Excise guidelines for the fuel industry

-

This document incorporates revisions made since original publication. View its history and amending notices, if applicable.

11 BLENDING

11.1 PURPOSE

This Chapter deals with:

- •

- what a blended product is

- •

- how it is classified

- •

- the rates of excise that apply, and

- •

- penalties that can apply to offences in relation to blending.

11.2 INTRODUCTION

Fuel is commonly blended with other fuel or other substances to make products suitable for a particular purpose. The excise treatment of blends is quite complex and may vary. The correct excise treatment may depend on what components and proportions are in the blend and whether duty-paid products are used. The provisions relating to blends ensure that the correct amount of revenue is collected and that the fuel tax credit scheme operates appropriately.

11.3 POLICY AND PRACTICE

Although the term 'blend' is not defined in the Excise Act or the Excise Tariff Act, section 77G of the Excise Act specifically provides that fuel blending which produces goods covered by item 10(g) of the Schedule to the Excise Tariff Act (Schedule) constitutes the manufacture of those goods. Given that it is taken to be the manufacture of those goods, it follows that the blends are excisable.

In general, blends of any one or more of the following (with or without other substances) are excisable (unless an exclusion applies):

- •

- gasoline (petrol)

- •

- kerosene

- •

- diesel

- •

- heating oil

- •

- fuel oil (as defined in subsection 3(1) of the Excise Tariff Act)

- •

- biodiesel

- •

- fuel ethanol

- •

- liquid aromatic hydrocarbon products (for example, toluene, benzene or xylene)

- •

- mineral turpentine

- •

- white spirit

- •

- petroleum condensate

- •

- stabilised crude petroleum oil

- •

- topped crude petroleum oil.

Example 11A

Examples of blended fuel:

An importer mixes imported underbond diesel with locally produced underbond diesel. This is regarded as blending covered by section 77G of the Excise Act and is therefore manufacture for excise purposes.

A licensed manufacturer mixes duty-paid benzene with ' underbond ' benzene. This is regarded as blending for excise purposes.

Example 11B

A manufacturer produces white spirit by means of blending various petroleum products.

The product, though a blend of other products that fall within item 10 of the Schedule, is classified as white spirit, subitem 10.27 of the Schedule.

Exempt blending occurs where the blending process results in a product that would be classifiable to paragraph 10(g) of the Schedule but the Excise Act or related legislative instrument specify that this is not excise manufacture.

In some cases, the exemption relates to the blend and the constituents of the blend while in other cases, the exemption arises due to the circumstances in which the blending occurs.

The following series of questions sets out the process for deciding whether production of a particular blend is excise manufacture.

- 1.

- Does the blend fall under section 77G of the Excise Act?

The answer will be yes if:

- •

- the blend components are classifiable to Items 10, 15, 20 or 21 of the Schedule, and

- •

- the blend is covered by paragraph 10(g) of the Schedule.

The blend is excise manufacture.

- 2.

- Are the circumstances covered by a legislative instrument made under subsection 77H(4)?

The answer will be yes if the product meets any of the tests described in paragraphs 6(a) to (f) in the Excise (Blending Exemptions) Instrument 2024 detailed below.

The blend is not excise manufacture.

- 3.

- Is the blend a blend of the same kind of 'relevant fuel' (that is not subject to remission), and excise or customs duty has been paid on each component that is blended? [310]

If the answer is yes, the blended product is not covered by paragraph 10(g) of the Schedule.

The blend is not excise manufacture.

- 4.

- Is the blend a blend of LPG or a blend of LNG and for each amount in the blend either:

- •

- a remission of excise or customs duty applied, or

- •

- each amount in the blend was manufactured, produced or imported before 1 December 2011? [311]

If the answer is yes to either situation, the blended product is not covered by paragraph 10(g) of the Schedule.

The blend is not excise manufacture.

- 5.

- Is the blend either:

- •

- a blend of components that have all been duty-paid, and apart from any denatured ethanol for use as fuel in an internal combustion engine, or biodiesel, the rate of each of those duties is the same, or

- •

- covered by a determination under subsection 95-5(1) of the Fuel Tax Act 2006 that the blend does not constitute a fuel? [312]

If the answer is yes, the blended product is not covered by item 10(g) of the Schedule. However, the exemption does not apply if any of the duty-paid components of the blend are taxable fuel for which any entity has been entitled to a fuel tax credit under the Fuel Tax Act 2006. [313]

The following is a summary of the legislative provisions that result in these blends not being excisable and the source of the exemption.

Subsections 77H(3) and (4) of the Excise Act

Excise (Blending Exemptions) Instrument 2024 was created under subsections 77H(3) and (4) of the Excise Act. Blends covered by this Determination are generally of an incidental or trivial nature:

- •

- oil and gasoline are blended for use as two stroke gasoline where duty has been paid on both constituents

- •

- an incidental blend occurs where the constituents are placed in a tank containing remnants of those fuels listed above or another substance

- •

- diesel or biodiesel on which duty has been paid is blended with stabilised crude petroleum oil

- •

- fuel on which duty has been paid is blended with a dye

- •

- fuel on which duty has been paid is blended with prepared additives that enhance the performance of an internal combustion engine or assist in its maintenance (the prepared additives cannot be methanol or other fuel) and if the resultant blend is packaged into packages of more than 10 litres capacity, the total amount of all prepared additives in the blend does not exceed 0.5% volume per volume

- •

- goods that are the product of the blending of amounts of LPG without other substances and all the following apply

- –

- any applicable excise duty or an excise equivalent duty of Customs that is payable on each quantity of the LPG has been paid, and

- –

- the blending occurs

- o

- in a container that is capable of containing not more than 210 kilograms of LPG

- o

- in a tank at residential premises and the resultant blend is not for use in carrying on an enterprise, or

- o

- in a tank that is for use in a system for supplying LPG to at least 2 residential premises (whether or not the system also supplies fuel to premises other than residential premises)

- –

- the tank in which the blending occurs is not for use in a system for supplying fuel to an internal combustion engine of either a motor vehicle or a vessel, either directly or by filling another tank connected to such an engine.

Subsection 77H(1) of the Excise Act

Subsection 77H(1) of the Excise Act provides that excise manufacture has not occurred where the constituents of the blend have all had duty (customs or excise) paid, and except for denatured ethanol and biodiesel, the rate of duty was the same rate. The same exemption also applies where goods are covered by a determination in force under section 95-5 of the Fuel Tax Act 2006 .

In determining whether duty has been paid at the same rate on all of the components of the blend, disregard any changes of the rates due to indexation. [314]

Example 11C

A fuel retailer mixes duty-paid diesel with duty-paid kerosene to make winter mix, for use in diesel engines in cold climatic conditions. No one has been entitled to claim a fuel tax credit on the diesel or on the heating oil.

The blend is not excisable, as both components have been duty-paid at the same rate.

Fuel Tax (Fuel Blends) Determination 2016 (No. 1) has been created under section 95-5 of the Fuel Tax Act 2006 . This determination is largely directed at the solvents industry where various formulations could be used in internal combustion engines but are not marketed as such.

Blends covered by this determination are blends that are not marketed or sold as fuel for an internal combustion engine. The blend must consist of a taxable fuel classified to subitem 10, 21, 10.25, 10.26, 10.27 or 10.28 of the Schedule, and either the blend contains:

- •

- one of the substance in the minimum concentration listed below, or

- •

- more than one of the substances listed below so that the total concentration of these substances is at least 10% by volume.

| Product | Minimum concentration for percentage volume per volume |

|---|---|

| Tertiary butyl alcohol | 0.5 |

| Other alcohols (other than methanol, ethanol and isopropyl alcohol) | 10.0 |

| Ketones | 10.0 |

| Methyl tertiary butyl ether | 1.0 |

| Di-isopropyl ether | 1.0 |

| Other ethers | 10.0 |

| Esters | 10.0 |

| Surfactants | 1.0 |

| Silicone oils | 2.0 |

| Oleic acid | 2.0 |

| Water | 5.0 |

Example 11D

An entity makes a range of solvent formulations which it does not market as being for use as fuel in an internal combustion engine.

Blend 1: 90% toluene with 10% methyl ethyl ketone

This does not constitute a fuel for fuel tax credit purposes since the minimum concentration for ketones is 10%. Therefore, this product is covered by the Fuel Tax (Fuel Blends) Determination 2016 (No. 1) and the blend is not excisable.

Blend 2: 90% toluene with 8% methyl ethyl ketone and 2% butanol

This does not constitute a fuel for fuel tax credit purposes since the total of ketones and other alcohols is greater than 10%. Therefore, this product is covered by the Fuel Tax (Fuel Blends) Determination 2016 (No. 1) and the blend is not excisable.

Blend 3: 90% toluene with 4% methyl ethyl ketone, 4% butanol and 2% benzene

This constitutes a fuel for fuel tax credit purposes since the total of ketones and other alcohols is less than 10%. Therefore, this product is not covered by the Fuel Tax (Fuel Blends) Determination 2016 (No. 1) and the blend is excisable.

Subsection 77H(2) of the Excise Act

This subsection provides an exception to the exemptions provided for in subsection 77H(1) of the Excise Act where any of the constituents of the blend is a taxable fuel for which an entity has been entitled to claim a fuel tax credit (for example, kerosene that has been packaged in 20 litre containers).

Section 77H(2A) of the Excise Act

Subsection 77H(2A) applies to the blending of the following fuels [315] :

- •

- gasoline for use in aircraft

- •

- kerosene for use in aircraft

- •

- LPG

- •

- LNG

- •

- CNG that is classified to subitem 10.19C of the Schedule.

The blending of these fuels is not excise manufacture if the blended fuels:

- •

- are not subject to a remission of excise or customs duty, either in full or in part, and

- •

- any excise or customs duty payable on the fuels has been paid.

Example 11E

A quantity of LPG was duty-paid on 3 March 2025 at a rate of $0.1660 per litre (with no remission available because it was intended for use in transport), and it is added to a tank containing a quantity of LPG that was duty-paid prior to 3 February 2025 at a rate of $0.1650 (also with no remission available because it was intended for a transport use).

The blending does not constitute manufacture.

Subsection 77H(2B) of the Excise Act

Subsection 77H(2B) applies to the blending of LPG or LNG where the fuel has been eligible for an excise or customs remission, regardless of the level of remission.

The blending of LPG or LNG is not excise manufacture if the fuel is:

- •

- subject to a remission, either in full or in part, of excise or customs duty because it is not used, or intended for use, in an internal combustion engine in either a motor vehicle or a vessel, or

- •

- not subject to excise or customs duty because it was manufactured, produced or imported before 1 December 2011.

Example 11F

Evan's BBQ Bonanza Gas receives a delivery of 10,000 litres of LPG on 15 March 2025 that their supplier has applied a remission to as he knows that Evan's BBQ Bonanza only supplies LPG in 9 kilogram barbeque bottles. The LPG is delivered into the bulk tank of Evan's BBQ Bonanza that already contains 4,000 litres of LPG delivered on 20 January 2022 that was the subject of the full remission. The blending of these 2 quantities of LPG does not constitute excise manufacture and therefore the blend is not subject to duty.

We acknowledge that long-standing practice in the fuel industry in relation to imported fuels has been to mix imported fuel with local fuel and then deal with the resulting fuel through the excise system. We accept that mixing of imported fuel with local fuel, in premises covered by an excise manufacturer licence and a Customs warehouse licence, is blending covered by section 77G of the Excise Act and is therefore manufacture.

This position is supported by section 24 of the Excise Act. Section 24 provides:

- (1)

- Excisable goods may, while subject to the CEO's control, be used in the manufacture of other excisable goods in accordance with this Act.

- (2)

- Goods liable to duties of Customs may, while subject to customs control under the Customs Act 1901 , be used in the manufacture of excisable goods in accordance with this Act.

- (3)

- The regulations may prescribe conditions on the use of:

- (a)

- excisable goods, while subject to the CEO's control, in the manufacture of other excisable goods; or

- (b)

- goods liable to duties of Customs, while subject to customs control under the Customs Act 1901 , in the manufacture of excisable goods.

The Customs Act 1901 provides for the extinguishment of customs duty on fuel where certain imported goods (including fuel) are used in the manufacture of ' excisable goods '. [316] The manufacture must occur at premises covered by both an excise manufacturer licence and a Customs warehouse licence.

11.3.4 CALCULATING THE DUTY PAYABLE ON EXCISABLE BLENDED PRODUCTS

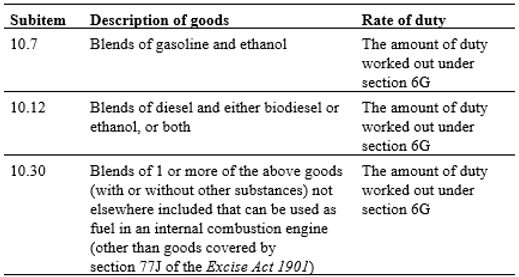

In the Schedule, there are 3 specific biofuel blends with separate subitems and a general subitem for other blends.

If you are blending fuels of the same type (for example, petrol with petrol) or where a blend has the characteristics accepted in the industry for a particular product mentioned in the Schedule (for example, see Example 11B above) it is classified to the specific subitem and not as a blend.

Figure 22: Description and rate of duty applicable to blends

Section 6G of the Excise Tariff Act sets out the method statement for working out the duty payable on blends as follows:

Step 1:

Add up the amount of duty that would be payable on each constituent of the blend that is classified to item 10 of the Schedule.

Step 2:

Work out the volume, in litres, of any other constituent of the blend (excluding any water) that was added to the blended goods. [317]

Step 3:

Multiply the result of Step 2 by the 'CPI Indexed rate' that applies on the day the goods are delivered into home consumption or when payment of duty is made, whichever is the earlier.

Note: the rate set out in this Step is indexed under section 6A of the Excise Tariff Act.

Step 4:

Total the results of Steps 1 and 3.

Step 5:

Subtract from the total any duty paid on a constituent of the blended goods that is classified to item 10 or 15 of the Schedule.

If a constituent of the blended goods was imported, and customs duty was paid or payable on the goods, treat that customs duty as if it were excise duty in working out the duty payable.

If the rate of excise duty on a constituent of the blended goods would be less than the customs duty-paid, use the lesser amount in working out the duty payable.

Example 11G

A manufacturer makes a solvent blend to a customer's specification from 10,000 litres of underbond toluene (classified to subitem 10.25 of the Schedule) and 5,000 litres of a duty-paid product classified to 10.28 of the Schedule. The blend is capable of being used as fuel in an internal combustion engine.

The resulting blend is classified to subitem 10.30 of the Schedule and is delivered into home consumption on 1 March 2025. Duty is payable on the blend as follows:

Step 1:10,000 litres of toluene × $0.508 per litre = $5,080.00

Step 2:5,000 litres of petroleum product

Step 35,000 litres × $0.508 = $2,540.00

Step 4:Total of steps 1 and 3 = $5,080 + $2,540 = $7,620.00

Step 5:Step 4 less duty paid = $7,620 – $2,540Duty payable on the blend (to nearest dollar) = $5,080.00.

11.3.5 ACCOUNTING FOR FUEL USED IN THE MANUFACTURE OF NON-EXCISABLE GOODS

Before underbond excisable fuel products can be blended as part of the manufacture of non-excisable goods (for example, when they are used in the manufacture of paint), they must be 'delivered' into home consumption. If you have a PSP, the underbond product is deemed to be delivered into home consumption at the point the blend is made and would be included in the next ' excise return '. If you do not have a PSP, you need to enter the product on an excise return, pay the duty and receive an Authority to deliver excisable goods before you make the blend.

Example 11H

Lionel's Solvents is licensed to manufacture toluene and has a PSP. On 25 August 2024, Lionel's Solvents uses some underbond toluene to make a blend that cannot be used as fuel in an internal combustion engine.

Lionel's Solvents must include the toluene used in the blend on its next excise return as subitem 10.25 of the Schedule and pay duty at the rate of $0.508 per litre.

The toluene is delivered into home consumption at the time the blend is made.

Example 11I

Barry's Blenders wants to make a blend of 90% toluene and 10% methyl ethyl ketone. They have 9,000 litres of underbond toluene.

The blend is covered by Fuel Tax (Fuel Blends) Determination 2016 (No. 1) and is not excisable.

The act of blending the toluene into the final product that can't be used in an internal combustion engine is the point where the toluene is considered to be delivered into home consumption. Barry's Blenders don't hold a PSP and therefore must include the 9,000 litres of toluene in an excise return and pay the duty, prior to undertaking the blending process. The toluene is entered on the return under subitem 10.25 of the Schedule and duty is payable at the rate in force on the day the payment is made.

The blend itself is not included in an excise return.

You may make blends that are not excisable using duty-paid components even if you do not hold an excise manufacturer licence.

As these blends are not excisable, they are not subject to excise control. Excise duty has been paid on any excisable component before the blend is made.

11.4 PROCEDURES

If you need more information on blending, contact us via:

- •

- phone 1300 137 290

- •

- ATO Online Services , or

- •

- write to us at

- Australian Taxation Office

PO Box 3514

ALBURY NSW 2640

We will ordinarily respond to written information requests within 28 days. If we cannot respond within 28 days, we will contact you within 14 days to obtain more information or negotiate an extended response date.

11.5 PENALTIES THAT CAN APPLY IN RELATION TO BLENDING

The following are the penalties that may apply after conviction for an offence.

Manufacture

If you manufacture excisable fuel products without a manufacturer licence, the penalty is a maximum of 2 years in prison or the greater of 500 ' penalty units ' and 5 times the amount of duty on the excisable fuel products. [318]

If you manufacture excisable fuel products contrary to the Excise Act or any conditions specified in your licence, the penalty is a maximum of 2 years in prison or 500 penalty units. [319]

If you manufacture excisable fuel products at premises that are not specified in your licence, the penalty is a maximum of 2 years in prison or the greater of 500 penalty units and 5 times the amount of duty on the excisable fuel products. [320]

Move, alter or interfere

If you move underbond excisable fuel products without approval, the penalty is a maximum of 2 years in prison or the greater of 500 penalty units and 5 times the amount of duty on the excisable fuel products. [321]

Note: this includes moving underbond excisable fuel products from your premises to any other location or for export.

If your movement of underbond excisable fuel products does not comply with the permission to move the underbond excisable fuel products, the penalty is a maximum of 2 years in prison or the greater of 500 penalty units and 5 times the amount of duty on the excisable fuel products. [322]

If you move, alter or interfere with excisable fuel products that are subject to excise control, without permission, the penalty is a maximum of 2 years in prison or the greater of 500 penalty units and 5 times the amount of duty on the excisable fuel products. [323]

Deliver

If you deliver excisable fuel products into home consumption contrary to your permission, the penalty is a maximum of 2 years in prison or the greater of 500 penalty units and 5 times the amount of duty on the excisable fuel products. [324]

Sell

If you sell excisable fuel products on which duty has not been paid (unless it is an underbond sale or a sale for export), the penalty is a maximum of 2 years in prison or the greater of 500 penalty units and 5 times the amount of duty on the excisable fuel products. [325]

Records

If you do not keep, retain and produce records in accordance with a ' direction under section 50 ' of the Excise Act, the penalty is a maximum of 30 penalty units.

Directions

If you do not comply with a direction in regard to what parts of the factory can be used for various matters, the penalty is a maximum of 10 penalty units. [326]

False or misleading statements

If you make a false or misleading statement or an omission from a statement in respect of duty payable on particular goods, to us, the penalty is a maximum of 50 penalty units and twice the amount of duty payable on those goods. [327]

Evade

If you evade payment of any duty which is payable, the maximum penalty is 5 times the amount of duty on the excisable fuel products, or where a court cannot determine the amount of that duty the penalty is a maximum of 500 penalty units. [328]

Facilities etc.

If you do not provide all reasonable facilities for enabling us to exercise our powers under the Excise Act, the penalty is a maximum of 10 penalty units. [329]

If you do not provide sufficient lights, correct weights and scales, and all labour necessary for weighing material received into and all excisable fuel products manufactured in your factory, and for taking stock of all material and excisable fuel products contained in your factory, the maximum penalty is 10 penalty units. [330]

If we mark or seal excisable fuel products or fasten, lock or seal any plant in your factory and you alter, open, break or erase the mark, seal, fastening or lock, the maximum penalty is 50 penalty units. [331]

11.6 TERMS USED

Excisable goods are goods on which excise duty is imposed. Excise duty is imposed on goods that are manufactured or produced in Australia and listed in the Schedule.

As this Guide deals with fuel products, we have used the term excisable fuel products.

Excisable fuel products include:

- •

- petrol

- •

- diesel

- •

- renewable diesel

- •

- crude petroleum oil

- •

- condensate

- •

- heating oil

- •

- kerosene

- •

- fuel ethanol

- •

- biodiesel

- •

- compressed natural gas (CNG)

- •

- liquefied natural gas (LNG)

- •

- liquefied petroleum gas ((LPG).

Goods are subject to excise control from the point of manufacture until they have been delivered into home consumption or for export.

Goods subject to excise control cannot be moved, altered or interfered with except as authorised by the Excise Act.

An excise return [332] is the document that you use to advise us the volume of excisable fuel products that you:

- •

- have delivered into home consumption during the period designated on your PSP, or

- •

- wish to deliver into home consumption following approval.

'Home consumption' [333] is the term used in the Excise Act and this Guide to describe when excisable fuel products are released into the Australian domestic market for consumption. The term used in the legislation is 'deliver for home consumption'.

Normally, this will be by delivering the goods away from premises covered by a licence but includes using those goods within those premises (for example, using fuel to run equipment in premises covered by your licence). It does not include goods delivered for export or the movement of goods underbond (see definition below) to another site covered by a licence.

The term 'home consumption' is not defined in the Excise Act and there is no definitive case law that looks at the issue in question. However there are several cases where issues closely related to it are considered. [334]

The conclusion drawn from those cases is that 'home consumption' refers to the destination of goods as being within Australia as opposed to exporting them.

The value of a penalty unit is contained in section 4AA of the Crimes Act 1914 , and is indexed regularly. The dollar amount of a penalty unit is available at Penalties .

This is a written instruction issued under section 50 of the Excise Act to a licensed manufacturer, or proprietor of premises covered by a storage licence, to keep specified records, furnish specified returns, retain records for a specified period and produce those records on demand by us.

This is an expression not found in excise legislation but it is widely used to describe goods that are subject to excise control. Excisable goods that are subject to excise control are commonly referred to as 'underbond goods' or as being 'underbond'. This includes goods that have not yet been delivered into home consumption and goods moving between premises under a movement permission.

11.7 LEGISLATION (quick reference guide)

In this Chapter, we have referred to the following legislation:

- •

- Excise Act 1901

- –

- section 24 – excisable goods and goods liable to duties of Customs may be used in manufacturing excisable goods

- –

- section 25 – only licensed manufacturers to manufacture excisable goods

- –

- section 26 – licensed manufacturers to manufacture in accordance with Act and licence

- –

- section 27 – licensed manufacturers to manufacture only at premises covered by a licence

- –

- section 49 – facilities to officers

- –

- section 50 – record keeping

- –

- section 51 – collector may give directions

- –

- section 52 – weights and scales

- –

- section 58 – entry for home consumption etc.

- –

- section 61 – control of excisable goods

- –

- section 61A – permission to remove goods that are subject to CEO's control

- –

- section 61C – permission to deliver certain goods for home consumption without entry

- –

- section 77G – fuel blending is to be treated as manufacture

- –

- section 77H – blending exemptions

- –

- section 77HB – liquefied petroleum gas and liquefied natural gas that is exempt from excise duty

- –

- section 77J – goods that are not covered by subitem 10.25, 10.26, 10.27, 10.28 or 10.30

- –

- section 92 – seals etc. not to be broken

- –

- section 117A – unlawfully moving excisable goods

- –

- section 117B – unlawfully selling excisable goods

- –

- section 120 – offences

- •

- Excise Tariff Act 1921

- –

- section 6G – duty payable on blended goods

- –

- The Schedule

- •

- Customs Act 1901

- –

- Part VAA – special provisions relating to excise-equivalent goods

- •

- Fuel Tax Act 2006

- –

- section 95-5 – determination of blends that no longer constitute fuels

- •

- Crimes Act 1914

- –

- section 4AA – penalty units

Amendment history

| Part | Comment |

|---|---|

| Throughout | This chapter was updated to take into account the law changes as a result of the Excise and Customs Legislation Amendment (Streamlining Administration) Act 2024 . |

| Throughout | Updated in line with current ATO style and accessibility requirements. |

Copyright notice

© Australian Taxation Office for the Commonwealth of Australia

You are free to copy, adapt, modify, transmit and distribute this material as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).

References

| Date: | Version: | |

| 1 July 2006 | Updated document | |

| 1 April 2015 | Updated document | |

| 12 July 2017 | Updated document | |

| 11 December 2017 | Updated document | |

| 4 June 2021 | Updated document | |

| 1 July 2024 | Updated document | |

| You are here | 27 June 2025 | Current document |