| Disclaimer This edited version has been archived due to the length of time since original publication. It should not be regarded as indicative of the ATO's current views. The law may have changed since original publication, and views in the edited version may also be affected by subsequent precedents and new approaches to the application of the law. You cannot rely on this record in your tax affairs. It is not binding and provides you with no protection (including from any underpaid tax, penalty or interest). In addition, this record is not an authority for the purposes of establishing a reasonably arguable position for you to apply to your own circumstances. For more information on the status of edited versions of private advice and reasons we publish them, see PS LA 2008/4. |

Edited version of your private ruling

Authorisation Number: 1011970975517

This edited version of your ruling will be published in the public register of private binding rulings after 28 days from the issue date of the ruling. The attached private rulings fact sheet has more information.

Please check this edited version to be sure that there are no details remaining that you think may allow you to be identified. If you have any concerns about this ruling you wish to discuss, you will find our contact details in the fact sheet.

Ruling

Subject: GST and specialist pathology services

Question

Are you making taxable supplies of services when you provide specialist pathology services to students under an agreement between you and the schools?

Answer

Yes, you are making taxable supplies of services when you provide specialist pathology services to students under an agreement between you and the schools.

Relevant facts and circumstances

This ruling is based on the facts stated in the description of the scheme that is set out below. If your circumstances are materially different from these facts, this ruling has no effect and you cannot rely on it. The fact sheet has more information about relying on your private ruling.

You are a specialist pathologist operating as a sole trader.

You are registered for GST.

You are a member of an Association of Australia Ltd (AB), the national peak body for the specialist pathology profession in Australia.

AB is the national peak body for the specialist pathology profession in Australia and has uniform membership requirements.

You do not employ anyone to perform services on your behalf.

You are contracted to provide specialist pathology services to several public primary and secondary schools in your State.

You do not have written contracts with the schools. All contracts are verbal. Schools allocate funds and commit to a verbal agreement that they will fund your services for a calendar year.

You select students as patients for treatment via screening and classroom observation or by recommendation.

You always determine the type and frequency of the treatment, the school only has input in the scheduling of the sessions.

You have advised that the services you provide to patients are generally accepted in your profession as being necessary for the appropriate treatment of the patients.

You are renumerated on an hourly basis directly by the schools, which do not seek reimbursement from parents, as the government provides funding for these services.

Your services to the schools are reviewed in November / December each school year and decisions are made by the schools as to whether or not they can continue funding the outsourced specialist pathology services you provide.

There is no state law governing the supply of specialist pathology services in your State.

Relevant legislative provisions

A New Tax System (Goods and Services Tax) Act 1999 Section 9-5

A New Tax System (Goods and Services Tax) Act 1999 Subsection 38-10(1)

A New Tax System (Goods and Services Tax) Act 1999 Section 195-1.

Reasons for decision

Under section 9-5 of the A New Tax System (Goods and Services Tax) Act 1999 (GST Act), you make a taxable supply if:

· you make the supply for consideration

· the supply is made in the course or furtherance of an enterprise that you carry on

· the supply is connected with Australia, and

· you are registered, or required to be registered for GST.

However, a supply is not taxable to the extent that it is GST-free or input taxed.

In your circumstances, subsection 38-10(1) of the GST Act is relevant and provides that the supply of other health services is GST-free if it is:

· a listed health service

· performed by a recognised professional, and

· generally accepted in the relevant health profession as being necessary for the appropriate treatment of the recipient of the supply.

These three requirements need to be considered in your case.

Listed health service

Speech pathology is a listed health service at item 19 in the table to subsection 38-10(1) of the GST Act). The supply of the service may be GST-free where the other requirements of subsection 38-10(1) of the GST Act are met.

Performed by a recognised professional

A recognised professional for GST purposes is a person who, amongst other things:

· is registered, permitted or approved under state or territory law to supply the listed health service, or

· if there is no relevant state or territory law, is a member of a professional association that has uniform membership requirements relating to the supply of the health service.

We understand that there is no state law governing the supply of specialist pathology services in your State. AB is the national peak body for the specialist pathology profession in Australia and has uniform membership requirements. You have advised that you are a member of AB and are a recognised professional for GST purposes.

Appropriate treatment of the recipient of the supply

A health practitioner provides appropriate treatment when they assess a patient's health and determine a course of action to preserve, restore, or improve the physical or psychological wellbeing of that patient as far as their training allows.

The treatment is appropriate if it would generally be accepted by the relevant health profession as being appropriate for the patient. Appropriate treatment includes further treatments and the principles of preventative medicine.

You have advised that the specialist pathology services you provide fall within the meaning of appropriate treatment for GST purposes.

We must also consider for this requirement who is the recipient of the appropriate treatment.

Section 195-1 of the GST Act defines 'recipient' as:

· in relation to a supply, means the entity to which the supply was made.

Where there are only two parties to an arrangement, for example, you as the supplier of specialist pathology treatment and the client receiving that treatment, the recipient of the supply is the client receiving the treatment. However, where there is a third party involved who is paying for your services (for example, in your case, the school), that third party may be the recipient of a supply made by you, depending on the contractual relationship in place.

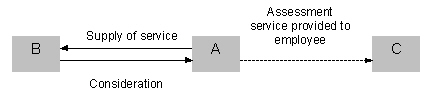

Goods and Services Tax Ruling GSTR 2006/9 provides guidance about the meaning of 'supply' using a number of propositions. In particular, Proposition 13 is that when A has an agreement with B for B to provide a supply to C, there is a supply made by B to A (contractual flow) that B provides to C (actual flow). In relation to Proposition 13 and supplies of health services, paragraph 155 of GSTR 2006/9 states:

155. Under the GST health provisions in Subdivision 38-B (except for sections 38-45 and 38-47 dealing with particular supplies of goods and section 38-55 dealing with private health insurance and ambulance insurance), the supply is only GST-free where an individual receiving that service or specific health treatment is the recipient of that supply. This outcome results from the specific wording in some health provisions, whilst in other provisions it is due to the nature of the services themselves. This means that a GST-free supply of a health service cannot be made to a business entity or a non-profit body.

It needs to be determined, by examining the verbal contracts between you and the schools, whether you are making supplies to a third party that do not amount to the appropriate treatment of that third party. Any such supply would not be GST-free and may be taxable where the requirements of section 9-5 of the GST Act are met. The analysis must consider the verbal contracts between you and your clients, the schools.

GSTR 2006/9 provides a number of examples to illustrate the concept of supply. Of most relevance to your situation are paragraphs 161 to 163 of example 5 in relation to Proposition 13 which state:

Example 5: occupational therapist

161. A, an occupational therapist, is engaged by B, a company, to assess the needs of C, its employee. C suffers from multiple sclerosis and needs to use a wheelchair. A and B enter into an agreement which requires A to undertake an assessment of C's condition, to give recommendations in a report to B and for B to pay for the service.

162. A's supply of services is made to B. Although C may benefit from these services, it is B who contracts for the supply of these services and is the recipient of the supply.

This supply is not GST-free under subsection 38-10(1). This is because paragraph 38-10(1)(c) requires the supply to be generally accepted in the relevant profession as being necessary for the appropriate treatment of the recipient of the supply. B is the recipient of the supply. The supply is not for the treatment of B. Paragraph 38-10(1)(c) is not satisfied.

Under your verbal contracts with the schools, you are engaged to provide specialist pathology services to students. You are renumerated on an hourly basis directly by the schools, which do not seek reimbursement from parents, as the government provides funding for these services. You agree on your fee with the school and it is the school that has a liability to pay you for your services. You also do not have any direct contractual relationship with the students or their families as your verbal contract is with the school.

We consider your circumstances are analogous to those discussed in paragraphs 161 to 163 of example 5, in relation to Proposition 13, in GSTR 2006/9 set out above. The guidance in paragraph 162 can be applied as if you are entity A, the school is entity B and the student is entity C. It is the schools that are acquiring your services and requesting they be provided to the students. The schools are the recipients of the supplies made by you.

Therefore, the requirement of subsection 38-10(1) of the GST Act that the health service is generally accepted in the relevant health profession as being necessary for the appropriate treatment of the recipient of the supply is not satisfied

Conclusion

As the schools are the recipients of the supplies made by you, your supplies to the schools cannot be GST-free supplies of specialist pathology services. You are supplying services to the schools which contract with you, although the students benefit from your services.

Consequently, as you are registered for GST and you have made these supplies in the course of your enterprise in Australia, the supplies are taxable supplies under section 9-5 of the GST Act for which you are liable to remit GST and issue tax invoices when requested.