Excise guidelines for the fuel industry

-

This document incorporates revisions made since original publication. View its history and amending notices, if applicable.

6 PAYMENT OF DUTY

6.1 PURPOSE

This Chapter deals with:

- •

- when duty is payable

- •

- when duty is payable under periodic settlement

- •

- when duty is payable under prepayment of excise duty

- •

- when duty is not payable

- •

- how to work out the amount of duty you're liable to pay, including tariff proposals and quotas

- •

- what to do if you have a dispute as to the duty

- •

- whether you have to account for excisable fuel products

- •

- how to get a periodic settlement permission (PSP)

- •

- what your PSP will include

- •

- what to do to deliver fuel products into ' home consumption '

- •

- how to lodge ' excise returns ' and pay excise duty

- •

- what to do if you have made an error on your excise return, and

- •

- penalties that can apply to offences in relation to payment of duty.

6.2 INTRODUCTION

Excise duty is imposed at the time of manufacture of ' excisable fuel products '. [130] However, the duty is not required to be paid at the time of manufacture.

This Chapter focuses on the payment of duty and the factors that influence when and how much duty is payable.

To ensure the duty is ultimately acquitted, excisable fuel products remain subject to our control until they are delivered [131] :

- •

- into home consumption, or

- •

- for export to a place outside Australia.

The liability for duty, imposed at the time of manufacture, can be acquitted by:

- •

- payment of the duty

- •

- export of the goods

- •

- ' remission ', or

- •

- use of the goods in the manufacture of other excisable goods.

Alternatively, the liability can be transferred with the goods if they are sold while ' underbond '.

6.3 POLICY AND PRACTICE

When the liability for duty becomes payable depends on how authority is given to deliver the excisable fuel products into home consumption. If goods are delivered for home consumption in accordance with a continuing permission issued under section 61C of the Excise Act, duty is payable at the same time the return for the relevant period is due for lodgment. [132] If goods are entered on an ad hoc basis, you will have to pay duty in order for the entry to be passed. [133]

6.3.2 WHEN DUTY IS PAYABLE UNDER A PERIODIC SETTLEMENT PERMISSION

Under a PSP, the duty is paid after the excisable fuel products are delivered into home consumption.

A PSP allows you to deliver goods for home consumption and then, for each period, report those deliveries and pay duty at the rates applicable at the time of each delivery. [134] Periodic settlement is the most common arrangement for the delivery of goods into home consumption.

PSPs may be granted on a weekly, monthly or quarterly basis.

Weekly PSPs: You may apply for a PSP that covers any recurring 7-day reporting period. [135] You may specify in your application the 7-day period you wish to use, for example, Wednesday to Tuesday. [136] The application must be made on the approved form. [137]

Monthly PSPs: You may apply for a monthly [138] PSP if you are either:

- •

- a small business entity or eligible business entity [139] , or

- •

- included in a particular class of business or you deliver goods that are of a particular kind as prescribed by the Excise Regulation. [140]

You may only apply for a quarterly PSP if you are an eligible business entity.

A 'small business entity' [141] is an entity with an aggregated turnover for the previous year of less than $10 million or one that is likely to have an aggregated turnover for the current year of less than $10 million. Aggregated turnover includes the turnover of any entities connected with you and any of your affiliates. However exclude any turnover from dealings between you, and any entities connected with you or your affiliates.

An 'eligible business entity' [142] is an entity that would be a small business entity if the turnover thresholds were $50 million rather than $10 million.

Stabilised crude oil and condensate are currently prescribed in the Excise Regulation as being goods for which a person may apply for a PSP in respect of a calendar month. If a person is granted a PSP in respect of a calendar month, they will be required to give the Collector a return, in an approved form, on the day of each month specified in the PSP. The return must contain details of goods that have been delivered into home consumption under the PSP in the preceding month. [143]

A PSP is given in writing and includes [144] :

- •

- your name as the holder of the PSP

- •

- the kind of goods to which the PSP applies

- •

- the place from which the goods may be delivered

- •

- the start date of the PSP and whether it is for a 7-day, monthly or quarterly period

- •

- the 7-day period specified (if applicable), and

- •

- any special requirements of the periodic settlement.

In considering your application for a PSP, we will take into account various issues including compliance with the law and the protection of the excise revenue. We will also consider whether you have complied with the requirements of any previous permission you have been given. If we refuse to give you a PSP, we will issue you a notice in writing setting out the reasons for the refusal. [145]

A decision we make in relation to the period of a PSP or any condition for a PSP is a reviewable decision. [146]

If you have a 7-day PSP for a fuel that is other than CNG, LNG or LPG [147] :

- •

- You must lodge an excise return, on the first business day following the end of the 7-day period, specified in your PSP. The excise return details the goods you have delivered into home consumption during the settlement period.

- •

- You must, at the time you lodge your return, pay any duty at the rate applicable when the goods were delivered into home consumption.

If you have a 7-day PSP for CNG, LPG or LNP the same requirements apply, however you must give us a return and pay any excise duty on or before the 6th business day following the end of the 7-day period. [148]

If you have a monthly PSP, the same requirements apply, however you must give your return and pay any excise duty on or before the 21st day of month following the end of the monthly period. [149]

If you have a monthly permission because you are in a class of persons prescribed in the regulations of the Excise Act or because you deliver goods into home consumption of a kind prescribed, the regulations of the Excise Act can impose alternative conditions.

If you have a quarterly PSP, you must give your return and pay any excise duty:

- •

- for a quarter ending on 31 March, 30 June or 30 September, the 28th day after the end of the quarter

- •

- for a quarter ending on 31 December, the 28th day of February after the end of the quarter.

We may also determine a different PSP period if:

- •

- you do not have any excise duty to pay [150]

- •

- you are an eligible business entity and have a PSP for a monthly period and have advised us in writing that the business has ceased to be an eligible business entity [151]

- •

- you are included in a particular class of business and have a PSP for a monthly period and have advised us in writing that your business has ceased to be included in the class. [152]

If we change your PSP period, we will advise you in writing that your PSP is revoked from the date specified in the notice. We will give you another PSP for a 7-day period. [153]

If you are no longer eligible for a monthly or quarterly settlement period, it is a condition of your licence that you notify us in writing and we will revoke your permission from a specified day and give you another PSP for a 7-day period. [154] If you advise us in writing that you wish to change the period relating to your 7-day period, we may, in writing, revoke your current PSP and give you a new permission for the preferred period. We will notify you of the day the change comes into effect. [155]

Example 6A

Buy Me Pty Ltd (Buy Me) does not hold an excise licence and does not qualify as a small business entity or eligible business entity. A licensed manufacturer manufactures excisable fuel products for Buy Me under contract. The fuel products are not of a particular class of goods prescribed in the Excise Regulation. Buy Me is also not included in a class of persons prescribed in the Excise Regulation.

Under the terms of the contract, Buy Me has title to the goods from the time of manufacture and will pay the excise duty.

Buy Me applied for, and was granted, a 7-day PSP for the period Tuesday to Monday.

Buy Me is able to arrange delivery of the excisable fuel products into home consumption and defer payment of excise duty, on those goods, until after the end of the 7-day period. On the first working day after the end of the period (that is, Tuesday, unless it is a public holiday in which case it will be due on Wednesday) Buy Me must lodge an excise return for any excisable fuel products delivered during the prior Tuesday to Monday and pay the excise duty owing on those goods.

6.3.3 WHEN DUTY IS PAYABLE UNDER PREPAYMENT OF EXCISE DUTY

Under prepayment, the duty is paid before the excisable fuel products are delivered into home consumption.

If you do not hold a PSP, you must receive a Delivery authority from us before you are allowed to deliver the excisable fuel products into home consumption. We require you to pay any applicable duty before we give you a Delivery authority. To request a Delivery authority you need to lodge an excise return.

- •

- lodge an excise return

- •

- pay the relevant duty, and

- •

- receive a Delivery authority from us.

6.3.4 WHEN DUTY IS NOT PAYABLE

There are circumstances in which no duty will be payable. These include where:

- •

- goods are classified to an item or subitem with a free rate of duty

- •

- goods are exported

- •

- an exemption circumstance applies

- •

- a remission circumstance applies, or

- •

- excisable fuel products that are subject to our control are used in the manufacture of other excisable fuel products.

6.3.5 WORKING OUT THE AMOUNT OF DUTY

To work out how much duty you need to pay you will need to:

- •

- check whether your fuel products are excisable fuel products according to the Schedule to the Excise Tariff Act [157] and identify the correct duty rate

- •

- work out the quantity of fuel products subject to duty, in each tariff subitem, that you deliver into home consumption

- •

- multiply the quantity of fuel products by the rate of duty on the excisable fuel products, and

- •

- add up the total for each subitem to work out total duty to be paid.

(i) Classifying excisable fuel products

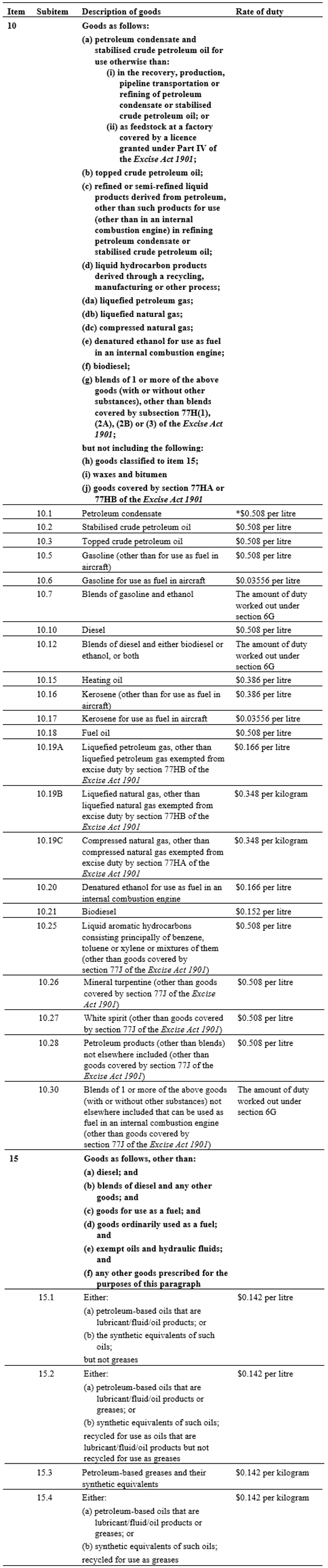

The Schedule to the Excise Tariff Act lists those goods that, if manufactured or produced in Australia, are subject to excise. The Schedule also contains the rate of duty applicable to the goods. For excisable fuel products, the relevant part of the Schedule is as follows:

Figure 2: Extract of the table in the Schedule to the Excise Tariff Act with current rates of duty

*Rate of duty as at 3 February 2025. The law indexes the excise duty rates for fuel and petroleum products (other than aviation fuels and certain petroleum-based products) twice a year, based on the upward movement of the consumer price index (CPI). The Australian Bureau of Statistics is responsible for determining and publishing the CPI which provides the basis for indexation. Generally, indexation occurs on 1 February and 1 August.

In addition there has been a legislated phasing in of the rates of excise duty on biodiesel applied annually on 1 July. The final phased increase will occur on 1 July 2030.

For the current rates of duty, refer to our tariff working page Excise duty rates for fuel and petroleum products.

(ii) Working out quantities of excisable fuel products

We measure fuel quantity in litres or, in some cases, kilograms. However, the volume of fuel varies with temperature.

To work out your fuel quantity for excise duty purposes, volume is generally used and must be measured at a temperature of 15 degrees Celsius, which is an industry standard, and the quantity rounded to the nearest whole litre.

The method used to calculate the litres figure is the standard conversion of a weight measurement, which is to take the weight and divide it by the density corrected to 15 degrees Celsius.

If you are dealing with LPG, there are other factors to be considered when determining volume. These factors can include the density and vapour pressure.

The fuel quantity of CNG is measured in kilograms for excise purposes. If you are dealing with CNG which is measured via a different method (either volume or energy value), there are factors to be considered when determining the mass.

You may have instances when product is invoiced in kilograms and you then need to convert the quantity to litres to:

- •

- record it in your stock records, and

- •

- include on an excise return, when delivered into home consumption.

The method used to calculate the litres figure is the standard conversion of a weight measurement to a liquid measurement, which is to take the weight and divide it by the density corrected to 15 degrees Celsius.

Example 6B

100 kilograms of fuel oil having a density of 0.94 at 15 degrees Celsius converts to 106 litres:

100 ÷ 0.94 = 106.38 rounded to 106 litres

(iii) Calculating duty payable on each excisable fuel product

The rates of duty are set out in the Schedule to the Excise Tariff Act.

The rate of duty you use is the rate contained in the working tariff for the subitem. It will also depend on whether you have a PSP. If you do, it is the rate applicable at the time you deliver the excisable fuel products into home consumption. If you do not have a PSP, it is the rate applicable at the time you make the pre-payment. [158]

For the current rates of duty, refer to our tariff working page Excise duty rates for fuel and petroleum products .

When goods are delivered into home consumption under a PSP, the rate of duty that applies is the rate in force at the time the goods are delivered.

Example 6C

On 13 August 2024, a manufacturer delivers lubricating oil under its PSP.

The lubricating oil is classified to subitem 15.1 of the excise tariff.

The rate of duty that applies is the rate in force on 13 August 2024 – $0.142 per litre.

Example 6D

When goods are entered on an ad hoc basis prior to being delivered into home consumption, the rate that applies is the rate in force at the time payment is made.

On 29 June 2023, a manufacturer that does not hold a PSP lodges an ad hoc entry and prepays duty for a quantity of lubricating oil that is on hand but has not yet been delivered into home consumption. The lubricating oil is delivered on 10 July 2023.

The lubricating oil is classified to subitem 15.1 of the excise tariff.

The rate of duty that applies is the rate in force on 29 June 2023 – $0.085 per litre.

Lubricating oil is not subject to bi-annual indexation. Any change to the rate of duty for lubricating oil is made by a change to the law.

On 1 July 2023, there was an increase in the rate from $0.085 per litre to $0.142 cents per litre.

Example 6E

10,000 litres of diesel are delivered into home consumption on 10 February 2025.

The diesel is classified to subitem 10.10 of the excise tariff and has a duty rate of $0.508 per litre.

Therefore, the duty payable is 10,000 litres × $0.508 = $5,080.00.

(iv) Calculating total duty payable

Duty payments are notified to us by including details on your excise return. Excisable fuel products classified to different items or subitems of the excise tariff must be shown separately on your excise return on what are referred to as lines.

Example 6F

My Fuel Sales needs to report deliveries of fuel and grease for the period ended 10 November 2024.

On their excise return, My Fuel Sales reports their deliveries and duty liability as:

Table 2: Deliveries and duty liability reported by My Fuel Sales Line Tariff item Quantity Units Duty rate 1 10.5 100,000 L $0.508 2 15.3 15,000 Kg $0.142

The total excise amount was $52,390.

If the rate changes during the settlement period

If the rates of duty change within your settlement period, you may lodge 2 excise returns or, alternatively, include separate lines for the same product on one return – that is:

- •

- one return or line for goods delivered under the old rates, and

- •

- one return or line for goods delivered under the new rates.

The applicable rate of excise duty can also be affected by:

- •

- changes to the Excise Tariff Act (including tariff proposals), or

- •

- quotas.

Changes to the Excise Tariff Act

Where the government decides to change the rate of excise applying to excisable goods, or to apply excise to new goods or stop applying excise to certain goods, it notifies its intention to do this with a tariff proposal.

Tariff proposals

Tariff proposals are a means of changing the excise tariff.

Changes to the excise tariff can be notified in the parliament or, if the parliament is not sitting, by notice in the Gazette.

The tariff proposal is required to be validated by an Act within 12 months of the date of notification, with the Act giving retrospective effect to the date of the proposal.

You cannot commence proceedings against us for any action taken to collect the amount set by the tariff proposal during the periods specified in section 114 of the Excise Act. [159]

Effectively, this means you need to pay in line with a tariff proposal. Any increases in rates or introduction of new products through a tariff proposal technically does not impose excise until the amending Act receives royal assent, but we will protect the revenue by collecting amounts in line with the proposal.

If an amending Act validating the changes outlined within the tariff proposal is not passed within the prescribed periods, any additional amounts will be refunded.

Quotas

Quotas are a means of ensuring that people cannot gain an advantage by anticipating rises in excise rates and then delivering more excisable fuel products than they would normally. Effectively, quotas restrict the quantity of excisable fuel products you can deliver into home consumption at the existing excise rate. If you exceed your quota for the period you will need to pay the duty at the new rate.

Where we believe that persons are anticipating an increase in the rate of duty, and as a result clearances of excisable fuel products in a particular period are likely to be greater than usual, we will publish a notice in the Gazette. This notice will state that a particular period is a 'declared period'. [160]

The 'declared period' is the period during which quotas will operate. To establish what your quota is we will consider the amounts of your past deliveries. [161]

Once we have established your quota, we will give you a written quota order that specifies the maximum level (which can be nil) [162] of excisable fuel products that you can deliver into home consumption at the applicable excise rate in force during the declared period.

If, at any time during the declared period you exceed your quota, you are required to pay the duty on the excess goods at the existing rate, and in addition we may require you to pay a security, by cash deposit, equal to the duty on the excess goods. [163]

At the end of the declared period we will reconcile your deliveries with your quota. If you delivered into home consumption more than your quota allowed, the duty for the amount in excess of the quota is calculated at the rate in force the day after the declared period ends. Therefore, if the rate has gone up, you will pay the higher rate of duty on the amount in excess of your quota.

We can vary or revoke a quota order any time before the end of the declared period or 60 days after the making of the quota order, whichever occurs last.

You may deposit with us the amount of duty demanded if you dispute [164] :

- •

- the amount of duty

- •

- the rate of duty, or

- •

- the liability of goods to duty (for example, whether the goods are excisable).

The deposit of this duty is to be made on an excise return. The excise return should be accompanied by a letter which sets out the details of the dispute. Upon receipt of the amount deposited we will authorise delivery of the goods. You have 6 months after making the deposit to commence court action. If that action is decided in your favour, we are obliged to refund you the deposit along with interest of 5% per annum, unless we are of the opinion that any evasion under the Excise Act has been committed or attempted. If the action is not commenced within 6 months or the court does not find in your favour, the amount deposited is taken to be the correct amount of duty.

However, if you have received a private ruling and subsequently lodge an objection that relates to the amount or rate of duty, or the liability of goods to duty, you cannot commence court action to recover your deposit on grounds that are, or could have been, in your objection. [165]

Example: 6G

A licensed manufacturer anticipates manufacturing a new type of excisable good. They seek a private ruling as to the rate of duty that would be payable on the good. They do not accept the rate of duty advised by us in the private ruling and they lodge an objection. Subsequently, they commence manufacture of the excisable goods. They pay the amount of duty at the rate that we claimed was payable in the private ruling and commence an action against us under section 154 of the Excise Act. Their ability to commence an action under section 154 is limited to matters that are not covered and could not have been covered under the objection to the private ruling.

We consider that section 154 of the Excise Act, because it permits you to deliver goods provided you pay the amount of duty determined by the Collector, has no application where you are delivering goods under a PSP. Under a PSP, goods are delivered prior to the lodgment of returns or payment of duty. If you wish to avail yourself of your options under section 154, you can lodge an ad hoc entry for the goods rather than delivering them under your permission. Alternatively, you can deliver the goods under your PSP, pay the duty determined by the Collector and then apply for a refund of the amount you believe has been overpaid (subject to time limits).

6.3.7 ACCOUNTING FOR EXCISABLE FUEL PRODUCTS

If you have or had, or have been entrusted with, possession, custody or control of any excisable fuel products [166] (subject to ' excise control '), you have to be able to satisfactorily account for them.

If we ask you to account for excisable fuel products, and you cannot satisfactorily do so, we may demand payment of an amount equal to the duty. Our demand will be given in writing. The amount you are required to pay is calculated using the rate of duty in force on the day the demand is made.

When requested to account for excisable fuel products, you must be able to show that:

- •

- the goods are still at your premises

- •

- duty has been paid

- •

- duty was not payable (for example, where a remission applied), or

- •

- the goods have otherwise been dealt with in accordance with the excise law (for example, moved under a movement permission or included on an excise return at a concessional rate).

Excisable fuel products will not have been accounted for satisfactorily just because they were:

- •

- given away for promotional purposes [167]

- •

- stolen from premises covered by a licence [168] , or

- •

- delivered into home consumption under the mistaken belief that they were not excisable.

We may also demand payment from you if you have failed to keep excisable fuel products safely (for example, if you have a break-in and a theft occurs, you will be required to pay an amount equal to the duty that would have applied to the excisable fuel products that have been stolen).

Our decision to demand payment is a reviewable decision. [169]

In determining whether you have accounted for the excisable fuel products, we may allow you to offset any stock shortages and surpluses.

Example 6H

My Petroleum Wholesalers is asked to account for their excisable fuel products. They carry out a stocktake and find there is a surplus of 100,000 litres of unleaded petrol and a shortage of 200,000 litres of diesel.

We will allow them to offset the surplus and shortage. Therefore, there are 100,000 litres of diesel that have not been accounted for.

A demand will be issued for an amount equal to the excise duty payable on the 100,000 litres.

My Petroleum Wholesalers corrects its book stock to take up the surplus stock of 100,000 litres of unleaded petrol and, when the demand is paid, write off the shortage of 200,000 litres of diesel.

Example 6I

Continuing from Example 6H, a couple of months later, My Petroleum Wholesalers decides to conduct another stocktake. They find a surplus of 250,000 litres of heating oil and a shortage of 200,000 litres of fuel oil. Both products are subject to duty at the same rate.

They decide to offset the surplus and shortage. Therefore, there are no litres that have not been accounted for but there is a surplus of 50,000 litres.

My Petroleum Wholesalers corrects its book stock to take up the surplus stock of 250,000 litres of heating oil and write off the shortage of 200,000 litres of fuel oil. They do not need to notify us as there has been no shortage in the payment of the duty. If a shortfall had occurred, they would need to contact us before the offsetting could occur.

Out-of-period adjustment arrangements

There are circumstances in which you may make 'out-of-period' adjustments to your excise liability on your excise return without our prior approval.

For example, a PSP holder who is eligible for refunds or drawbacks or has underpaid duty in a previous settlement period may be able to use the out-of-period adjustment arrangement to account for the variations within the current settlement period.

Adjustments covered include refund claims, drawback claims and underpayments of duty. An out-of-period adjustment report must be lodged with the relevant excise return.

Before you can use the out-of-period adjustment system, you must obtain approval from us.

Returning fuel products to underbond stock

Fuel products that have been delivered into home consumption but returned before the end of the settlement period are not required to be included on the excise return for that period. The product can be returned to underbond stock and treated as though they have never left excise control. Fuel that has been returned to a place covered by a licence after the settlement period in which the fuel was delivered, can be included in the out-of-period adjustment as described above.

6.4 PROCEDURES

6.4.1 OBTAINING A PERIODIC SETTLEMENT PERMISSION

If you apply for a manufacturer or storage licence, you can use your application form to indicate whether you intend to apply for a periodic settlement permission or pay excise duty on an ad hoc basis prior to delivery. We will contact you to discuss your requested payment option.

If you do not have a licence, or you originally chose not to pay excise duty periodically, contact us to get a PSP.

If we approve your PSP, we will notify you in writing within 28 days of receiving your request.

We may also:

- •

- refuse to grant a PSP

- •

- impose conditions on a PSP, or

- •

- revoke a PSP.

Failure to comply with a condition may result in the revocation of the PSP. [170] In such an instance, we would take into account a variety of factors, including your payment history.

A decision to refuse, impose conditions on, or to revoke a PSP is a reviewable decision. [171]

6.4.2 WHAT A PERIODIC SETTLEMENT PERMISSION INCLUDES

Your PSP in relation to excisable fuel products will include:

- •

- permission to deliver excisable fuel products into home consumption

- •

- conditions, such as

- –

- your settlement period – the period during which goods can be delivered before a return must be lodged

- –

- the type of goods that may be delivered from each premises

- –

- quantity limits (if any)

- –

- when and how to lodge your excise return

- –

- when you must pay the duty

- –

- how you must pay – permitted methods (for example, electronic funds transfer, cheque, at a post office)

- –

- record-keeping requirements

- •

- a schedule listing one or more premises from which deliveries may be made.

Even if you do not deliver into home consumption any excisable product in the period prescribed in your PSP, you must still lodge a return for that prescribed period and indicate that the lodgment is a 'nil return'.

Example 6J

A PSP specifies a settlement period starting on Saturday and ending on Friday. It states that excise returns must be lodged by 4:00 pm on the first business day after the end of the settlement period. It also says that the duty on deliveries made during the settlement period must be paid at the same time as the excise return is required to be lodged.

An excise return must be lodged and the duty paid by 4:00 pm on Monday for all goods delivered during the settlement period.

When a public holiday falls on a Monday, the excise return is due for lodgment and duty is to be paid by 4:00 pm on Tuesday, the next business day.

Where you have deliveries in different states of Australia, there may be different public holidays in those states. If your returns are prepared by an office in a state different from that in which the delivery into the Australian domestic market occurs, lodgment is due on the next business day in the state where the return is prepared. [172]

6.4.3 DELIVERING FUEL PRODUCTS INTO HOME CONSUMPTION

Delivery under periodic settlement permission

If we provide you with a PSP, you must take the following steps to deliver excisable fuel products into home consumption:

- •

- deliver the fuel products into home consumption (where delivered in accordance with the permission the products are now no longer subject to excise control)

- •

- complete and submit your excise return in accordance with the timeframes in the permission, and

- •

- pay the duty to us in accordance with the timeframes in the permission.

Delivery after prepaying the excise duty

If you do not have a PSP, you must take the following steps to enter excisable fuel products into home consumption:

- •

- complete and submit your excise return

- •

- pay the duty to us

- •

- obtain a Delivery authority from us, and

- •

- deliver the fuel products into home consumption.

6.4.4 LODGING EXCISE RETURNS AND PAYING EXCISE DUTY

Lodge your excise return via:

- •

- ATO Online Services , or

- •

- post it to

- Australian Taxation Office

PO Box 3007

PENRITH NSW 2740

You can pay excise duties by:

- •

- electronic funds transfer, including direct credit and BPAY

- •

- credit or debit card

- •

- in person at a post office, or

- •

- mail (cheque or money order), The payment must be received by the day and time stated in your PSP.

If you pay the excise duty at a post office, you must use a payment advice. To obtain a payment advice booklet, phone us on 13 72 26 or 1800 815 886 and supply us with your Australian Business Number (or Excise Identification Number) and client account number.

Lodgment of an excise return and payment of any duty must be made by the day and time stated on your PSP.

Failure to pay on time may result in the revocation of your PSP.

- •

- see Excise return , or

- •

- phone 1300 137 290 .

Instructions to help you complete your excise return can be found st Excise return .

6.4.5 MAKING AN ERROR ON AN EXCISE RETURN

You may correct errors in your excise return or add new lines by lodging an amending excise return and referencing the number of your original return. This can be done by using ATO Online Services or by filling out and lodging a PDF form.

If your amendment results in a shortfall in excise duty paid, you must pay the additional duty when you lodge the amending return.

If your amendment results in an overpayment of excise duty, you may apply for a refund or treat the amount as a credit and offset it against the duty you are liable to pay in your next excise return. In this situation, time limits may apply in which to lodge your amended return.

An amending return can only be used to change product details.

If you wish to change other information in your original excise return (for example, your individual details or the settlement period) you must lodge a new excise return as the amending excise return does not cater for changes to these sections. The new return must contain the amended details and refer to the original return. You should also request cancellation of the original return.

- •

- see Excise amendment , or

- •

- phone 1300 137 290 .

Help to complete the form is available at Excise amendment .

If you need more information on payment of duty, contact us via:

- •

- phone 1300 137 290

- •

- ATO Online Services , or

- •

- write to us at

- Australian Taxation Office

PO Box 3514

ALBURY NSW 2640

We will ordinarily respond to written information requests within 28 days. If we cannot respond within 28 days, we will contact you within 14 days to obtain more information or negotiate an extended response date.

6.5 PENALTIES THAT CAN APPLY IN RELATION TO PAYMENT OF DUTY

The following are the penalties that may apply after conviction for an offence.

Move, alter or interfere

If you move, alter or interfere with excisable fuel products that are subject to excise control, without permission, the penalty is a maximum of 2 years in prison or the greater of 500 ' ' and 5 times the amount of duty on the excisable fuel products. [173]

Deliver

If you deliver excisable fuel products into the Australian domestic market contrary to your permission, the penalty is a maximum of 2 years in prison or the greater of 500 penalty units and 5 times the amount of duty on the excisable fuel products. [174]

Evade

If you evade payment of any duty which is payable, the maximum penalty is 5 times the amount of duty on the excisable fuel products, or where a court cannot determine the amount of that duty the penalty is a maximum of 500 penalty units. [175]

False or misleading statements

If you make a false or misleading statement, or an omission from a statement in respect of duty payable on particular goods, to us, a penalty not exceeding the sum of 50 penalty units and twice the amount of duty payable on those goods. [176]

6.6 TERMS USED

Excisable goods are goods on which excise duty is imposed. Excise duty is imposed on goods that are manufactured or produced in Australia and listed in the Schedule to the Excise Tariff Act.

As this Guide deals with fuel products, we have used the term excisable fuel products.

Excisable fuel products include:

- •

- petrol

- •

- diesel

- •

- renewable diesel

- •

- crude petroleum oil

- •

- condensate

- •

- heating oil

- •

- kerosene

- •

- fuel ethanol

- •

- biodiesel

- •

- compressed natural gas (CNG)

- •

- liquefied natural gas (LNG), and

- •

- liquefied petroleum gas (LPG).

Excise control

Goods are subject to excise control from the point of manufacture until they have been delivered into home consumption or for export.

Goods subject to excise control cannot be moved, altered or interfered with except as authorised by the Excise Act.

An excise return [177] is the document that you use to advise us the volume or mass of excisable fuel products that you have:

- •

- delivered into home consumption during the period designated on your PSP, or

- •

- wish to deliver into home consumption following approval.

'Home consumption' [178] is the term used in the Excise Act and this Guide to describe when excisable fuel products are released into the Australian domestic market for consumption. The term used in the legislation is 'deliver for home consumption'.

Normally, this will be by delivering the goods away from premises covered by a licence but includes using those goods within those premises (for example, using fuel to run equipment in premises covered by your licence). It does not include goods delivered for export or the movement of goods underbond (see definition below) to another site covered by a licence.

The term 'home consumption' is not defined in the Excise Act and there is no definitive case law that looks at the issue in question. However there are several cases where issues closely related to it are considered. [179]

The conclusion drawn from those cases is that 'home consumption' refers to the destination of goods as being within Australia as opposed to exporting them.

The value of a penalty unit is contained in section 4AA of the Crimes Act 1914 , and is indexed regularly. The dollar amount of a penalty unit is available at Penalties .

A remission of excise duty extinguishes the liability for duty that was created at the point of manufacture, in prescribed circumstances.

This is an expression not found in excise legislation but it is widely used to describe goods that are subject to excise control. Excisable goods that are subject to excise control are commonly referred to as 'underbond goods' or as being 'underbond'. This includes goods that have not yet been delivered into home consumption and goods moving between premises under a movement permission.

6.7 LEGISLATION (quick reference guide)

In this Chapter, we have referred to the following legislation:

- •

- Excise Act 1901

- –

- section 24 – excisable goods and goods liable to duties of Customs may be used in manufacturing excisable goods

- –

- section 58 – entry for home consumption etc.

- –

- section 59 – payment of duty

- –

- section 59A – declared period quotas - effect on rates of excise duty

- –

- section 60 – persons to keep excisable goods safely etc.

- –

- section 61 – control of excisable goods

- –

- section 61C – permission to deliver certain goods for home consumption without entry

- –

- section 114 – time for commencing action

- –

- section 120 – offences

- –

- section 154 – deposit of duty

- –

- section 155 – limited dispute rights because of objection against private ruling

- –

- section 162C – review of decisions

- •

- Excise Tariff Act 1921

- –

- section 5 – duties of excise

- –

- The Schedule

- •

- Crimes Act 1914

- –

- section 4AA – penalty units

- •

- Income Tax Assessment Act 1997

- –

- section 328-110 – meaning of small business entity

- •

- Taxation Administration Act 1953

- –

- section 359-60 – objections, review and appeals relating to private rulings

Amendment history

| Part | Comment |

|---|---|

| Section 6.3.5 | Updated to reflect the current duty rates |

| Throughout | This chapter was updated to take into account the law changes as a result of the Treasury Laws Amendment (Refining and Improving Our Tax System) Act 2023 and Excise and Customs Legislation Amendment (Streamlining Administration) Act 2024 . This includes permissions to lodge excise returns and pay the applicable excise duty on a quarterly basis. |

| Throughout | Updated in line with current ATO style and accessibility requirements. |

Copyright notice

© Australian Taxation Office for the Commonwealth of Australia

You are free to copy, adapt, modify, transmit and distribute this material as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).

References

| Date: | Version: | |

| 1 July 2006 | Updated document | |

| 1 April 2015 | Updated document | |

| 12 July 2017 | Updated document | |

| 11 December 2017 | Updated document | |

| 4 June 2021 | Updated document | |

| 1 July 2024 | Updated document | |

| You are here | 27 June 2025 | Current document |