Excise guidelines for the fuel industry

-

This document incorporates revisions made since original publication. View its history and amending notices, if applicable.

10 FUEL IN THE EXCISE TARIFF

10.1 PURPOSE

This Chapter deals with:

- •

- the items in the Schedule to the Excise Tariff Act (Schedule) that apply to fuels (including biofuels) and other petroleum products, oils, greases and hydraulic fluids

- •

- the rates of excise that apply

- •

- penalties that can apply to offences in relation to the excise tariff.

10.2 INTRODUCTION

10.2.1 'FUEL' IN THE SCHEDULE TO THE EXCISE TARIFF ACT

Fuel is covered by items 10, 15, 20 and 21 of the Schedule, however this Guide does not cover items 20 (stabilised crude oil) and 21 (condensate).

All ' excisable fuel products ' are classifiable to a subitem of the Schedule, which uses a 2-tiered numbering system of items and then subitems.

Items in the Schedule have a general description (which is also referred to as the preamble) of the goods classified to the item. Under each item are subitems, which provide more specific descriptions of the products included in or excluded from the subitem. Goods classified to a subitem must first be goods of the kind described in the relevant items.

Example 10A

In the general description of item 10, paragraph (i) excludes bitumen from the item. Therefore, bitumen cannot be classified to subitem 10.28 of the Schedule, which includes petroleum products not elsewhere included.

The scope of the subitems may narrow the application of a tariff item in the Schedule.

Example 10B

Paragraph (g) of item 10 refers to blends other than blends covered by subsections 77H(1), (2A), (2B) or (3) of the Excise Act.

Subitem 10.30 of the Schedule (which covers all blends other than 3 specific biofuel blends) applies only to blends that can be used as fuel in an internal combustion engine. This further restricts the application of excise to certain blends.

Using imported products

Imported products attract customs duty and are administered by the Australian Border Force (ABF). Imported fuel products can, in certain circumstances, be used in the manufacture of excisable products. This includes blending. The result of this is the creation of an excise liability and, provided the correct Customs requirements and procedures are followed, the extinguishment of the customs duty liability.

It is common practice for fuel importers to blend imported goods with excisable goods. Blending results in the manufacture of an excisable fuel product.

You should refer to the ABF for import requirements, however if you wish to use imported fuel in the manufacture of excisable goods you should speak to us. In these circumstances, you would need an excise manufacturer licence and a warehouse licence issued under section 79 of the Customs Act 1901 (Customs Act).

Imported fuel is an excise-equivalent good (EEG) and we administer warehoused EEGs under delegation from ABF. We therefore assess applications for warehouse licences for EEGs issued under section 79 of the Customs Act.

Where imported lubricant oils and greases are customs duty-paid (nature 10 entry) and are subsequently used in excise manufacture at an excise licenced site, a refund of the customs duty may be applied for. All customs duty refund applications are dealt with by the ABF.

Product names and descriptions

Some product names in the Schedule are defined in the legislation. The definitions are found in:

- •

- section 3 of the Excise Tariff Act (for example, 'biodiesel')

- •

- the preamble to the Schedule ('lubricant/fluid/oil products'), and

- •

- section 4 of the Excise Act (for example. LPG).

Most products however are not specifically defined and take their meaning according to ordinary usage. Ordinary usage may be determined by physical characteristics, how the products are used, or by current industry practice – for example, gasoline, diesel and kerosene.

Fuel quality standards are made by the Commonwealth department responsible for the administration of the Fuel Quality Standards Act 2000, which provides a legislative framework for setting national fuel quality and fuel quality information standards. [263] The requirements are in place to reduce the adverse effects of motor vehicle emissions on air quality and human health, and to enable Australia to effectively adopt new vehicle engine and emission control technologies.

Fuels to which fuel quality standards apply include petrol, diesel and biodiesel.

Products to which a fuel quality standard applies are excisable even if they do not meet the applicable standard. For example, biodiesel made through chemically altering vegetable oils to form mono-alkyl esters is excisable even if it does not meet the fuel quality standard for biodiesel.

'For use'

Some item classifications in the Schedule depend on the intended use of the goods.

The expression 'for use' means the intended end-use of the product at the time the goods are delivered from ' excise control ' in Australia.

Example 10C

Examples of 'for use' in the Schedule:

- •

- subitem 10.6 Gasoline for use as fuel in aircraft

- •

- Item 15 Goods … other than (a) goods for use as a fuel

Items on your excise return

When you enter a product on your ' ' under a classification from the Schedule that stipulates a particular use, you must have reasonable grounds for believing the product will be used for that purpose and not for any other purpose. Where a classification excludes a particular use, you must have reasonable grounds for believing the product will not be used for that purpose.

You need to keep documentation to substantiate the information you include on your excise return.

Rates of duty when the item is measured by volume

Temperature correction of volume

The volume of fuel products is affected by density and temperature (that is, the volume changes when the temperature changes). In most instances, where rates of duty refer to volume in litres, you should use the volume of the product as if it was measured at 15° C.

*Standardised calculations of measured quantities of petroleum fluids, regardless of point of origin, destination or units of measure used by custom or statute, have been adopted by petroleum companies through an international agreement. The result is the Petroleum Measurement Tables Volume Correction Factors, Volume VIII . [264]

Conversion of weight to volume

There are instances when product is invoiced in kilograms and needs to be converted to litres, such as to:

- •

- record it in stock records, and

- •

- include it in your excise return.

Conversion of measurement of LPG

If you have a liability for excise duty on LPG which was measured in kilograms you can convert the unit of measurement from kilograms to litres by using the conversion rate contained in the Excise Regulation. [265]

You may also, under certain circumstances, use a conversion method determined by the Commissioner in the Excise (Volume of LPG – Temperature and Pressure Correction) Determination 2016 (No. 2) .

Conversion of unit of measurement in the Excise Regulation

LPG that is measured in kilograms may be converted to litres at the rate of 1 kilogram to 1.885 litres. You may only use this conversion factor when the LPG has not been measured using volumetric measurement equipment.

If you decide to apply a particular unit of measurement for LPG which is used for a particular purpose, you are required to apply that unit of measurement throughout the financial year for all LPG used for that purpose. You may, however, seek our permission to use a different unit of measurement during the financial year for that LPG.

Example 10D

John's business is licensed for excise purposes. John supplies LPG to wholesale customers who collect the product from John's LPG refinery (wholesale sales). In these circumstances, the LPG supplied is measured in tonnes by weighbridge measurement and is not measured using temperature and pressure corrected volumetric measurement equipment.

John also separately delivers LPG from his refinery in his own tankers (tanker deliveries to customers). In these circumstances, measurement occurs in litres when delivered to clients.

John is able to determine duty liability for wholesale sales in kilograms and then convert to litres using the conversion factor. John can measure LPG for duty liability purposes in litres for the tanker deliveries to customers.

John is not able to change the measurement unit from kilograms to litres for wholesale sales, or from litres to kilograms for deliveries to customers. If John wishes to change measurement units, he can obtain permission from us or wait until the end of the financial year.

Conversion of unit of measurement in the Excise (Volume of LPG – Temperature and Pressure Correction) Determination 2016 (No. 2)

Excise (Volume of LPG – Temperature and Pressure Correction) Determination 2016 (No. 2) prescribes methods that can be used to determine the volume of excisable LPG delivered into home consumption from premises covered by an excise licence.

There are 3 methods for converting the measurement of transport LPG to litres. The method you may use is dependent on the amount of transport LPG you deliver or reasonably expect to deliver into home consumption in an accounting period.

You are required to use the same method of conversion for the transport LPG you deliver in the accounting period unless we have given you the authority, in writing, to use a different method during the period.

Method 1 – based on density

This method is used where:

- •

- the total amount of transport LPG you deliver, or reasonably expect to deliver, into home consumption from all of your premises covered by an excise licence exceeds 150,000 litres in the accounting period, and

- •

- is measured in kilograms not using volumetric measurement equipment.

The amount of kilograms is converted to litres by either:

- •

- the use of a factor based on the measured density of the LPG at ambient temperature corrected to 15° Celsius using the American Society for Testing and Materials (ASTM) Petroleum Measurement Tables for Light Hydrocarbon Liquids - Density range 0.500 to 0.653 Kg/litre at 15° C [266] ( ASTM Petroleum measurement tables for light hydrocarbon liquids:0.500-0.653kg/l ), or

- •

- the use of the conversion factor stipulated in section 24 of the Excise Regulation.

Example 10E

If a quantity of transport LPG delivered into home consumption has been weighed as having 15.682 tonnes, the volume of the LPG would be determined by applying the conversion factor 1.885 as stipulated in the Excise Regulation for every kilogram of transport LPG (unless the person elects to measure the density of the quantity of transport LPG and apply a specific conversion factor). Application of the Excise Regulation factor 1.885 would result in a volume of 29,561 litres. Excise duty is then calculated on 29,561 litres for a person who has delivered, or reasonably expects to deliver transport LPG exceeding 150,000 litres per accounting period .

Method 2 – based on equilibrium vapour pressure

This method is used where:

- •

- the total amount of transport LPG you deliver, or reasonably expect to deliver, into home consumption from all of your premises covered by an excise licence, exceeds 150,000 litres in the accounting period, and

- •

- is measured using uncorrected volumetric measurement equipment.

This method applies 2 correction factors.

The first correction factor uses the American Petroleum Institute Manual of Petroleum Measurement Standards at Chapter 11.2.2M Compressibility Factors for Hydrocarbons: 350-637 kg/m 3 Density (15° C) and -46° C to 60° C Metering Temperature [267] (API's Petroleum Measurement Compressibility Factor Tables for Hydrocarbons: 350-637 kg/m3), to correct the volume that was metered under operating pressure to the corresponding volume at the equilibrium vapour pressure to account for pressure effects.

The second correction factor uses the ASTM Petroleum measurement tables for light hydrocarbon liquids:0.500-0.653kg/l to correct the volume to 15º C to account for temperature effects.

Example 10F

A quantity of transport LPG is dispensed from an LPG tanker which meters an uncorrected volume of 30,000 litres under a pressure of 3000 kilopascals at a temperature of 27.5° C. During the delivery, the density and equilibrium vapour pressure of the LPG is also measured (at 27.5° C) and shown to be 515 kg/m3 and 510 kilopascals respectively. To determine the corrected volume of LPG delivered, the metered volume would need to be adjusted by the pressure correction factor 1.0121 (as per the American Petroleum Institute's Petroleum Measurement Compressibility Factor Tables for Hydrocarbons: 350-637 kg/m3) to determine the volume at equilibrium vapour pressure and the volume temperature correction factor 0.9675 (as per the ASTM Petroleum measurement tables for light hydrocarbon liquids:0.500-0.653kg/l) to determine the volume at 15° C. Application of the relevant factors would result in an adjusted volume of 29,367 litres. Excise duty is then calculated on 29,367 litres for a person who has aggregated clearances of transport LPG exceeding 150,000 litres per accounting period.

Method 3 – based on ambient temperature and operating pressure

This method may be used where:

- •

- the total amount delivered, or reasonably expected to be delivered into home consumption from all your premises covered by an excise licence in the accounting period is less than 150,000 litres, and

- •

- there is no requirement on your PSP to correct to 15° C and equilibrium vapour pressure.

Under this method you may either correct the volume of transport LPG using either Method 1 or 2 or use the measured volume of transport LPG at ambient temperature and operating pressure.

Example 10G

Following on from Example 10F, if a person's aggregated clearances of transport LPG are less than 150,000 litres per accounting period, and that person delivers transport LPG into home consumption using uncorrected volumetric measuring equipment, that person may either apply Method 2 and correct the volume of fuel to 15° C and equilibrium vapour pressure (that is, 29,367 litres) or use the uncorrected measured volume of fuel at ambient temperature and operating pressure (that is, 30,000 litres). If the uncorrected measured volume is used, excise duty is then calculated on 30,000 litres for a person who has aggregated clearances of transport LPG not exceeding 150,000 litres per accounting period.

Conversion of measurement of compressed natural gas (CNG)

If you have a liability of duty for excisable CNG and the quantity of CNG is measured in megajoules, you are required to use the conversion rate contained in the Excise Regulation. The conversion rate, as at 1 April 2025, is 1 megajoule of CNG to 0.01893 kilograms of CNG. [268]

The conversion rate is subject to periodic review to ensure it continues to accurately reflect the physical characteristics of CNG supplied in the domestic market.

Conversion of unit of measurement in the Excise (Mass of CNG) Determination 2016 (No. 2) Excise (Mass of CNG) Determination 2016 (No. 2) prescribes methods that can be used to determine the mass of excisable CNG delivered into home consumption from premises covered by an excise licence where the CNG is measured in units other than kilogram or megajoules.

10.3 POLICY AND PRACTICE

Fuel products and some products which may not generally be considered as fuel are classified to item 10 of the Schedule.

For example, paragraph 10(d) of the Schedule refers to 'liquid hydrocarbon products derived through a recycling, manufacturing or other process'.

Most hydrocarbon products are derived from petroleum, that is, almost exclusively from crude oil or natural gas production and refining. However, hydrocarbon products can also be derived from non-petroleum sources.

To classify hydrocarbon products derived from non-petroleum sources to a subitem of the Schedule, the product must:

- •

- have the characteristics of gasoline, kerosene, diesel, liquefied natural gas, CNG, heating oil, mineral turpentine or white spirit

- •

- have the physical characteristics of 'fuel oil' set out in subsection 3(4) of the Excise Tariff Act

- •

- have the physical characteristics of 'LPG' set out in section 4 of the Excise Act, or

- •

- be a liquid aromatic hydrocarbon consisting principally of benzene, toluene or xylene or a mixture of them.

Example 10H

Diesel can be produced from used tyres or waste plastic. This diesel is still classified to subitem 10.10, even though not derived from petroleum.

In addition to these hydrocarbon products, item 10 of the Schedule also captures 2 non-hydrocarbon products which can be used as transport fuels. Like any other fuel product, these non-hydrocarbon products must meet the description at both the item and sub-item level to be classified to item 10. Currently, the 2 non-hydrocarbon products classified to item 10 are goods that:

- •

- have the physical characteristics of 'biodiesel' set out in section 3 of the Excise Tariff Act

- •

- are denatured ethanol for use as a fuel in an internal combustion engine.

Exclusions from item 10

Item 10 of the Schedule contains a number of exclusions. These apply to:

- •

- certain uses of fuel in oil production and refining, including

- –

- stabilised crude petroleum oil and condensate for use in the recovery, production, pipeline transportation or refining of petroleum, or as refinery feedstock, and

- –

- refined or semi-refined liquid petroleum products for use in refining petroleum at a refinery covered by a licence, apart from use as fuel in internal combustion engines

- •

- goods classified to item 15 of the Schedule, and

- •

- waxes and bitumen.

Other exclusions from item 10 of the Schedule are referred to under relevant subitems.

10.3.2 PRODUCTS CLASSIFIED TO SUBITEMS OF ITEM 10

The information below provides some context around subitems included in item 10 of the Schedule, grouped according to product type. All excise duty rates listed are current as at 3 February 2025.

Major road transport fuels

Gasoline (other than for use as fuel in aircraft)

The primary use of gasoline is in spark ignition internal combustion engines.

Technology is currently available to produce gasoline from natural gas using the gas to liquids (GTL) method. Gasoline produced in this manner would be classified to item 10(d), subitem 10.5 of the Schedule. Gasoline refined from crude oil and condensate would similarly be classified to subitem 10.5 of the Schedule via item 10(c).

Figure 3: Description and rate of duty applicable to gasoline (other than for use as fuel in aircraft)

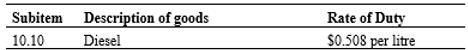

Diesel

Diesel is primarily used as the fuel for compression ignition internal combustion engines (diesel engines). Diesel is not specifically defined in the Excise Tariff Act; therefore, we look to the physical characteristics, how the products are used and current industry practice to determine whether a particular product is diesel.

Recent developments in technology have meant that hydrocarbon fuels can be manufactured from sources other than crude oil or waste oil. Technology now exists that allows fuel to be manufactured from feed-stocks such as waste plastic, used tyres and general household waste or from the hydrogenation of animal fats or vegetable oils.

Renewable diesel is not specifically defined in the Excise Tariff Act and takes the ordinary definition, being diesel manufactured from renewable resources. Paragraph (d) of item 10 of the Schedule includes liquid hydrocarbon products derived through a recycling, manufacturing or other process, and subitem 10.10 specifies diesel.

If the fuel produced from these alternative feedstock can be used to run a diesel engine and its characteristics are generally in line with diesel, it would be classified to item 10(d), subitem 10.10 of the Schedule.

As with gasoline, diesel can also be produced using gas-to-liquid technology.

Figure 4: Description and rate of duty applicable to diesel

Aviation fuels

The major aviation fuels are:

- •

- aviation gasoline (AVGAS), and

- •

- aviation kerosene (also known as aviation turbine fuel, AVTUR or Jet A1).

AVGAS is primarily used in small piston-engine aircraft. It is classified to subitem 10.6 of the Schedule. [270]

AVTUR is primarily used in large turbine-powered aircraft. It is classified to subitem 10.17 of the Schedule. [271]

The excise duty imposed on aviation gasoline and aviation kerosene is used to fund the Civil Aviation Safety Authority (CASA).

Biofuels

Biofuels are fuels made from renewable or organic feedstock or both. Denatured ethanol for use in an internal combustion engine (commonly referred to as 'fuel ethanol'), biodiesel and renewable diesel are biofuels currently in commercial use in Australia.

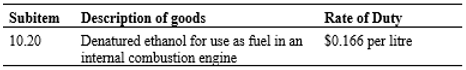

Fuel ethanol

Denatured ethanol for use as fuel in an internal combustion engine is classified to subitem 10.20 of the Schedule. Ethanol is another term for ethyl alcohol.

Manufacturing fuel ethanol

If you produce ethanol for any purpose, you must hold an excise manufacturer licence. If you produce ethanol for fuel and non-fuel applications, your licence must specify this.

Denaturing

Fuel ethanol is usually denatured by the addition of 1% or more of unleaded petrol. However, we will accept other denaturants, provided that they meet the requirements of Excise (Denatured spirits) Determination 2016 (No. 3) which deals specifically with alcoholic beverages. The Explanatory Statement explains the background, purpose and operation of this determination.

Figure 5: Description and rate of duty applicable to denatured ethanol

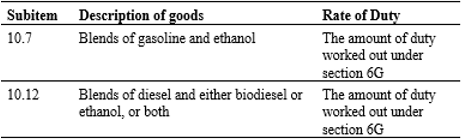

Fuel ethanol blends

Fuel ethanol is usually blended (primarily with petrol) for use as a fuel in spark ignition engines.

In other limited cases, denatured ethanol can be used in compression ignition engines. Although rare, blends of diesel and ethanol are sometimes referred to as 'Diesohol'.

In the Schedule, there are specific subitems for ethanol blends:

Figure 6: Description and rate of duty applicable to fuel ethanol blends

Blending fuel ethanol with products such as petrol or diesel is excise manufacture,. [272] The only exceptions to this rule are:

- •

- where all the components of the blend are duty-paid

- •

- where the blending meets the circumstances prescribed in a determination. [273] For example, fuel ethanol is incidentally blended with other fuel and there is no intention to manufacture a further fuel ethanol blend.

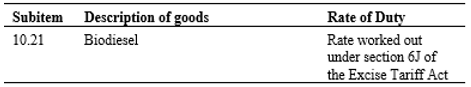

Biodiesel

Biodiesel is defined in subsection 3(1) of the Excise Tariff Act as 'mono-alkyl esters of fatty acids of a kind used as a fuel, derived from animal or vegetable fats or oils whether or not used.' Subitem 10.21 of the Schedule applies only to products that meet this definition. Therefore, fuel produced from animal fats or vegetable oils by hydrogenation (renewable diesel) is not biodiesel for the purposes of the Schedule. Fuel made from other feedstock, such as waste plastics, is also not biodiesel.

Figure 7: Description and rate of duty applicable to biodiesel

Biodiesel manufacture

Biodiesel can be made from the following feedstock:

- •

- new or used vegetable oils (for example, soybean oil, rapeseed/canola oil, cotton seed and mustard seed oils)

- •

- oils from oil bearing trees (for example, palm & coconut oil)

- •

- animal fats for example, beef tallow), and

- •

- waste cooking oils (for example, used frying oil, grease trap waste).

In general, biodiesel can be manufactured by the following processes:

- •

- alkali-catalysed transesterification of the feedstock with alcohol

- •

- direct acid-catalysed esterification of the feedstock with alcohol, or

- •

- the conversion of the feedstock to fatty acids and then to alkyl esters with acid catalysis.

To make biodiesel, you must be licensed as an excise manufacturer regardless of the amount you make or whether you only use it for your own purposes.

Biodiesel blends

Biodiesel is often blended with other fuel (primarily diesel) prior to being used.

Blending biodiesel with products such as diesel is excise manufacture. The only exceptions to this rule are:

- •

- where all the components of the blend are duty-paid fuels [274]

- •

- where the blending meets the relevant circumstances prescribed in a determination. For example, biodiesel is incidentally blended with other fuel and there is no intention to manufacture a biodiesel blend duty-paid

Example 10I

A non-licensed fuel supplier makes a commercial decision to stop supplying biodiesel and to use the tank to expand their diesel storage capability. When the last sale of biodiesel is made the fuel supplier orders a bulk quantity of diesel from their distributor which is discharged into the tank. The tank contained remnants of the biodiesel as it is impractical to completely empty the biodiesel from the tank. There is no intention to make a blend of diesel and biodiesel.

This circumstance is incidental blending as covered by the determination. It is not excise manufacture. (It would also be excluded from excise manufacture on the basis that all components are duty-paid fuels).

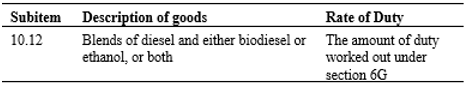

Diesel and biodiesel blends

Blends of diesel and biodiesel are covered by subitem 10.12 of the Schedule.

Figure 8: Description and rate of duty applicable to diesel and biodiesel blends

Diesel and biodiesel blends are usually named by reference to the percentage of biodiesel in the blend. For example, a blend containing 10% biodiesel is referred to as 'B10'. A blend containing 5% biodiesel is referred to as 'B5'.

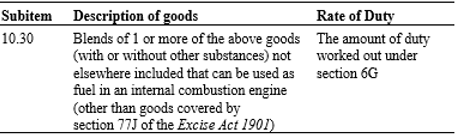

Other fuel blends

Fuel blends that do not have their own specific classification are classified to subitem 10.30 of the Schedule. For a blend to be classified to this subitem, it must be able to be used as fuel in an internal combustion engine. This is accepted as meaning the blend can be used in an internal combustion engine without causing material damage to an engine within a short period (for example, a day or within 100 kilometres).

Figure 9: Description and rate of duty applicable to other fuel blends

Example 10J

Diesel and base oil can be blended together to produce a mould release agent that is used in brick manufacture.

The blend can be used in internal combustion engines and is therefore classified to subitem 10.30 of the Schedule.

- •

- it has been used as a solvent and recycled for use again as a solvent by the user [275] (this is further discussed in Chapter 11 Blending)

- •

- all the components are duty-paid and apart for denatured ethanol and biodiesel, the rate of duty for each component is the same (but not where an entity is eligible to claim a fuel tax credit on any of the components) [276]

- •

- the blend is not marketed or sold for use as fuel in an internal combustion engine and it contains products listed in the Schedule of the Fuel Tax (Fuel Blends) Determination 2016 (No. 1) at a concentration equal to or greater than the specified minimum, or

- •

- it is covered by Excise (Blending Exemptions) Instrument 2024 .

Calculating duty according to section 6G of the Excise Tariff Act

The rate of duty applicable to these specified blends is determined in accordance with the method statement in section 6G of the Excise Tariff Act. This method takes account of any duty already paid on the components of the blend.

The method for working out the duty payable on these blends is:

Step 1

Add up the amount of duty that would be payable on each constituent of the blend that is classified to item 10 of the Schedule.

Step 2

Work out the volume, in litres, of any other constituent of the blend (excluding any water added to the manufacture of the blended goods). [277]

Step 3

Multiply the result of Step 2 by the rate $0.508.

Note: the rate set out in this Step is indexed under section 6A of the Excise Tariff Act.

Step 4

Total the results of Steps 1 and 3.

Step 5

Subtract from the total any duty paid on a constituent of the blended goods that is classified to item 10 or 15 of the Schedule.

If a constituent of the blended goods was imported, and customs duty was paid or payable on the goods, treat that customs duty as if it were excise duty in working out the duty payable. In the unlikely situation where the rate of excise duty on a constituent of the blended goods would be less than the customs duty paid, use the lesser amount in working out the duty payable. [278]

Example 10K

Marvin's Fuel manufactures a B20 blend (20% biodiesel ÷ 80% diesel) using 16,000 litres of ' underbond ' diesel and 4,000 litres of duty-paid domestic biodiesel.

Marvin's Fuel works out the duty payable on the blend under section 6G of the Excise Tariff Act as follows:

Step 1:

- •

- 16,000 litres of diesel at $0.508 per litre = $8,128.

- •

- 4,000 litres of biodiesel at $0.152 per litre = $608

- •

- Total = $8,736

Step 2: Nil

Step 3: Nil

Step 4: Total of Steps 1 and 3 = $8,736

Step 5:

- •

- Step 4 less duty paid = $8,736 - $608

- •

- Duty payable on the blend (to nearest dollar) = $8,128.00

Example 10L

Esther's Fuels manufactures an E10 blend from 18,000 litres of duty-paid gasoline and 2000 litres of duty-paid fuel ethanol.

Step 1:

- •

- 18,000 litres of gasoline at $0.508 per litre = $9,144.

- •

- 2,000 litres of fuel ethanol at $0.166 per litre = $332

- •

- Total = $9,476

Step 2: Nil

Step 3: Nil

Step 4: Total of Steps 1 and 3 = $9,476

Step 5:

- •

- Step 4 less duty paid = $9,476 - $9,476

- •

- Duty payable on the blend (to nearest dollar) = $0.

As there is no duty payable on the blend, Esther's Fuels is not required to enter the E10 blend on the excise return (or returns) for the period (or periods) when the blend is delivered into home consumption as all components are duty-paid.

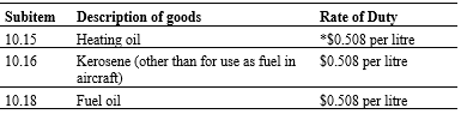

Burner fuels

Kerosene, heating oil and fuel oil [279] are often described as burner fuels because these products are mainly used in burner applications (for example, as fuel for heating appliances). They are also capable of being used in other applications, for example, as solvents.

Figure 10: Description and rate of duty applicable to burner fuels

*Rate of duty as at 5 August 2024.

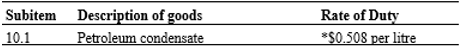

Crude oil and condensate used as fuel

Condensate, stabilised crude oil and topped crude oil are included in item 10 of the Schedule when these products are used directly as fuel.

Condensate or stabilised crude oil is excluded from item 10 of the Schedule when used:

- •

- in the recovery, production, pipeline transportation or refining of crude oil or condensate, or

- •

- as refinery feedstock.

Condensate is a defined term meaning [281] :

- (a)

- liquid petroleum, or

- (b)

- a substance:

- (i)

- that is derived from gas associated with oil production; and

- (ii)

- that is liquid at standard temperature and pressure.

Figure 11: Description and rate of duty applicable to condensate used as fuel

*Rate of duty as at 3 February 2025.

Stabilised crude petroleum oil (stabilised crude oil) is produced when crude oil from a well is extracted in, or converted to, a state in which it can be safely stored, transported and further dealt with.

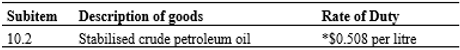

Figure 12: Description and rate of duty applicable to stablised crude oil

*Rate of duty as at 3 February 2025.

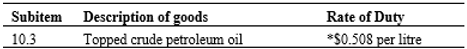

Topped crude petroleum oil (topped crude oil) is produced when the more valuable light fractions are removed from crude oil.

Figure 13: Description and rate of duty applicable to topped crude oil

*Rate of duty as at 3 February 2025.

*Rate of duty as at 3 February 2025.

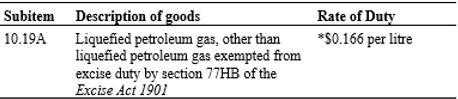

Liquefied petroleum gas (LPG)

LPG is defined to include [282] :

- •

- liquid propane

- •

- liquid mixture of propane and butane

- •

- liquid mixture of propane and other hydrocarbons that consists mainly of propane, or

- •

- a liquid mixture of propane, butane and other hydrocarbons that consists mainly of propane and butane.

LPG is the generic name for mixtures of light hydrocarbon gas, consisting of mainly propane or propane and butane that have been liquefied through cooling or compression. These gases are produced either directly through the processing of crude oil and natural gas or as a by-product of the petroleum refining process.

LPG is generally supplied as a mixture of propane and butane but it can also be supplied as 100 percent propane. It may also include a small proportion of other hydrocarbons.

In addition to being used as a transport fuel, LPG containing propane only is used for a variety of purposes including commercial and domestic cooking, drying and heating.

A remission of duty is available where the LPG is supplied for non-transport use. [283]

Although this means that no duty is payable on non-transport LPG, you still need an excise licence to manufacture the goods.

LPG is exempt from duty when it is used at the premises specified in a manufacturer licence in the process of manufacturing [284] :

- •

- petroleum condensate or stabilised crude petroleum oil, or

- •

- liquefied petroleum gas, liquefied natural gas or other hydrocarbons.

This is provided the manufacture of the goods is done in accordance with the manufacturer licence.

Figure 14: Description and rate of duty applicable to LPG

*Rate of duty as at 3 February 2025.

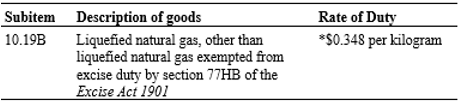

Liquefied natural gas (LNG)

LNG is produced from natural gas that is cooled to the point that it condenses to a liquid. The majority of LNG manufactured in Australia is exported although some is used as a transport fuel, generally in heavy-duty long range road transport.

Excise is calculated as a rate of cents per kilogram, rather than cents per litre as with other fuels.

A remission of duty is available where the LNG is supplied for non-transport use. [285]

Although this means that no duty is payable on non-transport LNG you still need an excise licence to manufacture the goods.

LNG is exempt from duty when it is used at the premises specified in a manufacture licence in the process of manufacturing [286] :

- •

- petroleum condensate or stabilised crude petroleum oil, or

- •

- liquefied petroleum gas, liquefied natural gas or other hydrocarbons.

This is provided the manufacture of the goods is done in accordance with the manufacturer licence.

Figure 15: Description and rate of duty applicable to LNG

*Rate of duty as at 3 February 2025.

Compressed natural gas

CNG is natural gas that is compressed. CNG is used in some bus fleets, street sweepers and garbage collection vehicles. There is currently no significant use of CNG in cars in Australia.

CNG is exempt from duty if it was compressed:

- •

- for use other than as a fuel for a motor vehicle [287]

- •

- other than in the course of carrying on an enterprise [288]

- •

- for use as a fuel for a forklift vehicle that is used primarily off public roads, or [289]

- •

- at a residential premises

- AND

- •

- the rate at which the gas was compressed at those premises is not more than 10 kilograms of compressed natural gas per hour, and

- •

- the gas is not sold or otherwise supplied in the course of carrying on an enterprise. [290]

In most instances, the ultimate use of CNG will be known at the time of compression. For instance, compression will commonly occur directly before delivery into the motor vehicle or into storage tanks for other uses. Hence, it will be readily established whether CNG is eligible for exemption. If the CNG you manufacture is exempt, you do not need to hold a licence under the Excise Act to undertake that activity.

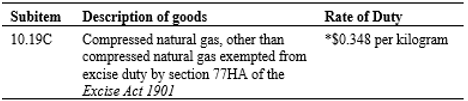

Figure 16: Description and rate of duty applicable to CNG

*Rate of duty as at 3 February 2025.

Liquid aromatic hydrocarbons

Some industrial processes, such as coal coking, waste incineration and some plastics production, result in by-products consisting principally of the aromatic hydrocarbons benzene, toluene and xylene, or mixtures of them. These can be used as fuels.

Other substances may be present in these products, but these aromatics must be the principal constituents to be classified to subitem 10.25 of the Schedule.

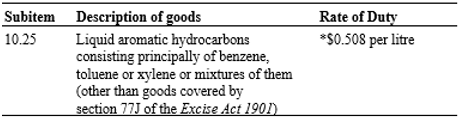

Figure 17: Description and rate of duty applicable to liquid aromatic hydrocarbons

*Rate of duty as at 3 February 2025.

Mineral turpentine and white spirit

Mineral turpentine and white spirit are very similar and are predominantly used as solvents.

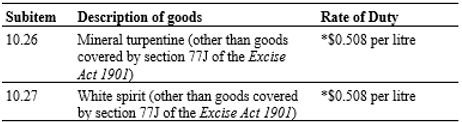

Figure 18: Description and rate of duty applicable to mineral turpentine and white spirit

*Rate of duty as at 3 February 2025.

Petroleum products not elsewhere included

Subitem 10.28 of the Schedule includes all unblended petroleum products not elsewhere included that fall within the general description of item 10 of the Schedule. Products classified to this subitem can be as diverse as lighter fluid, naphtha and recycled waste oil, including waste oil recycled by filtering, dewatering and demineralisation. Waste oil that is only subjected to a filtering and dewatering process is not an excisable good captured by the Schedule as the process is not considered to be excise manufacture. [291]

Recycled waste oil is only classified to this subitem if it cannot be classified elsewhere (for example, diesel to subitem 10.12 of the Schedule; re-refined base oil not for fuel use to subitem 15.2 of the Schedule).

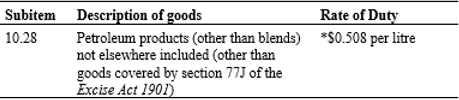

Figure 19: Description and rate of duty applicable to petroleum products not elsewhere included

*Rate of duty as at 3 February 2025.

10.3.3 PRODUCTS CLASSIFIED TO ITEM 15

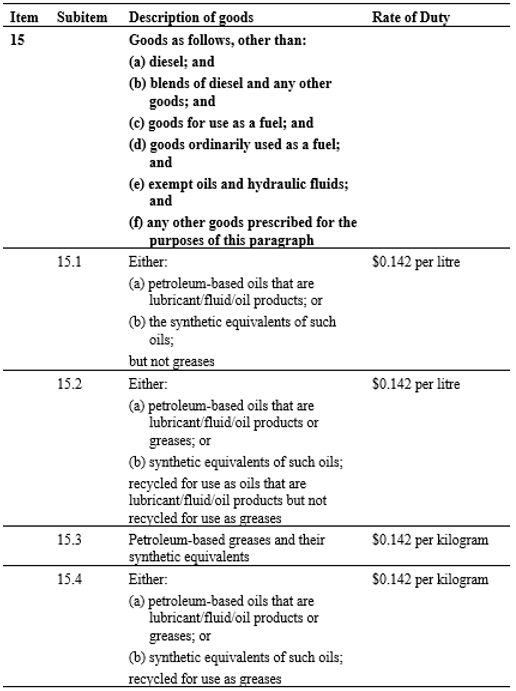

Figure 20: Description and rate of duty applicable to goods classified to item 15

The preamble to item 15 covers:

Goods as follows, other than:

- (a)

- diesel; and

- (b)

- blends of diesel and any other goods; and

- (c)

- goods for use as a fuel; and

- (d

- goods ordinarily used as a fuel; and

- (e)

- exempt oils and hydraulic fluids; and

- (f)

- any other goods prescribed for the purposes of this paragraph

Exempt oils and hydraulic fluids are those that meets the specified industry standards or criteria specified in the Excise Tariff Act [292] and which are:

- •

- food grade white mineral oil

- •

- polyglycol brake fluids, and

- •

- aromatic process oils.

Goods for use as a fuel and goods ordinarily used as a fuel are not classified to item 15 of the Schedule but may be excisable under item 10 of the Schedule.

Example 10M

An oil recycler produces re-refined base oil which can be manufactured into lubricating oil by the addition of suitable additives. It can also be used as fuel and in its current form is ordinarily used as a fuel.

The base oil is delivered for home consumption. It does not meet industry standards for diesel or another specified product under item 10 of the Schedule.

The base oil is not classified to item 15 of the Schedule to the Excise Tariff Act. It is classified to subitem 10.28 of the Schedule (as a petroleum product (other than a blend) not elsewhere included (and not covered by section 77J of the Excise Act). Duty is payable at $0.508 per litre.

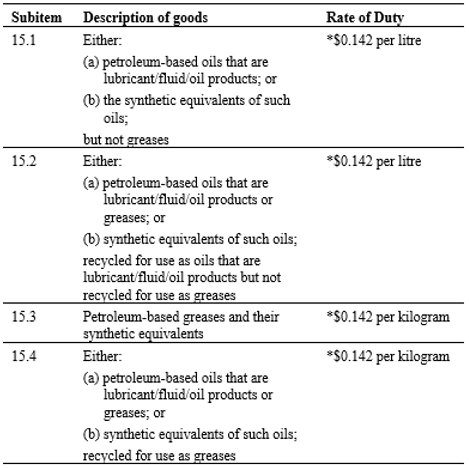

Item 15 of the Schedule specifies the following subitems:

Figure 21: Description and rate of duty applicable to subitems under item 15 of the Schedule

*Rate of duty as at 3 February 2025.

Synthetic equivalents of petroleum based oils and greases

A synthetic product is equivalent to a petroleum-based (lubricant or fluid or oil) product where it performs the equivalent function of the petroleum-based oil. Factors to consider include indicated use and marketing. [293]

Example 10N

Synthetic lubricating oil is designed to be used as lubricating oil in an engine. It performs the same function as petroleum-based lubricating oil. It is therefore the equivalent of petroleum based lubricating oil.

If you are unsure whether your products are subject to excise duty under item 15 of the Schedule, you can seek advice from us.

10.4 PROCEDURES

If you need more information on fuel in the excise tariff, contact us via:

- •

- phone 1300 137 290

- •

- ATO Online Services , or

- •

- write to us at

- Australian Taxation Office

PO Box 3514

ALBURY NSW 2640

We will ordinarily respond to written information requests within 28 days. If we cannot respond within 28 days, we will contact you within 14 days to obtain more information or negotiate an extended response date.

10.5 PENALTIES THAT CAN APPLY IN RELATION TO THE EXCISE TARIFF

The following are the penalties that may apply after conviction for an offence.

Manufacture

If you manufacture ' excisable fuel products ' without a manufacturer licence, the penalty is a maximum of 2 years in prison or the greater of 500 ' penalty units ' and 5 times the amount of duty on the excisable fuel products. [294]

If you manufacture excisable fuel products contrary to the Excise Act or any conditions specified in your licence, the penalty is a maximum of 2 years in prison or 500 penalty units. [295]

If you manufacture excisable fuel products at premises that are not specified in your licence, the penalty is a maximum of 2 years in prison or the greater of 500 penalty units and 5 times the amount of duty on the excisable fuel products. [296]

Move, alter or interfere

If you move underbond excisable fuel products without approval, the penalty is a maximum of 2 years in prison or the greater of 500 penalty units and 5 times the amount of duty on the excisable fuel products. [297]

Note: this includes moving underbond excisable fuel products from your premises to any other location or for export.

If your movement of underbond excisable fuel products does not comply with the permission to move the underbond excisable fuel products, the penalty is a maximum of 2 years in prison or the greater of 500 penalty units and 5 times the amount of duty on the excisable fuel products. [298]

If you move, alter or interfere with excisable fuel products that are subject to excise control , without permission, the penalty is a maximum of 2 years in prison or the greater of 500 penalty units and 5 times the amount of duty on the excisable fuel products. [299]

Deliver

If you deliver excisable fuel products into ' home consumption ' contrary to your permission, the penalty is a maximum of 2 years in prison or the greater of 500 penalty units and 5 times the amount of duty on the excisable fuel products. [300]

Records

If you do not keep, retain and produce records in accordance with a ' direction under section 50 ' of the Excise Act, the penalty is a maximum of 30 penalty units.

Directions

If you do not comply with a direction in regard to what parts of the factory can be used for various matters, the penalty is a maximum of 10 penalty units. [301]

False or misleading statements

If you make a false or misleading statement, or an omission from a statement in respect of duty payable on particular goods, to us, the penalty is a maximum of 50 penalty units and twice the amount of duty payable on those goods. [302]

Evade

If you evade payment of any duty which is payable, the maximum penalty is 5 times the amount of duty on the excisable fuel products, or where a court cannot determine the amount of that duty the penalty is a maximum of 500 penalty units. [303]

Facilities etc.

If you do not provide all reasonable facilities for enabling us to exercise our powers under the Excise Act, the penalty is a maximum of 10 penalty units. [304]

If you do not provide sufficient lights, correct weights and scales, and all labour necessary for weighing material received into and all excisable fuel products manufactured in your factory and for taking stock of all material and excisable fuel products contained in your factory, the maximum penalty is 10 penalty units. [305]

If we mark or seal excisable fuel products or fasten, lock or seal any plant in your factory and you alter, open, break or erase the mark, seal, fastening or lock, the maximum penalty is 50 penalty units. [306]

10.6 TERMS USED

Excisable goods are goods on which excise duty is imposed. Excise duty is imposed on goods listed in the Schedule and that are manufactured or produced in Australia and listed in the Schedule.

As this Guide deals with fuel products, we have used the term excisable fuel products.

Excisable fuel products include:

- •

- petrol

- •

- diesel

- •

- renewable diesel

- •

- crude petroleum oil

- •

- condensate

- •

- heating oil

- •

- kerosene

- •

- fuel ethanol

- •

- biodiesel

- •

- compressed natural gas (CNG)

- •

- liquefied natural gas (LNG), and

- •

- liquefied petroleum gas (LPG).

While oils and grease classified to item 15 are not technically fuel, we have included them in this generic term in this Guide.

This Guide does not cover stabilised crude petroleum oil or condensate classified to items 20 and 21 respectively in the Schedule.

Goods are subject to excise control from the point of manufacture until they have been delivered into home consumption or for export.

Goods subject to excise control cannot be moved, altered or interfered with except as authorised by the Excise Act.

An excise return [307] is the document that you use to advise us the volume of excisable fuel products that you have:

- •

- delivered into home consumption during the period designated on your PSP, or

- •

- wish to deliver into home consumption following approval.

'Home consumption' [308] is the term used in the Excise Act and this Guide to describe when excisable fuel products are released into the Australian domestic market for consumption. The term used in the legislation is 'deliver for home consumption'.

Normally, this will be by delivering the goods away from premises covered by a licence but includes using those goods within those premises (for example, using fuel to run equipment in premises covered by your licence). It does not include goods delivered for export or the movement of goods underbond (see definition below) to another site covered by a licence.

The term 'home consumption' is not defined in the Excise Act and there is no definitive case law that looks at the issue in question. However there are several cases where issues closely related to it are considered. [309]

The conclusion drawn from those cases is that 'home consumption' refers to the destination of goods as being within Australia as opposed to exporting them.

The value of a penalty unit is contained in section 4AA of the Crimes Act 1914 , and is indexed regularly. The dollar amount of a penalty unit is available at Penalties .

This is a written instruction issued under section 50 of the Excise Act to a manufacturer, or proprietor of licensed premises covered by a storage licence, to keep specified records, furnish specified returns, retain records for a specified period and produce those records on demand by us.

This is an expression not found in excise legislation but it is widely used to describe goods that are subject to excise control. Excisable goods that are subject to excise control are commonly referred to as 'underbond goods' or as being 'underbond'. This includes goods that have not yet been delivered into home consumption and goods moving between premises under a movement permission.

10.7 LEGISLATION (quick reference guide)

In this Chapter, we have referred to the following legislation:

- •

- Excise Act 1901

- –

- section 4 – definitions

- –

- section 24 – excisable goods and goods liable to duties of Customs may be used in manufacturing excisable goods

- –

- section 25 – only licensed manufacturers to manufacture excisable goods

- –

- section 26 – licensed manufacturers to manufacture in accordance with Act and licence

- –

- section 27 – licensed manufacturers to manufacture only at premises covered by a licence

- –

- section 49 – facilities to officers

- –

- section 50 – record keeping

- –

- section 51 – collector may give directions

- –

- section 52 – weights and scales

- –

- section 58 – entry for home consumption etc.

- –

- section 61 – control of excisable goods

- –

- section 61A – permission to remove goods that are subject to CEO's control

- –

- section 61C – permission to deliver certain goods for home consumption without entry

- –

- section 77H – blending exemptions

- –

- section 77HA – compressed natural gas that is exempt from excise duty

- –

- section 77HB – liquefied petroleum gas and liquefied natural gas that is exempt from excise duty

- –

- section 77J – goods that are not covered by subitem 10.25, 10.26, 10.27, 10.28 or 10.30

- –

- section 77K – crude oil and condensate may attract more than one excise duty

- –

- section 92 – seals etc. not to be broken

- –

- section 117A – unlawfully moving excisable goods

- –

- section 117B – unlawfully selling excisable goods

- –

- section 120 – offences

- •

- Excise Tariff Act 1921

- –

- section 3 – definitions

- –

- section 6G – duty payable on blended goods

- –

- Schedule item 10(j) –goods covered by 77HA or 77HB of the Excise Act 1901

- •

- Excise Regulations 2015

- –

- section 24 – conversion of measurements of LPG and compressed natural gas

- –

- clause 2 of Schedule 1

- •

- Crimes Act 1914

- –

- section 4AA – penalty units

Amendment history

| Part | Comment |

|---|---|

| Throughout | This chapter was updated to take into account the law changes as a result of the Excise and Customs Legislation Amendment (Streamlining Administration) Act 2024 . |

| Throughout | Updated in line with current ATO style and accessibility requirements. |

Copyright notice

© Australian Taxation Office for the Commonwealth of Australia

You are free to copy, adapt, modify, transmit and distribute this material as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).

References

| Date: | Version: | |

| 1 July 2006 | Updated document | |

| 1 April 2015 | Updated document | |

| 12 July 2017 | Updated document | |

| 11 December 2017 | Updated document | |

| 4 June 2021 | Updated document | |

| 1 July 2024 | Updated document | |

| You are here | 27 June 2025 | Current document |