stating a wine tax liability as $1,000 rather than the correct amount of $10,000, and

- (c)

- clerical errors overstating the amount of a wine tax credit, such as by including an amount of wine tax credit in the sum of the wine tax credits twice in the same tax period.

12. A credit error is a mistake you made in working out your wine tax or wine tax credits included in the net amount for an earlier tax period that would, if it was the only mistake made in that tax period, have resulted in the net amount, or assessed net amount, being overstated. In practice this would result in your amount payable being overstated or your refund being understated.

13. Examples of credit errors include:

- (a)

- reporting a wine tax liability on an assessable dealing twice,

- (b)

- overstating the wine tax payable, for example, entering the wine tax liability on an assessable dealing as $10,800, rather than the correct amount of $10,000, and

- (c)

- under-claiming the amount of a wine tax credit for example, entering wine tax credits of $1,000 rather than the correct amount of $10,000.

14. Amounts of wine tax and wine tax credits affect the net amount, worked out under section 17-5 of the GST Act, therefore an instrument in relation to wine tax can be made under subsection 17-20(1) of the GST Act.

Effect of this instrument15. Where the circumstances in this instrument are met, you may choose to correct an error that has been included in working out a net amount for an earlier tax period by including the amount of that error in the next GST return you lodge with the Commissioner. This provides an alternative method to address the error, instead of having to either revise an earlier GST return or request the Commissioner to amend the assessment for the earlier tax period.

16. This instrument minimises compliance costs and any liability you may otherwise have to the general interest charge or administrative penalties. The Commissioner's administrative costs are also minimised by reduced costs in processing revised GST returns or amendment requests.

When an error may be corrected

17. Section 6 of the instrument provides that an error made in working out the net amount for an earlier tax period may only be corrected in a later tax period if:

- (a)

- the error relates to an amount of wine tax or wine tax credit. Accordingly, any error that results in the net amount for an earlier tax period being incorrect due to the operation of the WET Act is covered by this instrument,

- (b)

- the earlier tax period in which the mistake was made started on or after 1 July 2012, and you lodge the GST return for the later tax period within the period of review for the assessment of the net amount of the earlier tax period,

- (c)

- at the time of lodging your GST return for the later tax period, the error does not relate to any current compliance activity or, if it does relate to any current compliance activity, the Commissioner has notified you in writing that the error can be corrected under the instrument,

- (d)

- you have not corrected the error, to any extent, in working out your net amount for another tax period,

- (e)

- where the error is a debit error, the conditions in section 7 are met, and

- (f)

- you are registered for GST.

Period of review

18. To maintain the integrity of the time limits for amending assessments, you cannot correct an error made in an earlier tax period unless the GST return for the later tax period is lodged within the period of review for the assessment of the net amount for the earlier tax period.

19. The period of review starts on the day the Commissioner gives you a notice of assessment and ends 4 years from the day after the notice of assessment is given (subsection 155-35(2) in Schedule 1 to the Taxation Administration Act 1953 (TAA)). An assessment of your net amount is generally made on the day you lodge your GST return. The GST return is taken to be the notice of assessment given on the same day.

Example 2

Waugh Company, a quarterly lodger, made an error in relation to its wine tax credits for the December 2023 tax period that resulted in its assessed net amount for that tax period being overstated. Waugh Company lodged its GST return on 21 January 2024. Accordingly, Waugh Company must notify the Commissioner of the error within the 4 year period of review. They may correct the error in a GST return for any tax period lodged within the 4 year period from 21 January 2024 to 22 January 2028.

Compliance activity can impact on correcting an error

20. Generally, if you are subject to compliance activity that covers the tax period in which the error was made, or the error relates to the subject matter of compliance activity, you cannot use this instrument to correct the error.

21. However, the Commissioner can notify you in writing that you can use the instrument to correct an error despite the current compliance activity. The Commissioner may do this in circumstances where the compliance activity is of such a nature that it would still be appropriate for you to have the choice to apply this instrument. In such circumstances, the Commissioner may consider that it is a more streamlined and cost-effective process for both the taxpayer and the Commissioner for you to correct an error identified during the compliance activity.

22. The term 'matter' in this context takes on its ordinary meaning and includes any issue or enquiry that is specified as being subject to the compliance activity.

Example 3

In June 2024, the ATO notifies Graves Company that it is conducting a review of its past WET transactions. In preparation, Graves Company undertakes its own review of its WET transactions. Graves Company discovers that it made an error in treating a particular transaction as an assessable dealing. Graves Company also made an error in claiming wine tax credits in relation to this supply. As these errors relate to a matter that is specified as being subject to compliance activity, Graves Company cannot correct these errors by applying the instrument.

Example 4

In June 2024, the ATO notifies ABC Pty Ltd that it is conducting a general review of its WET affairs for each of the monthly tax periods ending 31 January 2023 to 29 February 2024. ABC Pty Ltd also conducts its own review and discovers an error made in working out its net amount for the tax period that ended December 2022. As the error is made for an earlier tax period that is not subject to compliance activity (and is not related to a matter that is specified as being subject to compliance activity), ABC Pty Ltd can correct the error by applying the instrument, if the other conditions are satisfied.

23. From a taxpayer's perspective, a compliance activity begins on the day the Commissioner tells you that an examination is to be made of your WET affairs and ends on the day when either the Commissioner gives you a notice of assessment or an amended assessment for the tax periods under examination or tells you that the examination has been finalised. Usually, the Commissioner tells you that the ATO is examining your WET affairs in a letter, but you may also be told through other mediums of communication including by email or phone.

Choosing how to correct an error

24. While the instrument allows you to correct errors (in relation to wine tax or wine tax credits) made in an earlier tax period in working out a net amount in a later tax period, you are not obliged to do so. You may instead choose to correct the error by requesting the Commissioner to amend the assessment for the earlier tax period in which the error was made. If you do this, paragraph 6(e) of the instrument clarifies that you cannot also apply the instrument to correct the error.

25. Paragraph 6(e) restricts your application of the instrument to one time per error. Once you have taken account of that error, to any extent, in working out your net amount for another tax period (that is by applying the instrument to correct an error), you cannot apply the instrument to correct the same error again. For example, where you partially correct a debit error because the relevant debit error value limit is exceeded, that error has already been corrected in working out your net amount for another tax period. You cannot apply the instrument to correct any part of that error again.

26. Paragraph 6(g) of the instrument limits use of this instrument to entities that are registered for GST.

Correcting debit errors

27. While paragraphs 6(a) to 6(e), and 6(g) apply to all errors, the additional conditions in section 7 must be met before correcting a debit error (see paragraph 6(f)).

28. Under section 7, a debit error can only be corrected:

- (a)

- if the error was not a result of recklessness as to the operation of a wine tax law or intentional disregard of a wine tax law,

- (b)

- if that error is corrected in a tax period that is within the debit error time limit that corresponds with your current GST turnover specified in the table in section 7, and

- (c)

- to the extent that the net sum of the debit errors is within the debit error value limit that corresponds with your current GST turnover specified in the table in section 7.

29. These additional conditions apply to each debit error. In working out whether the relevant debit error can be corrected in the tax period, and to what extent, all 3 additional conditions must be satisfied. If any of the conditions are not satisfied (for example, the error is not within the relevant debit error time limit), the debit error cannot be corrected by applying the instrument. In working out whether you can correct a debit error in a current tax period by relying on this instrument, it is the net sum of the debit errors that must be below the limit, not the amount of an individual debit error.

Alignment with GST Correcting Errors limits

30. The current GST turnover and debit error time limits specified in the table in section 7 are the same as the current GST turnover and debit error time limits specified in the A New Tax System (Goods and Services Tax) (Correcting GST Errors) Determination 2023 (Correcting GST Errors Determination). However, the debit error value limits differ due to the different tax rates for GST and WET. To align the WET debit error value limits with those in the Correcting GST Errors Determination, the WET payable has been calculated on a GST-inclusive transaction amount (based on the corresponding GST value limit).

31. The WET taxable value is multiplied by 29% (the current WET rate) to determine the amount of WET payable. For this purpose, the WET taxable value is assumed to be the notional wholesale selling price. The half retail price method has been used to calculate the notional wholesale selling price of wine by multiplying the GST-inclusive retail sale price (or what the retail price would be for own use wine if it were sold) by 50%.

32. The method used to align the debit error value limit in the table in section 7 with its equivalent in the Correcting GST errors determination is shown in Table 1.

| Step number | Steps in method | How it is calculated |

|---|---|---|

| 1 | GST correcting debit error value limit (for GST turnover of less than $20 million) is $12,500 | $12,500 limit obtained from GST Correcting Errors Determination |

| 2 | Where GST is $12,500, the GST-inclusive value of the transaction (that is a taxable supply) is $137,500 | 11 × $12,500 = $137,500 |

| 3 | The WET taxable value, calculated using the half retail method, is $68,750 | $137,500 × 50% = $68,750 |

| 4 | WET payable is $19,937 | $68,750 × 29% = $19,937 |

33. Using the above method, the amount of WET payable on a transaction where the GST is $12,500 (equal to the debit error limit in the GST Correcting Errors Determination for GST turnover under $20 million), using the half retail price method, is $19,937. Given this, $20,000 (which is approximately equal to this amount) is the appropriate debit error value limit for that GST turnover. This same method was used to determine the appropriate debit error limits for each GST turnover limit in the table in section 7.

Recklessness or intentional disregard

34. The terms 'recklessness' and 'intentional disregard' have the same meaning as used in Subdivision 284-B in Schedule 1 to the TAA.

35. The Commissioner's published views on the terms 'recklessness' and 'intentional disregard' are contained in Miscellaneous Taxation Ruling MT 2008/1 Penalty relating to statements: meaning of reasonable care, recklessness and intentional disregard.

36. Taxpayers who deliberately under report their assessed net amount by making one or more debit errors will not be able to correct those errors by applying this instrument as they will not meet the requirements of paragraph 7(a) of the instrument. This is irrespective of whether the debit errors would otherwise meet the requirements of paragraph 7(b) and (c).

Example 5

Blyton Company, facing a cash flow problem, deliberately under reports the wine tax payable on its assessable dealings by $10,000 when lodging its GST return for the November 2023 tax period.

As the debit errors (the under reporting of wine tax payable) result from Blyton Company intentionally disregarding the WET law, the errors cannot be corrected by applying the Instrument.

Debit error time limit

37. If your current GST turnover is less than $20 million, a debit error must be corrected in a GST return that is lodged within 18 months after the due date of the GST return for the tax period in which the debit error was made. If your current GST turnover is at or above $20 million, the time limit is 12 months.

38. The term 'current GST turnover' for the purposes of the instrument has the meaning given in section 188-15 of the GST Act. This section provides that your current GST turnover at a time during a particular month is the sum of the value of all the supplies that you have made, or are likely to make, during the 12 months ending at the end of that month, other than supplies that are input taxed or supplies that are not for consideration or supplies that are not made in connection with an enterprise that you carry on. The value of all the supplies in the definition refers to the GST-exclusive value.

39. Requiring a debit error to be corrected in a GST return that is lodged within 12 or 18 months of the due date for lodging the GST return for the tax period in which the debit error was made ensures that a consistent time limit applies to all taxpayers, regardless of whether the relevant GST return is lodged on time or not.

40. By contrast, if the time limit was based on the start or end of the tax period for a GST return in which the debit error is corrected, taxpayers who lodged late would effectively gain further time in which to correct their debit errors.

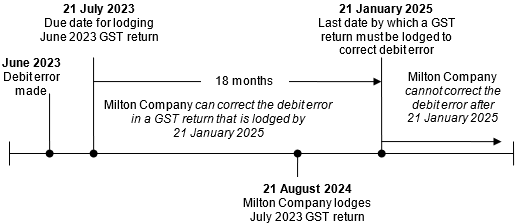

Example 6

While preparing its July 2024 GST return, Milton Company (a monthly lodger with current GST turnover below $20 million) discovers a debit error of $15,450 in its GST return lodged for the June 2023 tax period.

The debit error can only be corrected in a GST return that is lodged within 18 months of the due date for lodging the GST return for the tax period in which the debit error was made. The due date for lodging the GST return in which the debit error was made was 21 July 2023. Eighteen months from that date is 21 January 2025.

If Milton Company lodges its July 2024 GST return on 21 August 2024, assuming the debit error meets the other requirements in sections 6 and 7, Milton Company can correct the $15,450 debit error in that GST return. This is because the lodgment date of 21 August 2024 is within 18 months from the due date of the GST return for the June 2023 tax period (that is, 21 July 2023), and the debit error is within the debit error value limit.

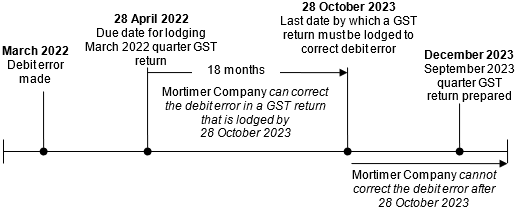

Example 7

Mortimer Company has a current GST turnover of less than $20 million and lodges its GST returns quarterly. While preparing its GST return for the September 2023 tax period in December 2023, Mortimer Company discovers a debit error made in its GST return for the March 2022 tax period. The September 2023 GST return is being lodged late as it should have been lodged by 28 October 2023.

The debit error can only be corrected in a GST return that is lodged within 18 months of the due date for lodging the GST return for the tax period in which the debit error was made. The due date for lodging the GST return in which the debit error was made was 28 April 2022. Eighteen months from that date is 28 October 2023 and therefore any correction must be made on a return lodged prior to this date.

As it is already December 2023, it is too late for Mortimer Company to correct the debit error in their September 2023 (or later) GST return. They will need to seek an amendment to their assessment for the March 2022 tax period to correct the debit error.

Debit error value limit

41. A debit error can only be corrected to the extent that the 'net sum of the debit errors' is within the 'debit error value limit' that corresponds with your current GST turnover in the table.

42. The net sum of the debit errors is defined as the sum of any debit errors, less the sum of any credit errors, which you include in the net amount for the tax period in which you seek to correct the relevant debit error. This formula allows you to offset credit errors against your debit errors in working out whether you fall within the relevant debit error value limit.

43. Where the amount determined after applying the formula is less than the relevant debit error value limit (including where it results in a negative value, which would occur where the sum of the credit errors exceeds the sum of the debit errors), you can correct the debit error by applying this instrument.

44. Where the net sum of the debit errors exceeds the debit error value limit, you will only be able to correct the debit error or errors up to the relevant debit error value limit. Where there is an amount over the relevant debit error value limit, this debit error amount may only be corrected by requesting the Commissioner to amend the assessment for the earlier tax period in which the debit error was made.

45. While there are no restrictions on your ability to correct credit errors, other than those prescribed in paragraph 6(a) to 6(g), these errors can be taken into account in working out your debit error value limit. However, in working out the net sum of the debit error s, you can only take into account any credit errors which you include in the net amount for the tax period in which you are correcting the relevant debit error.

46. While paragraph 7(c) tests whether the net sum of the debit errors exceeds the relevant debit error value limit, it ultimately determines the extent to which the individual debit error made in the earlier tax period can be corrected in the later tax period. That is, once you work out the net sum of the debit errors and whether it is within the relevant debit error value limit, you can determine the extent to which the individual debit error can be corrected under paragraph 7(c).

Example 8

Kipling Company has a current GST turnover of $5 million and lodges its GST returns quarterly. As part of its year-end review for the 2024 income year (conducted at the end of August 2024), it identifies 2 debit errors made in the previous year:

- (a)

- an error of $15,000 that occurred in the September 2023 tax period, and

- (b)

- a second error of $8,000 that also occurred in the September 2023 tax period.

The requirements of paragraph 7(a) and (b) are satisfied. However, as the net sum of the debit errors ($15,000 + $8,000 = $23,000) exceeds the relevant debit error value limit of $20,000, Kipling Company can only correct the debit errors up to $20,000 in the current tax period. Kipling Company decides to correct the first error of $15,000 and $5,000 (out of the $8,000) of the second error.

The balance of $3,000 of the second error must then be corrected in the earlier tax period in which the error was made. That is, Kipling Company must request the Commissioner to amend its assessment for the September 2023 tax period to increase its assessed net amount by $3,000.

Alternatively, Kipling Company may choose not to apply this instrument (and therefore not attempt to correct any part of the errors in its current tax period) but instead request the Commissioner to amend its assessment for the September 2023 tax period to increase its assessed net amount by $23,000.

Example 9

Tennyson Company lodges quarterly GST returns and has a current GST turnover of $10 million. On 11 October 2024, while preparing its GST return for the September 2024 quarter, Tennyson Company discovers the following errors:

Table 2: Tennyson Company's debit and credit errors December 2021 Double counted wine tax $10,000 CR September 2023 Over claimed wine tax credits $13,000 DR December 2023 Clerical error, transcribing error $5,000 CR March 2024 Over claimed wine tax credits $6,000 DR

The credit errors meet the requirements of section 6 and the debit errors meet the additional requirements of section 7. Tennyson Company can correct the credit errors by taking them into account in the GST return for the September 2024 quarter.

The net sum of the debit errors is $4,000 (that is, ($13,000 + $6.000) - ($10,000 + $5,000)). As the net sum of the debit errors is below the relevant debit error value limit ($20,000), Tennyson Company can also correct both the debit errors by taking them into account in the September 2024 GST return (that is, the over claimed wine tax credits of $19,000).

Example 10

While preparing its monthly GST return for the August 2024 tax period, Beckett Company, which has a current GST turnover above $1 billion, discovers 2 errors made in working out its net amount for earlier tax periods. One is a credit error for $1.5 million and the other a debit error for $1 million.

Both errors meet the conditions in section 6 and, in the case of the debit error, the additional conditions in section 7.

Beckett Company includes the credit error in its GST return for the August 2024 tax period. As the net sum of the debit errors is minus $500,000 ($1 million debit errors less $1.5 million credit errors), it is within the debit error value limit of $894,000 which applies to companies with a GST turnover of $1 billion, like Beckett Company. Accordingly, Beckett Company can also correct the debit error of $1 million in its GST return for the August 2024 tax period.

Example 11

Du Maurier Company is registered for GST and has a current GST turnover of less than $20 million. While preparing its GST return for the June 2024 quarterly tax period (being lodged on time), it discovers 2 errors (a debit error and a credit error) made in working out its net amount for earlier tax periods.

The first error is a $15,000 debit error made in working out the net amount for the March 2023 tax period. The debit error relates to under reporting wine tax payable on a supply of wine, based on incorrect advice Du Maurier Company received at the time that the supply was a non-assessable dealing. Du Maurier Company lodged its March 2023 GST return on 28 April 2023.

The second error is a $7,000 credit error. Du Maurier incorrectly calculated the value of an assessable dealing for the June 2022 tax period. As a result of the errors, they overpaid wine tax by $7,000 for the tax period. The $7,000 was not passed on to the purchaser. Du Maurier Company lodged its June 2022 GST return on 28 July 2022.

Du Maurier Company is not subject to any compliance activity at the time of preparing its GST return for the June 2024 tax period and has not taken the errors into account (in whole or part) in working out its net amount for another tax period.

Du Maurier Company works out whether it can apply the instrument to correct the errors as follows:

Table 3: Du Maurier Company's error calculation matrix Relevant instrument paragraphs summary $7,000 credit error

June 2022 quarterly tax period$15,000 debit error

March 2023 quarterly tax periodError relates to an amount of wine tax or wine tax credit under the WET Act [Paragraph 6(a)]? Yes. Yes. Tax period starts on or after 1 July 2012 and you lodge the correction within the period of review for the assessment of the net amount for the earlier tax period [Paragraph 6(b), 6(c)]? Yes. June 2024 quarterly tax period starts within period of review for June 2022 tax period [28 July 2022 to 29 July 2026].

Yes. June 2024 quarterly tax period starts within period of review for March 2023 tax period [28 April 2023 to 29 April 2027].

At time of lodging GST return for the tax period, the error:

- •

- does not relate to a matter that is specified as being subject to compliance activity, and

- •

- is not made in working out the net amount for an earlier tax period that is subject to compliance activity [Paragraph 6(d)]?

Yes. Yes. Error not taken into account in working out net amount for another tax period [Paragraph 6(e)]? Yes. Yes. Not recklessness or intentional disregard [Paragraph 7(a)]? N/A – credit error. Yes. Errors corrected within applicable debit time limit – corrected in a GST return lodged within 18 months of the due date for lodging the GST return in which the error was made [Paragraph 7(b)]? N/A – credit error. Yes. Lodgment date for June 2024 GST return is within 18 months of the due date for lodgment of the March 2023 GST return (that is within 18 months of 28 April 2023).

Net sum of the debit errors within the applicable debit error value limit [Paragraph 7(c)]? N/A – credit error. Yes. Net sum of the debit errors is $8,000 ($15,000 less $7,000), which is below the applicable debit error value limit of $20,000.

Du Maurier Company can correct both errors in its GST return for the June 2024 quarterly tax period.

47. The debit error value limit applies to the entity that is required to give to the Commissioner a GST return and is liable to pay wine tax, or is entitled to a wine tax refund. For example, it applies to the representative member of the GST group (rather than each individual member) and the GST joint venture operator of a GST joint venture.

Record keeping

48. If, in working out your net amount for a tax period, you correct a credit or debit error that was made in an earlier tax period you must keep records in accordance with section 382-5 in Schedule 1 to the TAA. This includes records that explain the correction of the error in accordance with the instrument.

Correcting error by Commissioner amending assessment

49. You do not have to apply this instrument to correct an error made in an earlier tax period, but may instead choose to correct an error by requesting the Commissioner amend the assessment for the tax period in which the error was made. However, under section 8 you cannot correct an error made in an earlier tax period by requesting the Commissioner amend an assessment for any tax period other than the one in which the error was made.

Compliance cost assessment Consultation51. Subsection 17(1) of the Legislation Act 2003 requires that the Commissioner is satisfied that appropriate and reasonably practicable consultation has been undertaken before they make an instrument.

52. As part of the consultation process, you are invited to comment on the draft instrument and its accompanying draft explanatory statement.

Please forward your comments to the contact officer by the due date.

| Due date | 11 June 2025 |

| Contact officer | Sally Fonovic |

| sally.fonovic@ato.gov.au | |

| Phone | (08) 7422 2049 |

Statement of compatibility with human rights

Prepared in accordance with Part 3 of the Human Rights (Parliamentary Scrutiny) Act 2011

A New Tax System (Goods and Services Tax) (Correcting Wine Equalisation Tax Errors) Determination 2025This legislative instrument is compatible with the human rights and freedoms recognised or declared in the international instruments listed in section 3 of the Human Rights (Parliamentary Scrutiny) Act 2011.

Overview of the legislative instrumentUnder this instrument taxpayers may choose to correct credit or debit errors that relate to an amount of wine tax or wine tax credit under the A New Tax System (Wine Equalisation Tax) Act 1999, that was made in an earlier tax period, by including the amount of that error in working out the net amount of a later tax period.

This will reduce compliance costs for taxpayers as they will not need to request the Commissioner to amend their assessment for an earlier tax period to correct certain errors in circumstances covered by the instrument. It will also reduce the likelihood of taxpayers being subjected to any related general interest charge or penalties.

Human rights implicationsThis instrument does not engage any of the applicable rights or freedoms. It merely specifies the circumstances in which a taxpayer may correct debit or credit errors that were made in working out their net amount for an earlier tax period without having to request the Commissioner to amend their assessment for that earlier period.

ConclusionThis instrument is compatible with human rights as it does not raise any human rights issues.

Draft published 14 May 2025

Ben Kelly

Deputy Commissioner of Taxation

Legislative References:

A New Tax System (Goods and Services Tax) Act 1999

The Act

A New Tax System (Wine Equalisation Tax) Act 1999

The Act

Acts Interpretation Act 1901

The Act

Human Rights (Parliamentary Scrutiny) Act 2011

The Act

Legislation Act 2003

The Act

Taxation Administration Act 1953

The Act

LI 2025/D4 - Legislative Instrument