Miscellaneous Taxation Ruling

MT 2012/1A2 - Addendum

Miscellaneous taxes: application of the income tax and GST laws to immediate transfer farm-out arrangements

-

Please note that the PDF version is the authorised version of this ruling.View the consolidated version for this notice.

Addendum

This Addendum is a public ruling for the purposes of the Taxation Administration Act 1953. It amends Miscellaneous Taxation Ruling MT 2012/1 to clarify that, as a result of the decision in Shell Energy Holdings Australia Limited v Commissioner of Taxation [2021] FCA 496, where applicable legislation states that a farmee cannot carry out activities on the relevant mining tenement or have a right to become the legal owner of an interest in the relevant mining tenement until requisite approvals have been obtained, a farmee cannot begin to hold an interest in the mining tenement for the purposes of Division 40 of the Income Tax Assessment Act 1997 until those approvals have been obtained.

MT 2012/1 is amended as follows:

Omit footnote 1.

(a) Omit 'ITAA 1997'; substitute 'Income Tax Assessment Act 1997'.

(b) In footnote 2, omit 'ITAA 1997'; substitute 'Income Tax Assessment Act 1997'.

(c) In footnote 3, omit 'ITAA 1997'; substitute 'Income Tax Assessment Act 1997'.

(a) Omit the wording of the second dot point; substitute:

- •

- a deferred transfer farm-out arrangement. A deferred transfer farm-out arrangement is discussed in Miscellaneous Taxation Ruling MT 2012/2 Miscellaneous taxes: application of the income tax and GST laws to deferred transfer farm-out arrangements.

(b) Omit footnote 4.

(c) After the paragraph, insert new paragraph 3A:

3A. For the remainder of this Ruling, the Income Tax Assessment Act 1997 is referred to as the ITAA 1997; the Income Tax Assessment Act 1936 is referred to as the ITAA 1936. For the GST law, the A New Tax System (Goods and Services Tax) Act 1999 is referred to as the GST Act.

(a) Omit ''the farmor giving up future economic benefits, in the form of reserves, in exchange for a reduction in future funding obligations''; substitute 'the farmor giving up future economic benefits, in the form of reserves, in exchange for a reduction in future funding obligations'.

(b) Omit footnote 6.

In footnote 8, after 'footnote 7', insert 'of this Ruling'.

Omit the wording of the paragraph, including heading; substitute:

Class of arrangement or scheme

10. This Ruling applies to an immediate transfer farm-out arrangement that has the following characteristics:

Table 1: Immediate transfer farm-out arrangements to which this Ruling applies Characteristics of the farmor Characteristics of the farmee

- •

- transfers a percentage interest in the mining tenement to the farmee (leaving the farmor with a reduced percentage interest in that mining tenement);9

- •

- may also share mining information with the farmee as part of that transfer.

- •

- undertakes exploration commitments10 which may be referable to a period of time; an amount or amounts; a schedule of works; or a combination thereof; or

- •

- undertakes to make cash payments to the joint venture on behalf of the farmor to meet cash calls that the farmor would otherwise be obliged to meet in respect of the farmor's retained interest in the mining tenement;

- •

- may make cash payments to the farmor – these payments may, or may not, be referable to the exploration costs the farmor has incurred prior to the farm-out arrangement being entered into;

- •

- may make cash payments to third parties to meet expenses incurred by the farmor thereby relieving the farmor from meeting those expenses.

After 'paragraph 15', insert 'of this Ruling'.

After 'paragraph 15(i)', insert 'of this Ruling'.

In footnote 15, omit 'GSTR 2001/6: non-monetary consideration'; substitute 'GSTR 2001/6 Goods and services tax: non-monetary consideration'.

Omit 'and/or the amount of each payment is unascertainable'; substitute 'or the amount of each payment is unascertainable (or both)'.

In the heading, after 'paragraph 15(i)', insert 'of this Ruling'.

In the heading, after 'paragraph 15(ii)', insert 'of this Ruling'.

After 'paragraph 75', insert 'of this Ruling'.

Omit the wording of the paragraph; substitute:

If the applicable legislation or agreement provides that activities on the mining tenement cannot be carried out by the farmee until the requisite approvals under any applicable legislation have been obtained then, until those approvals have been obtained, the farmee cannot exercise, or have a right to exercise immediately, the subject matter of the interest in the mining tenement. As such, the farmee will not begin to hold the interest in the mining tenement under item 5 of the table in section 40-40 of the ITAA 1997 at the time when the agreement is executed. This includes the application of any statutory provisions to the effect that the relevant transfer of title is of no force until it is approved and registered.

Omit the paragraph.

In the heading, after ' paragraph 15(i) or 15(ii) ', insert ' of this Ruling '.

(a) In the heading, after ' paragraph 15(ii) ', insert ' of this Ruling '.

(b) Omit 'and/or unascertainable'; substitute 'or unascertainable (or both)'.

In the heading, after ' paragraph 15(ii) ', insert ' of this Ruling '.

In footnote 51, omit 'GST Ruling'.

Omit 'A New Tax System (Goods and Services Tax) (Particular Attribution Rules Where Total Consideration Not Known) Determination (No. 1) 2000'; substitute 'Goods and Services Tax: Particular Attribution Rules Where Total Consideration Not Known Determination 2017'.

Omit the wording of footnote 56; substitute 'Goods and Services Tax Ruling GSTR 2002/5 Goods and services tax: when is a 'supply of a going concern' GST-free?'.

(a) Omit the wording of the paragraph; substitute:

The income tax consequences for Farmor Co and Farmee Co are summarised in Tables 2 and 3 of this Ruling. These tables assume that:

- •

- if mention is made of subsection 40-730(1) of the ITAA 1997 – all of the other requirements of subsection 40-730(1) of the ITAA 1997 are satisfied and subsections 40-730(2) and 40-730(3) of the ITAA 1997 do not apply;

- •

- if mention is made of any other provision – all of the requirements of that provision are satisfied; and

- •

- all legislative references are to the ITAA 1997 and all amounts are GST-exclusive.

| Event | Assessable or (deductible) | Timing |

| 1 – In return for Farmor Co transferring a 90% interest in the mining tenement to Farmee Co, Farmor Co receives a cash payment and an exploration benefit. | $100,000 under item 1 of the table in paragraph 40-305(1)(b)

$20,000 under item 4 of the table in paragraph 40-305(1)(b) (See paragraph 27 of this Ruling.) |

When Farmee Co begins to hold the interest in the mining tenement.

(See paragraphs 34 to 39 of this Ruling.) |

| 2 – Farmor Co expends the 90% interest in the mining tenement partly in return for the exploration benefit. | ($20,000) – subsection 40-730(1)

(See paragraphs 28 and 29 of this Ruling.) |

When the farm-out agreement is executed on the basis that Farmor Co has an obligation to transfer the interest in the mining tenement. (See paragraph 30 of this Ruling.) |

| Event | Assessable or (deductible) | Timing |

| 3 – Farmee Co makes a cash payment and provides an exploration benefit to Farmor Co in return for the 90% interest in the mining tenement. | ($100,000) under item 1 of the table in paragraph 40-185(1)(b)

($20,000) under item 4 of the table in paragraph 40-185(1)(b) $120,000 is the first element of cost of the interest in the mining tenement and immediately deductible if Farmee Co's 90% interest is first used for exploration or prospecting – subsections 40-25(1) and 40-80(1) (See paragraphs 40 to 43 of this Ruling.) |

When Farmee Co's interest in the mining tenement is first used for exploration or prospecting if it is immediately deductible.

Alternatively, when the interest in the mining tenement starts to decline in value under subsection 40-25(1). (See paragraphs 40 to 43 of this Ruling.) |

| 4 – Farmee Co provides an exploration benefit (on revenue account) to Farmor Co for which Farmee Co earns part of its 90% interest in the mining tenement. | $20,000 – section 6-5 or 15-2

$20,000 of the interest in the mining tenement earned by the Farmee Co is attributable to its provision of the exploration benefit (See paragraphs 55 and 56 of this Ruling.) |

To the extent that Farmee Co provides an exploration benefit to Farmor Co in an income year.60

(See paragraph 56 of this Ruling.) |

| 5 – Farmee Co incurs exploration expenditure in the course of undertaking the exploration it committed to under the agreement. | ($800,000) –subsection 40-730(1) or section 8-1

(See paragraphs 44 and 57 of this Ruling.) |

When the expenditure is incurred.

(See paragraphs 44 and 57 of this Ruling.) |

(b) After the paragraph, insert new paragraphs 73A and 73B:

73A. The net income tax outcome for Farmor Co is $100,000, Farmor Co is effectively assessed on the $100,000 cash payment it receives.

73B. The net income tax outcome for Farmee Co are deductions of $900,000.

(a) Omit the wording of the paragraph; substitute:

The GST consequences for Farmor Co and Farmee Co are summarised in Tables 4 and 5 of this Ruling. These tables assume that:

- •

- Farmor Co and Farmee Co are each registered for GST and account for GST on a non-cash basis; and

- •

- the supplies are taxable supplies and the acquisitions are creditable acquisitions for a fully creditable purpose.

| Event | GST payable and input tax credits (ITCs) | Attribution to a tax period (non-cash basis) |

| 1 – Farmor Co makes a taxable supply of the 90% interest in the mining tenement to Farmee Co. | GST payable of $12,000

(one-eleventh of $132,000 GST-inclusive) (See paragraphs 58 to 62 of this Ruling.) |

When an invoice is issued or any of the consideration is received, whichever is earlier.

(See paragraphs 64 and 65 of this Ruling.) |

| 2 – Farmor Co makes a creditable acquisition of an exploration benefit. | ITC entitlement of ($2,000)

(one-eleventh of $22,000 GST-inclusive) (See paragraphs 58 to 62 of this Ruling.) |

When any of the consideration is provided by Farmor Co and Farmor Co holds a tax invoice; or an invoice that is also a tax invoice is issued by Farmee Co to Farmor Co for the exploration benefit.

(See paragraphs 64 and 65 of this Ruling.) |

| Event | GST payable and input tax credits (ITCs) | Attribution to a tax period (non-cash basis) |

| 3 – Farmee Co makes a taxable supply of an exploration benefit to Farmor Co. | GST payable of $2,000

(one-eleventh of $22,000 GST-inclusive) (See paragraphs 58 to 62 of this Ruling.) |

When an invoice is issued or any of the consideration is received, whichever is earlier.

(See paragraphs 64 and 65 of this Ruling.) |

| 4 – Farmee Co makes a creditable acquisition of the 90% interest in the mining tenement. | ITC entitlement of $12,000

(one-eleventh of $132,000 GST-inclusive) (See paragraphs 58 to 62 of this Ruling.) |

When any of the consideration is provided by Farmee Co and Farmee Co holds a tax invoice; or an invoice that is also a tax invoice is issued by Farmor Co to Farmee Co for the interest in the mining tenement.

(See paragraphs 64 and 65 of this Ruling.) |

(b) After the paragraph, insert new paragraphs 74A and 74B:

74A. The net GST outcome for Farmor Co is $10,000 GST payable (relates to the cash payment received).

74B. The net GST outcome for Farmee Co is a $10,000 net GST refund (relates to the cash paid).

(a) Omit the wording of the paragraph; substitute:

The income tax consequences for Farmor 2 Co and Farmee 2 Co are summarised in Tables 6 and 7 of this Ruling. These tables assume that:

- •

- if mention is made of subsection 40-730(1) of the ITAA 1997 – all of the other requirements of subsection 40-730(1) of the ITAA 1997 are satisfied and subsections 40-730(2) and 40-730(3) of the ITAA 1997 do not apply;

- •

- if mention is made of any other provision – all of the requirements of that provision are satisfied; and

- •

- all legislative references are to the ITAA 1997; all amounts are GST-exclusive.

| Event | Assessable or (deductible) | Timing |

| 1 – In return for Farmor 2 Co transferring a 90% interest in the mining tenement to Farmee 2 Co, Farmor 2 Co receives a cash payment, a right to (constructively) receive a cash payment and an exploration benefit. | $100,000 under item 1 of the table in paragraph 40-305(1)(b)

$80,00061 under item 3 of the table in paragraph 40-305(1)(b) $1,00062 under item 4 of the table in paragraph 40-305(1)(b) (See paragraph 27 of this Ruling.) |

When Farmee 2 Co begins to hold the interest in the mining tenement.

(See paragraphs 34 to 39 of this Ruling.) |

| 2 – Expenditure is incurred on exploration or prospecting through the joint venture, although met by Farmee 2 Co on Farmor 2 Co's behalf. | ($80,000)

subsection 40-730(1) (See paragraphs 31 to 33 of this Ruling.) |

In the 2011–12 income year, when the expenditure is incurred by the joint venture operator.

(See paragraph 33 of this Ruling.) |

| 3 – Farmor 2 Co receives a cash payment contributed by Farmee 2 Co on its behalf and expended by the joint venture operator. This cash payment is in full satisfaction of the right. | $19,000 – subsection 102-5(1)

CGT event C2 happens under section 104-25 $20,000 capital proceeds less $1,000 cost base of the right (See paragraphs 48 and 49 of this Ruling.) |

When the joint venture operator expends Farmee 2 Co's further contribution to the joint venture and the right ends.

(See paragraphs 48 and 49 of this Ruling.) |

| 4 – Expenditure is incurred in meeting the exploration or prospecting expenses of the joint venture. | ($20,000)63 – subsection 40-730(1)

(See paragraphs 31 to 33 of this Ruling.) |

In the 2012–13 income year, when the expenditure is incurred by the joint venture operator.

(See paragraph 33 of this Ruling.) |

| Event | Assessable or (deductible) | Timing |

| 5 – Farmee 2 Co makes a cash payment to Farmor 2 Co and to the joint venture and provides a non-cash benefit to Farmor 2 Co to the extent that a future payment or payments is contingent or the amount unascertainable. This is in return for the 90% interest in the mining tenement. | ($100,000) under item 1 of the table in paragraph 40-185(1)(b)

($80,000) under item 2 of the table in paragraph 40-185(1)(b) ($1,000) under item 4 of the table in paragraph 40-185(1)(b) $181,000 is the first element of cost of the interest in the mining tenement and immediately deductible if Farmee 2 Co's 90% interest is first used for exploration or prospecting – subsections 40-25(1) and 40-80(1) (See paragraphs 40 to 43 of this Ruling.) |

When Farmee 2 Co's interest in the mining tenement is first used for exploration or prospecting if it is immediately deductible.

Alternatively, when the interest in the mining tenement starts to decline in value under subsection 40-25(1). (See paragraphs 40 to 43 of this Ruling.) |

| 6 – Farmee 2 Co creates a contractual right in Farmor 2 Co for Farmee 2 Co to meet future joint venture cash calls that are contingent and the amounts unascertainable at the time of entering into the agreement. The capital proceeds for that right is so much of the interest in the mining tenement that relates to that right. | $1,000 – subsection 102-5(1)

CGT event D1 happens under section 104-35 $1,000 assessable capital gain assuming that there are no incidental costs (See paragraph 52 of this Ruling.) |

When Farmee 2 Co enters into the farm-out agreement as this is when the right is created.

(See paragraph 52 of this Ruling.) |

| 7 – Expenditure is incurred in meeting the exploration or prospecting expenses of the joint venture. | ($720,000)64 – subsection 40-730(1) or section 8-1

(See paragraphs 44 and 57 of this Ruling.) |

In the 2011–12 income year when the expenditure is incurred by the joint venture operator.

(See paragraphs 44 and 57 of this Ruling.) |

| 8 – Expenditure is incurred in meeting the exploration or prospecting expenses of the joint venture. | ($200,000) – subsection 40-730(1) or section 8-1

(See paragraphs 44 and 57 of this Ruling.) |

When the joint venture operator expends Farmee 2 Co's further contribution to the joint venture.

(See paragraphs 44 and 57 of this Ruling.) |

(b) After the paragraph, insert new paragraphs 77A to 77F:

77A. The net income tax outcome for Farmor 2 Co for the 2011–12 income year is $101,000.

77B. The net income tax outcome for Farmor 2 Co for the 2012–13 income year is deductions of $1,000.

77C. Overall, the income tax outcome for Farmor 2 Co is $100,000 taxable income.

77D. The net income tax outcome for Farmee 2 Co for the 2011–12 income year is deductions of $900,000.

77E. The net income tax outcome for Farmee 2 Co for the 2012–13 income year is deductions of $200,000.

77F. The overall income tax outcome for Farmee 2 Co is deductions of $1,100,000.

Omit 'Table 4 that follows. It assumes'; substitute 'Tables 8 and 9 of this Ruling. These tables assume'.

(a) Omit the wording of the paragraph; substitute:

Based on the facts, total consideration is not known at the time of the supply of the interest in the mining tenement. What is the total consideration depends on future events not within Farmor 2 Co's control. Therefore, the attribution rules as set out in Goods and Services Tax: Particular Attribution Rules Where Total Consideration Not Known Determination 2017 apply instead of the basic attribution rules.

| Event | GST payable and input tax credits (ITCs) | Attribution to a tax period (non-cash basis) |

| 1 – Farmor 2 Co makes a taxable supply of the 90% interest in the mining tenement to Farmee 2 Co. | GST payable of $18,000

(one-eleventh of $198,000 GST-inclusive) (See paragraphs 58 to 62 of this Ruling.) |

Assuming an invoice is issued for $198,000 (and any consideration received is not in excess of this amount and is not received in an earlier tax period) – the tax period in which the invoice is issued.

(See paragraphs 64 and 65 of this Ruling.) |

| 2 – Farmor 2 Co receives further consideration upon a further contribution to the joint venture by Farmee 2 Co on Farmor 2 Co's behalf. | GST payable of $2,000

(one-eleventh of $22,000 GST-inclusive) (See paragraphs 58 to 62 of this Ruling.) |

Assuming an invoice is issued for $22,000 (and is not received in an earlier tax period) – the tax period in which the invoice is issued.

(See paragraphs 64 and 65 of this Ruling.) |

| Event | GST payable and input tax credits (ITCs) | Attribution to a tax period (non-cash basis) |

| 3 – Farmee 2 Co makes a creditable acquisition of the 90% interest in the mining tenement. | ITC entitlement of $18,000

(one-eleventh of $198,000 GST-inclusive) (See paragraphs 58 to 62 of this Ruling.) |

The tax period in which Farmee 2 Co holds a tax invoice.

(See paragraphs 64 and 65 of this Ruling.) |

| 4 – Farmee 2 Co makes a further contribution to the joint venture on Farmor 2 Co's behalf. | ITC entitlement of $2,000

(one-eleventh of $22,000 GST-inclusive) (See paragraphs 58 to 62 of this Ruling.) |

The tax period in which Farmee 2 Co holds a tax invoice

(See paragraphs 64 and 65 of this Ruling.) |

(b) After the paragraph, insert new paragraphs 79A and 7B:

79A. The net GST outcome for Farmor 2 Co is $20,000 GST payable.

79B. The net GST outcome for Farmee 2 Co is a $20,000 net GST refund.

(a) Omit 'IT 2378'; substitute 'IT 2378 Income tax : capital gains : disposal of prospecting or mining right : disposal of right to receive income : farm-out arrangements'.

(b) Omit the wording of subparagraph (b); substitute:

Refer to the 'Immediate transfer farm-out arrangements' fact sheet for guidance (available through our Publication Ordering Service ) on the treatment of an immediate transfer farm-out arrangement that satisfies subsection 40-1100(1) of the ITAA 1997 and is entered into after 7:30 pm, by legal time in the Australian Capital Territory, on 14 May 2013.

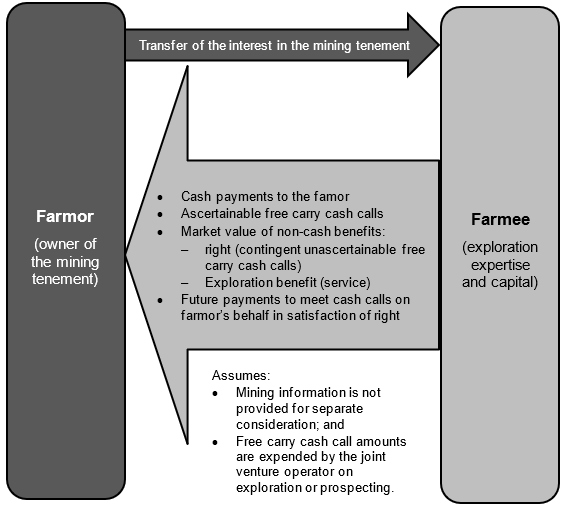

Omit the diagram; substitute:

Diagram 1: Characterisation of an immediate transfer farm-out arrangement

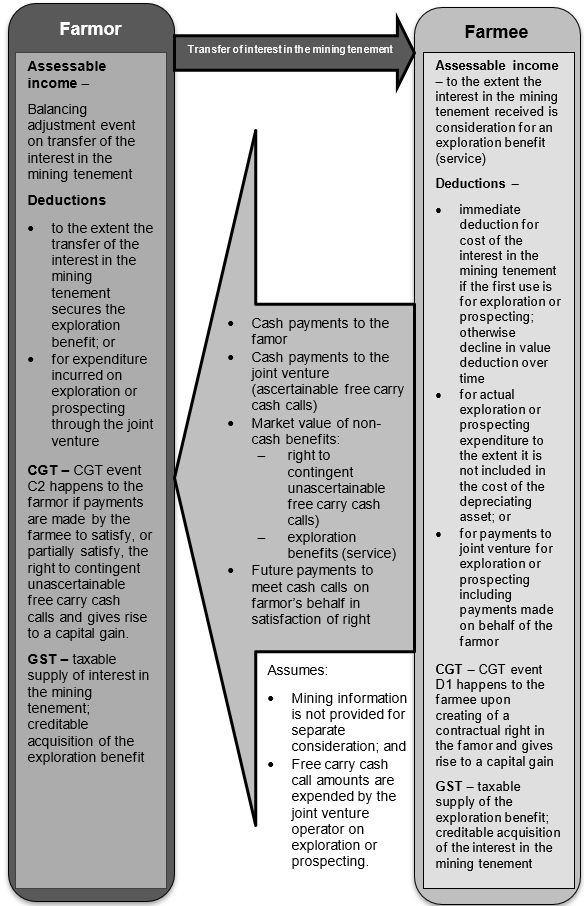

Omit the diagram; substitute:

Diagram 2: Usual income tax and GST consequences from the transfer of the interest in the mining tenement

(a) Omit '(Fourth Edition)'.

(b) After 'Macquarie Dictionary', insert new footnote 67A:

67A Pan Macmillan Publishers (2025), The Macquarie Dictionary online, www.macquariedictionary.com.au , accessed 26 November 2025.

(a) Omit both instances of '(Fourth Edition)'.

(b) After 'Macquarie Dictionary', insert new footnote 79A:

79A Pan Macmillan Publishers (2025), The Macquarie Dictionary online, www.macquariedictionary.com.au , accessed 26 November 2025.

(c) Omit 'the act of expending, disbursement or consumption'; substitute 'the act of expending; disbursement; consumption'.

(d) Omit 'Australian Concise Oxford Dictionary'; substitute 'Australian Oxford Dictionary79B.'.

(e) After 'Dictionary', insert new footnote 79B.

79B Oxford University Press (2004), Australian Oxford Dictionary, 2nd ed, www.oxfordreference.com , accessed 26 November 2025.

Omit the wording of the paragraph, including the quote; substitute:

Support for this view can be found in Oram (Inspector of Taxes) v. Johnson80 where Walton J states (emphasis added):

So I return to basically to para 4(1)(b) 'the amount of any expenditure." It seems to me that, although one does in general terms talk about expenditure of time and expenditure of effort, having regard particularly to the opening words of paragraph 4(1), where the expenditure is to be a "deduction," the primary matter which is thought of by the legislature in sub-sub-paragraph(b) is something which is passing out from the person who is making the expenditure. That will most normally and naturally be money, accordingly presenting no problems in calculation; but that will not necessarily be the case. I instance the case (it may be fanciful, but I think it is a possible one and tests the principle) of the taxpayer employing a bricklayer to do some casual bricklaying about the premises, the remuneration for the bricklayer being three bottles of whisky at the end of the week. It seems to me that that would be expenditure by the taxpayer, because out of his stock he would have to give something away to the person who was laying the bricks, and I do not think that that would present any real problems of valuation or other difficulty.

Omit the dot points; substitute:

- •

- whether the farmee exercises, or has a right to exercise immediately, the subject matter of the interest in the mining tenement. That is, whether the farmee:

- -

- has a right to explore the area covered by the mining tenement;

- -

- becomes a joint venture participant whereby the joint venture operator acts on behalf of the farmee and the other participants in exploring the tenement through expending funds from the joint venture account contributed to by the farmee;

- -

- becomes the joint venture operator thus acting on its own behalf as well as on behalf of other participants;

- •

- whether the farmee has a right to become the legal owner of the interest in the mining tenement; or

- •

- whether there are circumstances that would indicate that the farmee does not have a reasonable expectation of becoming the legal owner of the interest.

(a) Omit the wording of the paragraph; substitute:

In relation to the first consideration, if the applicable legislation or agreement provides that activities on the mining tenement cannot occur until the requisite approvals have been obtained, then the farmee cannot exercise, or have a right to exercise immediately, the subject matter of the interest in the mining tenement until those approvals have been obtained. This includes the application of any statutory provisions to the effect that the relevant transfer of title is of no force until it is approved and registered.84A

(b) After the paragraph, insert new footnote 84A:

84A Shell Energy Holdings Australia Limited v Commissioner of Taxation [2021] FCA 496 at [105–118], per Colvin J. Although this decision was appealed, this particular issue was not subject to appeal.

After 'legislation may', insert 'also'.

Omit the paragraph.

Omit the wording of the paragraph; substitute:

The following is a detailed contents list for this Ruling:

| Paragraph | |

| What this Ruling is about | 1 |

| Background | 4 |

| Immediate transfer farm out arrangement | 8 |

| Class of arrangement or scheme | 10 |

| Other rights under the arrangement | 11 |

| Applying this Ruling | 12 |

| Ruling | 14 |

| Characterisation of the arrangement | 14 |

| Mining information | 18 |

| Market valuation | 21 |

| Application of the UCA provisions to the farmor | 24 |

| Balancing adjustment event | 24 |

| Exploration or prospecting expenditure deductions if paragraph 15(i) of this Ruling applies | 28 |

| Exploration or prospecting expenditure deductions if paragraph 15(ii) of this Ruling applies (that is, it is a 'free-carry' arrangement) | 31 |

| Application of the UCA provisions to the farmee | 34 |

| Decline in value deduction for the interest in the mining tenement | 34 |

| When the farmee begins to hold the interest in the mining tenement | 34 |

| The cost of the interest in the mining tenement | 40 |

| The amount of the decline in value of the interest in the mining tenement | 41 |

| Exploration or prospecting expenditure deductions | 44 |

| Deduction for expenditure on mining information | 45 |

| Application of the CGT provisions | 46 |

| CGT consequences for the farmor – applicable whether paragraph 15(i) or 15(ii) of this Ruling applies | 46 |

| Additional CGT consequences for the farmor if paragraph 15(ii) of this Ruling applies (that is, it is a 'free-carry' arrangement) | 48 |

| CGT consequences for the farmee – applicable whether paragraph 15(i) or 15(ii) of this Ruling applies | 50 |

| Additional CGT consequences for the farmee if paragraph 15(ii) of this Ruling applies (that is, it is a 'free-carry' arrangement) | 52 |

| Application of the ordinary income and deduction provisions | 53 |

| Farmor sharing mining information for identified consideration | 53 |

| Farmee's reward for providing the exploration benefit | 55 |

| Farmee's exploration related expenditure | 57 |

| Application of the GST provisions | 58 |

| Mining information | 63 |

| Attribution rules | 64 |

| The net GST outcome | 66 |

| GST going concern | 69 |

| Examples | 71 |

| Example 1 – farmor receives a cash payment and an exploration benefit | 71 |

| Example 2 – farmor receives a cash payment and a 'free carry'by the farmee | 75 |

| Date of effect | 80 |

| Appendix 1 – Explanation | 82 |

| Part A – Diagrammatic representation of certain key issues | 83 |

| Part B – Approach to certain key issues | 85 |

| Exploration benefit | 85 |

| Market valuation | 95 |

| Part C – application of the income tax law | 104 |

| Application of the UCA provisions | 105 |

| Splitting of the mining tenement | 107 |

| Exploration or prospecting expenditure deductions | 110 |

| When the farmee begins to hold its interest | 123 |

| Application of sections 6-5, 15-2 and 15-40 of the ITAA 1997 | 129 |

| Farmor sharing mining information for identified consideration | 129 |

| Farmee's reward for providing the exploration benefit | 132 |

| Appendix 2 – Detailed contents list | 135 |

This Addendum applies on and from the date of publication.

Commissioner of Taxation

10 December 2025

© AUSTRALIAN TAXATION OFFICE FOR THE COMMONWEALTH OF AUSTRALIA

You are free to copy, adapt, modify, transmit and distribute this material as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).

References

ATO references:

NO 1-19NAY06U