Review of Business Taxation

A Tax System RedesignedMore certain, equitable and durable

Report July 1999

SECTION 9 - FINANCIAL ASSETS AND LIABILITIES

Allowing elective market valuation

Recommendation 9.1 - Elective market valuation

| Mark-to-market election

|

| Scope of election

|

| Tax revenue safeguards

|

The policy of allowing elective mark-to-market was canvassed in A Platform for Consultation (Chapter 5, page 148). The policy proposal received general support in submissions to the Review. Allowing elective market value tax accounting for financial assets and liabilities will be particularly relevant for those taxpayers that make markets and undertake trading activities. While taxation on the basis of market value accounting can create liquidity or income volatility problems in certain situations, traders and price makers in financial markets are not subject to these problems as they have high turnovers or large portfolios of financial assets and liabilities that are hedged in net value terms. The mark-to-market election allows taxpayers to avoid large swings in tax liabilities that could arise from taxing on a realisations basis the disposal of assets and liabilities in the hedged portfolios in different income years.

Financial institutions with trading desks have argued in favour of market value treatment to improve pricing neutrality and reduce compliance costs. Investment funds, on the other hand, have argued that a mandatory market value approach based on a broad definition of trading would bring investment portfolio activities within the ambit of trading and potentially create cash flow and income volatility problems. The general corporate sector has indicated that it would be unlikely to want to use market value for its financial assets and liabilities, given that corporates generally do not undertake significant market-making or trading activities.

Scope of election

The elective mark-to-market taxation framework will require that transactions marked to market for tax purposes also be marked to market for financial accounting purposes, and audited as such.

Under the election in Recommendation 9.1(b)(i), all financial assets and liabilities marked to market for financial accounting purposes will be automatically marked to market for tax purposes. This requirement is consistent with and reflects the purpose-based approach taken in the commercial accounts of financial institutions. This election allows a taxpayer that uses the same type of asset or liability for different purposes (trading and non-trading), as reflected in differential and audited financial accounting treatments, to have corresponding differential tax treatments. Market value tax treatment would apply where market valuation was used for financial accounting purposes. Moreover, this approach will not require separate recording or designation for tax and accounting purposes where the portfolios for tax and financial accounting purposes are identical. It will reduce compliance costs and enhance the integrity of tax returns.

The 'asset class' election in Recommendation 9.1(b)(ii) allows a taxpayer that uses market value in its audited profit and loss statement for particular financial assets and liabilities to elect to use market value as the tax value for classes of those assets and liabilities. The principal reason for providing this asset class election is that within a larger portfolio of different types of assets and liabilities, one class may be turned over rapidly and have relatively short holding periods. In such cases there would be little or no difference between the use of the market value method and taxation on an accruals or realisation basis. Further, if the taxpayer is required to use mark-to-market for commercial accounting purposes for such transactions, there would be compliance cost savings for that taxpayer if the market value method were also used for tax purposes.

On the other hand, other financial assets and liabilities marked to market in the financial accounts might be less rapidly turned over and to subject them to market valuation for taxation purposes could give rise to liquidity problems.

Asset classes

Consistent with the definition of asset classes for trading stock purposes, it is proposed that taxpayers be able to define their own classes of assets and liabilities, subject to some restrictions. This will provide flexibility and avoid the difficulties that would be associated with attempting to define classes of assets in legislation. In order to guard against 'cherry picking', an asset class will need to be defined on the basis of clearly identifiable characteristics relating to the nature of the associated rights and obligations and could not be based on either of the following:

- •

- the purpose for which - or when - an asset or liability is acquired, held, issued, disposed of or otherwise dealt with; or

- •

- the term of the asset or liability.

Revenue safeguards

While providing taxpayers with the benefit of choice, an elective market value regime without adequate safeguards would open the door to selective and after-the-event application of the mark-to-market tax treatment in a way that reduces taxation revenue (for example, in situations where there is a change in market value between the time of entering the arrangement and the end of the tax year).

The first safeguard in Recommendation 9.1(c) requires that the transaction is recorded as a mark-to-market transaction at the time entered into. This safeguard removes the ability of taxpayers to base their decisions concerning the mark-to-market election on the tax gain or loss position of the asset or liability at the end of the financial year. This safeguard will be satisfied automatically where the relevant election has been made in a prior year and up-front mark-to-market designation is undertaken for the entity's financial accounts.

The second safeguard in Recommendation 9.1(c) requires that once an election has been made it cannot be reversed. For example, if a mark-to-market election had been made for a particular asset class in one year, that decision could not be reversed in subsequent years. Additional asset classes could be elected to receive mark-to-market treatment in subsequent years but once an additional election was made it also could not be reversed.

In addition, once an individual asset or liability has been marked to market for tax purposes, the asset must be marked to market for its life - even if the accounting standards change and require the asset to receive a different treatment. This safeguard will prevent the taxpayer electing in and out of mark-to-market tax treatment for the purposes of deferring or lowering tax liabilities for a given period.

Accruals and realisation approaches to determining tax values

Recommendation 9.2 - Accruals approach to determining tax values of financial assets and liabilities

| Accruals of tax value

|

| Rate of return for accruals

|

| Membership interests with at least annual distributions not to be accrued

|

Recommendation 9.3 - Tax value at cost for 'uncertain' returns or obligations

|

That where for particular assets and liabilities - including options, forwards, futures and ordinary shares -

such assets and liabilities have

|

Accruals versus realisation treatment

Where the mark-to-market election is not adopted, gains and losses from financial assets and liabilities will be accrued, except where the future gains or losses are 'uncertain' - in which case they will be taxed on a realisation basis.

While market value taxation achieves after-tax neutrality across instruments, including those that have similar before-tax benefits, that basis of taxation, in certain circumstances, can introduce cash flow difficulties (where relevant markets are relatively volatile) and valuation problems (where markets are relatively illiquid).

The accruals approach ensures that any gain or loss is allocated on a time value of money basis to the tax period to which it relates. In that sense, reflecting the pricing basis of transactions in highly liquid financial markets, the accruals approach will typically provide a better reflection of income than a realisation basis.

'Certain' and 'uncertain' gains and losses

Under this accruals/realisation framework for financial assets and liabilities, gains and losses which are 'certain' need to be distinguished from those that are 'uncertain'. An example of a gain (or loss) which is 'certain' occurs where the amounts of all future payments are stipulated in the relevant contract (for example, a fixed interest debt instrument or a zero coupon bond). A gain or loss is also 'certain' where a future payment is linked to a variable and the variable has been determined (for example, where the periodic rate has been set in respect of a variable rate debt instrument) prior to a taxing point. On the other hand, a payment which is not contractually specified and relies entirely on the discretion of the issuer of the financial instrument is 'uncertain' (for example, dividends on ordinary shares).

However, the borderline between 'certain' and 'uncertain' is not always clear-cut. For example, varying degrees of certainty attach to payments which are:

- •

- calculated by reference to future inflation rates;

- •

- calculated by reference to the future level of a share price index (for example, the All Ordinaries Index);

- •

- linked to the future level of the price of a single share; or

- •

- linked to future exchange rates.

Legislation will contain a statement of the general principle to be used to determine what is 'certain' or 'uncertain'.

Future gains or losses are considered to be 'certain' (and therefore able to be accrued) if they are represented by rights to receive or obligations to pay amounts that are 'non-contingent'. 'Non-contingent' is described in Recommendation 12.11. The term is used to cover circumstances where taxpayers might use artificial, immaterially remote or theoretical contingencies to attempt to attract realisation tax treatment rather than accruals.

For example, a payment which is contingent only on the level of the All Ordinaries Index being above 1,000 points at some future date should not mean that the gain reflected in that payment is uncertain. The contingency - that the All Ordinaries Index not be above 1,000 points - is considered remote or theoretical and consequently the gain should be accrued.

Another example would be where a taxpayer acquires a 'deep-in-the-money' option over a risk-free fixed-rate debt instrument maturing on the date of exercise of the option. The cost of the option would be expected to be equal to the present value of the face value of the debt instrument. Although the gain on the option is theoretically contingent on the value of the debt instrument, the gain is certain and should be accrued.

The credit risk of a debtor will not preclude a future gain or loss from being 'certain'. The right of a creditor to payment is not contingent on a debtor's solvency, although payment is.

The general principle used to determine whether payments are 'certain' or 'uncertain' will be supported by a list of instruments and variables that will not be subject to accruals because their returns are considered too 'uncertain'.

Ordinary shares (including declared and unpaid dividends on such shares), options, forwards and futures will be listed as instruments that have 'uncertain' returns and, therefore, will be taxed on realisation. Similarly, the future price of a single share and future exchange rates are examples of indices or variables that are 'uncertain'.

Debt/membership interest and 'certain'/'uncertain' borderlines

The debt/membership interest borderline (Recommendations 12.10 and 12.11) and the 'certain'/'uncertain' borderline (Recommendations 9.2 and 9.3) highlight key practical features of the framework for taxing financial assets and liabilities.

- •

- The debt/membership interest borderline determines whether payments made by entities on financial instruments are deductible to the entity or non-deductible (and 'frankable'). But this distinction does not determine whether tax applies on an accruals basis or on realisation.

- •

- Separately, and mark-to-market election aside, the question whether the changing value of a stream of payments on an instrument is to be taxed on an accruals basis or on realisation depends on the classification of these payments as 'certain' or 'uncertain'. The change in value of those payments that are 'certain' is subject to accruals. If all the payments are 'uncertain' the gain or loss on the instrument is assessed on realisation - with a list of instruments to be subject to tax on realisation provided to add to clarity.

- •

- Those instruments in the realisation list may, nevertheless, be subject to accruals if their associated payments are in substance 'non-contingent' because the contingencies associated with the payments are artificial. Thus, dealing in call options - even though options are in the realisation list - would be subject to accruals for tax purposes if the options involve returns that are effectively certain.

- •

- Instruments classed as membership interests may be subject to accruals for tax purposes if the associated distributions are 'certain' and give rise to substantial deferral opportunities (see below).

Determination of accrued tax values

In principle, all financial assets and liabilities (except those excluded because of 'uncertain' future returns or the adoption of the mark-to-market election) should have tax values calculated by applying a 'rate of return' that takes into account the latest information available, at balance date, relevant to the return on the asset or liability.

The new tax value at the balance date under this approach is determined by starting with the opening tax value (say, the up-front cost of an asset or amount received for incurring a liability) and adjusting that for:

- •

- an amount equal to the opening tax value times the relevant 'rate of return' - adding to the tax value of the asset or liability; and

- •

- any receipt generated by the asset or payment required by the liability.

This tax value calculation would occur at the end of a financial year, at the time of a 'rate of return' change (such as with variable rate debt) or when a receipt or payment occurs on the asset or liability.

This is the yield-based accruals methodology explained on page 31 of A Platform for Consultation and applied to tax value calculations with various assets and liabilities throughout the publication: a fixed rate discount bond (pages 162-163); a variable interest rate loan (pages 165-166); a fixed to floating interest rate swap (pages 187-188); various leases and rights in Chapter 9 and 10; and fixed term annuities in Chapter 34.

The 'rate of return' on any financial arrangement is determined by the regular 'interest' payments (including fixed coupons and variable interest payments), the difference between the acquisition price and the face value and, in some cases, the level of or change in an index (for example, indexed bonds) or other variable.

Accordingly, the 'rate of return' to be applied in determining the tax value of relevant instruments would take into account the following factors:

- •

- The 'interest rate' applicable when a new tax value is calculated - except that, if that interest rate has not been set at the date on which the tax value is calculated, the interest rate applicable to the last tax value calculation would be used.

- •

- The rate of return determined by calculating the internal rate of return using any 'certain' future cash flows and the dates of those cash flows. This could include the internal rate of return in respect of any discount or premium derived from the acquisition price of the instrument on the one hand, and the face value of the instrument or the redemption value attributed to the instrument at the time of acquisition, on the other.

- •

- Any return based on an 'index' or other factor. While any index or other variable could potentially be applied - indices or variables which are considered uncertain, including indices based on a single share price and those based on exchange rates, will be excluded.

The draft legislation accompanying this report sets out formulas for calculating the tax value of financial assets able to be accrued. Examples of the application of the formulas are contained in the explanatory notes to the draft legislation, also accompanying this report.

Accruing fixed distributions

'Fixed' distributions contracted and paid by an entity on certain instruments could be judged to be 'certain' and, therefore, taxed to the recipient on an accruals basis, unless specifically exempted.

For example, a converting preference share that is treated as a membership interest may pay annual dividends at a rate which is fixed in after-company-tax rate terms, but varies according to whether the dividends are franked or not (if unfranked, the rate would represent the grossed-up amount of the dividend). For example, assuming a 30 per cent company tax rate, a converting preference share may give the shareholder a right to receive each year a 10 per cent unfranked dividend or a 7 per cent fully franked dividend. Because the dividend rate is fixed (in after-company-tax rate terms), the grossed-up (10 per cent) dividend can be taxed to the recipient on an accruals basis. When the cash dividend is paid, any attached franking credits would, as usual, be available to the taxpayer at that time.

A case could be made, however, on compliance and simplification grounds for exempting distributions from accruals tax treatment where they are payable at least once a year.

Fixed distributions which are 'certain' will be accrued if they are payable in respect of a period in excess of one year. For example, if some or all of the distribution on the converting preference share described above were payable every two years instead of annually, the (grossed-up) dividend will be accrued year-by-year. Accrual of such distributions will ensure consistency of tax treatment with other (non-distribution) returns that are known with a similar degree of certainty.

Because excess franking credits will be refunded, the correct amount of tax will be paid by all investors at the time the fixed distributions are paid once the credits attaching to the distribution are allowed as a tax offset or refund, and so long as there are not significant delays in the receipt of refunds. Significant delays should not occur under new payment arrangements.

For taxpayers who pay tax in instalments under the new 'Pay As You Go' (PAYG) system (including superannuation funds) an offset would be available, quarter-by-quarter, against tax payments made during the year of income in which the distribution is paid. As a result, there would be no significant delay in the timing of a tax offset. A refund of tax, and an offset for 'Pay As You Earn' (PAYE) taxpayers, would occur when the taxpayer pays tax on income for the year in which the distribution is paid (unless the payment is made by a closely held entity to an individual investor, in which case it can occur at the time of payment of the distribution). PAYE taxpayers may also be able to adjust their tax instalment deductions on salary and wage income to reflect the franking rebate to be allowed at the end of the year.

Recommendation 9.4 - Retranslation election for foreign currency financial arrangements

| That taxpayers have an irrevocable election to calculate on a retranslation basis the tax values of all foreign currency denominated financial assets and liabilities not subject to a mark-to-market election. |

Future gains and losses attributable to changes in exchange rates are generally considered to be highly uncertain and should, therefore, generally be taxed on a realisation basis. Some taxpayers (for example, banks) have requested that scope be provided for them to 'retranslate' the foreign currency amount of financial assets and liabilities.

Retranslation involves valuing the foreign currency denominated asset or liability in Australian dollars at the exchange rate prevailing at the balance date. Retranslation brings to account changes in value attributable to foreign currency movements but, unlike market value accounting, not changes in value attributable to interest rate movements or changes in creditworthiness.

Submissions from the banking sector have argued that, given current commercial accounting treatments, major systems and compliance costs would be created by applying the mark-to-market election to foreign currency gains and losses, and that retranslation provides a simpler method to establish an appropriate measure of gain or loss in relation to non-traded foreign currency denominated transactions.

Where the retranslation or market value elections are not taken up, foreign currency gains and losses will be taxed on a realisation basis.

Tax recognition of hedges

Recommendation 9.5 - Treatment of internal hedges between domestic business units

| Tax recognition of internal hedges

|

| Exclusions from internal hedging

|

| Safeguards in respect of internal hedging

|

Internal hedging is well established commercial practice, reflected in the way many banks segment their trading and investment activities into separate business units established to carry out these activities. Where the financial institution operates in this way, hedging of exposures in the investment business unit is often undertaken through the trading business unit. This is facilitated by way of an internal hedge. The trading business unit hedges positions transferred from the investment division and its own trading positions on an aggregate basis, thereby reducing hedging costs but precluding identification of individually matched positions.

The trading units will typically account for assets and liabilities on a mark-to-market basis for both tax and accounting purposes. This avoids major swings in tax liability where there is little change in accounting income and vice versa. Investment units will account on an accruals or realisation basis for both accounting and tax purposes.

To achieve after-tax matching, effectively offsetting positions held in the different business units need to be taxed on the same basis. If this does not occur because, for example, the business units with the offsetting positions tax account on different bases, after-tax timing mismatches occur. Tax will have interfered with the efficiency of the hedging activity. The profitability of the financial institution and its cost of funds could be adversely affected.

Although this mismatch could be addressed by an external hedge, this would increase transaction costs and impact on capital adequacy. As an alternative response, the Review believes the tax system should recognise internal hedges.

A general principle in tax and accounting is that an entity cannot make a gain or loss from transacting with itself. Consistent with this principle, for example, the proposed arrangements for consolidated groups (see Section 15) and the removal of grouping provisions for wholly owned groups outside consolidation (see Recommendation 15.1) are designed, in part, to address the ability of a wholly owned group to create artificial benefits from dealing with itself. On the face of it, the recognition of internal hedges appears to contravene this principle.

In practice, however, internal hedge arrangements are a risk management mechanism driven by commercial rather than tax considerations. The internal hedge arrangements can be viewed as a way of tracing, in aggregate if not directly, the taxpayer's trading transactions to the associated investment transactions - and then reversing the effect of the taxpayer's choice to apply mark-to-market tax treatment to the trading arrangements. The net effect is to obtain the same matched tax treatment as would be achieved by applying accruals treatment to both the trading and investment transactions. This is achieved by recognising the internal hedge transaction, with non-market value treatment in the hands of the investment unit and market value treatment in the hands of the trading unit.

Recognition of internal hedging necessitates a range of safeguards. These safeguards are designed to ensure that the internal transactions are conducted on the basis of the same arm's-length conditions that would prevail if they were conducted with external bodies. As well, the safeguards will ensure that internal hedging transactions are recorded when entered into, to prevent 'after the event' nominations for tax purposes.

Recommendation 9.6 - Treatment of gold hedges

| Rollover of gold hedges for nominated period

|

| Safeguards in respect of gold hedges

|

Allowing rollover provision for production hedges is canvassed in A Platform for Consultation (Chapter 6, page 172). Gold producers have argued that, as reflected in their existing commercial and tax accounting practices, the characteristics of their hedging and production activities require rollover provisions in order to achieve a timing match between the hedge and the underlying gold production. The duration of gold hedge contracts can be significantly shorter than the time horizon of gold production. Generally, under the proposed taxation framework for financial arrangements, the taxing point would be no later than the maturity of the transaction or each rollover point. At that time, gold producers may have realised gains or losses on the hedge contract but without an offsetting loss or gain on the yet-to-be-produced gold.

Policy must achieve an appropriate balance between ensuring that the taxation of risk-reducing financial arrangements not interfere with before-tax production decisions and ensuring that opportunities for indefinite gain deferral or early loss crystallisation be minimised.

Large hedge books can be created that, over time, build up significant unrealised gains. Without safeguards, significant adverse selection and deferral are possible, such as by allocating a low value hedge to production and holding on to high value hedges.

The proposed framework for gold production hedge rollovers will facilitate legitimate hedging activity in relation to gold production and, subject to certain conditions, the rollover of relatively short-term hedging instruments will not trigger a taxing event. At the same time it guards against adverse effects on tax revenue by linking the financial arrangement to underlying gold production.

The mere likelihood of future discoveries of gold will not constitute a basis for hedging rollover treatment. Expectations of underlying production will be based on estimates of ore reserves and a proportion of estimated mineral resources, excluding 'inferred resources', and be consistent with an achievable plan for production delivery within the nominated hedge timeframe. The relevant ore reserves and mineral resources would be verified by a 'competent person' as prescribed in The Australian Code for Reporting of Mineral Resources and Ore Reserves. Substantiation of achievable production would be by way of a mine plan where such a plan has been developed.

Where production is forecast beyond that covered by a mine plan, it would need to be demonstrated that the estimate of production is realistic. This would require evidence that reserves and resources, including 'inferred resources', are substantially in excess of those required to produce the estimated gold output. Other supporting evidence could be a study demonstrating economic feasibility of a mine, or mines, capable of the estimated output, or the existence of production facilities at which ore from the relevant reserves and resources could be treated.

The estimates of reserves and resources to be used as the basis for the hedge rollover arrangements could be developed, if appropriate, on a group basis where the group is taxed as a consolidated entity.

While tax law in this area is unclear, the above framework represents a tightening up of the tax practice under which hedging arrangements are rolled over indefinitely with close-out at the discretion of the gold producer. In concept, this potentially allows companies to take advantage of adverse selection to minimise tax.

Some gold producers have submitted that it is very difficult to introduce a tagging system for matching hedges with production, as the timing of extraction is very uncertain when the hedge is originally entered into. For example, there can be metallurgical problems, adverse weather conditions, restricted availability of water for treatment processes and volatility in the reserves thought to be available.

Allowing the expiration nomination to occur in relation to two financial years rather than a set date seeks to address these production uncertainties. The hedge nomination will need to be consistent with reasonable expectations of underlying production. Production uncertainty is further addressed by allowing the gold producer to roll hedges forward without a taxing event, or to close out a hedge, if it can be demonstrated that there are extraction difficulties or, more generally, that the basis of the future production estimate has materially changed from when it was originally nominated.

The legislation will have regard to the potential tax avoidance opportunities from re-ordering gain and loss contracts under such an arrangement. Early close-out for other reasons will result in deferral of losses until the first year of the original two-year hedge nomination period along with immediate recognition of gains.

The rollover conditions will require that hedge gains and losses be rolled over into a similar hedge product at the cessation of each hedge contract. This safeguard will facilitate identification of the hedge through rollover points and is consistent with the hedge disposal principle that economic risks and legal form should not change substantially over the life of the hedge.

By requiring the hedge to be linked to the underlying production, the above framework will bring the tax treatment of gold hedges closer to proposed accounting guidance.

Compliance costs of the proposed hedging framework should not be significant.

Taxation perspective on hedging of financial arrangements

Under the general framework for taxing financial assets and liabilities, hedging will be facilitated in a wide variety of circumstances. In particular, tax-timing matches will generally be achievable:

- •

- in the market-making/trading sector (where banks and other institutions have largely hedged portfolios and where, typically, longer term underlying assets may be hedged by short-term derivatives);

- •

- in the banking sector where, under certain conditions, internal hedging transactions will be recognised for tax purposes;

- •

- in the gold producing sector where, under certain conditions, the rollover of relatively short-term hedging instruments will not trigger a taxing event;

- •

- where instruments such as options, forwards and futures, which are taxed on a realisation basis, are used to hedge underlying assets that are also taxed on a realisation basis; and

- •

- where instruments such as swaps, which are taxed on an accruals basis, are used to hedge underlying assets that are also taxed on an accruals basis.

Nevertheless, some residual circumstances may still arise where tax-timing mismatches may be encountered such as where the hedge is subject to accruals treatment and the hedging instrument is taxed on a realisation basis, or vice versa. However, such circumstances are not expected to impact significantly on normal commercial activities.

Tax recognition of disposal

Recommendation 9.7 - Defining disposal

| Disposal principle

|

| Exclusions to disposal principle

|

Consistent with the proposed treatment of assets and liabilities generally, a disposal with associated balancing adjustment - a 'taxing point' - will occur if a taxpayer ceases to hold a financial asset or be subject to a financial liability.

As a general rule, a taxpayer will cease to hold a financial asset or be subject to a financial liability when there is a change in the legal ownership of the asset or liability or if the asset or liability matures. Generally, the recognition of a disposal for tax purposes will occur on sale, transfer, exchange, maturity or other alienation or extinguishment.

An asset or liability is constituted by sets of rights and obligations that have a particular risk profile. Disposal of the asset or liability (or part of the asset or liability) also encompasses any change in the risk attributes of the asset or liability - including through removal of some or all of the associated rights and obligations. Partial disposal is the subject of Recommendation 9.8.

Where a mixture of realisation, accruals and market value taxation applies (as in the recommended treatment of assets and liabilities), taxpayers dealing in diverse portfolios may be able to undertake apparently unrelated (synthetic) transactions to achieve the effect of disposal or part disposal of particular financial assets or liabilities. In broad terms this is referred to as 'synthetic disposal'. The disposal would not attract immediate tax consequences unless appropriate safeguards are in place. Recommendation 9.9, which addresses synthetic disposal involving significant tax deferral, therefore augments the disposal and part disposal principles discussed here.

As a general rule all disposal gains will normally be included in the taxpayer's taxable income. As an exception to this rule, Recommendations 6.8(b) and (c) address the proposed tax relief for the gain on a liability that is extinguished as a result of a debtor's financial distress.

Another general rule, and again consistent with the treatment of assets and liabilities generally, is that a taxing point will occur regardless of whether the financial asset or liability is exchanged for cash or for a different form of property. To provide otherwise would leave barter transactions outside the tax system. Exceptions to this general rule - for specific policy reasons - will apply to converting and convertible instruments, deliverable derivatives and scrip-for-scrip takeovers or demergers involving a widely held entity (see Recommendations 19.3 and 19.4).

Some legal disposals may not trigger an 'effective' change in ownership. This occurs in the case of daily settlement of exchange-traded futures contracts.

Converting and convertible instruments

Under Recommendation 12.11, all the payments associated with each converting or convertible instrument will be classed either as membership distributions or debt-related payments. This 'blanket' treatment will be determined by the application of a debt test. Such blanket treatment classifies the instrument as either debt or equity at a point in time but says nothing about whether the point of conversion represents a taxing point or not. In particular, notwithstanding the determination under this blanket treatment, the nature of the risk reflected in the financial arrangement can change from that of debt to equity (or from preference share to ordinary share) at conversion.

In the absence of specific measures, there would normally be a taxing point on conversion - regardless of whether the payments on the instrument were classed as distributions or debt payments and regardless of whether the payments were certain enough to be assessed on accrual. The tax value of the instrument at that time would be effectively compared with the value of the cash or property received on conversion - for example, the value of ordinary shares that the instrument converts into - to determine the resulting addition to or subtraction from taxable income.

Taxing converting and convertible instruments on conversion could create potential cash flow difficulties arising from a gain on conversion being in the form of shares rather than cash. Moreover, the point of conversion is not a taxing point in the United States, Canada or the United Kingdom. Against these considerations, the Review considers that the conversion of converting and convertible instruments should not be a taxing point for the holder.

Deliverable derivatives

Physically deliverable derivatives are economically similar to cash settled derivatives. The risk attributes are similar, and physically deliverable derivatives can be turned into cash by assignment or transfer.

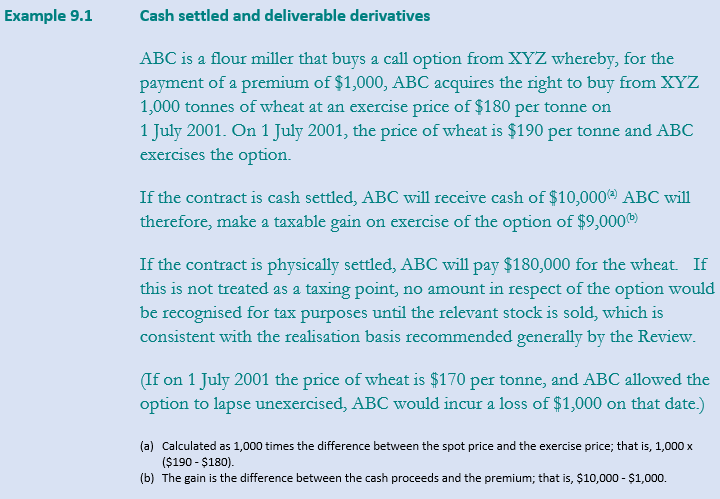

Cash settled derivatives will be disposed of and taxed at the time of settlement. Not bringing gains and losses on physically deliverable derivatives to account in the hands of the acquirer of the underlying asset at settlement means that physically delivered derivatives would incorporate a timing advantage over cash settled derivatives. As an offsetting consideration, physical delivery does not result in the receipt of cash. Cash would only result at the point of realisation, when tax will be payable on any gain. Example 9.1 illustrates a transaction of this kind.

As the example illustrates, the tax treatment between two economically similar transactions would be different.

At the same time, there is a difference in cash positions. Where settlement is by physical delivery, the holder does not receive cash at the time of delivery to reflect the $9,000 gain in respect of the option. If deliverable derivatives were taxed on settlement, the holder would not be in receipt of cash from the transaction to service the tax liability. Also, if the holder exercises the option, it will obtain delivery of 1,000 tonnes of wheat that has to be stored, insured and processed, further reducing the holder's cash resources.

Again, taking account of the cash flow impact and tax treatment in other countries, the Review considers that there should not be a taxing point to the acquirer of the underlying asset at the time derivatives are settled by delivery but that any gains be taxed upon realisation of the physically delivered assets.

Exchange-traded futures

Exchange-traded instruments are deemed by the Clearing House rules to be settled, and identical instruments deemed to be opened, daily. In the absence of specific treatment, the instrument would cease to be held when settled, resulting in a disposal for tax purposes.

However, the settlement and opening of these instruments involve no material change in the economic circumstances, including risk, faced by the holder of the instrument, merely being a mechanism by which the exchange makes margin calls on the instrument. Although legally disposed of, the commercial reality is that the exchange traded futures instrument continues until it is closed out by the acquisition of an equal and opposite position or on maturity.

Futures contracts are essentially standardised, margined forward contracts. As forwards will be taxed on realisation, not to defer the taxing point on a futures contract until it is closed out in the above manner would create a lack of neutrality between broadly equivalent instruments. Both commercial reality and neutrality considerations accordingly suggest there should be no disposal on daily settlement.

Gold hedging

Recommendation 9.6 separately addresses gold hedging.

Recommendation 9.8 - Partial disposal principle

|

That where a taxpayer holds a financial asset or is subject to a financial liability and enters into an arrangement under which it no longer holds some of the rights or is no longer subject to some of the obligations, the tax value of the remaining asset or liability be adjusted to reflect:

|

A partial disposal can be effected either directly, by an actual disposal, or by a material alteration.

- •

- In a direct partial disposal, part of the original asset or liability is disposed of or extinguished, the remainder continuing in place unchanged.

- •

- Similarly, in a material alteration, the terms of a continuing transaction are changed. Where that change of terms results in something of value being given up or an obligation being removed, such a material alteration may be economically identical to a partial disposal.

As with a full disposal, a partial realisation of gains and losses may be a result, not from a legal disposal or legal variation of rights or obligations under the financial asset or liability, but from a separate arrangement which has the effect of removing such rights or obligations.

To ensure that the same tax treatment applies to both forms of disposal, when part disposal involves a separate arrangement with another taxpayer, a link will be drawn between the underlying asset or liability and the separate arrangement (as is done in the two examples below). The tax value of the asset or liability acquired by the other taxpayer will be determined according to the general rules. The tax value of the asset or liability remaining with the original taxpayer will be adjusted to take into account:

- •

- the up-front effect of the disposal of some of the rights or obligations; and

- •

- the subsequent effect on tax value - which would be a reflection of the tax value over time of the asset or liability acquired by the other taxpayer.

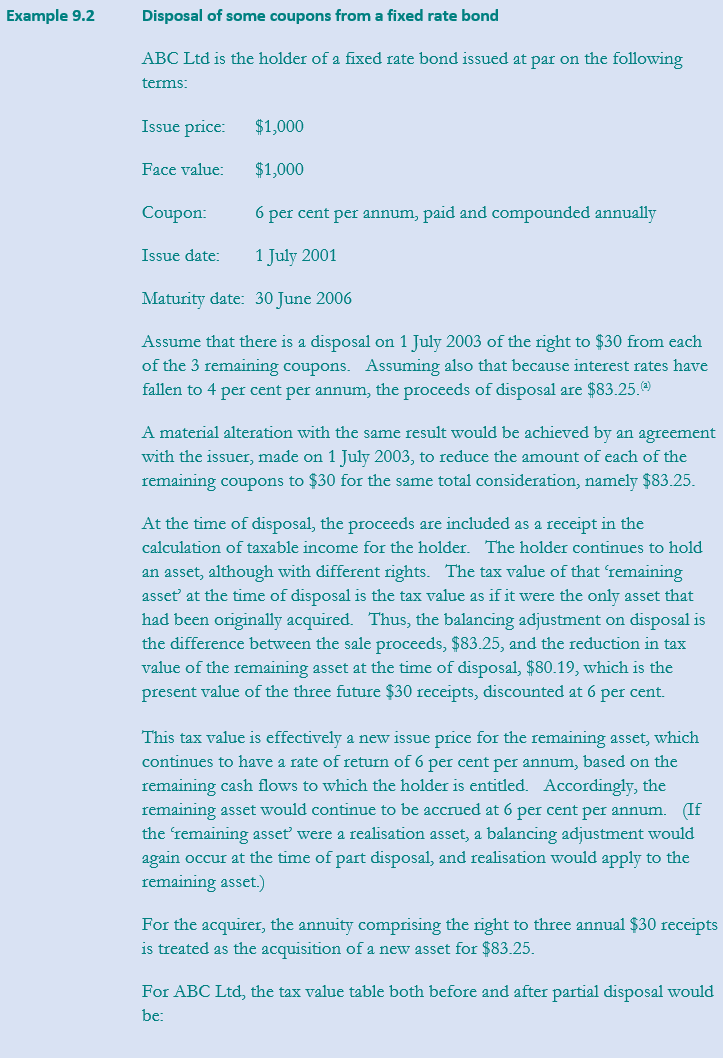

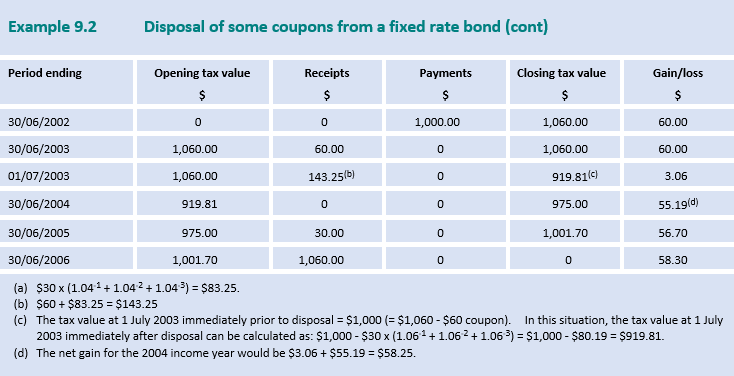

Illustrations of this treatment are given below. Example 9.2 illustrates the sale of some coupon receipts from a bond. Example 9.3 illustrates an in-substance defeasance. The treatment is consistent with the treatment of rights over non-financial assets - Recommendations 10.1 to 10.6.

Disposal of some benefits of a financial asset

As illustrated in Example 9.2, only the gain or loss from the disposal of the particular rights (or obligations) will be brought to account on partial disposal.

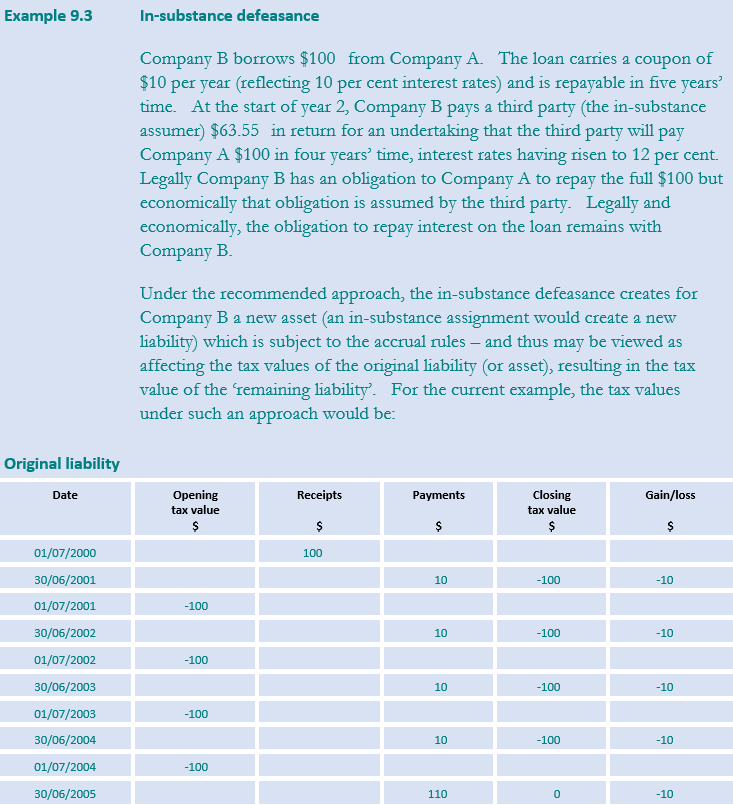

In-substance assignment and in-substance defeasance

Under existing law, the treatment of in-substance assignments and defeasances is uncertain.

An in-substance assignment of cash flows is one where the assignor receives from a third party an amount, approximating the net present value of the cash flows, in return for the assignor agreeing to pay to the third party amounts equal to the cash flows. The assignor's obligations to the third party offset its rights to the cash flows. Legally, the assignor's rights in relation to the cash flows remain.

An in-substance defeasance of a liability is one where a debtor pays a third party assumer an amount, approximating the net present value of the debt, in return for the third party agreeing to meet some or all of the debtor's payment obligations. Figure 9.1 illustrates such an arrangement. The assumer may agree to pay to the creditor the amount of the outstanding liability, or the payment may be to the debtor. (The same result could be achieved by the debtor acquiring securities, the terms of which match its obligations under the liability.) The rights that the debtor acquires offset its obligations on the liability. Legally, the debtor's obligations to the creditor remain.

Example 9.3 shows the proposed treatment of an in-substance defeasance.

Responding to synthetic arrangements

Recommendation 9.9 - Synthetic arrangements

| Wash sales and straddles

|

| 'Certain' synthetic arrangements exceeding one year

|

A tax policy perspective on synthetic arrangements

Business taxation simultaneously imposes tax on risk-free returns received for patience in investment and on the premiums for bearing risk. The taxation of both forms of returns is usually dealt with on an instrument-by-instrument or transaction-by-transaction basis. That is the general approach taken by the Review in its recommendations for the taxation of financial assets and liabilities.

In relation to the taxation of risk, there is considerable scope for tax arbitrage for two basic reasons:

- •

- first, risk is itself a portfolio property, in the sense that markets compensate holders only for their undiversifiable risk - the risk that cannot be removed by widening the holder's portfolio of assets and liabilities (at the extreme widened to the 'market' portfolio, which effectively represents national wealth); and

- •

- second, because of fundamental pricing relationships between the basic financial building blocks of assets, derivatives on those assets and risk-free debt, portfolios having the same risk and return can often be constructed (or aggregated or synthesised) from individual assets in different ways.

Unless all instruments or transactions were to be taxed on the same basis (for example, either mark-to-market or realisation or accruals), these portfolios may have different after-tax returns while generating the same before-tax yields. In the presence of the debt/equity boundary line as well as the alternative tax valuation bases of market value, accruals or realisation, taxation of portfolios carrying risk entails accentuated problems of tax arbitrage through the construction of synthetic portfolios (or combinations of selected instruments).

In particular, combinations of risky assets may correspond to a risk-free portfolio (as in perfect hedging); equivalently, a risk-free position which would justify accruals-based debt treatment may be able to be decomposed into individual assets eligible for realisation-based equity treatment.

Practical considerations in relation to tax arbitrage

In practice, tax systems around the world have faced great practical difficulties in addressing, via taxation imposed at the individual asset level, the taxation consequences of portfolio level risk. Those difficulties have been manifested, on the one hand, in calls for a more neutral treatment of hedging (see discussion following Recommendation 9.6) and, on the other hand, by the scope for tax arbitrage inherent in the use of synthetic portfolios, as discussed here.

The need to minimise tax avoidance associated with synthetic arrangements was canvassed in A Platform for Consultation (Chapter 7, pages 205-207). Through the development of innovative ways of dealing in risk, financial engineering has enhanced the opportunities for tax deferral and tax arbitrage.

- •

- Wash sales involve legally disposing of and reacquiring an asset in order to bring forward a tax loss. Before and after such an arrangement, the economic position of the taxpayer is similar.

- •

- Straddles involve holding both an asset and a liability whose values offset each other. The instrument that has decreased in value is then disposed of, while the instrument that has increased in value is retained until a future income period. Without straddle rules, the taxpayer would have access to deductions for tax losses while deferring the tax liabilities from the instrument that has increased in value. Such practices would result in tax subsidised risk-free returns.

- •

- Synthetic disposal involves transferring or selling economic benefits associated with an asset (or the obligations associated with a liability), while not bringing to tax an unrealised but locked-in profit because legal ownership of the asset or liability is retained. Recommendation 9.9 deals with synthetic disposals when all related transactions are known. As noted also, apparently unrelated transactions, when viewed collectively, can produce a certain return even though the returns on the individual transactions are uncertain and would attract realisation tax treatment (for example, where a person owns a share and buys an option to sell that share at a pre-determined future date and price and simultaneously sells an option to buy the same share at that date and price).

The cost to the revenue from not introducing tax rules to cope with synthetic arrangements is difficult to estimate. Specific anti-avoidance rules for wash sales, straddles and synthetic disposal have been introduced in the United States. On balance, the Review considers that some targeted measures are an appropriate response, with their effectiveness and scope to be monitored regularly.

Synthetic arrangements: purpose versus effect

It was noted in A Platform for Consultation (Chapter 7, page 207) that an issue for consideration is whether targeted rules for wash sales, straddles and synthetic disposals should be based on the 'effect' of the arrangement or its 'purpose'.

The Review has concluded that the existing dominant purpose test in the general anti-avoidance rule - Recommendation 6.1 - provides sufficient scope to deal with tax avoidance activity.

Wash sales and straddles

Taking these considerations into account, the Review proposes that the law make clear that legal disposals arising out of wash sales and straddles - where the dominant purpose is to obtain a tax benefit - will attract the general anti-avoidance rule.

'Certain' synthetic arrangements exceeding one year

For synthetic disposal, or more generally synthetic arrangements that produce 'certain' outcomes, the general anti-avoidance rule on its own is unlikely to be effective because it is more difficult to differentiate those arrangements that have a commercial purpose from those that have a tax avoidance purpose.

The Review's approach to 'certain' synthetic arrangements, therefore, strikes a balance between competing objectives. Setting the specific economic disposal rule to cover disposals beyond twelve months will minimise compliance costs and allow the vast bulk of non-tax driven commercial hedging activities to proceed. At the same time, that rule will reduce, to a maximum of one financial year, the opportunity for tax deferral through synthetic arrangements.

Synthetic arrangements beyond one year, that produce certain returns will be subject to accruals treatment.

An equitable transition to the new regime

Recommendation 9.10 - New financial arrangements

| That the new tax rules for financial assets and liabilities apply to all financial assets first held and liabilities issued by the taxpayer after commencement of the new rules. |

Recommendation 9.11 - Existing financial arrangements

| Exclusions from new regime

|

| Election to include in new regime

|

| Calculation of transitional balancing adjustment upon such election

|

| Spreading the transitional balancing adjustment

|

Recommendation 9.12 - Material alterations

| Effect of material alteration to existing arrangements

|

| Transitional spreading for material alteration

|

Generally new tax laws should apply on a prospective basis. The new regime for financial arrangements will, therefore, not apply to transactions undertaken before the commencement date, unless the taxpayer so elects at the time of commencement of the new rules.

Election

Distinguishing between financial assets and liabilities held before the commencement of the new rules and those acquired after that time could add significantly to a taxpayer's cost of compliance. By applying the new rules to all transactions, the additional compliance costs would be avoided.

Notwithstanding such compliance cost advantages to some taxpayers, the mandatory application of the new rules to existing financial assets and liabilities of all taxpayers may disadvantage those taxpayers for whom the compliance cost savings may not be important. The elective basis of applying the new rules will overcome this problem.

To avoid undue reductions in tax revenue caused by taxpayers electing to apply the new rules to transactions producing a favourable outcome for the taxpayer, the election will apply only on the basis that all existing financial assets and liabilities held or issued by a taxpayer are brought within the new rules.

Transitional balancing adjustment

Bringing financial assets and liabilities held prior to the commencement of the new rules into those new rules will result in a balancing adjustment.

- •

- For any such financial asset or liability subject to mark-to-market treatment under the new rules, the transitional balancing adjustment is equal to the amount that would be recognised for tax purposes if the taxpayer disposed of and reacquired those financial assets and liabilities at the time of commencement of the new rules.

- •

- For any such financial asset or liability which is subject to accruals treatment under the new rules, the balancing adjustment equals the difference when the new rules commence between the tax value of the financial asset or liability under the old rules and the tax value of the asset or liability had the new accruals rules applied at all times.

The gains or losses resulting from the transitional balancing adjustment under Recommendation 9.11(c) may be substantial. To smooth the transitional effects on taxpayers and the revenue, it is appropriate to spread the gain or loss over four years.

Material alteration

A material alteration, after the commencement of the new tax rules, of a financial asset or liability that is held prior to that time will have the effect of subjecting the transaction to the new rules from the time that the material alteration occurred. This is because a material alteration in substance gives rise to a new transaction.

Where a material alteration takes place within the four year period that begins with the commencement of the new rules, the recognition of any gains or losses in relation to that material alteration will be spread over the remaining part of that four year period. Without mandatory spreading of such gains and losses, there would be increased incentive to arrange material alterations of those financial arrangements existing at the commencement of the new rules on which there were unrealised losses. This would effectively provide access to unrealised losses to reduce tax payable while unrealised gains would remain untaxed until realisation.