Review of Business Taxation

A Tax System RedesignedMore certain, equitable and durable

Report July 1999

SECTION 12 - DISTRIBUTIONS

A comprehensive definition of distribution

Recommendation 12.1 - Use of a comprehensive definition of distribution

|

That a common concept of distribution:

|

Taxing companies (including co-operatives), trusts and limited partnerships under an entity taxation system requires a definition of distribution that, as far as possible, can be applied consistently to the entities covered by the system. A broad definition is also necessary to ensure that members (particularly individuals) are not able to extract gains from entities for consumption or personal investment without paying tax at their marginal tax rate. A consistent, broad definition thereby contributes to the fairness of the entity tax system. A robust definition also needs to take account of the fact that distributions can be indirectly effected through dealings involving associates of the entity or of the member, so treating such dealings as distributions.

Distributions involve transfers of value from the entity to members in their capacity as members. Distributions are distinguished from other transactions between entities and their members as they occur in a membership capacity and not some other capacity (such as contractor or employee).

Value can be shifted from an entity to a member in four main ways:

- (i)

- a payment of money (such as a dividend or a distribution to a beneficiary) by the entity without consideration in return;

- (ii)

- the transfer of an asset by the entity at less than fair value, including the making of a loan at less than commercial interest rates;

- (iii)

- the provision of services by the entity, including the use of assets, at less than fair value; and

- (iv)

- the release of a liability by the entity at less than fair value consideration for that release.

A distribution would also result from a member's transferring assets, providing services or releasing liabilities to the entity at more than fair value, rather than the reverse.

All ways of transferring value to members should ideally have the same tax consequences for the entity and for the member, so that no method changes the tax liability of the entity or of the member compared with any other method. Thus, each method should, for example, produce the same credit for tax paid by the entity. For this reason distribution treatment should generally take precedence over the taxing of the transfer of value by other provisions such as those relating to value shifting or debt forgiveness.

The recommendation is essentially Option 1 in Chapter 18 of A Platform for Consultation.

Implication of the comprehensive definition of distribution for Division 7A and FBT

For private companies, a similar wide definition of dividend currently applies under Division 7A of the 1936 Act. The introduction of the general wide definition will allow the removal of many of the provisions currently in that division.

The main differences between Division 7A and the recommendation are that Division 7A does not currently apply:

- •

- where a private company provides a service directly to the shareholder, or associate, rather than paying for someone else to provide the service; or

- •

- to the use of assets, such as the use of a motor vehicle, if the benefit does not amount to the transfer of a property interest in the item being used.

Interaction between the wide definition of distribution and FBT

The recommended broad definition of distribution will mean that the separate FBT treatment, proposed in A New Tax System, will not be required for benefits provided to members or their associates in their capacity as members or associates.

This treatment is consistent with, but not dependent on, the recommendation that benefits to employees, currently covered by FBT, should in future be included in the taxable income of the individual who receives the benefits (see Recommendation 5.1). The fringe benefits recommendation only applies to members and their associates when they receive benefits in their capacity as employees of an entity rather than as members. If that recommendation is not accepted, the current FBT will continue to apply only to benefits received in an employee capacity.

Recommendation 12.2 - Treatment of certain discounts provided by widely held entities

| Tax treatment of eligible discounts to members

Eligible discounts

Tax treatment of ineligible discounts to members

|

Some arrangements - generally known as shareholder loyalty schemes - currently operate under which the shareholders of certain public companies (or their operating subsidiaries) are entitled to discounts, which are not available to members of the general public, on purchases from the entity of goods and services in which the entity regularly trades with the public at large. In some cases, members' associates can also be entitled to discounts on the members' account. Recognising current practices, it is considered appropriate for the taxation system to provide a limited form of concession in respect of these member discount schemes offered by widely held entities.

In A Platform for Consultation (page 407), the Review discussed the possibility of a $1,000 threshold, similar to that suggested in A New Tax System for taxing shareholder benefits as fringe benefits subject to FBT. The Review has also considered the possibility of a percentage limit on member discounts, for the purposes of limiting any concession. These possibilities are complex and impose substantial compliance costs.

- •

- A limit on the total dollar value of member discounts is apt to encourage the provision of discounts up to that level to all qualifying members by all qualifying entities, regardless of whether the discounts are commercially reasonable. Administratively, such a limit would require entities to track the levels of discounts provided to each member (or on the member's account), with necessarily substantial compliance costs.

- •

- A limit on the percentage of member discount again encourages the provision of member discounts up to the specified level, regardless of whether the discounts are commercially reasonable. No one percentage has the same commercial effect across businesses; nor is the discount percentage directly related to the value of the membership interests. Where the discount can apply to any benefit to members, there are significant costs in establishing the base cost compared with that on which the percentage discount must be calculated.

In the interests of simplicity and equity, the Review prefers a flexible concession limited by commercial considerations. Eligible discounts must be objectively reasonable, commercially justifiable and not excessive to that commercial purpose, on the basis of an arm's length relationship between the entity and the members who receive the discounts. That means the discounts must be consistent with a fiduciary obligation by the managers and controllers towards the entity. Member discounts will need to relate to the provision of goods or services that the entity makes available to the public in the course of its business. And the discounts must be applied when the benefits - the goods or services - are provided to the member, rather than being a subsequent decision distributing value to members in the light of overall performance.

Widely held entities are relatively less likely than closely held entities to act to the advantage of a small group of their members. Limiting eligible discounts to those provided by widely held entities whose membership interests are required to be publicly available (by listing or other general availability) lessens the risk of abuse.

Taxpayers will disregard such discounts in calculating their taxable income. Where an associate receives the discount on the member's account, the associate will also disregard any discount in calculating their taxable income.

Ineligible discounts may arise where an entity does not qualify to provide eligible discounts, or discounts fail to satisfy the other requirements specified. In such circumstances, the discounts will be treated as a normal frankable distribution.

Applying a profits first rule

Recommendation 12.3 - A profits first rule

| That distributions from entities to members be treated as income of the members to the extent of available profits of the entities. |

Distributions to members should be treated as coming from profits to the extent of the entity's available profits, and hence be included in the members' taxable income and be subject to imputation arrangements. Members generally acquire their interest in an entity to share in its profits while they remain members. A profits first rule (discussed in Chapter 19 of A Platform for Consultation) best ensures fairness among members and simplicity of the entity tax system.

Existing law gives companies and trusts some discretion as to whether distributions are out of profits or contributed capital. This can result in deferral of tax, as well as the streaming of profits and contributed capital according to members' tax positions. Currently, complex specific anti-avoidance provisions are aimed at limiting tax benefits flowing from such discretion. Implementation of the profits first rule and other related entity reforms will enable these specific anti-avoidance provisions to be repealed (Recommendation 6.6), reflecting the structural nature of these proposals.

The available profits of an entity will be measured as the excess of the net assets of the entity over its contributed capital (subject to Recommendation 12.4). Distributions to members in excess of available profits will be treated as being from contributed capital and will generally reduce the tax value of the member's interest.

Distributions which cancel a member's interest in an entity would be treated as coming proportionally from the available profits and contributed capital of the entity (with the exception of on-market buy-backs for practical reasons) - see Recommendation 12.17.

Recommendation 12.4 - Use of accounting records for the profits first rule

| That entities be able to rely on their accounting records (if kept in accordance with generally accepted accounting principles) in applying the profits first rule if the amount of a distribution does not exceed the available profits in those accounts. |

While A Platform for Consultation noted that, in practice, book values could be relied on in applying the profits first rule greater certainty will be achieved by providing an explicit 'safe harbour' in the legislation.

The profits first rule proposed in Recommendation 12.3 treats an entity distribution as coming from profits to the extent that the entity has available profits. Where there are in fact no available profits, distributions would be treated as coming from contributed capital. Under this approach, the available profits of an entity are equal to the fair value of the entity's net assets less its contributed capital.

Concerns were raised in consultations that a fair value rule would have a significant compliance cost for taxpayers. Such a rule could require valuation of all assets and liabilities to be carried out before every distribution, even where accounting records would satisfactorily establish that the distribution was out of profits.

If an entity maintains accounts prepared in accordance with generally accepted accounting principles, the profits in those accounts (adjusted if necessary for differences between contributed capital for tax purposes and capital for accounting purposes) will be acceptable in establishing that a distribution is out of profits. Entities in such cases will not need to establish the fair value of assets before making the distribution. For most entities that are ongoing and not being wound-up, it will usually be the case that the use of accounting records will recognise a distribution as coming entirely from profits. Entities could, nevertheless, choose to use fair values in preference to book values should they wish to do so.

If a distribution exceeds profits recorded in the entity's accounts, it will be necessary to establish the fair value of assets in order to determine the extent to which there are profits (generally unrealised gains) not recognised in those accounts. If the accounts of an entity do not accord with generally accepted accounting principles, they will not be acceptable for determining whether a distribution is out of profits.

Recommendation 12.5 - Specific exceptions to the profits first rule

|

That distributions of the following amounts be specific exceptions to the profits first rule:

Current year gains on pre-CGT trust assets

Current year exempt gains on pre-announcement trust assets

Trust income taxed outside entity regime

Distributions to members by associate entity

|

The exceptions recommended, are intended to ensure that individuals receive the same treatment in some important respects in relation to existing assets held in trusts.

Exceptions to the profits first rule that largely reflected the transitional arrangements for trusts proposed in A New Tax System (page 124) were canvassed in A Platform for Consultation (pages 437-438). Concerns were raised in consultations that those exceptions were too limited in scope or too restricted in time (for example, only certain amounts distributed within the year of realisation) and overly complex.

Recommendation 12.5(iii) is a necessary extension of the proposals in A New Tax System. It differs from the option discussed in A Platform for Consultation (page 436) by not applying a five year time limit in respect of prior-taxed income. Applying the time limit would require complicated tax value adjustments for undistributed amounts at the end of the period. The exception applies whether the income was taxed to the entity or another person (for example, a presently entitled beneficiary of a trust). It also applies to income taxed after commencement of the new entity tax system, for example, income of a trust which is initially an excluded trust and later becomes subject to entity taxation.

Recommendation 12.5(ii) caters for the changes recommended to the taxation of capital gains (Recommendations 18.1 and 18.6) by maintaining the commitment in A New Tax System in relation to treatment of capital gains on existing post-CGT assets in trusts. Under Recommendation 18.1, however, entities will have the indexed cost bases on their post-CGT assets 'frozen' at 30 September 1999, and the 50 per cent capital gains exclusion will not apply. Recommendations 12.5(i) and (ii) accordingly need to apply from the date of announcement of these arrangements, rather than the commencement of the new entity system. The earlier start date will address the incentive companies would otherwise have to shift post-CGT assets into trusts prior to the commencement of the entity tax regime.

Providing an even wider exception, such as for purported distributions of all transitional contributed capital of trusts, would be contrary to the objective of applying the same regime to trusts as to other entities. It is not recommended that companies receive any transitional relief from the profits first rule.

It was suggested in consultations that exceptions similar to those available in the United States' tax code be provided. The United States' tax code contains a similar provision to the profits first rule, generally requiring distributions to be out of earnings and profits in the first instance. That requirement also applies to distributions in connection with a cancellation or redemption of stock. However, there is an exception if the distribution is substantially disproportionate with respect to the shareholding being redeemed or if it terminates the shareholder's entire interest, and in certain other cases. Given the availability of the 'slice' approach (Recommendation 12.17), additional exceptions to the profits first rule by analogy to the United States' provisions have not been recommended. The slice approach will apply to cancellations or redemptions of membership interests, and will allow contributed capital attributable to the redeemed or cancelled membership interests to be distributed, proportionately, ahead of retained profits.

Measuring contributed capital

Recommendation 12.6 - Measuring the contributed capital of entities

| For entities: general principles

For trusts: inclusion of exempt goodwill gains

For companies: inclusion of liquidation gains on pre-CGT assets

Commencement provisions for existing entities

|

General principle

A system of entity taxation needs to recognise amounts contributed to an entity by or on behalf of its members, past or present, and the return by the entity of those amounts to its members.

In A Platform for Consultation, categories of amounts were specified that could be taken to be a contribution of capital to a company (pages 429-430), a trust (page 431-432) and a limited partnership (page 437) after the commencement of the entity tax system. Examples included amounts settled on a trust and receipts from the issue of new shares.

The general principles underlying the various types of amounts specified in A Platform for Consultation are that a payment to an entity constitutes a contribution of capital to the entity if it is:

- •

- provided as consideration for the issue of membership interests in the entity (for example, an issue of new shares or units);

- •

- provided to satisfy an obligation in respect of existing membership interests (for example, a call on unpaid amounts on shares); or

- •

- provided to allow membership interests in an entity to be created or their value enhanced (for example, settlements on a trust in respect of a third party).

Trusts and exempt goodwill gains

A New Tax System proposed that, for both existing and future businesses in trusts, the 'current' tax status be maintained for distributions out of exempt CGT goodwill gains. This is achieved by including such exempt amounts in the contributed capital of a trust.

That proposed treatment needs adjustment to reflect Recommendation 17.5 that the existing CGT goodwill exemption for small business be replaced with a small business assets exemption of 50 per cent of all capital gains arising on the disposal of active assets (including goodwill). All exempt amounts under the new small business exemption will be included in contributed capital on realisation.

Pre-CGT assets and liquidations

Including realised gains from sale of pre-CGT assets in a company's contributed capital upon liquidation - Recommendation 12.6(c) - preserves the effect of the current law, which treats these distributions like returns of share capital. A return of such contributed capital in respect of a pre-CGT membership interest will not be assessable. This is consistent with the treatment proposed in A New Tax System (page 124). Simplicity and consistency are served by formally including the pre-CGT gains in contributed capital, and not allowing a special discretion to distribute as capital outside the operation of the profits first and slice approaches.

For trusts, the same result is achieved through the commencement arrangements for taxing trusts like companies. These will include realised gains on pre-CGT assets in a trust's contributed capital whenever the gains are realised - Recommendation 12.6(d)(i).

Other transitional rules

For entities existing at the commencement of the new entity tax system, it is necessary to have transitional rules to determine their starting contributed capital that recognise previous contributions (and returns of capital). Amounts will also be added to contributed capital, in effect, to retain the existing tax treatment in respect of certain assets held in trusts.

For companies, those transitional rules will be based on a company's share capital account adjusted for tainted or unpaid amounts.

For limited partnerships (which are already taxed like companies), contributed capital will be the amount that would have been the balance of the limited partnership's contributed capital account if they had observed the general principles set out above.

For trusts, the options discussed in A Platform for Consultation (pages 434-436) reflect the proposed transitional arrangements in A New Tax System (page 114). The basic principle behind the proposals in A New Tax System is to maintain the same substantive tax treatment of certain future gains on the realisation of pre-commencement assets as would have been achieved if trusts had continued to not be taxed like companies. This is achieved by treating certain exempt gains as contributed capital.

The future gains identified in A New Tax System were realised gains on pre-CGT assets, indexed component of realised gains on post-CGT assets and exempt CGT goodwill gains for small business. As discussed above with respect to exempt CGT goodwill gains, these proposed arrangements require modification to reflect other recommendations of the Review regarding the tax treatment of assets. In particular, the general 50 per cent exclusion (or choice of indexed cost base) available for eligible capital gains of individuals (see Recommendation 18.2) will also be available to trusts in respect of assets held prior to the date of announcement of these arrangements. Realised gains on assets held at the date of announcement that are exempt either by indexation or choice of the 50 per cent CGT exclusion will be included in contributed capital on realisation.

Recommendation 12.7 - Exclusion of prior taxed income from contributed capital

| That the prior-taxed income of trusts be treated separately and not be included in the contributed capital of an entity. |

Prior -taxed income is the retained income of a trust taxed prior to the entity becoming subject to the entity tax system. The distribution of prior-taxed income needs to take account of its prior tax status, and hence receive a different tax treatment (that is, not be part of taxable income nor reduce the tax value of membership interests) from distributions of profit or contributed capital.

The option outlined in A Platform for Consultation (page 436) was for prior-taxed income to form part of a trust's contributed capital, but to be subject to different tax consequences upon distribution to members. However, the very different tax treatment of prior-taxed income, as against contributed capital generally, makes it more practical to deal with it separately and not include it in contributed capital.

Separate treatment will not result in any substantive change to the treatment of prior-taxed income under the general entity tax system. Compared with the options outlined in A Platform for Consultation in Chapter 19, consequential changes will be required to the rules for the contributed capital of trusts existing at the commencement of the new tax system and to the operation of the profits first rule (see Recommendation 12.5(iii)). It will simplify the legislative rules required.

Recommendation 12.8 - Contributed capital account

| That all entities taxed under the new entity tax system be required to keep a contributed capital account for tax purposes. |

All entities will need to know their contributed capital for tax purposes in various situations. For example, they will need to know their contributed capital when applying the profits first rule to a dividend or when applying the 'slice' approach to buying back a share off-market.

For companies, the Review outlined two options in A Platform for Consultation (pages 428-431) for determining contributed capital - by reference to existing tax rules that rely on the company's share capital account or by requiring companies to maintain a separate contributed capital account (as for trusts and limited partnerships). Concerns were expressed in consultation that requiring maintenance of a separate contributed capital account would involve significant additional reporting and information obligations for companies.

The existing approach of relying on a company's share capital account can be complex, relies on specific anti-avoidance provisions to prevent abuse, and is not relevant to trusts or limited partnerships (as they do not have a share capital account and keep capital accounts in a different way). It would also be difficult to integrate the existing approach with a profits first rule, as that rule may treat distributions as being profit or contributed capital whether they are debited to a company's share capital account or not.

The Review recognises that there will be some ongoing compliance costs associated with companies maintaining a separate contributed capital account for tax purposes - consistent with other entities in the new entity tax system - but does not believe that they would be particularly onerous.

Recommendation 12.9 - Contributed capital sub-accounts for multiple classes

| Sub-accounts for each class of membership interest

Definition of 'class of membership interests'

|

Where a distribution from an entity to a member is part of a process that results directly in the cancellation of a membership interest in the entity (for example, an off-market share buy-back), the 'slice' approach will apply (Recommendation 12.17). The slice approach involves ascertaining the slice of contributed capital, taxed profits, and untaxed profits attributable to the cancelled membership interest.

The contributed capital attributable to a membership interest is clear cut where the entity consists of a single class of membership interests, such as ordinary shares. Separate classes require determination of the amount of contributed capital of the entity attributable to each class in order to calculate the appropriate slice (as discussed in Appendix C of Chapter 19 in A Platform for Consultation). Rules for determining the contributed capital of each class of interests in an entity are set out in the draft exposure legislation accompanying this Report.

For the purposes of the entity tax system, a class of membership interests will consist of all those membership interests in an entity having identical, or strictly proportional, rights in relation to distributions from the entity.

Deciding who is a member

Recommendation 12.10 - Principles for defining 'membership interest'

|

That, subject to Recommendation 12.11 (dealing with debt-like interests), a person be deemed to have a membership interest in an entity if the person satisfies one of the following conditions:

Specified interests

Rights in respect of management and control

Where returns contingent on issuer discretion/performance

|

The need for definition

This recommendation provides a broad definition of 'membership interest'. Interests that fall within this definition which are not excluded by Recommendation 12.11 broadly get returns from the entity that are frankable and not deductible to the entity; other interests (for example, debt) get returns from the entity which are not frankable but are deductible to the entity.

The different tax treatment of debt and equity will continue to exist in the tax law. This means that the distinction between membership interests and non-membership interests is an important borderline, particularly as regards non-resident and tax-exempt investors (see page 198 of A Platform for Consultation). The distinction between membership interests and non-membership interests needs to be as certain as possible to enable companies and other entities to raise capital in the knowledge of the tax consequences. The positioning of the membership/non-membership borderline should seek to avoid inconsistent treatment of effectively identical interests. Inevitably, however, investors will structure their arrangements according to how the borderline is drawn.

Key tests

The key element that distinguishes debt from equity is a lower level of economic risk, resulting from ordering of access to the assets of the entity in the event of insolvency. The level of risk is also reflected in the various contractual features attached to debt, such as covenants and pledges, imposed by debtholders to manage that risk. The risk differential does not, however, provide the basis for a practical and general distinction between all debt and equity interests.

The recommended approach therefore looks to tangible considerations for distinguishing member interests from other interests - equity from debt - as follows.

- •

- Whether the taxpayer has an interest that comes under any of the familiar specific categories of membership. For example, a member for tax purposes will include a member of a company, or of a registered managed investment scheme, for the purposes of the Corporations Law as well as a beneficiary, or a discretionary object, of a trust and a partner in a limited partnership. This is the effect of Recommendation 12.10(i).

- •

- Whether the taxpayer holds substantial rights in the management or control of an entity. A membership interest (subject to Recommendation 12.11) is indicated by the associated power over the distribution of gains of the entity. This is the effect of Recommendation 12.10(ii). The test is needed to ensure that parties such as 'golden' shareholders, trust controllers and the like will be members so that transfers of value to them by an entity because of their status will be distributions. Familiar exceptions found in the Corporations Law (for example, voting consistent with the protection of non-member interests) would not connote membership for tax purposes.

- •

- Whether the taxpayer has rights to returns that include a share of profit or a discretionary amount giving access to available profit - that is, whether the rights to returns are contingent on the economic performance of the issuer. This is the effect of Recommendation 12.10(iii). Contingency here is about the absence of a right to a contractually specified and fixed return, not about its collectability. So a return is not contingent (in this defined sense) because the payer may not be able to meet its obligation when a contractually-specified payment is due. Nor is it contingent merely because it is based on an uncertain component, as rent with a gross turnover component may be. Interests issued by an entity that may or will convert into a membership interest also provide a return affected by the economic performance of the issuer and should be treated as membership interests unless excluded by the debt test in Recommendation 12.11. Because of the requirement that these convertible interests be issued by the entity into whose membership interests they convert, derivatives such as options that are created by third parties over membership interests in an entity will not be covered.

These tests identify interests which represent a membership interest in an entity. They do not extend to interests issued by one entity which provide an equivalent exposure to a membership interest in another, unrelated entity. Therefore, for example, an equity-linked bond will not constitute a membership interest in the issuer if the returns on the bond are unrelated to the economic performance of the issuer itself.

Recommendation 12.10(ii) will not necessarily result in preference shares being treated as equity, as preference shares do not necessarily have substantial rights of voting or control. Such shares will often be membership interests on essentially historical/formal grounds - under Recommendation 12.10(i) - but the debt test in Recommendation 12.11 could still exclude them from the definition of equity for taxation purposes.

Some exclusions

Recommendation 12.11 modifies the broad definition of membership interest in this recommendation, looking to risk considerations to help fine tune the borderline to ensure debt-like interests are excluded from the definition of membership interests.

The breadth of the definition will also be reduced by excluding from Recommendation 12.10(iii) employment contracts which provide remuneration on the basis of economic performance of the employer. This exception is necessary to prevent performance-linked salary bonuses being paid as franked dividends rather than salary. The exception means that a salary package that includes a bonus linked to profitability of the employer will never be a membership interest.

This combination of tests aims to achieve consistency, simplicity and clarity of treatment while promoting integrity of the system. These aims are made more important by the extension of the entity tax system to apply to a wide range of legal structures, each with its own differing types of membership interest.

Recommendation 12.11 - Exclusion of debt interests from membership interests

| Where contractually specified payments determinative

Certain 'contingencies' disregarded

Benchmark interest rate

Non-commercial arrangements not debt interests

|

In consequence of the continuing debt/equity borderline, this recommendation seeks to exclude from membership interests those interests with lower associated risk.

Without this approach for identifying 'debt-like' instruments, instruments issued by entities that would be defined as membership interests would include:

- •

- debentures where a minor part of the returns are made contingent on a nominated feature of the economic performance of the issuer;

- •

- redeemable preference shares that provide fixed returns and repayment of principal on terms which make them equivalent to bonds;

- •

- convertible notes issued on terms which render conversion unlikely (therefore obligating the issuer to repay their issue price); and

- •

- converting preference shares likely to convert at the end of their term into a number of ordinary shares whose total value is equal only to the issue price of the converting preference share (effectively ensuring that investors only get back what they originally invested, and possibly obliging the issuer to buy back the shares before conversion to prevent an unacceptable dilution of its share price by issuing a large number of ordinary shares to converting preference shareholders).

Minimising uncertainty

The proposed approach minimises uncertainty at the border between debt and equity by focusing on a single determinative factor (Option 2 on page 202 of A Platform for Consultation). This factor - the contractually guaranteed return of the original investment - brings to the fore the lower level of economic risk that distinguishes debt from equity.

Minimising uncertainty is consistent with the common theme running through the consultations on this issue: more importance is attached to the provision of certainty than on precisely where the distinction between membership interests and non-membership interests is drawn. In this regard, a 'facts and circumstances' test (described in Option 1 on page 201 of A Platform for Consultation) is not considered appropriate by taxpayers - the United States' experience with such a test indicates that it is unable to provide sufficient certainty.

It is not possible, however, to provide absolute certainty. Most particularly, it is not practicable to limit the right to returns valued in the debt test to rights that are subject to no contingency at all other than the solvency of the issuer. Taxpayers would easily be able to impose artificial contingencies in order to pass or fail the debt test as desired. Hence, the recommended debt test ensures that 'non-contingent' rights include rights that are formally contingent, but the contingencies are immaterially remote or artificial. This issue is discussed in example 12.1 below.

In effect, satisfaction of the repayment tests provided in Recommendation 12.11(a) will generally suffice to determine that an arrangement is a debt interest - notwithstanding the presence of contingent return elements in that arrangement.

Excluding consideration, under Recommendation 12.11(c), of any indices to which an interest's returns are subject adds strength to the characterisation of the interest as debt on the basis of the up-front assessment of whether the repayment amount is reasonably likely to exceed the investment amount.

Nominal value versus present value debt tests

The present value debt test - Recommendation 12.11(a)(ii) - will ensure that all instruments where the present value of future 'non-contingent' returns (calculated at the benchmark discount rate specified in Recommendation 12.11(d)) exceeds the issue price will be treated as debt. Satisfaction of this test demonstrates that the holder of the instrument is bearing no more risk in relation to the economic performance of the issuer than the holder of an ordinary debt instrument.

The present value debt test is necessary for more complex hybrid instruments. For example, a convertible note that converts at the end of its term into a fixed value of ordinary shares of the issuer will be categorised as debt if that value, combined with the value of other non-contingent returns, equals or exceeds, in present value terms, its issue price. If the total value of the non-contingent returns is less than that amount, or if the conversion is into a fixed number of shares (irrespective of their value), then the note will be treated as a membership interest. The same principles apply to converting preference shares.

For non--converting instruments repayable within 20 years of issue the compliance costs of applying the present value test are not justified. That is why the simpler nominal value test is proposed for such instruments.

Non--commercial arrangements

Non--commercial arrangements could nominally satisfy the debt test without representing genuine debt. Some examples include non-commercial loans to associated entities (Recommendation 12.23), and artificial arrangements under which beneficiaries of family trusts pay a nominal sum for the right to be a discretionary object of the trust where the trustee guarantees repayment of the nominal sum within 20 years. As Recommendation 12.11(e) recognises, it would be inappropriate to allow such arrangements to be treated as debt.

Distributions of contributed capital

Recommendation 12.12 - Capital distributions in respect of fixed interest in entity

| Capital distribution to reduce tax value

Capital distribution where no tax value has applied

|

The treatment of distributions of contributed capital under the new entity tax system is discussed in Appendix A to Chapter 19 of A Platform for Consultation. Appendix A needs to be read in conjunction with the paragraphs in Chapter 22 which clarify the rules for cost bases of beneficial interests in trusts.

A distribution of contributed capital will generally result in a reduction in the tax value of the membership interest held by the member who receives the distribution. Without the reduction in tax value the member could manufacture a capital loss on the sale of the membership interest. If the contributed capital distribution exceeds the tax value (reflecting returns greater than original capital contribution), the excess is appropriately included in the member's income.

In certain situations the recipient of a distribution of contributed capital does not have a tax value in respect of the fixed interest which gave rise to the distribution. For example, a settlement on a trust on behalf of a third party could lead to a beneficiary having no tax value. Recommendation 12.12(b) will ensure that, in such circumstances, the distribution will not be included in the recipient's income (so as to effectively not tax the settlor's gift in the above example).

Recommendation 12.12(b) will not apply, for example, if the membership interest originally had a tax value, but that value has been reduced to zero due to receipt, in the past, of distributions of contributed capital.

Additionally, Recommendation 12.12(a) will reduce the tax value of the member's fixed interest in the entity where someone else receives the distribution of contributed capital, provided that the member either currently has (or previously had) a tax value in respect of the interest. This situation could arise if, for example, a distribution of contributed capital is made to an associate of a member of a trust, rather than directly to that member. This approach will ensure that the tax value reduction rules apply appropriately whether the contributed capital distribution is made to the member or to an associate.

Recommendation 12.13 - Capital distributions to object of discretionary trust

|

That if, as the consequence of the exercise of a discretion by a trustee, contributed capital is distributed to an object of the trust, it is neither:

|

In A Platform for Consultation (pages 495-498), the Review presented options for ensuring that distributions of contributed capital by discretionary trusts would not be taxed in the hands of the discretionary object. The recommendation is considered the easiest method of ensuring this outcome.

The profits first rule in Recommendation 12.3 (see also Recommendations 12.4 and 12.5) means that a distribution made by a continuing discretionary trust will be taxable to the discretionary object to the extent that the trust has 'available profits'. Where no profits are available, the full amount of the distribution will be contributed capital and tax free in the hands of the object.

Similarly, where the trust fully vests (effectively, winds up), the contributed capital component of any distribution will be free from tax in the hands of the object. These rules will mean that for a discretionary trust with profits, contributed capital could not be distributed until after the profits (including net unrealised gains) had been distributed, which often may not happen until the trust is vested.

Distributions via creation of membership interests

Recommendation 12.14 - Provision of additional membership interests to members

| Where additional interests qualify as distributions

Value of such distributions

|

The provision of additional membership interests among members of an entity (for example, by way of bonus units or a share split) can be a substitute for a distribution, as discussed at pages 417 to 421 of A Platform for Consultation. Treating such cases as distributions reflects the substance of the transaction and assists, in conjunction with other measures, in limiting capital streaming, so permitting the repeal (see Recommendation 6.6) of specific anti-avoidance sections (sections 45 and 45A of the 1936 Act).

While the value shifting among members involved in cases other than proportionate issues theoretically could be dealt with by value shifting rules, in practice such rules would be unworkable (Recommendation 12.16). Distribution treatment is the simplest approach to the issue and is used in a number of countries.

The amount of the distribution as a general rule will be the fair value of the additional interest provided less any consideration paid by the member for that interest (Recommendation 12.1), as for the general case of the passing of assets by an entity to a member. However, as suggested in A Platform for Consultation (page 419), where members of a widely held entity have a choice between receiving a distribution or additional membership interests (for example, via bonus shares), it would be logical for the value of the alternative distribution to be used.

For the provision of additional membership interests not to be a distribution will necessitate that no substantive change occur in the proportionate interests of members in the entity. For example, additional interests may be provided to all members in uniform proportion to their existing holdings, such as through a general bonus share issue. In these cases there is not likely to be a shift in value between members arising from the provision of additional membership interests. To deal adequately with entities with multiple classes of membership interests, Recommendation 12.14(a) is worded as a value shift test - where no shift in value of members' interests would reasonably be expected, there is no distribution.

Recommendation 12.15 - Tax values of existing and additional membership interests

| Tax values for interests via distributions

Tax values for proportionate issues

|

Where a distribution by way of additional membership interests is from profits or prior-taxed income, the provision of additional membership interests is recharacterised by Recommendation 12.15(a) as a distribution of profit to members, who then use that profit to purchase the additional interests in the entity. That gives rise to a tax value of the additional interest equal to the amount (actually or notionally) paid.

Where the distribution is from contributed capital, the provision of additional membership interests is recharacterised by Recommendation 12.15(a)(ii) as a distribution of contributed capital to members (which reduces tax values), who then return that capital in exchange for additional interests in the entity (which increase tax values). In net terms, therefore, there is no change in tax values, except to the extent consideration was paid as part of the arrangement.

However, it is necessary to spread the existing tax values over the existing and additional interests to prevent the manufacture of realisation losses (through the sale of existing interests whose fair value would have fallen while their tax value otherwise remained the same). Any consideration paid for the additional interests will be added to the tax value of those additional interests only. The same considerations apply to proportionate issues (Recommendation 12.15(b)).

Where an amount needs to be spread over additional and existing interests, it will be spread so that, for each member, additional interests attract their share of the total tax value of the existing interests in proportion to their share of the total fair value of the new and existing interests of the member (adjusted for any consideration provided or profit distribution element). The balance of the total tax value is then distributed among the existing interests of the member in proportion to their existing tax values.

Where an existing membership interest is a pre-CGT interest, some modifications to the above rules are required to maintain the current treatment of pre-CGT assets. For example, additional interests provided in respect of pre-CGT membership interests will also be pre-CGT assets where the additional interests are a distribution entirely from contributed capital or part of a proportionate issue.

Recommendation 12.16 - Additional membership interests and general value shifting rules

| That where Recommendations 12.14 and 12.15 apply, the proposed generalised value shifting regime not apply. |

Distributions via membership interests involve a shift of value between members, rather than from an entity to a member. Conceivably then, the general value shifting rules could apply.

However, the general value shifting rules are subject to a control test and there is a de minimis exclusion. It is therefore appropriate to apply, as occurs for distributions generally, the specific rules in Recommendations 12.14 and 12.15 in preference to the general value shifting rules.

Distributions upon cancellation of membership interests

Recommendation 12.17 - Cancellation of membership interests - general treatment of distributions

| That a 'slice' approach apply to determine the proportions in which a distribution on the cancellation of a membership interest is from contributed capital, taxed profits and untaxed profits. |

Under the 'slice' approach discussed in A Platform for Consultation (Chapter 19), a distribution from an entity to a member that arises in relation to the cancellation of a membership interest in the entity will be treated as coming from the contributed capital, taxed profits and untaxed profits attributable to the cancelled membership interest. The cancellation may be, for example, by means of a buy-back, a redemption, on a liquidation, or on the vesting of all trust assets.

Adoption of the slice approach provides a means for entities to return contributed capital along with profits when a member's interest is cancelled as a result of a distribution from the entity. It does so in a manner which is fair as between members, while placing a limit on dividend substitution and capital streaming opportunities. The mechanics of the slice approach are set out in the draft legislation accompanying this Report.

Under the slice approach, the contributed capital component of a distribution related to the cancellation of a membership interest may differ from the capital actually contributed in respect of that interest by the particular member. Concerns were raised in consultations about this difference. However, the difference reflects the substance of what is happening ? a person contributing capital to, say, an established company in respect of a new issue of ordinary shares is purchasing a right to the capital and accumulated and future profits of the company, not a right to a return of their contributed capital as such. Such a position already exists under current provisions. It could only be avoided, even if that was desirable, by tracking contributed capital as against each membership interest on a historical basis, which in practice is not possible.

Recommendation 12.18 - Treatment of components of a cancellation distribution

| Three components

Realisation loss allowed

|

This recommendation taxes each component of the distribution (as determined under the slice approach) in the same way that distributions of contributed capital, taxed profits and untaxed profits will generally be taxed. It corresponds to the current treatment of off-market share buy-backs where shareholders are individuals and extends that treatment to members that are entities taxed like companies.

By providing a potential realisation loss to the member, provides the mechanism to address the potential for double taxation. This is illustrated in Example 20.1 on page 454 of A Platform for Consultation. The potential for double taxation arises where an entity's retained profits have been taxed and the sale of a membership interest (the value of which reflects retained profits) gives rise to a realisation gain. As illustrated in Figures 20.1 and 20.2 on page 457 of A Platform for Consultation, the realisation loss allowed under the slice approach offsets the realisation gain. The taxation of any associated unfranked inter-entity profit distributions (Recommendation 11.1) is an integral feature of these arrangements.

The recommendation is consistent with the dividend treatment option outlined in A Platform for Consultation (page 459).

Recommendation 12.19 - Distributions by a liquidator

| That distributions made by a liquidator of a company be treated using the slice approach where the distribution is the 'final' distribution in respect of the relevant membership interest. |

A distribution by a liquidator does not in itself cause the cancellation of a membership interest. This occurs when the company is subsequently dissolved. But for practical purposes a distribution that is 'final' for a particular membership interest does extinguish the member's entitlement to any further distribution of income or capital in respect of that interest.

In consequence, a final distribution should be treated the same as a distribution that results in the cancellation of a membership interest, with a slice approach being applied. A distribution that is not final does not extinguish the member's entitlement to any further distribution of income or capital in respect of that interest. As such, the profits first rule will apply to it.

This recommendation adopts the first option from A Platform for Consultation (page 466) for treatment of interim distributions. Any analogous cases for trusts will be dealt with under the general rules relating to cancellations.

Recommendation 12.20 - Tax treatment of on-market buy-backs

|

That on-market buy-backs be taxed on a realisation basis as follows:

|

The realisation treatment of on-market buy-backs that is recommended recognises the fact that members generally do not know the identity of the buyer. It continues the existing distinction between on and off-market share buy-backs. It will also apply to on-market buy-backs of units in a listed unit trust that is not a collective investment vehicle.

Not debiting the entity's franking account while providing a realisation loss to the entity establishes a mechanism to avoid double tax (unlike the current treatment of on-market buy-backs which debits the franking account and does not allow a realisation loss). This is illustrated in Figure 20.3 on page 461 of A Platform for Consultation. The loss will be quarantined in accordance with the proposals set out in Recommendation 4.10(c).

The recommendation adopts the second option from A Platform for Consultation (page 461) for dealing with the untaxed profit component of a distribution. Any untaxed profit component is effectively subject to a single level of taxation in the hands of the member by treating it as proceeds for disposal of the interest.

Off-market buy-backs will be subject to the general treatment in Recommendation 12.18 for distributions subject to the slice approach.

Recommendation 12.21 - Proportionate cancellations of membership interests

| That where the cancellation of membership interests for less than full consideration would not of itself be expected to change the total fair value of any member's interests (that is, proportionate cancellations), the tax value of a member's cancelled interest (less any consideration) be spread over the member's remaining interests. |

Cancellation of a uniform proportion of the interests held by each member in an entity would not reduce the actual value of any member's total interests. If the tax values of existing interests were not adjusted, then a loss would be realised unless a fair value or arm's length rule applied. Application of a fair value rule (as currently applies to off-market share buy-backs) would, however, give the wrong result where a member has not benefited from the cancellation. A spreading rule for proportionate cancellations prevents a loss being realised inappropriately or members being taxed on amounts that they did not receive.

Selective cancellations for less than full consideration will be subject to general arm's length and value shifting rules.

Non-commercial loans involving closely held entities and their members

Recommendation 12.22 - Non-commercial loans from a closely held entity to a member

| That rules substantially similar to the loan provisions relating to private companies currently in Division 7A of the 1936 Act (including a requirement for annual repayments of principal) apply to loans made on or after the date of commencement of the new entity tax system by closely held entities to their members, or the associate of a member. |

Entities should not be able to convert distributions of profits otherwise taxable in the hands of members into non-taxable distributions through the use of non-commercial (low interest) loans to members. Low interest on the loans is a benefit to members. In addition, unpaid balances on loans could be forgiven by the entity.

The general definition of distribution (Recommendation 12.1) is a key structural feature of the new law. The definition will result in members (or their associates) including in their income the difference between the rate of interest on the loan and what would be a commercial interest rate to a non-member. The definition will also treat as income so much of the loan balance as is forgiven because the borrower is a member (or the associate of a member) of the entity.

To the extent that the amount forgiven is not a distribution under the general definition of distribution, the general debt forgiveness provisions will also apply.

Assessment of the loan at commercial rates ensures taxation of the return the entity would have generated from the assets underlying the loan, year by year, until those assets are ultimately distributed. The assets may be distributed either as a regular distribution after repayment of the loan or in the form of debt forgiveness (treated as a distribution by the general definition of distribution). The resulting year-by-year revenue flow from assessing the loan at commercial rates preserves the revenue from earnings on the original assets compared with up-front distribution of the assets.

Treatment of non-commercial loans made by widely held entities

These two general design features are sufficient to deal adequately with situations in which a widely held entity makes low interest loans to members or their associates. The general definition of distribution applies to all benefits provided by an entity to a member or their associate, including loans by widely held entities to the extent that they are at less than commercial interest rates. Benefits by way of low interest loans would be included in a similar way to other types of discounts provided by widely held entities (Recommendation 12.2).

This general definition of distribution would apply, for example, to interest free loans made between entities in the same wholly owned group - unless the group consolidated its tax treatment, in which case such transactions will be ignored for tax purposes.

This approach broadly corresponds to the second of the two options canvassed in A Platform for Consultation (pages 410 to 413) for dealing with non-commercial loans to members of closely held entities (although that option also incorporates intra-year loans).

Given the greater public scrutiny and the competing interests of members, widely held entities are generally not likely to seek to use low interest loans and debt forgiveness to achieve tax-free distributions of profit for particular members.

Treatment of non-commercial loans made by closely held entities

The close relationship between some closely held entities and their members provides greater scope to achieve tax free distribution of profits via non-commercial loans provided to a particular member (see discussion of Recommendation 6.8). Treating as distributions year-by-year the difference between commercial and actual interest rates on the loans may not be a sufficient disincentive to the seeking of tax free outcomes via debt forgiveness.

In such situations the principal of the loans could remain unpaid for a considerable period of time. In a practical sense the entity could be viewed as having forgiven the debt, even though in a legal sense the loan still exists. In such circumstances, non-commercial loans from closely held entities to members should be treated in the same way as debt forgiveness. Moreover, in order for a loan not to be classed as non-commercial, regular repayments of principal should be required. Without a requirement to repay, there would be greater opportunity for closely held entities and their members to arrange their affairs so that debts are forgiven when:

- •

- the relevant member's income is otherwise low (minimising tax paid on the forgiven debt); or

- •

- the relevant member is not able to repay (in which case the rules may not apply).

Division 7A currently applies to private companies and includes requirements to repay the principal of the loan. The making of a non-commercial loan, or the failure to meet the repayment requirements, is treated under Division 7A in the same way as the forgiveness of a debt. The amount is treated as a distribution. Applying a similar approach under the new entity tax regime to all closely held entities will prevent tax avoidance through the use of non-commercial loans by these entities.

Thus, loans from closely held entities need to meet the commercial loan criteria set out in the discussion following Recommendation 12.23. Furthermore, non-commercial loans from a closely held entity to a member will be required to make annual repayments of principal. Failure to meet any of the criteria will see the entire outstanding amount of the loan taxed as a distribution.

Recommendation 12.23 - Non-commercial loans from a member to a closely held entity

| Non-commercial loans to entity increase contributed capital

Payments on such loans treated as distributions

Date of effect

|

Background

In A Platform for Consultation (paragraph 24.27, page 523), it was stated that:

'The use of debt may also provide a means by which the members of closely held entities could avoid the operation of the profits first rule canvassed in Chapter 19. Loans from members to entities could be substituted for contributed capital, and returned ahead of retained profits.'

This issue was also raised indirectly in the Chairman's letter of 22 February 1999 to the Treasurer where he stated:

'There are also other possible reforms, including transitional arrangements for the taxation of trusts, that could give rise to strategic exploitation prior to their introduction, also with significant implications for expected post-reform revenue.'

These quotes point to both structural and transitional issues relating to non-commercial loans from members to closely held entities.

Structural considerations

The recommended rules are structural, rather that anti-avoidance, in nature. They characterise loans made to closely held entities by members on the basis of underlying economic substance, rather than by reference to their legal form. Thus, the rules treat non-commercial loans by members as equity, not debt.

It was proposed in A New Tax System that, with some exceptions, returns of contributed capital be subject to a profits first rule under the new entity tax regime. That is, contributed capital can generally only be returned if there are no profits in the entity.

In the absence of the recommendations, the provision of debt financing on non-commercial terms could be used as a substitute for equity funding. This would provide a method for both existing entities (including trusts), and entities created after the introduction of the entity tax system, to avoid the operation of the profits first rule, should the Government introduce such a rule.

These structural considerations suggest that the recommendations should treat as membership interests all relevant non-commercial loans either in existence at the start of the entity tax regime or made subsequently.

Transitional considerations

Shortly after the announcement of a review of the taxation of trusts in the 1997-98 Budget advice was widely published, in both the general and professional taxation press, on a purported method for beneficiaries to avoid the effects of any new regime on the taxation of tax-preferred income in existing trusts. The method involved trustees, prior to the introduction of the new regime, distributing tax-preferred income to beneficiaries in existing trusts, including unrealised capital gains. These distributions in many cases would be tax-free under the existing law. Beneficiaries would then lend the amount distributed back on non-commercial terms to the trust. Once the new regime was introduced the trustees would distribute the amounts as non-taxable repayments of the outstanding loan rather than assessable distributions.

The transitional arrangements for certain types of realised capital gains earned by existing trusts - as announced in A New Tax System, discussed in A Platform for Consultation (pages 437 and 438) and covered by Recommendation 12.6 - will generally treat distributions of such gains as tax free in the hands of beneficiaries after the start of the new entity tax regime. The gains will be treated as contributed capital.

These transitional arrangements do not, however, include unrealised gains on trust assets. Thus, distributions sourced from unrealised gains on pre-CGT assets and the indexation component of gains on post-CGT assets will generally be tax free to the beneficiary if made prior to the commencement of the new system - but not if made after the start of the new system.

The distribution and non-commercial loan back arrangement discussed above would therefore provide a means of distributing tax free unrealised pre-CGT gains and the unrealised indexation component from post-CGT assets after the start of the new regime.

Loans to which the recommendations apply

At least in respect of loans in existence at the date of implementation of the entity tax regime, the integrity of the rules will largely depend on which of those loans the legislation will encompass. Moreover, as noted, structural considerations point to the recommendations applying to all non-commercial loans in closely held entities at the start of the new entity system. However, it is not the place of the Review to recommend that the legislation apply to loans made prior to the Government's stating its intention to undertake legislative action relating to these non-commercial loans. Consequently, the Review is not going beyond recommending that the legislation apply at least to those non-commercial loans made on or after the date on which the Government announces such an intention.

The recommendations are not retrospective. They will apply only from the commencement date of the new system to non-commercial loans in existence at the time of announcement by the Government of legislative action in this area. Taxpayers will have time, prior to implementation, to rearrange their affairs so that their loan arrangements are unaffected by the measures.

Definition of commercial loan

A 'commercial loan' will have the same meaning for a loan made to an entity by a member, and a loan made by an entity to a member. The criteria will essentially be same as those for an 'excluded loan' currently in Division 7A of the 1936 Act:

- •

- the loan must be made under a written agreement;

- •

- the interest rate payable on the loan, for years of income after the year in which the loan is made, must equal or exceed the 'Indicator Lending Rates - Bank variable housing loan interest rate' last published by the Reserve Bank of Australia before the start of the year in which the loan is made; and

- •

- the maximum term of the loan must not exceed 25 years, for a loan secured over real property, and for all other types of loans must not exceed 7 years.

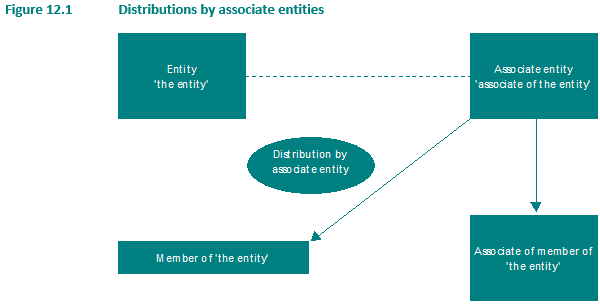

Distributions by associate entities

Recommendation 12.24 - Distributions by associate entities

| Distributions to members of a related entity

Distributions to associates of members of the related entity

|

Benefits provided by associated entities to members of a related entity were raised as an issue in A Platform for Consultation (page 407). It canvasses the possibility that when an associate of an entity makes a distribution (that is, provides a benefit, on less than fair terms) to a member of the entity the benefit could be treated as a distribution by the entity. The complexity associated with such an approach would increase compliance costs for taxpayers. Additionally, that approach may not accurately reflect the actual flow of funds.

Under Recommendation 12.1, the broad definition of 'distribution' will cover all transfers of net value provided by the entity to its members. This general rule applies if the entity transfers net value through an associate by providing net value to the associate so that the associate can provide the benefit to members of the entity. The net value provided to the associate would be treated as an application of entity funds 'for or on behalf of' the member who received the benefit, and hence as a distribution by the entity.

In the case of a group of entities which are not consolidated for taxation purposes, the operation of the wide definition of distribution could be avoided by the entity arranging for an associate entity to provide benefits on its behalf (in such cases the associate entity has not provided the benefit to its members). There may be no compensation between the entities and, therefore, no payment 'for or on behalf' of the member and, hence, no distribution as defined in the absence of this recommendation.

In order to ensure integrity to the comprehensive definition of distribution without undue complexity, Recommendation 12.24(a) would treat the provision of a benefit to a non-member as a distribution by the associate.

Recommendation 12.24(a) will treat the benefit as a distribution of profits regardless of whether an associate has available profits. No calculation of available profits will be required. Where a benefit has been provided to a non-member for less than fair consideration, the benefit should be treated as a distribution out of profits because there has been a shift in value from the associate to the non-member. The non-member cannot logically be entitled to a distribution of contributed capital from the associate so it can only be a distribution from profits. For the same reason the distribution will be unfrankable.

It is not appropriate to apply these rules when an individual provides the benefit. There should be a higher threshold for applying the associate rules when the associate is not an entity (because, for example, an individual does not have franking credits which could be streamed). The provision of benefits by individuals should only be treated as distributions if they have been made 'for or on behalf' of a member of the entity. This would be achieved through the broad definition of distribution. There is no need for specific legislation.

Likewise it is inappropriate to have the associate rules apply to benefits provided by unrelated third parties. The nature of the relationship between such entities is fundamentally different from that between associates. Unrelated third parties will generally only provide benefits to non-members if they receive an economic benefit. But Recommendation 12.24(b) is necessary to cover the situation where distributions are made from associate entities to associates of members of the related entity.

Private use assets held in entities

Recommendation 12.25 - Use of main residence not a distribution

| That if a member of an entity, or an associate of a member, uses as their main place of residence property held by an entity, the use of the property not be treated as a distribution, provided that the entity does not treat the expenses incurred in respect of the main residence as either payments or liabilities for tax purposes. |

In A Platform for Consultation (page 406), the Review gave consideration to excluding the use of a main residence owned by an entity from the definition of distribution. Many of these entities are trusts, which hold the main residence for beneficiaries of the trust and have no 'income-producing assets'. It is argued that holding assets in an entity, in these circumstances, is akin to beneficiaries owning them directly while also providing additional asset protection benefits. For example, it is very common for primary producers to live in the residence on a farming property, and for the property to be owned by the family trust.

The recommendation would necessarily entail greater administration and compliance costs. For example, a trust could claim a wide range of deductions in respect of the whole property (for example, mortgage interest and rates and taxes). The trustee would be required to apportion out that part of the expenditure associated with the main residence if seeking to claim the exemption.

However, it is considered appropriate that all entities be given the option not to treat expenditure as either payments or liabilities when calculating the entity's taxable income - thereby allowing the use of the main residence not to be treated as a distribution.

The position of such common entities as strata title bodies corporate, and companies holding apartments in company title, does not generally raise issues of this kind. A strata title body corporate, or a company in a company title arrangement, owns common property (in the strata title case) or even the whole property (in the company title case) which the owners of strata units or of company title residential shares respectively have the right to use in common. But these rights are not generally distributions by the body corporate or the company, because they do not arise by transfer to the members of value from the body corporate or company. They are rights which are inherent in the strata title units or the residential shares themselves. It may be possible to identify the rights in any case as attaching to a main residence; but it is not generally necessary. Special exclusive rights granted to members (for example, the rent-free occupation by a residential unit-holder of a shop forming part of the common property of a strata title building) are apt to be distributions, in the rare cases where they arise.

Recommendation 12.26 - Use of certain other assets also not a distribution

| Circumstances under which use of an entity's assets by members or their associates not a distribution

All the members of the entity to be individuals

Use of the entity's assets treated as a private use

|

Entities are often used to hold assets, in addition to a main residence, which are not used for income producing purposes, other than capital gains that may be realised on the assets.

For example, accountants and dentists who are required by law to practise in their own name can hold their assets, such as their main residence and a holiday home, in a discretionary trust. This structure provides a form of liability protection in the event of a lawsuit by a client or a patient. Individuals might also hold assets in a trust that have been purchased from after-tax income for reasons such as their personal relationships.

Where the use of the assets is solely of a private nature, holding assets in an entity is akin to individuals holding them directly for their private use.

The recommendation provides an exclusion from the definition of a distribution provided certain conditions are met, without undermining the necessary integrity provided by the broad definition of distribution.

Recommendation 12.26(a)(i) requires that the arrangements would not have had any tax consequences (other than upon realisation) if the assets had been held directly.

The combination of Recommendations 12.26(a)(ii) and (iii) effectively requires that the assets are purchased from after-tax funds contributed by individuals or from borrowings that are serviced from individuals' after-tax funds.

Under the recommendation, some but not all assets held by the entity may satisfy the criteria. Where not all assets satisfy the criteria, taxpayers will be required to apportion all of the relevant amounts if the use of an entity's assets is not to count as a distribution. This is no more than is required of individual taxpayers holding assets having both private and business use.

If the assets were not required to be financed from after-tax funds, it would be possible for entities to shift value to members or their associates (for example, accommodation on a luxury yacht owned by the entity) via benefits financed from income that had only been taxed at the entity tax rate (or not taxed at all). This would particularly be the case where the entity had significant operations and assets. This would be contrary to the intent of Recommendation 12.1. Personal consumption should always be from income taxed at the person's own marginal rate.

Because it is possible that the use of a main residence would not satisfy the conditions set out in this recommendation, Recommendation 12.25 is still needed separately to exclude the use of a main residence. Rights of unit-holders in relation to common property in strata title schemes, and rights of shareholders in relation to the residential property under company title schemes, are generally not distributions in the first place for the reasons discussed under Recommendation 12.25; those reasons are equally applicable here.