| Disclaimer You cannot rely on this record in your tax affairs. It is not binding and provides you with no protection (including from any underpaid tax, penalty or interest). In addition, this record is not an authority for the purposes of establishing a reasonably arguable position for you to apply to your own circumstances. For more information on the status of edited versions of private advice and reasons we publish them, see PS LA 2008/4. |

Edited version of private advice

Authorisation Number: 1052350751529

Date of advice: 22 January 2025

Ruling

Subject: Deceased estates - exemption

Question

Are you eligible for the partial main residence exemption for the dwelling you inherited from a deceased estate under section 118-200 of the Income Tax Assessment Act 1997 (ITAA 1997)?

Answer

Yes.

This ruling applies for the following period:

Year ended 30 June 20XX

The scheme commenced on:

XX XXXX 20XX

Relevant facts and circumstances

After 20 September 1985, the deceased solely purchased the property.

The property is less than two hectares.

After 20 September 1985, the deceased did not treat any other property as their main residence.

For a period, the deceased used the property as main residence, and it was not used to produce income.

On XX XXXX 20XX, the deceased moved into a nursing home. They did not acquire an ownership interest in any nursing home properties.

Between the specified dates, the deceased chose to apply the six-year absence rule and continue to treat the property as their main residence.

When the deceased moved into the nursing home, the property was used to produce assessable income.

After XX XXXX 20XX, the property was left vacant until it was sold.

On XX XXXX 20XX, the deceased passed away.

On XX XXXX 20XX, you sold the property.

On XX XXXX 20XX, settlement occurred.

Relevant legislative provisions

Income Tax Assessment Act 1936 section 254.

Income Tax Assessment Act 1997 section 103-25

Income Tax Assessment Act 1997 section 104-10

Income Tax Assessment Act 1997 subdivision 118-B

Income Tax Assessment Act 1997 section 118-110

Income Tax Assessment Act 1997 section 118-115

Income Tax Assessment Act 1997 section118-130

Income Tax Assessment Act 1997 section 118-145

Income Tax Assessment Act 1997 section 118-185

Income Tax Assessment Act 1997 section 118-190

Income Tax Assessment Act 1997 section 118-192

Income Tax Assessment Act 1997 section 118-195

Income Tax Assessment Act 1997 section 118-200

Income Tax Assessment Act 1997 section 118-255

Reasons for decision

Section 118-195 of the ITAA 1997 states that if you own a dwelling in your capacity as a beneficiary in a deceased estate, or you owned it as the trustee of a deceased estate, that you are exempt from tax on any capital gain made on the disposal of the property if:

• The property was acquired by the deceased before 20 September 1985, or

• The property was acquired by the deceased on or after 20 September 1985 and the dwelling was the deceased's main residence just before the deceased's death and was not then being used for the purpose of producing assessable income, and

• Your ownership interest ends within 2 years of the deceased's death.

In your case, you have not met the requirements of section 118-195 of the ITAA 1997 as the deceased acquired the property after 20 September 1985, and the property was used to produce assessable income just before their death.

Partial exemption

Section 118-200 of the ITAA 1997 considers eligibility for a partial exemption for deceased estate dwellings when you are not able to apply section 118-195 of the ITAA 1997.

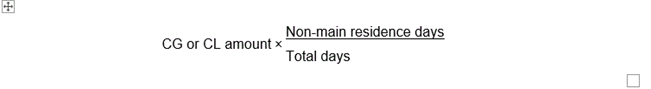

You calculate your capital gain or capital loss using the formula set out in subsection 118-200(2) of the ITAA 1997:

1: Calculation of capital gain or capital loss

>

>

non-main residence days is the sum of:

(a) If the deceased acquired the ownership interest on or after 20 September 1985 - the number of days in the deceased's ownership period when the dwelling was not the deceased's main residence; and

(b) The number of days in the period from the death until your ownership interest ends when the dwelling was not the main residence of an individual referred to in item 2, column 3 of the table in section 118-195.

total days is:

(a) If the deceased acquired the ownership interest before 20 September 1985 - the number of days in the period from the death until your ownership interest ends; or

(b) If the deceased acquired the ownership interest on or after that day - the number of days in the period from the acquisition of the dwelling by the deceased until your ownership interest ends.

Absence rule

Subsection 118-145(1) of the ITAA 1997 provides a taxpayer can choose to continue to treat a dwelling as their main residence if it ceases to be their main residence. The period for which the dwelling can continue to be treated as their main residence depends on whether or not it is used for the purpose of producing assessable income.

Subsection 118-145(2) of the ITAA 1997 states that, if the dwelling that was a taxpayer's main residence was used for the purpose of producing assessable income, the maximum period that you can treat it as their main residence under section 118-145 while it is used for that purpose is 6-years.

When the deceased moved to the nursing home, they chose to continue to treat the property as their main residence for the maximum 6-year period. Based on the information provided they did not treat any other residence as their main residence in this time.

Application to your circumstances.

You are not eligible for a full main residence exemption on the disposal of the property, as dwelling was used by the deceased to produce assessable income during their ownership period. However, you are eligible for a partial main residence exemption.

As the deceased elected to continue to treat the dwelling as their main residence, the Commissioner will allow you as executor of the estate to apply the 6-year absence rule.

The 6-year absence period will reduce the non-main resident days when calculating the capital gain or capital loss using the formula set out in subsection 118-200(2) of the ITAA 1997.

Furthermore, you are entitled to apply the 50% discount when calculating the capital gain as you have held your ownership interest for more than 12 months.