| Disclaimer You cannot rely on this record in your tax affairs. It is not binding and provides you with no protection (including from any underpaid tax, penalty or interest). In addition, this record is not an authority for the purposes of establishing a reasonably arguable position for you to apply to your own circumstances. For more information on the status of edited versions of private advice and reasons we publish them, see PS LA 2008/4. |

Edited version of private advice

Authorisation Number: 1052271859644

Date of advice: 29 July 2024

Ruling

Subject: Medicare levy surcharge

Question

Are you considered to be a person covered by an insurance policy that provides private patient hospital cover for the purpose of subsection 8B of the Medicare Levy Act 1986?

Answer

No.

This ruling applies for the following periods:

Year ended XX June 20XX

Year ended XX June 20XX

The scheme commenced on:

XX June 20XX

Relevant facts and circumstances

You are an Australian resident for taxation purposes.

Your taxable income for the 20XX income year is $XXX,XXX.

You no longer have a spouse as you are divorced.

You have two adult children, who are no longer dependants, they are aged XX and XX, citizens and residents of Australia and both work.

You are employed at Company A.

Company A manages properties in Country A.

You are required, within this position, to be in Country A for several months per year.

You cannot be in Country A without Health Insurance Cover.

You have subscribed to an international hospital insurance company - named Company B - they cover 100% of your hospital costs both here in Australia and Country A.

You have peace of mind when you are overseas with this hospital and evacuation cover.

Your hospital treatments do not cost anything to the Australia taxpayer nor to Medicare.

This will be a recurring issue.

You cannot avoid having an insurance that covers your health risk beyond Australia, and no Australian Health Insurance fund offers the same product.

Health Insurance Fund details:

• Fund Name: Company B

• Policy number XXXXX

• Host country: Australia

• Effective XX/X/20XX (renewed X January each year)

• Your benefits:

o Type of membership: Individual

o Type of Cover: XXX top-up cover

o Level of Cover: Medium

o Option: Hospitalisation only at 100% of actual costs

o Zone of cover: X (Worldwide)

• The policy information provided does not indicate that the policy meets the conditions to exempt you from the Medicare Levy Surcharge.

Relevant legislative provisions

Medicare Levy Act 1986

Medicare Levy Act 1986 subsection 8B

Medicare Levy Act 1986 Subsection 3(5)

Reasons for decision

Summary

You are not considered to be a person covered by an insurance policy that provides private patient hospital cover for the purpose of subsection 8B of the Medicare Levy Act 1986 (MLA 1986).

Detailed reasoning

Medicare Levy Surcharge

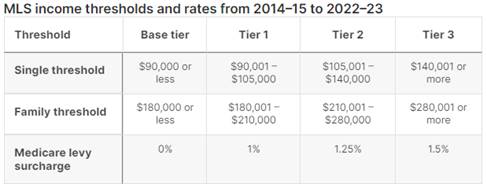

The Medicare Levy Surcharge (MLS) is imposed by the MLA 1986. The MLS is a levy surcharge that is paid in addition to the Medicare Levy. It is payable by taxpayers who are not covered by an insurance policy with adequate private patient hospital cover and who earn more than the relevant income threshold, which includes both your taxable income and reportable fringe benefit amounts for the year.

A taxpayer's liability to pay the MLS during an income year is affected by whether the taxpayer:

• Is single or married.

• Has dependants

• Is covered by private patient hospital insurance (and whether dependants are also covered by such insurance)

• Is a "prescribed person".

• Whether a taxpayer's income and reportable fringe benefits total exceeds the threshold amount (if the taxpayer is married this would be the combined totals of both partners).

Where any of the above factors change for the taxpayer during the income year, the surcharge liability is determined separately in respect of each period during the income year.

Subsection 8B(2) of the MLA 1986 sets out the procedure of the MLS for taxpayers who are singles during whole or part of the income year. Subsection 8B(1) states that the MLS will apply to a taxpayer during a period, if for the whole period:

• The person is not a married person.

• The person does not have any dependants.

• The person is not covered by an insurance policy that provides appropriate private patient hospital cover.

• The person is not a prescribed person.

Subsection 8B(2) of the MLA 1986 advises us that if the person's income for surcharge purposes exceeds the person's single tier 1 threshold for the year of income, the amount of the levy that, would have been payable by the person under this Act for the year of income is to be increased:

• If this section applies to the person for the whole of the year of income-by 1% of the person's taxable income; or

• If this section applies to the person for only some of the days in the year of income-by the amount worked out using the formula:

Number of those days ÷ (1% of the person's taxable income × Number of days in the year of income)

• Increase the amount of each percentage mentioned in subsection (2) by 0.25 of a percentage point if the person is a tier 2 earner for the year of income.

• Increase the amount of each percentage mentioned in subsection (2) by 0.5 of a percentage point if the person is a tier 3 earner in the year of income.

In the year ended 30 June 20XX, you were single, your taxable income (including the income sourced in Indonesia) was $XXX,XXX, which exceeds the minimum single threshold amount of $XX,XXX or less. This makes you a Tier X income earner. If you are not covered by an insurance policy that provides an appropriate level of private patient hospital cover then you are required to pay the MLS. Please refer to the tables below:

>

>

>

>

Insurance policy with private patient hospital cover

The meaning of an insurance policy that provides private patient hospital cover is provided by the subsection 3(5) of MLA 1986 which states:

(a) The policy is a complying health insurance policy (within the meaning of the Private Health Insurance Act 2007 (PHIA 2007)) that covers hospital treatment (within the meaning of that Act) and

(b) Any excess payable in respect of benefits under the policy is no more than the applicable amount set out in subsection 45-1 of that Act in any 12-month period.

Complying Health insurance product and policy

A complying health insurance policy is defined in subsection 63-10 of the PHIA 2007, as an insurance policy that meets a number of conditions including providing private patient hospital cover that provides benefits in relation to some, or all, of the fees and charges for hospital treatment. If the cover is for extras or general services only, for example ambulance cover or medicines, it is not health cover that provides private patient hospital cover. An up-to-date record of all registered private health insurers providing complying policies can be found on the PrivateHealth.gov.au website.

Under the subsection 63-5(1) of the PHIA 2007 the meaning of a complying health insurance product is a "product made up of" complying health insurance policies.

Under the subsection 63-5(2) of the PHIA 2007, a product is all the insurance policies issued by a private health insurer:

• That cover the same treatments.

• Provide benefits that are worked out the same way.

• Whose other terms and conditions are the same as each other.

Normally health insurance funds will indicate which of their policies meet these conditions. Your private health insurance does not meet the requirements under the PHIA 2007.

Some countries have reciprocal agreements that may provide an exemption of the Medicare Levy Surcharge.

In your case Indonesia is not on the list of countries that Australia has a reciprocal agreement with to provide the exemption for the Medicare Levy Surcharge.

We have considered your circumstances and conclude that you are not eligible for the Medicare Levy Surcharge exemption for the year ended 20XX.

Considering your previous year's income, your income for the year ended 20XX and following income years may also be above the single threshold of $XX,XXX. If so, then you will not be eligible for the Medicare Levy Surcharge exemption for the year ended 20XX and following income years.

Your private health insurance policy does not meet the requirements under the PHIA 2007. Accordingly, your policy will not exempt you from paying the MLS. You are therefore required to pay the MLS in the relevant income year(s).