Excise guidelines for the fuel industry

-

This document incorporates revisions made since original publication. View its history and amending notices, if applicable.

ABOUT THIS GUIDE

| 1 INTRODUCTION

3 LICENSING: Assessing applications 4 LICENSING: Suspension and cancellation |

OUR COMMITMENT TO YOU

The information in this publication is current at 27 June 2025.

We are committed to providing you with accurate, consistent and clear information to help you understand your rights and entitlements and meet your obligations.

If you follow our information in this Guide and it turns out to be incorrect, or it is misleading and you make a mistake as a result, we must still apply the law correctly. If that means you owe us money, we must ask you to pay it but we will not charge you a penalty. Also, if you acted reasonably and in good faith, we will not charge you interest.

If you feel that this Guide does not fully cover your circumstances, or you are unsure how it applies to you, you can seek further assistance from us.

About this Guide

This Guide is intended to be a reference tool for the fuel industry to assist its members to meet their excise obligations. It contains information about the excise system and how it applies to fuel products that are manufactured or produced (hereafter the reference to 'manufacture' or 'manufactured' is a reference to 'manufactured or produced', 'manufacture or produce' or 'manufacture or production' having regard to the relevant context unless otherwise specified) in Australia.

The Guide will provide you with a broad outline of excise law and your compliance obligations – it does not cover every aspect of how excise law applies to every situation.

If this Guide does not fully cover your circumstances, seek help from us or a professional adviser. Contact us via:

- •

- ATO Online Services

- •

- phone 1300 137 290 , or

- •

- write to us at

- Australian Taxation Office

PO Box 3514

ALBURY NSW 2640

We will ordinarily respond to electronic requests within 28 business days and finalise private rulings within 28 days of receiving all necessary information. If we cannot respond within 28 days, we will contact you within 14 days to obtain more information or negotiate an extended response date.

TERMS WE USE

When we say 'you', we mean you as a member of the fuel industry who is either registered or wishes to register for excise.

Some technical terms used in this Guide may be new to you – some are defined in the legislation, others are not. These are indicated in quotation marks when first used and are explained at the end of that chapter.

The terms CEO, Collector, and Commissioner are all used in the legislation in reference to various officers. In most instances in this Guide we have not used these specific terms and simply refer to 'us' or 'we'.

Copyright notice

© Australian Taxation Office for the Commonwealth of Australia

You are free to copy, adapt, modify, transmit and distribute this material as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).

1 INTRODUCTION

1.1 PURPOSE

This Chapter deals with:

- •

- what excise is

- •

- an overview of excise legislation relevant to fuel

- •

- who administers excise, and

- •

- when you are involved in the excise system.

It provides a general introduction to excise as it relates to 'fuel products'.

1.2 WHAT EXCISE IS

The Commonwealth of Australia Constitution Act (Constitution) provides that only the Commonwealth can impose duties of excise.[1]

In Ha v New South Wales[2] (Ha), the High Court explained a duty of excise as follows[3]:

… duties of excise are taxes on the production, manufacture, sale or distribution of goods, whether of foreign or domestic origin. Duties of excise are inland taxes in contradistinction from duties of customs which are taxes on the importation of goods.

Excise imposed by the Excise Tariff Act 1921 is imposed on goods dutiable under the Schedule to that Act (Schedule) and manufactured or produced in Australia. It can be seen that this clearly fits the definition of duty of excise as described by the High Court in the Ha case.

1.3 OVERVIEW OF EXCISE LEGISLATION

The principal legislative framework for the excise system, relating to fuel, is contained in the:

- •

- Excise Tariff Act 1921 (Excise Tariff Act)

- •

- Excise Act 1901 (Excise Act), and

- •

- Excise Regulation 2015 (Excise Regulation).

The Excise Tariff Act imposes excise on certain goods manufactured or produced in Australia[4] and the Excise Act sets out the administration of excise duties. The imposition of excise duties is in a separate Act to their administration because the Constitution provides that laws imposing taxation (such as excise) shall only deal with the imposition of tax.

To change the Excise Tariff Act, an amending Act must be passed through Parliament. However, there are parliamentary procedures which allow for changes to the excise tariff to apply immediately, pending amendment of the Act through Parliament. These procedures are known as tariff proposals.

There are 3 key provisions in the Excise Tariff Act that operate to:

- •

- impose excise duty

- •

- identify excisable goods and the applicable duty rates (the Schedule), and

- •

- index the duty rate.

Imposition of excise duty

Section 5 of the Excise Tariff Act imposes excise duty on goods that are listed in the Schedule and manufactured or produced in Australia. Excise duty is imposed at the time of manufacture or production of the relevant goods. The Schedule lists the various goods that are subject to excise and the rate of duty applicable. It is sometimes referred to as the excise tariff.

The Schedule of excisable goods and the duty rates

The Schedule is a table that lists the goods manufactured or produced in Australia that are subject to excise duty. These are called 'excisable goods'. The goods that are currently subject to excise fall within 3 broad groups:

- •

- alcoholic beverages (other than wine) and spirits

- •

- cigarettes and other tobacco products, and

- •

- fuel and oils.

Within those 3 broad groups, the Schedule provides 8 different items and those items are (in most cases) further broken down into subitems. The table contains a description of the items and subitems and provides the rate of duty applicable to them.

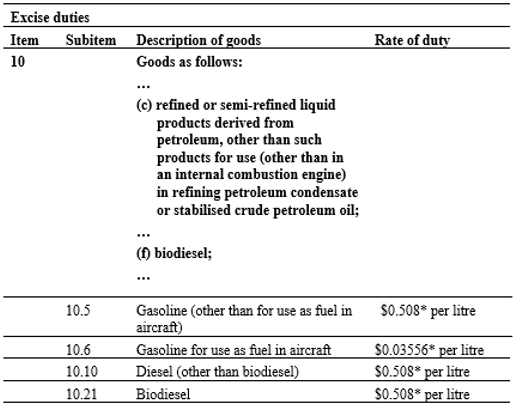

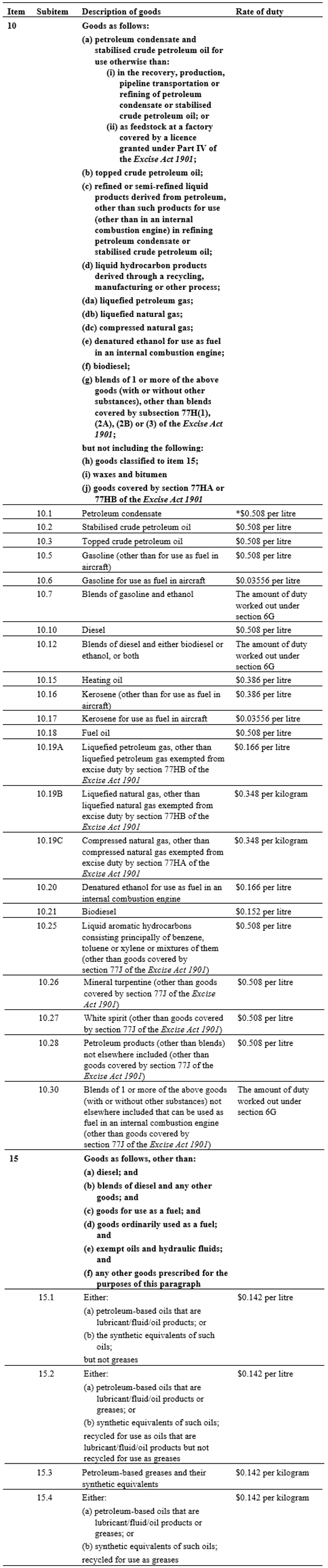

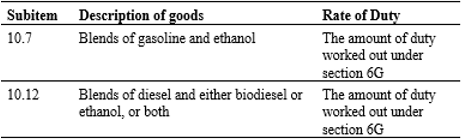

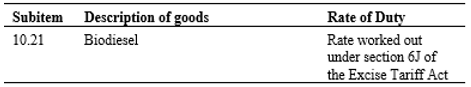

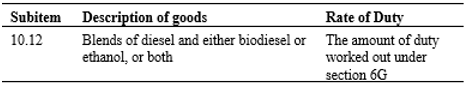

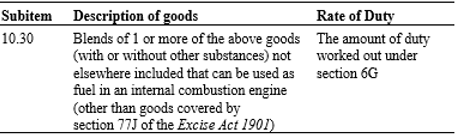

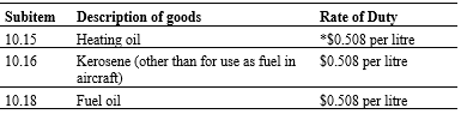

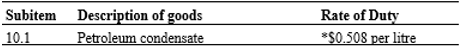

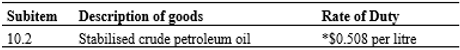

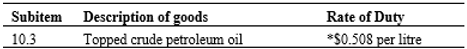

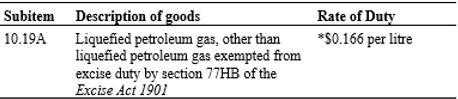

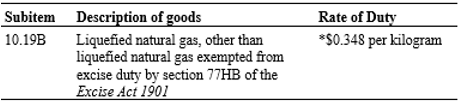

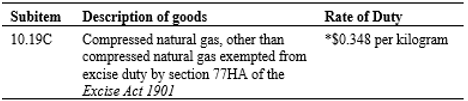

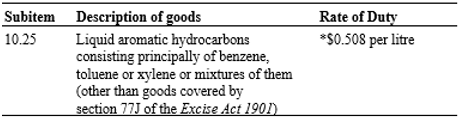

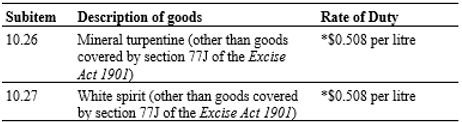

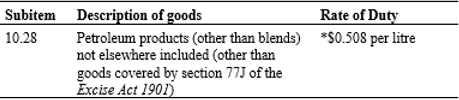

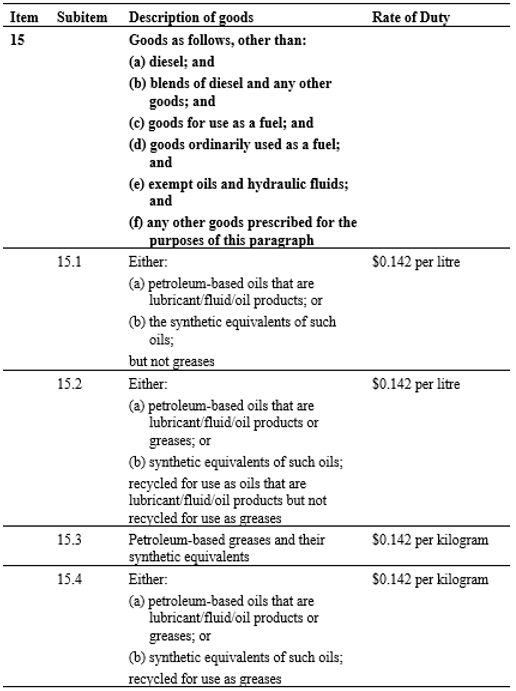

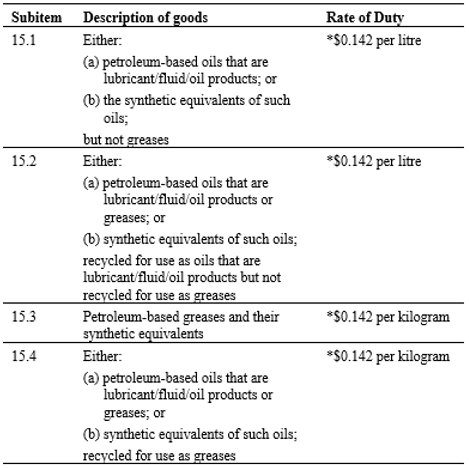

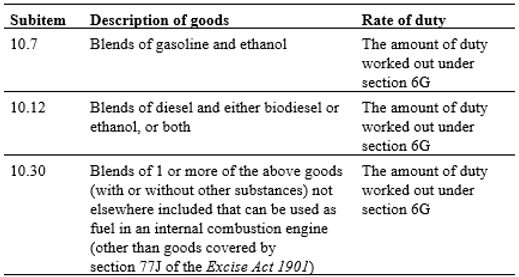

The following is an extract from the fuel products section of the table.

Figure 1: Extract of the table in the Schedule to the Excise Tariff Act

*Rate of duty as at 3 February 2025. For the current rates of duty, refer to Excise duty rates (referred to in this Guide as the Tariff working page or working tariff).

While we use the term 'fuel', the Schedule also includes goods that are not ultimately used as a fuel (in transport or for combustion), and as a result goods like paint thinners are classified to the Schedule even though they are not used as a fuel.

This Guide does not cover stabilised crude petroleum oil or condensate classified to items 20 and 21 respectively of the Schedule.

Indexation of the duty rate

The rates of excise duty are set out in the Schedule. However, section 6A of the Excise Tariff Act provides that the rates of duty may increase every 6 months (generally 1 February and 1 August). The amount of any increase is calculated by reference to the All Groups Consumer Price Index published quarterly by the Australian Bureau of Statistics.

These increases are commonly referred to as indexation. We publish these in the Commonwealth Gazette and, for ease of reference, we provide a working tariff which shows an up-to-date rate taking account of the indexation increases.

Indexation increases also apply to rates set under a tariff proposal.

Tariff proposals

Tariff proposals[5] are a means of changing the excise tariff so that the change is effective from the time it is proposed rather than after the enactment of an excise tariff amendment Act. Rates may be adjusted up or down or products may be added or removed under a tariff proposal.

Changes to the excise tariff can be notified in the Parliament or, if the Parliament is not sitting, by notice in the Gazette. We then apply the proposal as if it is law.

The tariff proposal is required to be validated by an Act within 12 months giving retrospective effect to the date of the proposal.[6]

You cannot commence proceedings against us for any action taken to collect the amount set by the tariff proposal during the periods specified in section 114 of the Excise Act unless it is sanctioned by a Supreme Court of a state or territory.[7]

Effectively this means you need to pay in line with a tariff proposal. Any increases in rates or introduction of new products through a tariff proposal must ultimately be levied by an amending Act, but we will protect the revenue by collecting amounts in line with the proposal.

If an amending Act validating the changes outlined within the tariff proposal is not passed within the prescribed periods, any additional amounts will be refunded to you.

All excisable goods are subject to our control

Under section 61 of the Excise Act, all excisable goods are subject to the CEO's control until they are delivered for home consumption or exported to a place outside Australia. Excisable goods subject to the CEO's control are called 'underbond' goods.

The CEO is the Commissioner of Taxation.

Goods are delivered for home consumption when they are released into the Australian market in an authorised manner, whether through the lodgment and passing of an entry or under a periodic settlement permission.

Manufacture, storage and movement of excisable fuel products

Before you can legally manufacture 'excisable fuel products' you need a manufacturer licence granted under the Excise Act.[8] Under this licence you are also permitted to store excisable goods of a kind specified in the licence upon which duty has not been paid including like products that you did not manufacture It is an offence to manufacture excisable goods unless you have an excise manufacturer licence that specifies the goods you intend to manufacture.

If you are not a manufacturer, or you wish to store excisable goods upon which duty has not been paid and that are not of a kind specified in your manufacturer licence, you need a storage licence granted under the Excise Act that specifies the kind of excisable goods you wish to store.[9]

Before you can remove excisable fuel products from premises covered by a licence, on which duty has not been paid, you need permission (a movement permission) granted under the Excise Act.[10]

There are several types of movement permission that we can issue. These include:

- •

- a 'one-off' permission to move goods specified in the permission to another place specified in the permission

- •

- an ongoing permission to move goods of a kind specified in the permission to another place specified in the permission (and such a permission remains in place until revoked)

- •

- an ongoing permission to move goods of a kind specified in the permission to any other place licensed to manufacture or store goods of that kind

- •

- permission to deliver goods for export.

Generally, we will not grant permission to move excisable fuel products on which duty has not been paid to a place that is not covered by either a manufacturer licence or a storage licence or unless the place is a wharf or airport and the goods are for export.

Payment of duty on excisable fuel products

The Excise Tariff Act imposes duty when excisable fuel products are manufactured. The Excise Act specifies when the duty must be paid, how and what you must report to us, the relevant time to determine the rate of duty in force and provides a mechanism to require payment where duty has not been correctly accounted for on excisable fuel products.

In general terms, duty must be paid on the goods before they are delivered from premises covered by a licence (other than being delivered to another premises covered by a licence). Permission may be granted to deliver the goods prior to paying the duty.

The Excise Regulation sets out provisions in relation to excisable goods such as:

- •

- refunds and remissions, and

- •

- drawbacks.

1.4 ADMINISTRATION OF EXCISE

The Commissioner of Taxation has the general administration of the Excise Act and the Excise Tariff Act.[11] This means you deal with the Australian Taxation Office (ATO) for Australian-manufactured fuel products.

Customs duty applies to imported fuel products. The Australian Border Force (ABF) is responsible for administration of the Customs Act 1901 (Customs Act) and Customs Tariff Act 1995 (Customs Tariff Act); however, the ATO has been delegated responsibility for administering imported fuel that is warehoused under the Customs Act.

However as most bulk imported fuel is blended in Australia with other fuel when transferred into storage tanks, the fuel is considered to be manufactured in Australia and as a result the duty liability transfers from the customs regime into the excise regime.

Who you need to deal with is summarised in Table 1.

| Type of fuel product | ABF | ATO |

|---|---|---|

| Australian-manufactured fuel products | No | Yes |

| Imported fuel products not for further manufacture in Australia | Yes | No |

| Imported fuel products for further manufacture in Australia | Yes | Yes |

1.5 INVOLVEMENT IN THE EXCISE SYSTEM

You are involved in the excise system if you:

- •

- manufacture fuel products (excisable goods)

- •

- store or own fuel products on which duty has not been paid, or

- •

- are seeking a refund, remission or drawback of excise duty.

1.6 MORE INFORMATION

If you need more information on excise, as it relates to fuel, contact us via:

- •

- ATO Online Services

- •

- phone 1300 137 290 , or

- •

- write to us at

- Australian Taxation Office

PO Box 3514

ALBURY NSW 2640

We will ordinarily respond to written information requests within 28 days. If we cannot respond within 28 days, we will contact you within 14 days to obtain more information or negotiate an extended response date.

Most of your business reporting and transactions can be done through ATO Online Services.

1.7 TERMS USED

Excisable goods are goods on which excise duty is imposed. Excise duty is imposed on goods that are listed in the Schedule and manufactured or produced in Australia.

As this Guide deals with fuel products, we have used the term excisable fuel products.

Excisable fuel products include:

- •

- petrol

- •

- diesel

- •

- crude petroleum oil

- •

- condensate

- •

- heating oil

- •

- kerosene

- •

- liquid hydrocarbon solvents

- •

- fuel ethanol

- •

- biodiesel

- •

- compressed natural gas (CNG)

- •

- liquefied natural gas (LNG), and

- •

- liquefied petroleum gas (LPG).

While oils and grease classified to item 15 of the Schedule to the Excise Tariff Act are not technically fuel, we have included them in this generic term in this Guide.

This Guide does not cover stabilised crude petroleum oil or condensate classified to items 20 and 21 respectively of the Schedule.

1.8 LEGISLATION (quick reference guide)

In this Chapter, we have referred to the following legislation:

- •

- Excise Act 1901

- –

- section 4 – definitions

- –

- section 7 – general administration of Act

- –

- section 25 – only licensed manufacturers to manufacture excisable goods

- –

- Part IV – manufacture, storage, producer and dealer licences

- –

- section 61A – permission to remove goods that are subject to CEO's control

- –

- section 114 – time for commencing action

- •

- Excise Tariff Act 1921

- –

- section 1A – general administration of Act

- –

- section 5 – duties of excise

- –

- section 6A – indexation of rates of duty

- –

- The Schedule

- •

- Constitution

- –

- section 90 – exclusive power over customs, excise, and bounties

Amendment history

| Part | Comment |

|---|---|

| 1.3.1 | Updated to reflect the current duty rates. |

| Throughout | Updated in line with current ATO style and accessibility requirements. |

Copyright notice

© Australian Taxation Office for the Commonwealth of Australia

You are free to copy, adapt, modify, transmit and distribute this material as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).

2 LICENSING: Applications

2.1 PURPOSE

This Chapter deals with:

- •

- why there is a licensing regime

- •

- what a licence is

- •

- different licence types

- •

- what records need to be kept

- •

- responsibilities of a licence holder

- •

- how long a licence is valid for

- •

- whether licences are transferable

- •

- disclosure of your licensing information

- •

- how to register for excise

- •

- how to apply for a licence

- •

- how to change your licence details, and

- •

- penalties that can apply to offences in relation to licences.

2.2 INTRODUCTION

2.2.1 WHY THERE IS A LICENSING REGIME

The excise duty attached to 'excisable fuel products' forms a significant component of the overall value of the goods. A licensing regime helps the CEO maintain control of excisable goods and ensure the correct amount of duty is paid.

A licence enables you to manufacture or store excisable goods, or both. If you undertake these activities without a licence or contravene your licence conditions you are committing an offence and may be prosecuted.

A licence is issued to a specific entity and specifies the premises[12] where the activities may be undertaken. A licence may specify one or more premises and an entity may have multiple licences.

Licences can be issued to:

- •

- individuals

- •

- partnerships and companies in their own right, and

- •

- individuals and companies in their capacity as trustees.

There may be different licensing processes depending on the type of entity applying for the licence.

2.3 POLICY AND PRACTICE

There are 2 licence types:

- •

- manufacturer, and

- •

- storage.

A licence may specify one or more premises at which excisable goods may be manufactured or stored. A licence that only specifies one premises (single premises licence) also includes details of the kinds of goods allowed to be manufactured or stored and any conditions to which the licence is subject.

A licence issued to an entity in respect of multiple premises (entity level licence) will contain a schedule showing the address for each premises covered, goods allowed to be manufactured or stored in those premises and any conditions to which the licence is subject.

Broadly, if you have a manufacturer licence covering one premises and a separate storage licence covering another premises and you want to consolidate your licences, you will need an entity level manufacturer licence. This is because by limitation of the definition of the 2 licence types, an entity cannot undertake manufacture of excisable goods at premises that are not licensed for that manufacture.

If you have an entity level licence, you may also receive a general movement permission, which will allow you to move 'underbond' goods of a kind specified in your permission from any premises covered by your licence to any other premises licensed to manufacture or store goods of that kind.

Manufacturer licence

You need a manufacturer licence to manufacture excisable goods.[13] The goods can only be manufactured at premises specified in your licence.[14]

'Manufacture' is defined in the Excise Act to include all processes in the manufacture of excisable goods.[15]

Guidance on how the courts would interpret the term 'manufacture' may be found in court decisions examining the meaning of 'manufacture' in the context of other legislation.

In summary, the courts have given the word 'manufacture' the meaning of either producing a thing which is different from its inputs or bringing a new article into existence by skill or knowledge.[16]

Processes that involved the application of knowledge, the application of skill, experience, services or labour which results in the conversion of materials into a saleable commodity may fall within the definition of 'manufacture'. The commodity must be different from the inputs which went into making it.

In an excise context, the conversion may result in a change in physical or chemical properties (or both) of goods, for example, in colour, shape, density, viscosity, distillation temperature, composition, texture, aroma or taste.

We consider that these common activities in relation to fuel are manufacture:

- •

- certain crude oil and condensate production

- •

- petroleum refining

- •

- certain blending[17]

- •

- recycling[18]

- •

- biodiesel manufacture

- •

- fuel ethanol manufacture

- •

- production of LPG or LNG

- •

- production of CNG for transport use.

Excise manufacturer licences specify the manufacturing activity or activities permitted. For example, your licence may show approved activities such as:

- •

- oil refining

- •

- recycling

- •

- biodiesel manufacture, etc.

You must have a manufacturer licence before starting to manufacture excisable fuel products. This means that you cannot test your manufacturing equipment or produce samples to market to potential buyers if you do not hold a licence.

Exemptions from excise duty

The Excise Act and Excise Tariff Act specifically exclude certain activities from being excise manufacture. They also exempt certain goods from excise duty.

If you only undertake activities specifically excluded from being excise manufacture, or manufacture goods that are specifically exempt from excise duty, you do not need a manufacturer licence. However, a manufacturer licence is still required to lawfully manufacture goods which have a 'free' duty rate or are eligible for a full remission of duty.

LPG and LNG are exempt from excise duty when a licensed manufacturer uses the fuel at premises specified in a manufacturer licence in the process of manufacturing:

- •

- petroleum condensate or stabilised crude petroleum oil, or

- •

- LPG, LNG or other hydrocarbons.

This is provided the manufacture of the goods is done in accordance with a manufacturer licence.[19]

CNG is exempt from excise duty if compressed for use other than as a fuel in a motor vehicle. There are some instances when CNG is compressed for use in a motor vehicle and is also exempt, specifically where CNG is:

- •

- compressed other than in the course of carrying on an enterprise, or

- •

- compressed at residential premises in equipment that is not capable of compressing more than 10 kilograms per hour or an amount per hour specified in the regulations, and the CNG is not sold or otherwise supplied in the course of carrying on an enterprise.

CNG is also exempt if it is compressed for use in forklifts primarily off public roads, or motor vehicles of a kind prescribed in the regulations.[20]

Certain liquid fuels are also exempt from excise duty when used in refining of petroleum condensate or stabilised crude petroleum oil. This exemption applies as these goods are not classified to item 10 of the Schedule to the Excise Tariff Act. However, fuel for use in an internal combustion engine within a refinery is not exempt.

The blending of fuel is manufacture for the purposes of the Excise Act if it is of one or more of the following (with or without other substances)[21]:

- •

- petroleum condensate or stabilised crude petroleum oil

- •

- topped crude petroleum oil

- •

- refined or semi-refined liquid petroleum products derived from petroleum

- •

- liquid hydrocarbon products derived through recycling manufacturing or any other process

- •

- denatured ethanol for use as fuel in an internal combustion engine

- •

- biodiesel

- •

- LPG

- •

- LNG, or

- •

- CNG.

However certain blending of those products is excluded from being manufacture.[22] This is where:

- •

- the blending is of goods that have all had duty (customs or excise) paid, and apart from denatured ethanol for use as fuel in an internal combustion engine or biodiesel, the rate of each of those duties is the same[23]

- •

- the product is covered by a determination made under subsection 95-5(1)[24] of the Fuel Tax Act 2006 (Fuel Tax Act)[25]

- •

- the product is covered by a determination under subsection 77H(4) of the Excise Act[26], or

- •

- blends of one type of gaseous fuel where excise or customs duty has been paid on all fuel components of the blend at different rates and no remission has applied to any of the fuel.

Using imported fuel products in the manufacture of excisable fuel products

Imported fuel products are subject to customs duty at a rate that is equivalent to the duty on excisable fuel products (except for denatured ethanol for use as fuel in an internal combustion engine or biodiesel). If you intend to use imported fuel products in the manufacture of excisable products you will not need to pay the customs duty if you follow the provisions in the Customs Act.[27] If you have any questions regarding this you should contact the ABF.

In general, if your premises are specified in an excise manufacturer licence and also in a customs warehouse licence you can enter the imported fuel products for warehousing and then use the imported fuel products to manufacture excisable goods. The liability to pay the customs duty on the imported fuel products is extinguished (except for any ad valorem duty that is payable) upon the manufacture of excisable goods.[28] You will then be liable to pay excise duty on the excisable fuel products.

Example 2A

Michaels Renewable Fuels imports 10,000 litres of renewable diesel which it intends to blend with mineral diesel obtained underbond (duty not paid) from a local refiner to produce an R20 blend to be sold into the Australian marketplace.

Michaels Renewable Fuels has a customs warehouse licence for the facility where the imported renewable diesel will be stored. Michaels Renewable Fuels also has an excise manufacturer licence for the same facility.

The renewable diesel is entered for warehousing with the ABF at the time it is imported using a warehouse declaration entry form.

Michaels Renewable Fuels blends the 10,000 litres of renewable diesel with 40,000 litres of locally manufactured diesel and reports the 10,000 litres of renewable diesel used in the blend to the ABF by completing a Nature 30 form (N30).

Michaels Renewable Fuels delivers the 50,000 litres of R20 blend into the Australian domestic market in accordance with their 'periodic settlement permission ' and pays the applicable excise duty to the ATO.

Michaels Renewable Fuels is not required to pay customs duty on the imported renewable diesel product as it was entered for warehousing and used in the manufacture of excisable goods.

You can only manufacture goods at the premises specified in your licence.[29] We may also give you written directions about what parts of your factory any manufacturing process may be undertaken in and where inputs used in manufacture, and excisable fuel products, respectively are to be kept.[30]

Storage licence

If you have a manufacturer licence that covers only one premises and you wish to store excisable fuel products upon which duty has not been paid at a place that is not specified in your licence you will either require a separate storage licence for that premises or vary your existing licence to cover an additional premises. As fuel blending is considered to be manufacture for excise purposes, storage licences for fuel are generally only applicable where the only fuel products to be stored there are packaged goods that will not undertake any further blending or other forms of manufacture.

If you do not manufacture excisable goods at a particular premises but wish to store excisable goods upon which duty has not been paid, (whether owned by you or someone else), you will require a storage licence.

Regardless of who owns the goods, anyone who has, or has been entrusted with the possession, custody or control of excisable goods is responsible for the security of the goods and may be liable to pay an amount equivalent to the duty if excisable goods subject to the CEO's control are not kept safely or are not satisfactorily accounted for.[31]

A storage licence will specify the type of excisable fuel products and premises covered by the licence. It will also specify the activities, if any, you can undertake in relation to those goods (such as packaging in bottles, tins or drums), and whose excisable goods you can store.[32]

2.3.2 RESPONSIBILITIES OF A LICENCE HOLDER

You are responsible for the secure storage of all excisable fuel products held on your premises or under your control (or direction) and must store excisable fuel products only at premises that are covered by your licence.[33]

You must be able to account for the excisable goods in your possession, custody or control to our satisfaction when requested to do so.

You may be responsible for paying an amount equal to the excise duty that would have been payable on any stolen, missing or unaccounted for excisable fuel products.[34]

If we take stock of excisable fuel products manufactured, and the materials you use in the manufacturing process, and it appears to us that not all the duty that should have been paid has been paid, you must pay the difference between the amount paid and the amount that should have been paid unless you can account for the deficiency to our satisfaction.[35]

You must not move underbond excisable fuel products without our approval. This includes moving excisable fuel products from premises covered by your licence to any other location or for export.[36]

You must comply with the Excise Act and all the conditions of your licence.[37]

You must keep, retain and produce records in accordance with a direction under 'section 50' of the Excise Act.

You must ensure excisable fuel products are only delivered into 'home consumption' with appropriate authority, such as in accordance with a periodic settlement permission or Delivery authority.[38]

You must pay the correct amount of excise duty if you are the owner or manufacturer and you deliver the goods into home consumption.[39]

You must provide all reasonable facilities to enable us to exercise our powers under the Excise Act.[40]

You must provide sufficient lights, correct weights and scales, and all labour necessary for:

- •

- weighing material received into your factory

- •

- weighing all excisable goods manufactured in your factory, and

- •

- taking stock of all material and excisable goods contained in your factory.[41]

Access

We have the right to enter premises covered by your licence at any time and can examine and take account of all the goods at the premises.[42] Note: we will usually only seek to enter your premises during normal business hours.

Stop vehicles

We can stop any vehicle leaving premises covered by your licence and check that there is proper documentation for excisable fuel products leaving the premises. We can question the driver about any goods in the vehicle. We can direct that the vehicle be unloaded and goods taken to particular parts of the premises for further examination. We must not detain a vehicle for longer than is necessary to do the checking.[43]

Search vehicles

We can stop and search any vehicle (not just vehicles leaving a premises covered by a licence) without a warrant if we have reasonable grounds for believing that the vehicle contains excisable fuel products and that the vehicle has been used, is being used or will be used in the commission of an offence under the Excise Act (and certain offences in the Crimes Act 1914 (Crimes Act)[44] and Criminal Code[45] relating to accessory after the fact, attempt to commit an offence, aid and abet someone to commit an offence and conspiracy to commit an offence).[46]

Examine goods

We can open packages and examine, weigh, mark and seal any excisable fuel products that are subject to 'excise control' and, if you are a manufacturer, lock up, seal, mark or fasten any fuel products in or on your factory.[47]

We can also:

- •

- supervise the manufacture of excisable fuel products[48], and

- •

- take samples of materials, partly manufactured excisable fuel products and excisable fuel products subject to excise control, and fuel products that we have reasonable grounds for suspecting are excisable fuel products on which duty has not been paid.[49]

The Excise Act provides that a licence holder shall[50]:

- (a)

- keep such records and furnish such returns as directed

- (b)

- keep these records for the period directed, and

- (c)

- on demand, produce those records to us.

Any such direction will be in writing and included with your licence. We can amend this direction at any time and will provide written notification of this to you.

We can inspect and take copies of any records kept as directed.

If you cease to hold an excise licence you must still keep all records of your previously licensed activities. Records must be kept for the period of time as directed.

Your licence does not have an expiry date. Your licence stays in force until it is cancelled either by the Collector[51] or at your request.[52]

Generally you cannot transfer your licence to another individual, business entity or premises. The proposed new licence holder must apply for a new licence. You must also request cancellation of your current licence if you are no longer carrying out an excise activity. It is important that you advise us of any change before it takes effect.

The exception to the above rule arises when a licence holder dies. If this is the case, the licence is taken to be transferred to the person's legal personal representative. This allows for the finalisation of the affairs and, unless cancelled earlier, the licence is taken to be automatically cancelled 3 months after the licence holder dies.[53]

2.3.7 DISCLOSING LICENSING INFORMATION

As well as the protection provided by the Privacy Act 1988, the tax laws have secrecy provisions about using and disclosing taxpayer information. We can only look at, record, discuss or disclose information about you when it is a necessary part of our work, or where the law specifies that we may.

Subdivision 355-B of Schedule 1 to the Taxation Administration Act 1953 (TAA) allows us to record or disclose information about you in certain circumstances. For example, the Excise Act specifically allows us to disclose information about you to the ABF.

In relation to licensing information, the TAA specifically allows us to disclose information about:

- •

- whether another person holds a current excise licence, and

- •

- any conditions that apply to their licence.

The ATO is lawfully required to publish and maintain a public register on the ATO website, disclosing the name of the licence holders, their Australian Business Number (ABN) and the name of the Act under which the licence was granted.[54] This will assist business to identify entities that are licensed to manufacture and store excisable and excise equivalent goods.[55]

Information may be disclosed by us in the performance of our duties and would cover disclosing information:

- •

- to a person dealing or proposing to deal with another person in relation to goods subject to excise control, and

- •

- provided we are satisfied that disclosure is necessary for the purposes of ensuring the dealing or proposed dealing is in accordance with excise law.

Example 2B

Raul is licensed under the Excise Act to manufacture biodiesel. Tim also has a licence to manufacture issued under the Excise Act to allow him to blend biodiesel with diesel to produce biodiesel blends. Tim wants to buy 10,000 litres of biodiesel underbond from Raul. Raul contacts us to check that Tim's licence to manufacture is still current. We are permitted to divulge details of Tim's licence to Raul to allow Raul to fulfil his obligations under the Excise Act

Example 2C

Janice manufactures fuel at her licensed premises. Janice's storage tanks are full and she needs to find additional storage space for her finished fuel products. Ryan offers to store her fuel underbond. Before delivering her fuel underbond to Ryan's premises, Janice needs to check that Ryan's premises are covered by a manufacturer licence to manufacture and store excisable fuel products, and so contacts the ATO.

If we decide that the disclosure is necessary, we must provide the information in writing to the person who requires it. If the matter is urgent, we may advise by phone. However, we must later confirm the information in writing.

Anyone who receives licensing information should use it only for the purpose for which it was given. Any other use may be unlawful.

Note: the TAA imposes certain obligations on you concerning the on-disclosure of information that affects another person.[56] The Privacy Act 1988 imposes certain obligations on you concerning the privacy of information that you have received about an individual. Further information can be obtained from the Office of the Australian Information Commissioner.

Our decision in relation to the disclosure of protected information is not a reviewable decision. However, you have the right to make a complaint to the Commonwealth Ombudsman about a range of administrative actions we take or the Australian Information Commissioner if you think we have breached the Privacy Act 1988 in dealing with your personal information.

2.4 PROCEDURES

You must register for excise before you can be issued with a licence to store or manufacture excisable fuel products.

While it is not compulsory to provide an ABN or tax file number (TFN) for registration, it will help us to process your application.

If you need an ABN, phone 1300 657 162 for a registration pack. You can lodge your completed ABN registration form with your completed excise registration application.

If you would like to apply for a manufacturer or storage licence:

- •

- contact us by phone on 1300 137 290 , and

- •

- lodge an Excise registration together with all the required supporting documents (see below).[57]

Our staff will:

- •

- discuss your particular circumstances with you

- •

- give you advice about the appropriate licence or licences

- •

- explain how to apply

- •

- explain your ongoing obligations as a licence holder, and

- •

- provide you with a licence application form.

Before lodging your application form, make sure you have included the required supporting documents. Your application form contains information to help you work out which supporting documents you must provide. You may also need to complete other excise forms, depending upon your proposed activities.

Supporting documents include:

- •

- an accurate plan of the premises that clearly indicates the area for manufacture or storage

- •

- a Fit and proper person declaration

- •

- an application for permission to move underbond, and

- •

- if requested by us, a Consent to a national criminal history check - excise.

- •

- lodge online using ATO Online Services, or

- •

- post them to

- Excise Licensing Group

Australian Taxation Office

PO Box 3514

ALBURY NSW 2640

We will ordinarily respond to written information requests within 28 days. If we cannot respond within 28 days, we will contact you within 14 days to obtain more information or negotiate an extended response date

Applying to vary a licence

Where you hold an existing manufacturer or storage licence, you can apply to vary your licence[59] to:

- •

- add new premises to your existing manufacturer or storage licence

- •

- remove one or more of the premises from your licence (as long as your licence will still cover at least one premises)

- •

- consolidate your existing licences into one licence that covers multiple premises.

Example 2D

Frank's Fuel Pty Ltd, operating under one ABN holds one storage and 3 manufacturer licences and wants to consolidate the licences into one licence. Frank's Fuel therefore apply to vary one of their existing manufacturer licences to cover the additional premises covered in the 3 other licences.

The ATO grants the variation with the existing nominated manufacturer licence covering all the premises and notifies in writing of the cancellation of the other 3 licences, as they no longer cover any premises.[60] As part of the new entity level licence, Frank's Fuel are issued a schedule which specifies the premises covered, the type of excisable goods that can be manufactured and stored, activities authorised to be undertaken at the premises and any special conditions imposed on the licence.

We will ordinarily respond to written information requests within 28 days. If we cannot respond within 28 days, we will contact you within 14 days to obtain more information or negotiate an extended response date.

2.4.3 CHANGING LICENCE DETAILS

We can amend your licence for changes that do not involve a change of entity or physical location. This includes a change of:

- •

- business name (that is your trading name)

- •

- postal address, or

- •

- street name or property address made by a relevant authority.

A change in composition of a partnership does not affect the continuity of the partnership's licence. Any one or more of the partners may act on behalf of the partnership in notifying changes.[62]

You must advise us of any of these changes within 30 days. We will then provide you with an amended licence.

If you need more information on licensing matters, contact us via:

- •

- phone 1300 137 290

- •

- ATO Online Services, or

- •

- write to us at

- Australian Taxation Office

PO Box 3514

ALBURY NSW 2640

2.5 PENALTIES THAT CAN APPLY IN RELATION TO LICENCES

The following are the penalties that may apply after conviction for an offence.

Manufacture

If you manufacture excisable fuel products without a manufacturer licence, the penalty is a maximum of 2 years in prison or the greater of 500 'penalty units' and 5 times the amount of duty on the excisable fuel products.[63]

If you manufacture excisable fuel products contrary to the Excise Act or any conditions specified in your licence, the penalty is a maximum of 2 years in prison or 500 penalty units.[64]

If you manufacture excisable fuel products at premises that are not specified as manufacturing premises in your licence, the penalty is a maximum of 2 years in prison or the greater of 500 penalty units and 5 times the amount of duty on the excisable fuel products.[65]

Keeping or storing excisable goods without permission

If you possess or have custody or control of excisable fuel products without permission, the penalty is a maximum of 2 years in prison or the greater of 500 penalty units and 5 times the amount of duty on the excisable fuel products.[66]

False or misleading statements

If you make a statement to us that is false or misleading, or make an omission from a statement that makes it false or misleading, the penalty is a maximum of 50 penalty units.

However, if that false or misleading statement is in respect of duty payable on particular goods, the penalty is a maximum of 50 penalty units and twice the amount of duty payable on those goods.[67]

Records

If you do not keep, retain and produce records as directed, the penalty is a maximum of 30 penalty units.[68]

Directions

If you do not comply with a direction in regard to what parts of the factory can be used for various matters, the penalty is 10 penalty units.[69]

Facilities etc. of a licensed manufacturer

If you, a licensed manufacturer, do not provide all reasonable facilities for enabling us to exercise our powers under the Excise Act, the penalty is a maximum of 10 penalty units.[70]

If you do not provide sufficient lights, correct weights and scales, and all labour necessary for weighing material received into, and all excisable fuel products manufactured in, your factory and for taking stock of all material and excisable fuel products contained in your factory, the maximum penalty is 10 penalty units.[71]

Marks and seals

If we mark or seal excisable fuel products or fasten, lock or seal any plant in your factory and you alter, open, break or erase the mark, seal, fastening or lock, the maximum penalty is 50 penalty units.[72]

2.6 TERMS USED

Excisable goods are goods on which excise duty is imposed. Excise duty is imposed on goods that are manufactured or produced in Australia and listed in the Schedule to the Excise Tariff Act.

As this Guide deals with fuel products, we have used the term excisable fuel products.

Excisable fuel products include:

- •

- petrol

- •

- diesel

- •

- renewable diesel

- •

- crude petroleum oil

- •

- condensate

- •

- heating oil

- •

- kerosene

- •

- fuel ethanol

- •

- biodiesel

- •

- compressed natural gas (CNG)

- •

- liquefied natural gas (LNG)

- •

- liquefied petroleum gas (CNG).

Goods are subject to excise control from the point of manufacture until they have been delivered into 'home consumption' or for export.

Goods subject to excise control cannot be moved, altered or interfered with except as authorised by the Excise Act.

'Home consumption'[73] is the term used in the Excise Act and this Guide.

Most commonly, excisable goods will be delivered for home consumption when they are physically removed from premises covered by a licence. However, excisable goods may also be delivered for home consumption through their use within those premises (for example, using fuel to run equipment in premises covered by your licence).

Excisable goods will NOT be delivered for home consumption if they are delivered for export or moved underbond (see definition below) to another site covered by a licence.

The term 'home consumption' is not defined in the Excise Act and there is no definitive case law that looks at the issue in question. However there are several cases where issues closely related to it are considered.[74]

The conclusion drawn from those cases is that 'home consumption' refers to the destination of goods as being within Australia as opposed to exporting them.

The value of a penalty unit is contained in section 4AA of the Crimes Act 1914, and is indexed regularly. The dollar amount of a penalty unit is available at Penalties.

Periodic settlement permission

A periodic settlement permission is a permission granted by us for you to deliver excisable goods from a place covered by a licence for home consumption prior to providing an excise return for the goods and paying the duty. At the end of the period (usually 7 days) you need to give us an excise return specifying all of the excisable goods delivered for the period and you also need to pay the relevant duty.

This is a written instruction issued under section 50 of the Excise Act to a licensed manufacturer, or proprietor of premises covered by a licence, to keep specified records, furnish specified returns, retain records for a specified period and produce those records on demand by us.

This is an expression not found in excise legislation, but it is widely used to describe goods that are subject to excise control. Excisable goods that are subject to excise control are commonly referred to as 'underbond goods' or as being 'underbond'. This includes goods that have not yet been delivered into home consumption and goods moving between premises under a movement permission.

2.7 LEGISLATION (quick reference guide)

In this Chapter, we have referred to the following legislation:

- •

- Excise Act 1901

- –

- section 4 – definitions

- –

- section 6A – how this Act applies to partnerships

- –

- section 24 – excisable goods and goods liable to duties of Customs may be used in manufacturing excisable goods

- –

- Part III Division 1 – manufacturers

- –

- section 25 – only licensed manufacturers to manufacture excisable goods

- –

- section 26 – licensed manufacturers to manufacture in accordance with Act and licence

- –

- section 27 – licensed manufacturers to manufacture only at premises covered by a licence

- –

- section 39 – applications for licences

- –

- section 39E – duration of licences

- –

- section 39FA – application for variation

- –

- section 39FB – variation of licence

- –

- section 39O – death of licence holder

- –

- section 46 – supervision by officers

- –

- section 49 – facilities to officers

- –

- section 50 – record keeping

- –

- section 51 – Collector may give directions

- –

- section 52 – weights and scales

- –

- section 53 – responsibility of manufacturers

- –

- section 54 – liability to pay duty

- –

- section 58 – entry for home consumption etc.

- –

- section 60 – persons to keep excisable goods safely etc.

- –

- section 61A – permission to remove goods that are subject to CEO's control

- –

- section 61C – permission to deliver certain goods for home consumption without entry

- –

- section 62 – deficiency in duty

- –

- section 77HB – liquefied petroleum gas and liquefied natural gas that is exempt from excise duty

- –

- section 86 –officers to have access to factories and approved places

- –

- section 87 – power to stop conveyances about to leave an excise place

- –

- section 87AA – searches of conveyances without warrant

- –

- section 91 – examine all goods

- –

- section 92 – seals etc. not to be broken

- –

- section 106 – samples

- –

- section 117 – unlawful possession of excisable goods

- –

- section 120 – offences

- –

- section 159 – protection of confidentiality of information

- •

- Excise Tariff Act 1921

- –

- The Schedule

- •

- Taxation of Alternative Fuels Legislation Amendment Act 2011

- –

- item 1 to 4

- •

- Customs Act 1901

- –

- section 105B – extinguishment of duty on excise-equivalent goods

- •

- Crimes Act 1914

- –

- section 4AA – penalty units

- –

- section 6 – accessory after the fact

- •

- Criminal Code Act 1995

- –

- section 11.1 – attempt

- –

- section 11.2 – complicity and common purpose

- –

- section 11.5 – conspiracy

Amendment history

| Part | Comment |

|---|---|

| Throughout | This chapter was updated to take into account the law changes as a result of the Excise and Customs Legislation Amendment (Streamlining Administration) Act 2024. This includes:

|

| Throughout | Updated in line with current ATO style and accessibility requirements. |

Copyright notice

© Australian Taxation Office for the Commonwealth of Australia

You are free to copy, adapt, modify, transmit and distribute this material as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).

3 LICENSING: Assessing applications

3.1 PURPOSE

This Chapter deals with:

- •

- licensing criteria

- •

- licence conditions

- •

- securities

- •

- what happens if your licence is not granted

- •

- what will happen if your licence is granted, and

- •

- penalties that can apply to offences in relation to making an application.

3.2 INTRODUCTION

We have the discretion whether to grant or refuse a licence. We base our decision on the information you supply.

Subsection 39A(2) of the Excise Act provides that if we consider certain criteria exist, they can be the basis for refusal.

Those criteria include:

- •

- you, or a director, officer, shareholder or associate, are not 'fit and proper'

- •

- you do not have, or do not have available to you, the skills and experience required to carry out the activity that would be authorised by the licence

- •

- the physical security of the premises is not adequate

- •

- the plant and equipment to be used at the premises is not suitable

- •

- you will not have a market for the goods

- •

- you would not be able to keep proper books of account for audit purposes

- •

- the grant of a storage licence would delay liability for duty, or

- •

- it is necessary to refuse to grant the licence to protect the revenue.

These criteria are explained in more detail below.

How any of these criteria affects a particular licence application depends on the facts in each particular case. There are, however, some criteria that are critical, for instance:

- •

- whether you are 'fit and proper'

- •

- the existence of a market, and

- •

- protection of the revenue.

3.3 POLICY AND PRACTICE

(1) 'Fit and proper' person or company

The nature of the entity applying for the licence will affect who is assessed as being fit and proper[75]:

- •

- if it is an individual, the individual is assessed

- •

- if it is a partnership, each partner is assessed, and

- •

- if it is a company, the company is assessed.

Persons other than the applicant can also be assessed as to whether they are fit and proper. These persons are:

- •

- another person who would participate in the management or control of the premises that is the subject of the licence application

- •

- if the applicant is a company, any director, officer, or shareholder of the company that would participate in the management or control of the company, and

- •

- certain associates of the applicant (associates can be people or companies).

What does fit and proper mean?

The term 'fit and proper' is not defined in the Excise Act or Excise Regulation. Fit and proper is dependent on the purpose of the legislation and the proposed activities of the person concerned. In general, qualities of diligence, honesty and the likelihood of observance of the law are pivotal characteristics to be taken into account in considering fitness and propriety. In an Excise Act context, we are assessing the suitability of the people who will have access to and control over 'excisable fuel products' if a licence is granted.

The Excise Act provides a definitive list of factors that we will take into account in determining whether a person or company is fit and proper. These factors generally relate to:

- •

- any prosecution history

- •

- solvency

- •

- the honesty of information provided by the applicant

- •

- compliance with tax obligations, and

- •

- licensing history if applicable.

In assessing these factors, we will consider whether your circumstances demonstrate that you are diligent, honest, and likely to observe excise laws.

A single factor will not necessarily be determinative of whether a person or company is 'fit and proper'. It will depend on the facts and circumstances of each case.

The weight afforded to each factor in reaching a decision about whether a person or company is 'fit and proper' is a matter for us to decide after considering all relevant information.

Some factors apply to both individuals and companies; others are specific to individuals or to companies.

- •

- individual or company:

- –

- whether, within a year of lodging the application, the person or company has been charged with:

- o

- an offence under the excise legislation, or

- o

- an offence under Commonwealth, state or territory law punishable by imprisonment for one year or longer (for an individual), or by a fine of 50 'penalty units' or more

- –

- whether, within 10 years of lodging the application, the person or company has been convicted of:

- o

- an offence under the excise legislation, or

- o

- an offence under Commonwealth, state or territory law punishable by imprisonment for one year or longer (for an individual), or by a fine of 50 penalty units or more

- –

- the extent of the person's or company's compliance, within 4 years of lodging the application, with any law administered by us (for example, income tax, goods and services tax (GST))

- –

- whether the person has held an excise licence which has been cancelled or varied to no longer cover one or more premises, or

- –

- the person's or company's financial resources.

- •

- individual only

- –

- whether the person has participated in the management or control of a company that has had an excise licence cancelled or varied to no longer cover one or more premises

- –

- whether the person is an undischarged bankrupt

- –

- any misleading statement made in the application by the person, or

- –

- where any false statement was made in the application – whether the person knew it was false.

- •

- company only

- –

- whether a receiver has been appointed over the property, or part of the property, of the company

- –

- whether the company is under administration under the Corporations Act 2001 (Corporations Act)

- –

- whether there is a current deed of company arrangement in place under Part 5.3A of the Corporations Act

- –

- whether the company is restructuring, or

- –

- whether the company is being wound up.

Where a person makes false or misleading statements in their application

It is important that you provide information that is accurate and complete. If your application (that is, your completed application form, any supporting documentation and any oral statements made), contains false or misleading statements we will take this into account.[76]

Misleading statements

The term 'mislead' is not defined in the Excise Act. The Australian Oxford Dictionary[77] defines 'mislead' as follows:

- 1.

- cause (a person) to go wrong, in conduct, belief, etc.

- 2.

- lead astray or in the wrong direction.

A misleading statement does not have to successfully mislead us, but it can be taken into account if it was reasonably foreseeable that we could have been misled when assessing the application.

Misleading may be by omission as well as what has been said.

Example 3A

You advise us that you have installed a state-of-the-art security system at your premises. You failed to advise us that a design fault has resulted in repeated false alarms to the point where you have switched off the security system and have no intention of re-engaging it. The design fault cannot be remedied. The only security in operation at the premises is a rusty padlock.

The information you provided, whilst not false, could lead us to believe that your premises are secure. This is misleading, and may be taken into account in determining whether you are 'fit and proper'.

False statements

If you make a false statement, we will consider whether you knew the statement was false.[78]

In essence, a statement is false if it is not true. A false statement may be made expressly, such as stating you have no criminal convictions when in fact you have been convicted. A false statement may also be made by omission, such as leaving a blank response to the question on your application form in relation to criminal convictions when in fact you have been convicted.

Associates that can be assessed under the fit and proper person test

To avoid situations where people with a high risk of non-compliance can exercise control over licence holders or excisable goods, certain associates[79] can be assessed under the fit and proper person test.

The word associate effectively takes its meaning from the Income Tax Assessment Act 1936 and is summarised below.

An associate of a natural person (other than in the capacity of trustee) includes:

- •

- a relative[80]of the individual, for example, their spouse, parent, sibling, uncle or aunt

- •

- a partner of the individual or a partnership in which the individual is a partner

- •

- if a partner of the individual is a natural person otherwise than in the capacity of trustee, the spouse or child of the partner

- •

- a trustee of a trust under which the individual or their associate benefits, or

- •

- a company under the control of the individual or their associate.[81]

Although an associate includes a spouse, a legally married spouse of a person who lives separately and apart on a permanent basis is not an associate.[82]

An associate of a company includes[83]:

- •

- a partner of the company or a partnership in which the company is a partner

- •

- if a partner of the company is an individual, the spouse or child of the partner

- •

- a trustee of a trust under which the company or their associate benefits

- •

- another entity (a company, partnership, trustee or an individual), or its associate (or associates) who controls the company, or another company which is under the control of the company, or the company's associate.

The control of a company looks to whether another entity (including individuals):

- •

- has sufficient influence over the company, or

- •

- holds a majority voting interest in the company.

An associate of a trustee includes an entity or an associate of the entity that benefits or is capable of benefiting either directly or indirectly under the trust.[84]

For a partnership, an associate includes each partner of the partnership or associate of the partner.[85]

(2) Skills and experience

The next criterion for licensing relates to skills and experience.[86]

Skills and experience are not defined in the Excise Act or Excise Regulation. There is no case law regarding skills and experience in an excise context.

In forming an opinion as to whether you have the required skills and experience, we will consider your ability to:

- •

- carry out the activity requiring a licence

- •

- conduct a business, and

- •

- comply with excise obligations.

It is important to note that you, as the applicant, do not necessarily need to possess the skills and experience yourself provided that you can demonstrate that you will use another person's skills and experience, for example, by hiring them or using a consultant. Should that be the case, we will assess the other person's skills or experience.

Example 3B

Mr X, as a Director of Z Transport and Logistics Pty Ltd, applies for a storage licence.

Neither Mr X nor any of his staff have the skills and experience to comply with the company's excise obligations. This poses a risk that excisable fuel products may be sold without adequate record keeping and may adversely affect revenue and compliance.

Therefore, when assessing this element of subsection 39A(2) of the Excise Act in isolation, Z Transport and Logistics Pty Ltd would fail the requirements of skills and experience. However, a decision on granting a licence is made based on an assessment of all elements of subsection 39A(2).

Z Transport and Logistics Pty Ltd may choose to address the deficiency in skills and experience by such measures as appointing a manager who has the relevant skills and experience.

(3) Physical security of the premises

Physical security of the premises[87] relates to measures that prevent unauthorised access to excisable fuel products and thus protects against theft or loss of goods and excise revenue.

In forming an opinion about the physical security at the premises, we will consider the:

- •

- nature of the site

- •

- kinds and quantities of goods to be kept, and

- •

- procedures and methods adopted to ensure the security of goods.

Consideration of the nature of the site can include:

- •

- construction (for example, floor, walls, ceiling, windows and doors) and whether material is difficult to penetrate or remove

- •

- barriers (for example, fences or wire) to a standard that would prevent unauthorised access

- •

- locks and bars

- •

- alarms, security lighting, security guard patrols or closed-circuit TV cameras

- •

- physical security of all warehouse facilities within the site, and

- •

- fire alarms, smoke detectors, sprinklers etc.

Consideration of the kind and quantity of goods to be kept at the site can include the:

- •

- ease with which goods can be handled, for example, bottles of spirits are easier to move than fuel in a large refinery tank

- •

- rate of excise duty applicable to the goods (goods that attract a greater rate of excise duty represent a greater revenue risk), and

- •

- greater the quantity of excisable goods to be dealt with, the higher the level of physical security that would be required.

Consideration of the security procedures and methods can include:

- •

- gate security system that would identify all people entering and leaving the site, and confirm their right to do so

- •

- gate security system that would identify the type and quantity of all goods entering and leaving the site

- •

- surveillance system

- •

- procedures to handle and retain information from surveillance system (if there is one)

- •

- access control, for example, by limited distribution of keys and access swipe cards or codes

- •

- security responses when breaches are detected, for example, back-to-base system, and

- •

- an independent security audit function to oversee all of the above.

(4) Suitability of plant and equipment

Plant and equipment are considered suitable[88] if they are capable of performing the intended tasks and will allow you to properly account for excisable fuel products and calculate the correct amount of excise duty.

Plant and equipment that are used in relation to goods at premises covered by a licence include:

- •

- temperature measuring equipment

- •

- storage tanks

- •

- weighing equipment, for example, scales and weighbridges, and

- •

- volume measuring equipment.

(5) Market for the goods

In this criterion, we are primarily concerned with the presence of an available market within Australia.[89] That market must be legal. Licensing is concerned with minimising the risk of excisable fuel products entering an illicit market in Australia and the resultant loss of revenue.

You must provide sufficient information to identify your proposed market.

You may be able to demonstrate that you have a market by, for example, supplying:

- •

- evidence of contracts (including 'in principle' contracts) you have negotiated, or

- •

- a business plan which outlines the market you have identified.

A legitimate market may exist overseas for locally manufactured excisable fuel products. Applications relating to overseas markets may be subject to additional scrutiny and you may be required to provide additional information or documentation as evidence of the legitimacy of your overseas market.

Therefore, market should be taken to mean that there exists a proven or demonstrated demand for a commodity, or an opportunity for (legally) buying or selling (trading in) a specified commodity. In such cases a market can be either in Australia or overseas.

If you intend to manufacture excisable goods and use them within the operation of your business, or entirely for personal (non-commercial)[90] use, you do not need to meet the market test.

Examples of this situation are:

- •

- a farmer who produces biodiesel to use in his farm equipment

- •

- a person who produces biodiesel for their personal non-commercial use.

However, the farmer or person in these 2 examples would still need to obtain a licence and pay duty on the biodiesel they produce.

(6) Ability to keep proper books of account

This criterion is whether you can keep 'proper books of accounts and records'[91] that enable us to audit those records.

You may be asked to demonstrate:

- •

- the recording systems you intend to use, whether they are manual or electronic

- •

- where an electronic record-keeping system is used, systems documentation showing details such as screens, reports available and security controls, and

- •

- the internal documentation supporting the recording systems, ensuring that the recording systems will record sufficient detail.

(7) Delay liability for duty (storage licence only)

This criterion only relates to an application for a storage licence where the granting of the licence would delay liability for duty.[92]

The liability for excise is imposed on goods at the time of manufacture.[93] However, it is not actually paid until a later point.

The wording in paragraph 39A(2)(k) of the Excise Act '… delay the liability for duty' suggests that one is able to delay the point in time in which the liability arises. However, this is not possible as the imposition of excise, and therefore the time at which the liability arises, is not dependent on any further dealings or processes on those goods. It is only the payment of the liability, the duty, which can be delayed depending on how the goods are dealt with.

We consider that the only possible interpretation of paragraph 39A(2)(k) of the Excise Act is that it operates to delay the time the liability must be paid. A storage licence allows for the storage of excisable goods on which duty has not been paid. It effectively allows a manufacturer to defer the payment or transfer the liability to a storage licence holder. The question then arises as to how far down the distribution chain payment of an excise liability may be deferred.

It is our view that we may refuse to grant a storage licence where the grant of the licence would delay payment of duty beyond the point of storage occurring in the normal wholesale distribution of the goods. Using a different perspective, we may refuse to grant a storage licence when refusal is necessary to ensure that excise duty is paid before goods reach the retail level in the distribution chain.

In forming an opinion as to whether the granting of an excise storage licence would delay liability for duty, we will consider:

- •

- the purpose for which the goods are to be stored, and

- •

- whether the premises in question are for storage occurring in the normal wholesale distribution of the goods, or for storage beyond the normal wholesale distribution of the goods (for example, storage for a retail premises).

(8) Protect the revenue

The term 'necessary to protect the revenue'[94] is not defined in the Excise Act.

The meaning of 'protect the revenue' was considered by Deputy President Forgie in Martino and Australian Taxation Office.[95] She said, at [50–52]:

… The expression "protect the revenue" is not defined in the Act and I am not aware of any authorities that have considered it. The word "revenue" has been considered in Stephens v Abrahams (1902) 27 VLR 753 by Hodges J. … Hodges J took:

"… the 'revenue' to be moneys which belong to the Crown, or moneys to which the Crown has a right, or moneys which are due to the Crown

…

The ordinary meanings of the word "protect" include "keep safe, take care of" … and they would seem to be the senses in which the word is used in the expression "protect the revenue". Mr Martino's licence may only be cancelled if it is necessary to take care of the money belonging to the Crown in right of the Commonwealth. That has the aspect of ensuring that the Commonwealth receives all that it should in the form of any excise that is ultimately payable in respect of tobacco originally grown on Mr Martino's farm and keeps all that it receives. It also has the aspect of not spending more of the Commonwealth's money than need be spent in carrying out its supervisory duties and responsibilities under the Act and in ensuring that the tobacco is not marketed illegally in Australia, and so avoid the payment of excise duty, if it cannot be marketed legally.

What is meant by the word "necessary"? I have taken the view that the meaning adopted by Allen J in State Drug Crime Commission of NSW v Chapman (1987) 12 NSWLR 447:

"As to the word 'necessary' it does not have, in my judgment, the meaning of 'essential'. The word is to be subjected to the touchstone of reasonableness. The concept is one as to what reasonably is necessary in a commonsense way.

While this case was in relation to tobacco, the finding is equally applicable to fuel. 'Protect the revenue' therefore means ensuring that the Commonwealth receives the full amount of excise duty that is ultimately payable, and we do not spend more Commonwealth funds than necessary to carry out our responsibilities.

Licence conditions form part of your licence. If you fail to comply with a condition, we may suspend or cancel your licence.[96]

All excise licences are subject to certain conditions imposed by:

- •

- the Excise Act, and

- •

- us (special conditions).

We are able to add, vary or revoke conditions even after the licence has been granted.[97] We will notify you in writing if we do so and provide you with an amended licence that includes the amended conditions.

Conditions imposed under the Excise Act

You must advise us in writing within 30 days if[98]:

- •

- you become bankrupt

- •

- a person not listed in the licence application starts to participate in the management or control of premises covered by the licence or of the company, as the case may be

- •

- there is a change in the membership of a partnership that holds a licence

- •

- a company that holds a licence comes under receivership, administration or begins to be wound up

- •

- there is a change that substantially affects the physical security of premises covered by the licence or plant and equipment used in relation to excisable goods at the premises

- •

- you hold a manufacturer licence and you cease to manufacture excisable goods at premises covered by the licence

- •

- you hold a storage licence and you cease to keep and store goods at premises covered by the licence, or

- •

- you or any person participating in the management or control of a licensed company or premises is charged with or convicted of:

- –

- an offence against a provision of the Excise Act, or

- –

- an offence against a law of the Commonwealth, a state or a territory that is punishable by imprisonment for a period of one year or longer or by a fine of 50 penalty units or more

Special conditions

We can also impose special conditions on your licence if we find it necessary to protect the revenue or ensure compliance with the Excise Act.[99] Examples of conditions that have been imposed under this provision are:

- •

- the trustee for a trust to notify the Collector of the appointment of a new trustee in writing and prior to the appointment of the new trustee

- •

- restriction of the storage of excisable goods (by a storage licence holder) to ship's stores and aircraft's stores, or

- •

- restriction of the quantity of excisable goods that a licensed manufacturer may manufacture.

The examples of special conditions given above are only for illustrative purposes. The decision to impose special conditions is considered on a case-by-case basis.

You can apply to have these special conditions varied, revoked or added. We will consider and advise you of our decision.

If you are not satisfied with our decision, you can ask for a review by lodging an objection within 60 days of the day we notify you.[100]

We can use conditions as a mechanism to increase the level of protection of the revenue or to ensure compliance with the Excise Act. However, prior to granting the licence, we may also require you to provide a security to achieve the same result. Even if we don't require a security prior to the granting of the licence, we may ask for a security at a later time. We can also ask you to increase the value of any security you may already have given.[101]