| Disclaimer You cannot rely on this record in your tax affairs. It is not binding and provides you with no protection (including from any underpaid tax, penalty or interest). In addition, this record is not an authority for the purposes of establishing a reasonably arguable position for you to apply to your own circumstances. For more information on the status of edited versions of private advice and reasons we publish them, see PS LA 2008/4. |

Edited version of private advice

Authorisation Number: 1052184700514

Date of advice: 26 October 2023

Ruling

Subject: Refund of excess GST

Question

Question 1

Did you, the Trustee for XXX, make a taxable supply pursuant to section 9-5 of the A New Tax System (Goods and Services Tax) Act 1999 (GST Act) when you sold the property located at XXX (the Property)?

Answer

No

Question 2

If the answer to question 1 is 'no', will Division 142 of the GST Act apply to prevent the refund of excess GST on the supply of the Property made by you in the amount of $X?

Answer

Yes

This ruling applies for the following period:

DD MM YYYY to DD MM YYYY

The scheme commenced on:

DD MM YYYY

Relevant facts and circumstances

You, XXX as the Trustee for XXX (ABN: XXX) conduct a commercial property investment enterprise - acquisition and leasing of commercial property.

Aside from the income derived by way of commercial rent, you also conduct financial trading activities and investment into listed shares and funds.

You registered for GST with respect to your commercial property investment activities from:

• DD MM YYYY to DD MM YYYY; and

• DD MM YYYY to current date.

You registered for GST from DD MM YYYY to DD MM YYYY in relation to the purchase and lease of a commercial property - a factory located at XXX. You subsequently disposed of this commercial property in YYYY as a result of a restructure of family assets. This property was disposed with a lease in place as a going concern. As you were no longer required to be registered for GST at that time you cancelled your registration.

You re-registered for GST from DD MM YYYY in anticipation of the receipt of commercial rental income from the commercial property you purchased on DD MM YYYY (settlement date). The commercial property - retail/office space, is located at XXX.

You report GST on a cash and quarterly basis

On DD MM YYYY you entered into a contract for the purchase of a residential property located at XXX (the Property) for $X. The Property is formally known as Lot XXX on Plan of Subdivision XXX contained in Certificate of Title Volume XXX Folio XXX. When purchased, the Property consisted of approximately Xm2 in land size, was zoned General Residential Zone - Schedule 3 (GRZ3) and contained an existing six-bedroom, two-bathroom two-storey house with a kitchen, dining, parlour, lounge area, study/library and a garage. The house itself was built in or around YYYY, comprised of approx. Xm2 and was in poor condition although it was advertised in the sales brochure as liveable.

You provided a copy of the floor plan of the Property at the time you purchased it in YYYY.

The Property is subject to a number of overlays and specific area provisions.

Additionally, all or part of the Property is in an area of Aboriginal cultural heritage sensitivity.

Given the above the Property is in a precinct of historical significance and its development, and/or restoration must be consistent with its surroundings. The dwelling itself cannot be entirely demolished and replaced by a new house.

Use of the Property during period of ownership

This Property was the first and only residential property purchased by you to date. The Property was purchased with the intention of one day being renovated and used as the principal place of residence of one of your primary beneficiaries - XXX (the Beneficiary). In support of this contention, you supplied a copy of the signed form (dated DD MM YYYY) submitted to the State Revenue Office of XXX nominating XXX as the nominated beneficiary of the discretionary trust over the Property for the purposes of the Land Tax Act 2005. Additionally, you supplied a copy of correspondence between XXX of XXX and XXX (the Beneficiary's father), dated DD MM YYYY which initially read "Purchase by XXX of XXX" but subsequently the Beneficiary's name was crossed out and replaced with the name of the Trust. Due to the significant lapse of time since you acquired the Property you have not been able to find any additional documentation that records the purpose behind the acquisition of the Property. At no point in time have you sought to purchase residential premises for the purpose of development and resale. You are not in the business of property development.

When you purchased the Property in YYYY, the dwelling ceased to be used as a residence. During the period of ownership, the Property primarily remained vacant with the exception of a short period of time (two to three months) approximately in YYYY where it was occupied intermittently by a family friend whilst they sought permanent accommodation on a return from overseas. Accommodation was provided entirely rent free. The occupant covered the cost of utilities during their stay. Neither you nor the Beneficiary received any benefit in exchange for the accommodation.

The Property was kept neat and secure with a regular gardener attending the Property during the entire period of ownership.

The Property did not generate any form of ongoing income during the period of ownership.

Renovations

While you intended to renovate the Property within a reasonable timeframe after acquisition, due to the illness of both of the Beneficiary's parents, your financial resources were directed towards their care as a priority. Following this you did not have sufficient funds available to renovate the Property until future years.

In YYYY, you decided to renovate the Property. You engaged an architect and a builder to assist with designing, renovating and developing the Property. You formally entered into a contract with builder XXX to complete the alterations/renovations valued at $X (inclusive of GST) on DD MM YYYY.

Work was to be carried out in stages. Stage 1 included the following:

• Demolition of the kitchen, maid room, laundry, bathroom and garage

• Removal of fireplaces, chimney supports and other ad hoc fittings

• Removal and storage of the front verandah/terrace.

Building Permit XXX issued on DD MM YYYY provided authorisation for the demolition of part of the existing dwelling (Stage 1).

In MM YYYY the builder issued a pro-forma progress claim for works carried out up until DD MM YYYY valued at $X.

No further work was conducted after DD MM YYYY as the local Council did not approve and endorse the building permit for Stage 2 of the works which included the main renovation and build of the Property. Whilst you appealed the Council's decision to the Building Appeals Board you were unsuccessful. The determination of the Building Appeal Board dated DD MM YYYY affirms the Councils decision to refuse consent to the construction of additions/alterations to the existing dwelling and the construction of the pergola on the basis that the extension to the street side of the Property did not have sufficient setback between the boundary of the Property and its existing dwelling to meet specified building regulations.

This therefore meant that the original plans and drawings issued by the architect were no longer feasible. Given the position of the dwelling on the Property (facing the XXX) and its historic façade, the Property does not lend itself to any substantial extension towards the river side and with restriction on setback and an angled street frontage, renovation and development was limited in scope. This did not meet your requirements to build a substantial family home. Given a significant amount of money and time had already been spent on the initial renovation design and building contract, the costs to start the process again were prohibitive, consequently you decided to sell the Property instead, albeit years later.

Accounting for the Property

You did not claim any input tax credits associated with the costs of acquiring, holding, maintaining or renovating the Property. For income tax purposes, any annual and ongoing costs attributable to the Property were capitalised as the third element cost of owning a CGT asset. The total cost of owning the Property as recorded in the trusts 'Transaction Detail by Account - All transactions' extract you provided is $X, however we note that the first transaction listed is only dated back to DD MM YYYY. There were no interest expenses as you did not obtain finance to purchase the Property. Any costs associated with the renovation of the Property were accounted for separately in the balance sheet and were not deducted. The Property was treated as a fixed/capital asset of the trust and did not generate any form of ongoing income.

You recorded the disposal of the Property in the Profit and Loss Statement for the period DD MM YYYY through to DD MM YYYY. The recorded total gain on disposal of assets (which includes the disposal of the Property) is listed as $X.

Sale of the Property

You owned the Property for approximately X years before deciding to sell it in YYYY. The decision to sell the Property was only made after Stage 2 Permit was refused by the local council. Had Stage 2 Permit been granted the Property would not have been sold and would currently be used as the primary place of residence of the Beneficiary.

You engaged the services of a real estate agent XXX of XXX to market and sell the property in MM YYYY. You signed the exclusive sale authority on DD MM YYYY.

The Property was offered for sale under an expression of interest campaign which is a sale process whereby prospective buyers are invited to submit their highest and best offer in writing to purchase a particular property on /or before the nominated closing date. The offer submitted must be on a contract of sale and will include the terms of their offer. The vendor will then choose which offer to accept or can even opt not to sell if they haven't received the price they expected. A statement of information will be given to prospective buyers, which will give them a guide as to how much the house is worth. They will also be guided by the selling agent.

Setting of purchase price

On DD MM YYYY the real estate agent provided you with a purchase price guide of $X to $X. This price guide was based on similar prices for which existing mansion-style houses were selling in similar locations although the real estate agent noted that there were limited comparable properties in the area, due to the size, river frontage and age of the Property. In setting the purchase price, the prices for which new houses and apartments were selling were not considered.

The Property was advertised on the market on an expression of interest campaign on DD MM YYYY in its 'unrenovated condition".

Description of the Property at the time of sale/settlement

At the time the Property was marketed for sale, the condition of the dwelling had deteriorated further, the dwelling was dilapidated. The Property was neither occupied as a residence nor was it capable of being occupied as a residence without significant repairs and remediation.

As part of the renovations you commenced in YYYY, the kitchen, laundry and bathroom located on the ground level was demolished altogether and the bathroom on the first level was stripped leaving only taps and plumbing in place. As no additional works were completed prior to settlement, the bathroom located on the first level was consequently not considered to be functioning at the time of the Property settlement. Additionally, the dwelling had no electricity, gas or internet.

The Property was however secure and watertight, connected to running water and the sewage systems.

Despite its state, the Property had not been condemned by a government authority.

You provided copy of the floor plan illustrating the layout of the Property and photographs of the condition and structure of the Property at the time it was advertised for sale.

The Property generated considerable interest and you received an offer pursuant to an expression of interest which was well above the purchase price guide.

Despite its condition, both you and the purchaser were confident that the dwelling could be repaired and remediated.

Contract of Sale

On DD MM YYYY you entered into a contract for the sale of XXX formally with purchaser XXX and/or nominee (the Purchaser) for $X (purchase price) (the Contract of Sale).

The Purchaser did not subsequently nominate an entity to accept the title of the Property.

The contract settled on DD MM YYYY.

Under the Contract of Sale, you as Vendor, agreed to sell the Property and the Purchaser agreed to buy the Property for $X inclusive of GST (if any).

GST under the Contract of Sale was to be calculated using the margin scheme pursuant to table item 2 of paragraph 75-10(3)(b) of the GST Act.

The conditions pertaining to GST treatment of the sale as contained in the Contract of Sale have been extracted and included below.

The general conditions of the Contract of Sale include:

13. GST

13.1. The purchaser does not have to pay the vendor any GST payable by the vendor in respect of a taxable supply made under this contract in addition to the price unless the particulars of sale specify the price is 'plus GST'...

13.2. The purchaser must pay to the vendor any GST payable by the vendor in respect of a taxable supply made under this contract in addition to the price if the particulars of sale specify that the price is 'plus GST'.

13.3. If the purchaser is liable to pay GST, the purchaser is not required to make payments until provided with a tax invoice, unless the margin scheme applies...

...

13.6. If the particulars of sale specify that the supply made under this contract is a 'margin scheme' supply, the parties agree that the margin scheme applies to this contract....

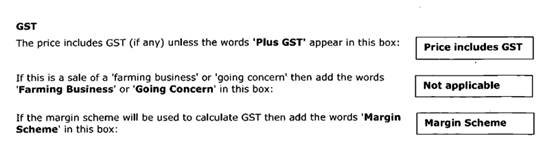

The particulars of the Contract of Sale include:

>

>

The Special Condition of the Contract of Sale also include:

2. Amendment to General Conditions

....

2.3.18 General Condition 13.3 is amended to read as follows:

'13.3 If the vendor makes a taxable supply under this contract (that is not margin scheme supply) and:

a) the price includes GST;

b) the purchaser is obliged to pay an amount for GST in addition to the price (because the price is "plus GST" or under general condition13.1 (a), (b) or (c)),

the purchaser is not obliged to pay the GST included in the price, or the additional amount payable for GST, until a tax invoice has been provided.'

....

11. GST Withholding

11.1. The Purchaser must notify the Vendor in writing the name of the recipient of the supply for the purpose of section 14-255 of Schedule 1 of the Tax Act at least 21 days before the Settlement Date unless the recipient is the Purchaser named in the contract.

11.2. The Vendor must provide the Purchaser and any person nominated by the Purchaser under the Contract a GST withholding notice in accordance with section 14-255 of Schedule 1 to the Tax Act (Vendor Notice), no later than 5 Business Days before the Settlement Date.

11.3. Subject to Special condition 11.2, the Purchaser must lodge a notice that it is required to give under section 16-150(2) of Schedule 1 of the Tax Act with Commissioner and provide the Vendor with a copy of the notice as lodged (Purchaser Notice) including the payment refence number and lodgement reference number at least 2 Business Days before Settlement Date. The Vendor is not required to effect settlement until the Purchaser has provided the Vendor with a copy of the Purchaser Notice. If the Purchaser fails to give a copy of the Purchaser Notice in accordance with this special condition, the Purchaser is deemed to be in default in payment of the Balance from the date settlement is due under this Contract to the date settlement tales place if, pursuant to this special condition 11.3, the Vendor effects settlement after the date settlement is due under this Contract.

11.4. If the Vendor Notice specifies an amount that the Purchaser is required to pay to the Commissioner under section 14-250 of Schedule 1 of the Tax Act (GST withholding amount):

11.4.1. The Purchaser must provide a bank cheque to the Vendor at Settlement that is payable to the Commissioner for the GST withholding Amount;

11.4.2. The Purchaser authorises the Vendor to submit the bank cheque to the Commissioner; and

11.4.3. The Vendor will submit the bank cheque to the Commissioner.

11.5. The Purchaser's obligation in special condition 11.4 will be discharged if the Purchaser pays the GST Withholding amount to the Commissioner via ELN as part of Settlement electronically in the ELN allows payment of GST to the Commissioner.

11.6. If the Purchaser is registered (within the meaning of the GST Act) and acquires the Property for a creditable purpose, the Purchaser must give written notice to the Vendor stating this as soon as practicable, nut in any event, no later than 10 Business Days before Settlement Date and the parties agree that, if the Property is 'potential residential land' (withing the meaning of the GST Act), special condition 11.3 to 11.7 will not apply.

11.7. This special condition 11 does not merge on settlement.

....

18. GST

.....

18.2. The Purchaser acknowledges and understands that:

18.2.1. The Price is inclusive of any GST payable in respect of any Taxable Supply made by the Vendor under this Contract for which the Consideration if the Price; and

18.2.2. Any other payments specified in the Contract to be paid, unless specified otherwise are exclusive of GST

18.3. The Vendor and Purchase agree that the Vendor will be adopting the Margin Scheme to calculate the GST in respect of the Taxable Supply for which the Consideration is the Price. Except if the Vendor give the Purchaser notice prior to settlement that Margin Scheme will not apply.

18.4. If any payment or part payment (other than the Price) is made to a party for or in connection with a Taxable Supply, that part is also entitled to recover from the party making the payment, the GST Amount payable in relation to the taxable supply,

18.5. The GST Amount payable pursuant to special condition 18.4 must be paid when the relevant payment is due

18.6. A parties right to recover GST does not merge at settlement.

GST treatment of the sale of the Property

You supplied a letter from your real estate agent XXX of XXX dated DD MM YYYY stating the following, amongst other things:

The Purchaser was content to pay $X for the Property when he submitted his offer to purchase the Property under the expression of interest campaign. At the time the offer was submitted, there was no mention of GST.

In the event that GST was payable by the Vendor in respect of the sale of the Property, it was confirmed to the Purchaser that the Vendor would not charge the GST amount as an additional cost to the Purchaser. In particular, the purchase price under the contract of sale for the Property was stipulated as "inclusive of GST (if any)" to make it clear to the Purchaser that the Vendor would bare the liability for GST (to the extent that it was applicable).

GST advice sought

In or around the time the Contract of Sale was drawn up on DD MM YYYY, you and XXX (your legal practitioner or conveyancer) discussed the GST treatment of the sale of the Property. At the time there was some reservation regarding the GST treatment of the sale of the Property. There was uncertainty about the proper GST treatment of the supply of the Property for several reasons including the following;

• you were registered for GST at the time of the supply,

• you considered the supply of the Property, was a supply of residential premises (or at the very least it was your intention that the Property was to be residential premises after it was renovated). The heritage overlays that apply to the Property prevented it from being anything other than residential premises.

• you considered the Property to be a private asset completely separate to the enterprise you carried on - leasing commercial premises

• the incorrect GST treatment of the supply could result in a liability to penalties and interest payable to the ATO

In your correspondence to the ATO dated DD MM YYYY, you stated that at the time you believed your options in relation to the GST treatment of the supply of the Property were as follows:

The options to the Taxpayer were that it could proceed to treat the supply as not subject to GST and risk GST, penalties and interest if the ATO disagreed. Alternatively, it could apply GST to the sale entirely and pass on the applicable GST to the purchaser or assume the GST liability itself. It could also apply the margin scheme to the sale to reduce the GST liability. Adopting one of the alternatives would eliminate the Taxpayer's exposure to the payment of GST, penalties and interest.

You maintain that at all times, that it was clear to you and the agent acting for the sale that any GST liability arising on the sale of the Property could not be borne by or passed on to the purchaser, as otherwise it may jeopardise the sale. Additionally, you did not want to pass on any GST to the Purchaser as an added cost given the Purchaser offered to purchase the Property for $X which is well above what the Property was advertised for sale at the time. The offer did not mention GST.

Given the short settlement period under the Contract of Sale (scheduled for DD MM YYYY), XXX suggested that the purchase price under the Contract of Sale stipulated the price as "inclusive of GST (if any)" and to apply the margin scheme to calculate the GST payable on the sale of the Property (if any) so as to not pass on any added GST cost to the Purchaser. The wording "Price includes GST" and "Margin Scheme" were inserted into the relevant parts of the Contract of Sale on or about DD MM YYYY.

Ultimately you treated the supply of the Property as a taxable supply to minimise your risk of penalties in case it was later determined by the ATO the sale of the Property was a taxable supply.

At time of Contract of Sale negotiations, no discussions were undertaken between you/your representatives and the Purchaser in relation to the GST treatment of the sale of the Property. At the time this was not considered necessary as the Purchaser was content to pay $X and given the contract of sale for the Property stipulated that the purchase price was "inclusive of GST (if any), the Purchaser was put on notice that the purchase price would have been the same if the supply of the Property was treated as an input taxed supply or taxable supply.

After the fact, XXX suggested that a private ruling be obtained to confirm if the supply should have been treated as an input taxed supply of residential premises. A private ruling application was lodged by XXX on your behalf on DD MM YYYY.

GST withheld and BAS reporting

On DD MM YYYY, you provided the Purchaser with a GST withholding notice in accordance with section 14-255 of Schedule 1 to the Taxation Administration Act 1953 (TAA 1953). The withholding notice identified, amongst other things, that the total GST amount that should be withheld by the Purchaser from the purchase price as $X (X% of $X).

Pursuant to special condition of the Contract of Sale, the Purchaser paid the GST withholding amount of $X to the Commissioner on DD MM YYYY on your behalf via PEXA.

You reported the sale of the Property as a taxable supply in your business activity statement (BAS) for the period DD MM YYYY to DD MM YYYY and calculated the GST payable on the sale in accordance with table item 2 of subsection 75-10(3) of the GST Act. You lodged this BAS on DD MM YYYY.

As the Property was valued at $X as at DD MM YYYY (being when you were first registered for GST), the sale of the Property was recorded as $X at label G1 (total sales including GST) on your BAS, being the 'margin' of the sale (ie. $X - $X).

Whilst the Purchaser withheld and remitted X% of the purchase price, the GST amount reported and payable by you, the Vendor, in respect of the Property was $X (being the GST on the margin).

You have not reimbursed any amounts pertaining to GST to the Purchaser.

Relevant legislative provisions

A New Tax System (Goods and Services Tax) Act 1999 section 9-5

A New Tax System (Goods and Services Tax) Act 1999 section 9-20

A New Tax System (Goods and Services Tax) Act 1999 section 9-40

A New Tax System (Goods and Services Tax) Act 1999 section 40-65

A New Tax System (Goods and Services Tax) Act 1999 section 195-1

A New Tax System (Goods and Services Tax) Act 1999 section 142-10

A New Tax System (Goods and Services Tax) Act 1999 section 142-15

Taxation Administration Act 1953 Division 3

Taxation Administration Act 1953 Division 3A

Reasons for decision

In this ruling,

• unless otherwise stated, all legislative references are to the A New Tax System (Goods and Services Tax) Act 1999 (GST Act)

• all legislative terms of the GST Act marked with an asterisk are defined in section 195-1 of the GST Act.

• all reference materials, published by the Australian Taxation Office (ATO), that are referred to are available on the ATO website ato.gov.au

Question 1

Did you, the Trustee for XXX, make a taxable supply pursuant to section 9-5 of the A New Tax System (Goods and Services Tax) Act 1999 (GST Act) when you sold the property located at XXX (the Property)?

Section 9-40 provides GST is payable on taxable supplies. Section 9-5 provides that you make a taxable supply if:

(a) you make the supply for consideration

(b) the supply is made in the course or furtherance of an enterprise that you carry on

(c) the supply is connected with the indirect tax zone (Australia)

(d) you are registered or required to be registered.

However, the supply is not a taxable supply to the extent that it is GST-free or input taxed.

Division 38 and 40 provide for certain supplies to be GST-free and input taxed respectively.

We consider that Division 38 has no application to your supply of the Property. Accordingly, your supply of the Property was not GST-free.

As the Property contains an existing Dwelling, it is relevant to consider whether the sale of the Property can be considered to be a supply of residential premises, and therefore input taxed under Division 40.

Subsection 40-65(1) provides that a sale of real property is input taxed, but only to the extent that the property is residential premises to be used predominantly for residential accommodation (regardless of the term of occupation).

However, subsection 40-65(2) provides that the sale will not be input taxed to the extent the residential premises are commercial residential premises or new residential premises.

In this case the Property does not meet the definitions of new residential premises or commercial residential premises under the GST Act.

Section 195-1 defines 'residential premises' to mean land or a building that:

(a) is occupied as a residence or for residential accommodation; or

(b) is intended to be occupied, and is capable of being occupied, as a residence or for residential accommodation.

The ATO's position on what constitutes residential premises to be used predominantly for residential accommodation under section 40-65 is set out in the public ruling Goods and Services Tax Ruling GSTR 2012/5 Goods and services tax: residential premises(GSTR 2012/5).

Paragraphs 6 and 7 of GSTR 2012/5provide that:

6. Premises, comprising land or a building, are residential premises under paragraph (a) of the definition of residential premises in section 195-1 where the premises are occupied as a residence or for residential accommodation, regardless of the term of occupation. The actual use of the premises as a residence or for residential accommodation is relevant to satisfying this limb of the definition.

7. Premises, comprising land or a building, are also residential premises under paragraph (b) of the definition of residential premises if the premises are intended to be occupied, and are capable of being occupied, as a residence or for residential accommodation, regardless of the term of the intended occupation. This limb of the definition refers to premises that are designed, built or modified so as to be suitable to be occupied, and capable of being occupied, as a residence or for residential accommodation. This is demonstrated through the physical characteristics of the premises.

To satisfy the requirements of section 40-65, not only must the Property meet the definition of 'residential premises', but it also needs to be residential premises that is predominantly used for or capable of being used for residential accommodation (regardless of the term of occupation). This limb of section 40-65 is a single test that looks to the physical characteristics of the property to determine the premises' suitability and capability for residential accommodation.

Paragraphs 10 and 11 of GSTR 2012/5 look at this aspect of section 40-65 in more detail:

10. The requirement for residential premises to be used predominantly for residential accommodation does not require an examination of the subjective intention of, or use by, any particular person. Premises that display physical characteristics evidencing their suitability and capability to provide residential accommodation are residential premises even if they are used for a purpose other than to provide residential accommodation (for example, where the premises are used as a business office).

11. Premises that do not display physical characteristics demonstrating that they are suitable for, and capable of, being occupied as a residence or for residential accommodation are not residential premises to be used predominantly for residential accommodation, even if the premises are actually occupied as a residence or for residential accommodation. For example, someone might occupy premises that lack the physical characteristics of premises suitable for, or capable of, residential accommodation (such as a squatter residing in a disused factory). Although the premises may satisfy paragraph (a) of the definition of residential premises in section 195-1, the premises are not residential premises to be used predominantly for residential accommodation.

A premise must provide, at the very least, shelter and basic living facilities to satisfy the definition of 'residential premises'. This is discussed in detail in paragraph 15 of GSTR 2012/5:

15. To satisfy the definition of residential premises, premises must provide shelter and basic living facilities. Premises that do not have the physical characteristics to provide these are not residential premises to be used predominantly for residential accommodation.

You state the following in your submission at paragraphs 4.8 to 4.10:

4.8 It is submitted that the Dwelling is 'residential premises to be used predominantly for residential accommodation' in the form of a house. The Dwelling was designed, built and used solely as a residence for more than 100 years. When it was first built, it was intended to be used predominantly for residential accommodation and it is still intended to be occupied as a residence. In fact, the Dwelling can only be occupied as a residence. Therefore, the fundamental nature of the Dwelling is that of a home.

4.9 Paragraph 80 of GSTR 2012/5 states that '[p]remises are not suitable for, or capable of, human habitation if they are dilapidated to the extent that their condition prevents occupation for residential accommodation (as may be evidenced by a demolition order issued by a relevant authority because of the premises' condition).' Despite the Dwelling's dilapidated condition, we submit that this did not make it unfit for human habitation as at the Settlement Date, as it retained its original design features which provide shelter and basic living facilities. In fact, the Dwelling cannot be demolished and replaced by a new house.

4.10 Furthermore, we submit the Dwelling was capable of being occupied as a residence or for residential accommodation as at the Settlement Date, as the Vendor and the Purchaser were confident that it could be repaired and remediated such that it would again become fit for human habitation.

We disagree with your analysis above making the following comments.

In considering whether premises are 'residential premises' and furthermore whether the premises are 'residential premises to be used predominantly for residential accommodation', we need to consider the nature and characteristics of the Dwelling at the time of the supply or sale. In this case DD MM YYYY.

We acknowledge the Dwelling located on the Property was designed and used predominantly for residential accommodation up until the time Stage 1 renovations were carried out in mid to late YYYY, and comprised of six-bedrooms, two-bathrooms, a kitchen, dining, parlour, lounge area, study/library and a garage. At this point we would consider the Dwelling capable of providing shelter and basic living facilities regardless of being left unoccupied following your purchase of the Property.

However, the structure of the dwelling was altered in YYYY when you commenced renovating the Property which included the demolition/removal of the kitchen, laundry and bathroom located on the ground level together with the bathroom on the first level being stripped leaving only taps and plumbing in place. As the local council did not approve/endorse the building permit for Stage 2 of the works which included the main renovation and build of the Property, all planned works ceased and did not recommence.

At this point we consider the Dwelling no longer contained the physical characteristics of basic living facilities.

You subsequently decided to sell the Property in YYYY in its current state. Although the Property had not been condemned by a government authority, it was dilapidated and required considerable repairs/renovations prior to being habitable.

You also make reference to our private ruling register, specifically PBR 1051967836234 and the reliance of Example 3 (at paragraphs 23 and 24 of GSTR 2012/5) in that private ruling. You submit that the Commissioner should adopt a similar approach as taken in PBR 1051967836234 to the current case.

Example 3 in GSTR 2012/5 and PBR 1051967836234 differ to current case in that the basic living facilities of the respective properties/dwellings were still in existence when the properties were sold, albeit in a dilapidated state and in need of repair.

In this case, the bathing and cooking areas (and also other areas) of the Dwelling were demolished and removed altogether. It is not the situation in this case that the Dwelling still contained bathroom and kitchen facilities with those facilities requiring repairs. In this case such facilities no longer existed and had been consciously removed/demolished approximately X years prior to your eventual sale of the Property.

In summary, in your case, the fundamental design and physical characteristics of the dwelling were altered when the kitchen, laundry and bathroom on the ground floor were demolished altogether and the bathroom on the first floor was stripped in YYYY and which were never replaced prior to the sale of the Property. These facilities are fundamental characteristics of a residential premises without which, a premises is not suitable for or capable of being occupied as a residence or for residential accommodation. At the time of settlement, these basic facilities had been missing from the premises altogether for a prolonged period of time and it cannot be said that they could be repaired but rather they needed to be constructed from new in order for the premises to be said to possess these 'basic living facilities' and meet the fundamental physical characteristics of residential premises as defined for GST purposes. At the time of settlement, the Property consisted of land and a building comprised of 4 bedrooms, a study, living/dining room and sitting/lounge as outlined in the plan above.

We do not consider the Property met the definition of 'residential premises' to be used predominately for residential accommodation at the time of your supply of the Property (settlement date) to the Purchaser Therefore, your supply of XXX is not an input taxed supply under subsection 40-65(1).

It remains to be determined whether the supply of the Property is a taxable supply in accordance with the conditions set out in paragraph 9-5(a) to (d). The supply of the Property will be a taxable supply if it satisfies all of the requirements of section 9-5.

In this case, the supply of the Property was for consideration of $X. The supply was connected with the indirect tax zone as the Property was located in Australia. At the time of the supply, you were registered for GST. It therefore remains to be determined whether the supply of the Property was made in the course or furtherance of the commercial property investment enterprise or another enterprise that you were carrying on.

Based on the facts of this case, we consider the supply of the Property was not made in the course or furtherance of your commercial property investment enterprise which involves the acquisition and lease of commercial properties, so it remains to be determined whether the activities associated with the acquisition, renovation and sale of the Property were undertaken in relation to another enterprise that you carried on.

Supply in the course or furtherance of enterprise

The term 'carrying on' in the context of an enterprise is defined in section 195-1:

carrying on an enterprise includes doing anything in the course of the commencement or termination of the enterprise.

Subsection 9-20(1) relevantly defines an enterprise to include an activity, or series of activities, done:

(a) in the form of a business

(b) in the form of an adventure or concern in the nature of trade, or

(c) on a regular or continuous basis, in the form of a lease, licence or other grant of an interest in the property

The meaning of 'enterprise' is considered in Miscellaneous Taxation Ruling MT 2006/1 The New Tax System: the meaning of entity carrying on an enterprise for the purposes of entitlement to an Australian Business Number (MT 2006/1) and in Goods and Services Tax Determination GSTD 2006/6 Goods and services tax: does MT 2006/1 have equal application to the meaning of 'entity' and 'enterprise' for the purposes of the A New Tax System (Goods and Services Tax) Act 1999? (GSTD 2006/6) which provides that the discussion on 'enterprise' in MT 2006/1 applies to the GST Act.

MT 2006/1 includes the following guidelines:

159. Whether or not an activity, or series of activities, amounts to an enterprise is a question of fact and degree having regard to all of the circumstances of the case.

160. It is important that the relevant activity or series of activities are identified in order to determine whether an enterprise is being carried on. This is because one activity may not amount to an enterprise but that activity taken into account with other activities may form an enterprise. All activities need to be taken into account including activities from the commencement to the termination of the enterprise. For further information on commencement and termination activities, see paragraphs 120 to 148 of this Ruling.

234. Ordinarily, the term 'business' would encompass trade engaged in, on a regular or continuous basis. However, an adventure or concern in the nature of trade may be an isolated or one-off transaction that does not amount to a business but which has the characteristics of a business deal.

244. An adventure or concern in the nature of trade includes a commercial activity that does not amount to a business but which has the characteristics of a business deal. Such transactions are of a revenue nature. However, the sale of the family home, car and other private assets are not, in the absence of other factors, adventures or concerns in the nature of trade. The fact that the asset is sold at a profit does not, of itself, result in the activity being commercial in nature.

Paragraph 245 of MT 2006/1 refers to 'the badges of trade' which provides a 'common sense guidance' in reaching a conclusion on whether a transaction has the characteristics of a business deal and whether an asset is held as a trading/revenue asset or a capital/investment asset held for either investment or personal enjoyment. While an activity such as the selling of an asset may not of itself amount to an enterprise, account should be taken of the other activities leading up to the sale to determine if an enterprise is carried on.

The Commissioner's view on badges of trade in MT 2006/1:

The subject matter of realisation

247. This badge of trade considers the form and the quantity of property acquired. If the property provides either an income or personal enjoyment to the owner it is more likely to be an investment than a trading asset.

The length of period of ownership

249. A trading asset is generally dealt with or traded within a short time after acquisition. ...

The frequency or number of similar transactions

251. The greater the frequency of similar transactions the greater the likelihood of trade.

Supplementary work on or in connection with the property realised

252. Improving property beyond preparing an asset for sale, to bring it into a more marketable condition and gain a better price suggests an element of trade.

The circumstances that were responsible for the realisation

253. Trade involves operations of a commercial character. As assets can be sold for reasons other than trade, the circumstances behind the sale need to be considered. For example, a quick resale may have occurred as a result of sudden financial difficulties.

Paragraph 264 of MT 2006/1 discusses two seminal cases in this area: Statham & Anor v Federal Commissioner of Taxation 89 ATC 4070 (Statham) and Casimaty v FC of T 97 ATC 5135 (Casimaty).

Paragraph 265 of MT 2006/1 extracts the key elements of both cases and provides a list of factors that can be used to assist in determining whether isolated property transactions are an adventure or concern in the nature of trade or a mere realisation of a capital asset:

265. From the Statham and Casimaty cases a list of factors can be ascertained that provide assistance in determining whether activities are a business or an adventure or concern in the nature of trade (a profit-making undertaking or scheme being the Australian equivalent, see paragraphs 233 to 242 of this Ruling). If several of these factors are present it may be an indication that a business or an adventure or concern in the nature of trade is being carried on. These factors are as follows:

• there is a change of purpose for which the land is held;

• additional land is acquired to be added to the original parcel of land;

• the parcel of land is brought into account as a business asset;

• there is a coherent plan for the subdivision of land;

• there is a business organisation - for example, a manager, office and letterhead;

• borrowed funds financed the acquisition or subdivision;

• interest on money borrowed to defray subdivisional costs was claimed as a business expense;

• there is a level of development of the land beyond that necessary to secure council approval for the subdivision; and

• buildings have been erected on the land.

In addition to the above, paragraphs 266 and 267 of MT 2006/1 provide that there may be other relevant factors outside this list that need to be weighed up in reaching an overall conclusion and that no individual factor is determinative to the question of whether an enterprise is present:

266. In determining whether activities relating to isolated transactions are an enterprise or are the mere realisation of a capital asset, it is necessary to examine the facts and circumstances of each particular case. This may require a consideration of the factors outlined above, however there may also be other relevant factors that need to be weighed up as part of the process of reaching an overall conclusion. No single factor will be determinative rather it will be a combination of factors that will lead to a conclusion as to the character of the activities.

267. No two cases are likely to be exactly the same. For instance, while the conclusions reached in the Statham and Casimaty cases were similar, different facts and factors were considered to reach the respective conclusions.

Paragraphs 303 to 322 of MT 2006/1 discuss activities done on a regular or continuous basis, in the form of a lease, licence or other grant of an interest in property.

Application to this case

You purchased the Property in YYYY with the intention to one day renovating it for use by the primary beneficiary as their principal place of residence. Even though it was sometime, approximately X years since you purchased the Property, before you commenced renovating the Property, the original intended use of the Property did not change. There was no profit-making intention at the time of purchasing the Property nor was the Property subject to renovating for the purpose of attracting a higher sale price for the Property, for lease or for other enterprising purposes. Instead, the renovations were entered into in order to allow for the Property to be restored into a liveable condition - to allow for its use as the principal place of residence of the Beneficiary.

The reason you eventually sold the Property is because Stage 2 Permit for the renovations was not granted by the Council. Whilst you appealed the Council's decision to the Building Appeals Board you were unsuccessful. Given the imposed restriction on the Property, renovation and development of the Property became limited in scope and no longer met the Beneficiaries requirements to build a substantial family home as per the desired architectural/building plans. The $X renovation plans were abandoned with only approximately $X of works completed in total. You sold the Property in a dilapidated and 'unrenovated' state.

The Property is the first and only residential property purchased by the trust. You have not acquired, sold or otherwise dealt with any other residential property since the trust was established. The only other properties purchased by the trust were commercial in nature and were used in your commercial property investment enterprise unlike the Property. You have not undertaken residential property development before.

During the period of ownership, the Property remained vacant with the exception of a two/three-month period in YYYY in which it was occupied by family friends. The accommodation was supplied rent-free during the period of occupation. The Property did not generate any form of ongoing income during the entire period of your ownership.

You held the Property for a prolonged period of time - approximately X years before selling it.

You have always treated the Property as a fixed/capital asset. You kept records of your expenditure to maintain the Property over the years, capitalising these costs as the third element cost of owning a CGT asset. There were no interest expenses capitalised as you did not obtain finance to purchase the Property.

On balance having considered the facts of the case against the badges of trade and other factors listed above, we consider the activities you have undertaken in the acquisition, part renovation and sale of the property located at XXX was a way of disposing your capital asset that did not amount to an enterprise for GST purposes under subsection 9-20(1). Accordingly, the requirement specified in paragraph 9-5(b) was not satisfied and your supply of the Property did not meet all the requirements of section 9-5 to be a taxable supply. As such GST was not applicable to the sale.

Question 2

If the answer to question 1 is 'no', will Division 142 of the GST Act apply to prevent the refund of excess GST on the supply of the Property made by you in the amount of $X?

Division 142 provides that an excess amount of GST will not be refunded where that refund would result in a windfall gain for an entity.

Excess GST is defined in subsection 142-5(1) as an amount of GST that has been taken into account in an assessed net amount but is not in fact payable. However, pursuant to subsection 142-5(2), excess GST does not include:

• an amount of GST that was correctly payable but is later subject to a decreasing adjustment, and

• an amount of GST that is payable but is correctly attributable to another tax period

Under section 142-10, if the excess GST has been passed on to another entity, that excess GST is taken to have always been payable, and payable on a taxable supply, until the passed-on GST is reimbursed to the other entity.

However, if the excess GST has not been passed on, section 142-10 does not apply, and the supplier may request an amendment to their assessment for the relevant tax period to reduce the amount of GST attributed to that tax period. Any resulting refunds are then to be paid or applied in accordance with Division 3 and 3A of Part IIB of the Taxation Administration Act 1953 (TAA 1953).

Is there an amount of excess GST?

In this case, the supply of the Property did not meet all the requirements of section 9-5 to be a taxable supply. However, you treated the supply of the Property as a taxable supply and reported an amount of GST on the sale on you MM YYYY quarter BAS. The amount of GST reported on the BAS was $X, calculated using the margin scheme under Division 75. Therefore, there is an amount of excess GST of $X.

Was the excess GST passed on?

Goods and Services Tax Ruling GSTR 2015/1 Goods and services tax: the meaning of the terms 'passed on' and 'reimburse' for the purposes of Division 142 of the A New Tax System (Goods and Services Tax) Act 1999 (GSTR 2015/1) states at paragraph 23 that whether the excess GST has been passed on is a question of fact and must be determined on a case-by-case basis taking into account the particular circumstances of each case.

Paragraphs 24-27 of GSTR 2015/1 states:

24. The Explanatory Memorandum to the Tax Laws Amendment (2014 Measures No. 1) Bill 2014 states that the GST Act envisages that the supplier 'passes on' the GST to the recipient of the supply. This simply reflects the design of the GST as an indirect tax which is generally expected to be passed on to the customer when a supply is treated as a taxable supply.

25. If excess GST is included on a tax invoice, this is prima facie evidence that the excess GST has been passed on.

26. However, while there is a general expectation that, in ordinary circumstances, excess GST has been passed on, the particular facts and circumstances of an individual case may demonstrate that excess GST has not in fact been passed on.

27. A supplier claiming a refund, because it considers that the excess GST has not been passed on, will need to clearly substantiate the grounds on which it claims the refund. In any dispute, the taxpayer would have the onus of proving that its circumstances are outside the ordinary and that it did not pass on the excess GST.

In paragraph 28 of GSTR 2015/1 the Commissioner considers that the matters relevant to determining whether excess GST has been passed on include:

(i) the manner in which the excess GST arose

(ii) the supplier's pricing policy and practice

(iii) the documentary evidence surrounding the transaction, and

(iv) any other relevant circumstances

Paragraph 29 of GSTR 2015/1 states that the question of passing on is one of fact and not of fairness - considerations of fairness may be relevant in deciding whether the Commissioner exercises the discretion under subsection 142-15(1) but are not relevant to whether excess GST has been passed on.

Each of the four matters relevant to determining whether excess GST has been passed on is considered in detail below.

The manner in which the excess arose

The manner in which the excess GST arose is relevant in determining whether or not the excess GST has been passed on. Paragraph 30 of GSTR 2015/1 provides that an amount of excess GST may arise in a variety of fact situations and paragraph 31 of GSTR 2015/1 details some common circumstances where excess GST may arise. It includes:

• incorrectly treating something which is not a supply as a taxable supply

• miscalculating a GST liability under the GST law

• incorrectly reporting an amount of GST on a GST return

• incorrectly treating a GST-free or input taxed supply as a taxable supply (including incorrectly apportioning the taxable and non-taxable components of a mixed supply).

In your circumstances, you incorrectly treated a non-taxable supply as a taxable supply.

The Commissioner at paragraph 33 of GSTR 2015/1 is of the view that where the excess GST arises as a result of an error made before setting the price (for example where a supplier mischaracterises a non-taxable supply as a taxable supply) this error will generally flow through to the sale price paid by the recipient and is likely to point towards a finding that excess GST has been passed on.

You advised that you first turned your mind to the GST treatment of the sale when the initial contract of sale documentation was prepared by XXX. You were uncertain of the correct GST treatment of the supply but did not have time to seek a private ruling from the ATO before the transaction occurred. You considered the alternatives and ultimately decided to treat the supply as taxable.

In your case, you first received the offer from the prospective purchaser to buy the Property on DD MM YYYY. You were aware that purchasers would not accept a mark-up of prices for GST so the contract specified that the agreed price was inclusive of GST. You accepted the offer and the words 'Price includes GST' and 'Margin Scheme' were inserted into the relevant part of the contract of sale in or about DD MM YYYY. Acceptance of the offer was communicated verbally on DD MM YYYY and the contract for sale was signed on DD MM YYYY.

Based on the information provided, the excess GST arose as a result of an error (i.e. mischaracterisation of the supply) before the price was contractually agreed. In line with paragraph 33 of GSTR 2015/1, this indicates that excess GST has been passed on.

The supplier's pricing policy and practice

The supplier's pricing policy and practice involves considering your conduct and knowledge at the relevant time of setting the price of a supply.

Paragraphs 41-46 of GSTR 2015/1 states:

41. Where a supplier sets a price with the knowledge or belief that the transaction is subject to GST, including a belief that the GST which later proves to be an overpayment is a real cost of doing business, that will point towards a finding that the excess GST has been passed on.

42. This may be demonstrated where the price charged is calculated so as to exceed costs (including GST) by a profit margin. Even if there is very little or no profit margin, this will not necessarily mean that the GST was not taken into account as a cost.

43. Similarly, a GST liability calculated under either the margin scheme or the general rules is likely to be a foreseeable cost which forms part of the cost recovery and pricing structure of doing business.

44. On the other hand, where a supplier sets a price on the basis that no GST is payable on the transaction, and subsequently pays the GST liability without seeking (or being able to seek) recovery from the recipient, this may point towards a finding that the supplier has absorbed and not passed on the cost of the excess GST.

45. A supplier may seek to demonstrate that GST was not considered when setting the price it charged its customers. This is not, of itself, sufficient to establish that the excess GST has not been passed on. For example, where a supplier is a 'price taker' in a market that primarily makes taxable supplies, this usually indicates that the supplier has passed on the excess GST. The fact that the supplier may not have been aware of the GST cost when setting its prices is not enough by itself to demonstrate that GST has not been passed on.

46. On the other hand, where a supplier sets its prices to a market that primarily makes non-taxable supplies, this may tend to support a conclusion that the supplier has not passed on the excess GST.

In your case there was no comparable market sales data for properties in the near vicinity to assist with price setting. Instead, you relied on discussions your real estate agent had with prospective buyers to determine a desired price. The desired price is set out in the Statement of Information provided for the sale, dated DD MM YYYY, which shows an indicative selling price in the range of $X to $X. Under the contract of sale for the Property, the agreed sale price was $X, inclusive of GST calculated under the margin scheme.

These terms of the contract are not indicative of passing on one way or the other (see Domestic Property Developments Pty Ltd as trustee for the Dals Property Trust v. Commissioner of Taxation 2022 ATC 10-661 (Dals), at [81] where Senior Member Olding stated that the contractual terms for the sale of a property, unit 3, signified no more than that, if GST is payable without adjustment to the price, the vendor has the liability, but it may be calculated under the margin scheme).

However, in Dals, Senior Member Olding at [100] reiterated that just because the contract required the applicant to meet any GST payable without adjustment to the price, it did not mean the applicant necessarily bore the economic burden of the excess GST.

In finding that an amount of excess GST had been passed on in Dals in respect of the sale of unit 3, Senior Member Olding, at [98] citing the High Court in Avon Products Pty Ltd v. Federal Commissioner of Taxation 2006 ATC 4296, placed weight at [99] on the fact that the applicant in Dals achieved a price that exceeded all their costs including a substantial amount that was erroneously understood to be payable as GST, achieving a small profit on the sale (Dals at 94). It was because of this that Senior Member Olding considered that the applicant faced a difficult challenge in proving it had borne the burden of the excess GST itself.

As a consequence of conducting your commercial leasing activities you must have had knowledge of GST and understood that by treating the supply of property as a taxable supply, you would be liable for GST and the amount of GST would be significant. In the current case, the price achieved for the sale was well above the desired price range, and there is a general expectation that in agreeing to this price, all costs would have been covered including the GST calculated under the margin scheme that later turned out to be excess GST. In line with paragraph 43 of GSTR 2015/1, a GST liability calculated under the margin scheme is likely to be a foreseeable cost which forms part of the cost recovery and pricing structure of doing business.

Accordingly, from the information provided, a profit was achieved on the sale and the price attained covered all costs the taxpayer understood it would incur, including GST. This points towards a finding that the excess GST has been passed on.

Documentary evidence surrounding the transaction

Whether GST is included in the price of a supply may be demonstrated by the documentary evidence surrounding that transaction. This evidence may be in any form including but not limited to, a tax invoice, contract of sale, correspondence between the parties, internal pricing policy documents etc.

Paragraph 58 - 63 of GST 2015/1 states:

58. In most cases, a supplier will have issued a tax invoice, or received a recipient created tax invoice, for the transaction which gives rise to the excess GST. In other cases where a supply is made under contractual obligations (such as a supply of real property), a contract of sale may disclose that GST has been included in the price of the supply.

59. Subsection 142-25(2) provides that a tax invoice, issued to or by another entity, containing enough information to allow the amount of GST payable in relation to the supply to be clearly ascertained, is prima facie evidence of the excess GST having been passed on (although in cases where the supplier must pay an assessed net amount, the invoice is only prima facie evidence if the amount has been paid).

60. However, the tax invoice is only prima facie evidence. It is not conclusive evidence and there may be other documentary evidence to indicate that the excess GST has not been passed on. For example, a written agreement entered into by the supplier and recipient on the basis that a supply is GST-free is documentary evidence indicating that the excess GST has not been passed on, even though a tax invoice showing an amount of GST was inadvertently created and issued by the supplier. Under these circumstances, the recipient would not be entitled to claim an input tax credit.

61. Where a tax invoice has been issued, but the amount on the invoice has not yet been paid by the recipient, the non-payment is evidence that the excess GST has not yet been passed on.

62. For example, a supplier accounting on an accruals basis (rather than on a cash basis) can demonstrate that the excess GST has not yet been passed on to the recipient where the supplier:

• issues a tax invoice to the recipient

• remits the excess GST to the Commissioner in the tax period in which the tax invoice was issued

• but can show that the recipient has not paid the amount shown on the tax invoice.

63. However, excess GST may have been passed on even if there is no tax invoice, or if a tax invoice has been issued but does not contain enough information to enable the GST amount to be clearly ascertained.

A tax invoice was not issued for the sale. However a tax invoice is not required if GST is calculated under the margin scheme. Under section 142-25, passing on of excess GST may occur even if a tax invoice is not issued.

In this case, relevant documentation is the contract for sale which specified that GST was included in the price and would be calculated under the margin scheme. However, as mentioned above these terms of the contract are not indicative of passing on one way or the other.

Accordingly, the documentary evidence for the transaction carries little weight in this case in determining whether the excess GST has been passed on.

Other relevant circumstances

There may be other relevant circumstances which are relevant to the question of whether excess GST has been passed on.

No other relevant facts and circumstances have been identified.

Conclusion

Having regard to the matters relevant to determining whether excess GST has been passed on as set out in GSTR 2015/1, and the particular facts and circumstances of this case, we consider that the excess GST has been passed on to the purchaser.

As there is excess GST and it has been passed on to the purchaser, under section 142-10 the excess GST is treated as having always been payable on a taxable supply until you reimburse the other party for the passed-on GST.