Review of Business Taxation

A Tax System RedesignedMore certain, equitable and durable

Report July 1999

SECTION 10 - LEASES AND RIGHTS

Unifying the treatment of leases and rights over non depreciable assets

Recommendation 10.1 - Taxation of rights over non depreciable assets

| That leases and other rights over non depreciable assets be taxed under a general framework which more closely reflects the economic substance of the arrangements. |

In Chapter 10 of A Platform for Consultation, the Review canvassed revised arrangements to put the taxation of leases and other rights over non-depreciable assets on a basis that more closely reflects the changes in value of the assets and liabilities associated with the rights.

Certain problems with the existing taxation of rights were outlined in A Platform for Consultation (page 269).

- •

- In the hands of the grantee, many expenditures on rights are currently not deductible except as a capital loss at the end of the right. Examples include franchise fees, lease premiums, restrictive covenants and some statutory licenses.

- •

- Such rights are treated as the creation of new assets by the grantor and up-front payments to the grantor are taxed on receipt.

- •

- In other cases, taxpayers are able to gain unwarranted tax benefits by structuring the profile of payments for a right so that the profile differs significantly from that of the benefits obtained from the right.

Consultation

Submissions to the Review supported straight line write-off of expenditure over the period of a right that is likely to provide broadly uniform annual benefits - under the proposed 'deemed benefits' approach outlined on pages 274-275 of A Platform for Consultation.

Concerns were raised however, over the complexity of the proposed 'implicit benefits approach' canvassed in A Platform for Consultation (page 274) as a method of taxing rights where the annual benefits from the rights vary depending on a range of circumstances. Concerns were also raised in submissions about the potential for balancing charges on the granting of rights to impose taxation on unrealised gains associated with the asset underlying the rights - under options canvassed in A Platform for Consultation (pages 278-80).

Summary of proposed framework

The proposed framework for taxing rights will reduce the current inconsistency and distortionary nature of the law while also addressing concerns raised in submissions. Significant exclusions for 'routine' rights - Recommendation 10.2(a) - will mean that the taxation of many rights which are currently taxed reasonably will be unaffected by the changes, reducing the compliance burden of taxpayers. Beyond 'routine' rights, the tax treatment of a right will recognise the assets and liabilities involved: the nature of the asset (the right) acquired by the grantee, which affects the tax value of the underlying asset retained by the grantor; and, if the right is not paid for entirely up-front, the stream of payments for the right, which represents an asset to the grantor and a liability to the grantee.

The grantee will attract write-off to reflect the declining value of the right to the grantee (Recommendation 10.3). Simple straight line write-off will apply where the right is likely to decline steadily in value (reflecting, say, broadly equal benefits from access to the underlying asset).

The grantor will be subject to a balancing adjustment on disposal of rights where the right represents a permanent disposal (Recommendation 10.4). The grantor will also be subject to a balancing adjustment where the disposal is not permanent but the right lasts longer than 10 years (Recommendation 10.5). In each case, a balancing adjustment will arise to the extent that there are previously unrealised changes in value associated with that part of the underlying asset associated with the right. The balancing adjustment results from a difference between the reduction in tax value of the underlying asset and the up-front value of the payments for the right.

For rights which are not permanent disposals (where the grantor regains access to the underlying asset on expiry of the right), the tax value of the underlying asset will recover at the end of the right to its level prior to the sale of the right (Recommendation 10.5). The profile of recovery will generally mirror the write-off profile of the grantee's right. This treatment is in line with that recommended for part disposals of benefits or obligations associated with financial assets and liabilities (Recommendation 9.8).

These changes will significantly improve the tax treatment of rights. Up-front payment for short term rights, for example, will become deductible to the grantee and assessable to the grantor over the term of the right. Distortions and inconsistencies, as well as tax benefits and disadvantages from the structuring of payments for rights, will be removed or reduced significantly.

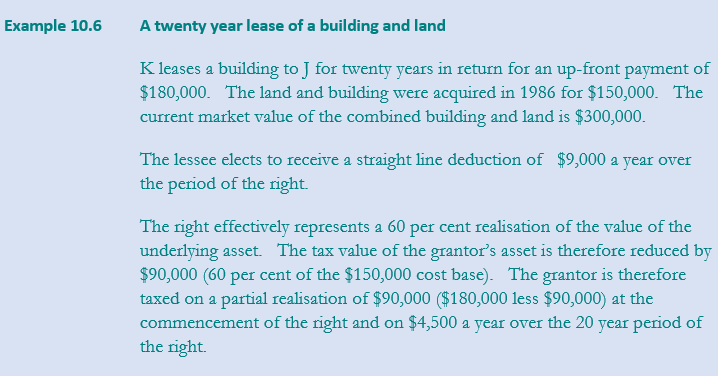

Cameos 10.2 and 10.4 on pages 272 and 277, respectively, of A Platform for Consultation illustrate the recommended treatment of the grantee and grantor. Some further examples are provided here to illustrate the proposed treatment of different rights.

Recommendation 10.2 - 'Routine' rights and service contracts excluded from cashflow/tax value treatment

| Where rights payments 'match' benefit profile

|

| Personal services

|

A Platform for Consultation (page 273) emphasised the importance of new arrangements for taxing rights being easy to apply and not imposing high compliance costs on taxpayers, especially in the majority of cases where payments are not structured to obtain tax benefits.

The payments for most 'routine' rights will be assessed when they are due regardless of the period of the right. That will apply where regular payments are made for the right which 'broadly approximate the benefits received in each period' under the right. It is expected that this will include most leases of land and service contracts where there are no prepayments.

To simplify compliance, leases of realty will be treated as being single leases (rather than multiple leases) over non-depreciable assets, providing that they do not involve the use of depreciable assets the value of which exceeds the limits set out in Recommendation 10.7(c). Leases of realty which include buildings and other depreciable assets in excess of those limits would be divided into a lease of depreciable assets covered by Recommendation 10.8 and a lease of non-depreciable assets.

Rights will be treated as 'routine' where, in line with ordinary commercial practice, the payments are commensurate with the benefits received in each period - such as equal payments or payments that escalate over the period of the right in line with the CPI or market expectations (such as realty rents). Payments will also need to be specified as being required at least yearly. Rights for a period of less than one year will also be treated as routine rights.

Contracts relating to the provision of personal services by individuals (including through personal service companies), such as sports signings, 'golden hello' payments and endorsements - will also be treated in a similar way to routine rights and taxed on a receivables basis.

Rights which are taxed as being 'routine rights' will not be subject to Recommendations 10.3, 10.4 and 10.5.

Recommendation 10.3 - Write-off treatment for grantees of 'non-routine' rights

|

That grantees of 'non-routine' rights that are not perpetual receive a write-off consistent with the profile of reduction in value of the right (in turn reflecting the nature of the underlying asset):

|

Many expenditures on rights are currently not deductible except as a capital loss at the end of the right (when it has no value). The proposed arrangements will give a deduction to the grantee based on the broad profile of reduction in value reflecting the nature of the asset underlying the right. The write-off will apply over the period of the right or the period over which the associated benefit will be taken, where shorter.

Where the grantee takes the benefits under a right on a roughly equal basis over the period, straight line write-off broadly reflects the economic and commercial reality particularly if the right is not of long duration. Straight line treatment is therefore proposed in a range of cases, including leases of land. Nevertheless, providing straight line treatment is not appropriate where the grantee can structure the benefits from the right or for long dated leases of land and property, especially where the benefits may be expected to increase rather than remain constant over the lease.

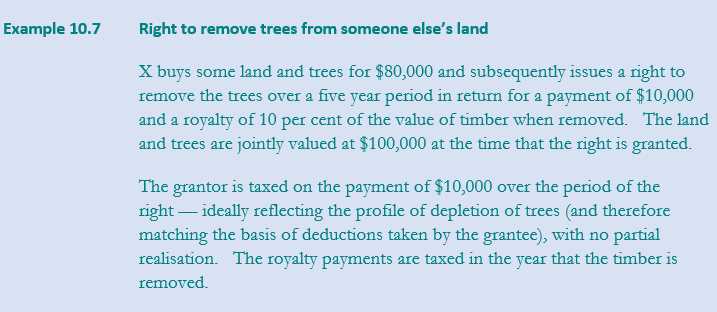

Straight line write-off would not be appropriate where the grantee takes the benefit at a point the grantee determines; for example in the case of a right to take something from another's land (profits à prendre). It would create both structuring opportunities in some situations and disadvantage taxpayers in others. In such cases, the grantee's write-off will be based on the actual rate of usage.

The change in value of the benefits from the right may be reasonably predictable by the grantee and grantor at the beginning of a right. In such cases, the grantee will be able to apply write-off over the period of the right on the basis of an up-front estimate of the expected change in value of the benefits where that estimate is reasonable and mutually agreed.

The longer the right the less straight line write-off would approximate the change in value of the benefits from a right over say land and property. In these circumstances straight line treatment would produce significant arbitrage opportunities. To address this by taxing rights over say 50 years as a sale of the underlying asset would introduce an arbitrary boundary line. An alternative would be to tax the change in the expected benefits - say moving in line with the CPI - for rights of long duration.

Another possibility would be to split the taxing of non-routine leases over land (crown leases in particular) into a routine element and a non-routine element. Many pastoral leases involve an up-front premium and annual rent. Treating the annual rents as 'routine' and the premium as 'non-routine' could result in simpler treatment, reduce arbitrage opportunities and smooth the routine/non-routine borderline.

While recognising these considerations, the Review opted for the practical approach reflected in the recommendations.

Restrictions on the ability to deduct payments which relate to benefits enjoyed beyond the period of the right, such as where options exist, will be necessary to remove avoidance possibilities - for example, where an agreement turns a series of non-perpetual rights into a perpetual right.

Treatment of payments stream

If the grantee pays for the right with a stream of payments, the grantee's write-off will be based on the present value of the payments stream. The fall in the value of the stream of future payments (an outstanding liability of the grantee) will be added to the taxable income of the grantee over the payment period.

Where future payments for the right include royalties that are not certain (subject, for example, to the size of the benefits extracted under the right), such royalties will not be included in the determination of the present value of the payments stream. They will be taxed on a receivables basis. This removes a potential for double taxation of rights under the current law.

Cameo 10.4 on page 277 of A Platform for Consultation illustrated the recommended treatment for both the grantee and grantor of a five-year right over a non-depreciable asset where the payments for the right are spread over the first three years. Straight line write-off over the five years applies to the grantee and the grantee is also taxed on the fall in annual value of the payments.

Cameo 10.2 on page 272 of A Platform for Consultation illustrated the recommended treatment for both the grantee and grantor of a right over the same asset - but where the payment for the right is up-front and the grantee and grantor agree on a profile of equal benefits from the asset over the five years of the right.

Recommendation 10.4 - 'Non-routine' rights representing disposal

| That non-routine rights which in substance represent the full economic disposal of an asset or the permanent disposal of part of an asset be treated as being a disposal (or part disposal) of the asset by the grantor and acquisition by the grantee. |

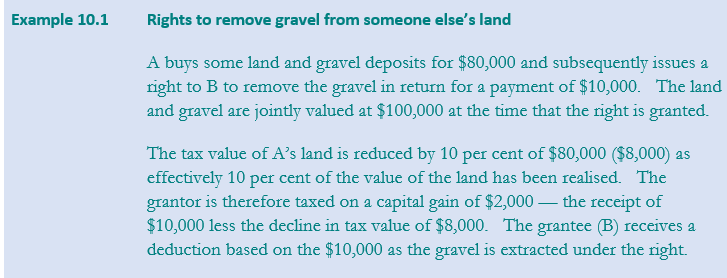

Many rights in substance represent the economic disposal of assets, either because the right is effectively in perpetuity or because the grantor otherwise does not regain an asset at the end of the right. Examples are rights to remove gravel or slate from someone else's land. These rights differ from other cases, in which the grantor regains the use of an underlying asset at the end of the right. (Rights relating to the removal of timber are covered under Recommendation 10.5 as these rights can be granted several times in succession over the same piece of land.)

Taxing such rights as disposals of an asset by the grantor reflects the economic substance of the transaction. This represents a change from the current treatment whereby many rights are treated as representing the creation of a new asset rather than a part disposal of an existing asset.

The tax value of the portion of the underlying asset being disposed of often cannot be separately identified. In those cases, the tax value of the underlying asset prior to the disposal will be reduced by the ratio of the present value of the payments for the right to the market value of the underlying asset at that time. Any excess between the payment for the right and the reduction in tax value (a gain) will add to taxable income, and vice versa for a loss.

These gains or losses will attract capital gains treatment on the same basis as sale of the underlying asset. Thus, where the right is granted over a pre-CGT asset, the right will be treated as being the part disposal of the pre-CGT asset.

Rights where there is no specific underlying asset

Rights where there is no specific underlying asset (such as franchises and some restrictive covenants) will be treated as being the disposal of an asset with a tax value of zero plus any undeducted attributable costs. The disposal should not attract the capital gains treatment or small business capital gain concessions. In a realisation based tax system, not all assets are recognised on creation, or as their value builds up over time (often on the basis of expenditures that are immediately deductible for income tax purposes).

Treatment of payments stream

To the extent that the right is not paid for up-front, the fall in the tax value of the stream of future payments will reduce the grantor's taxable income over the period involved. The stream of payments is an asset to the grantor with an initial tax value equal to the present value of those payments. This matches the treatment of the grantee. (This treatment applies also in the case of rights not representing disposals.)

Recommendation 10.5 - Grantor's treatment: 'non-routine' rights not representing disposal

| That where non-routine rights in substance do not represent the disposal of an asset, or part of an asset, the grantor be taxed on the following basis: |

| Term exceeding 10 years

|

| Term not exceeding 10 years

|

The grantor may regain the use of the underlying asset at the end of the right. This would be the case with non-perpetual leases and rights over land and realty.

This categorisation would also apply to rights to remove standing timber from someone else's land. In contrast to other rights to remove, the owner of the land can grant a succession of rights over replanted timber on the same land. Especially in relation to pre-CGT land, treating such rights simply as a part disposal would be a significant concession.

With such rights, a balancing adjustment on disposal of the right should apply, in principle, reflecting any previously unrealised changes in value associated with that part of the underlying asset subject to the right. The balancing adjustment will be determined as in the case of rights representing permanent disposals. Any portion of the present value of payments for the right not assessed via the balancing adjustment will be assessed over the period of the right ? usually on the basis of the 'mirror image' of the write-off profile attracted by the grantee.

Without a balancing adjustment, it would be more attractive to grant long duration rights than to sell assets. Treating rights as a part disposal of the underlying asset avoids taxing any economic gains which are attributable to the part of the underlying asset which has not been disposed of, and is consistent with the realisation treatment which is applied to assets more generally.

This treatment will ensure that the value of the right is only taxed once over the period of the right, with the timing of assessment depending on the extent of unrealised gains associated with the underlying asset. Where there are no unrealised gains, all the value will be assessed over the period of the right. Where (in the extreme case) the payments reflect 100 per cent unrealised gains, all the value will be assessed at the commencement of the right, with no subsequent further taxation (effects of delayed payments aside).

This approach means that at the end of the right, the underlying asset would have the same tax value as at the beginning, with unrealised gains which are taxed at the beginning of the right effectively being returned to the grantor by the end of the right. Because the unrealised gains are not permanently taxed, the income received through the partial realisation at the beginning of the right will not attract capital gains treatment.

For simplicity, the Review proposes that there should be no partial realisation associated with the granting of rights (which do not in substance represent the disposal of an asset) for 10 years or a shorter period. The assessment of a payment received up-front for a right will simply be spread over the period of the right, on the same basis as the deduction by the grantee. This will reduce compliance costs associated with short duration rights ? particularly in relation to market valuation of the underlying asset in order to determine the reduction in tax value of the underlying asset at the start of the right and the associated balancing adjustment.

Recommendation 10.6 - Treatment of rights over Australian assets granted by non-residents

| That amounts paid to non-residents for rights granted in relation to an Australian asset be taxed on the basis of the character of the income from the right. |

Under existing law, gains by non-residents on realisation or alienation of Australian assets are generally subject to Australian tax. Contrary to that intended outcome, a non-resident can avoid royalty withholding tax by assigning to an Australian entity a stream of royalties associated with an Australian asset in return for a lump sum payment.

In order to avoid potentially increased avoidance opportunities from the granting of rights by overseas entities for up-front payments which are deductible to Australian entities, amounts paid to non-residents for rights granted in relation to Australian assets will be taxed on the basis of the character of the income from the right. In the royalty example, the lump sum payment to the non-resident will be characterised as being a royalty payment and hence subject to royalty withholding tax.

Leases and other rights over depreciable assets

Recommendation 10.7 - 'Routine' leases excluded from cashflow/tax value treatment

| Tax treatment of routine leases

|

| Routine leasing defined

|

| Exclusions from routine leasing

|

Recommendation 10.8 - Non-routine leases included in cashflow/tax value treatment

| Where accelerated depreciation removed: 'sale and loan' tax treatment

|

| Should accelerated depreciation remain notwithstanding the Review's recommendation: cashflow/tax value treatment

|

The immediate focus of the Review is on the treatment of leases over depreciable assets in the context of the Review's recommendation to remove accelerated depreciation. Nevertheless, in the case of leasing it is imperative - because of the potential for tax benefit transfer - to consider alternative arrangements, in the event accelerated depreciation remains. Hence separate recommendations, including in relation to leases involving tax exempts, are provided covering the circumstances of both removal and retention of accelerated depreciation.

How equipment leases might be taxed in order to reflect more the economic nature of transactions was discussed in A Platform for Consultation (Chapter 9, pages 231-265). The present law does not provide the basis for taxing leases in a way that appropriately reflects the changing values of the parties' assets and liabilities under lease contracts. As a result, in some instances significant tax benefits can be obtained from rear weighting lease payments, while tax disadvantages are associated with up-front lease premiums.

The current lease treatment allows the transfer of the benefits of accelerated depreciation between taxable lessors and lessees by way of lower lease payments (tax preference transfer).

Two options for the taxation of leases were discussed in A Platform for Consultation (pages 235-239):

- •

- the 'sale and loan' approach (Option 1) - under which depreciation allowances are taken by the lessee; and

- •

- the 'tax-preferred' leasing approach (Option 2) - which leaves the accelerated component of depreciation allowances with the lessor in order to facilitate tax preference transfer via reduced lease rentals (for example, for lessees in a tax loss position).

In submissions and during consultations with accounting, corporate and industry representatives, there was some questioning of the need to deal with structuring of lease payments because payments under most 'routine' leases are spread evenly over the term of the lease. It was suggested that deliberate structuring arrangements could be dealt with by specific anti-avoidance rules.

The general view was that taxable lessors and lessees should be able to continue to transfer the benefits of accelerated depreciation (assuming acceleration were to continue).

Some concern was also expressed about the potential administrative and compliance complexity in the 'tax-preferred' leasing option discussed in A Platform for Consultation.

Background to the proposed approach

The issues relating to the taxation of a lease or right over depreciable assets are identical conceptually to those discussed earlier in relation to the taxation of rights over non-depreciable assets. Thus, ideally, the tax treatment of leases over depreciable assets should recognise the changing values of both the lease (which, in turn, reflects the declining value of the underlying depreciable asset) and the stream of payments for the lease (an asset to the lessor and a liability to the lessee). The declining underlying asset may be a tangible depreciable asset or an intangible depreciable asset such as a copyright, patent or registered design.

Such treatment would broadly parallel that proposed in Recommendations 10.3 and 10.5 for grantees and grantors of rights over non-depreciable assets - in the circumstances where they agree on a 'demonstrated reasonable' estimate of the annual rate of change in the benefits provided by the underlying assets. In the case of leases over depreciable assets, the annual rate of change in underlying benefits would correspond to the rate of depreciation of the assets.

Beyond these similarities between leases and rights, leases over depreciable assets involve particular considerations in the following areas:

- •

- accelerated depreciation for tax purposes - a key issue identified in Chapter 9 of A Platform for Consultation (pages 239-45) is whether tax preference transfer (transfer of accelerated depreciation from the lessor to the lessee via reduced lease rentals) should be permitted in relation to leases and similar arrangements;

- •

- the structuring of lease rentals - under current arrangements, even in the absence of accelerated depreciation, delayed lease rentals can provide tax benefits to high marginal rate lessors (equal periodic rentals can provide such benefits because of the decline in the benefit profile of the depreciable asset subject to the lease); and

- •

- potential tax advantages associated with balancing charge offset and the lack of general debt forgiveness provisions - these issues are discussed under Recommendation 10.13 relating to lease assignments.

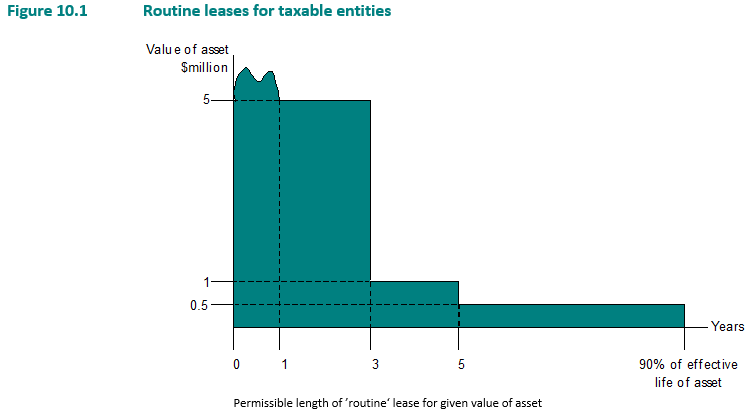

Routine leases

In the interests of simplicity - and because of the relatively small revenue implications of leases with equal regular payments - the treatment of 'routine' leases will not differ substantially from their treatment under the existing law. They will not be recognised as assets or liabilities under the generalised asset regime.

Under the new tax code, the lessor under a 'routine' lease will be treated as holding the depreciable asset and be entitled to depreciation allowances. The lessor's net income will be increased by rental receipts from the lease, including specified rents due but not paid at the end of the income year. A taxable business lessee will be entitled to reductions in taxable income for rental amounts paid and amounts due but not paid.

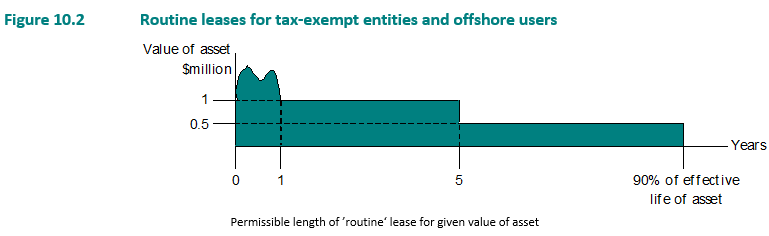

Equal periodic lease rentals have the potential to involve excessive costs to tax revenue when expensive depreciable assets are involved, particularly for long leases. Hence, excluded from 'routine' leases will be those over assets costing more than $5 million (if the lease is for more than one year), or more than $1 million (if the lease is for more than three years) or more than $500,000 (if the lease is for more than five years) or those that are for periods longer than 90 per cent of the effective life of the assets for tax purposes. This is illustrated in Figure 10.1. It will be necessary to ensure that taxpayers are not able simply to disaggregate high value leases into smaller components in order to qualify for 'routine' lease treatment.

Some administrative conditions will still be required to determine whether a lease is involved or a hire purchase agreement (such as, no option to purchase by the lessee or associate or provision of finance by the lessee). The exclusion from routine leasing of high value items over longer periods, however, suggests that other conditions are not necessary that are currently designed to stop revenue leakage associated with the structuring of lease payments.

Under the recommendations, the only structuring of lease rentals permitted is the equal periodic payments under routine leases. Should the routine lease specification prove too broad (even with the exclusion of high value items), it would be preferable to extend the structurally sound 'non-routine' leasing arrangements further into the 'routine' leasing area to address the effect on tax revenue of equal periodic lease rentals rather than imposing a range of arbitrary rules. Leasing by individuals and sale and leasebacks may be relevant in this regard.

As noted below, the Review believes that tax preference transfer should be permitted in relation to leasing between taxpayers (and the removal of accelerated depreciation would, in any case, essentially remove this as an issue).

Should accelerated depreciation be retained, relaxing some current restrictions in ATO rulings - such as requiring at least 20 per cent 'at risk' equity financed by the lessor and that leases be 'tax positive' over the period of the lease - would result in additional costs to revenue, as noted in A Platform for Consultation (page 245). Relevant here, too, are current ATO arrangements that do not permit individuals to be leveraged lessors of plant and equipment unless they are in 'the business of leasing' (an issue highlighted by any increase in the gap between the top personal tax rate and the company rate). Similar, and indeed more severe, conditions apply to leasing in most other countries, such as the United States and the United Kingdom.

Beyond blatant tax avoidance arrangements in the leasing area (such as leases that are a series of 'round robins') - where the general anti-avoidance rule (GAAR) may have a role - the Review believes that structural solutions should be used to address avoidance activity driven by flaws in the income tax base (Recommendation 6.2). Accelerated depreciation is, however, a policy choice of government. The GAAR and specific anti-avoidance rules should generally not be used to address the effects on tax revenue of such policy choices. If excessive revenue loss is involved, the policy itself should be adjusted. The case for specific anti-avoidance measures would have to be assessed against the preliminary questions posed for this purpose in relation to Recommendation 6.2(b)(ii).

'Non-routine' leases

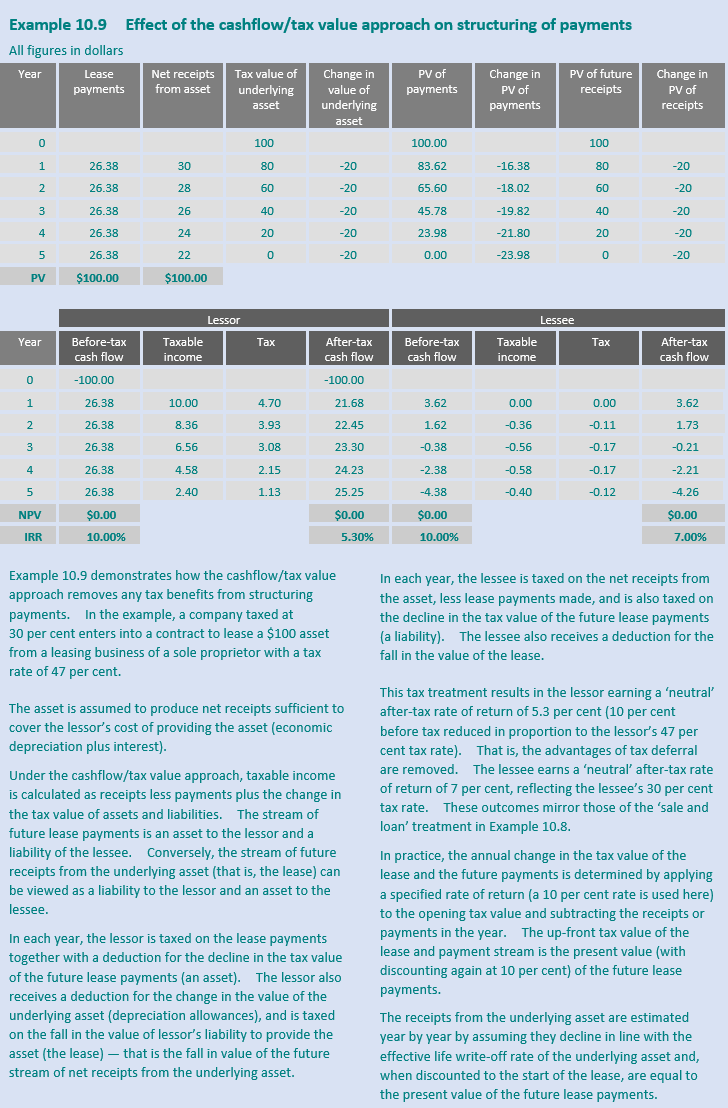

The tax treatment of leases that involve significant specified structuring of the profile of lease payments - beyond regular equal payments - or expensive assets for long periods will reflect the changing tax values of the associated assets and liabilities: either under a 'sale and loan' treatment or under the general cashflow/tax value framework. The choice between these two treatments depends on whether or not accelerated depreciation is removed.

The 'sale and loan' treatment, by formally transferring depreciation allowances from tax lessor to the lessee, provides the benefits of accelerated depreciation to the lessee at the lessee's tax rate. Those in a tax loss position would not, however, be able to benefit immediately from any acceleration in those allowances. Were accelerated depreciation to be retained in some form, the Review believes that tax preference transfer should, in principle, be permitted in relation to leasing between taxpayers. Permitting tax preference transfer for taxable lessees generally preserves the present position under which taxable entities (including those in tax loss) are able to access the benefits of accelerated depreciation through leasing. This places tax loss entities in the same competitive position as entities which are able to benefit directly from accelerated allowances. Thus, the 'sale and loan' treatment is more suitable when accelerated depreciation is not available.

In contrast, the general cashflow/tax value treatment would allow those in a tax loss position to benefit immediately from tax preference transfer. In this case, the transfer would be effected via reduced lease rentals, rather than by formal access by the lessee to the accelerated allowances. This treatment would avoid the complexity associated with dividing the depreciation allowances between the lessee and lessor that would have been involved with the 'tax-preferred' leasing option in A Platform for Consultation.

Where accelerated depreciation is removed

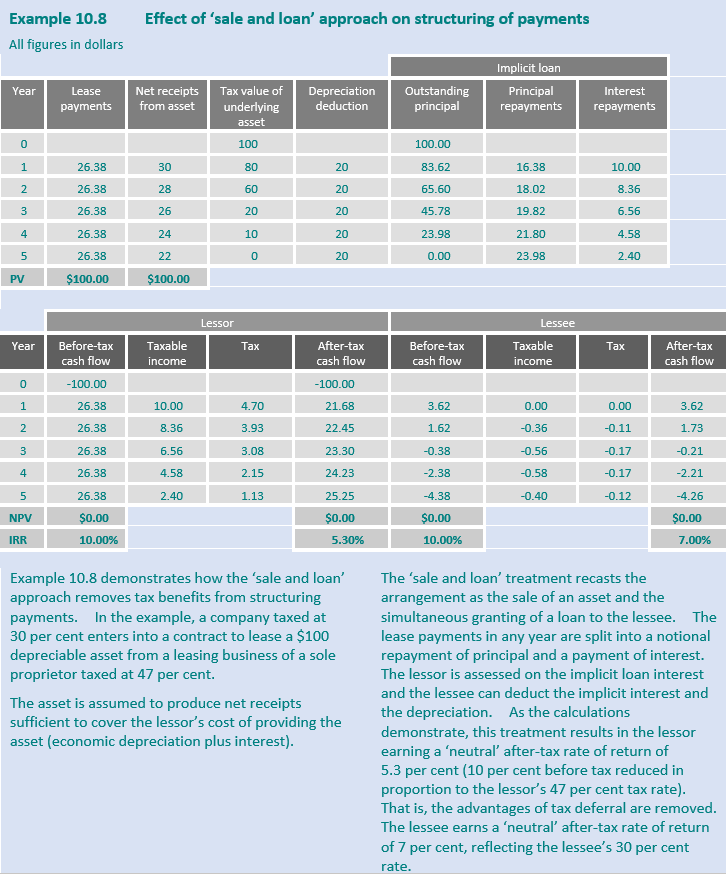

In the absence of accelerated depreciation, lease transactions not constituting a 'routine' lease will be treated for tax purposes under a 'sale and loan' approach. The lease is recast for tax purposes as a sale of the leased asset by the lessor to the lessee financed by a loan from the lessor to the lessee. This is a simple, familiar method of taking into account the changing tax values of the associated asset (the right of access to the leased asset) and liability (any future structured lease rentals).

This approach therefore addresses in a structural way both the tax benefit and tax disadvantage currently associated with structured lease payments. Neutrality is achieved in the decision between leasing and borrowing to purchase the asset.

Cameo 9.1 on page 236 of A Platform for Consultation illustrated the operation of the 'sale and loan' treatment for a lease over a high value asset with equal annual rental payments over five years. A similar example is reproduced in Example 10.8.

Where a lease or other right is not 'routine' and does not apply to the whole asset (for example, an indefeasible right of use over a submarine communications cable), sale and loan treatment could be applied on a partial basis. Specification of the proportion involved would be needed when the lease is over a period less than the life of the asset in order to determine the value of the associated 'loan'.

Should accelerated depreciation remain

The general cashflow/tax value treatment again addresses in a structural way both the tax benefit and tax disadvantage currently associated with structured lease payments. It achieves neutrality in the decision between leasing and borrowing to purchase an asset, regardless of the profile of lease payments, while also offering the opportunity for tax loss lessees to benefit immediately from accelerated depreciation via reduced lease rentals.

Consistent with the treatment of rights over non-depreciable assets, this treatment takes into account the change in value of the lease to both the lessee and the lessor - with that change in value reflecting the rate of effective life depreciation of the underlying assets. In practice, the annual benefits from the lease are estimated by equating the present value of the stream of lease rentals with a profile of benefits declining at the depreciation rate. The changing value of the stream of lease payments is also taken into account.

The operation of this treatment is illustrated in Example 10.9. The example illustrates the same lease used in the 'sale and loan' treatment of Example 10.8 in the case where there is no accelerated depreciation. Should accelerated depreciation remain, the mechanics of the general cashflow/tax value treatment would be the same as shown in Example 10.9.

If accelerated depreciation remained, a balancing charge would be needed at the start of the lease where used assets which are not being used predominantly for leasing are leased for a sufficient duration - say, a period greater than half the effective life for tax purposes of the associated asset. That change maintains neutrality in the decision to sell a currently owned asset (in which case a balancing charge will apply) or lease it to someone else. The application of the balancing charge at the start of the lease is equivalent in concept to the balancing charges recommended to apply on the part disposal of long term rights over non-depreciable assets (Recommendation 10.5) and to the disposal of benefits or obligations associated with financial assets and liabilities (Recommendation 10.8(a)).

This treatment would handle any lease over part of a depreciable asset for any number of years. Instead of the 'sale and loan' treatment, it could also be used more generally in the presence of accelerated depreciation.

Hire purchase and luxury car leases - whether or not depreciation is accelerated

Hire purchase arrangements (including cross border leases) and luxury car leases will continue to be taxed on the basis of sale and loan treatment regardless of whether or not accelerated depreciation remains. Under the existing law, hire purchase is used as a mechanism to finance the purchase of depreciable property in a way that enables the asset user to obtain the associated capital allowances, and also applies where there is an effective option to purchase the asset. The existing law also treats lessees of luxury cars as being entitled to capital allowances to ensure that the capital allowance limitation on luxury cars is effective.

Sale and leasebacks under accelerated depreciation

Sale and leaseback transactions currently offer the opportunity for owners to 'refresh' any accelerated capital allowances on depreciable assets while allowing the excess of the 'sale price' over depreciated value to be offset against the depreciated value of other assets. The recommended removal of current balancing charge offset and adjustment rules (Recommendation 8.11) will largely address this tax bias with sale and leaseback arrangements - although taxpayers in a tax loss position would not be immediately affected by the balancing charge that will arise from a sale and lease back arrangement when accelerated depreciation is available.

A workable leasing treatment for tax exempts or assets used offshore

Recommendation 10.9 - Abolition of section 51AD

| That section 51AD be abolished, as part of the package of reforms including Recommendations 10.10 and 10.11. |

Section 51AD currently denies all deductions relating to property predominantly financed by non-recourse finance which is 'leased to or effectively controlled by' a tax-exempt entity.

Section 51AD has a severe impact where it applies because all deductions are denied to the taxpayer but the associated income is still assessable. It has been continually criticised by State governments and infrastructure providers for its severe impact where it applies and the uncertainty it creates. Section 51AD has become even more problematical in recent years because of increased levels of privatisation and outsourcing of government services which were not contemplated when it was first conceived.

In A Platform for Consultation (pages 249 and 257) it was argued that the severe treatment of arrangements that are currently prohibited by section 51AD is unnecessary - and there is no reason why leases (and similar arrangements) involving tax exempts should be treated differently simply because they are financed using non-recourse finance - providing structural measures are in place to address potential structured non-payment of non-recourse finance, tax preference transfer to tax exempts and the timing advantages of delayed lease and service contract rentals.

The Review believes that section 51AD can no longer be justified. Structural measures recommended to deal with extinguishment of liabilities (Recommendation 6.8) address potential abuse of non-recourse finance through debt forgiveness. 'Sale and loan' treatment would also address this issue, as well as tax preference transfer and timing benefits.

Thus, leases and similar arrangements involving tax exempts covered by section 51AD will be broadly treated in the same manner as those currently subject to Division 16D. The degree of complexity involved will depend on whether or not accelerated depreciation is retained (Recommendations 10.10 and 10.11). Overseas use of assets (also presently subject to section 51AD in some cases) will also be treated in a unified manner (Recommendations 10.10 and 10.12).

Both industry and State government representatives strongly supported the abolition of section 51AD and the development of a single, less severe provision to cover asset financing arrangements involving tax exempts.

Abolition of section 51AD is recommended not as a stand-alone reform but as part of the integrated reforms in this area reflected in Recommendations 10.9, 10.10 and 10.11.

Recommendation 10.10 - Replacing Division 16D under recommended removal of acceleration

|

(a)

That if accelerated depreciation (apart from that applying to small business - Recommendation 17.3) is removed:

|

Recommendation 10.11 - Replacing Division 16D if acceleration retained notwithstanding the Review's recommendation

| That if accelerated depreciation is not removed: |

| Continued restrictions on tax preference transfer

|

| Replacement arrangements based on 'predominant interest'

|

| Defining 'predominant interest' in assets

|

| Negotiating tax preference transfer to States

|

General provision

The current Division 16D applies to arrangements involving the use or control of assets by tax exempts where those arrangements are not financed by non-recourse debt. These arrangements are therefore not subject to the more severe (and commonly encountered) section 51AD. Division 16D applies to arrangements that are broadly similar to finance leases.

Under Division 16D, these arrangements are recharacterised as the provision of loan finance. Tax-exempt lessees are therefore denied the benefit of accelerated depreciation on the assets. Division 16D is a form of 'sale and loan' treatment but is complex in terms of its drafting and has a number of technical limitations. As is the case with section 51AD, Division 16D applies where there is 'effective control' of assets by tax exempts, a concept which has been problematical.

If accelerated depreciation is removed as recommended

If accelerated depreciation is removed (Recommendation 8.1), there will be no need for complex provisions to determine which arrangements should be specifically subjected to 'sale and loan' treatment under the 'predominant interest' test in Recommendation 10.11(b). The increased simplicity of tax law and certainty for taxpayers which would result in the tax exempt area is a further substantive argument for removing accelerated depreciation.

There would nevertheless be significant benefits from equal periodic payments under 'routine' leasing between tax-exempt and taxable entities. There would be a significant tax incentive to tax exempts to arrange 'routine' leases over assets (including existing assets) which they would otherwise purchase or hold themselves directly under existing law. To illustrate, under an extreme assumption that all new assets of tax exempts were leased under 'routine' arrangements, the cost to revenue from structuring payments could be up to $350 million by 2003-04. This cost would be increased by the sale and leasing back of existing assets of tax exempts.

The scope of 'routine' leases involving tax exempts therefore needs to be narrowed significantly - hence, the recommendation to exclude from the 'routine' category any leasing arrangement involving items of value greater than $1 million, regardless of the length of the contract, as well as leases involving assets previously owned by tax exempts. The resulting restrictions from 'routine' leasing relating to high value items are illustrated in Figure 10.2.

As with taxable leasing, if this lease specification of routine leases involving tax exempts proved to be too broad, it would be necessary to extend further the structurally sound non-routine leasing approach into the routine areas.

Structuring opportunities with service arrangements involving tax exempts would be addressed by the application of the cashflow/tax value approach regime to those arrangements - consistent with the application of that regime to service arrangements between entities generally. The application of this approach to arrangements involving tax exempts would also benefit from consultation with State and Territory governments and industry.

If accelerated depreciation remains, should tax preference transfer be permitted to tax exempts?

As noted earlier, the Review in principle supports tax benefit transfer effected by leasing between taxpayers. Arguments in favour of allowing tax preference transfer generally (including where tax exempts are involved) include making the benefits of accelerated depreciation available equally to all taxpayers and tax exempts, improving investment neutrality and competitive neutrality and reducing the complexity of the tax system.

Arguments against allowing tax preference transfer in relation to tax exempts include the financing bias that provides in favour of leasing and the significant cost to revenue. In theory, the cost to revenue could be met by an agreement between the Commonwealth and State and Territory governments which provided for offsetting changes in the level of transfers between the different levels of government.

State government and industry representatives considered that, over the time horizon encompassed by the Review, the complexities associated with reaching an agreement between the Commonwealth and State and Territory governments mean that the option of permitting tax preference transfer in relation to tax exempts is unlikely to be feasible. The argument was also put that it is impossible to quantify the effect on Commonwealth and State and Territory finances of allowing unlimited tax preference transfer to tax exempts and, hence, it was preferable to continue to restrict access to tax preferences.

The Review believes that it is appropriate in the short term to continue to restrict access by tax-exempts to accelerated depreciation should that remain, given the cost to revenue of allowing tax preference transfer and the difficulties associated with reaching a suitable agreement between the Commonwealth and the States and Territories to address the costs.

The Review also believes that, given its deficiencies, Division 16D should be replaced. However, application to tax exempts of the improved replacement will still necessarily remain relatively complex and uncertain, given the inherent complexities associated with determining the boundary line between those arrangements where tax preference transfer should be restricted and those where it should not.

Negotiating tax preference transfer

If accelerated depreciation allowances were to be retained, the Review considers that there would be benefits in the Commonwealth and State and Territory governments entering into negotiations about addressing the costs to revenue associated with allowing tax preference transfer to tax exempts through offsetting adjustments to financial transfers between the different levels of government.

The Review recognises the great practical difficulties that would be involved in assessing the cost to revenue from allowing tax preference transfer and in assessing the distribution of the benefits among the States and Territories. Nevertheless, the Review recommends that should accelerated depreciation provisions remain, the Government enter into negotiations because, if such an agreement could be reached, there would be no need for complex provisions to determine which arrangements involving tax exempts should be specifically subjected to 'sale and loan' treatment. The arrangements in Recommendation 10.10 would apply. This would significantly reduce tax law complexity.

Tax Equivalent Regimes

Both State and Territory governments and private sector representatives argued that tax preference transfer should be permitted where the end user of an asset is a Government Trading Enterprise (GTE) which is subject to a Tax Equivalent Regime (TER). State government representatives also argued that permitting tax preference transfer to entities subject to TERs is consistent with the principles of National Competition Policy.

State and Territory governments also argued that a reciprocal arrangement between the Commonwealth and the States and Territories to allow tax preference transfer between taxable entities and entities subject to TERs will not, a priori, involve any cost to Commonwealth revenue. They suggested that deductions being taken by taxable entities in relation to assets used by GTEs would, as likely as not, be balanced by deductions being taken by TER entities in relation to assets used by taxable entities.

The nature of GTE operations means that they are more likely to be lessees of assets rather than lessors of assets to taxable entities. Although, at the moment, TERs do not fully mirror Commonwealth tax, it is intended that a national tax equivalent regime be operational for State and Territory GTEs from 1 July 2000.

It remains the case that, notwithstanding independence of GTEs from their State and local government owners, it will be more beneficial from their owners' point of view if GTEs were to access Commonwealth tax preferences through leasing than to access tax preferences provided by their owners through the TER.

Around 50 per cent of total annual investment in depreciable plant and equipment by the tax exempt sector is currently undertaken by State and local government GTEs. Providing an exemption for TER entities from the restriction on tax preference transfer to tax exempts would therefore involve a substantial proportion of the cost of allowing tax preference transfer. Such an exemption could also create an incentive for tax exempts to undertake more of their investment through TER entities.

The Review proposes that, under the revised arrangements, tax preference transfer should be restricted in relation to arrangements involving all tax-exempt entities, not just public tax exempts as under the current Division 16D. Similar issues arise in relation to tax exempts which are not public entities as with those that are. The revised provisions should therefore apply equally to all tax exempt entities. This is similar to the current coverage of section 51AD.

Which arrangements should be subject to a tax exempt leasing provision?

A Platform for Consultation (page 262) suggested that, based on experience with section 51AD and Division 16D, restrictions on tax preference transfer to tax exempts should not be based on the concept of which entity 'controls' the asset. Instead, the Review suggested that the criteria for the restriction should be based on the extent to which the tax exempt has equity risks and benefits in the asset.

Four options were canvassed for determining when a tax exempt had sufficient of the risks and benefits of an arrangement to justify denying tax preference transfer. These were:

- •

- including only those arrangements which were similar to finance leases;

- •

- including those arrangements where the tax exempt had the 'predominant' interest (or majority interest) in the underlying asset;

- •

- including essentially all arrangements which represented the provision of finance, subject to specific exclusions; and

- •

- denying deductions in proportion to the degree to which the tax exempt was 'at risk'.

During consultations, State government representatives and industry supported a framework which it was agreed could form the basis for developing criteria to be used to determine arrangements subject to the 'sale and loan' treatment. Under the proposed framework, an arrangement will be subject to the 'sale and loan' provision when the tax exempt holds the 'predominant interest' in the arrangement (or the assets involved in an arrangement).

Provisionally, it is proposed that a tax exempt's 'predominant interest' in an arrangement would be established through a 'two tailed test'. The tax exempt would be deemed to have a predominant interest if:

- •

- an indicative list of relevant project risks suggests that sufficient risks were being borne by the tax exempt; or

- •

- quantification of the financial burden of the risks of the arrangement to the extent possible (using a methodology which will need to be developed) indicated that over a threshold proportion of between 50 and 75 per cent of the risks were borne by the tax exempt.

When quantifying the financial burden of the risks, a threshold of over 50 per cent was favoured by State government representatives on the basis that it provided for a margin of error necessarily inherent in any methodology to quantify the aggregate burden of the risks. This test could be applied both to cases in which the tax exempt has a predominant interest in arrangements where assets are owned by taxable entities, and also to cases where the tax exempt is the owner and leases the asset to a taxable entity - although developing criteria that both provide sufficient protection for the revenue and also provide some certainty and ease of compliance for taxpayers and tax exempts could prove difficult.

Recommendation 10.12 - Assets used offshore

| That access to any accelerated depreciation allowances be prevented where assets are used offshore, except where the assets are 'primarily used for non-leasing purposes' by an Australian taxpayer. |

A Platform for Consultation (pages 245-6) noted that where Australian-based lessors lease assets to overseas users, the benefits of any accelerated depreciation allowances can be passed to the overseas lessee if tax benefit transfer is permitted. If the purpose of accelerated depreciation allowances is to increase the level of such activities in Australia, this is not appropriate.

Where Australian businesses such as airlines and shipping firms are the end users of assets used outside Australia to generate assessable income in Australia, it is appropriate to allow them to access tax preferences in relation to these assets in the normal way. However, in a world of increasingly globalised operations, it can be difficult to be sure that an Australian business is the 'end user' of an asset and has not instead effectively transferred use to an overseas business.

Some industry representatives argued that there should be no restrictions on the overseas operations of assets which form part of an Australian business. However, other industry representatives accepted that there was a need to delineate circumstances in which overseas use of assets should not attract Australian tax preferences.

The preferred approach to addressing the issue of overseas use of assets is to have Australian tax preferences only available in relation to overseas use of assets when an Australian business is the 'primary user for non-leasing purposes' of the asset. Under this test, Australian business will be able to access Australian tax preferences in relation to overseas use of assets if, during a relevant period, an asset is primarily used for non-leasing purposes by that business.

The test could be constructed so that it not apply where assets were temporarily used for leasing purposes by an Australian business because of unforeseen circumstances (such as during economic downturn).

The intention behind the test is not to hinder sound commercial practice in relation to assets that are used in the ordinary course of trade by an Australian business, but to prevent tax preferences being taken where assets are effectively leased by Australian businesses (or financiers) to overseas users.

Such a test could apply in more cases than under the current Division 16D, which only applies to finance leases, but would be significantly less severe than the test which currently applies under section 51AD in relation to arrangements which are financed using non-recourse finance.

Development of the test, and its application in practice, will involve additional work and consultation with industry representatives. The test would not be required if accelerated depreciation allowances were abolished (Recommendation 8.1).

Addressing the assignment of leases

Recommendation 10.13 - Addressing lease assignments

| Consideration for assignment taxable

|

| Disposal of majority interest in leasing subsidiary

|

| Asset or equity assignment upon lease termination

|

| Qualifying period for disposal of majority interest

|

Date of commencement

These lease assignment measures will apply to arrangements entered into after 22 February 1999. In a press release of 22 February 1999, the Treasurer gave notice that the Government reserved the right to take such action as was necessary to address any exploitation of deficiencies in the current business tax system in the period between the release of A Platform for Consultation and when legislation on a new business tax system is enacted. Lease assignments were specifically raised as an area of concern in this regard in a letter of 22 February 1999 from Mr Ralph to the Treasurer on that day (and referred to in the Treasurer's press release of that date).

Tax avoidance through lease assignments

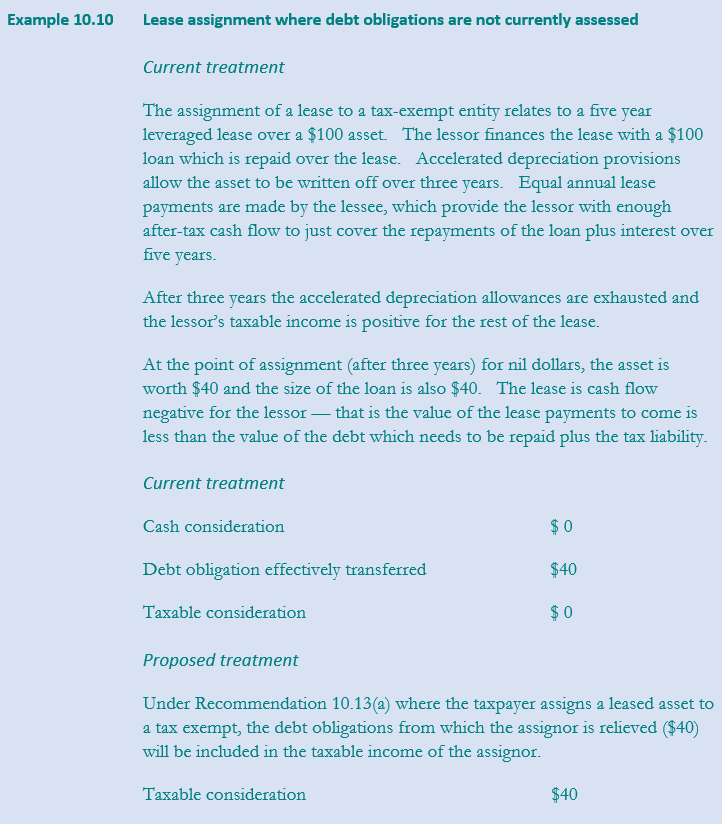

In Chapter 8 of A Platform for Consultation (page 221) it was explained that tax can be avoided on some lease transactions through assigning (or selling) leases along with associated debt liabilities to a tax exempt or low tax rate taxpayer.

The following aspects of the existing law facilitate tax avoidance through lease assignments:

- •

- The current structurally unsound treatment of the changing values of the assets and liabilities associated with the leasing of depreciable assets. Even in the absence of accelerated depreciation, the current poor treatment encourages delayed rental payments to the benefit of high marginal tax rate lessors - and results in no tax being paid in the early part of the lease because depreciation and debt interest deductions (at high tax rates) exceed the lease income. This produces a 'lease tail' of lease rentals and outstanding debt ready for assignment by the lessor.

- •

- Where debt obligations have been assigned along with the leased asset, the benefit of being relieved of the debt is not brought to account as part of the assignment proceeds.

- •

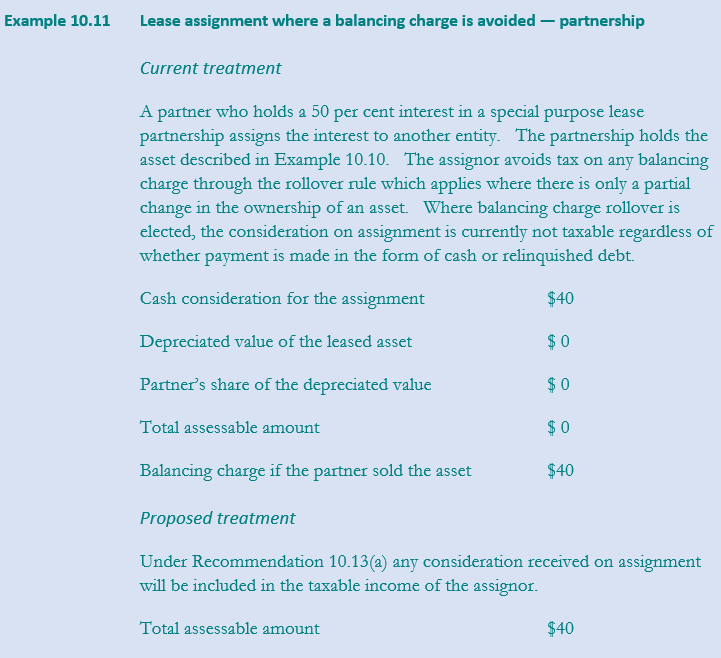

- Assignors are able to avoid tax on balancing charges - essentially recoupment of depreciation - when the leased asset is disposed of, by taking advantage of a balancing charge rollover rule which applies where there is only a partial change in the ownership of an asset (such as a change in interests in a partnership). The effect of the rollover is that tax is permanently avoided, as the new partner is a tax-exempt or low tax entity.

Structural measures recommended by the Review - including reformed treatment of non-routine leases (Recommendation 10.8), changes to partnerships (Recommendation 16.16) and taxation on extinguishment of liabilities (Recommendation 6.8) - could, if adopted, largely remove the scope for obtaining unintended tax benefits from assigning new leases after the commencement of these new arrangements (see A Platform for Consultation, pages 250-251).

There will, however, be opportunities to assign leases prior to these structural measures being enacted, and there would be continuing opportunities for gaining unwarranted tax benefits in relation to lease transactions in place before that time.

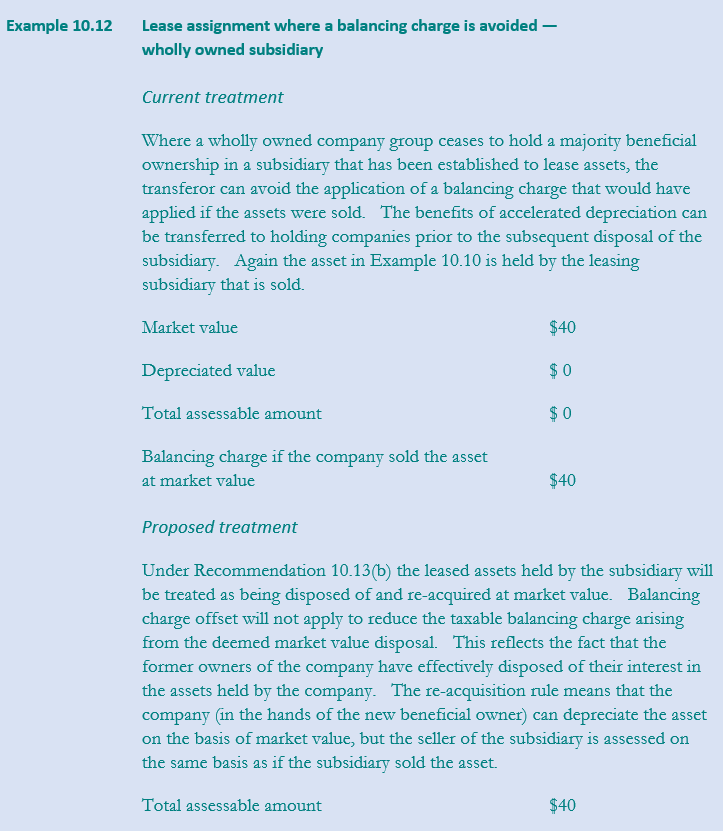

Assignments through selling the entity

The exploitation of lease assignments can also be achieved by selling the entity that holds the leased asset (or an interest in a leased asset) to a low tax entity rather than assigning the lease. Gains and losses on assets are reflected in the value of interests in the entities that own those assets. As the value of the shares in an entity represents the value of its assets net of liabilities, there is an effective realisation of the value of the assets by the transferor of the shares.

By selling the entity that owns the assets, a transferor can also avoid the application of a balancing charge that would have applied if the assets were sold. This is particularly relevant where the entity that holds the assets is a wholly owned subsidiary in a corporate group because the benefits of accelerated depreciation can be transferred to the holding company prior to the subsequent disposal of the subsidiary.

Recommendation 10.13(b) is therefore intended to address situations where unwarranted tax benefits are obtained by assigning an entity rather than a direct interest in a leased asset, and is needed as an integrity measure. In order to target the measure, it will only apply to sales of wholly owned subsidiaries that are predominantly used to lease assets and where the sale is to another entity that is not in the same business as the company group. This will mean that legitimate transfers of interests to similar businesses will not be affected.

In some circumstances a lessor company that has been degrouped may not have the funds to pay the tax liability arising, as the benefits have been previously taken by the group. It is therefore reasonable to require the former group to pay the tax if the former subsidiary does not pay within six months of the due date for payment.

With both direct lease assignments and sales of leasing subsidiaries, it is necessary to ensure that the measures are not avoided by prior termination of the leases - Recommendation 10.13(c). To target this additional measure - Recommendation 10.13(d) - it will apply only to assets which were leased on or after 22 February 1999 and which were leased for a majority of the period that they were held by the assignor or group prior to disposal of the asset or associated subsidiary.

Some stylised examples of a lease assignment and how the proposed measures will apply are shown below.