| Disclaimer This edited version has been archived due to the length of time since original publication. It should not be regarded as indicative of the ATO's current views. The law may have changed since original publication, and views in the edited version may also be affected by subsequent precedents and new approaches to the application of the law. You cannot rely on this record in your tax affairs. It is not binding and provides you with no protection (including from any underpaid tax, penalty or interest). In addition, this record is not an authority for the purposes of establishing a reasonably arguable position for you to apply to your own circumstances. For more information on the status of edited versions of private advice and reasons we publish them, see PS LA 2008/4. |

Edited version of your private ruling

Authorisation Number: 1012059406441

This edited version of your ruling will be published in the public register of private binding rulings after 28 days from the issue date of the ruling. The attached private rulings fact sheet has more information.

Please check this edited version to be sure that there are no details remaining that you think may allow you to be identified. If you have any concerns about this ruling you wish to discuss, you will find our contact details in the fact sheet.

Ruling

Subject: GST and supply of a new residential property to an associate as a gift

Question

Are you making a taxable supply as a property developer when you supply a new residential property, to an associate, as a gift for no consideration?

Answer

Yes, you are making a taxable supply as a property developer when you supply the new residential property, to an associate, as a gift for no consideration

This ruling applies for the following periods:

Not applicable

The scheme commences on:

Not applicable

Relevant facts and circumstances

You are registered for Goods and Services Tax (GST)

You are engaged in a property development activity.

A year ago, you supplied a new residential property to an associate, as a gift, for no consideration.

The residential property was built by you three years ago and it was never sold and was leased until you transferred the property to your associate.

You paid stamp duty for the value of the property when you transferred the property to your associate.

You confirmed that you did not claim any input tax credits in relation to the construction of this new residential property.

You informed that your associate is not registered for GST.

Your tax agent advised you that you are liable to pay GST on the supply of the property.

Relevant legislative provisions

A New Tax System (Goods and Services Tax) Act 1999 Section 9-5,

A New Tax System (Goods and Services Tax) Act 1999 Section 9-75,

A New Tax System (Goods and Services Tax) Act 1999 Section 40-65,

A New Tax System (Goods and Services Tax) Act 1999 Subsection 40-75(1),

A New Tax System (Goods and Services Tax) Act 1999 Section 72-5,

A New Tax System (Goods and Services Tax) Act 1999 Section 72-10 and

Income Tax Assessment Act 1936 (ITAA 1936) Section 318.

Reasons for decision

Division 72 of the A New Tax System (Goods and Services Tax) Act 1999 (GST ACT) ensures that supplies to, and acquisitions from, your associates without consideration are brought into the GST system, and that supplies to your associates for inadequate consideration are properly valued for GST purposes. Under the GST legislation consideration is any payment, or any act or forbearance, in connection with a supply of anything.

GST is payable on all taxable supplies. Section 9-5 of the GST Act provides that you make a taxable supply if you make the supply for consideration; and the supply is made in the course or furtherance of an enterprise that you carry on; and the supply is connected with Australia; and you are registered or required to be registered.

However the supply is not taxable to the extent that it is GST-free or input taxed.

You supplied the new residential property to your associate as a gift through your property development enterprise.

Under section 40-65 of the GST Act, a supply of residential premises is input taxed. However, the supply of the premises is not input taxed if the premises are new residential premises.

Under subsection 40-75 (1) of the GST Act, residential premises are new residential premises if they:

· have not previously been sold as residential premises and have not previously been the subject of a long-term lease; or

· have been created through substantial renovations of a building; or

· have been built, or contain a building that has been built, to replace demolished premises on the same land.

The premises you supplied to your associate would therefore be new residential premises as it was not previously sold as residential premises and was not previously been the subject of a long-term lease.

Section 72-5 of the GST Act relates to taxable supplies without consideration. The section provides that the fact that a supply to your associate is without consideration, does not stop the supply being a taxable supply if:

· your associate is not registered or required to be registered; or

· your associate acquires the thing supplied otherwise than solely for a creditable purpose.

This section has effect despite paragraph 9-5(a) (which would otherwise require a taxable supply to be for consideration).

In this case you have made a supply of the new residential premises to your associate, who is not registered or required to be registered for GST.

An associate has the meaning prescribed by section 318 of the Income Tax Assessment Act 1936 (ITAA 1936) which provides that an associate is any relative of an entity that is a natural person. Subsection 318(4) of the ITAA 1936 provides that if the primary entity is a partnership then if a partner in the partnership is a natural person, subsection 318(1) will apply.

Subsection 318(1) states (in part):

For the purposes of this Part, the following are associates of an entity (in this subsection called the "primary entity") that is a natural person (otherwise than in the capacity of trustee).

(a) a relative of the primary entity:

(b) a partner of the primary entity or a partnership in which the primary entity is a partner;

(c) if a partner of the primary entity is a natural person otherwise than in the capacity of trustee the spouse or child of that partner.

Therefore your relative is an associate of the primary entity which is you and the supply of the new residential premises will be covered by section 72-5 of the GST Act, and the supply will be a taxable supply.

This effectively means that although no money will change hands for the transfer of the property it will still be a taxable supply on which GST is required to be remitted to the Tax Office.

Section 72-10 of the GST Act provides that if a supply to your associate without consideration is a taxable supply; its value is the GST exclusive market value of the supply. This section has effect despite section 9-75 (which is about the value of taxable supplies)

Therefore, for the new residential premises you have supplied to your associate the GST would be calculated on the market value of the premises not including the GST. This figure then becomes the amount that the 10% GST rate is applied to.

Entitlement to input tax credit

Please note that you are entitled to claim input tax credits regarding the acquisitions made and that relates to the construction of this new residential property using an apportionment method to determine the extent of your creditable purpose.

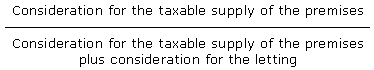

The extent to which new residential premises are applied for a creditable purpose can be determined by the following formula:

This method is based on the consideration received or liable to be received in respect of any taxable supply as compared to any input taxed supply. Please refer to the Australian Taxation Office (ATO) website at http://www.ato.gov.au/businesses/content.aspx?doc=/content/00162366.htm for more details in relation to the calculation of your entitlement to input tax credits.

Additional Information:

Margin scheme

The margin scheme provides some relief in relation to certain property transactions and allows for a reduced amount of GST to be paid. The margin is the amount by which the consideration for the supply exceeds the consideration for the acquisition on the interest, unit or lease in question. Under the margin scheme the amount of GST on a supply is 1/11 of the margin for the supply.

Further information about the application of the margin scheme is contained in Fact Sheets NAT 8680 and NAT 8682 which are available on the ATO website at www.ato.gov.au