Practice Statement Law Administration

PS LA 2005/2

Penalty for failure to keep or retain records

This version is no longer current. Please follow this link to view the current version. |

-

This document has changed over time. View its history.

| Contents | |

|---|---|

| 1. What this Practice Statement is about | |

| 2. Administering the penalty | |

| 3. General principles | |

| 4. When is a penalty imposed for failing to keep or retain records? | |

| 5. Who is liable for the penalty? | |

| 6. Working out the penalty amount | |

| 7. Considering whether to remit the penalty | |

| 8. Examples | |

| 9. Recording your decision | |

| 10. Record the penalty | |

| 11. Notifying the entity | |

| 12. Notice of Penalty and reasons for decision | |

| 13. Right of review | |

| 14. More information | |

| Attachment A |

| This Practice Statement is an internal ATO document and is an instruction to ATO staff.

Taxpayers can rely on this Practice Statement to provide them with protection from interest and penalties in the following way. If a statement turns out to be incorrect and taxpayers underpay their tax as a result, they will not have to pay a penalty. Nor will they have to pay interest on the underpayment provided they reasonably relied on this Practice Statement in good faith. However, even if they don't have to pay a penalty or interest, taxpayers will have to pay the correct amount of tax provided the time limits under the law allow it. |

This Law Administration Practice Statement provides guidelines in relation to penalty for failing to keep or retain records when required to do so by a taxation law.

1. What this Practice Statement is about

1A. This Practice Statement provides guidance on the administration of section 288-25 of Schedule 1 to the Taxation Administration Act 1953 (TAA).[1]

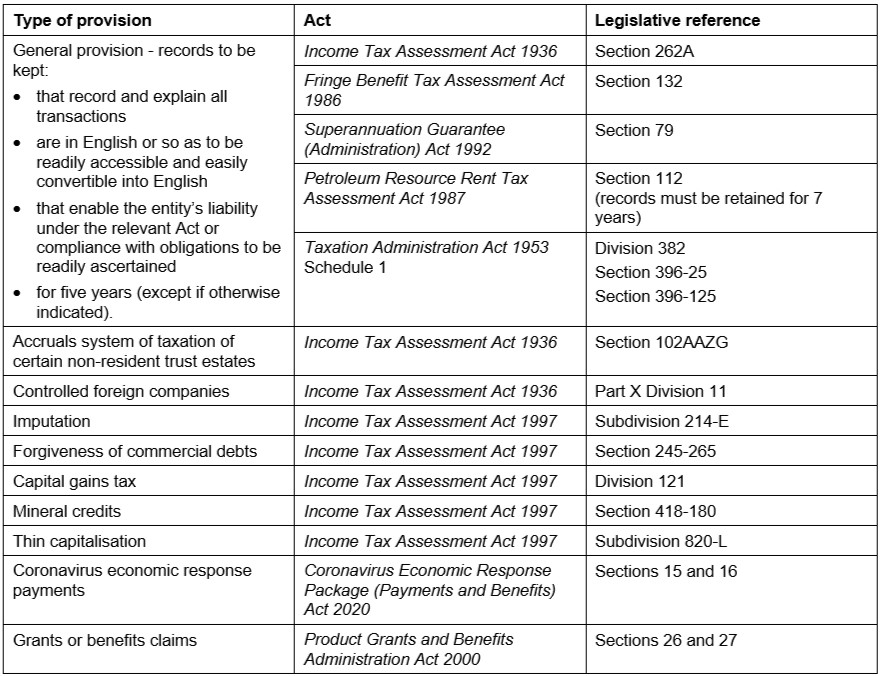

1B. Section 288-25 makes an entity liable to a penalty if the entity does not keep or retain records in a manner required by a taxation law. It applies to record keeping obligations that arise on or after 1 July 2000. These are listed in Attachment A of this Practice Statement.

1C. Record keeping is necessary so we can verify that taxpayers are reporting correct tax-related liabilities. The purpose of the penalty in section 288-25 is to influence positive compliance with record-keeping obligations and, as a result, accurate reporting of tax-related liabilities.

1D. ATO staff will usually provide help and education to ensure taxpayers meet their record-keeping obligations. The assessment of a penalty under section 288-25 is one of the final actions taken in an effort to influence a change in an entity's record-keeping behaviour and will generally be used only where help and education have failed to change behaviour.

1E. This Practice Statement does not apply in relation to the record-keeping obligations imposed by the Excise Act 1901, the Distillation Act 1901, the Spirits Act 1906, and the Fuel (Penalty Surcharges) Administration Act 1997. It also does not apply in relation to documents required to be kept under Part X of the Fringe Benefit Tax Assessment Act 1986 or Division 900 (substantiation rules) of the Income Tax Assessment Act 1997.

2A. There are four steps which must be taken in administering the penalty in section 288-25. They are:

- •

- step 1 - determine if the law imposes a penalty

- •

- step 2 - determine the amount of the penalty

- •

- step 3 - determine if remission is appropriate

- •

- step 4 - record the penalty and notify the entity.

3A. The following general principles should be considered in administering section 288-25:

- •

- The primary purpose of this penalty provision is to encourage entities to comply with their record-keeping obligations and, by extension, to accurately report their tax-related liabilities.

- •

- In the normal course of carrying on an enterprise, entities generally create contemporaneous records of the transactions they enter into. This reduces the risk of incorrectly reporting a tax-related liability or over-claiming a credit.

- •

- The general record-keeping provisions[2] require an entity to keep records that

- -

- record and explain all transactions and other acts engaged in by the person that are relevant for the purposes of the relevant Act, including the particulars of any election, choice, estimate, determination, or calculations

- -

- are in English or are readily accessible and convertible into English, and

- -

- enable the entity's liability under the relevant Act to be readily ascertained.

- •

- Generally, these records must be kept for five years, however the events that mark the beginning or the end of the retention period vary according to the relevant provisions of the particular law. For example, records relating to the acquisition of a CGT asset are generally required to be kept from the date of purchase until five years after the relevant CGT event (such as a disposal) has occurred.

- •

- The nature and scope of records to be retained will depend on the nature and size of the enterprise. Taxation Ruling TR 96/7 Income tax: record keeping - section 262A - general principles provides guidance on the type of records that, if maintained, will ensure that record-keeping obligations are met.

- •

- The appropriate use of record-keeping software consistent with Law Administration Practice Statement PS LA 2008/14 Record keeping when using commercial off the shelf software will meet the requirements under the various taxation laws to keep records in a manner that allow an entity's tax liability to be readily ascertained.

- •

- We recognise that there may be isolated instances where an entity misplaces or loses documents that explain a particular transaction. We will consider the circumstances in which the records were lost and what the entity has done to rectify the situation in deciding whether to remit the penalty.

- •

- Entities that use electronic records are expected to retain backup copies or have some other method to enable them to readily reconstruct their accounts in the event of a system malfunction.

- •

- Where records have been encrypted, entities must provide us with decrypted records, or the means required to decrypt the records.

- •

- Where a shortfall results from a record-keeping practice, a shortfall penalty under Division 284 may also apply.[3] The entity's approach to record keeping is one of the factors to be considered in determining the behaviour of the entity, and consequently the amount of shortfall penalty that will apply. Miscellaneous Taxation Ruling MT 2008/1 Penalty relating to statements: meaning of reasonable care, recklessness and intentional disregard provides guidance on the effect record keeping has on determining behaviour. An entity can be liable to both a record-keeping penalty and a shortfall penalty in relation to the same tax obligation.

- •

- An entity will generally not be penalised more than once for failing to comply with its obligations to keep records for a particular accounting period. For example, only one record keeping penalty will apply in cases where an entity fails to keep the same records required for both income tax and superannuation guarantee purposes for the same period.

Step 1 - determine if the law imposes a penalty

4. When is a penalty imposed for failing to keep or retain records?

4A. A penalty under section 288-25 is imposed where an entity or their agent:[4]

- •

- is required under a provision of a taxation law to keep or retain a record, and

- •

- the entity does not keep or retain the record in the manner required by that law.

4B. An entity is not liable for an administrative penalty if prosecution action is commenced by the Commissioner for a civil penalty for the same offence[5], even if the prosecution is later withdrawn. The TAA provides for three separate offences for incorrectly keeping records:

- •

- section 8L Incorrectly keeping records etc.

- •

- section 8Q Recklessly incorrectly keeping records etc., and

- •

- section 8T Incorrectly keeping records with the intention of deceiving or misleading the Commissioner etc.

4C. The most severe of these offences, incorrectly keeping records with the intention of deceiving or misleading the Commissioner, allows for a fine of up to 50 penalty units or imprisonment for a period not exceeding 12 months, or both, for a first offence. For subsequent offences the penalty is increased to a fine of up to 100 penalty units or imprisonment for a period not exceeding two years, or both.

4D. The ATO will consider referring a case to the Commonwealth Director of Public Prosecutions only where the case involves serious non-compliance such as falsifying records and fraud, or where the imposition of administrative penalties has failed to improve the entity's record-keeping behaviour. The Commonwealth policy on prosecutions is fully explained in the Prosecution Policy.

5. Who is liable for the penalty?

5A. The entity required by the taxation law to retain the records is the entity liable to the penalty.

Step 2 - determine the amount of the penalty

6. Working out the penalty amount

6A. The penalty is 20 penalty units.[6]

6B. The penalty applicable is calculated on the value of the penalty unit at the time of the contravention, being when the records were required to be kept or retained.

Step 3 - determine if remission is appropriate

7. Considering whether to remit the penalty

7A. The Commissioner has the discretion to remit all or part of the penalty.[7] This discretion is 'unfettered', meaning that there is no legal restriction on when we can and cannot remit. Remission provides the administrative flexibility to ensure the penalty imposed is aligned with the observed behaviour and the purpose of the penalty.

7B. This Practice Statement sets out guidance that must be used in exercising this discretion. Remission is not limited to the reasons listed here, and we should consider remission in any situation where the final penalty is not a just outcome. That is, if imposition of the penalty produces an unintended or unjust result, we may remit the penalty in whole or in part.

7C. We must make a remission decision whenever the penalty is imposed. We may decide that there are no grounds for remission or that there are grounds to remit in full or in part. The final penalty we apply must be defensible, proper and have regard to the overall circumstances of the entity, and the purpose of imposition and remission of this penalty.

7D. We need to consider each case on its merits, having regard to all the relevant facts and circumstances.

7E. Entities in the same circumstances should be treated consistently for remission purposes. This is particularly relevant for entities involved in examinations relating to the same arrangement. However, this should not be used as justification for replicating an incorrect penalty decision made in relation to another entity.

7F. Relevant matters to consider in making a remission decision include:

- •

- The purpose of the penalty provision is to encourage entities to comply with their record-keeping and tax-reporting obligations. Whether we are satisfied that an entity has reported the correct tax-related liability is therefore relevant.

- •

- The penalty regime also aims to promote consistent and equitable treatment by reference to specified rates of penalty. This objective would be compromised if the penalties imposed at the rates specified in the law were remitted without just cause, arbitrarily or as a matter of course.

- •

- The amount of the penalty the law imposes is not a valid reason for remission alone in the absence of specific reasons why it would be unjust in the entity's particular circumstances.

7G. Matters that we should not usually consider include:

- •

- behaviour or situations unrelated to the relevant record-keeping and tax-reporting obligation, such as the entity or registered agent becoming ill at a time after the failure to keep records occurred, and

- •

- whether there is a capacity to pay the penalty.[8]

8A. An entity that makes no attempt to keep records or deliberately destroys its records will not usually receive any remission of the penalty.

8B. Where the records kept by an entity are such that we cannot verify that the entity is reporting the correct tax-related liability, the record-keeping penalty will not usually be remitted in full, however a partial remission may be considered. The circumstances of the case and the size and level of sophistication of the entity will be relevant.

8C. We will usually remit the penalty in full where we are satisfied that an entity is reporting the correct tax-related liability, even though record-keeping obligations have not been fully complied with. This reflects the intention of the penalty to support correct reporting of tax-related liabilities.

8D. We will usually remit the penalty in full where the entity has made a reasonable and genuine attempt to comply with its record-keeping obligations, but the records have been lost or destroyed in circumstances outside the entity's control, and the entity has reconstructed the records to the best of its ability.

8E. Where an entity is liable to a record-keeping penalty and a shortfall penalty for the same tax obligation, we may remit part or all of the penalty if retaining both penalties would produce an unjust result, such as where the errors were unintentional and the combined penalties significantly exceed the actual tax shortfall.

9A. Record the reasons for your remission (or non-remission) decision on the relevant ATO system.

Step 4 - record the penalty and notify the entity

10A. Record the penalty amount owing after any remission in the relevant ATO accounting system.

10B. There is no obligation to key into the account any amount of the penalty that we have remitted, only the amount of the penalty after any remission. If the penalty has been fully remitted, there is no penalty, so we do not need to key any penalty on the account.

11A. There are two parts to notifying the entity of the penalty[9]:

- •

- explaining why there is a liability to a penalty, and

- •

- issuing a notice of the penalty which includes the due date for the payment of the penalty.

12. Notice of Penalty and reasons for decision

12A. Where there is a liability, we must give written notice to the entity[10] of:

- •

- their liability to pay the penalty, after any reductions and/or remissions

- •

- the reasons why they are liable to the penalty, and

- •

- the reasons why the penalty has not been remitted or has been remitted only in part.

12B. You must give (or serve) the entity with written notice of its liability to pay the penalty and why the entity is liable to pay the penalty.[11]

12C. The notice must specify the due date of the penalty. The due date must be at least 14 days after the notice is given to the entity.[12]

12D. Where the penalty is not paid by the due date, general interest charge will accrue on the outstanding balance until paid.[13]

12E. The reasons will set out the findings based on relevant facts and refer to the evidence or other material that those findings were based on. That is, we must explain what the decision and the penalty is, why we have made it, the law used, and the facts and evidence we considered. We must also address all issues raised by the entity about the penalty.

12F. The law does not specify when the written notice must be given. However, the reasons for decision should be given prior to, or at the same time as, the entity is notified of the penalty. Where this is not possible, they should be provided as soon as possible after issuing a notice of penalty.

12G. The law does not require us to give reasons for the penalty decision where the penalty has been remitted to nil. However, we may wish to notify the entity of the decision in order to positively influence compliance behaviour so the entity can meet its record keeping obligations in future.

12H. We must record complete reasons for the penalty decisions on the relevant ATO system. This could be through the same document in which the reasons for decision are provided to the entity.

13A. An entity that is dissatisfied with our decision not to remit some or all of the penalty may object to the decision where the penalty not remitted is more than two penalty units.[14]

13B. If the remaining penalty is not more than two penalty units, the entity may seek judicial review of the decision in the Federal Court or Federal Circuit Court.

13C. Where there is no liability to a penalty because of an exception or remission, there is no objection or review right.

14A. For more information, see:

- •

- TR 96/7 Income tax: record keeping - section 262A - general principles

- •

- MT 2008/1 Penalty relating to statements: meaning of reasonable care, recklessness and intentional disregard

- •

- PS LA 2008/14 Record keeping when using commercial off the shelf software

- •

- PS LA 2012/5 Administration of the false or misleading statement penalty - where there is a shortfall amount

- •

- TD 2011/19 Tax administration: what is a general administrative practice for the purposes of protection from administrative penalties and interest charges?

- •

- Prosecution Policy

- •

- Taxpayers' Charter

ATTACHMENT A - RECORD-KEEPING PROVISIONS

Amendment history

| Date of amendment | Part | Comment |

|---|---|---|

| 4 February 2021 | All | Updated to new LAPS format and style. |

| 9 July 2020 | Paragraph 45 and footnote 2 | Updated due to change in penalty unit value. |

| 25 June 2020 | Paragraph 28 | Removed specific dollar values for a penalty unit; included a reference to the source of the penalty unit value and where to locate it. |

| 6 December 2019 | Paragraph 28 | Updated to reflect current penalty units. |

| 22 January 2013 | Paragraphs 11 & 28 | Revised to reflect change in penalty unit value from 28 December 2012. |

| 11 July 2012 | Generally | Updated to current ATO publication style. |

| Paragraph 7 and Related public rulings | Updated reference from MT 2008/D1 to MT 2008/1. | |

| Paragraph 37 | Remove the reference to e-Record which is no longer available. | |

| Appendix 1 | Added Minerals Resource Rent Tax record keeping provisions. | |

| 2 September 2008 | Paragraph 7 and Related public rulings | Updated TR 94/4 to MT 2008/D1. |

| 5 March 2008 | Paragraph 29 | Added requirement of Commissioner to provide reasons to entity of why the entity is liable to pay a penalty under section 298-10 of Schedule 1 to the TAA (as amended by No. 75 of 2005). |

| Paragraph 33 | New paragraph added to clarify ATO policy of provided reasons for decision where penalty remitted in full, although no requirement exists under legislation (section 298-20 of Schedule 1 to the TAA). | |

| Related practice statements | Added PS LA 2006/2 and PS LA 2007/3. | |

| 1 July 2006 | References | Update reference to section 70 of the TAA to section 382-5 of Schedule 1 to the TAA. |

Date of Issue: 1 February 2005

Date of Effect: 1 February 2005

All legislative references in this Practice Statement are to Schedule 1 to the TAA unless otherwise indicated.

Section 262A of the Income Tax Assessment Act 1936 and section 382-5 of Schedule 1 to the TAA

See Law Administration Practice Statement PS LA 2012/5 Administration of the false or misleading statement penalty - where there is a shortfall amount.

Any reference to entity in this Practice Statement should be read as 'the entity or their agent' unless explicitly noted.

Section 8ZE of the TAA.

The value of a penalty unit is contained in section 4AA of the Crimes Act 1914 and is indexed regularly. A table containing penalty unit values can be found by searching for 'penalty unit' on ato.gov.au

Section 298-20.

Capacity to pay and hardship may be dealt with through payment arrangements, compromise, release and under other taxation or insolvency provisions, not through remission of penalties.

Section 298-10.

Sections 298-10 and 298-20.

Section 298-20.

Subsection 298-15.

Subsection 298-25.

Subsection 298-20(3).

Related Rulings/Determinations:

TR 96/7

MT 2008/1

TD 2011/19

Related Practice Statements:

PS LA 2008/14

PS LA 2012/5

Legislative References:

TAA 1953 8L

TAA 1953 8Q

TAA 1953 8T

TAA 1953 8ZE

TAA 1953 Sch 1

TAA 1953 Sch 1 Div 269

TAA 1953 Sch 1 Div 284

TAA 1953 Sch 1 288-20

TAA 1953 Sch 1 288-25

TAA 1953 Sch 1 298-10

TAA 1953 Sch 1 298-15

TAA 1953 Sch 1 298-20

TAA 1953 Sch 1 298-20(3)

TAA 1953 Sch 1 298-25

TAA 1953 Sch 1 Div 382

TAA 1953 Sch 1 382-5

TAA 1953 Sch1 396-25

TAA 1953 Sch1 396 125

ITAA 1936 Part X Div 11

ITAA 1936 section 102AAZG

ITAA 1936 Subdiv 214-E

ITAA 1997 245-265

ITAA 1936 262A

ITAA 1997 Div 121

ITAA 1997 418-180

ITAA 1997 Subdiv 820-L

ITAA 1997 Div 900

FBTAA 1986 Pt X

FBTAA 1986 Pt 132

SGAA 1992 79

Coronavirus Economic Response Package (Payments and Benefits) Act 2020 15

Coronavirus Economic Response Package (Payments and Benefits) Act 2020 16

Crimes Act 1914 section 4AA

Distillation Act 1901

Excise Act 1901

Fuel (Penalty Surcharges) Administration Act 1997

Petroleum Resource Rent Tax Assessment Act 1987 112

Product Grants and Benefits Administration Act 2000 26

Product Grants and Benefits Administration Act 2000 27

Spirits Act 1906

| Contact email | OperationalPolicyAssuranceandLawWorkManagement@ato.gov.au |

| Section | Operational Policy, Assurance and Law |

| Date: | Version: | |

| 1 February 2005 | Original statement | |

| 11 July 2012 | Updated statement | |

| 25 January 2013 | Updated statement | |

| 6 December 2019 | Updated statement | |

| 25 June 2020 | Updated statement | |

| 9 July 2020 | Updated statement | |

| You are here | 4 February 2021 | Updated statement |

| 13 March 2023 | Updated statement |