| Disclaimer You cannot rely on this record in your tax affairs. It is not binding and provides you with no protection (including from any underpaid tax, penalty or interest). In addition, this record is not an authority for the purposes of establishing a reasonably arguable position for you to apply to your own circumstances. For more information on the status of edited versions of private advice and reasons we publish them, see PS LA 2008/4. |

Edited version of private advice

Authorisation Number: 1051726288196

Date of advice: 7 August 2020

Ruling

Subject: Company restructure and share buy-back

Question 1

Are the Existing Shareholders of Originalco eligible for Capital Gains Tax roll-over relief under Division 615 of the Income Tax Assessment Act 1997 (ITAA 1997) in relation to their disposal of shares in Originalco in exchange for shares in New Holdco during Step 2 of the Proposed Restructure?

Answer

Yes

Question 2

Is the loan between New Holdco and Originalco, as issued under Step 4 of the Proposed Restructure, a debt interest as defined in Division 974 of the ITAA 1997?

Answer

Yes

Question 3

Is the average capital per share method an acceptable methodology for ascertaining the capital/dividend split for the purposes of section 159GZZZP of the Income Tax assessment Act 1936 (ITAA 1936) for the share buy-back undertaken by Originalco at Step 6 of the Proposed Restructure?

Answer

Yes

Question 4

Is the average capital per share method an acceptable methodology for ascertaining the capital/dividend split for the purposes of section 159GZZZP of the ITAA 1936 for the share buy-back undertaken by New Holdco at Step 6 of the Proposed Restructure?

Answer

Yes

Question 5

Where the New Shareholders' Originalco shares, issued at Step 5 of the Proposed Restructure, are disposed of (exchanged) for shares in New Holdco at Step 7 of the Proposed Restructure, and a capital gain results, will the New Shareholders be eligible for roll-over relief under

Subdivision 124-M of the ITAA 1997?

Answer

Yes

This ruling applies for the following periods:

Year ending 30 June 20XX

Year ending 30 June 20XX

Year ending 30 June 20XX

Year ending 30 June 20XX

The scheme commences on:

1 July 20XX

Relevant facts and circumstances

This ruling is based on the facts stated in the description of the scheme that is set out below. If your circumstances are materially different from these facts, this ruling has no effect and you cannot rely on it. The fact sheet has more information about relying on your private ruling.

|

Term |

Definition |

|

CGT |

Capital gains tax |

|

Commissioner |

Commissioner of Taxation |

|

Originalco |

Original company |

|

Originalco Buy-back |

The buy-back of Originalco shares from New Holdco occurring at Step 6 of the Proposed Restructure |

|

Existing Shareholders |

Current shareholders of Originalco as listed |

|

GST |

Goods and services tax |

|

GSTAct |

A New Tax System (Goods and Services Tax) Act 1999 (Cth) |

|

ITAA 1936 |

Income Tax Assessment Act 1936 (Cth) |

|

ITAA1997 |

Income Tax Assessment Act 1997 (Cth) |

|

Loan |

Interest-free loan from New Holdco (lender) to Originalco (borrower) at Step 4 of the Proposed Restructure |

|

MV |

Market value as defined in the Income Tax Assessment Act 1997 |

|

New Holdco |

Newly incorporated Australian holding company |

|

New Holdco Buy-back |

The buy-back of New Holdco shares from the Retiring Shareholders occurring at Step 6 of the Proposed Restructure |

|

New Shareholders |

Originalco employees issued with new shares in Originalco under the Originalco ESP at Step 5 of the Proposed Restructure |

|

ProposedRestructure |

Proposed restructure of Originalco detailed under the Proposed Restructure heading. |

|

PSLA 2007/9 |

Practice Statement Law Administration PSLA 2007/9 |

|

Retiring Shareholders |

Existing Shareholders that intend to dispose of their interest in Originalco in coming years |

Originalco - structure

Originalco is an Australian private company incorporated after 20 September 1985.

Originalco is presently structured as a single standalone Australian company in which its Existing Shareholders hold ordinary shares. No other equity interests have been issued by Originalco.

All Existing Shareholders and future shareholders of Originalco are Australian residents for tax purposes and hold their interests on "capital" account (that is, the shares in Originalco have and will be acquired with an intention of deriving long term gains as opposed to being realised over the short term).

For the entirety of the income year(s) during which the Proposed Restructure takes place, only fully franked dividends will be paid by Originalco. Both Originalco and New Holdco will have a sufficient franking account balance at all times in order to effect the payment of fully franked dividends as part of the Proposed Restructure.

All interests held in Originalco are post-capital gains tax (CGT) assets (i.e. were acquired after 19 September 1985 and are not considered pre-CGT assets by virtue of previous asset roll-overs, for example). Similarly, Originalco does not hold any pre-CGT assets.

Originalco employee share plan allows the issue of shares to new shareholders. All shares have and will be issued at MV.

All shares rank equally with all other ordinary shares in the capital of Originalco.

Originalco will purchase Retiring Shareholders shares at MV.

Retiring Shareholders will have their shares bought back by Originalco. However, no Retiring Shareholder will have their share bought back within 46 days of payment of the dividend from Originalco to New Holdco (i.e. Step 4 of the Proposed Restructure,).

Market value

All transactions where a valuation of shares has been or is required for taxation purposes that valuation was or will be at 'market value' as defined in section 995-1 of the ITAA 1997.

ProposedRestructure

Step 1 - Incorporation of New Holdco

A new Australian resident holding company (New Holdco) is incorporated. Upon incorporation ordinary shares in New Holdco will be issued to all Exiting Shareholders in the same proportion to the ordinary shares they hold in Originalco at the time of incorporation of New Holdco.

Step 2 - Interposition of New Holdco

New Holdco acquires all issued Originalco shares from the Existing Shareholders in exchange for a whole number of newly issued ordinary shares in itself (proportionate to each Existing Shareholder's Originalco share holdings).

New Holdco will choose that section 615-65 of the ITAA 1997 applies within 2 months of the completion of the interposition outlined in Step 2.

Step 3 - Declaration of dividend to New Holdco

At least one day following Step 2, Originalco declares a fully franked dividend to New Holdco equal to the maximum allowable amount payable, having regard to Originalco's franking account balance, corporations law considerations, and commercial requirements specific to Originalco.

Step 4 - Payment of dividend and issuance of Loan

The dividend is paid to New Holdco and subsequently loaned back to Originalco as an interest-free loan (the Loan) with a term of less than 10 years, under a written loan agreement.

The Loan agreement will have terms and conditions providing Originalco with an effectively non-contingent obligation to repay the principal amount to New Holdco over the term of the loan.

Step 5 - Issuance of employee shares to New Shareholders

New ordinary shares in Originalco are issued to Originalco employees (the New Shareholders).

Step 6 - Disposal of interests by Retiring Shareholders

At the relevant valuation time just prior to each Retiring Shareholder's Termination Date, a valuation is performed to determine the MV of each Retiring Shareholder's:

a) Interest in New Holdco, excluding Originalco; and

b) Indirect interest in Originalco (based on the MV of the underlying Originalco shares).

The cash consideration payable to the Retiring Shareholders (being the above amounts) is first repatriated from Originalco to New Holdco. This will occur by New Holdco calling for part of the Loan from Originalco equal to the amount determined at part a) above, and Originalco buying back a portion of its shares from New Holdco equal to the MV of the Retiring Shareholders' underlying interest in Originalco (i.e. the amount determined at part b) above).

New Holdco then uses the cash received from Originalco to buy back the Retiring Shareholders' shares in itself at MV.

Step 7 - Acquisition of Originalco shares from New Shareholders (optional)

New Holdco may at a future point in time seek to acquire the New Shareholders' shares in Originalco, in exchange for equivalent newly issued ordinary shares in itself, to consolidate all shareholders into a singular holding structure. Where this is pursued, all New Shareholders will elect to exchange their Originalco shares for New Holdco shares (such that New Holdco becomes the owner of 100% of the voting shares in Originalco) and will choose to obtain scrip for scrip roll-over relief under Subdivision 124-M of the ITAA 1997.

The MV of the New Shareholders' New Holdco shares (being the capital proceeds for the exchange of Originalco shares) is the same as the MV of the Originalco shares exchanged. The newly issued ordinary shares in New Holdco (i.e. the replacement interest) will carry the same kinds of rights and obligations as those attached to the ordinary shares of Originalco.

At the commencement of Step 7 neither Originalco nor New Holdco had 300 or more members.

At the time New Holdco offers to exchange shares in itself to the New Shareholders for their shares in Originalco all shareholders of Originalco are able to participate in the arrangement and on the same terms.

Holding period rule and benchmark franking rule

The holding period rule (under Division 1A of former Part IIIAA of the ITAA 1936, as required under section 207-145 of the ITAA 1997) and benchmark franking rule (section 203-25 of the ITAA 1997) will not impact the following analysis and the availability of franking credits (or the ability of a recipient to utilise franking credits) throughout the Proposed Restructure.

Average capital per share methodology

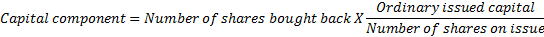

The cash consideration paid to shareholders for their shares at Step 6 of the Proposed Restructure will be allocated between return of capital and dividend using the formula and the remaining amount is a dividend:

>

>

Reasons for decision

These reasons for decision accompany the Notice of private ruling with Authorisation number: 1051726288196.

Question 1

Summary

The disposal of Originalco shares by the Existing Shareholders to New Holdco in exchange for shares in New Holdco (and nothing else), as described in section 615-5 of the ITAA 1997, happens when Existing Originalco shareholders disposed of their ordinary shares to New Holdco in exchange for a whole number of New Holdco ordinary shares during Step 2 of the restructure. As the conditions for roll-over under Division 615 of the ITAA 1997 are satisfied in relation to this disposal, Existing Shareholders are eligible to choose roll-over under Division 615. As roll-over is chosen, any capital gain or loss made when CGT event A1 happened will be disregarded (subsection 124-15(2) of the ITAA 1997).

Detailed reasoning

Application of Division 615

Division 615 of the ITAA 1997 refers to the term 'member'. Subsection 995-1(1) of the ITAA 1997 states that a 'member', in relation to an entity, has the meaning given by section 960-130 of the ITAA 1997. Item 1 in subsection 960-130(1) of the ITAA 1997 provides that where an entity is a company a member of a company or a stockholder in a company is a 'member'.

Listed below are the relevant requirements for Division 615 of the ITAA 1997 roll-over relief and their application during Step 2 of the Proposed Restructure. All legislative references in the following table are to the ITAA 1997.

|

|

Condition |

Condition satisfied |

|

|

1 |

Section 615-5: Under a scheme for reorganising its affairs, all existing members of a company dispose of all their shares in the company to an interposed company, in exchange for shares in the interposed company (and nothing else). |

Step 2 is a scheme for reorganising Originalco's affairs, under which the Existing Shareholders, being all existing members of Originalco, will dispose of all their shares in Originalco to New Holdco in exchange for shares in New Holdco (and nothing else). |

|

|

2 |

Section 615-15: The interposed company owns all the shares in the original company immediately after the time all exchanging members dispose of their shares in Originalco under the scheme (being the completion time). |

Immediately after the time the Existing Shareholders have disposed of their shares, New Holdco will own all shares in Originalco. |

|

|

3 |

Subsection 615-20(1): Immediately after the completion time each exchanging member must own: a) a whole number of shares in the interposed company, and b) a percentage of shares in the interposed company issued to the exchanging members that is equal to the percentage of shares in the original entity that were owned by the member and disposed of under the scheme. |

Each Existing Shareholder will be issued shares in New Holdco proportionate to their current holdings in Originalco, and each Existing Shareholder will be issued a whole number of shares in New Holdco. |

|

|

4 |

Subsection 615-20(2): The following ratios must equal: a) the *market value of each exchanging member ' s *shares in the interposed company; to the *market value of the shares in the interposed company issued to all the exchanging members (worked out immediately after the completion time); and (b) the market value of that member 's shares in the original entity that were disposed of, redeemed or cancelled under the *scheme; to the market value of all the shares in the original entity that were disposed of, redeemed or cancelled under the scheme (worked out immediately before the first disposal, redemption or cancellation). |

All Existing Shareholders currently hold identical ordinary shares in Originalco which have the same MV. They are issued identical ordinary shares in New Holdco, which have the same MV, in proportion to their current shareholdings in Originalco. Therefore, the ratios are equal. |

|

|

5 |

Subsection 615-20(3): The member is an Australian resident at the time your *shares or units in the original entity are disposed of, redeemed or cancelled under the *scheme; or |

The Existing Shareholders will be Australian residents at the time their shares in Originalco are disposed of. |

|

|

6 |

Subsection 615-25(1): Shares issued in the interposed company must not be redeemable shares. |

The shares issued in New Holdco will be ordinary shares and not redeemable shares. |

|

|

7 |

Subsection 615-25(2): Each exchanging member who is issued shares in the interposed company must own the shares from the time they are issued until at least the completion time. |

Each Existing Shareholder will be issued shares in New Holdco directly in exchange for their shares in Originalco. As such, the time the New Holdco shares are issued will correspond directly with the completion time. |

|

|

8 |

Paragraph 615-25(3)(b): Immediately after the completion time, entities other than the exchanging members own no more than 5 shares in the interposed company, and the MV of those shares expressed as a percentage of the MV of all the shares in the interposed company are such that it is reasonable to treat the exchanging members as owning all the shares. |

Immediately after the completion time, the only shareholders of New Holdco will be the Existing Shareholders. No more than 5 shares will be held by an entity that is not an Existing Shareholder. The MV of shares held by entities that are not Existing Shareholders is such that it would be reasonable to treat the Existing Shareholders as owning all the shares in New Holdco immediately after the completion time. |

|

|

9 |

Subsection 615-30: A choice by an interposed company that roll-over applies under section 615-65 of the ITAA 1997 must be made within 2 months of the completion time. |

New Holdco will choose that section 615-65 applies within 2 months of the completion time. |

|

As the relevant requirements under Division 615 of the ITAA 1997 are satisfied, the Existing Shareholders of Originalco are eligible for roll-over relief for their disposal of Originalco shares as a result of Step 2 of the Proposed Restructure.

Question 2

Summary

As all the requirements of the debt test are satisfied, the Loan, issued at Step 4 is a debt interest pursuant to section 974-20 of the ITAA 1997.

Detailed reasoning

Debt and equity interests

Division 974 of the ITAA 1997 provides the mechanism for determining whether an interest is a debt interest or an equity interest for tax purposes. Subsection 974-5(1) of the ITAA 1997 provides that the test for distinguishing between debt interest and equity interests focuses on economic substance rather than mere legal form. Under subsection 974-5(4) of the ITAA 1997, where an interest satisfies the tests for both debt and equity interest, the debt test prevails. Accordingly, there is no need to consider the equity test where the debt test has been satisfied.

Debt interests

Application of section 974-20 of the ITAA 1997

The basic test for determining if an interest is a debt interest is set out in section 974-20 of the ITAA 1997. All legislative references in the following table are to the ITAA 1997.

|

|

Condition |

Condition satisfied |

|

1 |

Paragraph 974-20(1)(a): There is a scheme, and the scheme is a financing arrangement for the entity. |

The issuance of the Loan is a scheme (noting the broad definition of "scheme" within section 995-1; see Note 1) occurring to provide finance to Originalco equal to the quantum of the Loan, and as such comprises a financing arrangement for Originalco (as defined in section 974-130). |

|

2 |

Paragraph 974-20(1)(b): The issuing entity receives or will receive a financial benefit under the scheme. |

Originalco will receive the financial benefit of the principal amount of the Loan (i.e. cash) which has economic value and therefore satisfies the definition of "financial benefit" within section 974-160 (See Note 2). |

|

3 |

Paragraph 974-20(1)(c): The entity has an effectively non-contingent obligation under the scheme to provide a financial benefit to one or more entities after the time when the financial benefit is received. |

The written agreement for the Loan will have terms and conditions providing Originalco with an effectively non-contingent obligation (as defined within section 974-135) to repay the principal amount (being, a financial benefit) to New Holdco. (See Note 3) |

|

4 |

Paragraph 974-20(1)(d): It is substantially more likely than not that the value provided will be at least equal to the value received. |

As the Loan will have a term of less than 10 years with the entire principal required to be repaid during this period, the value provided should be valued on nominal terms (per section 974-35) and should equal the value received. (See Note 2) |

|

5 |

Paragraph 974-20(1)(e): The value provided and the value received are not both nil. |

The value provided and received under the financial arrangement will be the quantum (principal) of the Loan, which will not be nil. |

Note 1:

A scheme is defined in section 995-1 of the ITAA 1997. Scheme means any arrangement, or any scheme, plan, proposal, action, course of action or course of conduct, whether unilateral or otherwise.

Note 2:

Paragraph 974-160(1)(a) of the ITAA 1997 relevantly provides that a financial benefit includes 'anything of economic value'.

Subsection 974-20(4) of the ITAA 1997 provides that a financial benefit provided under the scheme is taken into account only if it is one that the other entity has an effectively non-contingent obligation to provide.

Paragraph 974-35(1)(a)(i) of the ITAA 1997 provides that the value of a financial benefit received or provided under a scheme is its value calculated in nominal value terms under section 974-50 of the ITAA 1997 if the 'performance period' of the scheme must end no later than 10 years after the interest arising from the scheme is issued.

Subsection 974-35(3) of the ITAA 1997 defines a performance period as the period within which, under the terms on which the interest is issued, the non-contingent obligations of the issuer to provide a financial benefit in relation to the interest have to be met.

Note 3

Subsection 974-135(1) of the ITAA 1997 provides that there is a non-contingent obligation to take an action under a scheme if, having regard to the pricing, terms and conditions of the scheme, there is in substance or effect a non-contingent obligation to take that action. Subsection 974-135(3) of the ITAA 1997 provides that an obligation is non-contingent if it is not contingent on any event, condition or situation (including the economic performance of the entity having the obligation or a connected entity of that entity) other than the ability or willingness of that entity or connected entity to meet the obligation. Paragraph 2.30 of the Explanatory Memorandum to the New Business Tax System (Debt and Equity) Bill 2001 ('Explanatory Memorandum') provides that if a right that a creditor has to a return may be said to be contingent on the debtor company being able to meet its debts when they fall due, that by itself will not be taken as meaning that the right is contingent on the economic performance of the company.

Conclusion

Therefore, the requirements of the debt test contained in subsection 974-20(1) of the ITAA 1997 are satisfied in respect of the Loan, such that the Loan is a debt interest for the purposes of Division 974 of the ITAA 1997.

Questions 3 and 4

Summary

The average capital per share method is an acceptable methodology for ascertaining the capital/dividend split for the purposes of section 159GZZZP of the ITAA 1936 for the share buy-back undertaken by Originalco and New Holdco at Step 6 of the Proposed Restructure

Detailed reasoning

This reasoning applies equally to question 3 and question 4.

Division 16K of the ITAA 1936

Division 16K of Part III of the ITAA 1936 applies to buy-backs of shares.

Broadly, Division 16K of the ITAA 1936 outlines the income tax consequences of share buy-backs. This division applies where a company buys a share in itself from its shareholders.

Section 159GZZK of the ITAA 1936 provides that share buy-backs take the form of an on-market purchase or an off-market purchase. In accordance with paragraph 159GZZZK(d) of the ITAA 1936 the share buy-back will be an off-market purchase where it is not an on-market purchase. Paragraph 159GZZZK(c) of the ITAA 1936 provides that an on-market purchase will arise if:

(i) the share is listed for quotation in the official list of a stock exchange in Australia or elsewhere; and

(ii) the buy-back is made in the ordinary course of trading on that stock exchange.

As the Originalco and New Holdco shares are not listed for quotation on the official list of a stock exchange in Australia or elsewhere, the buy-backs at Step 6 of the Proposed Restructure cannot be made in the ordinary course of trading on that stock exchange. Therefore, in accordance with paragraph 159GZZZK(d) of the ITAA 1936, the buy-back arrangements entered into between New HoldCo and the Retiring Shareholders and Originalco and New Holdco are off-market buy-backs in accordance with section 159GZZZK of the ITAA 1936.

Under section 159GZZZM of the ITAA 1936, the purchase price in respect of shares the company acquires through the buy-back is the amount of money the participating shareholder received or are entitled to receive as a result of or in respect of the buy- back.

Under section 159GZZZP of the ITAA 1936, the purchase price will contain a dividend component if the buy-back price exceeds the amount debited against the company's share capital account.

Under subsection 159GZZZQ(1) of the ITAA 1936, the amount of consideration deemed to be received by the seller under an off-market buy-back will be an amount equal to the purchase price in respect of the buy-back.

Originalco and New Holdco will debit their share capital account. The amount will be determined by using the Average Capital Per Share method, in accordance with Practice Statement PSLA 2007/9 Share buy-backs. The average capital per share methodology is an appropriate method to determine the capital component for the Originalco Buy-back and the New Holdco Buy-back, with no exceptional circumstances on the facts which would necessitate an alternative methodology to be applied.

While all valuations for the purposes of this scheme are at market value as defined in 995-1 of the ITAA 1997, if the stated buy-back price is less than market value, the consideration received will be deemed to be market value (subsection 159GZZZQ(2) of the ITAA 1936).

From the perspective of the shareholder having shares bought back, a taxable capital gain (or loss) should be made to the extent the capital component exceeds (or falls below) its CGT cost base of shares.

Conclusion

The average capital per share method is an acceptable methodology for ascertaining the capital/dividend split for the purposes of section 159GZZZP of the ITAA 1936 for the share buy-backs undertaken by Originalco and New Holdco under Step 6 of the Proposed Restructure.

Question 5

Where the New Shareholders' Originalco shares, issued at Step 5 of the Proposed Restructure, are disposed of (exchanged) for shares in New Holdco at Step 7 of the Proposed Restructure, and a capital gain is made, will the New Shareholders be eligible for roll-over relief under Subdivision 124-M of the ITAA 1997?

Summary

The New Shareholders are eligible to choose a roll-over under section 124-780 of the ITAA 1997 in respect of the disposal of their shares in Originalco to New Holdco where they would have made a capital gain from the exchange.

Detailed reasoning

Division 124 of the ITAA 1997 provides for replacement asset roll-overs, allowing in certain cases, for a taxpayer to defer the making of a capital gain or loss from one CGT event until a later CGT event happens. Subdivision 124-M scrip for scrip roll-over allows a taxpayer to choose a roll-over where post-CGT shares are replaced with other shares. Pursuant to section 124-780 of the ITAA 1997, there is a roll-over if an entity exchanges a share in a company for a share in another company and the conditions outlined in section 124-780 of the ITAA 1997 are satisfied.

The transfer of Originalco shares by the New Shareholders to New Holdco will trigger CGT event A1 (per section 104-10 of ITAA 1997), resulting in a capital gain or loss broadly equal to the difference between the capital proceeds received (i.e. the MV of the New Holdco shares issued to each New Shareholder), less each New Shareholder's tax cost base in their Originalco shares.

The relevant requirements for the application of Subdivision 124-M of ITAA 1997 roll-over relief for the purposes of Step 7 of the Proposed Restructure are set out in the table below. All legislative references in the following table are to the ITAA 1997.

|

|

Condition |

Condition satisfied |

||

|

1 |

Subparagraph 124-780(1)(a)(i): The 'original interest holder' exchanges a share in a company for a replacement share in another company. |

Under Step 7, each New Shareholder (being an 'original interest holder') will exchange their shares in Originalco for replacement shares in New Holdco. |

||

|

2 |

Paragraph 124-780(1)(b) and Subparagraph 124-780(2)(a)(i): The exchange is a consequence of a single arrangement that results in the acquiring company that is not a member of a wholly owned group becoming the owner of 80% or more of the voting shares in the original company. |

The exchange of Originalco shares for New Holdco shares is a 'single arrangement' for the purposes of Subdivision 124-M, and results in New Holdco increasing its ownership of voting shares in Originalco to 100%. |

||

|

3 |

Paragraphs 124-780(2)(b) and 124- 780(2)(c): The arrangement must allow all the owners of voting shares in the original company to participate in the scrip for scrip arrangement and participation must be available on substantially the same terms for all the owners of interests of a particular type. |

All New Shareholders are offered the ability to participate in the scrip for scrip arrangement on the same terms. |

||

|

4 |

Paragraph 124-780(1)(c) and paragraph 124-780(3)(a): The original interest holder acquired its original interest on or after 20 September 1985. |

The New Shareholders will have acquired their interest in Originalco as part of the Proposed Restructure, which will take place after 20 September 1985. |

||

|

5 |

Paragraph 124-780(1)(c) and paragraph 124-780(3)(b): Apart from the roll-over, a capital gain would be made from a CGT event happening in relation to the original interest. |

CGT event A1 will occur on the transfer of the Originalco shares to New Holdco and to the extent that a capital gain occurs for the New Shareholders this will be satisfied. |

||

|

6 |

Paragraph 124-780(1)(c) and paragraph 124-780(3)(c): The replacement interest must be a share in the acquiring entity, if the acquiring entity is not a member of a wholly owned group. |

The "replacement interest" will comprise of shares in New Holdco, being the acquiring entity of Originalco (noting New Holdco is not a member of a wholly owned group). |

||

|

7 |

Paragraph 124-780(1)(c) and paragraph 124-780(3)(d): The original interest holder chooses to obtain the roll-over. |

Each New Shareholder will choose to obtain roll-over relief. |

||

|

8 |

Paragraph 124-780(1)(c) and paragraph 124-780(3)(f): If New Holdco is a member of a wholly- owned group, no member of the group issues equity (other than a replacement interest), or owes new debt under the arrangement to an entity that is not a member of the group and in relation to the issuing of the replacement interest. |

This requirement is not applicable, on the basis that New Holdco is not a member of a wholly-owned group. |

||

|

9 |

Paragraph 124-780(1)(d) and Subsections 124-780(4) and 124-780(5): Where an original interest holder and an acquiring entity did not deal with each other at 'arm's length' (See Note 4) and neither the original entity nor the replacement entity had at least 300 members just before the arrangement started: a) The MV of the original interest holder's capital proceeds for the exchange must be at least substantially the same as the MV of its original interest; and b) The replacement interest must carry the same kinds of rights and obligations as those attached to the original interest. |

The MV of the New Shareholders' New Holdco shares (being the capital proceeds for the exchange of Originalco shares) is the same as the MV of the Originalco shares exchanged, to ensure that each shareholder's underlying interest in Originalco does not change as a result of this step. Additionally, the newly issued ordinary shares in New Holdco (i.e. the replacement interest) will carry the same kinds of rights and obligations as those attached to the ordinary shares of Originalco. |

||

|

10 |

Section 124-790: Only a partial roll-over for an original interest holder can be obtained if its capital proceeds for its original interest include something, being the ineligible proceeds, other than its replacement interest. |

The New Shareholders will only receive shares in New Holdco in exchange for their shares in Originalco and will not receive any ineligible proceeds. |

||

|

11 |

Section 124-795: Relevantly, roll-over does not apply if the following exceptions apply: a) If the taxpayer is a foreign resident before the taxpayer stops owning the original interest unless, just after acquiring the replacement interest, it is 'taxable Australian property'; b) If any capital gain that could be made from the replacement interest would be disregarded (except because of a roll-over); c) If the taxpayer and the acquiring entity are members of the same "wholly- owned group" just before the exchange and the acquiring entity is a foreign resident; or d) If the taxpayer could choose roll-over under Division 122 or 615 of the ITAA 1997 in relation the exchange of the original interest. |

a) The New Shareholders are Australian residents for tax purposes; b) There is no other circumstances where the capital gain that could be made from the replacement interest by the New Shareholders would be disregarded, except because of a roll-over; c) The New Shareholders and New Holdco are not members of the same wholly owned group; and d) The New Shareholders should not be eligible for roll-over under Division 122 or 615, noting that New Holdco is not a wholly owned company, and the New Shareholders will not own all the shares in New Holdco immediately after this step. |

||

Note 4: Section 995-1 of the ITAA 1997 defines 'arm's length' as: in determining whether parties deal at arm's length, consider any connection between them and any other relevant circumstance.

Conclusion

As the requirements within subsection 124-780(1) of the ITAA 1997 are satisfied, the New Shareholders are eligible for roll-over relief under Subdivision 124-M of the ITAA 1997.