| Disclaimer This edited version has been archived due to the length of time since original publication. It should not be regarded as indicative of the ATO's current views. The law may have changed since original publication, and views in the edited version may also be affected by subsequent precedents and new approaches to the application of the law. You cannot rely on this record in your tax affairs. It is not binding and provides you with no protection (including from any underpaid tax, penalty or interest). In addition, this record is not an authority for the purposes of establishing a reasonably arguable position for you to apply to your own circumstances. For more information on the status of edited versions of private advice and reasons we publish them, see PS LA 2008/4. |

Edited version of your private ruling

Authorisation Number: 1012007002626

This edited version of your ruling will be published in the public register of private binding rulings after 28 days from the issue date of the ruling. The attached private rulings fact sheet has more information.

Please check this edited version to be sure that there are no details remaining that you think may allow you to be identified. If you have any concerns about this ruling you wish to discuss, you will find our contact details in the fact sheet.

Ruling

Subject: Taxation treatment of a superannuation lump sum payment

Issue 1

Question:

Is any part of the superannuation lump sum payable on total and permanent disability (TPD) included in your client's assessable income for the 2011-12 income year?

Answer:

Yes.

This ruling applies for the following period:

Year ending 30 June 2012.

The scheme commences on:

1 July 2011.

Relevant facts and circumstances:

Your client, who is under age 60, became a member of a superannuation fund (the fund) several years ago.

In mid November 20XX, your client suffered an injury at work. It is stated that at this time your client's superannuation interest in the fund consisted of employer contributions. It is also stated that your client had Total and Permanent Disablement (TPD) insurance cover in the fund.

In early December 20XX, your client lodged a claim for a TPD benefit with the fund.

The trustee of the fund (the fund trustee) has a group life (death and TPD) insurance policy (the policy) with its insurer. The policy is for the provision of death only or death and TPD insurance to members of the fund.

In late June 20XX, the insurer accepted your client's TPD benefit claim.

It is also stated that at this time the insurer transferred an insurance benefit into your client's superannuation account with the fund.

In a fund member statement covering a period of several weeks early in the 2011-12 income year, your client was advised of the value of the withdrawal benefit in the fund, prior to the payment of a lump sum superannuation benefit. The fund member statement further states that this amount is also the value of your client's TPD benefit in the superannuation account at this time.

At the time the fund member statement was issued to your client, a superannuation lump sum was paid from your client's superannuation account. A PAYG payment summary-superannuation lump sum for the 2011-12 income year shows that the payment is not a death benefit, and that tax was withheld by the fund at the rate of 21.5%. The PAYG payment summary further shows that the payment is made up of a tax-free component and a taxable component - taxed element.

Your client was under the preservation age at the time the payment was made by the fund.

In the fund member statement, our client was advised of the balance of the withdrawal benefit in the superannuation account after the payment of the TPD benefit. The fund member statement also states the value of your client's insured TPD cover in the fund after the payment was made.

In a letter you sent to the fund in early August 20XX, you described the TPD benefit as an insurance benefit. You further submitted that the TPD benefit represented an invalidity component and is compensation for loss of an asset. You also submitted that the TPD benefit is capital in nature and not taxable.

The fund responded to your enquiry in a letter sent to you in early September 2011. After the definition of 'disability superannuation benefit' in subsection 995-1(1) of the Income Tax Assessment Act 1997 (ITAA 1997) was quoted in full, you were advised that in this instance your client has been deemed totally and permanently disabled and as a consequence payment of the insurance benefits was made to the fund trustee.

The letter further states that the TPD benefit paid was comprised of your client's accumulated benefits in the fund and the TPD insurance payout. The letter also states that the tax-free component of the benefit was calculated by reference to a prescribed formula, and in accordance with, section 307-145 of the ITAA 1997.

The policy document for the policy document for the TPD insurance policy issued to the fund trustee by the insurer, states that the policy is issued by the insurer to the policy owner described in the policy schedule. The policy document further states that the policy is issued by the insurer to the policy owner in its capacity as the trustee of the fund (referred to in the policy as 'the trust').

In addition, the policy document states that in consideration of payment to the insurer of all premiums due, and subject to both the conditions of insurance cover and the other general conditions of the policy, the insurer will pay to the policy owner the benefits calculated in the policy, immediately upon proof being given to the satisfaction of the Insurer of the following:

· the identity of the insured member upon whose death or total and permanent disablement (as defined in the policy) the insurer is asked to make payment;

· the correct age of the insured member; and

· the insured member meets the requirements specified in the policy for the payment of the death or TPD benefit.

The policy owner is defined in the policy as meaning the policy owner stated in the policy schedule and its legal successors. The policy schedule describes the 'policy owner/trustee' as the fund trustee and the 'trust' as the fund.

Relevant legislative provisions:

Income Tax Assessment Act 1997 Section 301-30.

Income Tax Assessment Act 1997 Subsection 301-35(1).

Income Tax Assessment Act 1997 Subsection 301-35(2).

Income Tax Assessment Act 1997 Section 307-5.

Income Tax Assessment Act 1997 Subsection 307-5(1).

Income Tax Assessment Act 1997 Section 307-65.

Income Tax Assessment Act 1997 Section 307-120.

Income Tax Assessment Act 1997 Subsection 307-120(1).

Income Tax Assessment Act 1997 Section 307-145.

Income Tax Assessment Act 1997 Subsection 307-145(2).

Income Tax Assessment Act 1997 Subsection 307-145(3).

Income Tax Assessment Act 1997 Subsection 995-1(1).

Taxation Administration Act 1953 Section 357-55 of Schedule 1 and

Taxation Administration Act 1953 Division 359 of Schedule 1.

Reasons for decision

Issue 1

Summary

The lump sum payment was made to your client by the superannuation fund because your client is a fund member. Therefore, the payment is a superannuation benefit. In addition, it is accepted that the payment is also a disability superannuation benefit.

As your client was aged under the preservation age when the superannuation lump sum was paid by the superannuation fund:

The tax-free component is not subject to tax and is not included in your client's assessable income; and

The taxable component - taxed element is included in your client's assessable income. However, a tax offset will apply to ensure that the rate of tax payable on this amount is no more than 20% plus Medicare levy.

No tax has been incorrectly withheld from the payment by the superannuation fund.

Detailed Reasoning

The taxation treatment of superannuation lump sums is set out in Divisions 301 and 307 of the Income Tax Assessment Act 1997 (ITAA 1997).

Superannuation benefit

A superannuation lump sum is described in section 307-65 of the ITAA 1997 as a superannuation benefit that is not a superannuation income stream.

Section 307-5 of the ITAA 1997 defines what is a 'superannuation benefit'. A superannuation benefit is a payment described in the table contained in subsection 307-5(1) and will either be a superannuation member benefit or a superannuation death benefit.

Item 1, column 2 of the table contained in subsection 307-5(1) of the ITAA 1997 defines a 'superannuation member benefit' as being:

A payment to you from a superannuation fund because you are a fund member.

A lump sum payment was made to your client by a superannuation fund (the fund) early in the 2011-12 income year. The benefit was paid from your client's superannuation account, because your client is a member of the fund. As such, the benefit is a superannuation benefit as defined under subsection 307-5(1).

Your client was also eligible for additional insurance cover for Total and Permanent Disablement (TPD) where certain criteria under the rules of the fund were satisfied.

In a letter sent to you by the fund in early September 2011, you were advised that the TPD benefit paid to your client was comprised of your client's accumulated benefits and a TPD insurance payout. The TPD insurance payout represents the proceeds of a TPD insurance policy the fund has with its insurer.

It is stated that at the time the insurer accepted your client's TPD benefit claim, an insurance benefit was transferred into your client's superannuation account.

However, whilst your client was insured for death or for death and TPD under this additional insurance cover, the TPD insurance policy with the insurer is owned by the fund, and not by your client in this instance. The facts show that the policy document for the group life (death and TPD) insurance policy issued to the fund trustee by the insurer, states that the policy is issued to the policy owner described in the policy schedule, in its capacity as the trustee of the fund. The policy schedule then specifies that this 'policy owner' is the fund trustee.

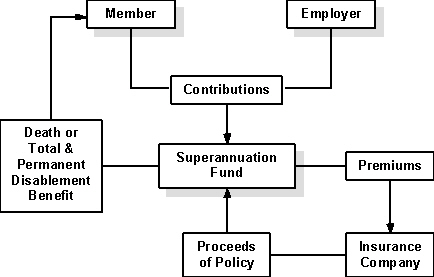

As a result any proceeds of the insurance policy are paid by the insurer to the policy owner (in this instance the fund). The policy owner will then in turn pay an equivalent amount to the fund member (in this instance your client) in satisfaction of the obligation to pay the TPD benefit. The following diagram illustrates this process.

In this case, the superannuation lump sum benefit your client received from the fund included an amount equivalent to the TPD insurance proceeds paid to the fund by the insurer. Because the policy is owned by the fund and not by your client, your client is only entitled to the benefits that are specified in the trust deed of the fund. This does not entitle your client, as a member of the fund, to a beneficial ownership of, or beneficial interest in, the assets of the fund. Accordingly, the TPD benefit does not represent compensation to your client for the loss of an asset.

Therefore, as the superannuation lump sum payment was made to your client by the fund because your client is a fund member, the entire lump sum payment is a superannuation benefit as defined under subsection 307-5(1) of the ITAA 1997.

Components of a superannuation lump sum benefit

As provided in subsection 307-120(1) of the ITAA 1997, a superannuation lump sum benefit can include:

· a taxable component; and

· a tax-free component.

This apportionment is not limited to the part of the benefit consisting only of employer contributions and employee contributions, as has been asserted. The entire benefit, including the equivalent amount of the TPD insurance proceeds which forms part of the benefit, is apportioned in accordance with section 307-120 of the ITAA 1997.

The taxable component is the part of the benefit that is taxable. Though tax must be paid on the entire taxable component, it may include two parts - one where tax has already been paid and one where tax has not yet been paid. These are called taxed and untaxed elements of the taxable component:

A taxed element is the amount of the benefit that has already had tax paid within the fund. Your client may need to pay additional tax on it when it is paid out, depending on your client's age when your client took the lump sum.

An untaxed element is the part of the benefit that has not had any tax paid on it in the fund, but is still taxable. Where an untaxed element is included in the taxable component of a superannuation lump sum, the untaxed element must be included in the recipient's tax return.

The tax-free component is the part of a benefit that is tax-free and is not included in your client's tax return (section 301-30 of the ITAA 1997).

The facts show that the superannuation lump sum is divided into a tax-free component and a taxable component - taxed element. As such, the payment is divided into the components shown on the PAYG payment summary-superannuation lump sum issued to your client by the fund, and the tax treatment relevant to each component applies.

Taxation treatment of the taxable component-taxed element of a superannuation lump sum

The tax treatment of a taxed element of a taxable component depends on the age of the person at the time the superannuation lump sum is received and whether or not the person has reached their preservation age.

Preservation age is the age at which retirees can access their superannuation benefits. This is 60 years of age for persons born after 30 June 1964.

For a person who receives a superannuation lump sum when the person is aged under the preservation age, the entire taxable component - taxed element of the payment is taxed at a maximum rate of tax (including Medicare levy) of 21.5%.

Disability superannuation benefit

In this case, the question as to whether the superannuation benefit is also a disability superannuation benefit and contains a modified tax-free component, is not in dispute.

In the advice letter from the fund mentioned previously, the definition of 'disability superannuation benefit' in subsection 995-1(1) of the ITAA 1997 was quoted in full.

As stated in the advice letter, a disability superannuation benefit is defined in subsection 995-1(1) as meaning a superannuation benefit if:

· the benefit is paid to an individual because he or she from ill-health (whether physical or mental); and:

· 2 legally qualified medical practitioners have certified that, because of the ill-health, it is unlikely that the individual person can ever be gainfully employed in capacity for which he or she is reasonably qualified because of education, experience or training.

The letter further states that your client has been deemed totally and permanently disabled. It is clear from this letter that the fund trustee has determined under the rules of the fund that a TPD payment should be made to your client.

Accordingly we accept that your client's benefit is a disability superannuation benefit.

It follows, therefore, that the tax-free component of the benefit can be modified under section 307-145 of the ITAA 1997. As mentioned in the advice letter, this is so that the benefit can 'have an increased tax-free component calculated by reference to a prescribed formula'. This formula is prescribed in subsection 307-145(3) of the ITAA 1997. In light of the foregoing, we accept that the benefit has a tax-free component determined in accordance with subsection 307-145(2) of the ITAA 1997.

Taxation of your client's superannuation lump sum payment

As noted in the facts, the PAYG payment summary-superannuation lump sum issued by the REST to your client for the superannuation lump sum shows that it consists of a tax-free component and a taxable component - taxed element.

The tax-free component is not included in your client's assessable income, in accordance with section 301-30 of the ITAA 1997.

Your client was under the preservation age at the time the payment was made by the fund.

As your client was under the preservation age when the payment was made, the taxable component - taxed element is fully included in your client's assessable income for the 2011-12 income year, under subsection 301-35(1) of the ITAA 1997.

Although the superannuation lump sum may have the character of a capital receipt, the entire taxable component - taxed element is specifically brought to account as assessable income in accordance with subsection 301-35(1) of the ITAA 1997.

Further, your client is entitled to a tax offset under subsection 301-35(2) of the ITAA 1997, to ensure that the rate of tax on the taxable component - taxed element is no more than 20% plus Medicare levy.

In this case, there is no evidence to show that the fund incorrectly withheld tax from the taxable component of the superannuation lump sum payment at the rate of 21.5%.