Explanatory Memorandum

(Circulated by authority of the Assistant Treasurer, Minister for Housing and Minister for Homelessness, Social and Community Housing, the Hon Michael Sukkar MP)Chapter 1: CCIVs - Introduction

Outline of chapter

1.1 Schedules 1 to 4 to the Bill amend corporate and financial services law to establish a CCIV as a new type of a company limited by shares that is used for funds management. A CCIV is an umbrella vehicle that is comprised of one or more sub-funds and is operated by its single corporate director.

1.2 Schedule 5 to the Bill amends the taxation law to specify the tax treatment for the newly established CCIV. The amendments give effect to the core CCIV tax framework to ensure that the CCIV is taxed on a flow-through basis, with the objective that the general tax treatment of CCIVs and their members align with the existing tax treatment of AMITs (and their members).

1.3 This Chapter of the explanatory memorandum discusses the policy context for CCIVs and provides an overview of the regulatory and tax frameworks.

1.4 All legislative references in this Chapters 1 to 12 are to the Corporations Act unless otherwise stated.

1.5 All legislative references in Chapter 13 are to the ITAA 1997 unless otherwise stated.

Context of amendments

History

1.6 In November 2009, the Australian Financial Centre Forum released the Australia as a Financial Centre: Building on our Strengths report (the Johnson report). The Johnson report made several policy recommendations aimed at increasing Australia's cross-border trade in financial services and improving the competitiveness and efficiency of the financial sector.

1.7 In relation to funds management, the Johnson report included recommendations to develop the ARFP regime, along with the establishment of a new collective investment vehicle with a corporate structure.

1.8 The ARFP provides a multilateral framework that allows eligible funds to be marketed across member countries, with limited extra regulatory requirements. The ARFP is intended to support the development of a regional managed funds industry through improved market access and regulatory harmonisation. The Government implemented legislative changes for the ARFP regime in mid-2018, and the program commenced in February 2019 (after Japan and Thailand enacted their respective legislative changes).

1.9 The Johnson report also identified Australia's need for a collective investment vehicle that provides flow-through tax treatment, maintains investor protection, and is more internationally recognisable than a MIS (Australia's current trust based collective investment vehicle). To address this gap, the report recommended that the Board of Taxation review the scope for providing a broader range of collective investment vehicles that would be subject to flow-through taxation.

1.10 The then Government accepted this recommendation and the subsequent Review of Tax Arrangements Applying to Collective Investment Vehicles was released by the Board of Taxation in December 2011. The review recommended the creation of new collective investment vehicles which provide tax neutral outcomes for investors. The report also recommended that overseas experience in offshore jurisdictions inform the design of the new collective investment vehicles.

1.11 In the 2016-17 Budget, as part of the Ten Year Enterprise Tax Plan, the Government announced it would introduce tax and regulatory frameworks for two new types of collective investment vehicles, the CCIV and a limited partnership collective investment vehicle.

1.12 In the 2021-22 Budget, the Government reconfirmed its commitment to establishing the CCIV regime and announced a commencement date of 1 July 2022 for the regime.

1.13 Schedules 1 to 5 to the Bill establish the regulatory and tax frameworks for CCIVs.

Policy objectives

1.14 In developing the regulatory framework for CCIVs, a key policy objective has been to increase the competitiveness of Australia's managed funds industry internationally to attract offshore investment.

1.15 In developing the tax framework for CCIVs, the policy objective has been to ensure that a CCIV is taxed on a flow-through basis, with the general tax treatment of CCIVs and their members aligned with the existing tax treatment of AMITs (and their members).

1.16 To this end, the Government has focused on ensuring the CCIVs framework would offer internationally recognisable investment products, flow-through tax treatment, commercial flexibility and strong investor protections.

1.17 Australian funds management is currently conducted through a MIS, which has a trust-based structure. While the Australian managed funds industry is well established, it is predominantly domestically focused. Many offshore investors perceive the MIS structure to be inappropriate for large-scale funds management. The limited range of vehicles that can be used for funds management reduces the ability for Australian funds management to engage competitively with financial centres that offer significant cross-border funds management through the use of corporate vehicles for collective investment, such as Europe, the United Kingdom and Singapore.

1.18 The Government has analysed the regulatory regimes of leading fund domiciles, target export markets, and major financial centres in our region. The regulatory framework draws on the features of other equivalent vehicles internationally. It has been developed to facilitate the competitiveness and commercial viability of CCIVs while ensuring integrity of Australia's investor protections and tax framework.

1.19 Like other international corporate collective vehicles, CCIVs will operate with a corporate structure, meaning they will have the legal form of a company limited by shares with most of the powers, rights, duties and characteristics of a company.

1.20 Aligning Australia's regulatory framework with well-developed international regimes can lower the barriers to entry for new fund managers seeking to operate in Australia. This can increase competition and allow Australian consumers greater product choice, including exposure to new asset classes.

1.21 The introduction of the CCIV regime is also intended to complement the ARFP as it will provide Australian fund managers with a vehicle that will be compliant with the requirements for the ARFP and is similar to the corporate funds already available in parts of Asia.

1.22 The legislation also contributes to the more general objective of global regulatory alignment. The introduction of the CCIV helps to create a cohesive regional managed funds industry and facilitate more efficient participation in the global marketplace.

Regulatory framework

1.23 The CCIV regulatory framework utilises a company structure limited by shares so that it is recognisable to offshore investors and fund managers.

1.24 As a company, a CCIV will generally be subject to the ordinary company rules under the Corporations Act unless otherwise specified. Features of the MIS regime have also been incorporated into the design of CCIVs to the extent that they are consistent with the policy objective. In doing so, regulatory parity is maintained (to the extent possible) between the existing MIS framework and the CCIV framework. This will ensure efficient operation of the domestic funds management industry and ease of adoption for fund managers wishing to establish a CCIV.

1.25 For example, a CCIV must have share capital but the CCIV can issue some or all of its shares as being redeemable at the member's option. This feature is similar to a member's right to withdraw from a registered scheme. Further, while other types of companies are required to appoint natural person directors, a CCIV must have a single corporate director, which is consistent with the OEIC model and also similar to the structure for MISs (which are operated by a corporate trustee).

1.26 The CCIV regulatory framework distinguishes between retail and wholesale CCIVs. It aligns with the retail investor protections of a registered scheme while also replicating elements of the flexibility and lighter touch regulatory approach applying to wholesale MISs. This reflects the higher degree of investor sophistication among wholesale investors and their capacity to negotiate bespoke contractual protections and assess investment risks.

Tax framework

1.27 The CCIV tax framework provides flow-through tax treatment for investors. It achieves this by leveraging the existing trust taxation framework and the existing attribution flow-through regime (i.e., the new tax system for MITs, or the AMIT regime), rather than by creating a new bespoke tax regime. The general intent is that the tax outcomes for an investor in a sub-fund of a CCIV be the same as an investor in an AMIT.

Summary of new law

Registration

Registration of a CCIV

1.28 A CCIV is a new type of company that is limited by shares and has as its director a public company with an AFSL authorising it to operate the business and conduct the affairs of the CCIV (the corporate director).

1.29 A company may be registered as a CCIV if it meets certain basic registration requirements, including that upon registration it will have at least one sub-fund (which must have at least one member). The registration requirements are broadly similar to those of other companies.

1.30 Upon registration, the persons identified in the application as the proposed corporate director and members of the CCIV assume those roles (subject to meeting the relevant requirements for the roles). The shares specified in the application form are taken to be issued to those members upon registration.

1.31 A CCIV may be either retail or wholesale, with retail CCIVs subject to a regulatory framework that encompasses additional regulatory protections necessary for retail investors. Wholesale CCIVs are subject to a more limited regulatory framework, reflecting the higher degree of investor sophistication among wholesale investors and capacity to negotiate bespoke arrangements with fund providers.

1.32 A CCIV will be a wholesale CCIV unless it has at least one investor that acquires securities in the CCIV as a 'retail client' (within the existing meaning in Chapter 7 of the Corporations Act) because securities in the CCIV were issued or transferred to them in circumstances that would have required a PDS be given to them. In this case, the whole CCIV is treated as a retail CCIV.

1.33 A retail CCIV with a single sub-fund, or a sub-fund of a retail CCIV (that has a single sub-fund) may be included in the official list of a prescribed financial market operated in Australia. Listing of a retail CCIV with more than one sub-fund, or of multiple sub-funds of a retail CCIV, will be considered further once the CCIV regime is operating.

1.34 These restrictions only apply to listing on a prescribed financial market operated in Australia. Nothing in the new law prevents a security in a CCIV from being quoted on a financial market or settled using financial market infrastructure, such as the ASX Quoted Assets Market, subject to the rules of the relevant market. The restrictions on listing do not affect the capacity for a security in a CCIV to be quoted (regardless of the number of sub-funds of that CCIV).

Registration of a sub-fund of a CCIV

1.35 A CCIV is an umbrella vehicle that is comprised of one or more sub-funds. Each sub-fund may offer investors a different investment strategy. The capacity to group these funds together under one umbrella vehicle supports funds managers to build capacity and economies of scale.

1.36 A sub-fund of a CCIV is all or part of the CCIV's business that is registered by ASIC as a sub-fund of the CCIV. A sub-fund is established on registration.

1.37 The initial sub-fund (or sub-funds) of the CCIV are registered by ASIC as part of the registration of the CCIV. Registration of a sub-fund of the CCIV after the registration of the CCIV itself is by a standalone process.

1.38 An ARFN is given to each sub-fund as part of the registration process. A sub-fund's name is the name specified in the record of the sub-fund's registration. A sub-fund's name is subject to naming requirements, including that it must have the CCIV's name at the start of its name.

Registers

1.39 Similar to a company and a registered scheme, a CCIV must maintain a register of its members that includes certain information (such as the details of the sub-fund that the members shares are referable to). If a CCIV is a member (for example, under cross-investment within a CCIV), then the CCIV's register of members must also identify the sub-fund to which the CCIV's membership relates.

Corporate governance

Governance rules

1.40 As a CCIV is a type of company, it has the legal capacity and powers of an individual and a body corporate, including the power to enter into contracts and issue and cancel shares in the company.

1.41 Unlike other companies, a CCIV has a single corporate director. The corporate director is a public company with its own officers and employees. The new law includes provisions that allow the natural person officers of the corporate director to undertake certain activities for the CCIV, such as enter into a contract on behalf of the CCIV in certain circumstances.

1.42 Both retail and wholesale CCIVs must have a constitution. The constitution of a CCIV is enforceable as a statutory contract between:

- •

- the CCIV and each member;

- •

- the CCIV and the corporate director;

- •

- the corporate director and each member; and

- •

- a member and each other member.

1.43 The constitution of a retail CCIV must make adequate provision for certain matters (such as the establishment of sub-funds and the method by which member complaints are to be dealt with).

Officers of the CCIV

1.44 The CCIV must have as its sole director a public company that holds an AFSL authorising it to operate the business and conduct the affairs of a CCIV (the corporate director). The CCIV does not have any officers or employees other than the corporate director. The primary exception to this is any liquidator, administrator or receiver appointed to the CCIV, who is also an officer of the CCIV.

1.45 The corporate director of a CCIV has an obligation to operate the business and conduct the affairs of the CCIV. The corporate director must also perform the functions conferred on it by the CCIV's constitution and the Corporations Act.

1.46 The new law sets out the powers and obligations of the corporate director in relation to the CCIV and its members. The corporate director has certain duties and obligations that arise from its role as a director of a company, and others that are specific to CCIVs.

1.47 The corporate director of a CCIV, and the officers and employees of the corporate director of a retail CCIV, owe additional duties and obligations that reflect those that apply to the responsible entity of a registered scheme or the corporate trustee of a MIS (as relevant). Some of the additional duties owed by the corporate director of a wholesale CCIV may be expressly excluded under the CCIV's constitution. Overall, the duties for the corporate director of a CCIV are designed to provide investors in a CCIV comparable protections as investors in a MIS.

1.48 If there is any conflict between the duties that officers and employees of the corporate director owe to the CCIV and the duties they owe to the corporate director, the duties owed to the CCIV prevail. This approach ensures general parity between the MIS and CCIV regimes. In addition, if there is any conflict between the duties the corporate director owes to the CCIV and those it owes to the CCIV's members, the duties to members prevail.

1.49 For the purposes of determining certain liabilities, the corporate director of a retail CCIV is liable for the acts of its agents (and other persons taken to be its agents, such as the agents of the CCIV), even if those acts are fraudulent or outside the scope of its authority. This ensures parity with the existing model for registered schemes and ensures the corporate director is ultimately liable for all of the CCIV's operations.

Compliance plan

1.50 A retail CCIV must have a compliance plan and a compliance plan auditor (similar to the requirements for a compliance plan of a registered scheme).

1.51 The compliance plan must set out adequate measures to be applied by the corporate director in operating the CCIV to ensure compliance with the Corporations Act and the CCIV's constitution. This is the only basic content requirement for the compliance plan.

1.52 The corporate director must ensure at all times that the CCIV's compliance plan meets the legislative requirements for compliance plans. The corporate director must also comply with the compliance plan.

Member protection

1.53 Except in limited circumstances, a CCIV must obtain the approval of the members of each affected sub-fund if the CCIV wishes to give a financial benefit to a related party of the CCIV.

1.54 As for other companies, members of a CCIV may seek a remedy against a CCIV if its affairs (or the affairs of one or more sub-funds) are being conducted in a manner that is contrary to the interests of the members of the CCIV as a whole or one or more sub-funds of the CCIV. The grounds for an order by the Court are not exhaustive and include an order to modify or repeal the CCIV's constitution.

1.55 A member of a CCIV may bring, or intervene in, legal proceedings on behalf of the CCIV in certain circumstances.

1.56 The corporate director of a CCIV has civil liability to members of the CCIV for a contravention of Chapter 8B (regardless of whether the corporate director has been convicted of an offence or has had a civil penalty order made against it). This is consistent with the right of a member of a registered scheme to seek a remedy against the responsible entity of the scheme in similar circumstances.

Meetings

1.57 The corporate director (being a company with its own board of directors) may pass a resolution on behalf of the CCIV if the directors of the corporate director pass a resolution that expressly states it is on behalf of the corporate director and, if it is the corporate director of more than one CCIV, the CCIV to which the resolution applies.

1.58 A meeting of the members of the whole CCIV or a sub-fund of the CCIV may be called by the corporate director or by a member. The requirements for meetings of members of a CCIV are based on the requirements that apply to registered schemes.

1.59 Some modifications are made to account for a CCIV's corporate status. In particular, a member's voting power at a meeting (of either the CCIV or a sub-fund) is generally referable to the value of the shares the member holds in the CCIV.

Corporate contraventions

1.60 The corporate director of a CCIV is generally responsible for conduct of the CCIV. This reflects the fact that a CCIV does not have any employees and the corporate director is its only director. The new law includes bespoke rules that apply across all Commonwealth laws and to conduct that constitutes a contravention of a criminal offence or a civil penalty provision. These rules operate in place of Part 2.5 of the Criminal Code and any other attribution rules that would otherwise apply in relation to conduct undertaken by or in relation to a CCIV.

1.61 The consequences of contravening a criminal offence or civil penalty provision by a CCIV do not apply to the CCIV. A CCIV is not liable for any fine or penalty and may not be issued an infringement notice. However, if a CCIV is found to have committed an offence or contravened a civil penalty provision, then the corporate director of the CCIV at the time of the offence or contravention is also taken to have committed the offence or contravened the provision and is liable for any associated fine or penalty.

1.62 The new law does not apply to contraventions of State and Territory laws. However, if a CCIV contravenes a State or Territory law then ASIC, the CCIV or a member of the CCIV may apply to a Court for a compensation order to be made against the corporate director in respect of any loss or damage as a result of the contravention.

Shares and debentures

1.63 A CCIV may have a variable capital structure that provides flexibility for the issue, redemption or repurchase of its shares. Like many managed funds, some CCIVs or sub-fund(s) may be 'open-ended' - meaning that its share capital is not limited. It has broad flexibility to issue, redeem or repurchase shares. Other CCIVs or sub-fund(s) may be 'close-ended' (such as listed CCIVs or sub-funds) whose share capital is fixed or limited.

1.64 Many of the rules that apply to issuing or reducing share capital in an ordinary company do not apply to CCIVs given its variable capital nature.

1.65 A CCIV may issue shares and debentures, provided that each security is referable to only one sub-fund. The shares referable to one sub-fund form a class of shares, if it is not divided into two or more classes.

1.66 A member may have a right to redeem their shares if provided for by the CCIV. These are 'redeemable shares' (or 'redeemable preference shares' if preferences are also attached to those shares). A CCIV may redeem shares if the sub-fund to which the shares are referable is solvent. Unlike for ordinary companies, redemptions do not need to be paid out of profit or out of the proceeds of a new issue of shares. Retail CCIVs must comply with additional requirements (for example, any relevant requirements set out in its constitution).

1.67 A CCIV may distribute its income and capital to members by paying dividends. Each share in a class of shares has the same dividend rights unless provided for in the CCIV's constitution or by special resolution of the members of the sub-fund to which the shares are referable. A CCIV may pay a dividend on a share if the sub-fund to which the share is referable is solvent. The rules for the payment of dividends by ordinary companies do not apply to CCIVs (such as the rules regarding the payment of dividends if a company's assets exceed its liabilities).

1.68 A CCIV is generally permitted to engage in cross-investment between sub-funds of the CCIV. This involves a CCIV acquiring in respect of any of its sub-funds, one or more shares that are referable to another of its sub-funds. This approach aligns the CCIV framework with other international corporate collective vehicles and ensures that a CCIV can utilise funds management structures such as a master-feeder structure or a hedging structure.

1.69 A CCIV may reduce its share capital (for example, under a buy back) if it is authorised under the law or, in any case, if it is permitted in its constitution and the sub-fund to which the share(s) are referable is solvent.

Financial record-keeping and reporting

1.70 All CCIVs must keep written financial records that reflect its financial position and performance, and enable true and fair financial statements to be prepared.

1.71 Retail CCIVs must prepare financial reports and directors' reports for each sub-fund of the CCIV. Certain requirements in Chapter 2M of the Corporations Act have been adapted to CCIVs consistent with its nature and for consistency with the MIS regime. For example, directors' reports must include specific details about the corporate director and its directors, such as any benefits or interests of a director of the corporate director in the CCIV.

Operating a CCIV

1.72 A CCIV must have at least one sub-fund. Each part of the CCIV's business must be referable to one (and only one) sub-fund of the CCIV. The cumulative business of all of the sub-funds of the CCIV must constitute the entire business of the CCIV.

1.73 A sub-fund is established on registration by ASIC and is identifiable by its unique name and ARFN. A sub-fund does not have legal personality. Each security that is issued by a CCIV must be referable to a sub-fund.

1.74 Allocation rules set out how assets and liabilities of the CCIV are attributed to the CCIV's sub-fund(s). In the event that money (acquired in a single lump sum) or property acquired by the CCIV relates to the business of more than one sub-fund, the corporate director must determine the proportion of the money or property that is to be allocated to each sub-fund of the CCIV. The proportion that is allocated must be fair and reasonable in the circumstances. A single item of property that relates to the business of more than one sub-fund of the CCIV must be converted into money or other property that can be allocated among the sub-funds of the CCIV in accordance with the allocation rules.

1.75 Similar rules also apply to liabilities incurred by a CCIV.

External administration and deregistration

External administration

1.76 External administration applies on a sub-fund-by-sub-fund basis. This is achieved by applying translation rules to the existing external administration provisions in Chapter 5.

1.77 The translation rules ensure that the process for winding up a company in Chapter 5 applies in respect of a sub-fund of a CCIV. A CCIV cannot be wound up.

1.78 The new law also sets out the powers of a liquidator and corporate director when a sub-fund is being wound up. A liquidator only has the power to perform a function to the extent that it relates to the sub-fund that is being wound up. The corporate director continues to make all allocation determinations and exercise its normal powers for the sub-funds that are not being wound up.

1.79 In the arrangement and reconstruction provisions in Part 5.1, the consequence of applying the translation rules is that sub-funds may be rearranged within a CCIV or transferred between CCIVs. The new law also grants the Court additional powers to make orders in the CCIV context. This includes the power to make orders in relation to the assets and liabilities of a sub-fund.

1.80 In the receivership provisions, receivers are taken to be appointed to the property of each sub-fund separately. Receivers have special powers to challenge allocation determinations before the Court.

Deregistration

1.81 A sub-fund of a CCIV may be voluntarily deregistered on application by the CCIV, the corporate director or the liquidator of the sub-fund. ASIC or a Court may also initiate deregistration of a sub-fund in certain circumstances.

1.82 A CCIV must be deregistered by ASIC after the CCIV's last sub-fund has been deregistered. This is the only way a CCIV may be deregistered.

1.83 The consequences of deregistering a sub-fund or CCIV generally mirror the consequences of deregistering other types of companies under Chapter 5A. On deregistration, a sub-fund ceases to be established and a CCIV ceases to exist. Any assets of the sub-fund vest in the Commonwealth or ASIC. The books of the sub-fund or the CCIV must be retained for three years after deregistration.

Takeovers, compulsory acquisitions, continuous disclosure and fundraising

1.84 The acquisition of a relevant interest in a CCIV is not regulated by the procedural rules and obligations regarding takeovers, compulsory acquisitions and buy-outs in Chapters 6 to 6B of the Corporations Act, unless the acquisition relates to a relevant interest in issued voting shares in a listed CCIV. This is consistent with the application of these rules to listed registered schemes.

1.85 Similarly, the Takeovers Panel's jurisdiction only applies in relation to the affairs of a listed CCIV. This means that the Takeovers Panel has the power to intervene in the affairs of a listed CCIV, including in relation to a takeover of a listed CCIV.

1.86 Under the existing law, all CCIVs must comply with the rules around takeovers, compulsory acquisitions and buy-outs when it is proposing to acquire interests in another entity that is covered by the rules in Chapters 6 to 6B of the Corporations Act.

1.87 If a CCIV is a disclosing entity (listed or otherwise), then it must comply with the continuous disclosure requirements in Chapter 6CA of the Corporations Act in a manner consistent with a registered scheme that is a disclosing entity.

1.88 The fundraising rules in Chapter 6D of the Corporations Act do not apply to CCIVs. Instead, offers of securities in a CCIV are covered by the rules in Chapter 7 (explained further below).

Financial services and markets

1.89 The new law modifies the operation of Chapter 7 of the Corporations Act, which regulates financial services and markets. Key modifications are made to provisions that relate to assigning responsibility for conduct, financial services licensing and disclosure for financial products.

1.90 The corporate director of the CCIV is taken to provide any financial services that would otherwise be provided by a CCIV, with the exception of issuing securities in a CCIV, which is undertaken by the CCIV itself. The corporate director, therefore, is required to hold an AFSL that authorises it to provide the financial service of 'operating the business and conducting the affairs of a CCIV'. Financial services provided by a CCIV are covered by the corporate director's AFSL. A CCIV is always exempt from the requirement to hold an AFSL.

1.91 A PDS, rather than a prospectus, must be given to retail clients who acquire a security in a CCIV under Part 7.9 of the Corporations Act. Limited exceptions apply to the PDS requirements where a retail client is associated with a CCIV or corporate director, and in other circumstances as appropriate under Part 7.9 of the Corporations Act as modified by Part 8B.6.

1.92 Consistent with the application of the PDS regime to retail CCIVs, the design and distribution obligations in Part 7.8A of the Corporations Act also apply in relation to retail CCIVs. Similarly, ASIC's power to make product intervention orders under Part 7.9 of the Corporations Act applies in relation to retail CCIVs.

Asia Region Funds Passport regime

1.93 The provisions relating to the ARFP regime have been extended to cover CCIVs. The corporate director of a retail CCIV may lodge an application with ASIC to register a sub-fund of the CCIV as an Australian passport fund. If the conditions for registration are satisfied, the sub-fund then becomes an Australian passport fund and the corporate director becomes the operator of the fund.

Other amendments to corporations and financial services law

Amendments to Chapter 9 of the Corporations Act

1.94 Chapter 9 of the Corporations Act includes a number of miscellaneous provisions, including relating to registers, auditors, penalties and offences. Modifications to certain provisions in Chapter 9 ensure that these administrative provisions work appropriately in relation to CCIVs and corporate directors.

Amendments to the ASIC Act

1.95 Amendments to the ASIC Act ensure that the definition of financial services in the ASIC Act applies correctly, and that ASIC can exercise its powers and functions effectively in relation to CCIVs.

Subordinate legislation for the regulatory framework

1.96 Certain matters may be prescribed in regulations where provided for in Chapter 8B. Regulations may also modify the operation of Chapter 8B, or the Corporations Act, for its application to CCIVs. In addition, ASIC may make exemption orders and modification declarations in relation to specified parts of Chapter 8B.

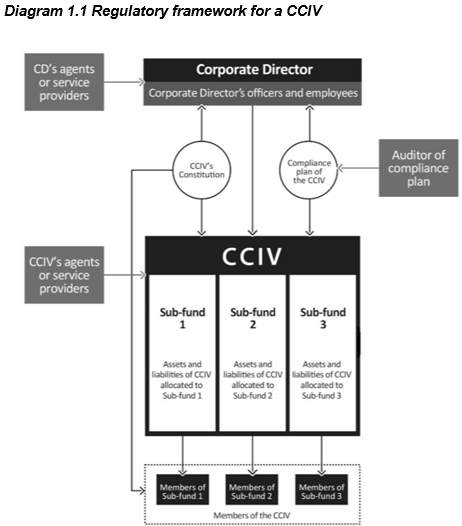

Note: This diagram shows the regulatory framework as it applies to a retail CCIV. A wholesale CCIV is not required to have a compliance plan. The CCIV and the corporate director may each appoint agents and service providers to exercise their respective powers and function.

Tax framework

1.97 The CCIV tax framework outlined in Chapter 13 amends the taxation law to specify the tax treatment for the CCIV regime. The amendments give effect to the core CCIV tax framework with the objective that the general tax treatment of CCIVs and their members aligns with the existing tax treatment of AMITs (and their members).

1.98 The CCIV tax framework achieves this objective by leveraging the existing trust taxation framework and the existing attribution flow-through regime (i.e., the new tax system for MITs, or the AMIT regime), rather than by creating a new bespoke tax regime.

1.99 Where a CCIV meets the AMIT eligibility criteria in respect of a sub-fund (which is a part of the CCIV), then the CCIV will be able to attribute amounts of assessable income, exempt income, non-assessable non-exempt income, and tax offsets derived or received by the CCIV to the relevant class of members of the CCIV. Those amounts will retain that character and be recognised (and taxed) in the hands of each member.

1.100 Where a CCIV does not satisfy the AMIT eligibility criteria in respect of a sub-fund for a particular income year, then the CCIV tax treatment will generally default to the general trust taxation framework for that year.

Objects and outline of new law

Outline of new Chapter 8B in the Corporations Act

1.101 Part 8B.1 of Chapter 8B sets out the objects of the new Chapter.

1.102 The objects of Chapter 8B are to establish a regulatory framework for forming and operating CCIVs in a way that is fair, efficient and competitive and, in conjunction with the financial services licensing framework in Chapter 7 of the Corporations Act, to promote confident and informed investors in CCIVs. [Schedule 1, item 4, section 1221]

1.103 Part 8B.2 of Chapter 8B sets out the registration requirements for a CCIV and a sub-fund of a CCIV. Part 8B.2 also sets out the rules for the register of the CCIV's members.

1.104 Part 8B.3 of Chapter 8B sets out the rules relating to the corporate governance of a CCIV. This includes the rules regarding:

- •

- governance of CCIVs (such as how a CCIV exercises company powers and the rules regarding a CCIV's constitution);

- •

- the officers and employees of the CCIV (including the core obligations for the corporate director of the CCIV and the rules relating to its replacement);

- •

- the officers, employees and auditors of the corporate director of the CCIV;

- •

- the compliance plan of a retail CCIV;

- •

- member protection (including related party transactions by retail CCIVs, rights and remedies for the member of a CCIV and the corporate director's civil liability to members);

- •

- meetings (including resolutions of a CCIV and meetings of the members of a CCIV (or a sub-fund of the CCIV)); and

- •

- corporate contraventions (including the rules for establishing civil and criminal liability under Commonwealth laws).

1.105 Divisions 1 to 3 of Part 8B.4 of Chapter 8B establish the rules for corporate financing of a CCIV. These Divisions outline the types of securities that CCIVs may issue and the circumstances when a CCIV is permitted to pay dividends. These Divisions also explain the requirements that must be satisfied before a CCIV may redeem its shares or reduce its share capital and set out the circumstances in which the sub-funds of the CCIV may cross-invest.

1.106 Divisions 4 and 5 of Part 8B.4 of Chapter 8B set out the rules for the maintenance of financial records by CCIVs and how financial reports and audits are to be prepared and conducted for sub-funds of CCIVs.

1.107 Part 8B.5 of Chapter 8B establishes the regulatory framework for operating the sub-funds of a CCIV and allocating the assets and liabilities to sub-funds.

1.108 Part 8B.6 of Chapter 8B outlines the process for winding up a sub-fund and how the other external administration processes apply in the CCIV context. It also outlines the process for deregistering a CCIV and sub-funds of a CCIV.

1.109 Part 8B.7 of Chapter 8B outlines the rules for control, financial services and disclosure. Divisions 1 to 3 of Part 8B.7 outline how the following Chapters of the Corporations Act apply to CCIVs:

- •

- Chapters 6 to 6B regarding takeovers, compulsory acquisitions and buy-outs;

- •

- Chapter 6C regarding information about ownership in listed entities;

- •

- Chapter 6CA regarding continuous disclosure; and

- •

- Chapter 6D regarding fundraising and disclosure.

1.110 Division 4 of Part 8B.7 modifies the operation of Chapter 7 for CCIVs and sets out how markets and financial services regulation apply to CCIVs and corporate directors - including the requirements for disclosure.

1.111 Part 8B.8 of Chapter 8B outlines consequential amendments to Chapter 9 of the Corporations Act. The new law modifies certain provisions, such as those relating to registers, to ensure that they operate appropriately in relation to CCIVs and their corporate directors.

1.112 Part 8B.9 of Chapter 8B allows ASIC to make exemption orders and modification declarations in relation to the application of specified parts of Chapter 8B. Regulations may also modify the operation of Chapter 8B, or any other provision of the Corporations Act in relation to its application to CCIVs.

Outline of Subdivision 195-C of the ITAA 1997

1.113 Subdivision 195-C of the ITAA 1997 provides that for taxation purposes, a trust relationship is deemed to exist between a CCIV, the business, assets and liabilities referable to a sub-fund and the relevant class of members.

1.114 Each sub-fund is treated as a separate unit trust (known as the 'CCIV sub-fund trust') with the CCIV as trustee and members of the CCIV as beneficiaries of the CCIV sub-fund trust, in accordance with their shareholding that is referable to the sub-fund.

1.115 Under the deeming principle, all taxation laws apply to the CCIV, sub-fund and members in their deemed capacities, unless expressly excluded.

1.116 Subdivision 195-C of the ITAA 1997 also does the following:

- •

- makes modifications to the AMIT criteria to ensure that only relevant criteria apply when determining a CCIV sub-fund trust's AMIT eligibility; and

- •

- makes amendments where a CCIV sub-fund trust fails to meet the modified AMIT eligibility criteria and is taxed in accordance with the general trust provisions.

Application and commencement

1.117 The amendments to corporate and financial services law and taxation law to give effect to the CCIV regime apply from 1 July 2022. [Section 2]

1.118 The contingent amendments to the Corporations Act made by Schedule 4 to the Bill also apply from 1 July 2022 if Schedule 2 to the Corporations Amendment (Meetings and Documents) Act 2021 has already commenced. Otherwise, it will not commence.