Taxpayer Alert

TA 2023/5

Research and development activities conducted overseas for foreign related entities

| Table of Contents | Paragraph |

|---|---|

| Description | |

| Example | |

| What are our concerns? | |

| What are we doing? | |

| What should you do? | |

| Do you have information? |

About Taxpayer Alerts

About Taxpayer Alerts

Alerts provide a summary of our concerns about new or emerging higher risk tax or superannuation arrangements or issues that we have under risk assessment. While an Alert describes a type of arrangement, it is not possible to cover every potential variation of the arrangement. The absence of an Alert on an arrangement or a variation of an arrangement does not mean that we accept or endorse the arrangement or variation, or the underlying tax consequences. Refer to PS LA 2008/15 for more about alerts. See Alerts issued to date. |

1. We are currently reviewing arrangements where Australian-resident research and development (R&D) entities[1] claim a tax offset under the R&D tax incentive (R&DTI) rules for expenditure incurred on R&D activities conducted overseas. We have seen instances where an R&D entity has purported that the R&D activities were conducted for the R&D entity's own benefit, but those activities were instead being conducted for (or to a significant extent, for) a foreign entity that is 'connected with'[2], or is an 'affiliate'[3] of the R&D entity (foreign related entity).

2. We are concerned that R&D entities might be incorrectly claiming the R&D tax offset irrespective of whether:

- •

- the R&D entity has an overseas finding[4] covering the R&D activities being conducted, or

- •

- under the contractual arrangements between the R&D entity and the foreign related entity, the R&D entity purportedly has an interest in any developed intellectual property (IP), know-how or other results from the R&D entity's expenditure on the R&D activities.

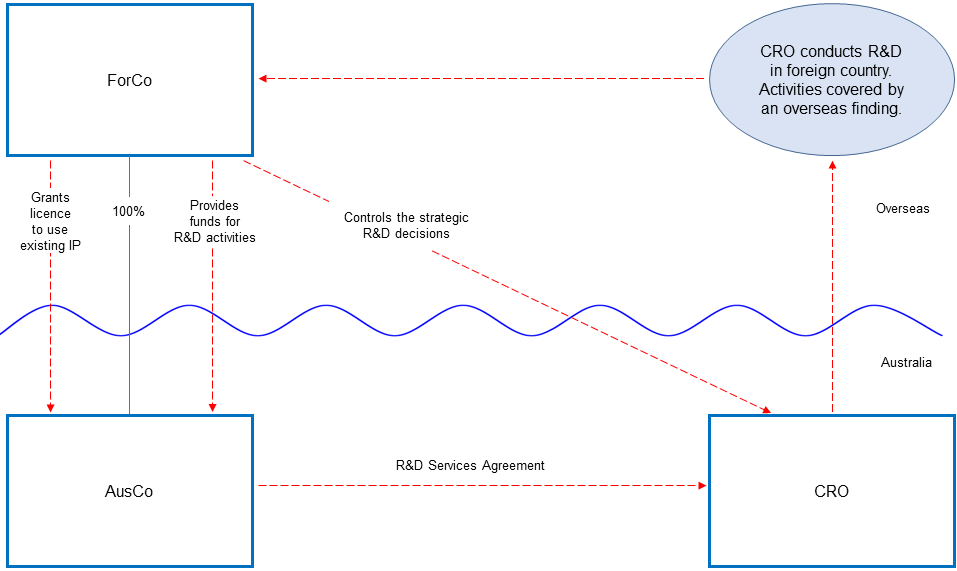

Diagram 1

3. The following illustrates the common features of these arrangements.

- •

- Foreign related entity (ForCo) causes R&D entity (AusCo) to be incorporated.

- •

- Under an agreement between ForCo and AusCo, ForCo:

- -

- grants to AusCo a licence (or otherwise allows) AusCo to use and develop ForCo's existing intellectual property

- -

- receives primary rights to exploit any developed intellectual property, know-how or other results (including data) from AusCo's overseas activities (the Developed IP) upon that IP's creation, and

- -

- provides funds to AusCo for AusCo to conduct its R&D activities.

- •

- AusCo has limited assets, minimal staff and negligible industry research experience or expertise, requiring AusCo to contract out the conducting of its R&D activities; whether those activities be conducted within Australia or overseas.

- •

- R&D activities that are conducted overseas purportedly for the benefit of AusCo are contracted out to a Contract Research Organisation (CRO).

- •

- AusCo has limited ability to itself commercially exploit the Developed IP.

- •

- AusCo obtains an overseas finding under paragraph 28C(1)(a) of the Industry Research and Development Act 1986.

- •

- AusCo claims a notional deduction for the expenditure incurred by it to the CRO, and thereby a tax offset under the R&DTI.

- •

- On objective review of the financing, licencing, service, corporate or other arrangements between AusCo and ForCo, it appears that ForCo is the sole or major beneficiary of AusCo's overseas activities.

4. Arrangements of concern are those where the R&D activities are for (or to a significant extent are for) the benefit of the related foreign entity and may display some or all the following features.

- •

- The agreements between the foreign related entity and the R&D entity:

- -

- are established by and under the instruction of the foreign related entity and its controllers

- -

- directly or indirectly result in the foreign related entity ultimately acquiring ownership rights in the Developed IP

- -

- for the period of the R&D entity's ownership of the Developed IP, impose restrictions on some or all of the R&D entity's right to exploit, right to alienate and right to itself manage the Developed IP

- -

- for the period of the R&D entity's ownership of the Developed IP, grant to the foreign related entity primary rights to exploit and itself manage the Developed IP

- -

- may have a legal form that is inconsistent with the actual commercial substance of the arrangement between the entities.

- •

- The foreign related entity:

- -

- owns the pre-existing intellectual property which is licensed to the R&D entity to undertake the R&D

- -

- in substance and effect

- o

- assumes the financial risk in relation to any funds committed to the R&D entity for the purposes of financing the R&D activities

- o

- sets the conditions for initial and subsequent funding of the R&D

- o

- assumes the operational risk for the conducting of the R&D activities

- o

- controls the strategic decisions regarding the R&D activities, including the instructions given to any contracted CRO as to the way the R&D activities are to be conducted

- -

- may itself be contracted by the R&D entity to conduct some (or all) of the R&D activities.

- •

- The R&D entity:

- -

- may not have a physical presence in Australia

- -

- may have one or more foreign-resident directors that are consistent with that of (or are appointed by) the foreign related entity

- -

- has an Australian-based resident director that acts in accordance with the directions and wishes of the foreign related entity or its controllers

- -

- has few (if any) employees with the technical capability to design, conduct or supervise any R&D activities being conducted

- -

- in the absence of either original and future committed funding from the foreign related entity or refundable tax offset under the R&DTI, lacks the economic capacity to either conduct the R&D activities or commercially exploit the Developed IP

- -

- may have been incorporated shortly before the end of the relevant income year in which the R&DTI is first claimed.

5. In respect of the arrangements covered in this Alert, we are concerned that R&D entities do not qualify for an R&D tax offset under Division 355 of the ITAA 1997 for expenditure incurred by them on R&D activities conducted overseas as the R&D activities were:

- •

- not conducted for the R&D entity[5], or

- •

- conducted to a significant extent for the foreign related entity, and that entity does not satisfy the statutory conditions for eligible R&D activities.[6]

6. Alternatively:

- •

- where the R&D entity is an Australian resident and the R&D activities are conducted for that R&D entity's own benefit, the R&D entity might not qualify for an R&D tax offset as the expenditure incurred by them might not be 'at risk' for the purposes of the at risk integrity rule in the R&D provisions, or

- •

- where the conditions for entitlement to an R&D tax offset are satisfied, if viewed objectively that one or more parties to the arrangement has entered into or carried out the arrangement for the purpose of obtaining either a refundable or non-refundable tax offset, the general anti-avoidance provisions in Part IVA of the Income Tax Assessment Act 1936 (ITAA 1936) may apply to cancel that tax offset.[7]

7. We are currently reviewing the arrangements we have identified and we will continue to closely scrutinise these arrangements as we identify them.

8. We are developing further website guidance on specific technical matters in this Alert that will be published in due course.

9. We have also issued Taxpayer Alert TA 2023/4 Research and development activities delivered by associated entities.

10. If you have entered, or are contemplating entering, into an arrangement of this type, we encourage you to:

- •

- phone or email us using the contact details provided at the end of this Alert

- •

- ask us for our view through a private ruling

- •

- seek independent professional advice

- •

- make a voluntary disclosure to reduce penalties that may apply.

11. Penalties may apply to participants in, and promoters of, this type of arrangement. This includes serious penalties for promoters under Division 290 of Schedule 1 to the Taxation Administration Act 1953. Registered tax agents involved in the promotion of this type of arrangement may be referred to the Tax Practitioners Board to consider whether there has been a breach of the Tax Agent Services Act 2009.

12. For more information about eligible R&D activities, what can be claimed under the R&DTI and recordkeeping, refer to Research and development tax incentive.

13. To provide information about this type of arrangement, or a promoter of this or another arrangement:

- •

- phone us on 1800 060 062

- •

- contact the officer named in this Alert.

Commissioner of Taxation

14 December 2023

© AUSTRALIAN TAXATION OFFICE FOR THE COMMONWEALTH OF AUSTRALIA

You are free to copy, adapt, modify, transmit and distribute this material as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).

Date of Issue: 14 December 2023

Date of Effect: N/A

As defined in section 355-35 of the Income Tax Assessment Act 1997 (ITAA 1997).

As defined in section 328-125 of the ITAA 1997.

As defined in section 328-130 of the ITAA 1997.

Issued under paragraph 28C(1)(a) of the Industry Research and Development Act 1986.

As required under paragraphs 355-210(1)(a), (d) and (e) of the ITAA 1997.

Subsection 355-210(2) of the ITAA 1997.

Sections 177D and 177F of the ITAA 1936. A refundable and non-refundable R&D tax offset is a tax benefit per paragraph 177C(1)(bd) of the ITAA 1936.

File 1-ZZ1FMRM

Related Practice Statements:

PS 2005/24

Legislative References:

ITAA 1936 Pt IVA

ITAA 1936 177D

ITAA 1936 177F

ITAA 1997 Div 355

ITAA 1997 355-35

ITAA 1997 355-210(1)(a)

ITAA 1997 355-210(1)(d)

ITAA 1997 355-210(1)(e)

ITAA 1997 355-210(2)

ITAA 1997 355-405

ITAA 1997 Subdiv 328-C

ITAA 1997 328-115

ITAA 1997 328-125

ITAA 1997 328-130

TAA 1953 Sch 1 Div 290

Tax Agent Services Act 2009

IRD Act 28C(1)(a)

Related Taxpayer Alerts:

TA 2023/4

| Contact officer: | Jared Birbeck |

| Email address: | InnovationTax@ato.gov.au |

ISSN: 2651-9550