| Disclaimer This edited version has been archived due to the length of time since original publication. It should not be regarded as indicative of the ATO's current views. The law may have changed since original publication, and views in the edited version may also be affected by subsequent precedents and new approaches to the application of the law. You cannot rely on this record in your tax affairs. It is not binding and provides you with no protection (including from any underpaid tax, penalty or interest). In addition, this record is not an authority for the purposes of establishing a reasonably arguable position for you to apply to your own circumstances. For more information on the status of edited versions of private advice and reasons we publish them, see PS LA 2008/4. |

Edited version of private ruling

Authorisation Number: 1011753138496

This edited version of your ruling will be published in the public Register of private binding rulings after 28 days from the issue date of the ruling. The attached private rulings fact sheet has more information

Please check this edited version to be sure that there are no details remaining that you think may allow you to be identified. Contact us at the address given in the fact sheet if you have any concerns.

Ruling

Subject: GST and payments from a government department

Questions

1. Are you making a taxable supply when you receive payment from the government department under your agreement with them?

Answer: Yes.

You are making a taxable supply when you receive payment from the government department under your agreement with them. Hence, GST is payable.

2. Do you have an outstanding liability for the period in which you received refunds of previously remitted GST?

Answer: Unless the overpaid refund amounts were avoided by fraud or evasion, the overpaid refund amounts for those periods cease to be payable.

Relevant facts

You provide community care services to targeted persons under an agreement that you entered into with a government department.

You entered into an agreement with the government department whereby the government department will accept financial responsibility for the delivery of a range of community care services to meet the home care needs of a targeted person upon referral from an 'ordering official'.

You are required to perform the tasks outlined in your designated region/s. The agreement further provides that you will undertake service provider functions for the government department and includes a list of service provider functions that you are required to undertake.

The agreement lists what deliverables are required. It further provides that you agree to comply with the requirements set out in the guidelines with regards to deliverables.

The agreement provides that the government department shall monitor your performance under the agreement and deliverables required. If the government department decides that your performance is unsatisfactory, then it may terminate the agreement.

You are to be paid fees in accordance with the schedule in the agreement and as amended from time to time. All fees are exclusive of GST.

Under the agreement you will make claims for payment based on the total number of hours of community care services you deliver to each targeted person.

Where you are advised by the ordering official in a written order that a co-payment is not to be charged, the government department will make up the shortfall. GST does not apply to co-payments.

The agreement further provides that where the government department specifically orders that it is fully liable for the total amount due for the service (ie no co-payment is to be charged), the full amount that the government department pays attaches to the supply that you make to the government department. In these specific cases GST will attract to the total amount of the cost for the service.

The Agreement forms a standing offer under which specific contract for services (or supplies) may be accepted by the government department, through the following process:

· An "ordering official" will provide you with a task requirement when there is a need for the services. The task requirement will be in the form of a written service plan. Each service plan issued to you constitutes a discrete contract between the parties for the services. Each discrete contract is subject to and incorporates the terms and conditions of the agreement.

· The government department shall not be liable for any work which the ordering officer has not requested in writing through the issue of a service plan.

· The government department does not bind itself to any exclusive arrangement, to order any specific quantities of the services or to engage any quantity at all, but reserves the right to engage such quantity of the services as may be required during the period of the agreement, according to the requirements of government department.

You have previously treated your supplies to the government department as taxable. However, in September 200Y, based on your former accountant's advice, you amended your activity statements for periods April 200X to March 200Y and treated your supplies to the government department as GST-free. This resulted in a refund of previously remitted GST totalling $x which was paid to you in September 200Y.

Due to your doubts about the GST status of your supply, you have been treating them as taxable since July 200Z.

Reasons for Decisions

Question 1

Summary

The payment you receive from the government department is consideration for a taxable supply that you make. Hence GST is payable.

Detailed reasoning

GST is payable on taxable supplies. A supply is a taxable supply if all the conditions under section 9-5 of the A New Tax System (Goods and Services Tax) Act 1999 (GST Act) are satisfied. Section 9-5 of the GST Act states:

You make a taxable supply if:

(a) you make the supply for *consideration; and

(b) the supply is made in the course or furtherance of an *enterprise that you *carry on; and

(c) the supply is *connected with Australia; and

(d) you are *registered or *required to be registered.

However, the supply is not a *taxable supply to the extent that it is *GST-free or *input taxed.

(* indicates a term defined in section 195-1 of the GST Act.)

Section 38-30 of the GST Act provides for the GST-free supply of community care. In your case of relevance is subsection 38-30(4) of the GST Act which provides that a supply of care is GST-free if:

(a) the supplier receives funding from the Commonwealth, a State or a Territory in connection with the supply; and

(b) the supply of the care is of a kind determined in writing by the *Aged Care Minister to be similar to a supply that is GST-free because of subsection (2).

For the purposes of section 38-30 of the GST Act, for the supply to be GST-free it must be a supply of 'care'.

GST-free Supply (Care) Determination 2000 (the Determination) defines care as 'services to enable a targeted person to continue to live at home'. The Determination provides that care can be provided to a targeted person or to a carer of a targeted person (provided that it substantially enables that carer to give care to a targeted person).

Section 4 and 5 of the Determination provides that it is only the care that is actually supplied to the targeted person or carer that can be GST-free.

Where a service is supplied to an entity other than the targeted person or carer, the supply will not satisfy the requirements of subsection 38-30(4) of the GST Act.

In your case, you have an agreement with the government department for the provision of home care services to entitled persons. Therefore, it is necessary to determine the recipient of the supply of services made by the service provider.

Goods and Services Tax Ruling 2006/9 provides the Commissioners view on multi-party transactions, commonly known as tripartite arrangements.

Paragraph 115 of GSTR 2006/9 provides that in more complex arrangements involving more than two entities, analysis may reveal:

· a supply made to one entity but provided to another entity;

· two or more supplies made; or

· a supply made and provided to one entity and consideration paid by a third party.

Furthermore, paragraph 116 of GSTR 2006/9 provides that as with two party transactions, the GST consequences of tripartite arrangements turn on identifying:

· one or more supplies;

· consideration (a payment, act or forbearance);

· a nexus between the supply and the consideration; and

· to whom the supply is made.

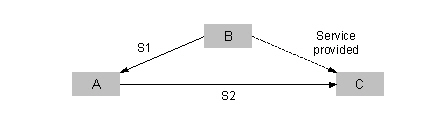

GSTR 2006/9 lists a number of propositions to analyse transactions. Of relevance is proposition 13 which is described as a situation whereby A has an agreement with B for B to provide a supply to C. In this instance, there is a supply made by B to A (contractual flow) that B provides to C (actual flow). This is illustrated in the following example:

Example 7: community care

171. A, a community care provider, receives Health and Community Care funding to provide home and maintenance services to people living at home, who are frail and have a moderate or severe disability. A sets the fees for its services according to the care recipient's ability to pay.

172. C, a client of A, is the care recipient. C is assessed by A as being entitled to receive a lawn-mowing service every fortnight at the subsidised rate of $10. There is a contractual relationship between A and C for the supply of the lawn-mowing service at the subsidised rate of $10.

173. A engages B, an independent contractor, to provide the lawn mowing service to C. A agrees to pay B $44 for its service.

174. C is required to pay A $10 for the service, but A directs C to pay the amount to B on A's behalf. A then pays B the balance of $34.

175. There is no contractual relationship between B and C.

176. B is making a supply of the lawn-mowing service (S1) for $44 to A but providing that service to C. A is also making a supply of a lawn mowing service (S2). A's supply is to C at the subsidised rate of $10.

In your case, the agreement creates a binding obligation between you and the government department for you to make the supply when the government department acceptance occurs (upon occurrence of certain events).

The remaining clauses in the agreement outline the details of the binding obligation that exist between you and the government department and the consequences of not satisfying that obligation. Furthermore, other clauses or parts in the agreement indicate that the supply is being made to the government department.

Based on the agreement, the government department exercises a significant level of control over you and in that the government department determines the nature of services to be performed, requires you to meet certain deliverables and monitors your performance.

Accordingly, you are making the supply to the government department. As the supply is made to the government department, an entity other than the targeted person or carer, the supply does not satisfy the requirements of subsection 38-30(4) of the GST Act. Hence, the supply is not GST-free under section 38-30.

In addition, the supply is not GST-free under the provisions of the GST Act or any other Act. Therefore, the supply you make to the government department is not GST-free.

The supply you make to government department is for consideration in the form of the fees payable in accordance with the agreement. The supply is made in the course or furtherance of your enterprise and is connected with Australia. Furthermore, you are registered for GST and the supply is not input taxed. Therefore, you are making a taxable supply to government department. Hence, GST is payable.

Question 2

Summary

Unless the overpaid refund amounts were avoided by fraud or evasion, the overpaid refund amounts for those periods cease to be payable.

Detailed reasoning

Under subsection 105-50(1) of Schedule 1 to the Taxation Administration Act 1953 (TAA), any unpaid net amount, net fuel amount or amount of indirect tax (together with any relevant general interest charge under the TAA) ceases to be payable four years after it became payable. The term indirect tax includes GST. These amounts covered by subsection 105-50(1) of Schedule 1 to the TAA are generally referred to as unpaid amounts.

Subsection 105-50(2) of Schedule 1 to the TAA provides that:

· if an amount was paid as a refund or applied under the Running Balance Account (RBA) provisions of the TAA, and

· that amount exceeded the amount (if any) that the entity was entitled to be paid or have applied,

the amount of the excess (together with any relevant general interest charge under the TAA) ceases to be payable four years after it became payable. Such excess amounts under subsection 105-50(2) of Schedule 1 to the TAA are generally referred to as overpaid refund amounts.

Under subsection 105-50(3) of Schedule 1 to the TAA, there are two exceptions to the general four year limit provided for in subsections 105-50(1) and (2) of Schedule 1 to the TAA. An unpaid amount or overpaid refund amount does not cease to be payable if:

· within four years after it became payable, the Commissioner has required payment of the unpaid amount or overpaid refund amount by giving a notice to the entity, or

· the Commissioner is satisfied that the unpaid amount or overpaid refund amount resulted from fraud or evasion.

Law Administration Practice Statement PS LA 2009/3 sets out the circumstances in which the ATO may recover indirect taxes outside the four year limit under the exceptions set out in section 105-50 of Schedule 1 to the TAA.

Paragraph 17 of PS LA 2009/3 provides:

There is an additional exception to the four-year limit in respect of fraud or evasion. Tax Office staff who suspect that an unpaid amount or overpaid refund amount has arisen due to fraud or evasion should refer to Law Administration Practice Statement PS LA 2008/6 Fraud or evasion. A formal determination by an appropriately authorised officer must be made prior to making any assessment which relies on this exception to the four-year time limit.

Following on from the above paragraph in PS LA 2009/3, paragraphs 16 and 17 of Law Administration Practice Statement PS LA 2008/6 state:

16. Evasion is best explained by reference to the judgment of Dixon J in Denver Chemical Manufacturing v. Commissioner of Taxation 79 CLR 296 in which his Honour described evasion as a blameworthy act or omission on the part of the taxpayer. Appendix 4 of this practice statement contains an overview of how evasion has been considered by the High Court.

17. Circumstances may arise where a taxpayers behaviour is not considered to constitute fraud but is nevertheless sufficiently blameworthy to constitute evasion. The threshold for finding evasion is not as high as fraud.

The four-year period for recovery of an overpaid refund amount commences from the date the overpaid refund amount became payable by the entity. An overpaid refund amount becomes payable by the entity at the time the refund is paid to the entity or applies to its RBA.

In your case, the amount totalling $X (together with any relevant general interest charge) represents the amount of incorrectly claimed refunds in activity statements for the quarterly tax periods from April 200X to March 200Y. As these amounts have not been paid back to the ATO, they are overpaid refund amounts.

ATO records indicate that we have not required payment of any part of these amounts by giving a notice to you within four years of any part of the amounts becoming payable. Therefore, these amounts will not be payable unless the Commissioner is satisfied that the overpaid refund amounts resulted from fraud or evasion.