Review of Business Taxation

A Tax System RedesignedMore certain, equitable and durable

Report July 1999

SECTION 25 - MODELLING INDUSTRY EFFECTS

Introduction

1 In May 1999, the Department of Industry, Science and Resources (ISR) commissioned Econotech to model the long-term effects of business tax reform on Australian industries, using its MM303 model of the Australian economy. The changes modelled were the business tax reform proposals announced in A New Tax System but at the company tax rates proposed by the Review, and the Review's recommended reforms. The model results reflect the combined effect of these business tax reform measures.

2 The aim of the modelling was to estimate how such reform might affect the distribution of economic activity between different industries. It was not intended to estimate the impact of the reforms on the overall level of economic activity. Econtech conducted the modelling with assistance from ISR and the Review of Business Taxation (RBT) Secretariat.

3 The modelling was conducted in two stages. The first stage was to estimate the change in taxes paid by industries as a result of the business tax reforms. The second stage involved entering these estimates into Econtech's MM303 model to estimate the extent to which they might alter the pattern of industry production.

4 The changes to the indirect tax system recently passed into law, and the personal income tax rate cuts associated with them, have also been incorporated into this modelling exercise. This is because these measures will be in place when any business tax reforms are implemented and they will also affect the level and pattern of activity in the economy.

5 The results are presented as a guide as to how the relative impact of the reforms might differ across particular industries and not their overall impact on the level of activity for individual industries. It is important to remember that the Review believes that an overall growth dividend of 3/4 of a per cent of GDP will result from its reforms and this growth dividend is not reflected in the modelling results.

6 Realisation of a growth dividend of this magnitude, particularly if shared across all industries, would make it very unlikely that any industry would lose as a consequence of the reforms.

7 As with all modelling, the results of this exercise are heavily dependent on the underlying methodology and assumptions used. In this case, the results depend on the Review's estimates of the revenue implications of the reforms, the methodology used to estimate the change in taxes paid by industries and the assumptions built into MM303. In addition, the modelling assumes that the impact of the reforms in 2004-05 are representative of what the relative effects would be in the longer term.

METHODOLOGY

8 The modelling takes account of three separate components of taxation reform.

9 The first component was the package of personal income tax rate cuts and reform of the indirect tax system originally announced in A New Tax System and subsequently revised before being passed into law. The indirect tax reforms included the introduction of a broad-based goods and services tax levied at a rate of 10 per cent with limited exemptions for some foods, the abolition of wholesale sales tax, reductions in fuel excises for petrol and diesel and the abolition of Financial Institutions Duty. These reforms, together with a cut in personal income taxes sufficient to deliver a revenue neutral package, were modelled using the MM303 model which covers all indirect taxes and the GST.

10 The second component of reform was also announced in A New Tax System and involved changes to the taxation of business entities. These proposals included taxing trusts as companies, the introduction of a deferred company tax along with refundable imputation credits, and measures affecting the life insurance industry.

11 The third component of the reforms constitutes that part of the Review's recommendations that would impact initially upon industries. These include a reduction in the company tax rate from 36 per cent to 30 per cent, the abolition of accelerated depreciation, and other measures.

12 The results reported refer to the relative impact of the business tax reforms on industry reflecting a benchmark established by modelling the impact of the first component on the economy.

13 Aggregate revenue estimates for 2004-05 were provided by the RBT Secretariat as a starting point for the analysis. These estimates were allocated to industries using the most recent available taxation statistics (1996-97) published by the Australian Taxation Office (ATO), unpublished small business taxation statistics, and both published and unpublished capital stock and expenditure data from the Australian Bureau of Statistics (ABS).

14 Both the ATO and the ABS use the ANZSIC industry classification which was used to match industry data with the MM303 model.

Allocation of taxation revenue estimates to industries

15 The impact of the direct business tax reforms on industry costs was estimated by allocating estimates of the taxation revenue effects of the proposals to different industries, thus changing the taxes paid, and costs borne, by them. One minor measure (treatment of private receipts and expenditures) was not allocated to specific industries because it would be unlikely to affect industry even indirectly.

16 The revenue gain from any measure that impacts on company tax takes account of both the change in company tax paid and any offsetting impact on shareholders' tax liabilities arising out of the operation of the imputation system.

17 This net impact from reforms like the company tax rate reduction and the abolition of accelerated depreciation has been allocated to industries. The alternative would have been to allocate the gross impact to business and the offsetting benefit to shareholders through the imputation system. Clearly there are arguments in favour of both options. The judgment has been made that the relevant variable is the impact of the tax changes on the cost of capital to industry and the net revenue impact is likely to be the more appropriate proxy for this variable. This judgment took into account the structure of the MM303 model and the way the different approaches could be best captured in the model.

Allocation of business tax reforms in 'A New Tax System'

18 The changes in taxation revenues for the business tax reforms announced in A New Tax System, as amended by the proposed reductions in the company tax rate, were allocated as follows:

- •

- the revenue raised from the introduction of the deferred company tax was allocated according to each industry's share of unfranked dividends paid by companies;

- •

- the revenue reduction from allowing refundable imputation credits was allocated according to each industry's share of franked dividends paid by companies;

- •

- the revenue raised by taxing trusts as companies was allocated according to each industry's share of net business income of trusts; and

- •

- the revenue raised from the life insurance proposals was allocated to the life insurance industry.

Allocation of impact of Review's recommendations

19 The impact of the Review's recommendations has been allocated to industry wherever possible. In one case the impact of a measure is clearly on households and so no impact on industry was allocated. Table 25.1 provides a reconciliation between the revenue impact allocated to industry and the overall net revenue impact of the full set of the Review's recommendations.

20 The two business tax proposals that would have the largest revenue effects are the reduction in the company tax rate from 36 per cent to 30 per cent and the abolition of accelerated depreciation.

21 The cost to revenue of lowering the company tax rate for the existing tax base has been allocated according to each industry's share of net company tax payments. The life insurance industry pays different tax rates on different portions of income and the effect of the change in the company tax rate for that sector is dealt with under the A New Tax System measures. The superannuation industry pays tax on earnings at a 15 per cent rate and is not directly affected by the reduction in the company tax rate.

22 Abolishing accelerated depreciation would impact more heavily on those industries which use longer-lived assets.

23 A major task was to develop a methodology and obtain data to allocate the revenue effects of removing accelerated depreciation to individual industries. The first step in deriving the estimates was to review the ATO's schedule of effective and taxation lives for capital assets to determine a depreciation loading for each asset. For example, an asset may have an effective life of 20 years and a taxation life of 10 years. This corresponds to a depreciation loading of 100 per cent (that is, 100 per cent above effective life depreciation).

24 Detailed unpublished statistics on capital stocks of broad asset classes by each industry group (one digit ANSZIC classification) were then used to estimate the relative importance of each asset for each industry, and to determine weighted average depreciation loadings (or the accelerated component of depreciation) for all broad asset classes within each industry group. These estimates were then used to allocate the RBT Secretariat's estimated revenue gains from abolishing accelerated depreciation across broad industries. Statistics on depreciation deductions were then used to determine estimates of the tax effect on each of the 107 industries modelled in MM303.

25 The allocation of the taxation revenues from the Review's other proposals is discussed at Attachment A.

Effects of the reforms on taxes paid by industries

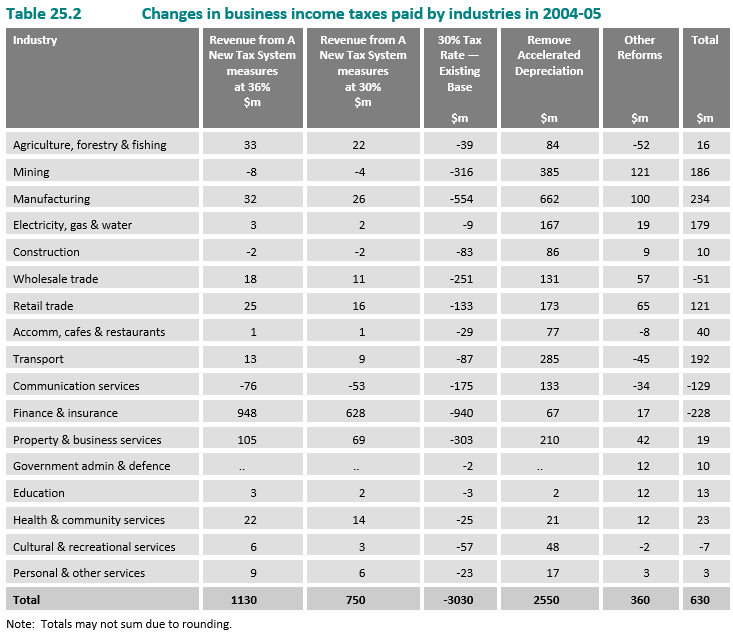

26 Table 25.2 shows the estimated allocation to major Australian industries of the proposed business taxation reform measures, including those proposed in A New Tax System and those proposed by the Review. The first column in the table shows the estimated impact on taxes paid by industries arising from the business tax measures announced in A New Tax System at the 36 per cent company tax rate. The second column shows the estimated impact on taxes paid by industries if the A New Tax System measures were adopted at the proposed company tax rate. The third column shows the estimated reduction in taxes paid by industries from reducing the company tax rate on the existing tax base. The fourth column shows the estimated increase in taxes paid by industries from abolishing accelerated depreciation. The fifth column shows the estimated net change in taxes paid by industries from the Review's other reform measures, including changes to the A New Tax System business tax measures, while the last column, which is the sum of columns two to five, represents the change in taxes paid by industries from both the measures proposed in A New Tax System and the Review's recommendations.

27 The figure in the last column are the aggregates of the direct revenue impacts that were fed into the model for each industry, at a more detailed level than shown here.

28 The net effect of these business tax reforms is small relative to the magnitude of the component changes. This is because many components offset each other. Most notably, the total impact of the reduction in the company tax rate from 36 per cent to 30 per cent is largely paid for by the abolition of accelerated depreciation. However, these two measures do not exactly offset each other and the trade-off changes the sectoral incidence of tax for a number of reasons.

- •

- Industries and firms with a higher level of profits would benefit more from a lower company tax rate than those with a lower level of profits.

- •

- The pattern of accelerated depreciation is not uniform over all types of capital. It particularly benefits long-lived plant and equipment and does not apply to some forms of intangible capital such as intellectual property. Removing accelerated depreciation would increase the burden of taxation on those industries employing a relatively large proportion of assets currently benefiting from accelerated depreciation.

- •

- Industries with a high proportion of taxpayers such as sole proprietors and partnerships that are not taxed as companies (such as agriculture, forestry and fishing) would not benefit to the same extent as other industries from a reduction in the company tax rate. However, although they would benefit from the personal income tax rate reductions that accompanied indirect tax reform, this benefit is not allocated to these industries in this modelling exercise. Therefore, the results understate the potential benefits to such industries from the overall tax reform package.

- •

- The small business package will mean that the impact of abolishing accelerated depreciation is substantially offset for some industries. For example, 99 per cent of primary producers would qualify for the small business package.

29 Business tax reform would also have a smaller effect on most industries than the effect of indirect tax reform. This is not surprising given that the magnitude of changes in the indirect tax system is much larger than the changes in the direct tax system.

30 Looking at the effect of the various measures on the individual industries the largest single measure is the reduction in the company tax rate. The method of estimating the effect of this measure on each industry essentially reflects the tax paid by the industry in 1996-97. Those industries that paid a large amount of tax in this year benefit the most from the proposed reduction in the company tax rate.

31 The second largest single measure is the removal of accelerated depreciation. Industries such as mining, manufacturing and transport are estimated to lose more from the removal of accelerated depreciation than they gain from the cut in the company tax rate. This occurs because they are major beneficiaries of accelerated depreciation, reflecting their relatively intense use of long-lived plant and equipment.

32 On the other hand, industries involved in communications services, finance and insurance, and property and business services are all estimated to pay less tax as a result of the proposed trade-off. These industries pay a lot of tax, have a lower intensity of long-lived assets and are not major users of accelerated depreciation.

33 For agriculture, forestry and fishing, the estimated reduction in company taxes is relatively low compared with the increase in taxes paid as a result of the removal of accelerated depreciation. In large part, this is explained by the fact that only about 30 per cent of primary producer income is accounted for by companies as many small producers are not incorporated. The simplified depreciation regime for small business would benefit this sector and that effect appears in the 'other' column in the table. The net result is an estimated small increase in tax paid by this industry. This does not include the effect of the reduction in personal taxes that will benefit the 70 per cent of agriculture, forestry and fishing income derived by unincorporated enterprises.

34 The estimated increase in tax paid by the electricity, gas and water sector also requires specific comment. The tax increase reflects the relatively low amount of company tax paid by the sector in 1996-97, and the resulting low estimated benefit of a reduction in company tax rate, relative to depreciation allowances claimed. The tax statistics for the electricity, gas and water industry for 1996-97 may not be representative of the longer term situation given the extent of privatisation occurring in that industry in recent years.

35 While the reduction in taxes paid by some industries, such as the finance and insurance and wholesale trade industries, is large in absolute terms, it is not large in relative terms. For example, the apparently large reduction in taxes paid by the finance and insurance industries represents a reduction of around 2 per cent of the company taxes paid by these industries.[1] It is not possible to do similar comparisons for all industries as the proportion of entities which are companies in each industry group varies considerably.

THE MODEL

36 MM303 is a computable general equilibrium model of the Australian economy. It models the production of over 300 commodities by 107 industries. The major features of the model are:

- •

- 25 separate categories of indirect taxes;

- •

- the recognition that a large number of substitution choices are open to producers and consumers including substitution between capital and labour, between detailed consumption categories, and between local and imported sources of supply. It also recognises substitution possibilities between different forms of energy as business inputs and between road and rail freight transport;

- •

- closure assumptions include a fixed labour supply so that total employment does not change and unchanged domestic savings so that any increase in capital is financed by foreign investors; and

- •

- an adjustment is made to personal income tax revenue to ensure the tax package modelled is revenue neutral in the long term.

37 MM303 is a good analytical tool to examine shifts in production between industries arising from indirect and direct tax reform. It is designed to measure the growth dividend arising from indirect tax reform. However, MM303 was not designed to determine any growth dividend from direct tax reform that may arise from treating entities, industries and assets more evenly for taxation purposes. Further development work would be needed to cover changes arising from direct tax reform, including work to quantify resource movements:

- •

- between different firms, for example between incorporated and unincorporated enterprises; and

- •

- reflecting different decisions within each firm, for example as a result of decisions about how much long or short-lived capital to use.

38 A significant element of the growth dividend would come from reactions by individual businesses at this microeconomic level. Further, some elements of the reform which are expected to make a significant contribution to additional economic growth are not included in the changes modelled because they have no revenue costs. Examples of the latter include the significant reduction in compliance costs expected to flow from the reforms and the measures relating to capital gains on venture capital investments.

39 The model provides estimates of the deviations from the level of production each industry would otherwise reach in the absence of tax reform and after the benefits of the growth dividend. It does not provide forecasts of the future growth of production in each industry.

THE RESULTS

Effects of the reforms on production by industries

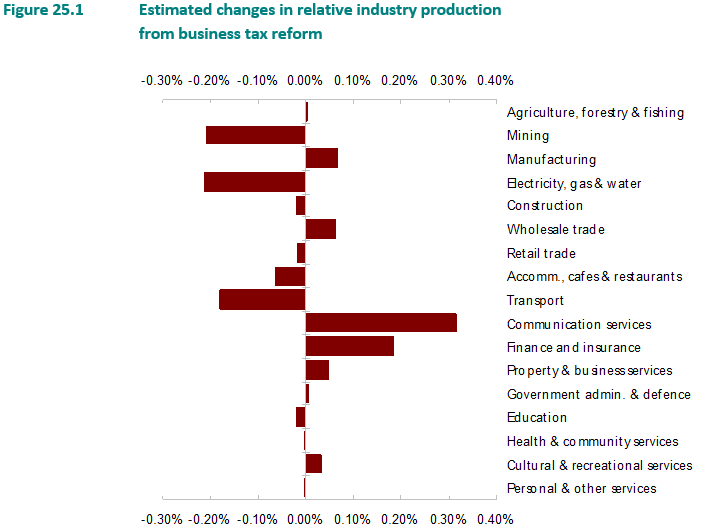

40 Figure 25.1 shows the estimated changes in long-term production by different industries arising from business tax reform, that is from the combined effect of the business tax measures proposed in the Government's A New Tax System document and the measures proposed by the Review of Business Taxation. These changes reflect the inter-industry relationships built into the MM303 model. As noted earlier these changes in production are relative to what would have happened in the absence of the reforms and do not include the general increase in production from the growth dividend expected to flow from the Review's recommendations.

41 For example the small decline in production shown for mining, electricity, gas and water, and transport sectors (-0.2 per cent in each case) has to be viewed in the context of the overall boost in production of these industries likely to be associated with any general expansion of the economy as a result of the growth dividend. Also it has to be viewed in the context of the benefit to these industries from the introduction of the indirect tax reforms such as the GST and fuel excise reforms.

42 The chart indicates that the effects of the Review's recommendations on any particular industry are not likely to be markedly different across industries. For example, the difference between the communication services industry, which receives the greatest relative benefit (0.3 per cent), and the industries with the largest relative detriment (-0.2 per cent) is only about half a percentage point, which is not a large figure compared to the changes in production generated by indirect tax reform and the influence of other factors affecting these industries.

43 Given the degree of uncertainty that must be attached to estimated effects on individual industries, the major conclusion that can be drawn from the model results is that the business tax reform measures will neither advantage or disadvantage, in relative terms, any industry sector to a significant degree.

44 An increase in tax paid by industries would tend to reduce production because the extra tax burden is passed on to consumers as higher prices. This tends to reduce demand and so production in the affected industries. Three industries with large estimated increases in taxes paid are the transport, electricity, gas and water, and mining sectors. These increases act to reduce production by about 0.2 per cent against the benchmark. Accommodation, cafes and restaurants also face an increase in taxation and record a smaller relative decrease in production.

45 On the other hand, communications services, finance and insurance, and wholesale trade benefit from reductions in taxes paid which act to increase production in the sectors by between 0.1 and 0.3 per cent against the benchmark.

46 The linkages between the changes in taxes paid by industries in Table 25.2 and changes in industry production in Figure 25.1 reflect the operation of so-called second round effects. These effects flow from the reaction of industries, their suppliers, and customers - reflecting the relationships built into the MM303 model - to the direct impacts set out in Table 25.2.

47 For example, lower taxes paid by the wholesale trade industries would reduce distribution margins on manufactured goods and promote manufacturing sales and production. These indirect effects mean that a number of industries facing increased taxation, most notably manufacturing, are still estimated to increase production. These indirect impacts are modelled in MM303.

48 While the taxes paid by the three trade-exposed sectors, namely agriculture, mining and manufacturing are expected to increase as a result of the business tax reforms, each of these industries is estimated to benefit from a small increase in international competitiveness. This increase arises from the broader economic effects of these business tax measures.

Comparison with financial modelling results

49 The largely offsetting effect of the reduction in the company tax rate and the removal of accelerated depreciation for most industries revealed from the analysis of the tax data discussed above is consistent with financial modelling of the effect of the trade-off for different assets.

50 An International Perspective, the information paper commissioned from Arthur Andersen by the Review of Business Taxation, presents marginal effective tax rates (METRs) for different classes of assets in different countries. Using the methodology in that paper it is possible to compare the METRs for different assets under a 36 per cent company tax rate and accelerated depreciation with the METRs applying under a 30 per cent company tax rate without accelerated depreciation. The results are presented at Attachment B.

51 For plant and machinery with different effective lives, the variance in METRs under the current system is reduced by the proposed change, with the METR for assets with short effective lives being reduced and those with long effective lives being increased. The net effect on the METR for any given project would depend on the distribution of the effective lives of the assets used in that project.

52 For mining development projects a similar result occurs. The shorter-lived projects have a lower METR under the lower company tax rate proposal but longer-lived projects incur a higher METR. The METRs for plant and machinery and mining development are identical under the proposed tax system, reflecting the assumption that the Commissioner of Taxations effective life estimates for both sets of assets are an accurate reflection of economic life.

Attachment A - Allocation of the revenue effects of the other proposals to industries

A.1 The allocation of the estimated revenue impact to individual industries was done using the best available data, much of which was obtained from Taxation Statistics 1996-97 published in CD-ROM by the ATO. Nonetheless, in a number of cases the allocation was done on the basis of limited information. For most of these measures the total impact is relatively small compared with the impact of the two major measures; the company tax rate reduction and removal of accelerated depreciation. Consequently any errors in the allocation of these measures are likely to have only a minor effect on the overall model results.

A.2 For all changes to taxation it is likely that the effective incidence of the change will differ from the direct incidence. For example, changes to company tax arrangements are likely to impact on prices for the products produced by companies and so the effective impact of the change will fall, at least partly, on the customers of the company rather than the company itself or the shareholders. This effect is picked up by the model and reflected in the overall results.

A.3 There are a number of measures recommended by the Review where the direct incidence of the tax change will be on individuals but it is possible that the effective incidence will fall partly on companies. In these cases the model cannot be relied upon to allocate the effective incidence appropriately.

A.4 A decision has been made to allocate the total incidence of these measures to industry. This is likely to overstate the impact on industry given that the total effect of these measures is significantly positive in revenue terms. However, the judgment was made that it would be better to err on the side of overstating the adverse impact on industry rather than run the risk of understating it.

- •

- Revenue costs from replacing the immediate deductibility of capital expenditures of $300 or less with pooling arrangements for assets with a value of $1,000 or less were allocated according to each industry's share of plant and equipment depreciation claims.

- •

- The cost to revenue of the changed arrangements for the write-off for luxury cars was allocated to the leasing and hiring industry.

- •

- Revenue costs of allowing new buildings and structures to be depreciated over their effective lives were allocated according to each industry's share of the capital stock of buildings and structures.

- •

- Revenue gains from moving capital expenditures on mining and quarrying assets to an effective life regime were allocated to the mining industry.

- •

- The revenue gain from reforming the balancing charge arrangements was allocated according to each industry's share of depreciable assets sold.

- •

- One third of the revenue costs from reforming rights over intangible assets was allocated to the communications industries and two thirds were allocated to the remaining services industries based on each of these services industry's share of total services industries' lease expenses.

- •

- One third of the revenue costs of allowing blackhole expenditures to be depreciated were allocated to the mining industries. Two thirds of the costs were allocated to the other industries according to their share of depreciation deductions.

- •

- The revenue from requiring the amortisation of overburden removal was allocated to mining.

- •

- The revenue gains from reforming the tax treatment of lease tails were allocated to the finance and insurance and personal and business services industries.

- •

- The revenue gains from reforming the tax treatment of financial arrangements were allocated to the finance and insurance industries.

- •

- Revenue gains from removing the ability of companies to transfer mining losses were allocated to the mining industry.

- •

- Revenue costs from allowing the flow-through of income in collective investment vehicles were allocated according to each industry's share of widely held trust income.

- •

- Revenue costs from replacing the deferred company tax with the taxation of unfranked inter-entity distributions were allocated in accordance with the industry distribution of unfranked dividends.

- •

- Revenue changes from allowing imputation credits for foreign dividend withholding taxes, reforming the thin capitalisation arrangements, and denying the deductibility of interest in highly geared cases were all allocated according to each industry's share of company tax.

- •

- Revenue costs from taxing only two thirds of life insurance management fees rather than all fees as proposed in A New Tax System were allocated to the life insurance industry.

- •

- The revenue changes from allowing consolidation of losses in acquired companies and from measures dealing with value shifting and loss duplication in groups were allocated in proportion to company tax paid.

- •

- Revenue gains from imposing capital gains tax on interposed entities were allocated according to each industry's share of net capital gains tax paid by companies.

- •

- Revenue costs of simplifying the depreciation regime and delaying the removal of accelerated depreciation for small business were allocated according to unpublished small business taxation data.

- •

- Capital gains tax measures were allocated in proportion to profits in the relevant industries.

- •

- The integrity measures were allocated according to data on CGT losses, company taxes paid, small business taxation data and gross industry product data as appropriate.

- •

- The fringe benefits tax measures were allocated at the broad industry level according to FBT data and within broad industry groups according to wage and salary data.

- •

- The tax design reform measures were allocated according to interest expenses in the case of the interest deductibility measures. The removal of the 13 month prepayment rule, which affects prepaid expenses was allocated according to an estimate of prepaid expenses derived from interest paid, leases and rent data after accounting for bank interest. The measure concerning consumable stores and spare parts was allocated over the economy in accordance with activity in each industry and the tax change in value of non-billable products measure was allocated to the gas and electricity industry, which would be the sector most affected by the measure.

Attachment B - Marginal effective tax rates

B.1 The estimates have been calculated by ISR using a model developed by Arthur Andersen for the RBT and published in An International Perspective. The methodology is outlined in An International Perspective.

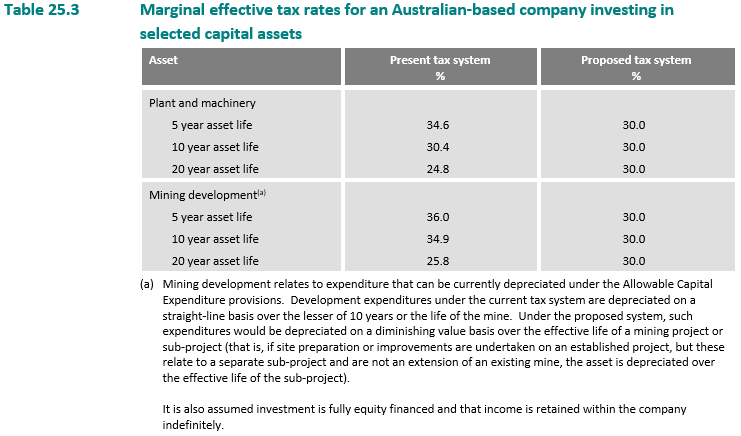

B.2 Marginal effective tax rates measure the percentage difference between the real minimum pre-tax rate of return to an investment and the real post-tax rate of return to a domestic investor who finances the investment. They are very sensitive to the underlying assumptions. As such, it is relative differences that are important rather than absolute levels.

B.3 The results presented for the present tax system are based on a corporate tax rate of 36 per cent with assets being depreciated as per the ATO's depreciation schedule with broad banding and accelerated depreciation. The results presented for the proposed tax system are based on a corporate tax rate of 30 per cent with assets being depreciated over their effective lives as set out in the ATO's schedule of effective lives.

B.4 The estimates assume the ATO schedule reflects the actual effective lives of assets, and accelerated depreciation is the difference between the scheduled life and the life over which the asset may be depreciated. For example, basic machinery for motor vehicle manufacturing has an effective life in the ATO schedule of 10 years. The annual straight line (diminishing value) depreciation rate for an asset with an effective life of 10 years is currently 17 per cent (25 per cent) rather than the 10 per cent (15 per cent) implied by the effective life without broad banding and accelerated depreciation.

B.5 These estimates assume that a diminishing value depreciation regime based on effective life equals true economic depreciation. If this is the case, the marginal effective tax rate under such a regime is equal to the statutory corporate tax rate. If the ATO's schedule of effective lives is incorrect the actual METRs will vary from the statutory tax rate.

B.6 The METRs reported in Table 25.3 reflect the increased amount of accelerated depreciation available for longer lived plant and equipment relative to shorter lived plant and equipment under the current system. The METR for 5 year plant and equipment is 10 percentage points above the METR for 15 year assets.

B.7 For mining development, there is currently effectively no accelerated depreciation for 5 year projects and little for 10 year projects, as reflected in the METRs reported in Table 25.3. Longer life projects, such as the 20 year project reported in the table, benefit from the current structure of accelerated depreciation for mining developments.

B.8 The current amortisation schedules for mining development projects do not allow sub-projects to be depreciated over the life of the sub-project but rather over the life of the mine or 10 years, whichever is the lesser. This means that short life sub-projects could face a METR higher than 36 per cent under the current system and this is not captured in the table. The Review's proposed system of depreciation will address this issue by allowing the depreciation of sub-projects under certain circumstances, resulting in a METR of 30 per cent for such sub-projects.

1996-97 company tax statistics have been increased in line with the growth parameters used by the Review to enable comparable years data to be used.