Legal professional privilege protocol

September 2021

| This Protocol contains the ATO's recommended approach for identifying communications covered by LPP and making LPP claims to the ATO.

We are now commencing public consultation on the draft Protocol. At this stage, the due date for written feedback is by 31 October 2021. We note that separate workshops will be held with a number of key stakeholders. |

| About this Protocol | 4 |

| Why do we have this Protocol? | 4 |

| What to expect from us? | 4 |

| The recommended approach | 5 |

| Step 1: Assess your engagement and each communication | 6 |

| Step 2: Explain your claim | 10 |

| Step 3: Advise us of your approach | 13 |

| Addendum 1 - Context and background | 14 |

| The setting in which LPP claims are usually made | 14 |

| The role we each play | 14 |

| Considerations for legal practitioners | 15 |

| Our concerns | 16 |

| Addendum 2 | 17 |

| High quality LPP claims do not mean LPP will be waived | 17 |

| Disputes about LPP claims | 17 |

| Addendum 3 | 18 |

| Your comments | 18 |

About this Protocol

1. This Protocol has been developed to assist you and your advisors when making legal professional privilege[1] (LPP) claims in response to requests for information we make under our formal information gathering powers. It does this by explaining our recommended approach for claiming LPP and providing you with information on what you can expect from us in different situations where you claim LPP. It is voluntary to follow the recommended approach.

2. We first set out what the approach is and Addendum 1 and 2 contain further information to explain why we recommend this approach and how we may challenge any LPP claims if we decide to do so.

3. While drawing on the principles of LPP in Australia, this Protocol does not, and is not intended to, provide an analysis of the law of LPP.

4. We will review and monitor this Protocol over the next three years to understand how it is used, its effectiveness on the quality of LPP claims, and the impact on taxpayers and the ATO. Any material revisions to this Protocol will be made at the end of the review period or on an 'as necessary' basis and will be informed by the outcomes of the review and any feedback. One area we will be further exploring is the use of computer-assisted technology in LPP claims. We will be seeking to understand how the actual use of, and outcomes from the testing of claims against, computer-assisted claims will assist the ATO in determining whether or not to challenge a claim.

5. Where a claim of LPP is made, we need to decide whether to accept or challenge that claim. To make an informed decision, we need information about the communication and the basis on which LPP is claimed. Sometimes not enough information is given to us to make this decision and at other times there is a team of people with different roles involved in the communication and it is not clear to us why a particular communication is privileged.

6. Where you follow the Protocol, we will usually have all of the information we need to be able to make a decision on what to do next. In many cases it is likely that we will accept your claim without any further enquiries.

7. However, following the Protocol does not mean we will never have concerns about your claims or challenge your claims. In these types of cases, it does mean that we will be able to more readily identify what concerns we do have and ask specific questions about those concerns. For example, we may be concerned that:

- a.

- the requisite lawyer/client relationship is not established, or

- b.

- the areas of concern referred to in Addendum 1 of this Protocol are present.

8. If you do not follow the recommended approach, there is no presumption that your claims are invalid. However, you should expect we are likely to ask you for further information in order to determine whether we can accept the claims you have made.

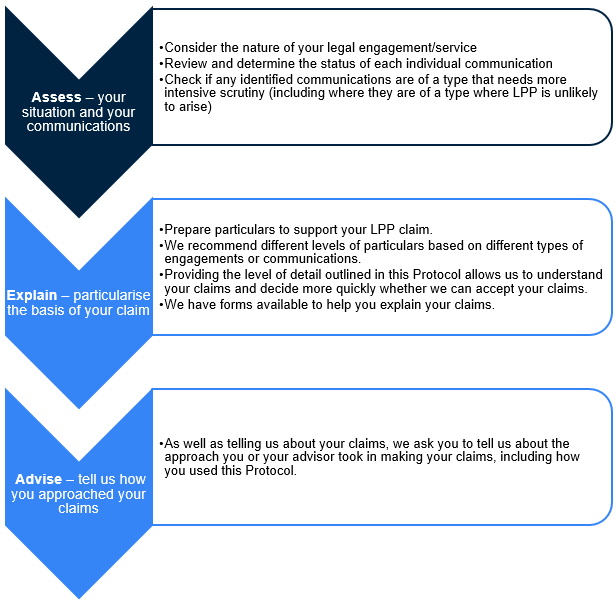

The recommended approach

9. Our recommended approach contains three steps. The recommended three-step approach is summarised below:

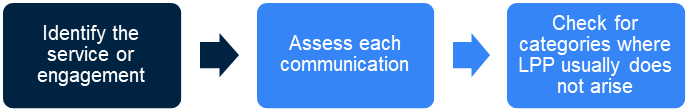

Step 1: Assess your engagement and each communication

Step 1.1 - Identify the service or engagement giving rise to the communication

10. Taxpayers can obtain advice from a variety of advisors. Identifying who is involved in creating the communications being assessed for privilege assists you to:

- a.

- consider whether the tests of LPP at law can be satisfied by that engagement, and

- b.

- identify the steps we recommend that you take in assessing whether LPP applies and explaining that assessment to us.

11. Our recommended steps for each type of service or engagement is summarised below:

| Type of service/engagement | To assess if LPP arises | To particularise your claim |

| Service or engagement involving only legal practitioners acting in their capacity as legal practitioners | Undertake the minimum steps outlined in step 1.2. | Provide the standard particulars in step 2. |

| In-house counsel | Undertake the minimum steps outlined in step 1.2. | Provide the standard particulars and in-house counsel particulars in step 2. |

|

Service or engagement that had involvement by non-legal persons or by legal practitioners not acting in the capacity of legal practitioners.

Service or engagement where third party advice was obtained other than from a legal practitioner. |

Undertake the minimum and additional steps outlined in step 1.2. | Provide the standard particulars and additional particulars in step 2. |

Step 1.2 - Assess each communication

12. Once you have identified the service or engagement (above), assess each communication as follows:

Minimum steps to assess LPP

13. Review each specific communication separately, guided by established legal principles. This means considering each communication on its merits, with a separate review undertaken for:

- a.

- each email within a chain of emails;

- b.

- the attachments to the emails;

- c.

- a forwarded copy of an email and its attachment.

14. When assessing copies of the same document, assess each copy separately.

| It may be that an original document is privileged, and copies made of that document are not. Equally, a copy of a document may be privileged even if the original document is not privileged. It is important to consider the purpose of each communication separately. |

15. Consider whether LPP has been waived by actions that are inconsistent with the maintenance of an immunity founded on maintenance of confidences, for example by communication with other parties.

|

Approaches that are not recommended

The following approaches are not consistent with our recommended approach and are likely to attract our attention:

|

Additional steps for specific engagements

16. For those services or engagements identified in step 1.1 as needing additional assessment:

- a.

- evaluate the overarching service/engagement or relationship to see if it:

- I.

- is capable of establishing the requisite lawyer/client relationship; and

- II.

- gives rise to any of the concerns referred to in Addendum 1;

- b.

- identify and review the role or function being performed by each non-legal persons involved in the communication;

- c.

- assess the purpose of any communication which was initiated or developed by non-legal persons and how it relates to the purpose of providing legal advice or use in anticipated legal proceedings; and

- d.

- determine the capacity in which the communication was made, giving due consideration to the terms of engagement. You will need to particularise the roles of the people involved in the communication, including, the capacity in which the advice was given.

Step 1.3 - Check for communications which are usually not privileged

17. As a final check on your LPP assessment, we recommend that you review the documents to identify if you are intending to claim LPP over communications which are usually not privileged. We have identified key categories below, and these are labelled Step 1.3 items (a) to (u), in paragraph 25.

18. These categories of documents are usually not privileged unless they are copies provided to a lawyer for the dominant purpose of receiving legal advice or use in litigation: d, e, g, i, j, k, o, p, s, t, u.

19. If you have identified any such documents as being potentially eligible for a claim, check to ensure that is appropriate and you have appropriately described the document.

20. These categories of documents are usually not privileged except to the extent they disclose the actual advice provided: h, q, r. In addition, legal engagement letters except to the extent they disclose the actual advice provided are also usually not privileged.

21. If you have made a claim over any such documents, check to ensure that this is because they do contain privileged content.

22. These particular categories require specific scrutiny: (i) Documents brought into existence for more than one purpose. You should only make a claim where you can provide that the dominant purpose satisfies the LPP tests at law. (ii) Communications made to and from a lawyer who had multiple roles. You should only make a claim where the person was acting in their capacity as a lawyer.

23. Carefully review the context of the engagement to ensure that you have not made claims over communications from the following types of arrangements or situations: b, f, l, m, n.

24. If you have made claims over such communications, or surrounding context suggest that LPP has been claimed inappropriately, we may ask you to provide more explanation about that claim.

25. Step 1.3 items (a) to (u)

- a.

- Documents brought into existence for more than one purpose and the claimant is unable to prove that the dominant purpose of the communication was the giving or receiving of legal advice or for use in litigation taking place or reasonably anticipated.

- b.

- Communications made before the client contemplated obtaining legal advice on the matter.

- c.

- Communications made to and from a lawyer, whether internal or external who had multiple roles and who was not acting in the lawyer capacity, e.g., executive, management or policy decisions.

- d.

- Internal reports and memoranda, such as board minutes and presentations that do not convey or record privileged communications and advices. We accept that legal advice can, and at times should, be conveyed to a board and might be reflected in internal reports and memoranda (and redactions should be made for that legal advice rather than claiming privilege over the entirety of the document).

- e.

- File notes and minutes of meetings with third parties in a non-confidential setting;

- f.

- Documents lodged with or provided to a lawyer simply for the purpose of obtaining immunity from production.

- g.

- Non privileged documents lodged with or provided to a bank or other third party for safe keeping.

- h.

- A lawyer's bill of costs except to the extent that the contents of the bill of costs discloses the content of the advice sought by the client and/or provided by the lawyer.

- i.

- Original documents which constitute or evidence transactions, e.g., contracts, conveyances, declarations of trust, offers or receipts, partnership agreements even if they are delivered to a solicitor or counsel for advice or used in litigation.

- j.

- Accounting, financial or banking records, invoices, company minutes, etc.

- k.

- Documents which would otherwise satisfy the requirements of privilege, but which were not intended to be confidential when made.

- l.

- Documents or communications made for or involving the participation in a fraud or an illegal or otherwise improper purpose.

- m.

- Documents or communications designed to obscure or hinder the Commissioner's understanding of a transaction.

- n.

- Communication made or the contents of a document prepared by a client or lawyer (or both) in furtherance of the commission of an act that renders a person liable to a civil penalty (for example, entering into or carrying out a scheme in circumstances in which a penalty arises under Subdivision 284-C of Schedule 1 of the Taxation Administration Act 1953).

- o.

- Lists of clients or associates.

- p.

- Lawyers' trust account records and client lists.

- q.

- Time sheets except to the extent that disclosure of the contents of the time entries would disclose the content of the advice sought by the client and/or provided by the lawyer.

- r.

- Performance appraisals except to the extent that disclosure of the contents of the appraisal would disclose the content of advice sought by the client and/or provided by the lawyer.

- s.

- A solicitor's trust account records.

- t.

- A written communication directing a solicitor to send money to a third party.

- u.

- Data demonstrating when communications were sent or received (for example, fax books recording faxes sent), to the extent that they do not disclose the actual advice.

26. You should explain (particularise) your LPP claims on or before the due date specified in the formal notice seeking information and/or documents.

27. Our Form for Claiming LPP will assist you in providing your particulars and can be accessed via our legal webpage.

Standard particulars

28. We recommend you provide the following:

- a.

- a Document ID, file name or reference number;

- b.

- the name of privilege holder(s);

- c.

- the date the document was prepared/communication was made;

- d.

- the number of pages in the document;

- e.

- title or subject line of the communication;

- f.

- the form of the communication i.e., email, letter, file note;

- g.

- the type of document i.e., advice, contract, invoice;

- h.

- the identity and role of each person between whom the document/communication is made:

- I.

- Author(s) and, if different, Sender (name, position, organisation).

- II.

- Identify all people who have received the document (name, position, organisation). If the document is an email this will include those in the 'cc' and 'bcc' fields;

- i.

- whether the document is a copy;

- j.

- the dominant purpose for which the communication was made (see the example below) but not to the extent this discloses the content of the advice;

- k.

- the legal issue being advised upon or for which the advice is being sought except to the extent that disclosure of the legal issue would also disclose the content of the advice;

- l.

- whether the communication was forwarded. If so, provide an explanation of:

- I.

- the purpose of forwarding it;

- II.

- how confidentiality in the communication was maintained;

- III.

- how you assured yourself that privilege was not lost.

- m.

- whether LPP is claimed in full or in part; and

- n.

- if there are attachments to the document whether LPP is being claimed over the attachment/s. If yes:

- I.

- Identify the relevant Document ID/number of the attachment/s e.g., Attachment to doc X;

- II.

- Provide the standard particulars for the attachment/s.

Example 1: How we are likely to respond to different levels of detail about the purpose of a communication

| Description of communication | Our indicative response |

| The communication from Person X in Law Firm to Person Y in Client Company providing legal advice about the consequences of an asset transfer from Country A to Country B under Division 40 of the Income Tax Assessment Act 1997 and Australian Intellectual Property law.

Person X prepared the advice and is a legal graduate and employee in Law Firm [and an admitted legal practitioner to be included where appropriate]. Person X was instructed by Partner A of Law Firm, who signed off upon the advice prepared by Person X. The advice of Partner A was provided under the terms of legal engagement/retainer [as appropriate] dated ##, between the Client Company and the Law Firm. |

This degree of specificity allows both the nature and purpose of advice to be clearly understood by the ATO.

We will generally accept claims that contain sufficient detail if they reveal that the communication is privileged. |

| Legal document | Vague and/or formulaic clam is insufficient. We will request further information from you about your claim. |

Additional particulars for in-house counsel

29. To support LPP claims in relation to communications by or to an in-house advisor acting as a legal advisor, provide the following additional particulars (in addition to the standard particulars):

- a.

- Identify the in-house legal advisor (name);

- b.

- Identify whether the in-house legal advisor has been admitted to practice and if so jurisdiction of admission;

- c.

- Describe all of the functions, positions, roles and responsibilities at the time of the communication of the person who is acting as the in-house legal advisor who prepared the communication; and

- d.

- Describe the capacity in which that person was acting in making the communication.

| The 'In-house counsel claims' worksheet to the [ATO LPP Schedule] lists the specific questions to be answered for this section of this Guide. |

Additional particulars for specific engagements

30. If you have the kind of engagement identified under step 1.1 as requiring additional particulars, provide the following details.

- Evaluation of the service/engagement/relationship

- a.

- Explain the steps taken to ascertain that the service/engagement/relationship was a legal one, given the involvement of non-legal persons.

- Purposes of the communications

- b.

- State all purposes of the communication.

- c.

- Explain why the legal advice from the legal practitioner/s is the dominant purpose of the communication.

- Role of non-legal practitioners

- d.

- Where communications were originally initiated or developed by non-legal persons

- I.

- provide a copy of the terms of engagement (also referred to as a statement of work) that they are engaged under for the communication

- II.

- explain the reason for their involvement in the communication.

- Preparation of the communications

- e.

- For each person involved in the preparation of the communication provide:

- I.

- their name (if not already provided in Standard Particulars);

- II.

- their position, role and responsibility held in the organisation at the time of preparing the communication;

- III.

- the specific capacity the person was acting in when preparing the communication; and

- IV.

- whether the person held a current practising certificate at the time of preparing the communication.

Example 2: How we are likely to respond to different levels of detail about the involvement of multiple authors

| Preparation of communication | Our indicative response |

| Person A, Corporate General Counsel associate, provide legal advice to ABC firm, holding a current practising certificate. Person A was the principal advisor in the circumstances and gave directions to Person B.

Person B, Corporate General Counsel graduate, provide legal advice under supervision to ABC Firm, not holding a practising certificate. Person B undertook legal research on questions posed by Person C and drafted the initial advice under supervision and guidance of Person A. Person C, Finance Officer, make financial decisions of Firm, not holding a practising certificate. Sought legal advice from Person A and B on the legal risks around a proposed venture with Company 123. |

This degree of specificity allows both the role and capacity of the legal practitioners and non-legal persons to be clearly understood by the ATO.

We will generally accept claims that contain sufficient details if they reveal that the communication is privileged to understand how consideration was given to the capacity in which people were advising. |

| Company ABC's internal legal department | Vague and/or formulaic claim is insufficient. We will request further information from you about your claim. |

Step 3: Advise us of your approach

31. In this last step we ask you to advise us of the process you used for making your claims, framed around these key questions:

| For taxpayers making their own LPP claims | For legal practitioners or non-legal persons making LPP claims on behalf of a client |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

32. Our Form for Claiming LPP has these questions included to assist you.

Addendum 1

Context and background

1. This Addendum provides additional context and background including:

- a.

- The setting in which LPP claims are usually made.

- b.

- The role we each play.

- c.

- Considerations for legal practitioners, including, the disclosure of conflicts of interest.

- d.

- Our concerns.

The setting in which LPP claims are usually made

2. Taxation law is complex and the personal and business arrangements on which those laws operate may also be complex. We expect and understand that people obtain advice pertaining to a wide range of aspects of their personal and business affairs, and taxation aspects of those affairs are just one aspect of them. We encourage people to seek quality professional advice to assist with meeting their tax obligations. Further we:

- a.

- recognise that LPP is a fundamental common law right; and

- b.

- support taxpayers making LPP claims where the communications are privileged.

3. Our information and document gathering powers are very extensive. These powers include being able to compel you to furnish information or produce documents to us that are in your custody and control. They are important features of Australia's taxation systems and important tools in administering Australian taxation laws. The exercise of those powers creates legal obligations to provide information and documents.

4. When it attaches and is claimed, LPP operates as an immunity from any obligation to disclose created by the exercise of our information and document gathering powers. Accordingly, we have no expectation of receiving communications to which LPP attached but will accept and review such information if it is provided.

5. It is important that LPP is only claimed where it properly applies and we will challenge claims if we think we are entitled to the information we need to determine correct tax outcomes.

6. Our primary role is to determine tax outcomes according to law and support taxpayers to get their tax positions right. We require full access to facts which help us to make a correct assessment of tax, and our intent is to support you to make LPP claims where the communications covered by a formal notice are privileged.

7. The respective roles in regards to LPP can be summarised as follows:

| Taxpayers | Taxpayer's advisors | ATO | Courts |

| Determine when and how to make and particularise LPP claims having regard to the law of LPP in Australia.

Claim LPP only where it is appropriate. Consider the recommendations in this Protocol when:

Engage in dispute resolution processes in a timely and effective manner, where necessary. |

Consider the recommendations in this Protocol when advising clients on their LPP claims.

Advise your client about the LPP Protocol and our recommendations. Fulfil professional obligations and duties to the client, and if a legal advisor, fulfil duties to the Court. |

Communicate to taxpayers and their advisors our recommended approach for claiming LPP in tax investigations.

Be transparent on the steps we will take to review and test claims (when needed). Be transparent on why and how we intend to test and challenge LPP claims. Engage in dispute resolution processes in a timely and effective manner, where necessary. |

Ultimate decision maker in respect of LPP.

Hear disputes from parties regarding LPP claims. |

Considerations for legal practitioners

8. Legal practitioners may be engaged to assess if LPP attaches to communications. They play an important role in exercising their professional judgement to decide if LPP applies, or not. Where a notice is issued to a firm, this may include assessing whether the client may be able to, and wishes to, claim LPP in relation to documents in the possession of the firm ("firm documents")

9. If you are a legal practitioner involved in assisting or advising a client in relation to their obligations to provide information and documents to us (or "firm documents"), we expect that:

- a.

- Where possible, you have received instructions from your client prior to making an LPP claim in response to a formal notice;

- b.

- your client understands the nature and extent of the claims they are making;

- c.

- you made reasonable enquiries to ensure the claiming of LPP has a proper basis;

- d.

- you have advised your client of the existence of the LPP Protocol and the approaches to making LPP claims that are available and the likely responses to those approaches. We recommend advising your client of the extent to which you have followed, or departed from, the recommended approach of this Protocol;

- e.

- if you or your firm was involved in the communications over which LPP claims are to be made, your client is specifically aware of this and any conflicts of interest have been disclosed and are appropriately managed and / or mitigated, including in relation to "firm documents"; and

- f.

- your instructions allow you to attend to the matters in b to e above.

10. In making privilege claims, we assume that legal practitioners will deal with these in a manner consistent with their professional obligations and duties, including to the Court.

11. We require, and are entitled to, full access to facts. We take issue with any contrived arrangements or relationships which purport to attract LPP in an effort to conceal communications from us. This is an abuse of LPP.

12. We have concerns in relation to LPP claims made over communications arising out of the following arrangements:

- a.

- Contrived arrangements or relationships which purport to attract LPP where there is a purpose of concealing communications from us. We will pay close attention to circumstances where LPP is actively promoted as a feature of tax advice. This is different to where an advisory firm is merely pointing out that privilege is an ordinary feature of communications that are for the sole or dominant purpose of giving or receiving legal advice or advice for litigation.

- b.

- Routing advice through a lawyer merely for the purpose of obtaining privilege. Again, communications having the purpose of obtaining privilege are not for the sole or dominant purpose of giving or receiving legal advice or for litigation.

- c.

- Legal engagements entered into after the substance of advice was provided by non-legal persons.

- d.

- Concepts and ideas proactively promoted or marketed, or presented by a person or firm, whether lawyer/law firm or otherwise, prior to a legal engagement and unsolicited by the taxpayer.

- e.

- Communications exclusively between non-legal persons in circumstances where the involvement of a lawyer is not apparent.

- f.

- Unclear (and potentially overlapping or inconsistent) capacities and relationships designated to different members of the firm. For example, non-legal persons purporting to be an agent of the client in dealing with legal staff, an agent of the lawyer in dealing with the client, as well as potentially being an independent expert on tax law matters.

Addendum 2

Additional aspects

High quality LPP claims do not mean LPP will be waived

1. Information about an LPP claim can be informative and assist us to understand the basis of the claim, without disclosing confidential information.

2. We will not contend that the information you provide about your LPP claims (particulars) in accordance with our recommended approach amounts, by itself, to a waiver of your LPP.

3. By sharing our recommended approach through the LPP Protocol we aim to support the provision of high quality LPP claims; we do not seek to create waiver of LPP by following the Protocol.

4. The ATO will work collaboratively with taxpayers to review LPP claims where we have questions or require more information with the objective of resolving those concerns without resorting to further formal processes. However, where we remain concerned that material facts are potentially withheld from investigations because those material facts are not properly the subject of an LPP claim, we will seek to resolve the dispute by initiating:

- a.

- alternate dispute resolution, or

- b.

- court proceedings.

5. The resolution option will depend on the facts and circumstances of each case. We will generally only use alternate dispute resolution processes for LPP disputes where it is agreed to be a binding process.

6. If we commence court proceedings seeking a declaration that information over which LPP has been claimed is not privileged, and are successful in obtaining that declaration, we will usually seek recovery of our costs.

7. Where our investigations determine that tax investigations were obstructed or hindered by, for example, the making of knowingly unsustainable LPP claims, we will consider other options including:

- a.

- penalties for making a false or misleading statement to the Commissioner; and/or

- b.

- referral to prosecution for failure to comply with the information notice issued under tax law.

8. We expect practitioners to fulfil professional obligations and duties to the client, and if a legal advisor, fulfil duties to the Court and acknowledge that the vast majority act consistently with their professional obligations and duties. Where a practitioner demonstrates deliberate attempts to obfuscate the ATO's information gathering, assessment or review, the ATO may consider referring the practitioner to the appropriate professional body for consideration.

Addendum 3

Your comments

1. You are invited to comment on this Protocol. Please forward your comments to the contact officer by the due date.

| Due date: | 31 October 2021 |

| Contact officer: | Faith Harako |

| Email address: | faith.harako@ato.gov.au |

| Phone: | (08) 9268 6336 |

Legal professional privilege is an immunity from compulsory disclosure of confidential communications passing between client and lawyer and certain documents or parts thereof that facilitate or record those communications.

The ATO recognises that for formal document requests involving large numbers of documents, computer assisted processes may be used to identify documents for relevance. We see great opportunities for taxpayers to use these tools to improve efficiency, timeliness and accuracy whilst reducing the cost of compliance. However, if you have used computer assisted processes you will still need to review your claims as computer-assisted processes alone are not a reasonable basis for determining if LPP applies. The ATO considers that reliance on such programs should be supported by a documented governance process to explain how relevance was tested and how compliance with the formal notice was achieved.