Excise guidelines for the fuel industry

-

This document incorporates revisions made since original publication. View its history and amending notices, if applicable.

1 INTRODUCTION

1.1 PURPOSE

This Chapter deals with:

- •

- what excise is

- •

- an overview of excise legislation relevant to fuel

- •

- who administers excise, and

- •

- when you are involved in the excise system.

It provides a general introduction to excise as it relates to 'fuel products'.

1.2 WHAT EXCISE IS

The Commonwealth of Australia Constitution Act (Constitution) provides that only the Commonwealth can impose duties of excise. [1]

In Ha v New South Wales [2] ( Ha ), the High Court explained a duty of excise as follows [3] :

… duties of excise are taxes on the production, manufacture, sale or distribution of goods, whether of foreign or domestic origin. Duties of excise are inland taxes in contradistinction from duties of customs which are taxes on the importation of goods.

Excise imposed by the Excise Tariff Act 1921 is imposed on goods dutiable under the Schedule to that Act (Schedule) and manufactured or produced in Australia. It can be seen that this clearly fits the definition of duty of excise as described by the High Court in the Ha case.

1.3 OVERVIEW OF EXCISE LEGISLATION

The principal legislative framework for the excise system, relating to fuel, is contained in the:

- •

- Excise Tariff Act 1921 (Excise Tariff Act)

- •

- Excise Act 1901 (Excise Act), and

- •

- Excise Regulation 2015 (Excise Regulation).

The Excise Tariff Act imposes excise on certain goods manufactured or produced in Australia [4] and the Excise Act sets out the administration of excise duties. The imposition of excise duties is in a separate Act to their administration because the Constitution provides that laws imposing taxation (such as excise) shall only deal with the imposition of tax.

To change the Excise Tariff Act, an amending Act must be passed through Parliament. However, there are parliamentary procedures which allow for changes to the excise tariff to apply immediately, pending amendment of the Act through Parliament. These procedures are known as tariff proposals.

There are 3 key provisions in the Excise Tariff Act that operate to:

- •

- impose excise duty

- •

- identify excisable goods and the applicable duty rates (the Schedule), and

- •

- index the duty rate.

Imposition of excise duty

Section 5 of the Excise Tariff Act imposes excise duty on goods that are listed in the Schedule and manufactured or produced in Australia. Excise duty is imposed at the time of manufacture or production of the relevant goods. The Schedule lists the various goods that are subject to excise and the rate of duty applicable. It is sometimes referred to as the excise tariff.

The Schedule of excisable goods and the duty rates

The Schedule is a table that lists the goods manufactured or produced in Australia that are subject to excise duty. These are called 'excisable goods'. The goods that are currently subject to excise fall within 3 broad groups:

- •

- alcoholic beverages (other than wine) and spirits

- •

- cigarettes and other tobacco products, and

- •

- fuel and oils.

Within those 3 broad groups, the Schedule provides 8 different items and those items are (in most cases) further broken down into subitems. The table contains a description of the items and subitems and provides the rate of duty applicable to them.

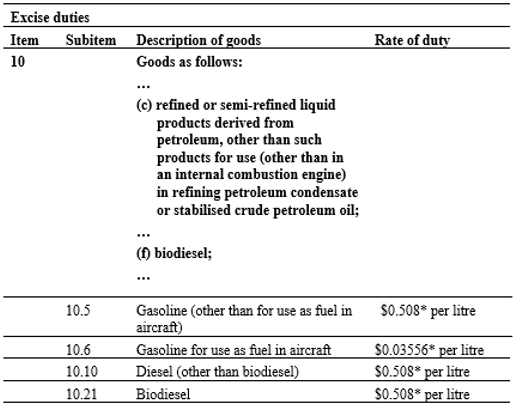

The following is an extract from the fuel products section of the table.

Figure 1: Extract of the table in the Schedule to the Excise Tariff Act

*Rate of duty as at 3 February 2025. For the current rates of duty, refer to Excise duty rates (referred to in this Guide as the Tariff working page or working tariff).

While we use the term 'fuel', the Schedule also includes goods that are not ultimately used as a fuel (in transport or for combustion), and as a result goods like paint thinners are classified to the Schedule even though they are not used as a fuel.

This Guide does not cover stabilised crude petroleum oil or condensate classified to items 20 and 21 respectively of the Schedule.

Indexation of the duty rate

The rates of excise duty are set out in the Schedule. However, section 6A of the Excise Tariff Act provides that the rates of duty may increase every 6 months (generally 1 February and 1 August). The amount of any increase is calculated by reference to the All Groups Consumer Price Index published quarterly by the Australian Bureau of Statistics.

These increases are commonly referred to as indexation. We publish these in the Commonwealth Gazette and, for ease of reference, we provide a working tariff which shows an up-to-date rate taking account of the indexation increases.

Indexation increases also apply to rates set under a tariff proposal.

Tariff proposals

Tariff proposals [5] are a means of changing the excise tariff so that the change is effective from the time it is proposed rather than after the enactment of an excise tariff amendment Act. Rates may be adjusted up or down or products may be added or removed under a tariff proposal.

Changes to the excise tariff can be notified in the Parliament or, if the Parliament is not sitting, by notice in the Gazette. We then apply the proposal as if it is law.

The tariff proposal is required to be validated by an Act within 12 months giving retrospective effect to the date of the proposal. [6]

You cannot commence proceedings against us for any action taken to collect the amount set by the tariff proposal during the periods specified in section 114 of the Excise Act unless it is sanctioned by a Supreme Court of a state or territory. [7]

Effectively this means you need to pay in line with a tariff proposal. Any increases in rates or introduction of new products through a tariff proposal must ultimately be levied by an amending Act, but we will protect the revenue by collecting amounts in line with the proposal.

If an amending Act validating the changes outlined within the tariff proposal is not passed within the prescribed periods, any additional amounts will be refunded to you.

All excisable goods are subject to our control

Under section 61 of the Excise Act, all excisable goods are subject to the CEO's control until they are delivered for home consumption or exported to a place outside Australia. Excisable goods subject to the CEO's control are called 'underbond' goods.

The CEO is the Commissioner of Taxation.

Goods are delivered for home consumption when they are released into the Australian market in an authorised manner, whether through the lodgment and passing of an entry or under a periodic settlement permission.

Manufacture, storage and movement of excisable fuel products

Before you can legally manufacture ' excisable fuel products ' you need a manufacturer licence granted under the Excise Act. [8] Under this licence you are also permitted to store excisable goods of a kind specified in the licence upon which duty has not been paid including like products that you did not manufacture It is an offence to manufacture excisable goods unless you have an excise manufacturer licence that specifies the goods you intend to manufacture.

If you are not a manufacturer, or you wish to store excisable goods upon which duty has not been paid and that are not of a kind specified in your manufacturer licence, you need a storage licence granted under the Excise Act that specifies the kind of excisable goods you wish to store. [9]

Before you can remove excisable fuel products from premises covered by a licence, on which duty has not been paid, you need permission (a movement permission) granted under the Excise Act. [10]

There are several types of movement permission that we can issue. These include:

- •

- a 'one-off' permission to move goods specified in the permission to another place specified in the permission

- •

- an ongoing permission to move goods of a kind specified in the permission to another place specified in the permission (and such a permission remains in place until revoked)

- •

- an ongoing permission to move goods of a kind specified in the permission to any other place licensed to manufacture or store goods of that kind

- •

- permission to deliver goods for export.

Generally, we will not grant permission to move excisable fuel products on which duty has not been paid to a place that is not covered by either a manufacturer licence or a storage licence or unless the place is a wharf or airport and the goods are for export.

Payment of duty on excisable fuel products

The Excise Tariff Act imposes duty when excisable fuel products are manufactured. The Excise Act specifies when the duty must be paid, how and what you must report to us, the relevant time to determine the rate of duty in force and provides a mechanism to require payment where duty has not been correctly accounted for on excisable fuel products.

In general terms, duty must be paid on the goods before they are delivered from premises covered by a licence (other than being delivered to another premises covered by a licence). Permission may be granted to deliver the goods prior to paying the duty.

The Excise Regulation sets out provisions in relation to excisable goods such as:

- •

- refunds and remissions, and

- •

- drawbacks.

1.4 ADMINISTRATION OF EXCISE

The Commissioner of Taxation has the general administration of the Excise Act and the Excise Tariff Act. [11] This means you deal with the Australian Taxation Office (ATO) for Australian-manufactured fuel products.

Customs duty applies to imported fuel products. The Australian Border Force (ABF) is responsible for administration of the Customs Act 1901 (Customs Act) and Customs Tariff Act 1995 (Customs Tariff Act); however, the ATO has been delegated responsibility for administering imported fuel that is warehoused under the Customs Act.

However as most bulk imported fuel is blended in Australia with other fuel when transferred into storage tanks, the fuel is considered to be manufactured in Australia and as a result the duty liability transfers from the customs regime into the excise regime.

Who you need to deal with is summarised in Table 1.

| Type of fuel product | ABF | ATO |

|---|---|---|

| Australian-manufactured fuel products | No | Yes |

| Imported fuel products not for further manufacture in Australia | Yes | No |

| Imported fuel products for further manufacture in Australia | Yes | Yes |

1.5 INVOLVEMENT IN THE EXCISE SYSTEM

You are involved in the excise system if you:

- •

- manufacture fuel products (excisable goods)

- •

- store or own fuel products on which duty has not been paid, or

- •

- are seeking a refund, remission or drawback of excise duty.

1.6 MORE INFORMATION

If you need more information on excise, as it relates to fuel, contact us via:

- •

- ATO Online Services

- •

- phone 1300 137 290 , or

- •

- write to us at

- Australian Taxation Office

PO Box 3514

ALBURY NSW 2640

We will ordinarily respond to written information requests within 28 days. If we cannot respond within 28 days, we will contact you within 14 days to obtain more information or negotiate an extended response date.

Most of your business reporting and transactions can be done through ATO Online Services .

1.7 TERMS USED

Excisable goods are goods on which excise duty is imposed. Excise duty is imposed on goods that are listed in the Schedule and manufactured or produced in Australia.

As this Guide deals with fuel products, we have used the term excisable fuel products.

Excisable fuel products include:

- •

- petrol

- •

- diesel

- •

- crude petroleum oil

- •

- condensate

- •

- heating oil

- •

- kerosene

- •

- liquid hydrocarbon solvents

- •

- fuel ethanol

- •

- biodiesel

- •

- compressed natural gas (CNG)

- •

- liquefied natural gas (LNG), and

- •

- liquefied petroleum gas (LPG).

While oils and grease classified to item 15 of the Schedule to the Excise Tariff Act are not technically fuel, we have included them in this generic term in this Guide.

This Guide does not cover stabilised crude petroleum oil or condensate classified to items 20 and 21 respectively of the Schedule.

1.8 LEGISLATION (quick reference guide)

In this Chapter, we have referred to the following legislation:

- •

- Excise Act 1901

- –

- section 4 – definitions

- –

- section 7 – general administration of Act

- –

- section 25 – only licensed manufacturers to manufacture excisable goods

- –

- Part IV – manufacture, storage, producer and dealer licences

- –

- section 61A – permission to remove goods that are subject to CEO's control

- –

- section 114 – time for commencing action

- •

- Excise Tariff Act 1921

- –

- section 1A – general administration of Act

- –

- section 5 – duties of excise

- –

- section 6A – indexation of rates of duty

- –

- The Schedule

- •

- Constitution

- –

- section 90 – exclusive power over customs, excise, and bounties

Amendment history

| Part | Comment |

|---|---|

| 1.3.1 | Updated to reflect the current duty rates. |

| Throughout | Updated in line with current ATO style and accessibility requirements. |

Copyright notice

© Australian Taxation Office for the Commonwealth of Australia

You are free to copy, adapt, modify, transmit and distribute this material as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).

References

| Date: | Version: | |

| 1 July 2006 | Updated document | |

| 1 April 2015 | Updated document | |

| 12 July 2017 | Updated document | |

| 11 December 2017 | Updated document | |

| 4 June 2021 | Updated document | |

| 1 July 2024 | Updated document | |

| You are here | 27 June 2025 | Current document |