Discussion Paper

Thin capitalisation - attribution of risk weighted assets to Australian branches of foreign banks

| Table of Contents | Paragraph |

|---|---|

| Background | |

| What this document is about | |

| The legislation | |

| Current thinking – proposed approach | |

| Examples | |

| Example 1 – Australian branch with Australian customers | |

| Example 2 – Transactions booked offshore – significant functions performed in Australia | |

| Example 3 – Transactions booked offshore interbranch funding from Australian branch | |

| Example 4 – Transactions booked offshore – no interbranch funding from Australian branch | |

| Example 5 – Transactions booked in Australia – functions performed offshore | |

| Example 6 – Transactions booked offshore – support services provided from Australia | |

| Documentation | |

| Appendix A – Factors considered in attribution of RWA | |

| Appendix B – Previous notification to industry in April 2021 |

|

Purpose and status of this discussion paper

The purpose of this paper is to facilitate consultation between the Australian Taxation Office (ATO) and the community as part of the process of developing advice on the application of the tax law. This paper is prepared solely for the purpose of obtaining comments from interested parties. All views in this paper are therefore preliminary in nature and should not be taken as representing either an ATO view or that the ATO will take a particular view. This paper is not a publication that has been approved to allow you to rely on it for any purpose and is not intended to provide you with advice or guidance, nor does it set out the ATO's general administrative practice. Therefore, this paper does not provide protection from primary tax, penalties or interest for any taxpayer that purports to rely on any views expressed in it. |

| Date of issue | 17 April 2024 | |

| Contact officer (for comments or further information) | Name of officer: | Johanna Tang |

| Email: | Johanna.Tang@ato.gov.au | |

| Phone: | 02 9374 1689 | |

| Final date for comments | 31 May 2024 | |

| Please note that your submission (including name and address details if included) will be published on the ATO website unless you indicate that you do not wish this to occur. Automatically generated confidentiality statements in emails do not suffice for this purpose. Respondents who would like part of their submission to remain unpublished should provide this information marked as such in a separate attachment. | ||

1. Foreign banks that conduct their banking business in Australia through a branch(es) are subject to Australia's thin capitalisation rules.[1],[2] The rules require a foreign bank to allocate a minimum amount of equity capital to its branch. The rules can impact on the amount of debt deductions allowable to the branch.

2. Typically, foreign banks use the safe harbour rule to work out their minimum capital amount. The rule is based on ensuring there is sufficient equity capital funding that part of the risk-weighted assets (RWAs) of the bank that is attributable to its branch.

3. The ATO does not have a published view on how to determine that part of the RWAs attributable to a branch. In historical audit and review activity, the ATO has not focused on this issue and has practically relied on amounts recorded in a branch's books for the purposes of determining the RWA attributable to the Australian branch, that is, the branch balance sheet prepared for management and Australian Prudential Regulation Authority (APRA) reporting purposes.

4. On 1 April 2021, we issued a letter titled 'Justified Trust Top 1000 Program, Banking and Finance: Key Observations – Income Tax' to the Australian Financial Markets Association and the Australian Banking Association. The letter contained an appendix titled 'Appendix D: Thin Capitalisation for inward investing ADIs' relating to attribution of RWA to Australian Branches.[3] The Appendix captured our observations from the first round of Top 1000 Justified Trust reviews where we noticed a lack of documentation to (i) confirm that RWAs are determined in accordance with prudential standards; and (ii) explain how the bank worked out that part of the RWAs attributable to the branch. The Appendix also outlined the information a foreign bank should provide to the ATO to assist in obtaining high assurance over its thin capitalisation position. However, as already pointed out, we did not have an ATO view on the attribution of RWA to the branch.

5. During our review activity, we discovered that some foreign banks were close to breaching their thin capitalisation threshold. We also discovered that a number of different factors and weightings were taken into account by foreign banks in deciding where RWAs are booked, and in general there wasn't a consistent approach. These factors are listed in Appendix A to this paper. In addition, there were a number of taxpayers that found it challenging to provide any response to explain their decision-making process around whether or not RWAs were booked in the Australian branch.

6. The primary objective of this discussion paper is to assist in developing an ATO view in relation to the attribution of the RWA, which will provide taxpayers with clear expectations as to the acceptable approach for the purposes of the thin capitalisation provisions.

7. This discussion paper is about the safe harbour formula used to work out the minimum capital amount of inward investing entities (ADIs). It outlines our suggested view on how to work out that part of the RWAs attributable to a branch of a foreign bank.[4] It also sets out the expected supporting documentation that will be accepted by the ATO for Justified Trust reviews in respect of thin capitalisation positions. However, this is a discussion paper, and we invite feedback and comments to assist in developing a final view.

8. The thin capitalisation rules for an inward investing entity (ADI) are in Subdivision 820-E of the Income Tax Assessment Act 1997 (ITAA 1997). A foreign bank is an inward investing entity (ADI) if it carries on its banking business in Australia at or through one or more branches. Branches are treated as if they are separate entities that require a certain minimum level of capital to operate a banking business in Australia.

9. The rules are based broadly on the methodology of the capital adequacy requirements prescribed by prudential regulators.

10. Step 1 of the method statement in section 820-405 of the ITAA 1997 requires entities to 'work out the average value, for the income year, of that part of the *risk-weighted assets of the entity that: (a) is attributable to the [branch] at or through which it carries on its banking business in Australia' (emphasis added). 'Risk-weighted assets' is defined in section 995-1 of the ITAA 1997 as the sum of the entity's risk exposures as determined by prudential standards of APRA or the prudential regulator in the bank's country of residence.

Current thinking – proposed approach

11. This discussion paper outlines the method which may be acceptable to the ATO based on our current thinking. While we consider this method produces outcomes which comply with the law, our focus is also on practical compliance.

12. We consider that an asset is attributable to the place where the significant people functions pertinent to the creation and management of the relevant asset are carried out.

13. Consistent with OECD guidance, we consider the significant people functions pertinent to the creation and management of the relevant asset to be those that are key entrepreneurial risk-taking functions.[5]

14. Below is an example in relation to a loan[6]:

- a.

- Significant people functions relating to the creation of a loan may include (but are not limited to) negotiating contractual terms (including pricing and credit enhancements), evaluating credit, currency and market risks, assessing the client's creditworthiness and banks' credit exposure to the client, and committing the bank to the loan.

- b.

- Significant people functions relating to the management of a loan would generally relate to decision-making in connection with risks and may include (but are not limited to) making decisions about whether and to what extent various risks should continue to be borne by the bank. This may involve decisions relating to the use of derivatives to transfer or hedge risks.

15. Not all functions relating to RWAs are significant people functions. Support functions, sometimes called back-office functions, are generally not significant people functions. They include general management, the setting of business strategies, personnel functions, clerical and administrative functions, and accounting and information technology (IT) services.

16. The attribution of assets by reference to significant people functions is consistent with OECD guidance relating to the attribution of profits to permanent establishments.[7] While the 2010 OECD Report relates to profit attribution, it contains useful guidance for determining whether an asset is attributable to a branch. Under Part 1 General Considerations, there is guidance on the 'attribution of assets' at paragraphs 18 to 20.

17. The 2010 OECD Report states at paragraph 18 of Part 1 that:

... there is a broad consensus that assets generally are to be attributed to the part of the enterprise which performs the significant people functions relevant to the determination of economic ownership of assets. ... The attribution of economic ownership of assets will have consequences for both the attribution of capital and interest-bearing debt and the attribution of profit to the [permanent establishment].

18. And at paragraph 20 of Part II:

In the case of financial assets of financial enterprises, the creation and management of such assets (and their attendant risks) is itself the significant people function relevant to determining the initial economic ownership of the assets ...

19. References throughout this paper, including the examples, to significant people functions means significant functions of the kind outlined in paragraphs 12 to 18 of this paper.

20. The ATO is aware that APRA generally expects foreign banks licensed as a foreign ADI in Australia to book their Australian business in the Australian branch. While the method of attribution outlined above is not based on APRA guidelines, it is expected that attribution based on significant people functions will generally be consistent with attribution under APRA's approach to asset attribution. In August 2021, APRA issued Guidelines for overseas banks operating in Australia.[8] At page 36, these Guidelines state that:

APRA has generally taken the position that overseas banks soliciting and operating an active business in Australia should be subject to Australian prudential regulation and supervision... An Australian branch of a foreign ADI is expected to be able to operate on a semi-stand-alone basis. It is expected to book its Australian business in the Australian branch (unless otherwise agreed by APRA...) and is expected to maintain local staffing sufficient to demonstrate adequate local control over the Australian business and compliance with all of APRA's prudential requirements applicable to foreign ADIs.

21. For completeness, we note that in limited circumstances, APRA may permit a foreign ADI to book parts of their Australian business offshore where APRA's ability to supervise is not reduced, the proposed business is immaterial compared to the total business operations of the foreign ADI's Australian branch, and the proposed business is not a critical function to the Australian financial services industry. There would also be instances where the Australian branch is transacting with an offshore client where the asset should be booked in Australia (that is, OBU business).

22. It is important to note that RWA attribution is separate and distinct from the requirement under Division 815 of the ITAA 1997 to determine the profit attributable to an Australian branch. The fact that an RWA is booked in a particular location does not necessarily mean the whole profit associated with that RWA is also booked there. Under Division 815 of the ITAA 1997, there is scope to reward functions in various jurisdictions associated with the creation and management of an RWA through the appropriate transfer pricing methodology.

23. Despite OECD guidance[9] regarding the splitting of assets, we are not proposing that individual assets be split between different parts of the same legal entity; although splitting may be relevant to a portfolio of assets – that is, a loan book, where some loans may be attributable to the branch and others not. We understand that for practical reasons, the industry practice is that the whole amount of a RWA is attributed to one location. For completeness, we note that attributing individual assets to one part of an entity does not necessarily impact the correct outcome under Division 815 of the ITAA 1997, given that determining the correct profit attribution to an Australian permanent establishment (PE) of a non-resident under Division 815 is a separate and independent decision to determining RWA attribution under Division 820 of the ITAA 1997.

24. We are currently considering the date of effect of our view and how to apply our view to income years. It may be necessary to reconstruct the prior year accounts of a branch even where our views are applied prospectively. This situation would arise, for example, where we undertake review or audit activity and discover after the end of an income year that a bank's approach is inconsistent with the acceptable method.

For example, if we applied our finalised view prospectively to income years commencing on or after 1 January 2025 and commenced an audit in January 2027 of the income year commencing 1 January 2025, any relevant adjustments to the RWAs attributable to the Australian branch would apply to the income year commencing 1 January 2025 and subsequent years. This would include assets created before and after 1 January 2025, such as a loan entered into on 30 May 2020.

25. We welcome your comments on these matters relating to the timing of application.

26. Finally, we recognise that the assets recorded in the accounts and books of an Australian branch could potentially form a practical starting point for identifying the RWAs attributable to a branch of a foreign bank if the way in which the assets were recorded align with where the majority of the significant people functions are performed. This approach is consistent with the relevant Explanatory Memorandum, which states (emphasis added)[10]:

The method statement requires an allocation or attribution of risk-weighted assets of the foreign bank to its Australian branch(es). Hence, inter-branch assets shown in the books of the branch will not automatically be taken to be part of the risk-weighted assets of the branch unless they can be shown to reflect the attribution process. Moreover, inter-branch dealings undertaken for risk management purposes will not, of themselves, increase or decrease the risk-weighted assets attributable to the Australian branch.

27. We note that paragraph 4.38 in the Explanatory Memorandum states (emphasis added)[11]:

The risk-weighted assets included in a report to the relevant prudential regulator will be accepted as supporting the branch's calculation of its risk-weighted assets to the extent that the report provides information on the risk-weighted assets attributed to the branch.

28. Similar to the above, while we observe that paragraph 4.38 in the Explanatory Memorandum expresses recognition of the supportive nature of reports (which include RWAs) to relevant prudential regulators, we do not consider this statement to be suggesting that such reports would be determinative for the purposes of RWA attribution.

29. We acknowledge that Taxation Ruling TR 2005/11 Income tax: branch funding for multinational banks (which deals with issues relating to the funding of a branch of a multinational bank) recognises the allocation of equity in an Australian bank's books of account, as a basis for the attribution of equity amounts to the bank's foreign branches for Division 820 of the ITAA 1997 purposes. The second part of the ruling deals with the attribution of equity capital to a branch of a bank and focuses on the interaction of Australia's PE attribution rules and Division 820. It states at paragraphs 11 to 12 that:

11. Subject to paragraph 12, the amount of equity attributable to an Australian bank's foreign branches for Division 820 purposes is the amount actually allocated to them in the bank's books of account.

12. Where an amount of equity capital allocated to a foreign branch in the bank's books of account is adjusted for foreign tax purposes or by the Tax Office for other tax purposes, the adjusted amount should be used in the calculation of the equity capital attributable to the branch for Division 820 purposes.

30. It is important to recognise that TR 2005/11 relates to the amount of equity capital attributable to a branch under sections 820-300 and 820-395 of the ITAA 1997 respectively, not the minimum capital amount under the safe harbour rules in sections 820-310 and 820-405 of the ITAA 1997. The concept of RWAs is expressly relevant to the determination of safe harbour minimum capital amounts, not the amounts to which TR 2005/11 applies.

31. Furthermore, in the Explanation section of TR 2005/11 under the heading 'The framework of Division 820 of the ITAA 1997', paragraph 35 states that (footnotes omitted):

Subject to paragraph 37, the 'equity capital attributable to the bank's foreign branches will be the amount actually allocated to them' in the entity's books of account, provided that those accounts are properly maintained in accordance with applicable accounting laws and standards.

32. While there is no legal requirement for the accounts of an Australian branch of a foreign bank to be prepared in accordance with Australian accounting standards, accounts are acceptable for the purposes of TR 2005/11 only if 'properly maintained in accordance with applicable accounting laws and standards'.[12] This indicates that it is not the books of accounts per se that are acceptable.

33. The examples below illustrate how the method acceptable to the ATO should be applied.[13] In addition to the impact on the thin capitalisation calculation, consideration should be given to other tax issues such as funding cost deductibility, interest withholding tax and transfer pricing.

34. The examples are limited to the internal funding and functions relevant to the specific RWA.

Example 1 – Australian branch with Australian customers

Diagram 1: An example where an Australian branch performs significant functions and provides loans to Australian customers

35. AusBranch is the Australian branch of a foreign bank. All of the significant people functions of the banking business of the branch are performed in Australia.

36. AusBranch has internal and external funds (that is, intra-entity funds – debt and equity – from head office, retained profits, wholesale Australian customer deposits and notes issued to the market). These sources provide sufficient funding and liquidity to manage AusBranch's risks.

37. AusBranch books its RWAs in AusBranch's accounts in compliance with APRA's guidelines. AusBranch correctly calculates interest withholding tax on its overseas cross-border internal debt funding.

38. In this scenario, the ATO accepts that AusBranch's accounts would be an appropriate basis to determine that part of the foreign bank's RWAs that is attributable to AusBranch for thin capitalisation purposes.

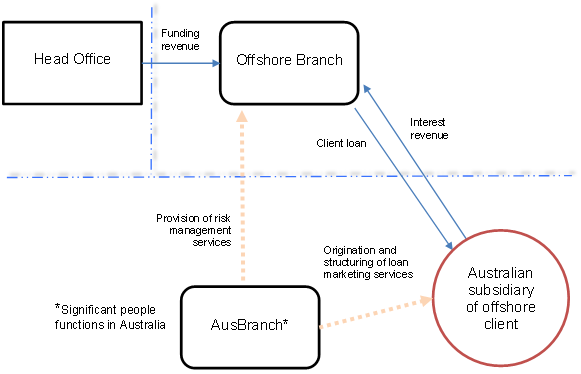

Example 2 – Transactions booked offshore – significant functions performed in Australia

Diagram 2: An example where an Australian branch performs significant functions and the loans are booked offshore

39. AusBranch is the Australian branch of a foreign bank. All of the significant people functions of the banking business of the branch are performed in Australia.

40. Some of the bank's global clients have subsidiaries in Australia. It is the preference of one particular offshore client that loans taken out by their Australian subsidiary are contracted with Offshore Branch. To accommodate this preference, these client loans are booked in the accounts of the Offshore Branch despite all the significant people functions relating to these loans being performed in Australia.

41. In this scenario, the ATO would expect the client loans executed as a result of business activities conducted by the Australian branch to be attributed to the balance sheet of AusBranch for thin capitalisation purposes.

42. For Australian tax purposes, the ATO expects adjustments to be made to attribute these loan assets and associated funding liabilities, in addition to their associated income and expenses, to the accounts of AusBranch. In this scenario, the reconstruction of the accounts of AusBranch and Offshore Branch may be required to achieve the correct tax outcomes. This may also mean that interest withholding tax is payable on interest on internal debt funding of the RWA attributable to Australia.

43. A transfer pricing analysis under Division 815 of the ITAA 1997 should also be conducted to ensure an appropriate amount of profit generated from the client loans is recognised in the Australian branch in accordance with arm's length principles.

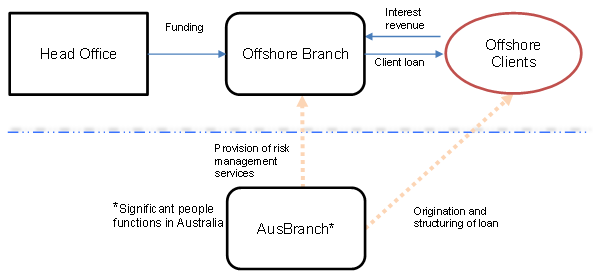

Example 3 – Transactions booked offshore – interbranch funding from Australian branch

Diagram 3: An example where an Australian branch performs significant functions and provides interbranch funding, and loans are booked offshore

44. AusBranch has a team of loan specialists and loan management personnel, amongst other professional staff. Offshore Branch has only two (administrative) staff. Loans to Offshore Clients are booked in the accounts of Offshore Branch, but the loans are originated and structured by the AusBranch team in Australia and the loan risk management functions are performed mainly by AusBranch staff – that is, the significant people functions are performed in Australia

45. To fund its lending activity, Offshore Branch sources its funding via an interbranch loan from AusBranch, which, in turn, is debt funded by its overseas head office (in addition to other external funding sources).

46. AusBranch records the interbranch loan to Offshore Branch as an RWA in its accounts and an appropriate risk weighting (determined as if Offshore Branch is an external client) is applied.

47. In this scenario, the ATO accepts that the appropriate RWA has been recognised in AusBranch for thin capitalisation purposes because the interbranch loan has been recognised in AusBranch's accounts.

48. AusBranch pays appropriate interest withholding tax on the loan from its overseas head office.

49. A transfer pricing analysis under Division 815 of the ITAA 1997 should also be conducted to ensure the interest rates on the interbranch and head office loans are appropriate, and an appropriate amount of profit generated from the Offshore Client loans is attributed to AusBranch in accordance with arm's length principles.

Example 4 – Transactions booked offshore – no interbranch funding from Australian branch

Diagram 4: An example where an Australian branch performs significant functions and loans are booked offshore

50. Presume the same facts as Example 3 of this discussion paper except Offshore Branch sources its funding directly from Head Office and does not receive funding from AusBranch. Consequently, there is no interbranch loan booked as an asset in the accounts of AusBranch.

51. In this scenario, notwithstanding the client loans are booked in the accounts of the offshore branch, these loans should be attributed to AusBranch for Australian tax purposes as the majority of the significant people functions are performed in Australia by AusBranch personnel.

52. Similarly, it would follow that the funding from Head Office and the related funding costs incurred by Offshore Branch in connection with these client loans should also be attributed to AusBranch. The notional funding costs would be deductible for Australian tax purposes and Australian interest withholding tax would apply.

53. Where these notional amounts are not recorded in the accounts of AusBranch, the basis on which interest withholding tax can be imposed requires further consideration.

54. A transfer pricing analysis under Division 815 of the ITAA 1997 should also be conducted to ensure an appropriate amount of profit generated from the client loans is recognised by AusBranch in accordance with arm's length principles.

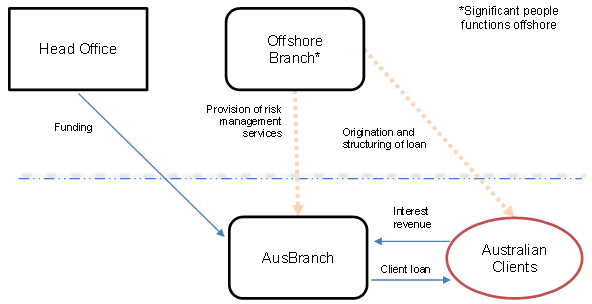

Example 5 – Transactions booked in Australia – functions performed offshore

Diagram 5: An example where an offshore branch performs significant functions and loans are booked in Australia

55. To comply with APRA requirements, client loans are booked in the accounts of AusBranch as the clients are in Australia. To fund this activity, AusBranch borrows from Head Office and pays appropriate interest withholding tax on interest payments on this loan.

56. The client loans are originated by the overseas affiliates and the majority of the significant people functions such as risk monitoring, loan management, and all decision-making in respect of the loans are performed offshore.

57. In this scenario, the loan assets should be attributed to Offshore Branch for the purposes of AusBranch's thin capitalisation calculation. As such, the RWA (the loan assets) would not be included in calculating the total RWA on the Australian branch's balance sheet – that is, not attributable to AusBranch.

58. Funding from Head Office and its associated funding costs related to these loans should also be attributed to the Offshore Branch. The funding costs should not be treated as deductible in AusBranch.

59. Where these notional amounts have incorrectly been recorded in the accounts of AusBranch and interest withholding tax already withheld and remitted to the ATO, the basis on which interest withholding tax can be refunded will require further consideration.

60. A transfer pricing analysis under Division 815 of the ITAA 1997 should also be conducted to ensure appropriate treatment and pricing of all related party activity.

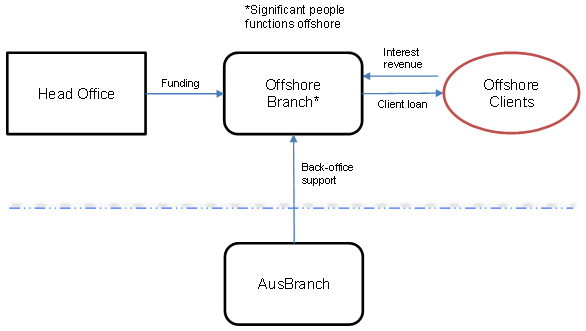

Example 6 – Transactions booked offshore – support services provided from Australia

Diagram 6: An example where an Australian branch provides back-office support services to an offshore branch, and loans are booked in the offshore branch

61. A global bank conducts lending activity and has branches in Australia and offshore jurisdictions. Loan transactions with offshore clients are booked in the accounts of the respective offshore branches where the loans are originated and risk managed, along with other functions critical to the management of the loans – that is, the significant people functions are performed offshore.

62. AusBranch provides back-office support services such as IT, human resources, legal and accounting support services to the regional loans desk. AusBranch is paid a service fee for the back-office support provided to the region.

63. As the loan transactions do not relate to Australian clients, the significant people functions relating to the loans are not performed in Australia, and the transactions are booked in the accounts of offshore branches, the ATO does not expect any adjustments to be made to where the RWA are attributed and as such, RWA adjustments for thin capitalisation purposes are not required.

64. AusBranch should, however, ensure it is appropriately remunerated for its provision of back-office support services under arm's length principles.

65. For the purposes of Justified Trust reviews on the thin capitalisation position, taxpayers are expected to maintain appropriate documentation to support and evidence the appropriate attribution of RWA to the Australian branch's balance sheet.

66. We expect taxpayers to maintain a documented policy that contains a sufficient level of detail to explain the factors that are considered in determining when RWAs should be booked in the accounts of the Australian branch or if they should be booked offshore.

67. The policy should describe the booking methodology for each type of RWA where the methodology varies per class of RWA – that is, loans versus derivatives. In addition, an explanation should be provided to justify the booking fact patterns where:

- a.

- the client is Australian but the RWA is not booked in the accounts of the Australian branch

- b.

- the client is offshore but the RWA is booked in the accounts of the Australian branch – that is, OBU business.

68. The policy should contain sufficient information regarding where significant people functions of particular business activities are performed and how this impacts the decision on where the respective assets are booked. Taxpayers should not rely solely on documentation prepared for other tax purposes. For example, in our assurance reviews, some taxpayers sought to rely on transfer pricing documentation to explain their RWA booking methodology for the purposes of applying the thin capitalisation rules, but this documentation did not contain the relevant level of detail.

69. Where there is a departure from this policy at a transaction level, explanations should be provided and documented.

70. In calculating the thin capitalisation position under the method statement in section 820-405 of the ITAA 1997, where adjustments are made in respect of the RWA attributed to the Australian branch (as a result of consideration of the factors discussed in this discussion paper), the workpapers that support the calculation should contain sufficient detail to explain the reason for each adjustment.

Appendix A – Factors considered in attribution of RWA

During Justified Trust Reviews we observed that foreign banks have regard to a number of different factors and weightings in deciding where RWAs are booked. The factors used differed between classes of RWA or even within classes of RWAs. The below is a non-exhaustive list of the factors used by foreign banks.

- •

- Prudential regulator or central bank – regulations or preference : This could either be APRA or the prudential regulator or central bank in the home jurisdiction. Some bookings are based on strict regulations, others on mere preferences.

- •

- Client location : Booking may be aligned with the location of the client – that is, Australian client deals are booked in Australia.

- •

- Significant people functions : Booking may be based on where the significant people functions are undertaken. This is consistent with OECD guidance.

- •

- Specific people functions : Booking may be where a specific people function is located – that is, authority or delegation to use funds or where risk management function is performed.

- •

- Profit generation or alignment with Division 815 : Booking is aligned with the location that derives the majority of the profit, or from a tax perspective, the location entitled to the majority of the profit attribution from the particular RWA.

- •

- Bank or client preference : In some cases, the bank may have a commercial preference to book RWAs in a particular jurisdiction. This may be influenced by client preference as they want to be transacting or dealing with the bank in a particular jurisdiction.

- •

- Accounting standards : Using principles related to the definition of an asset under accounting standards – that is, ownership, control and economic benefit.

Appendix B – Previous notification to industry in April 2021

Appendix D: Thin Capitalisation for inward investing ADIs

The Thin Capitalisation regime under Division 820 of the ITAA 1997 is a set of integrity rules intended to prevent multinational entities form allocating a disproportionate level of debt to their Australia operations. The regime's framework for Authorised Deposit-taking institutions ("ADIs") is based on the capital adequacy requirements that ADIs must meet for licensing guidelines administered for foreign prudential regulators and the Australian Prudential Regulation Authority ("APRA").

An Australian branch[b1] of a foreign bank is ordinarily subject to the rule applicable to 'inward investing entities (ADI)' unless the branch is grouped with a subsidiary where in some circumstances (offshore operations controlled from Australia) the rule applicable to 'outward investing entities (ADI)' may apply.

The Thin Capitalisation rule for a foreign bank is broadly based on the methodology for capital adequacy requirements prescribed by prudential regulators such that a branch is treated like a separate legal entity that requires a certain minimum level of capital in order to operate a banking business in Australia.

The Thin Capitalisation rule is breached if the branch has a capital shortfall which arises when its average equity capital ("AEC") is less than its minimum capital amount as calculated under the method statements in subdivision 820-D or E. Equity capital broadly includes paid-up capital, retained earnings, general and asset revaluation reserves while minimum capital is the lesser of its safe harbour capital amount and its arm's length capital amount under division 820. Most foreign banks determine the Thin Capitalisation position of its branch using the safe harbour capital amount which is based on the average value of that part of the risk-weighted assets ("RWAs") of the foreign bank that is attributable to the Australian branch (less the proportion attributable to its OBU) multiplied by 65%.

The risk-weighting calculations are carried out in accordance with the prudential standards determined by the prudential regulator in the foreign bank's jurisdiction, or by APRA. The RWAs included in a report to the relevant prudential regulator will be accepted as supporting the branch's calculation of its RWAs to the extent that the report provides information on those attributed to the branch.

A branch with a capital shortfall is disallowed a tax deduction for a portion of each of its debt deductions attributable to the branch unless sit relates to its OBU as the branch is not required to hold capital against its Australian assets attributable to its OBU.

The proportion of each relevant debt deduction to be disallowed will be calculated by dividing the branch's capital shortfall by the average value of its debt for the income year, other than debt used for its OBU.

During our engagement with taxpayers, the most common issue we found with the Thin Capitalisation calculations was a lack of information and documentation. We have documented a number of suggested measures you can put in place to obtain high assurance. These measures are relevant in the following circumstances:

- •

- Where the ATO has noted the taxpayer as having insufficient supporting documentation to validate that calculations of the Australian branch's RWAs are carried out in accordance with prudential standards of either the foreign bank's home jurisdiction regulator or APRA;

- •

- Where the ATO has noted the taxpayer as having insufficient evidence to demonstrate a proper attribution of RWAs that approximate the value of the foreign bank's RWAs that are attributable to the business carried on in the Australian branch.

Observation

Foreign banks are permitted to calculate the risk weightings associated with the RWAs attributable to an Australian branch in accordance with the prudential standards of its home jurisdiction regulator. Allowing foreign banks to rely on this information, prepared for capital adequacy purposes, is recognition that regulatory information provides reliable data for determining capital requirements. In a number of cases, the relevant report prepared for the prudential regulator has not been provided to the ATO and/or there is a lack of supporting information/working papers in relation to the assets attributable to Australia, which makes it hard to verify the risk weightings applied. In addition, there is a lack of information/working papers in relation to the tax decision making pursuant to the attribution of RWAs to the Australian branch. This makes it challenging for the ATO to obtain high assurance over the Thin Capitalisation position of the Australian branch. For the abundance of clarity, foreign banks cannot rely on the report prepared for the prudential regulator to determine the attribution of RWAs to Australia for Thin capitalisation purposes.

Pathway to high assurance

In order to achieve high assurance, we recommend taxpayers review their approach towards evidencing the calculation of their RWAs and the attribution of relevant assets to the Australian branch, and provide the following information:

- •

- a copy of the relevant foreign prudential standard (or relevant sections of the standard) in English which clearly articulate its requirements for calculating RWAs;

- •

- a copy of the report[b2] provided to the relevant foreign prudential regulator;

- •

- a reconciliation of the starting balance for total assets used in RWA calculations to the audited financial statements or ARF 320 Statement of Financial position (if audited financial statements prepared in accordance with Australian accounting standards are not available) including any adjustments made;

- •

- a breakdown of all of the Australian Branch's asset classes (both on-balance and off-balance sheet[b3]) that are included in the RWA calculations;

- •

- details of the relevant risk weights (such as credit, market and operational risk weights) applicable to each class of assets;

- •

- detailed calculation/working papers showing the application of the risk weights and calculation of RWA;

- •

- an explanation of any other adjustments made to the figures for RWA attributable to the Australian branch included in the report to the foreign regulator, that are required, to arrive at the final RWA figure for Thin Capitalisation purposes;

- •

- Evidence to support the tax decision making pursuant to the attribution of RWAs to the Australian branch, based on its business activities.

Example

ABC Bank Ltd ("Head Office") is a foreign bank headquartered in Country A which operates in Australia through a branch ("Australian Branch"). The Australian Branch applies the Thin Capitalisation rules relevant to an inward investing ADI under subdivision 820-E of ITAA 1997 to calculate their Thin Capitalisation position. Accordingly, the Australian Branch is permitted to rely on information prepared for capital adequacy purposes pursuant to Country A's prudential standards in calculating the RWAs attributable to is Australian Branch in determining whether it has satisfied or breached the Thin Capitalisation rules.

Under a justified trust review, the taxpayer provided the following information to the ATO:

- •

- High level calculations that do not include sufficient details of classes of assets attributable to the Australian Branch and the associated risk weightings applied;

- •

- High level explanations of the relevant foreign prudential standards including some extracts;

- •

- The final outcome of tax decision making associated with the attribution of RWA to the Australian Branch without details of the approach used;

The taxpayer will receive a low assurance rating in relation to compliance with the Thin Capitalisation requirements as the information provided and the level of detail is insufficient to verify the key issues mentioned in the pathway to high assurance.

© AUSTRALIAN TAXATION OFFICE FOR THE COMMONWEALTH OF AUSTRALIA

You are free to copy, adapt, modify, transmit and distribute this material as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).

Footnotes

Unless otherwise indicated, references to a branch or branches mean an Australian branch or Australian branches. The relevant legislation refers to a branch as a permanent establishment. Throughout the paper, it has been assumed that the relevant entity (the foreign bank) has a single branch which carries on banking business in Australia.

Most foreign banks operating in Australia are classified as inward investing entities (ADI) for thin capitalisation purposes.

We have annexed the appendix as Appendix B to this technical discussion paper.

This discussion paper does not address outward investing entities (ADI) (mainly Australian banks). While such entities are required to determine the attribution of RWA to their overseas branches in calculating the safe harbour capital amount in Subdivision 820-D of the ITAA 1997, this is not generally significant to their overall thin capitalisation position because overseas branches represent a relatively small proportion of their assets. Accordingly, this discussion paper focuses on inward investing entities ADI.

OECD (2010) 2010 Report on the Attribution of Profits to Permanent Establishments, https://web-archive.oecd.org/2012-06-14/104309-45689524.pdf (2010 OECD Report) at [16].

This example is based on the 2010 OECD Report, Section B-1.

2010 OECD Report.

Australian Prudential Regulatory Authority (2021) Guidelines - Overseas Banks: Operating in Australia, https://www.apra.gov.au/sites/default/files/2021-08/Guidelines%20-%20Overseas%20Banks%20Operating%20in%20Australia.pdf

2010 OECD Report, Part II at [75]

Explanatory Memorandum to the New Business Tax System (Thin Capitalisation) Bill 2001, paragraph 4.36.

Explanatory Memorandum to the New Business Tax System (Thin Capitalisation) Bill 2001, paragraph 4.38.

Paragraph 35 of TR 2005/11.

Consistent with paragraph 19 of TR 2005/11, the examples in this discussion paper proceed on the reasonable presumption that the vast bulk of funds transferred interbranch have been borrowed at some stage from third parties.

References to a "branch" in this document should be taken to refer to a permanent establishment of a foreign bank for tax purposes.

Refer to paragraph 4.38 of the EM to the New Business Tax System (Thin Capitalisation) Bill 2001. This may be referred to as the Basel III Pillar 3 Report in some jurisdictions.

Refer to paragraph 4.337 of the EM to the New Business Tax System (Thin Capitalisation) Bill 2001.

References

File

Legislative References:

ITAA 1997 Div 815

ITAA 1997 Div 820

ITAA 1997 Subdiv 820-D

ITAA 1997 820-300

ITAA 1997 820-310

ITAA 1997 Subdiv 820-E

ITAA 1997 820-395

ITAA 1997 820-405

ITAA 1997 995-1

Other References:

TR 2005/11

Australian Prudential Regulatory Authority (2021) Guidelines – Overseas Banks: Operating in Australia, https://www.apra.gov.au/sites/default/files/2021-08/Guidelines%20-%20Overseas%20Banks%20Operating%20in%20Australia.pdf

Explanatory Memorandum to the New Business Tax System (Thin Capitalisation) Bill 2001

OECD (2010) 2010 Report on the Attribution of Profits to Permanent Establishments, https://web-archive.oecd.org/2012-06-14/104309-45689524.pdf